Professional Documents

Culture Documents

Mas Memo - Vic

Uploaded by

esmith8899Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mas Memo - Vic

Uploaded by

esmith8899Copyright:

Available Formats

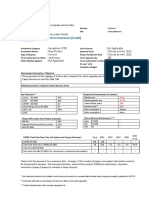

MASCO CORPORATION (NYSE: MAS) 12-18 Month Price Target ~$21 Stress Case ~$11

Stock (7/18/12) Shares Outs (MM; 4/26/12) MARKET CAP (MM) CAPITAL STRUCTURE Pro Forma $14.23 357 5,082 Dilution 29 Est 12/31/13 $14.23 386 5,494 VALUATION & PRICE TARGET 2014 EBITDA EBITDA Cabinets 192 Plumbing 646 Installation 176 Decorative Architectural 400 Other Specialty 80 Corporate (125) MAS Adj EBITDA (MM) 1,368 - Net Claims @ 2013-E Equity Value (MM) / FD Shares (MM) Per Share Norm US 800 $15.00 $15.41 $15.81 $16.22 $16.63 $17.04 $17.45 $17.86 (x) 6.0x 6.0x 6.0x 8.0x 6.0x 6.0x EV 1,149 3,873 1,053 3,202 477 (748) 9,007 (1,617) 7,390 386 $19.14

+ Total Funded Debt - Cash at 3/31/12 - Stock Options Cash - Financial Investments Carrying Value + C2Q12:3Q12-E Cash Burn / - Flow + 2013-E Cash Burn / - Flow PRO FORMA NET DEBT (MM) ENTERPRISE VALUE (MM)

4,379 (1,788) (107) 2,484 7,566

Cash (Sources) (284) (220) (363)

4,379 (1,788) (284) (107) (220) (363) 1,617 7,111

DEBT STACK 3/31/12 1.25B Revolver (Zero Outstanding; L + 50) 5.875% of 2012 (Repo 59 Par in 2010; 46 in 1Q12) 745 7.125% of 2013 200 4.8% of 2015 500 6.125% of 2016 1,000 5.85% of 2017 300 6.625% of 2018 114 7.125% of 2020 500 5.95% of 2022 400 296 7.75% of 2029 300 6.5% of 2032 Zeros Converts of 2031 (Accreted Value) Floaters of 2010 Other 24 TOTAL FUNDED DEBT (MM) 4,379

Maturity Unused Jan-14 1,250 Jul-12 Aug-13 Jun-15 Oct-16 Mar-17 Apr-18 Mar-20 Mar-22 Aug-29 Aug-30 -

$19.14 5% 10% 15% 20% 25% 30% 35% 40%

Housing (000) Starts VS Norm Europe 1,000 1,200 1,400 1,600 $16.45 $17.91 $19.37 $20.83 $16.86 $18.32 $19.78 $21.24 $17.27 $18.73 $20.19 $21.65 $17.68 $19.14 $20.60 $22.06 $18.09 $19.55 $21.01 $22.47 $18.50 $19.96 $21.42 $22.88 $18.91 $20.37 $21.83 $23.29 $19.32 $20.78 $22.24 $23.70 2014 FREE CASH FLOW

1,800 $22.29 $22.70 $23.11 $23.52 $23.93 $24.34 $24.74 $25.15

Free Cash Flow (MM) Per Share (x) Per Share 2014 EPS GAAP Adj EPS (All-in 36% Tax) (x) Per Share

675 $1.75 12.0x $20.97

$1.37 15.0x $20.60

Investment Thesis:

MAS unique portfolio of recessionary-proof products (Plumbing, Paint) and leverage to new housing starts provides an opportunity to participate in the recovery in residential construction at the same time raw material costs are moderating (base metals flat/down and TiO2 growth slowing) and prior year marketing/investment spending materialize. We believe MAS could trade to ~$21 in 12-18 months with additional upside once the housing cycle becomes consensus and MAS proves their prior years spending and cost initiatives are succeeding. 2010-2011 were transitional years for MAS with disappointing Cabinets and Installation, continued weakness in new residential construction, and margin erosion due to higher commodity costs and marketing investments. Reasonable Multiple on Plumbing and Paint Brands Matter: Note that SHW trades ~13x and 11x 2012E and 2013E EBITDA, respectively. SHW has higher growth prospects and more cyclical leverage with the professional contractor market, and we believe 8x to be reasonable for Mascos Paint business given their recent initiatives in the professional contractor market alongside HD. Furthermore, Plumbing has proven its stability thru the downturn and should also command a higher multiple than a cyclical 6x, but concerns around Europe (45% of 2011 Sales, mainly in Central/Eastern Europe) likely will keep this multiple capped in the near term. Limited Downside, Estimated ~$11: MAS traded to ~$8 (~3.5% Dividend Yield) in both 2Q09 and 4Q11 when housing starts were annualizing at 615K, Paint was facing unrelenting commodity increases, and Cabinets/Installation were annualizing at 160MM of negative EBIT. Since then, MAS has demonstrated their ability to pass thru rising commodity costs at Paint (though lagged) and clearly articulated their road to profit improvements at Cabinets/Installation.

Business Overview:

MAS manufactures, distributes, and installs home improvement and building products, with emphasis on brand-name consumer products, and is among the largest manufacturers in North America of faucets, cabinets, architectural paints and windows. In addition, the Installation segment holds a leadership position in insulation installation in the new home construction market. In 2011, ~25% of Sales were for new construction and 24% of Sales were international (45% of Plumbing and 25% of Cabinets and Specialty), which was mainly in Central Europe (37%), UK (23%), Emerging Markets (12%), and Eastern Europe (9%). The flagship brands of Delta and Hansgrohe in Plumbing and Behr in Decorative Architectural (Paint) are resilient businesses that have a proven ability to implement price increases and pass on rising commodity costs, product differentiation among competitors, and are non-cyclical consumer products. The company is organized into 5 segments as follows: Cabinets (16% of 2011 Net Sales; 25% International; UK, Denmark) Leverage to New Housing Starts + Turn-around: includes value-priced, stock, and semi-custom cabinetry for different price points and preferences, and recently included countertops to include the full vanity product. Home Centers currently account for a significant portion of sales due to low levels of new housing construction, but MAS has maintained and expanded relationships with homebuilders such as PHM and DHI and will

participate in the recovery in new housing construction. This segment has been particularly affected by the downturn due to consumer deferrals of big ticket items and an aggressive promotional environment. o Relative to AMWD and FBHS, MAS has inferior EBIT margins due to the focus on scale and volumes with 200MM of EBIT losses over the past three years while waiting for the recovery. MAS conceded that FBHS is more nimble and were more aggressive in stream-lining their portfolio. In 2011, MAS exited the ready-to-assemble products and has embarked on ~50MM EBIT initiatives to lower EBIT losses to 22MM assuming 600K housing starts and EBIT break-even at 700K.

Plumbing (39% of 2011 Net Sales; 45% International; 68% Ownership of Hansgrohe AG) Brand Matters + Lower Ticket Spending + No Deferred Maintenance: primarily faucets and showers under the Delta (USA) and Hansgrohe (Europe) brands, which consistently win various innovation and design awards. Competition in this segment is from private label brands and other premium brands such as Kohler and Moen (FBHS). Segment profitability troughed ~300MM EBIT (10% margins) in 2009, demonstrating the resiliency in the branded portfolio versus lower price points, the attractiveness of lower ticket re-modeling projects, and consumers inability to defer maintenance. Brass (Copper / Zinc) are the primary raw materials and the MAS has been able to re-capture margins in a rising cost environment. Other products include tub/shower systems, spas, and other brass plumbing system components. Installation (14% of 2011 Net Sales) Leverage to New Housing Starts + Turn-around: primarily installation and distribution of insulation products. Similar to Cabinets, Installation has been particularly affected by new housing construction (overhead, locations, and headcount) with 270MM of EBIT losses over the past three years. MAS projects 2012 cost and revenue opportunities to improve EBIT by 30MM in 2012 assuming 600K housing starts and EBIT break-even at 800K. Cumulative initiatives include the closure/consolidation of 110 branch locations, divesture of non-core services/products, ERP efficiencies, and expansion into the retrofit and light commercial markets. Decorative Architectural (22% of 2011 Net Sales) / Paint / Behr @ HD Margin Re-Capture VS TiO2 Stabilization + Do-itYourself Paradigm + Pro: Behr and Kilz paint brands account for this segments profits with an insignificant profit contribution from hardware. Behr is sold exclusively at HD and essentially grew alongside HD since the 1980s and has remained the incumbent brand at HD. The core DIY customers remain strong at HD and recent initiatives and marketing spend are focused on expanding into the professional segment, which would improve volumes and overhead absorption, though at slightly lower margins per gallon. Currently, MAS has limited exposure to the professional contractor (SHW leadership) and similar to HD initiatives, we believe this could be a growth area for Behr going forward. In 2011, Paint experienced TiO2 cost inflation of ~40% Y/Y, but MAS has shown its ability to increase prices on a 1-2Q lag. Other Specialty / Windows (8% of 2011 Net Sales; 25% International): primarily windows and doors under Milgard brand manufactured from vinyl, fiberglass, and aluminum sold thru dealers. Also includes a complete line of staple gun tackers (Arrow) sold thru home centers, retailers, and wholesalers. Specialty has generated slightly positive EBIT over the past few years due to business rationalizations and geographic/product expansions offset by higher commodity costs and lower volumes.

Catalysts & Opportunities:

Cabinets & Installation Profit Improvements Materialize: for the first time on the 1Q12 earnings call (5/1/12) management presented the Cabinets and Installation 2012 EBIT improvement plan of 53MM and 30MM, respectively, assuming 600K starts. While MAS still expects losses at 600K starts, investors can look forward and extrapolate the segments earnings power under different assumptions on housing starts. As discussed, these two segments have accounted for almost 500MM EBIT losses from 2009-2011, and break-even performance (or close to) would be a significant change in company fundamentals and investor perceptions. Moderation in Raw Materials (TiO2, Brass / Copper / Zinc) Potential Tailwind: TiO2 could experience another couple years of inflation, but at rates less than the ~40% experienced in 2011. When new TiO2 supply comes online ~2014, MAS should be able to maintain pricing as they (and SHW) have done historically when raw materials decrease. Paints Successful Growth at Professional Channels w/ HD: although incremental margins per gallon would be lower at professional, these volumes could further help with overhead absorption from lost volumes at Wal-Mart in 2011, estimated at ~20MM EBIT. HD strategy and commentary seems focused on building out their exposure to the professional contractors, and we believe MAS would benefit from this initiative for additional Paint leverage to new residential construction and overhead absorption. Normalized US Housing Starts: without re-creating data sets and charts on the case for housing starts, we believe 1.2MM normalized (2014 in Financial Projections) housing starts is reasonable.

Risks:

Poor Execution at Cabinets & Installation: in the 1Q12 earnings call, management clearly laid out a road-map to improve EBIT at Cabinets and Installation, which have generated close to 500MM of EBIT losses in the past three years combined. Investors have become skeptical of managements operating philosophy of waiting for housing to come back and decision not to restructure these segments more aggressively after 2008. If MAS is unable to execute on their cost and revenue initiatives (discussed in section above), this would further hurt their credibility as operators. If MAS demonstrates they cant turn these segments around without new housing starts, investors would likely look elsewhere for leverage to new housing starts.

Competitors (Akzo / Glidden) Aggressive Expansion at HD Pricing Erosion: Behr is the dominant brand at HD with color centers and computer kiosks, and HD accounts for all of Behr sales. The likely candidate would be Akzo / Glidden, but they are encountering their own profitability/restructuring issues in North America and seem unlikely to displace Behr as the dominant brand at HD. While prior peak EBIT margins of ~22% are not expected going forward due the lower-margin growth at professional contractors and TiO2 flattening (at high levels), the cost per gallon of paint is similar across competitors and there is no vertical integration. Raw Materials Inflation Margin Erosion: no competitors in Plumbing or Paint are vertically integrated, so this affects everyone. Although MAS may not be able to implement pricing as quickly as SHW, for example, they have proven their ability to raise pricing thru HD and other channels. MAS meets with HD as needed with a 1-2Q lag. Paint prices have historically been stable and pricing has not fallen with raw materials. Plumbing (Delta, Hansgrohe, Brizo) Failure to Innovate and Command Premium Pricing: brands matter and if MAS fails to innovate and design up to par (or ahead of) competition, consumers could easily trade down to private label or competitors. US / Europe Macro & Recession: Residential Construction Slowdown; Stressed Consumer Trade-down to Private Label Plumbing and Deferral Big Ticket Purchases (Cabinets)

Valuation Method:

EV / EBITDA: we believe MAS should trade at 8x mid-cycle EBITDA on Branded Consumer Discretionary (Decorative Architectural) and 6x mid-cycle EBITDA on Cyclical segments levered to housing starts (Cabinets, Plumbing, Installation, Specialty). Over the past 12 years, MAS has traded ~10x EBITDA on average and ~6x EBITDA on 2006-2007 peak earnings. We believe 8x Decorative Architecture EBITDA is conservative given SHWs valuation at ~13x 2012-E EBITDA and the proven resiliency of the Behr brand and HD/DIY paradigm. Free Cash Flow, P/E: multiples of 12x Free Cash Flow (8% Yield) and 15x EPS are generally within market multiples and MAS historical multiples.

Financial Projections:

MAS Assumptions:

2008 51.0% 5.4% 23.3% 59.2% 21.0% 2009 17.8% 6.8% 21.2% 88.2% 7.6% 2010 23.8% 40.6% (6.5%) 123.8% (66.7%) 2011 18.9% (4.1%) 61.1% 291.3% 75.0% 2012-E 217.4% 16.3% 46.4% (4.9%) 62.7% 2013-E 40.0% 102.5% 25.0% 157.0% 25.0% Norm 40.0% 30.0% 25.0% 25.0% 25.0% Norm 2Q12-E 40.0% 30.0% 25.0% 25.0% 25.0% 2Q12-E 15 (14) 6 (18) 3Q12-E 40.0% 30.0% 25.0% 25.0% 25.0% 3Q12-E 15 6 4Q12-E 40.0% 30.0% 25.0% 25.0% 25.0% 4Q12-E 15 6 1Q13-E 40.0% 30.0% 25.0% 25.0% 25.0% 1Q13-E 12 35 2Q13-E 40.0% 30.0% 25.0% 25.0% 25.0% 2Q13-E 12 35 3Q13-E 40.0% 30.0% 25.0% 25.0% 25.0% 3Q13-E 4Q13-E 40.0% 30.0% 25.0% 25.0% 25.0% 4Q13-E -

INCREMENTAL EBITDA % Cabinets Plumbing Installation Decorative Architectural Other Specialty MANUAL EBITDA ($MM) Cabinets Plumbing Installation Decorative Architectural Other Specialty

2008 2009 2010 2011 2012-E 2013-E In Addition to Macro Above: Revenue Opps, Cost Improvements In Addition to Macro Above: Mix, Price, Hedge In Addition to Macro Above: Revenue Opps, Cost Improvements In Addition to Macro Above: Raw Materials Inflation Recovery

Macro Assumptions:

2002 1,705 2003 1,848 8.4% 2004 1,956 5.9% 2005 2,068 5.8% 2006 1,801 (12.9%) 2007 1,355 (24.8%) 2008 906 (33.2%) 2009 554 (38.8%) 2010 587 5.9% 2011 609 3.7% 2012-E 701 15.1% 2013-E 850 21.3% Norm 1,200 41.2%

MACRO ASSUMPTIONS U.S. Housing Starts (000's; SAAR) % Y/Y Census: Construction ($MM; Not SAAR) Total Private Residential % Y/Y Census: Retail ($MM; Not SAAR) Furniture & Home Spending % Y/Y

396,698 -

446,039 12.4%

532,903 19.5%

611,900 14.8%

613,729 0.3%

493,247 (19.6%)

350,258 (29.0%)

245,913 (29.8%)

238,803 (2.9%)

237,267 (0.6%)

253,255 6.7%

265,918 5.0%

350,000 31.6%

94,610 -

96,882 2.4%

103,979 7.3%

109,362 5.2%

112,960 3.3%

111,335 (1.4%)

99,913 (10.3%)

86,657 (13.3%)

88,229 1.8%

90,059 2.1%

94,353 4.8%

97,184 3.0%

102,043 5.0%

Census: Retail ($MM; Not SAAR) Building Mat, Garden Equip, Supplies Dealers 248,888 % Y/Y "Euro Area" Residential Construction:

263,660 5.9%

295,884 12.2%

321,356 8.6%

334,520 4.1%

321,313 (3.9%)

305,085 (5.1%)

268,206 (12.1%)

283,970 5.9% -

300,184 5.7% (15.9%)

315,575 5.1% (0.9%)

325,042 3.0% 0.0%

341,294 5.0% 20.0%

Projections:

2002 2,644 2,068 1,845 1,292 982 8,831 2003 2,879 2,684 2,411 1,449 1,148 10,571 2004 3,289 3,057 2,771 1,610 1,347 12,074 2005 3,324 3,176 3,063 1,612 1,325 12,500 2006 3,286 3,296 3,158 1,717 1,261 12,718 2007 2,829 3,449 2,615 1,771 1,106 11,770 2008 2,276 3,002 1,861 1,629 716 9,484 2009 1,674 2,564 1,256 1,714 584 7,792 2010 1,464 2,692 1,041 1,693 596 7,486 2011 1,231 2,913 1,077 1,670 576 7,467 2012-E 1,264 2,969 1,195 1,768 591 7,785 2013-E 1,363 3,002 1,378 1,821 622 8,186 Norm 1,725 3,602 1,834 1,912 777 9,851

NET SALES ($MM) Cabinets Plumbing Installation Decorative Architectural Other Specialty Total Net Sales Reported Net Sales - Geographic North America International Total Net Sales Reported Net Sales % Y/Y Cabinets Plumbing Installation Decorative Architectural Other Specialty Total Net Sales ADJ EBITDA ($MM) Cabinets Plumbing Installation Decorative Architectural Other Specialty Total Adj Segment EBITDA - Adj Corporate Adj EBITDA Adj EBITDA Margin % Cabinets Plumbing Installation Decorative Architectural Other Specialty Total Adj EBITDA Margin %

7,686 1,145 8,831

8,763 1,808 10,571

9,879 2,195 12,074

10,440 2,060 12,500

10,537 2,181 12,718

9,271 2,499 11,770

7,482 2,002 9,484

6,135 1,657 7,792

5,823 1,663 7,486

5,669 1,798 7,467

2002 421 386 331 327 221 1,686 (77) 1,609

8.9% 29.8% 30.7% 12.2% 16.9% 19.7% 2003 497 422 401 237 241 1,798 (98) 1,700

14.2% 13.9% 14.9% 11.1% 17.3% 14.2% 2004 612 463 391 349 295 2,110 (176) 1,934

1.1% 3.9% 10.5% 0.1% (1.6%) 3.5% 2005 573 445 408 296 302 2,024 (168) 1,856

(1.1%) 3.8% 3.1% 6.5% (4.8%) 1.7% 2006 506 409 368 388 263 1,934 (189) 1,745

(13.9%) 4.6% (17.2%) 3.1% (12.3%) (7.5%) 2007 435 428 224 403 158 1,648 (158) 1,490

(19.5%) (13.0%) (28.8%) (8.0%) (35.3%) (19.4%) 2008 156 397 44 319 70 986 (121) 865

(26.4%) (14.6%) (32.5%) 5.2% (18.4%) (17.8%) 2009 63 365 (72) 394 55 805 (119) 686

(12.5%) 5.0% (17.1%) (1.2%) 2.1% (3.9%) 2010 41 410 (73) 368 45 791 (89) 702

(15.9%) 8.2% 3.5% (1.4%) (3.4%) (0.3%) 2011 (37) 406 (39) 298 52 680 (94) 586

2.7% 1.9% 10.9% 5.9% 2.5% 4.3% 2012-E 7 432 16 294 33 782 (90) 692

7.8% 1.1% 15.4% 3.0% 5.4% 5.1% 2013-E 47 466 62 377 41 993 (102) 891

26.6% 20.0% 33.1% 5.0% 24.9% 20.3% Norm 192 646 176 400 80 1,492 (125) 1,368

15.9% 18.7% 17.9% 25.3% 22.5% 19.1%

17.3% 15.7% 16.6% 16.4% 21.0% 17.0%

18.6% 15.1% 14.1% 21.7% 21.9% 17.5%

17.2% 14.0% 13.3% 18.4% 22.8% 16.2%

15.4% 12.4% 11.7% 22.6% 20.9% 15.2%

15.4% 12.4% 8.6% 22.8% 14.3% 14.0%

6.9% 13.2% 2.4% 19.6% 9.8% 10.4%

3.8% 14.2% (5.7%) 23.0% 9.4% 10.3%

2.8% 15.2% (7.0%) 21.7% 7.6% 10.6%

(3.0%) 13.9% (3.6%) 17.8% 9.0% 9.1%

0.6% 14.6% 1.3% 16.6% 5.6% 10.1%

3.4% 15.6% 4.5% 20.7% 6.6% 12.1%

11.1% 18.0% 9.6% 20.9% 10.2% 15.2%

You might also like

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryFrom EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- MEI Write-Up (Seeking Alpha)Document12 pagesMEI Write-Up (Seeking Alpha)Messina04No ratings yet

- OEM Paints & Finishes World Summary: Market Sector Values & Financials by CountryFrom EverandOEM Paints & Finishes World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Wienerberger AR 11 EngDocument172 pagesWienerberger AR 11 Eng0730118008No ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- SBL - Further Question and Practice 2022Document48 pagesSBL - Further Question and Practice 2022Mazni HanisahNo ratings yet

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryFrom EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Custom Wood Door and Window Business PlanDocument14 pagesCustom Wood Door and Window Business PlanLyndsey Ashley100% (1)

- Top 200 EnrDocument69 pagesTop 200 EnrasaithambikNo ratings yet

- HeidelbergCement Bangladesh Ltd. BUY RecommendationDocument11 pagesHeidelbergCement Bangladesh Ltd. BUY RecommendationTaqsim E RabbaniNo ratings yet

- 2 - Example Business PlanDocument14 pages2 - Example Business Planmuftahmail721No ratings yet

- 1 - 1 Acct3203 Group Assignment s2 2017Document4 pages1 - 1 Acct3203 Group Assignment s2 2017viqiNo ratings yet

- Kansai Financial Report 2011Document30 pagesKansai Financial Report 2011hamidshah520No ratings yet

- Voltas Limited KishoreDocument8 pagesVoltas Limited Kishorekishore26190No ratings yet

- Anyway, EPS Is An Important Element of InvestmentDocument5 pagesAnyway, EPS Is An Important Element of Investmentzhangshuang327No ratings yet

- MYTIL Update Report Sept 2011 FinalDocument14 pagesMYTIL Update Report Sept 2011 FinalParis TsogkarlidisNo ratings yet

- Financial Analysis - The Home DepotDocument7 pagesFinancial Analysis - The Home DepotbroetalzarmyNo ratings yet

- ING Direct StrategyDocument16 pagesING Direct Strategyalice376No ratings yet

- LieratureDocument5 pagesLieratureSapna SharmaNo ratings yet

- AWI investor presentation highlights cost cuts and emerging markets focusDocument31 pagesAWI investor presentation highlights cost cuts and emerging markets focushelix126No ratings yet

- Global Paint & Coating Market ReportDocument7 pagesGlobal Paint & Coating Market ReportNitin Nagpal100% (2)

- ENR The Top 225 International Design Firms 2013Document96 pagesENR The Top 225 International Design Firms 2013shanmars100% (1)

- BBMC3023 APM Week 2 AnswersDocument4 pagesBBMC3023 APM Week 2 AnswersTan Yi SuanNo ratings yet

- The McKinsey Quarterly-ElectroluxDocument27 pagesThe McKinsey Quarterly-Electroluxhoney210182No ratings yet

- BiffaDocument2 pagesBiffaeboroNo ratings yet

- Solution Manual For Microeconomics 19th Edition by McconnellDocument14 pagesSolution Manual For Microeconomics 19th Edition by Mcconnelllouisdienek3100% (22)

- MGMT-5310 - 1Document5 pagesMGMT-5310 - 1AdamNo ratings yet

- Economies & Diseconomies of ScaleDocument37 pagesEconomies & Diseconomies of ScaleShivesh RanjanNo ratings yet

- HomeDepot Case StudyDocument20 pagesHomeDepot Case StudyKhushbooNo ratings yet

- Brief Overview of I2Document7 pagesBrief Overview of I2api-3716851No ratings yet

- Long Test 2 Set BDocument2 pagesLong Test 2 Set BMonica ReyesNo ratings yet

- uBO PROJECTDocument16 pagesuBO PROJECTcephas darkoNo ratings yet

- Group:Jgs Name:Xiaoning Jia, Ying Gu, Song Song IN-CLASS EXERCISE: Analyzing Income Statement and CFSDocument4 pagesGroup:Jgs Name:Xiaoning Jia, Ying Gu, Song Song IN-CLASS EXERCISE: Analyzing Income Statement and CFSSong Song 송송No ratings yet

- WESCO Distribution, Inc. - Case Analysis: Business To Business MarketingDocument4 pagesWESCO Distribution, Inc. - Case Analysis: Business To Business MarketingSayakBiswasNo ratings yet

- Business PlanDocument14 pagesBusiness Plansamirmouhcine13No ratings yet

- HDPP FinalDocument23 pagesHDPP FinalGauravNo ratings yet

- Asian Paints Ratio ValuationDocument36 pagesAsian Paints Ratio Valuationjaichandani55No ratings yet

- The Downturn of Housing Output From An Economic PerspectiveDocument13 pagesThe Downturn of Housing Output From An Economic PerspectiveflorinNo ratings yet

- 1902 14 - Nexans FY 2018 - Final2 PublicationDocument35 pages1902 14 - Nexans FY 2018 - Final2 PublicationSaifa KhalidNo ratings yet

- BoozCo The 2012 Global Innovation 1000 Media ReportDocument22 pagesBoozCo The 2012 Global Innovation 1000 Media Reportmyownhminbox485No ratings yet

- MARKETING PLAN Assess 2Document11 pagesMARKETING PLAN Assess 2harika vanguruNo ratings yet

- RDocument17 pagesRSarmad Sadiq E4 42No ratings yet

- Hindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsDocument4 pagesHindalco - Media - Press Releases - Novelis Reports Strong Fiscal Year 2012 ResultsSandeep KumarNo ratings yet

- Havells India June 2012Document20 pagesHavells India June 2012VikramGhatgeNo ratings yet

- Nirmal Bang Paint Sector Update 010920Document88 pagesNirmal Bang Paint Sector Update 010920Anish AnandNo ratings yet

- Business Management Paper 2 SLDocument7 pagesBusiness Management Paper 2 SLSaket GudimellaNo ratings yet

- Top 200 Design FirmsDocument66 pagesTop 200 Design Firmssitara1987No ratings yet

- GDP Measures Total ProductionDocument15 pagesGDP Measures Total ProductionShakilaMissz-KyutieJenkinsNo ratings yet

- Economies Diseconomies of ScaleDocument37 pagesEconomies Diseconomies of Scalebhakti_kumariNo ratings yet

- ABB's Mission to Increase Power and ProductivityDocument7 pagesABB's Mission to Increase Power and ProductivityKushagra MathurNo ratings yet

- E&Y - Cash - On - The TableDocument20 pagesE&Y - Cash - On - The TableDeepak SharmaNo ratings yet

- FC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionDocument18 pagesFC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionQuang NhựtNo ratings yet

- Soitec Announces Full Year Results For 2011-2012Document11 pagesSoitec Announces Full Year Results For 2011-2012Lachlan MarkayNo ratings yet

- Case-8, Group-8Document59 pagesCase-8, Group-8njtithiNo ratings yet

- HomeDepot Case StudyDocument21 pagesHomeDepot Case StudyLamaRitscher80% (5)

- Port MGT 2Document105 pagesPort MGT 2Henry So E DiarkoNo ratings yet

- Singapore POST Capex - Docx Final 2022Document3 pagesSingapore POST Capex - Docx Final 2022Jonathan SulaimanNo ratings yet

- Merrill Lynch The B2B Market Maker BookDocument88 pagesMerrill Lynch The B2B Market Maker BookIgor SimunovicNo ratings yet

- Analysis For Cost Leadership Strategy and Core Competitiveness Points of IKEA CODocument4 pagesAnalysis For Cost Leadership Strategy and Core Competitiveness Points of IKEA COTody IsfitazliNo ratings yet

- Mini-Cases On Operations StrategyDocument5 pagesMini-Cases On Operations StrategySwastik MohantyNo ratings yet

- Pag IbigDocument2 pagesPag IbigJenne LeeNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (80)

- Direct Questions Asked in UPSC PrelimsDocument79 pagesDirect Questions Asked in UPSC PrelimsSam PitraudaNo ratings yet

- Ratio Analysis of APLDocument15 pagesRatio Analysis of APLTusarkant BeheraNo ratings yet

- Presentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceDocument32 pagesPresentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceShyam SunderNo ratings yet

- Break-Even Analysis and CVP Calculations for Multiple CompaniesDocument2 pagesBreak-Even Analysis and CVP Calculations for Multiple CompaniesKayla Shelton0% (1)

- SAP FICO Consultant ResumeDocument3 pagesSAP FICO Consultant ResumeAbdul RaheemNo ratings yet

- Government of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleDocument84 pagesGovernment of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleGifty BaidooNo ratings yet

- Business Law - Negotiable InstrumentsDocument8 pagesBusiness Law - Negotiable InstrumentsPrincessa Lopez MasangkayNo ratings yet

- Finnifty Sum ChartDocument5 pagesFinnifty Sum ChartchinnaNo ratings yet

- PT Kalbe Farma TBK.: Summary of Financial StatementDocument2 pagesPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- Hussein Abdullahi Elmi: Personal ProfileDocument3 pagesHussein Abdullahi Elmi: Personal ProfileHusseinNo ratings yet

- Mudaraba Case Study 1,2 and 3Document2 pagesMudaraba Case Study 1,2 and 3jmfaleel88% (8)

- Company Law 1 NewDocument62 pagesCompany Law 1 NewmuhumuzaNo ratings yet

- Department Restructuring and New LeadershipDocument25 pagesDepartment Restructuring and New Leadershipsathish kumar100% (2)

- Shopify Commerce Singapore Pte. Ltd. billing details for Whole FoodsDocument2 pagesShopify Commerce Singapore Pte. Ltd. billing details for Whole FoodsAshok Kumar MohantyNo ratings yet

- Takeovers: Reading: Takeovers, Mergers and BuyoutsDocument4 pagesTakeovers: Reading: Takeovers, Mergers and BuyoutsFreakin 23No ratings yet

- Inner Circle Trader - Sniper Course, Escape & EvasionDocument3 pagesInner Circle Trader - Sniper Course, Escape & EvasionKute HendrickNo ratings yet

- MGL IPO Note | Oil & Gas SectorDocument16 pagesMGL IPO Note | Oil & Gas SectordurgasainathNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- Strategic ManagementDocument17 pagesStrategic Managementfuture tradeNo ratings yet

- Mba Interview QuestionsDocument3 pagesMba Interview QuestionsAxis BankNo ratings yet

- 100+ Latest Current Affairs For B.ED Entrance Exams PDF Download - KARMA SHIKSHADocument20 pages100+ Latest Current Affairs For B.ED Entrance Exams PDF Download - KARMA SHIKSHAGanesh Chandra ParidaNo ratings yet

- Easi-Pay Service Form (Takaful)Document4 pagesEasi-Pay Service Form (Takaful)slayman_obnNo ratings yet

- U3A5 - Transactions With HST - TemplateDocument2 pagesU3A5 - Transactions With HST - TemplateJay Patel0% (1)

- All 760953Document13 pagesAll 760953David CheishviliNo ratings yet

- Project GuideDocument22 pagesProject GuideMr DamphaNo ratings yet

- Chapter 13-A Regular Allowable Itemized DeductionsDocument13 pagesChapter 13-A Regular Allowable Itemized DeductionsGeriel FajardoNo ratings yet

- Book 1 Chapter 2Document4 pagesBook 1 Chapter 2Tanveer AhmadNo ratings yet

- Dalit EntrepreneurshipDocument5 pagesDalit EntrepreneurshipSuraj GawandeNo ratings yet