Professional Documents

Culture Documents

Cost Accounting

Uploaded by

Afzal AbdullaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting

Uploaded by

Afzal AbdullaCopyright:

Available Formats

COST ACCOUNTING: AN INTRODUCTION Cost accounting is the process of accounting for cost.

This process begins with recording of income and expenditure and ends with preparation of statistical data. It is an art of determining the cost. It is a mechanism by which cost of products are ascertained and controlled.

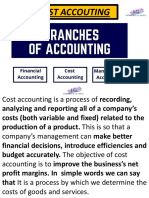

COST ACCOUNTING MEANING Cost accounting is concerned with recording, classifying and summarizing costs for determination of costs of products or services, planning, controlling and reducing such costs and furnishing of information to management for decision making.

COST MEANING: Cost means the amount of expenditure (actual or notional) incurred on, or attributable to, a given thing.

COSTING-MEANING: Costing is the technique and process of ascertaining cost.

IMPORTANT AMENDMENTS: COMPANIES ACT, 1956 In 1965 the GOI was authorized to make cost accounting compulsory for a company engaged in any industry notified in that order. As per act each company should prepare its accounts as per Cost Accounting Records rules given for various industries. As per section. 209(i)d the recording of cost accounts has been made legally compulsory.

From 1st January, 2004 MAOCARO has been changed by CARO (Company Audit Report Order). Auditor has to submit his audit report as per rules given in the CARO from now onwards.

CHARACTERISTICS OF COST ACCOUNTS 1. Cost accounts are important part of financial accounts. 2. The knowledge of per unit cost of production or service is obtained from cost accounts 3. Detail records are maintained for materials , labour and expense in these accounts 4. Adequate control on material, labour and expenses is maintained.

OBJECTIVE OF COST ACCOUNTS 1. Cost Ascertainment: The main object of cost accounting is to ascertain the cost of production correctly. Cost of two periods can be compared, selling price of items produced is fixed and tender or quotation price can be ascertained with the help of cost accounting. 2. Cost Control: The cost of production can be controlled by cost accounts. Every producer wants that his real cost should be more than its standard cost. If real cost is higher, efforts are made it to control it. 3. Cost Reduction: In order to increase the sale every industrialist tries to avoid the wastage of various elements of cost (material, labour and other expenses) with the help of cost accounts and thus, to reduce the cost. 4. Helpful in Decision-Making: Cost accounting helps the management in providing information for managerial decisions for formulating operative policies. These policies relate to the following matters: a. Determination of cost-volume-profit relationship. b. Make or buy a component c. Shut down or continue operation at a loss

d. Continuing with the existing machinery or replacing them by improved and economical machines. 5. To Provide reliable cost data: To main objects of cost accounting is to provide reliable data for controlling business activities and for ascertaining cost of production. Essentials of a good Cost Accounting System: i. ii. iii. iv. v. vi. vii. The Cost Accounting System should be tailor made, practical, simple and capable of meeting the requirements of a business concern. The method of costing should be suitable to the industry and serve its objectives. The Costing System should receive co-operation and participation of executives from various departments. The cost of installing and operating the system should justify the results. The system of costing should not sacrifice the utility by introducing meticulous and unnecessary details. The system should consider the organisational structure of the business and it should be designed as a sub-system of the overall organisation. There should be a harmonious relationship between costing system and financial accounts. Unnecessary duplication should be avoided. A single integrated accounting system would be ideal.

LIMITATIONS OF COST ACCOUNTING: Like other branches of accounting, cost accounting is not an exact science but is an art which has developed through theories and accounting practices based on reasoning and common sense. These practices are not static but changing with time. Cost accounting lacks a uniform procedure. There is no stereotyped system of cost accounting applicable to all industries. There are widely recognised cost concepts but understood and applied differently by different industries. Cost accounting can be used only by big enterprises. The limitations of cost accounting are as follows: i. It is expensive because analysis, allocation and absorption of overheads require considerable amount of additional work. ii. The results shown by cost accounts differ from those shown by financial accounts. Preparation of reconciliation statements frequently is necessary to verify their accuracy. This leads to unnecessary increase in workload.

iii.

It is unnecessary because it involves duplication of work. Some industrial units are functioning efficiently without any costing system. Costing system itself does not control costs. If the management is alert and efficient, it can control cost without the help of the cost accounting. Therefore it is unnecessary

iv.

ELEMENTS OF COST

COST

MATERIALS

OTHER EXPENSES LABOUR

DIRECT

INDIRECT DIRECT

INDIRECT

DIRECT

INDIRECT

OVERHEADS

DOH

FOH

AOH

SOH

MATERIAL: The substance from which the finished product is made is known as material. DIRECT MATERIAL is one which can be directly or easily identified in the product Eg: Timber in furniture, Cloth in dress, etc. INDIRECT MATERIAL is one which cannot be easily identified in the product. Examples of Indirect material:

At factory level lubricants, oil, consumables, etc. At office level Printing & stationery, Brooms, Dusters, etc. At selling & dist. level Packing materials, printing & stationery, etc. LABOUR: The human effort required to convert the materials into finished product is called labour. DIRECT LABOUR is one which can be conveniently identified or attributed wholly to a particular job, product or process. Eg:wages paid to carpenter, fees paid to tailor,etc. INDIRECT LABOUR is one which cannot be conveniently identified or attributed wholly to a particular job, product or process. Examples of Indirect labour: At factory level foremens salary, works managers salary, gate keepers salary,etc At office level Accountants salary, GMs salary, Managers salary, etc. At selling and distribution level salesmen salaries, Logistics manager salary, etc. OTHER EXPENSES are those expenses other than materials and labour. DIRECT EXPENSES are those expenses which can be directly allocated to particular job, process or product. Eg : Excise duty, royalty, special hire charges,etc. INDIRECT EXPENSES are those expenses which cannot be directly allocated to particular job, process or product. Examples of other expenses: At factory level factory rent, factory insurance, lighting, etc. At office level office rent, office insurance, office lighting, etc. At sales & distribution level advertising, show room expenses like rent, insurance, etc.

Cost Sheet: Cost sheet is a statement, which shows various components of total cost of a product. It classifies and analyses the components of cost of a product. Previous periods data is given in the cost sheet for comparative study. It is a statement which shows per unit cost in addition to Total Cost. Selling price is ascertained with the help of cost sheet. COST SHEET DIRECT MATERIAL DIRECT LABOUR DIRECT EXPENSES PRIME COST FACTORY OVERHEADS FACTORY COST

OFFICE OVERHEADS COST OF PRODUCTION

SELL & DIST OVERHEADS COST OF SALES PROFIT

SALES

Cost Sheet for the product. from .. To. Units produced. Elements of costs Direct material Direct Labour Direct expenses Prime Cost Production or Works or Factory Overheads: Administration overhead of Production nature Research & development cost Quality control cost Factory Cost Add: Opening WIP Less: Closing WIP Works Cost Add: Packing cost Less: Credit for scrap Cost of production Add: Opening stock of finished goods Less: Closing stock of finished goods Cost of goods sold Marketing overheads: Administration overhead of marketing nature selling overhead Distribution overhead Cost of sales Add: Profit Estimated sales price Amount (Rs.) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx

METHODS OF COSTING JOB COSTING CONTRACT COSTING BATCH COSTING PROCESS COSTING UNIT COSTING OPERATING COSTING OPERATION COSTING MULTIPLE COSTING JOB COSTING Job Costing is that category of basic costing method which is applicable where the work consists of separate contract jobs or batches each of which is authorized by specific order or contract. JOB COST SHEET particulars Materials Labour Direct expenses Prime cost Overheads : Variable Fixed Total cost Profit Selling price xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx amount amount xxxxx xxxxx xxxxx xxxxx

OPERATION COSTING Companies that manufacture goods that undergo some similar and some dissimilar processes use this system. Operation costing accumulates total conversion costs and determines a unit conversion cost for each operation. However, direct material costs are charged specifically to products as in joborder systems. Operating cost sheet Particulars A. Fixed Charges wages of drivers salary of office staff tax and insurance etc interest and other charge total fixed cost (A ) B. Variable charges Diesel Depreciation total variables cost(B) Total cost( A+B) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxxx xxxxx Total cost cost per km

TYPES OF COSTING UNIFORM COSTING MARGINAL COSTING STANDARD COSTING HISTORICAL COSTING DIRECT COSTING ABSORBTION COSTING

UNIFORM COSTING According to C.I.M.A (London), Uniform Costing refers to a system of costing under which several under-takings use the same costing principles or practices. MARGINAL COSTING Marginal Costing means, The ascertainment of marginal cost and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs. STANDARD COSTING According to C.I..M.A (London), standard costing is defined as The preparation and use of standard costs, their comparison with actual costs and the analysis of variances to their causes and point of incidence. HISTORICAL COSTING Historical Costing means, A measure of value used in accounting in which the price of an asset on the balance sheet is based on its nominal or original cost when acquired by the company. The historical-cost method is used for assets in the U.S. under generally accepted accounting principals (GAAP).

DIRECT COSTING Direct Costing is a method in which the cost of a product or operation is determined by allocating to it an appropriate portion of the variable (direct)costs ABSORBTION COSTING A managerial accounting cost method of expensing all costs associated with manufacturing a particular product. Absorption costing uses the total direct costs and overhead costs associated with manufacturing a product as the cost base.

You might also like

- East Africa University (Eau) Cost AccountingDocument27 pagesEast Africa University (Eau) Cost AccountingJohn HassanNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost AccountingDocument23 pagesCost AccountingSEEMANo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Cost Accounting - Meaning and ScopeDocument27 pagesCost Accounting - Meaning and ScopemenakaNo ratings yet

- Costing For A Spinning MillDocument9 pagesCosting For A Spinning MillNajmus SalihinNo ratings yet

- Accountancy SectionDocument124 pagesAccountancy Sections7k1994No ratings yet

- Costing For A Spinning MillDocument14 pagesCosting For A Spinning MillSakthivel JegarajanNo ratings yet

- Spinning Mill CostingDocument12 pagesSpinning Mill CostingKrithika Salraj50% (2)

- Costing For A Spinning MillDocument12 pagesCosting For A Spinning MillOUSMAN SEIDNo ratings yet

- Estimation & Costing TheoryDocument36 pagesEstimation & Costing TheoryarunNo ratings yet

- Nature and Purpose of Cost AccountingDocument10 pagesNature and Purpose of Cost AccountingJustus100% (1)

- COST ANALYSIS - 62 Questions With AnswersDocument6 pagesCOST ANALYSIS - 62 Questions With Answersmehdi everythingNo ratings yet

- Costing For A Spinning MillDocument14 pagesCosting For A Spinning Millvijay100% (1)

- Am Unit - IvDocument31 pagesAm Unit - IvTamilan Dhinesh Tamilan DhineshNo ratings yet

- Nature and Scope of Cost & Management Accounting: Unit 1Document24 pagesNature and Scope of Cost & Management Accounting: Unit 1umang8808No ratings yet

- 11th Sem - Cost ACT 1st NoteDocument5 pages11th Sem - Cost ACT 1st NoteRobin420420No ratings yet

- 79 52 ET V1 S1 - Unit - 6 PDFDocument19 pages79 52 ET V1 S1 - Unit - 6 PDFTanmay JagetiaNo ratings yet

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNo ratings yet

- Mba Cost and Management Accounting NotesDocument24 pagesMba Cost and Management Accounting Notesshanu rockNo ratings yet

- Cost Accounting: Basic Nature and ConceptsDocument28 pagesCost Accounting: Basic Nature and Concepts9986212378No ratings yet

- Cost of AccountingDocument9 pagesCost of Accountingnadeemahad98No ratings yet

- Cost and Management Accounting: Dr. Tripti TripathiDocument51 pagesCost and Management Accounting: Dr. Tripti TripathiHarendra Singh BhadauriaNo ratings yet

- 2importance of Cost Accounting 2Document3 pages2importance of Cost Accounting 2Jyoti GuptaNo ratings yet

- Cost AccountingDocument15 pagesCost AccountingADNo ratings yet

- Meaning of Cost AccountingDocument16 pagesMeaning of Cost Accounting1028No ratings yet

- Cost AccountingDocument21 pagesCost Accountingridon mbayiNo ratings yet

- Costtt NnewDocument92 pagesCosttt Nnewkeyur ShahNo ratings yet

- Cost AccountingDocument44 pagesCost Accountingknowledge informationNo ratings yet

- Business Process Analysis: 2.6 Cost SheetDocument9 pagesBusiness Process Analysis: 2.6 Cost SheetDarshitNo ratings yet

- Cost Accounting: College of AccountancyDocument22 pagesCost Accounting: College of AccountancyVanessa Arizo ValenciaNo ratings yet

- Accounting CostingDocument156 pagesAccounting CostingMorning32100% (1)

- Course Title: Cost & Management Accounting Course Code:ACC 205Document37 pagesCourse Title: Cost & Management Accounting Course Code:ACC 205Ishita GuptaNo ratings yet

- Chapter 2Document47 pagesChapter 2dawsonNo ratings yet

- Determine Cost of Product and Services With Various Costing: SystemDocument11 pagesDetermine Cost of Product and Services With Various Costing: SystemCherwin bentulanNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument174 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- Cost Accounting and Control by Sir ChuaDocument92 pagesCost Accounting and Control by Sir ChuaAnalyn Lafradez100% (3)

- RFG 196 0113Document16 pagesRFG 196 0113Lets fight CancerNo ratings yet

- Cost Accounting1Document134 pagesCost Accounting1Ryan Brown100% (1)

- Cost SheetsDocument28 pagesCost SheetsCA Deepak Ehn100% (2)

- Costing For A Spinning Mill PDFDocument13 pagesCosting For A Spinning Mill PDFyogesh kumawatNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument148 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (3)

- Cost Concept Uses and ClasificationsDocument8 pagesCost Concept Uses and ClasificationsSameel Ur RehmanNo ratings yet

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- What Is Costing?Document27 pagesWhat Is Costing?wickygeniusNo ratings yet

- CosmanDocument7 pagesCosmanShanen MacansantosNo ratings yet

- Unit 1 Cost AccountingDocument20 pagesUnit 1 Cost AccountingCollins NyendwaNo ratings yet

- AM UNIT-III MaterialDocument19 pagesAM UNIT-III MaterialVINAY BETHANo ratings yet

- CST Accounting by Ig ClassesDocument39 pagesCST Accounting by Ig Classesraman sharma100% (1)

- Cost NotesDocument16 pagesCost NotesKomal GowdaNo ratings yet

- AIOU8408 Assignment 1 0000603169Document18 pagesAIOU8408 Assignment 1 0000603169Farhan ShakilNo ratings yet

- Psba Ac 15 Cost Accounting Lecture Note 2019 Answer KeyDocument45 pagesPsba Ac 15 Cost Accounting Lecture Note 2019 Answer KeyracabrerosNo ratings yet

- Ca&c NotesDocument6 pagesCa&c NotesLourdes Sabuero TampusNo ratings yet

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- Costing SystemsDocument4 pagesCosting SystemsNeriza PonceNo ratings yet

- Universidad Tecnológica de Coahuila Production Cost Accounting ClassDocument13 pagesUniversidad Tecnológica de Coahuila Production Cost Accounting ClassEdgar IbarraNo ratings yet

- Cost AccountingDocument35 pagesCost AccountingShubham LankaNo ratings yet

- Cost AccountingDocument30 pagesCost Accountingmohammed33nNo ratings yet

- Topic One Introduction TopicDocument37 pagesTopic One Introduction Topicramadhanamos620No ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1026)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessFrom EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessRating: 4.5 out of 5 stars4.5/5 (407)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyFrom EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyRating: 4.5 out of 5 stars4.5/5 (300)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (799)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)