Professional Documents

Culture Documents

Parking Incentive Term Sheet (10 Year Term)

Uploaded by

Anonymous ZRsuuxNcCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Parking Incentive Term Sheet (10 Year Term)

Uploaded by

Anonymous ZRsuuxNcCCopyright:

Available Formats

PARKING INCENTIVE TERM SHEET

1.

The Downtown Improvement Board (DIB) will make available upon relocation of the employer up to fifty (50) parking spaces in the Jefferson Street Parking Garage at the rate of one (1) space per employee relocated to the downtown area. In addition, the four (4) existing spaces currently marked as Reserved will be immediately made available upon relocation of the employer to be marked as Reserved at the employers expense for shortterm use by the employers customers. If and when parking in the Jefferson Street Parking Garage overflows to the point that parking is unavailable, the spaces will be made available in other parking facilities in reasonably close proximity to the employers business location.

2.

An additional fifty-three (53) spaces will be made available in the Intendencia Street Garage as additional employees are relocated to the downtown area.

3.

The maximum number of parking spaces to be made available under this incentive program will be one hundred seven (107).

4.

As additional employees are relocated and parking spaces are increased or as the number of employees decreases and parking spaces are not used by employees of the employer, employer shall provide the Downtown Improvement Board with as much prior notice as is feasible under the circumstances. Such notice shall be required before an additional space will be made available. If a space is not immediately available in one facility, the

DIB will make space available in other parking facilities until spaces open up and do become available. 5. The parking spaces will be made available on a ten (10) year term at no cost to the employer so long as the terms and conditions in the agreement described in paragraph 19 below are satisfied. After the first ten (10) year term expires, the employer shall have the first option to take up to fiftyfour (54) spaces in the Jefferson Street Parking Garage as they become available at the then prevailing parking rates for such facility. 6. The mean wage for the relocated employees shall always be at least FortyFive Thousand Dollars ($45,000). 7. The employer shall at least as often as quarterly cause its independent third party public accounting firm to verify in writing the number of company employees in the building and the mean wage of those employees located in the identified downtown building. 8. After the first twenty-two (22) months of the term of the agreement, if the verifiable jobs having the required mean income levels drops below the required fifty (50) within the premises occupied by the employer, then the employer shall be required to pay the prevailing monthly parking rates plus applicable sales taxes for all jobs below fifty (50). 9. Each parking space will be made available to each job as each job is brought into the premises occupied by the employer, and each job shall be permanently located within such premises and a job with the employer.

10.

The parking incentives are absolutely not assignable in whole or in part in any manner by the employer.

11.

The incentive shall be available for the employer only and will not be available for contractors, subcontractors, tenants, subleases, or other assignees of the employer.

12.

The employer shall not be tax exempt under Section 501(c) of the Internal Revenue Code of 1986, as amended.

13.

Unless and until the DIB raises its tax millage to three (3) or more mils, the employer shall not pursue or have any ad valorem tax abatement of any kind on the premises occupied by the employer.

14.

If the owner of the premises occupied by the employer sells the premises, then the agreement shall become null and void unless the sale is to a party wholly owned by the employer.

15.

The agreement shall contain no options to renew. It will end exactly one hundred twenty (120) months from the date of commencement.

16.

The employer receiving this economic development incentive must be the same legal entity as the owner of the building being occupied.

17.

The employer may lease the building where its downtown employees will be located for up to one year prior to the closing on the sale of the building and still receive the economic development incentive outlined herein as long as the minimum employees number and average wage rates for employees in the building are still met throughout such lease term and so long as a binding

purchase and sale agreement is executed at the beginning of the lease term for the ultimate purchase and sale of such building. 18. During the term of the agreement, the DIB covenants not to offer parking incentive terms to any third party that are more favorable than the terms offered to the employer hereunder. 19. This Term Sheet is subject to fulfillment of the conditions specified in the Downtown Improvement Boards Policy Statement, attached and incorporated by reference as well as the condition that the DIB negotiate modifications to its agreements with the City of Pensacola and related agencies all on terms acceptable to the DIB. This term sheet is non-binding and does not constitute an offer. A binding agreement will exist only after the parties have negotiated and executed a more definitive agreement setting forth these terms and conditions and other terms and conditions typical in a transaction of this nature.

You might also like

- Streeter LawsuitDocument7 pagesStreeter LawsuitAnonymous ZRsuuxNcCNo ratings yet

- PR-Sisson Personnel FileDocument51 pagesPR-Sisson Personnel FileAnonymous ZRsuuxNcCNo ratings yet

- Airport Part TIme OfficersDocument1 pageAirport Part TIme OfficersAnonymous ZRsuuxNcCNo ratings yet

- Schmitt SchedulingDocument7 pagesSchmitt SchedulingAnonymous ZRsuuxNcCNo ratings yet

- Escambia County Commissioners Jan 23 2017Document3 pagesEscambia County Commissioners Jan 23 2017Anonymous ZRsuuxNcCNo ratings yet

- Financial Report - Nine Months Ending June 30 2017Document48 pagesFinancial Report - Nine Months Ending June 30 2017Anonymous ZRsuuxNcCNo ratings yet

- Potential SuspectDocument6 pagesPotential SuspectAnonymous ZRsuuxNcCNo ratings yet

- CollusionDocument1 pageCollusionAnonymous ZRsuuxNcCNo ratings yet

- FY17 Budget Prep ManualDocument66 pagesFY17 Budget Prep ManualAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0035Document1 pageScan Doc0035Anonymous ZRsuuxNcCNo ratings yet

- MEMO Port Staff Re-OrganizationDocument1 pageMEMO Port Staff Re-OrganizationAnonymous ZRsuuxNcCNo ratings yet

- Illuminated Signage FINAL SUBMITTAL 4.19.2017Document5 pagesIlluminated Signage FINAL SUBMITTAL 4.19.2017Anonymous ZRsuuxNcCNo ratings yet

- MDeWeese LetterDocument2 pagesMDeWeese LetterAnonymous ZRsuuxNcCNo ratings yet

- Glover ComplaintDocument13 pagesGlover ComplaintAnonymous ZRsuuxNcCNo ratings yet

- MEMO - Mayor Veto Statement - Budget AnalystDocument1 pageMEMO - Mayor Veto Statement - Budget AnalystAnonymous ZRsuuxNcCNo ratings yet

- RE - Fire ChiefDocument2 pagesRE - Fire ChiefAnonymous ZRsuuxNcCNo ratings yet

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDocument1 pageM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNo ratings yet

- Re Entry 2014Document8 pagesRe Entry 2014Anonymous ZRsuuxNcCNo ratings yet

- DocumentsDocument6 pagesDocumentsAnonymous ZRsuuxNcCNo ratings yet

- IndictmentDocument2 pagesIndictmentAnonymous ZRsuuxNcCNo ratings yet

- Aerose Amendment2Document3 pagesAerose Amendment2Anonymous ZRsuuxNcCNo ratings yet

- Re Entry 2013Document11 pagesRe Entry 2013Anonymous ZRsuuxNcCNo ratings yet

- Promotions Press ReleaseDocument1 pagePromotions Press ReleaseAnonymous ZRsuuxNcCNo ratings yet

- Allen DepoDocument58 pagesAllen DepoAnonymous ZRsuuxNcCNo ratings yet

- Handwritten NotesDocument1 pageHandwritten NotesAnonymous ZRsuuxNcCNo ratings yet

- Special Council Meeting - May 26 2016Document1 pageSpecial Council Meeting - May 26 2016Anonymous ZRsuuxNcCNo ratings yet

- MX-2615N 20160608 155412Document4 pagesMX-2615N 20160608 155412Anonymous ZRsuuxNcCNo ratings yet

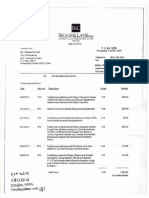

- B&L InvoicesDocument6 pagesB&L InvoicesAnonymous ZRsuuxNcCNo ratings yet

- Snowflake ArrestDocument3 pagesSnowflake ArrestAnonymous ZRsuuxNcCNo ratings yet

- ECUA Public Records JudgmentDocument4 pagesECUA Public Records JudgmentAnonymous ZRsuuxNcCNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Plaintiffs' Expert Guy DavisDocument85 pagesPlaintiffs' Expert Guy DavisMMA PayoutNo ratings yet

- ECON 301 CAT SolutionsDocument5 pagesECON 301 CAT SolutionsVictor Paul 'dekarNo ratings yet

- Kraft Heinz Case VF PDFDocument5 pagesKraft Heinz Case VF PDFNadine ElNo ratings yet

- MANAGEMENT AND ORGANIZATIONAL BEHAVIORDocument7 pagesMANAGEMENT AND ORGANIZATIONAL BEHAVIORAnonymous nTxB1EPvNo ratings yet

- JD of Sales TLDocument9 pagesJD of Sales TLChetanRaj ForeverforyouNo ratings yet

- Jesus Christ's Non-Probate WillDocument0 pagesJesus Christ's Non-Probate WillAZCMer100% (1)

- Costing MCQDocument19 pagesCosting MCQCostas PintoNo ratings yet

- 4.capital RationingDocument3 pages4.capital RationingmelonybluebellNo ratings yet

- PDFDocument4 pagesPDFPranjal SharmaNo ratings yet

- Bbap2103 Management AccountingDocument15 pagesBbap2103 Management AccountingeugeneNo ratings yet

- Module 2 - Pay For Position - Fixed Pay - FINAL - Oct2014Document101 pagesModule 2 - Pay For Position - Fixed Pay - FINAL - Oct2014zulianNo ratings yet

- Basic Accounting - Midterm 2010Document6 pagesBasic Accounting - Midterm 2010Trixia Floie GalimbaNo ratings yet

- Slide 1Document1 pageSlide 1Hazel CorralNo ratings yet

- The Philip Fisher Screen That Fishes Quality StocksDocument3 pagesThe Philip Fisher Screen That Fishes Quality StocksMartinNo ratings yet

- AIS Chapter 6Document14 pagesAIS Chapter 6Suen100% (2)

- CASE 03 Whole Foods Market in 2014: Vision, Core Values, and StrategyDocument43 pagesCASE 03 Whole Foods Market in 2014: Vision, Core Values, and StrategyIswan ArpadiNo ratings yet

- Internship ReportDocument28 pagesInternship ReportAhmad NawazNo ratings yet

- Rural MarketingDocument337 pagesRural MarketingAnirban MandalNo ratings yet

- CH 13 8Document2 pagesCH 13 8Meghna CmNo ratings yet

- Intangible Assets HomeworkDocument5 pagesIntangible Assets HomeworkIsabelle Guillena100% (2)

- Fa MCQDocument4 pagesFa MCQShivarajkumar JayaprakashNo ratings yet

- Taxation Cases Batch 5 Fringe Benefits TaxDocument15 pagesTaxation Cases Batch 5 Fringe Benefits TaxKaren Mae ServanNo ratings yet

- Lecture 5Document24 pagesLecture 5neri biNo ratings yet

- CPT Question Paper December 2015 With Answer CAknowledgeDocument26 pagesCPT Question Paper December 2015 With Answer CAknowledgerishabh jainNo ratings yet

- View Case PDFDocument29 pagesView Case PDFPuuParisNo ratings yet

- Individual Report: Professor Dr. K.M. Zahidul Islam School of Business and Economics North South UniversityDocument13 pagesIndividual Report: Professor Dr. K.M. Zahidul Islam School of Business and Economics North South UniversityIbrahim Khailil 1915216660No ratings yet

- Maintain Invoice Payment BlocksDocument5 pagesMaintain Invoice Payment Blockslucky2340No ratings yet

- Accounting For Single Entry and Incomplete Records PDFDocument18 pagesAccounting For Single Entry and Incomplete Records PDFCj BarrettoNo ratings yet

- The Global Economic Environment: Powerpoint by Kristopher Blanchard North Central UniversityDocument35 pagesThe Global Economic Environment: Powerpoint by Kristopher Blanchard North Central Universitys.vijayaraniNo ratings yet

- Problem Ch.14Document3 pagesProblem Ch.14kenny 322016048100% (1)