Professional Documents

Culture Documents

Activity Based Costing Example

Uploaded by

ImperoCo LLCCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Based Costing Example

Uploaded by

ImperoCo LLCCopyright:

Available Formats

WHITE CELLS ARE ADJUSTABLE

Kristoffer Burnett - Certified Management Accountant, 2009-2011

Activity Based Costing Example

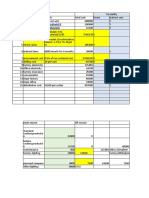

Product Profitability Analysis

1

Item1

Item2

Item3

Item4

Item5

Sales units

Sales dollars

14,790

$ 2,298,366

12,853

$ 3,435,928

24,311

$ 3,822,905

12,395

$ 3,233,236

31,021

$ 3,156,387

Direct Costs

Direct materials

Direct labor

Total direct costs

(378,953)

(1,696,401)

(1,129,207)

(1,040,302)

(938,312)

(598,320)

(294,637)

(888,315)

(600,617)

(868,180)

$ (977,273) $ (1,991,038) $ (2,017,522) $ (1,640,919) $ (1,806,492)

Activities

Research & development

Procure materials

Manufacturing

Shipping

Marketing/customer service

Total allocated costs

Total item margin

(308,649)

(361,244)

(437,444)

(333,640)

(406,624)

(114,314)

(141,907)

(100,167)

(114,477)

(909,366)

(1,409,101)

$ 411,727 $

35,789 $

Share of unallocated costs

Total item operating profit

Sales

Per Unit Breakdown

Average sales price per unit

Direct and allocated cost per unit

Item margin per unit

Unallocated cost per unit

Operating profit per unit

$

$

$

(397,933)

(437,444)

(375,345)

(417,050)

(126,140)

(137,965)

(100,167)

(114,477)

(999,585)

(1,106,937)

805,798 $

485,380 $

(58,109)

353,618 $

(58,109)

(22,320) $

(58,109)

747,689 $

(58,109)

427,271 $

155.40 $

(127.56)

27.84 $

(3.93)

23.91 $

267.32 $

(264.54)

2.78 $

(4.52)

(1.74) $

157.25 $

(124.10)

33.15 $

(2.39)

30.76 $

260.85 $

(221.69)

39.16 $

(4.69)

34.47 $

(308,649)

(262,466)

(239,804)

(86,721)

(71,548)

(969,188)

380,707

(58,109)

322,598

101.75 Sales dollars / Sales units

(89.48) (Total direct costs + Total allocated costs) / Sales units

12.27

(1.87) Share of unallocated costs / Sales units

10.40

Operating Profit by Item

$300

$250

$200

$150

Sales Price

Full cost

$100

Operating profit

$50

$0

-$50

Item1

Item2

Notes

1 Costs are reflected as (negative) in this section to better contrast with sales.

Item3

Item4

Item5

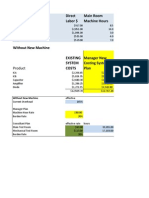

WHITE CELLS ARE ADJUSTABLE

Kristoffer Burnett - Certified Management Accountant, 2009-2011

Activity Based Costing Example

Item and Sales Information

Item

Sales units

Sales dollars

Item1

Item2

Item3

Item4

Item5

14,790

12,853

24,311

12,395

31,021

$ 2,298,366 $ 3,435,928 $ 3,822,905 $ 3,233,236 $ 3,156,387

Direct Cost Information

Direct materials

Direct labor

Activity Metric Breakdown

Number of products designed

Number of POs

Number of manufacturing batches

Number of shipments

Number of customers

378,953

598,320

1,696,401

294,637

1,129,207

888,315

1,040,302

600,617

The activity metrics are specified on the Analysis worksheet

Item1

Item2

Item3

Item4

1

128

155

141

155

32

39

36

40

29

36

32

35

7

8

7

8

938,312

868,180

Item5

Total

$ 5,183,175

3,250,069

Total

1

93

23

22

5

Notes

1 For the purposes of this example, a value of "1" means that this item was developed during the relevant period.

2

672

170

154

35

WHITE CELLS ARE ADJUSTABLE

Kristoffer Burnett - Certified Management Accountant, 2009 -2011

Activity Based Costing Example

Cost Outline

COGS Expenses

Direct materials

Direct labor

Indirect labor

Misc employee expenses

Supplies

Maintenance

Freight in

Depreciation

Utilities

Lease expense

Total COGS expenses

Operating Expenses

Salaries

Misc employee expense

Supplies

Maintenance

Shipping

Depreciation

Utilities

Lease expense

Total operating expenses

Amount

$ 5,183,175 Direct costs are broken out by item on the Data worksheet

3,250,069 "

499,999

100,000

157,142

271,428

642,856

499,999

328,571

357,142

$11,290,381

1

Amount

466,552

268,621

42,414

212,069

664,483

342,845

307,500

523,103

$ 2,827,587

$

Identify Activities

Activity

Research & development

Procure materials

Manufacturing

Shipping

Marketing/customer service

Metric

Number of products designed

Number of POs

Number of manufacturing batches

Number of shipments

Number of customers

Cost Breakdown by Activity

COGS Expenses

Direct materials

Direct labor

Indirect labor

Misc employee expenses

Supplies

Maintenance

Freight in

Depreciation

Utilities

Lease expense

Operating Expenses

Salaries

Misc employee expense

Supplies

Maintenance

Shipping

Depreciation

Utilities

Lease expense

Totals

Activity Metric

Number of products designed

Number of POs

Number of manufacturing batches

Number of shipments

Number of customers

Activity cost per measure

Research & development

$ 5,183,175

3,250,069

499,999

100,000

157,142

271,428

642,856

499,999

328,571

357,142

0%

0%

0%

0%

0%

0%

0%

0%

466,552

268,621

42,414

212,069

664,483

342,845

307,500

523,103

25%

20%

20%

25%

25%

20%

15%

20%

Procure materials

Manufacturing

Shipping

Marketing/customer service

Unallocated

Direct costs are already traceable to the individual items and do not need to be allocated

The sum of the percentages must = 100%

116,638

53,724

8,483

53,017

166,121

68,569

46,125

104,621

617,298

50%

30%

75%

30%

70%

55%

30%

40%

250,000

30,000

117,857

81,428

449,999

274,999

98,571

142,857

50%

35%

25%

70%

30%

45%

65%

55%

250,000

35,000

39,286

190,000

192,857

225,000

213,571

196,428

0%

0%

0%

0%

0%

0%

0%

0%

25%

15%

10%

15%

10%

15%

20%

15%

116,638

40,293

4,241

31,810

66,448

51,427

61,500

78,465

1,896,535

10%

20%

25%

15%

10%

25%

10%

20%

25%

10%

20%

20%

20%

30%

15%

25%

46,655

53,724

10,604

31,810

66,448

85,711

30,750

104,621

1,772,464

10,426

116,638

26,862

8,483

42,414

132,897

102,854

46,125

130,776

607,048

3,941.87

0%

0%

0%

0%

0%

0%

0%

0%

15%

25%

25%

25%

15%

10%

20%

20%

$

69,983

67,155

10,604

53,017

99,672

34,285

61,500

104,621

500,836

35

14,309.61

0%

35%

0%

0%

0%

0%

5%

5%

35,000

16,429

17,857

0%

10%

0%

0%

20%

0%

20%

0%

$

26,862

132,897

61,500

290,544

290,544 totals / Total of the Activity Metric on the Item Information worksheet

These totals are pulled from the Data worksheet

2

672

170

154

$

308,649

2,822

Notes

1 These figures should represent actual amounts spent. Therefore, they may not match what is shown on the income statement due to the use of accrual accounting.

2 For simplicities sake, only a handful of activities are initially recommended. This is to help assure that the costs associated with data collection

does not outweigh the benefits.

You might also like

- Financial Budget Example: White Cells Are AdjustableDocument5 pagesFinancial Budget Example: White Cells Are AdjustableImperoCo LLCNo ratings yet

- Product CostingDocument8 pagesProduct CostingHitesh RawatNo ratings yet

- Costing SampleDocument29 pagesCosting SampleAjiSuwandhiNo ratings yet

- Manufacturing SolutionsDocument8 pagesManufacturing SolutionsMothusi M NtsholeNo ratings yet

- Activity-Based Costing: A Guide to Calculating True Product CostsDocument3 pagesActivity-Based Costing: A Guide to Calculating True Product CostsRoikhanatun Nafi'ahNo ratings yet

- Hospital Activity Based CostingDocument29 pagesHospital Activity Based CostinggollasrinivasNo ratings yet

- TestDocument14 pagesTesthonest0988No ratings yet

- Cost and Management AccountingDocument84 pagesCost and Management AccountingKumar SwamyNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- Profitability of Products and Relative ProfitabilityDocument5 pagesProfitability of Products and Relative Profitabilityshaun3187No ratings yet

- Yuvraj Patil Section B 2010PGP435 Case: Bill French Mac IiDocument4 pagesYuvraj Patil Section B 2010PGP435 Case: Bill French Mac Iiyuveesp5207No ratings yet

- Product Costing ExampleDocument6 pagesProduct Costing ExampleChethaka Lankara SilvaNo ratings yet

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaNo ratings yet

- Target CostingDocument4 pagesTarget CostingBalamanichalaBmcNo ratings yet

- Value AnalysisDocument5 pagesValue AnalysisYAqoob DesaiNo ratings yet

- Harsh ElectricalsDocument7 pagesHarsh ElectricalsR GNo ratings yet

- 10E - Build A Spreadsheet 02-43Document2 pages10E - Build A Spreadsheet 02-43MISRET 2018 IEI JSCNo ratings yet

- Chapter 14 SolutionsDocument35 pagesChapter 14 SolutionsAnik Kumar MallickNo ratings yet

- Cost Accounting Fundamentals for Manufacturing BusinessesDocument21 pagesCost Accounting Fundamentals for Manufacturing Businessesabdullah_0o0No ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Case Case:: Colorscope, Colorscope, Inc. IncDocument4 pagesCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNo ratings yet

- Chapter 7 - Costing of Service Sector PDFDocument8 pagesChapter 7 - Costing of Service Sector PDFJohn Clefford LapezNo ratings yet

- Understand Support Department Cost Allocation MethodsDocument27 pagesUnderstand Support Department Cost Allocation Methodsluckystar251095No ratings yet

- Basic Cost Management ConceptsDocument15 pagesBasic Cost Management ConceptsKatCaldwell100% (1)

- Process Costing Assignment SolutionDocument16 pagesProcess Costing Assignment SolutionMudassirMehdiNo ratings yet

- Process Costing Examples (Matz Uzry)Document24 pagesProcess Costing Examples (Matz Uzry)Muhammad azeem100% (3)

- Cost-Volume-Profit Relationships1Document52 pagesCost-Volume-Profit Relationships1Kamrul Huda100% (1)

- Management Accounting Chapter 4Document53 pagesManagement Accounting Chapter 4yimer100% (1)

- Planning Plant ProductionDocument10 pagesPlanning Plant ProductionjokoNo ratings yet

- CVP Analysis SolutionsDocument23 pagesCVP Analysis SolutionsAdebayo Yusuff AdesholaNo ratings yet

- XyberSpace Consulting Inc RahulDocument5 pagesXyberSpace Consulting Inc RahulRatheesh MallayaNo ratings yet

- Photo Artistry BudgetsDocument10 pagesPhoto Artistry BudgetsAlee Di VaioNo ratings yet

- FRA Assignment UH18124Document26 pagesFRA Assignment UH18124Gourav ChatterjeeNo ratings yet

- Absorption & Direct CostingDocument22 pagesAbsorption & Direct CostingMuhammad azeemNo ratings yet

- CP - Cma CaseDocument5 pagesCP - Cma CaseYicong GuNo ratings yet

- MBA 504 Ch5 SolutionsDocument12 pagesMBA 504 Ch5 SolutionspheeyonaNo ratings yet

- Sanders CompanyDocument6 pagesSanders CompanyculadiNo ratings yet

- Activity Based Costing ModelDocument63 pagesActivity Based Costing ModelKnt Nallasamy GounderNo ratings yet

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- Cost Sheet: Solutions To Assignment ProblemsDocument3 pagesCost Sheet: Solutions To Assignment ProblemsNidaNo ratings yet

- Integrative Case - Relevant Cost PricingDocument4 pagesIntegrative Case - Relevant Cost PricingAudrey LouelleNo ratings yet

- Seligram Case Cost AccountingDocument3 pagesSeligram Case Cost Accountingsharkss521No ratings yet

- Cost AccountingDocument28 pagesCost Accountingrenjithrkn12No ratings yet

- Color ScopeDocument10 pagesColor Scopedharti_thakare100% (1)

- Cost-Volume-Profit AnalysisDocument50 pagesCost-Volume-Profit AnalysisMarkiesha StuartNo ratings yet

- Garrison Lecture Chapter 7Document64 pagesGarrison Lecture Chapter 7Enelyn Rose GigtintaNo ratings yet

- Donato's analysis of special order and ethical conflictDocument12 pagesDonato's analysis of special order and ethical conflictT Yoges Thiru MoorthyNo ratings yet

- Job Order Costing FINALDocument11 pagesJob Order Costing FINALmannu.abhimanyu3098No ratings yet

- Bill French Case FactsDocument4 pagesBill French Case FactsDaniel Francis BelmonteNo ratings yet

- 1.5performance Management PDFDocument232 pages1.5performance Management PDFsolstice567567No ratings yet

- 16.life Cycle CostingDocument6 pages16.life Cycle CostingSuraj ManikNo ratings yet

- Measuring and Assigning Support Department CostsDocument46 pagesMeasuring and Assigning Support Department CostsRavikumar Sampath100% (1)

- ch-3 To ch-5Document24 pagesch-3 To ch-5Riya DesaiNo ratings yet

- Wilkerson Company Break Even Analysis for Multi-product SituationDocument5 pagesWilkerson Company Break Even Analysis for Multi-product SituationYAKSH DODIANo ratings yet

- Activity-Based Costing: Demonstration Problems and Practice QuizDocument5 pagesActivity-Based Costing: Demonstration Problems and Practice QuizMike RobmonNo ratings yet

- Production Planning and Scheduling Complete Self-Assessment GuideFrom EverandProduction Planning and Scheduling Complete Self-Assessment GuideNo ratings yet

- Direct Material Variance ExampleDocument1 pageDirect Material Variance ExampleImperoCo LLCNo ratings yet

- Operating Budget ExampleDocument10 pagesOperating Budget ExampleImperoCo LLCNo ratings yet

- Matching Demand ExampleDocument1 pageMatching Demand ExampleImperoCo LLCNo ratings yet

- Managing Variability ExampleDocument2 pagesManaging Variability ExampleImperoCo LLCNo ratings yet

- Excessive Inventory AnalysisDocument23 pagesExcessive Inventory AnalysisImperoCo LLCNo ratings yet

- Managing Current Assets ExampleDocument2 pagesManaging Current Assets ExampleImperoCo LLCNo ratings yet

- Break Even Analysis WorksheetDocument2 pagesBreak Even Analysis WorksheetImperoCo LLCNo ratings yet

- Resource Utilization ExampleDocument4 pagesResource Utilization ExampleImperoCo LLCNo ratings yet

- Managing Investments WorksheetDocument7 pagesManaging Investments WorksheetImperoCo LLCNo ratings yet

- Direct Labor Variance ExampleDocument1 pageDirect Labor Variance ExampleImperoCo LLCNo ratings yet

- Job Order Costing ExampleDocument3 pagesJob Order Costing ExampleImperoCo LLCNo ratings yet

- Direct Material Variance ExampleDocument1 pageDirect Material Variance ExampleImperoCo LLCNo ratings yet

- Weighted Average Cost of Capital WorksheetDocument2 pagesWeighted Average Cost of Capital WorksheetImperoCo LLCNo ratings yet

- Departmental Expense Breakdown: Process Costing ExampleDocument5 pagesDepartmental Expense Breakdown: Process Costing ExampleImperoCo LLCNo ratings yet

- Overhead Variance ExampleDocument1 pageOverhead Variance ExampleImperoCo LLCNo ratings yet

- Flexible Budget ExampleDocument2 pagesFlexible Budget ExampleImperoCo LLCNo ratings yet

- Revenue Variance ExampleDocument1 pageRevenue Variance ExampleImperoCo LLCNo ratings yet

- Expected Value WorksheetDocument1 pageExpected Value WorksheetImperoCo LLCNo ratings yet

- Forecasting WorksheetDocument2 pagesForecasting WorksheetImperoCo LLCNo ratings yet

- Capital Budgeting WorksheetDocument2 pagesCapital Budgeting WorksheetImperoCo LLCNo ratings yet

- Linear Programming ExampleDocument1 pageLinear Programming ExampleImperoCo LLCNo ratings yet

- Monte Carlo Simulation ExampleDocument1 pageMonte Carlo Simulation ExampleImperoCo LLCNo ratings yet

- Operating Budget ExampleDocument10 pagesOperating Budget ExampleImperoCo LLCNo ratings yet

- Sukuk Al-SalamDocument5 pagesSukuk Al-SalamHasan Ali BokhariNo ratings yet

- Industrial Organization Chapter SummaryDocument54 pagesIndustrial Organization Chapter SummaryNaolNo ratings yet

- Bangladesh Business Structure ReportDocument32 pagesBangladesh Business Structure ReportMd. Tareq AzizNo ratings yet

- Not Payable in Case Subsidized Canteen Facilities Are ProvidedDocument1 pageNot Payable in Case Subsidized Canteen Facilities Are Providedsurabhiarora1No ratings yet

- Tiểu luận đã chỉnhDocument28 pagesTiểu luận đã chỉnhĐức HoàngNo ratings yet

- Summer internship report on ICA Pidilite JVDocument11 pagesSummer internship report on ICA Pidilite JVArnab Das100% (1)

- Labour Equipment & MaterialDocument33 pagesLabour Equipment & MaterialSaurabh Kumar SharmaNo ratings yet

- Walmart Enhances Supply Chain ManageDocument10 pagesWalmart Enhances Supply Chain Managecons theNo ratings yet

- Merit List Spring 2021Document6 pagesMerit List Spring 2021Rezwan SiamNo ratings yet

- PEN KY Olicy: Need For Open Skies PolicyDocument5 pagesPEN KY Olicy: Need For Open Skies PolicyDebonair Shekhar100% (1)

- Summer ProjectDocument21 pagesSummer ProjectDipesh PrajapatiNo ratings yet

- Indian Tax ManagmentDocument242 pagesIndian Tax ManagmentSandeep SandyNo ratings yet

- 1392628459421Document48 pages1392628459421ravidevaNo ratings yet

- Analysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Document13 pagesAnalysis of Methods That Enhance Sustainable Waste Management in Construction Process To Ensure Sustainable Living in Nigeria - Chapter 1Customize essayNo ratings yet

- Bluescope Steel 2016Document48 pagesBluescope Steel 2016Romulo AlvesNo ratings yet

- Barriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaDocument13 pagesBarriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaGlobal Research and Development ServicesNo ratings yet

- Bandai Namco Holdings Financial ReportDocument1 pageBandai Namco Holdings Financial ReportHans Surya Candra DiwiryaNo ratings yet

- Math 3 - EconomyDocument3 pagesMath 3 - EconomyJeana Rick GallanoNo ratings yet

- Discussion Papers in EconomicsDocument41 pagesDiscussion Papers in EconomicsdebasishNo ratings yet

- Recruitment Process for Salesperson Position at BIBICA CorporationDocument32 pagesRecruitment Process for Salesperson Position at BIBICA CorporationPhan Thao Nguyen (FGW CT)No ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAryan JaiswalNo ratings yet

- From press-to-ATM - How Money Travels - The Indian ExpressDocument14 pagesFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadNo ratings yet

- 3 Facts About Teachers in The Philippines AABDocument2 pages3 Facts About Teachers in The Philippines AABAndrewNo ratings yet

- Management Accounting Chapter 9Document57 pagesManagement Accounting Chapter 9Shaili SharmaNo ratings yet

- DEUTZ GROUP DRIVES FORWARDDocument170 pagesDEUTZ GROUP DRIVES FORWARDAditi DasNo ratings yet

- Sip Report MadhushreeDocument25 pagesSip Report MadhushreeMadhushreeNo ratings yet

- Questions With SolutionsDocument4 pagesQuestions With SolutionsArshad UllahNo ratings yet

- Applied Economics: January 2020Document18 pagesApplied Economics: January 2020Jowjie TVNo ratings yet

- Legend:: Bonus Computation (Shortcut) ExampleDocument4 pagesLegend:: Bonus Computation (Shortcut) ExampleJeremyDream LimNo ratings yet

- Social Studies Grade 10 Weeks 1-5 - Term 3Document58 pagesSocial Studies Grade 10 Weeks 1-5 - Term 3Daniel DowdingNo ratings yet