Professional Documents

Culture Documents

Customisation For Country

Uploaded by

sshaiju01Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customisation For Country

Uploaded by

sshaiju01Copyright:

Available Formats

Do the Following Customisation : Step 1: Check Calculation Procedure IMG >Financial Accounting>Financial Accounting Global Settings >Tax on Sales/Purchases>Basic

Settings >Check Calculation Procedure Tax procedures are available in SAP for most of the countries. In case a tax procedure is not defined for your country proceed as follows: In this go to Define Procedures Check for TaxINJ or TaxIN If it does not exist create a new one by copying it from TaxGB Step 2: Assign Country to CalculationProcedure IMG >Financial Accounting>Financial Accounting Global Settings >Tax on Sales / Purchases > Basic Settings >Check Calculation Procedure In this step we assign the calculation procedure created in the earlier step to the country. The country is the country of the company code. If you are living in India, then your country of the company code is India. Step 3. Define TaxCodes for Sales and Purchases IMG>Financial Accounting>Financial Accounting Global Settings >Tax for Sales and on Sales/Purchases >Calculation>Define Tax Codes Update the following:Define two Zero Tax Codes input and Output Tax codes. Go to OB40 Transaction code and Assign GL Account. Do this your problem will be solved.

You might also like

- Multiple Specifications Can Be Assigned To A Master Inspection Characteristic (MIC)Document15 pagesMultiple Specifications Can Be Assigned To A Master Inspection Characteristic (MIC)Sohail Hamid100% (3)

- Visibility White Paper For SAP Engineering Change Management v1 7Document17 pagesVisibility White Paper For SAP Engineering Change Management v1 7sshaiju01No ratings yet

- S4HANADocument87 pagesS4HANAsshaiju01100% (5)

- SmartSugar Sap 6589Document6 pagesSmartSugar Sap 6589Muhammad AfzalNo ratings yet

- HowTo MRP 88Document48 pagesHowTo MRP 88sshaiju01100% (2)

- Batch Management ConfigurationDocument71 pagesBatch Management Configurationabhirup_ghosh89% (9)

- Bill of MaterialsDocument25 pagesBill of Materialssshaiju01No ratings yet

- SAP PP PI For BeginnersDocument23 pagesSAP PP PI For Beginnerssshaiju01No ratings yet

- Batch Management ConfigurationDocument71 pagesBatch Management Configurationabhirup_ghosh89% (9)

- Visibility White Paper For SAP Engineering Change Management v1 7Document17 pagesVisibility White Paper For SAP Engineering Change Management v1 7sshaiju01No ratings yet

- Visibility White Paper For SAP Engineering Change Management v1 7Document17 pagesVisibility White Paper For SAP Engineering Change Management v1 7sshaiju01No ratings yet

- SAP Internal Order ConfigurationDocument36 pagesSAP Internal Order Configurationvish.sandy96% (27)

- SAP MRP - Materials Requirements PlanningDocument58 pagesSAP MRP - Materials Requirements Planningterrific104100% (2)

- ERPtips SAP123Document17 pagesERPtips SAP123tananthNo ratings yet

- Customisation For CountryDocument1 pageCustomisation For Countrysshaiju01No ratings yet

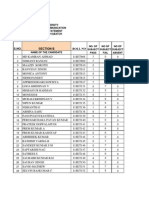

- S.NO. Section B Roll NoDocument4 pagesS.NO. Section B Roll Nosshaiju01No ratings yet

- SAP Internal Order ConfigurationDocument36 pagesSAP Internal Order Configurationvish.sandy96% (27)

- ECR Ignore Boot Config FinalDocument4 pagesECR Ignore Boot Config Finalsshaiju01No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)