Professional Documents

Culture Documents

Benetton

Uploaded by

Siddharth GuptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benetton

Uploaded by

Siddharth GuptaCopyright:

Available Formats

BENETTONS BOLD STRATEGY CASE STUDY

FBM II 5TH MARCH 2012

Mention the name Benetton to people over the age of 35, and chances are they'll remember shelves filled with brightly colored knitwear and, just as likely, some of the controversies over the brand's provocative advertising campaigns in the 1980s and '90s. In fashion terms, that was light-years ago. These days, upstart brands such as Zara and H&M are stealing the headlines and the allegiance of many younger shoppers as they storm the world from Moscow to Manila. But Benetton, which had sales last year of about $3 billion, hasn't gone away. The ads for its United Colors of Benetton stores are tamer and its growth less stellar, but even in middle age the brand turned 43 this year Benetton is proving itself to be a case study in business management. For behind the scenes, without fanfare, the four Benetton siblings, who started out in the 1950s making sweaters on their kitchen table with a borrowed knitting machine, have been engineering what is perhaps the hardest task facing any successful family business: passing the torch to the next generation. Luciano, Carlo, Gilberto and their sister Giuliana Benetton several years ago handed over day-today operations of Benetton Group, the apparel company they built from scratch, to professional nonfamily managers. Earlier this year, they went a big step further, by putting the finishing touches to a family-ownership structure that divides their combined assets into four equal sets of shareholdings. This new structure clearly indicates the lines of succession and lays down rules for family members who may in the future want to divest. Four of the 14 children, one per founding sibling, are now on the board of the family holding company, which is called Edizione. Only one of them is in an operational role: Alessandro Benetton, 45, the eldest son of Luciano, himself the eldest of the founders. For the past two years Alessandro has served as Benetton Group's executive vice chairman, overseeing top management and strategy. Putting Alessandro at the helm of the family's original business wasn't some dynastic reflex: he had to earn it. A graduate of Harvard Business School who spent several years at Goldman Sachs, he founded and grew a private-equity firm specializing in midsize Italian companies; its holdings currently total about $1.4 billion. Ending up at the family firm "was completely unexpected," he tells TIME in a rare interview. As a young man, there was never pressure on him to get involved; the unwritten rule was only that whatever he did, he should do it well. "Implicitly, we would live our own lives," he says. "If I went down the road and saw a Benetton store, it wasn't like I would say, Oh, that's mine. It was more like, Let's see if the windows are clean." Generational shifts in family businesses are notoriously tricky. A rule of thumb is that only 1 in 3 family firms survives the transition from the founding generation to the next, and only 1 in 10 makes the jump successfully from the second to the third generation. The more numerous and distant the cousins involved, the harder the task of keeping them all in line although sometimes the biggest problems come from the closest relatives. In India, brothers Mukesh and Anil Ambani, who split their father's business empire, have made headlines for months with their

sibling rivalry. In Germany, one of the most contentious business stories of the past year involved a feud between the two branches of the family that owns Porsche. In the northern Italian town of Ponzano where Benetton is based, near Treviso and a half-hour drive from Venice, discussion of the family and the roles played by individual members is treated with great delicacy. Executives there stress that even though Alessandro is the most prominent of the next generation, no decision has been made about which of the cousins will end up running the entire family holdings. For now, that's still Gilberto's role. He was the finance man of the founding generation, which worked brilliantly together as a team. Giuliana was responsible for the clothes, Carlo was in charge of production and Luciano, who posed naked in one ad, was the company's highly public face. As they grew rich on sweaters, the founders deliberately didn't stick to their knitting but diversified. Benetton Group now accounts for less than one-quarter of the family's corporate empire, which had sales exceeding $16 billion last year. The rest is made up of a clutch of different businesses. Buy a sandwich at the Empire State Building in New York City or Bangalore's new international airport, and a catering company called Autogrill that is 59% owned by the family will serve it up. In Italy, their holdings include stakes in the main business newspaper, the Pirelli tire company, Florence airport, an investment bank and the firm that manages the nation's 13 biggest railroad stations. Another major asset is the highwayconstruction and management company Autostrade, which runs more than 2,100 miles (3,400 km) of toll roads, including the Italian half of the Mont Blanc Tunnel. Some of the investments have done very well; others have tanked. The family lost several hundred million dollars with an ill-timed investment in Telecom Italia at the height of the Internet bubble. Another costly mistake was the acquisition of several sporting-goods companies, including Prince tennis rackets and Nordica ski gear, which have since been sold. Benetton Group has its ups and downs too. It still makes sweaters but it has also greatly expanded its product offerings to include a wide range of apparel as well as new brands such as fashion-forward Sisley and the leisurewear brand Playlife. Now in overall charge of the group, Alessandro has his hands full. The challenge today is to restore some of Benetton's luster and take the company global far more aggressively. Italy still accounts for 46% of sales Europe overall accounts for 80% at a time of sluggish economic growth and ferocious competition on its home turf from fast-fashion rivals. One of Alessandro's priorities has been to push Benetton more deeply into international markets with the help of strong local partnerships. In India he signed a deal with the Tata group, the country's largest conglomerate, which will open and manage Sisley stores; in the first half of this year, Benetton opened 95 new India outlets, despite the economic crisis. In Mexico, the partner is the billionaire Carlos Slim and his Sears Mexico group. Under a deal signed last year, Benetton aims to open 250 new standalone outlets and boutiques in Sears stores in Mexico. Alessandro is also targeting other Latin American countries as well as Turkey, Russia and China as significant future sources of growth. Conspicuously missing on this list is the U.S.; Benetton recently moved its U.S. headquarters from New York City to Miami, to be closer to the Latin American markets it's targeting.

International expansion is continuing despite the financial crisis, which has ravaged Benetton's bottom line. Profit in the first half of this year plunged 60% to $42 million from $115 million in the comparable period of 2008; sales in the same period were down 11% to just under $1.3 billion. The company has responded by putting in place a restructuring plan that mainly targets operating efficiency in its supply chain. Many financial analysts are lukewarm about the company's prospects because of the weak consumer-spending climate and the tough competition. "Benetton remains under pressure from multiple angles" is how Citigroup phrased it in a research note earlier this year that is typical of Wall Street sentiment. Alessandro in turn is critical of Wall Street and says the family fortunately ignored the advice of investment bankers to leverage up before the crisis. Alessandro has also had to sort out some tricky governance issues. The company's experience with nonfamily management hasn't been an unmitigated success. The first outside managing director, who came from automaker Fiat, served just three years before leaving, together with the chief financial officer, in 2006. A new CFO brought in from Burberry lasted just 21 months. As well as putting together a new management team, Alessandro has also sought to delineate more clearly the roles played by the family and by management. The new managing director, Gerolamo Caccia Dominioni, comes from Warner Music, while the current CFO, Alberto Nathansohn, jumped this year from luxury jeweler Bulgari. It's still too early to say how effective any of these steps will be. But Alessandro has already proved his abilities at the private-equity firm he founded, and Michael Porter, a Harvard Business School professor whom Alessandro describes as a mentor, says he thinks very highly of him. "He is a strategic thinker who has kept improving his skills as a manager and leader," Porter says. The key to the future, Alessandro says, is for Benetton to keep investing but also for it to retain its strong entrepreneurial culture. Ask him about strategy and he'll talk about changes but he always comes back to the idea of continuity. "Many people think that the way to start is by listing the things you want to change. My approach is to start from the list of things I thought it would be a big mistake to change," he says. He is, after all, a Benetton. As he says of his own ascent to prominence: "I love to describe this as a different chapter of the same book." One that, his shareholders and his cousins hope, will have a happier ending than many other family empires that ran into trouble when the new generation took over. CASE ANALYSIS Q1. Generational shifts in family businesses are notoriously tricky. Will the family survive the transition from the founding generation to the next? What according to you should be the Benetton strategy to manage their business going forward? Q2. How do you think Alessandros expansion plans inspite of declining profits will help the company keep pace with upstart brands such as Zara? Q3. Will he prove to be an effective leader or should they hire leadership from outside the Benetton family? Explain.

You might also like

- Tools of Industrial EngineeringDocument2 pagesTools of Industrial EngineeringSiddharth GuptaNo ratings yet

- Hula FileDocument2 pagesHula FileSiddharth GuptaNo ratings yet

- AimDocument1 pageAimSiddharth GuptaNo ratings yet

- D.H.U Levels in MeasurementDocument6 pagesD.H.U Levels in MeasurementSiddharth GuptaNo ratings yet

- Hula FileDocument2 pagesHula FileSiddharth GuptaNo ratings yet

- Hula FileDocument2 pagesHula FileSiddharth GuptaNo ratings yet

- Project Proposal: Title: Limitations & AssumptionsDocument1 pageProject Proposal: Title: Limitations & AssumptionsSiddharth GuptaNo ratings yet

- Notes: January February MarchDocument13 pagesNotes: January February Marchrettty15a3494No ratings yet

- 2013 CalendarDocument13 pages2013 CalendarSiddharth GuptaNo ratings yet

- Monthly Calendar 2011Document12 pagesMonthly Calendar 2011Desy HasrithaNo ratings yet

- What Attracts You To The Arrow Store ?Document7 pagesWhat Attracts You To The Arrow Store ?Siddharth GuptaNo ratings yet

- SDFGDocument7 pagesSDFGSiddharth GuptaNo ratings yet

- Notes: January February MarchDocument14 pagesNotes: January February Marchkyogesh07No ratings yet

- QuestionnaireDocument2 pagesQuestionnaireSiddharth GuptaNo ratings yet

- Cutting PlanDocument1 pageCutting PlanSiddharth GuptaNo ratings yet

- BRCS MRP Exit Strategy - Closure Planning Dec07Document18 pagesBRCS MRP Exit Strategy - Closure Planning Dec07Siddharth GuptaNo ratings yet

- Current Account BalanceDocument2 pagesCurrent Account BalanceSiddharth GuptaNo ratings yet

- Food and AlcoholDocument2 pagesFood and AlcoholSiddharth GuptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bep NowDocument25 pagesBep NowDenny KurniawanNo ratings yet

- PDF CropDocument1 pagePDF Cropr v subbaraoNo ratings yet

- 10 Activity 1 MRLFJRDDocument1 page10 Activity 1 MRLFJRDMurielle FajardoNo ratings yet

- 3 02.03.2020 NCLT Court No - IiiDocument5 pages3 02.03.2020 NCLT Court No - IiiVbs ReddyNo ratings yet

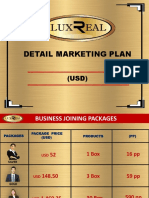

- Luxreal Detail Marketing Plan (2019) UsdDocument32 pagesLuxreal Detail Marketing Plan (2019) UsdTawanda Tirivangani100% (2)

- Chaotics KotlerDocument5 pagesChaotics KotlerAlina MarcuNo ratings yet

- Sales and Purchases 2021-22Document15 pagesSales and Purchases 2021-22Vamsi ShettyNo ratings yet

- The Feasibility of Merging Naga, Camaligan and GainzaDocument5 pagesThe Feasibility of Merging Naga, Camaligan and Gainzaapi-3709906100% (1)

- Fanshawe College Application FormDocument2 pagesFanshawe College Application Formdaljit8199No ratings yet

- Future of POL RetailingDocument18 pagesFuture of POL RetailingSuresh MalodiaNo ratings yet

- Hybrid Electric AircraftDocument123 pagesHybrid Electric AircraftSoma Varga100% (1)

- Od 429681727931176100Document5 pagesOd 429681727931176100shubhamsshinde01No ratings yet

- Masura 2Document2,156 pagesMasura 2ClaudiuNo ratings yet

- Rjis 16 04Document14 pagesRjis 16 04geo12345abNo ratings yet

- List of Maharashtra Pharrma CompaniesDocument6 pagesList of Maharashtra Pharrma CompaniesrajnayakpawarNo ratings yet

- IBM - Multiple Choice Questions PDFDocument15 pagesIBM - Multiple Choice Questions PDFsachsanjuNo ratings yet

- Economics of The Printing PressDocument39 pagesEconomics of The Printing PressNancy Xie100% (1)

- Monopolistic CompetitionDocument14 pagesMonopolistic CompetitionRajesh GangulyNo ratings yet

- Lesson 1 Business EthicsDocument21 pagesLesson 1 Business EthicsRiel Marc AliñaboNo ratings yet

- An Introduction To Private Sector Financing of Transportation InfrastructureDocument459 pagesAn Introduction To Private Sector Financing of Transportation InfrastructureBob DiamondNo ratings yet

- Master Coin CodesDocument19 pagesMaster Coin CodesPavlo PietrovichNo ratings yet

- Second Reading of Ordinance State Housing Law 01-05-16Document16 pagesSecond Reading of Ordinance State Housing Law 01-05-16L. A. PatersonNo ratings yet

- LANDON LTDDocument2 pagesLANDON LTDStephanie ChristianNo ratings yet

- 12 Risks With Infinite Impact PDFDocument212 pages12 Risks With Infinite Impact PDFkevin muchungaNo ratings yet

- 2012 - Communities Cagayan Incorporated Vs Nanol, GR 176791, November 14, 2012Document1 page2012 - Communities Cagayan Incorporated Vs Nanol, GR 176791, November 14, 2012Lyka Lim Pascua100% (1)

- Reflections Fall 2010Document84 pagesReflections Fall 2010campbell_harmon6178No ratings yet

- Internal Analysis of Nissan Motors Co - PPDocument1 pageInternal Analysis of Nissan Motors Co - PPvignesh GtrNo ratings yet

- STP DoneDocument3 pagesSTP DoneD Attitude KidNo ratings yet

- IRCTCs e-Ticketing Service DetailsDocument2 pagesIRCTCs e-Ticketing Service DetailsOPrakash RNo ratings yet

- Option To PurchaseDocument3 pagesOption To PurchaseAlberta Real EstateNo ratings yet