Professional Documents

Culture Documents

Deflation or Inflation (December 2010)

Uploaded by

bienvillecapOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deflation or Inflation (December 2010)

Uploaded by

bienvillecapCopyright:

Available Formats

CONFIDENTIAL

The most important question facing business owners and investors today

December 2010

DEFLATION OR INFLATION?

CONFIDENTIAL

DEFLATION OR INFLATION?

I have yet to see any problem, however complicated, which, when looked at the right way did not become still more complicated.

- Poul Anderson, author

Deflation or Inflation?| 2

CONFIDENTIAL

DEFLATION OR INFLATION?

EXECUTIVE SUMMARY The ultimate outcome of the epic struggle between deflation and inflation is arguably one of the worlds most important questions. Asset prices, business profitability and sovereign creditworthiness will all be affected. If either occur to a significant degree, the social fabric of society will likely be stretched, challenging existing political systems and currency regimes The disinflationary boom that existed between 1982 and 2007 has ended. This period, widely known as the Great Moderation, was highly beneficial to asset prices Strangely, although the increase in the money supply outpaced economic growth over this period (Slide 6), it did not incite higher consumer prices. This is largely because production capacity growth exceeded consumption (Slide 7) The result was a relatively steady and prolonged decline in inflation and interest rates (Slide 8), which reduced the cost of capital for businesses, as well as the discount rate used to value future cash flows for financial assets. A global asset boom ensued However, the boom was underpinned by an unsustainable amount of artificially cheap credit. As the credit bubble collapsed, the authorities around the world, particularly in the US, responded in a disproportionate and unparalleled fashion in attempt to forestall a debt deflation (Slide 10) Yet despite the unprecedented monetary and fiscal stimulus, the rate of measured inflation continues to decline (Slide 11) while the prospect of structurally high unemployment intensifies the current deflationary pressures (Slide 12). Productivity-focused businesses are also driving down wages costs (Slide 13) in order to protect profits Even as the Fed embarks on successive rounds of Quantitative Easing, broad money supply is rising less than nominal GDP (Slide 14), while the velocity of money remains depressed After years of accumulating debt, households are now in a deleveraging mode (Slide 15), an inherently deflationary process that removes credit from the financial system As a result, the economy is operating well below its estimated potential, resulting in a negative output gap (Slide 16)

Deflation or Inflation?| 3

CONFIDENTIAL

DEFLATION OR INFLATION?

SUMMARY CONTINUED However, despite the current deflationary pressures, the 1970s illustrates how inflation can arrive unexpectedly. Similar to today, the early part of the 70s also witnessed a negative output gap (Slide 18), low capacity utilization (Slide 19), a declining velocity of money (Slide 20) As a result, both inflation (Slide 21) and bond yields (Slide 22) were falling Although there is no evidence of inflation in reported indices (Slide 25), todays policies could ultimately be highly inflationary. The US government is running unprecedented budget deficits (Slide 26) while the Feds balance sheet will soon triple from its pre-crisis size (Slide 27) Recently, broad money supply has begun to pick up (Slide 28) And since QE began, commodity prices have also risen significantly (Slide 29), as have other hard currencies relative to the US dollar (Slide 30) Today, the deflationary forces of the collapse of the credit bubble have been met with an unprecedented inflationary response. Unfortunately, the ultimate outcome is unpredictable. Therefore, it is paramount that investors and business owners to be aware of todays challenges, and where possible, protect themselves sufficiently Interest rates tend to move in long cycles. Both inflation and the cost of credit has been falling for nearly 30 years (Slide 33). As a business owner or investor, are you prepared for a prolonged reversal? As the inflationary response has grown, the public has been losing confidence in uncollateralized paper money. Gold has risen to all-time highs (Slide 34). Is it anticipating another Great Inflation?

Deflation or Inflation?| 4

CONFIDENTIAL

THE GREAT MODERATION

CONFIDENTIAL

THE GREAT MODERATION

Until the late 90s, the money supply grew in line with the real economy. But following the Asian and LTCM crisis, money growth significantly outpaced economic growth

Real GDP vs. M2 Money Supply Index

275 250 225 200 175 150 125 100 75 90 93 96 M2 Index 99 02 Real GDP 05 08

Source: Bloomberg, Bienville Capital Management, LLC, Fielder Research & Management

Deflation or Inflation?| 6

CONFIDENTIAL

THE GREAT MODERATION

Ordinarily, excessive money growth would have ignited consumer prices. However, beginning in the mid-90s, capacity grew faster than consumption, which served to mitigate consumer prices. Other factors contributed to the macroeconomic tranquility. As a result, the monetary inflation appeared instead in asset prices

Total Capacity vs. Real Personal Consumption Expenditures

170 160 150 140 130 120 110 100 90 90 93 96 Total Capacity 99 02 05 08

Real Personal Consumption Expenditures

Source: Bloomberg, Bienville Capital Management, LLC, Fielder Research & Management

Deflation or Inflation?| 7

CONFIDENTIAL

THE GREAT MODERATION

Both inflation and interest rates fell resulting in a lower cost of capital and therefore higher economic profits for businesses. Additionally, lower interest rates increased the prevent value of future returns on assets. It appeared to be Goldilocks

US 10-Year Treasury Yields vs Inflation (CPI)

16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

Jan-80 Jan-83 Jan-86 Jan-89 Jan-92 Jan-95 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10

-2.0

10-Year Treasury Yields

Inflation (CPI)

Source: Bloomberg, Bienville Capital Management, LLC,

Deflation or Inflation?| 8

CONFIDENTIAL

DEFLATIONWILL IT HAPPEN HERE?

CONFIDENTIAL

DEFLATION?

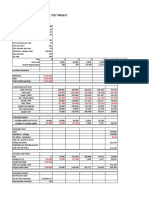

By every measure, the fiscal and monetary response today is disproportionate and unprecedented in history, nearly 4 times the response of the Great Depression where real growth contracted considerably more

Contraction Cycle Peak August 1929 May 1937 November 1948 July 1953 August 1957 April 1960 December 1969 November 1973 January 1980 July 1981 July 1990 March 2001 December 2007 Cycle Trough March 1933 June 1938 October 1949 May 1954 April 1958 February 1961 November 1970 March 1975 July 1980 November 1982 March 1991 November 2001 June 2009 in GDP -27.0% -3.4% -1.7% -2.7% -3.2% -1.0% -0.2% -3.1% -2.2% -2.6% -1.3% -0.2% -4.1% Length 43 13 11 10 8 10 11 16 6 16 8 8 18 Monetary 3.4% 0.0% -2.2% 0.7% 0.3% 0.9% 0.4% 0.3% 1.0% 1.3% 22.1%

Stimulus as % of GDP Fiscal 4.9% 2.2% 5.5% -1.4% 3.2% 1.0% 2.4% 3.1% 1.1% 3.5% 1.8% 5.9% 11.9% Total 8.3% 2.2% 3.3% -1.4% 3.2% 1.7% 2.7% 4.0% 1.5% 3.8% 2.8% 7.2% 31.0%

Source: Blackstone; Alan S. Blinder; Mark Zandi; The National Bureau of Economic Research; Lombard Street Research; Bienville Capital Management, LLC estimates

Deflation or Inflation?| 10

CONFIDENTIAL

DEFLATION?

However, as the structure of credit has collapsed, disinflationary pressures have persisted. Inflation has now been in a downtrend for 30 years and is currently below the level considered to be price stability by the Fed

US PCE Core Price Index (YOY)

12.0

10.0

8.0

6.0

4.0

2.0

0.0 60 65 70 75 80 85 90 95 00 05 10

The PCE price index is a United States-wide indicator of the average increase in prices for all domestic personal consumption. It is indexed to a base of 100 in 2005. Using a variety of data including U.S. Consumer Price Index and Producer Price Index prices, it is derived from the largest component of the Gross Domestic Product in the BEA's National Income and Produce Accounts, personal consumption expenditures. The less volatile measure is the core PCE price index which excludes the more volatile and seasonal food and energy prices

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 11

CONFIDENTIAL

DEFLATION?

With significant slack in the labor force, workers dont have pricing power. Rather, employers continue to drive productivity increases in the hopes of squeezing more out of fewer workers

US Employment Rate

11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0

Nov-98 Nov-00 Nov-02 Nov-04 Nov-06 Nov-08

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 12

CONFIDENTIAL

DEFLATION?

Therefore, labor costs are declining, intensifying deflationary pressures

US Unit Labor Costs Nonfarm Business Sector

(YOY % Change)

14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

Dec-79 Dec-82 Dec-85 Dec-88 Dec-91 Dec-94 Dec-97 Dec-00 Dec-03 Dec-06 Dec-09

-2.0 -4.0 -6.0

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 13

CONFIDENTIAL

DEFLATION?

Despite the efforts of the Federal Reserve, broad money supply has been growing at rates below nominal GDP. The credit creation process remains highly impaired

Money Supply M2 Index

(YOY % Change)

12.0

10.0

8.0

6.0

4.0

2.0

0.0

Nov-89 Nov-92 Nov-95 Nov-98 Nov-01 Nov-04 Nov-07

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 14

CONFIDENTIAL

DEFLATION?

Deleveraging, which has only just begun in the household sector, is a highly deflationary process as it removes money and credit from the financial system

Federal Reserve Consumer Credit Outstanding (in billions)

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0

Dec-09 Dec-19 Dec-29 Dec-39 Dec-49 Dec-59 Dec-69 Dec-79 Dec-89 Dec-99

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 15

CONFIDENTIAL

DEFLATION?

The output gap, an estimated measure of the US economys growth rate relative to potential, is still negative, implying more deflationary pressure to come

US Output Gap

4.0

2.0

0.0

Dec-89 Dec-91 Dec-93 Dec-95 Dec-97 Dec-99 Dec-01 Dec-03 Dec-05 Dec-07 Dec-09

-2.0

-4.0

-6.0

-8.0

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 16

CONFIDENTIAL

THE LESSON OF THE 70S

CONFIDENTIAL

THE LESSON OF THE 70S

Similar to today, the output gap between 1970 - 1972 was negative, suggesting inflation was not a threat

US Output Gap (1970-1980)

6.0

4.0

2.0

0.0 70 -2.0 71 72 73 74 75 76 77 78 79

-4.0

-6.0

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 18

CONFIDENTIAL

THE LESSON OF THE 70S

Utilization rates had also fallen from the previous years levels, implying an abundance of capacity. However, despite the overall economys excess capacity, bottlenecks were being created in critical sectors

US Capacity Utilization (% of Total Capacity)

90.0

85.0

80.0

75.0 67 68 69 70 71

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 19

CONFIDENTIAL

THE LESSON OF THE 70S

The velocity of money, a key ingredient to inflation, was also falling

Velocity of Broad Money (M2 Index)

1.80

1.75

1.70

1.65

1.60

1.55

1.50 59 61 63 65 67 69 71

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 20

CONFIDENTIAL

THE LESSON OF THE 70S

However, despite widely available economic data suggesting disinflation, the Great Inflation was unleashed in 1973

US Consumer Price Index (YOY % Change, 1960 - 1980)

16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 60 63 66

Nixon de-links the end of Bretton Woods

69 72 75 78

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 21

CONFIDENTIAL

THE LESSON OF THE 70S

Similar to economic indicators, interest rates failed to anticipate the ensuing inflation, before subsequently rocketing higher and peaking at nearly 16%. Higher borrowing rates decreased economic profits, which dis-incentivized business from investing in more productive capacity

US Government 10-Year Yield

16.0

14.0

12.0

10.0

8.0

6.0

4.0

Nixon de-links the end of Bretton Woods

2.0 62 64 66 68 70 72 74 76 78 80 82 84

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 22

CONFIDENTIAL

IS INFLATION BUILDING?

CONFIDENTIAL

IS INFLATION BUILDING?

WHAT IS INFLATION?

Inflation is a debasement of the currency. It isnt too much money chasing too few goods. Its simply too much money

Deflation or Inflation?| 24

CONFIDENTIAL

IS INFLATION BUILDING?

Conveniently, the Fed has shifted its emphasis from the PCE Deflator to Core CPI, which has a significantly larger weight to Owners Equivalent Rent (OER). The implication is that actual inflation may be understated

CPI Owners Equivalent Rent (YOY)

7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 83 -1.0 86 89 92 95 98 01 04 07

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 25

CONFIDENTIAL

IS INFLATION BUILDING?

Fiscal deficits, which are inherently inflationary, have exploded. Much of the increase is now structural, suggesting politically difficult changes are required in order to reduce the annual deficit to sustainable levels

US Treasury Budget Deficit or Surplus (as a % of GDP)

4.0 2.0 0.0 Dec-68 -2.0 -4.0 -6.0 -8.0 -10.0 -12.0 -14.0 Dec-73 Dec-78 Dec-83 Dec-88 Dec-93 Dec-98 Dec-03 Dec-08

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 26

CONFIDENTIAL

IS INFLATION BUILDING?

As a result of QE2, the Feds balance sheet will expand to nearly $3 trillion, or nearly 20% of GDP. The likelihood of perfectly timing the removal of stimulus is small. However, the potential unintended consequences are large

Federal Reserve Bank Total Assets

$2,500,000

$2,000,000

$1,500,000

$1,000,000

$500,000

$94 97 00 03 06 09

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 27

CONFIDENTIAL

IS INFLATION BUILDING?

Money supply has begun to rise

M2 Money Supply Index

$8,900

$8,800

$8,700

$8,600

$8,500

$8,400 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 28

CONFIDENTIAL

IS INFLATION BUILDING?

Since Quantitative Easing began, food and energy prices are up nearly 50% while the CPI is reporting a only 2.9% cumulative increase

Crude Oil & CRB Food Index (Rebased to 100)

180

160

140

120

100 Mar-09 May-09 Aug-09 Crude Oil Nov-09 Feb-10 May-10 CRB Food Index Aug-10

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 29

CONFIDENTIAL

IS INFLATION BUILDING?

While hard currencies have also risen significantly, reflecting a debasement in the US dollar

Appreciation versus US Dollar (March 2009 November 2010)

60%

50%

40%

30%

20%

10%

0%

Australian Dollar Brazilian Real Canadian Dollar Singapore Dollar Gold

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 30

CONFIDENTIAL

CONCLUDING THOUGHTS

CONFIDENTIAL

CONCLUDING THOUGHTS

Everyone has a game plan until they get hit in the mouth - Mike Tyson

Deflation or Inflation?| 32

CONFIDENTIAL

CONCLUDING THOUGHTS

Interest rates have been declining for nearly 30 years. In response to each crisis, the Fed has used them as a tool to entice borrowers to incur more debt and invest in more capacity. As an investor or business operator, it is imperative to ask yourself, Are you prepared for the inverse of this chart?

US Government 10-Year Yield

16.0 14.0 12.0 87 Crash 10.0 8.0 6.0 4.0 2.0 0.0 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 S&L Crisis / Gulf War I Mexican Peso Crisis Russia Default / LTCM Failure Dot.com Bust 9-11 Subprime Credit Crisis Penn Square Bank Failure Continental Illinois Failure

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 33

CONFIDENTIAL

CONCLUDING THOUGHTS

Today, gold is at all-time highs while interest rates are at generational lows. Both cannot be correct. Is gold anticipating another great inflation? Or is it reflecting declining confidence in uncollateralized currencies?

Gold (in USD)

1,600 1,400 1,200 1,000 800 600 400 200 0 01 02 03 04 05 06 07 08 09 10

Source: Bloomberg, Bienville Capital Management, LLC

Deflation or Inflation?| 34

CONFIDENTIAL

CONCLUDING THOUGHTS

Given the magnitude of the current global imbalances and the enormity of the fiscal and monetary response, price stability over the medium-to-long term is arguably the least likely outcome Recently, deflationary pressures have had the upper hand. However, prices in critical assets and sectors are rising, and in contrast to previous deflationary periods, today central banks have the ability and willingness to print money Correctly positioning an investment portfolio or business for the inevitable outcome of either continued deflation or significantly higher inflation is of critical importance, yet doing so too aggressively could prove disastrous should the other unfold Unfortunately, at this time, it remains impossible to accurately identify which side we will fall. Although higher inflation seems more likely, flexibility remains key As the analysis of the 1970s demonstrated, a significant inflation can occur with little-to-no warning signs. Estimated outputs gaps were of no help. Anticipating it would have required a fundamental understanding of the likely ultimate outcome of the policies implemented at the time Ironically, the outcome of Quantitative Easing could have the inverse of its intended effectthat is, increasing the things we need (i.e. commodities) which reduces real incomes and economic growth, while having only a negligible impact on the things we already own (i.e. residential real estate) We are at a critical juncture in economic history. Do you believe policymakers have the political will, as well as the necessary foresight to successfully navigate todays challenging environment?

Deflation or Inflation?| 35

CONFIDENTIAL

FIRM AND CONTACT INFORMATION

Bienville Capital Management, LLC is an SEC-registered, independent investment advisory firm offering sophisticated and customized investment solutions to high-net-worth and institutional investors. The members of the Bienville team have broad and complementary expertise in the investment business, including over 100 years of collective experience in private wealth management, institutional investment management, trading, investment banking and private equity. We have established a performance-driven culture focused on delivering exceptional advice and service to a select number of investors. We communicate candidly and frequently with our clients in order to articulate our views. Our clients include individual and institutional investors, high-net-worth families with complex needs, entrepreneurs and professionals with at least $1 million of investable assets. Bienville Capital Management has offices in New York, NY and Mobile, AL.

New York

Bienville Capital Management, LLC 32 Avenue of the Americas, Ste 2100 New York, NY 10013 Phone: 212.226.7348

Alabama

Bienville Capital Management, LLC 64 North Royal Street Mobile, AL 36602 Phone: 251.445.8139

Cullen Thompson cullen.thompson@bienvillecapital.com Donald Stoltz donald.stoltz@bienvillecapital.com

www.bienvillecapital.com

Deflation or Inflation?| 36

CONFIDENTIAL

DISCLAIMER

Bienville Capital Partners, LP (the Fund) is offered in reliance upon an exemption from registration under the U.S. Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. This document is not intended to be, nor should it be construed or used as, an offer to sell or a solicitation of any offer to buy securities of the Fund. No offer or solicitation may be made prior to the delivery of the Confidential Private Offering Memorandum of the Fund (the Memorandum). Securities of the Fund shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. No public or other market is available or is likely to develop for securities of the Fund. Furthermore, securities of the Fund have limited withdrawal rights and are not transferable without the prior written consent of Bienville Capital GP, LLC (the "General Partner"). Accordingly, an investment in the Fund is a relatively illiquid investment. This document is confidential, intended only for the person to whom it has been provided, and under no circumstance may be shown, transmitted or otherwise provided to any person other than the authorized recipient. While all information in this document is believed to be accurate, the General Partner makes no express warranty as to its completeness or accuracy and is not responsible for errors in the document. Furthermore, the information is furnished as of the date shown or cited, and the General Partner does not undertake any responsibility for updating the information herein. This document is provided for informational purposes only, does not contain all material information about the Fund is subject to change without notice. Furthermore, estimates, investment strategies and views expressed in this document are based upon current market conditions and/or may be based on information provided by unaffiliated third parties. In making an investment decision, investors must rely on their own examination of the Fund and the terms of the offering, including, but not limited to, the merits and risks involved. The interests of the Fund have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this presentation. Any representation to the contrary is a criminal offense. The information contained herein does not take into account the particular objectives or circumstances of any specific prospective investor and should not be construed as accounting, legal, tax or investment advice. Prospective investors should consult their tax, legal, accounting or other advisors about the matters discussed herein. An investment in the Fund may not be suitable for all investors and eligibility criteria will apply. No person has been authorized to give any information or to make any representation, warranty, statement or assurance not contained in the Memorandum and any such information may not be relied upon. This document contains information about the Funds investment objective, programs, guidelines and restrictions. Material economic conditions, market forces, and other factors may cause the Fund to adjust such objective, programs, guidelines and restrictions as necessary. No guarantee or representation is made that the Funds investment programs, including, without limitation, its investment objectives, diversification strategies or risk management goals, will be successful, and investment results may vary substantially over time. AN INVESTMENT IN THE FUND IS A SPECULATIVE INVESTMENT, INVOLVES SIGNIFICANT RISKS AND IS SUITABLE ONLY FOR THOSE PERSONS WHO CAN BEAR THE ECONOMIC RISK OF THE LOSS OF THEIR ENTIRE INVESTMENT AND WHO HAVE A LIMITED NEED FOR LIQUIDITY. THERE CAN BE NO ASSURANCE THAT THE FUND WILL ACHIEVE ITS INVESTMENT OBJECTIVE.

Deflation or Inflation?| 37

You might also like

- Top 10 Fixed Return Option Trading Strategies by Kavita MehataniDocument53 pagesTop 10 Fixed Return Option Trading Strategies by Kavita Mehatanitarun gautam78% (9)

- Bridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessDocument0 pagesBridgewater Daily Observations 4.28.2009 - A Modern D-Day ProcessChad Thayer V100% (2)

- The End of An Era: Uarterly EtterDocument10 pagesThe End of An Era: Uarterly EtterthickskinNo ratings yet

- 162 009Document2 pages162 009Angelli Lamique75% (4)

- Global Economics Weekly: From The Great Recession' To The Great Stagnation'?Document8 pagesGlobal Economics Weekly: From The Great Recession' To The Great Stagnation'?hotadidas5851No ratings yet

- The Theory of Corporate Finance by Jean Tirole Chapter 1 Notes - Corporate GovernanceDocument10 pagesThe Theory of Corporate Finance by Jean Tirole Chapter 1 Notes - Corporate GovernanceRupesh Sharma100% (1)

- Leases - Financial AccountingDocument34 pagesLeases - Financial AccountingMaria Danielle Fajardo Cuyson100% (2)

- Sinco Vs Longa & Tevez 1928 (Guardianship) Facts:: Specpro Digest - MidtermDocument2 pagesSinco Vs Longa & Tevez 1928 (Guardianship) Facts:: Specpro Digest - MidtermAngelic ArcherNo ratings yet

- Project Report On Impact of Recession in IndiaDocument25 pagesProject Report On Impact of Recession in Indiasimran sandhu82% (11)

- Pineapple Processing PlantDocument25 pagesPineapple Processing PlantMidul Khan100% (3)

- Danish RAPDocument40 pagesDanish RAPsalman0737100% (6)

- Rental Power Plant CurruptionDocument28 pagesRental Power Plant Curruptiontanzi7271No ratings yet

- 2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonDocument2 pages2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonPranjayNo ratings yet

- The Next Consumer Recession: Preparing NowDocument22 pagesThe Next Consumer Recession: Preparing NowPanther MelchizedekNo ratings yet

- INFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockDocument24 pagesINFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockVas RaNo ratings yet

- Economic Assignment MaterialDocument5 pagesEconomic Assignment MaterialAnmol killerNo ratings yet

- Bernanke 20121120 ADocument16 pagesBernanke 20121120 Atax9654No ratings yet

- Recession Full Data Report and Financial and Market Analysis DoneDocument46 pagesRecession Full Data Report and Financial and Market Analysis Doneamitsaini03No ratings yet

- Global Economic Trend Analysis - Contained DepressionDocument14 pagesGlobal Economic Trend Analysis - Contained DepressionMeishizuo ZuoshimeiNo ratings yet

- Review of Global EconomyDocument31 pagesReview of Global EconomyAnanthNo ratings yet

- Causes of Business CycleDocument17 pagesCauses of Business CycletawandaNo ratings yet

- Lowe Comments On InflationDocument12 pagesLowe Comments On InflationJayant YadavNo ratings yet

- Economic Recession in India: A Net Based Commentary: What The Issue Is All About?Document9 pagesEconomic Recession in India: A Net Based Commentary: What The Issue Is All About?Anshu ManzNo ratings yet

- Crisis SummariesDocument23 pagesCrisis Summariesa24dkNo ratings yet

- !!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentDocument6 pages!!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentGeneration GenerationNo ratings yet

- RecessionDocument55 pagesRecessionsinhasaumya100% (1)

- Special Macro Comment Inflated FearsDocument4 pagesSpecial Macro Comment Inflated FearsFlametreeNo ratings yet

- The Anti-Bubble Years (Part II)Document15 pagesThe Anti-Bubble Years (Part II)KJNo ratings yet

- Sustanability of Manufacturing Companies During Recession Period Orignal VersionDocument27 pagesSustanability of Manufacturing Companies During Recession Period Orignal VersionSuez GaekwadNo ratings yet

- Economic Enironment For Business ReportDocument47 pagesEconomic Enironment For Business Reportutpala123456No ratings yet

- Why Has Consumption Remained ModerateDocument64 pagesWhy Has Consumption Remained ModerateTasnim MahinNo ratings yet

- RecessionDocument6 pagesRecessionWilly RaoulNo ratings yet

- Global Macro Outlook: December 2019Document16 pagesGlobal Macro Outlook: December 2019bobbyhardianNo ratings yet

- Economist Insights: The Employment EnigmaDocument2 pagesEconomist Insights: The Employment EnigmabuyanalystlondonNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicykafiNo ratings yet

- Chapter 17 A Overview of Macroeconomics 2014Document38 pagesChapter 17 A Overview of Macroeconomics 2014Jemimah Rejoice LuangoNo ratings yet

- AMM - Q1 2010 LetterDocument4 pagesAMM - Q1 2010 LetterGlenn BuschNo ratings yet

- The Broyhill Letter - Part Duex (Q2-11)Document5 pagesThe Broyhill Letter - Part Duex (Q2-11)Broyhill Asset ManagementNo ratings yet

- LCG 2011 Economic OutlookDocument7 pagesLCG 2011 Economic OutlookC. Bradley ChapmanNo ratings yet

- Deflation and Its Economics SignificanceDocument19 pagesDeflation and Its Economics SignificanceAkshayNo ratings yet

- Ijrmec 881 32616Document14 pagesIjrmec 881 32616Nguyễn Viết ĐạtNo ratings yet

- So, What Is Inflation? and Why You Should Know About It?Document3 pagesSo, What Is Inflation? and Why You Should Know About It?Saurabhkumar SinghNo ratings yet

- Key Issues in The Global Economy 2011: Lecture Two AUGUST 2011Document109 pagesKey Issues in The Global Economy 2011: Lecture Two AUGUST 2011MiltonThitswaloNo ratings yet

- Basics Recession PDFDocument2 pagesBasics Recession PDFaila jasmin malabananNo ratings yet

- The End of Buy and Hold ... and Hope Brian ReznyDocument16 pagesThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaNo ratings yet

- MECO 121-Module 9 Introduction To MacroeconomicsDocument20 pagesMECO 121-Module 9 Introduction To MacroeconomicszainabmossadiqNo ratings yet

- The Outlook For Recovery in The U.S. EconomyDocument13 pagesThe Outlook For Recovery in The U.S. EconomyZerohedgeNo ratings yet

- #Business Economics Session MacroeconomicsDocument52 pages#Business Economics Session MacroeconomicsNADExOoGGYNo ratings yet

- Int Econ Final ExamDocument9 pagesInt Econ Final ExamWilson LiNo ratings yet

- 5 6 Special Topics in FINMGT PDFDocument11 pages5 6 Special Topics in FINMGT PDFramon olpotNo ratings yet

- Deflation Making Sure It Doesn't Happen HereDocument13 pagesDeflation Making Sure It Doesn't Happen Herefangliyuan123No ratings yet

- Chapter 10 The Economy and Business ActivityDocument29 pagesChapter 10 The Economy and Business ActivityLuis SilvaNo ratings yet

- Mgt333 Term PaperDocument18 pagesMgt333 Term PaperattractivemeNo ratings yet

- Fed Full SpeechDocument22 pagesFed Full SpeechZerohedgeNo ratings yet

- Quantitative Easing - A Blessing or A Curse?Document11 pagesQuantitative Easing - A Blessing or A Curse?David S ChenNo ratings yet

- Lectura KrugmanDocument2 pagesLectura KrugmanJHON FREDY TOVAR QUINTERONo ratings yet

- Our FrameworkDocument5 pagesOur FrameworkbienvillecapNo ratings yet

- Home Construction Sinks, Building Permits DownDocument30 pagesHome Construction Sinks, Building Permits DownAlbert L. PeiaNo ratings yet

- Business Cycles: Prof. (DR) Vandana BhavsarDocument34 pagesBusiness Cycles: Prof. (DR) Vandana BhavsarAKHIL JOSEPHNo ratings yet

- Lecture Notes-EconomicsDocument11 pagesLecture Notes-EconomicsHaniyaAngelNo ratings yet

- Federal Deficits and DebtDocument10 pagesFederal Deficits and DebtSiddhantNo ratings yet

- What Macroeconomics Is All About ?: Ratna K. ShresthaDocument36 pagesWhat Macroeconomics Is All About ?: Ratna K. ShresthaShavon ZhangNo ratings yet

- The Economic RecessionDocument6 pagesThe Economic RecessionAnak BaruNo ratings yet

- Effects of Global Crisis Unemployment: Social BenefitsDocument3 pagesEffects of Global Crisis Unemployment: Social BenefitsJay-r Mercado ValenciaNo ratings yet

- Effects of Global Crisis Unemployment: Social BenefitsDocument3 pagesEffects of Global Crisis Unemployment: Social BenefitsJay-r Mercado ValenciaNo ratings yet

- America RecessionDocument9 pagesAmerica RecessionashulibraNo ratings yet

- Conflict Between Economic Growth and InflationDocument17 pagesConflict Between Economic Growth and Inflationsatish4647No ratings yet

- Bienville Macro Review (U.S. Housing Update)Document22 pagesBienville Macro Review (U.S. Housing Update)bienvillecapNo ratings yet

- China's Paradox (October 2012)Document8 pagesChina's Paradox (October 2012)bienvillecapNo ratings yet

- The Lost Decade - Commentary & Strategy (October 2009)Document6 pagesThe Lost Decade - Commentary & Strategy (October 2009)bienvillecapNo ratings yet

- Bienville Capital Managment - Presentation (December 2010)Document52 pagesBienville Capital Managment - Presentation (December 2010)bienvillecapNo ratings yet

- Our FrameworkDocument5 pagesOur FrameworkbienvillecapNo ratings yet

- European UpdateDocument5 pagesEuropean UpdatebienvillecapNo ratings yet

- The Demand and Need For Transparency and Disclosure in Corporate GovernanceDocument9 pagesThe Demand and Need For Transparency and Disclosure in Corporate GovernanceAnis Ur Rehman KakakhelNo ratings yet

- Interim Order in The Matter of Goldmine Industries LimitedDocument14 pagesInterim Order in The Matter of Goldmine Industries LimitedShyam SunderNo ratings yet

- Finacial ManagmentDocument6 pagesFinacial ManagmentbhattbhadrikNo ratings yet

- Financial Management in Sick UnitsDocument22 pagesFinancial Management in Sick UnitsAnkit SinghNo ratings yet

- Chapter 8: Sources of Capital For Entrepreneurs: True/FalseDocument5 pagesChapter 8: Sources of Capital For Entrepreneurs: True/Falseelizabeth bernalesNo ratings yet

- The Time Value of Money: All Rights ReservedDocument55 pagesThe Time Value of Money: All Rights ReservedNad AdenanNo ratings yet

- HBR500Document11 pagesHBR500Harsh kapilaNo ratings yet

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- Capital Budgeting Example ExcelDocument1 pageCapital Budgeting Example ExcelNgoc Hong DuongNo ratings yet

- RIA ComplianceDocument3 pagesRIA ComplianceriacomplianceNo ratings yet

- Balance SheetDocument2 pagesBalance SheetPro ResourcesNo ratings yet

- EW00467 Annual Report 2018Document148 pagesEW00467 Annual Report 2018rehan7777No ratings yet

- Financial Services BBM NotesDocument44 pagesFinancial Services BBM Notesmanjunatha TKNo ratings yet

- Final Account GA2Document14 pagesFinal Account GA2Ashwin KushwahNo ratings yet

- Making Money December 2016Document116 pagesMaking Money December 2016Rhonda BushNo ratings yet

- Dorman Long Newsletter MAY 15...Document26 pagesDorman Long Newsletter MAY 15...jesusgameboyNo ratings yet

- Nflplayers Finance 16412 TrueDocument7 pagesNflplayers Finance 16412 Trueapi-313709590No ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Pgdba - Fin - Sem III - Capital MarketsDocument27 pagesPgdba - Fin - Sem III - Capital Marketsapi-3762419100% (1)

- 1 Controlling What Is Controlling?Document16 pages1 Controlling What Is Controlling?John Lester SalongaNo ratings yet

- Euromoney Institutional Investor PLC The Journal of Private EquityDocument11 pagesEuromoney Institutional Investor PLC The Journal of Private EquityJean Pierre BetancourthNo ratings yet

- Annual Report Aneka Tambang Antam 2015Document670 pagesAnnual Report Aneka Tambang Antam 2015Yustiar GunawanNo ratings yet