Professional Documents

Culture Documents

The Blue Bond Proposal (English)

Uploaded by

TheoTheodoridesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Blue Bond Proposal (English)

Uploaded by

TheoTheodoridesCopyright:

Available Formats

ISSUE 2010/03 MAY 2010

bruegelpolicybrief

THE BLUE BOND PROPOSAL

by Jacques Delpla SUMMARY How can the euro areas return to fiscal sustainability be organ-

ised in view of soaring debt levels and the sovereign debt crisis? How can we finance our debts efficiently, not least to prevent debt crises in weaker and Jakob von Weizscker countries where high debt levels compounded by a hike in risk premiums Research Fellow at Bruegel jvw@bruegel.org on government bonds can create a debt trap? This looks like a classic dilemma. European solidarity with the most vulnerable European Union countries runs the risk of further weakening the incentives for individual countries to pursue fiscally sustainable policies. While not a quick fix, our Blue Bond proposal charts an incentive-driven and durable way out of this dilemma while helping prepare the ground for the rise of the euro as an important reserve currency, which could reduce borrowing costs for everybody involved.

POLICY CHALLENGE

Conseil dAnalyse conomique, Paris jacques.delpla@orange.fr

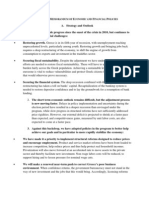

Blue Bonds: EU countries should pool up to 60 percent of GDP of their national debt under joint and several liability as senior sovereign debt, thereby reducing the borrowing cost for that part of the debt. Red debt: any national debt beyond a countrys Blue Bond allocation should be issued as national and junior debt with sound procedures for an orderly default, thus increasing the marginal Split of 2011 debt levels into red and blue debt cost of public borrowing % GDP 140 and helping to enhance Blue debt fiscal discipline. 120 Red debt Independent Stability 100 Council (ISC): Blue Bond al80 locations to member states 60 are to be proposed by an 40 ISC and voted on by 20 member states parliaments in order to safe0 guard fiscal responsibility.

GR MT IT PT FR IE DE ES SK BE SI NL LU AT CY FI

Source: DG ECFIN, authors. EA = euro area.

EA

THE BLUE BOND PROPOSAL

bruegelpolicybrief

02

THE SOVEREIGN BOND CRISIS in the euro area calls for both lower and higher sovereign bond yields. Lower yields are desirable because they would reduce the cost of financing government debt for European taxpayers. This is particularly relevant in the years ahead, when the financing of the accumulated debt will remain a serious burden even once deficits have come back to sustainable levels. And higher bond yields are desirable as an early warning signal to those countries on an unsustainable fiscal path. If financial markets are failing Greece now, they failed Greece even more before the crisis by continuing to provide cheap funding while fiscal policy was reckless. Achieving both higher and lower yields at the same time would appear to be impossible. Yet, in this paper we argue that our Blue Bond proposal can do just that. Before explaining what it is, let us first explore how the two objectives might be pursued separately. The cost of borrowing could be lowered significantly by pooling government debt within the euro area, creating a euro bond. The yield of that euro bond would likely be lower than the weighted average of the national bond yields. The euro bond would become a highly liquid asset with a volume of available debt rivaling the extremely successful US Treasury bond. This would help the euros rise as a second global reserve currency. Conversely, the cost of borrowing

should be increased for a country pooling one part of the debt while on a reckless borrowing path by ringfencing another part. disentangling sovereign debt responsibilities within the euro area Specifically, we propose that eligito the extent that the no-bailout ble EU governments should pool up clause becomes credible not only to 60 percent of GDP of their govde jure (which it is) but also de ernment debt in the form of a facto, which presently is not the common European government case as recent events show. bond, which we call the Blue Bond. Currently, euro-area members Any public debt in excess of their have collectively Blue Bond allocation come to agree that It needs to be credibly national governthe political and eco- established that ments would have to nomic cost of not at issue in junior nasovereign bankruptcy least attempting to tional debt, which we bail out Greece is so for euro-area memwill call the red debt bers is something enormous that it in the remainder of would be irresponsi- that has been proper- this paper. ble not to try. The ly planned for. reason is that in the Section 1 outlines present setting any sovereign de- the basic economics of the proposfault is likely to have systemic al. In section 2, the impact of consequences. To avoid these, it greater liquidity in the Blue Bond needs to be credibly established on borrowing cost is discussed. In that sovereign bankruptcy for the section 3, suitable institutional members of the euro area is some- underpinnings of our proposal are thing that has been properly explored and a transition regime is planned for rather than something proposed. Finally, in section 4, the that threatens the very existence likely implications of our proposal of the euro area. Such advance for different types of participating planning needs to concern the countries are explored. bankruptcy procedure itself and needs to reduce the vulnerability 1 THE BASIC ECONOMICS OF THE BLUE BOND of the European banking system to a sovereign-debt crisis. Also, the risk of contagion within the euro A country's total borrowing costs area needs to be brought under can be calculated as the product of the stock of outstanding debt better control. times the average interest rate to In a nutshell: cheaper borrowing be paid on that debt stock, as requires more integration whereas Figure 1 on the next page shows. more expensive borrowing requires measures to avoid sys- We propose that this essentially temic consequences. On that homogenous government debt basis, we now try to pursue both should be broken down into two objectives at the same time by tranches: a senior (blue) tranche

THE BLUE BOND PROPOSAL

up to a certain debt threshold which is assumed to be 60 percent of GDP in the following; and a junior (red) tranche for any additional debt above that threshold. In case of a partial default, the red tranche will be hit first and the blue tranche will only be affected by that part of the default (if any) that is not absorbed by the junior tranche. In other words, any government funds used to service and repay government debt will always first be used to satisfy the claims of the Blue Bond holders. As a result, the blue tranche will become less risky than the status quo debt, and the red tranche will be more risky, leading to a differentiation in interest rates, as Figure 2 shows. This rate differentiation is reinforced by liquidity effects. Under our proposal, all the countries participating in the Blue Bond would pool and merge their blue tranches, creating a government bond market similar in size, liquidity and quality to the US Treasury debt market. Due to this gain in liquidity, the cost of borrowing would be further reduced on the blue tranche. By contrast, the liquidity of the red tranche would be substantially less than the liquidity of homogeneous national bonds currently. This reduced liquidity should further increase borrowing costs on the red debt. There are additional risk considerations that should be borne in mind. For the blue debt we propose joint and several liability to ensure

Figure 1: Borrowing cost in the status quo

Interest rate

Cost of borrowing (status quo)

Debt level

Figure 2: Key factors that influence the cost of borrowing in the senior (blue) and junior (red) tranche

Interest rate Risk of orderly default Illiquidity Junior status Senior status Liquidity Joint and several liability

Debt level

Source for both figures: Bruegel.

that a triple A asset is created. From an investor's perspective, joint and several liability will reduce the risk of the asset further because default risks tend not to be perfectly correlated. Therefore, the blue debt cost of borrowing in the average euro-area country should be lower still. By contrast, defaulting on the entire red tranche would be less disruptive, because in this eventuality, the borrowing capacity in the senior tranche would not be destroyed. From an investor's perspective, the prospect of a less-

disruptive default on the junior tranche increases the risk of default, thereby calling for an additional risk premium (see eg Jochimsen and Konrad, 2006). To ensure the credible prospect of an orderly default on the red debt, the preparations for such an eventuality need to be thought of as an integral part of euro-area procedures. Tightened European supervision of banks and rating agencies would need to ensure that the financial sector does not become vulnerable to a default on the red debt by fiscally less-robust

bruegelpolicybrief

03

THE BLUE BOND PROPOSAL

bruegelpolicybrief

04

Figure 3: Improved fiscal discipline due to the increased marginal cost of debt

Interest rate

Fiscal discipl.

Figure 2, which assumes unchanged borrowing levels. Ultimately, this disciplining effect of the higher marginal cost of borrowing is the most important distinction between our Blue Bond proposal and the first generation of proposals to pool the debt of EU countries in a euro bond (see eg Bonnevay, 2010, Leterme, 2010, or the concerns voiced by Issing 2009). Together with the liquidity effect of the senior tranche, it is the fiscal-discipline effect of the junior tranche that would ensure that the average cost of borrowing would decrease compared to the current situation. Clearly, the proportions of blue and red debt would vary substantially from country to country as illustrated by Figure 4, and so will the nature of the benefits implied by the proposed scheme, as discussed in the closing section. 2 THE IMPACT OF LIQUIDITY ON BORROWING COSTS The euro-area Blue Bond market could amount to 60 percent of euro-area GDP (about 5,600 billion), which is about five times the current market for the German Bund and almost as large as the US Treasury debt market (about $8,300 billion). Other things being equal, greater liquidity in a bond reduces the borrowing costs (see Amihud et al, 2005, for the various measures of liquidity). Large public institutional investors (central banks and

Fiscal discipline

Debt level

Source: Bruegel.

member states. Among others, the European Central Bank (ECB) should take a prudent stand regarding the eligibility of red bonds for its repo facility. Furthermore, in order to qualify for pooled borrowing via the Blue Bond, national governments should be obliged to introduce a standardised collectiveaction clause for their red bond borrowing, which would make any debt restructuring a less messy and lengthy undertaking.

Finally, we need to add to the picture a key aspect that we have neglected so far: the likely impact of our proposal on overall debt. Generally, one would expect fiscal discipline to improve as a result of the increased cost of public-sector borrowing at the margin (Figure 3). Improved fiscal discipline would not only bring down overall debt, but would also reduce the cost of borrowing on the red tranche substantially compared to

Figure 4: Split of 2011 forecast debt levels into red/blue debt

% GDP

140 120 100 80 60 40 20

Germany Slovenia Slovakia Greece Portugal Spain Belgium Austria Cyprus Italy Ireland Malta Luxembourg Netherlands Euro area France Finland

Blue debt Red debt

Source: DG ECFIN, Bruegel. Forecast levels of debt as % of GDP.

THE BLUE BOND PROPOSAL

Figure 5: Sovereign bond spreads over the German Bund in the euro area (January 2008 to April 2010)

800 700 600 500 400 300 200 100 0

Jan 08 Apr 08 Jul 08 Oct 08 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10

GR PT IE ES IT

BE AT FR FI NL

currency. Increased demand for Blue Bonds by central banks and sovereign wealth funds, not least in China and other Asian countries, would increase the liquidity gains further. The reserve-currency effect could be significant: Gourinchas and Rey (2007) estimate that, thanks to its reserve currency status, the US has been able to borrow at reduced rates for the last 50 years by providing international investors, including central banks, with a large, safe and ultra-liquid pool of debt. For a back-of-the-envelope calculation, let us cautiously assume a 30 basis-point liquidity premium1 over the average of participating countries, and also averaging across times of calm and times of crisis in financial markets. With the long-run average real interest rate of government bonds in the euro area at around 300 basis points, a 30 basispoint reduction of borrowing costs would reduce the interest burden by an average of 10 percent at any point in time. It turns out that this is equivalent to reducing the net present value of the debt stock by 10 percent also. Thus, assuming a legacy debt stock of 60 percent of GDP, the liquidity advantage generated could amount to an average net present value of six percent of the GDP of participating countries. While this number is of course subject to considerable uncertainty, it

Source: Thomson Datastream, Eurostat.

sovereign wealth funds) greatly value liquidity. For instance, many Asian central banks buy almost only German Bunds and French government debt, because they are required to invest only in particularly safe and liquid fixedincome assets. In practice it can be difficult to separate yield differences on account of liquidity, from yield differences on account of risk. To illustrate the problem, it is instructive to look at the recent surge in sovereign-bond spreads in the euro area (Figure 5). This increase is partly due to a flight to liquidity and partly due to a flight to safety, with investors prepared to pay more for a given level of liquidity or safety. But, in addition, the crisis has also changed objective levels of liquidity and the risk of default for assets. Disentangling these four reasons for changing yields is anything but straightforward.

Finally, the dynamics of a self-fulfilling prophecy could be at work, with weaker countries suffering from expanding spreads, which can in turn further weaken their fiscal outlook. By creating a liquid asset such as the Blue Bond, one could hope to reap a moderate liquidity premium in normal times and a much more substantial liquidity premium in times of crisis. This increased liquidity premium for the Blue Bond in times of crisis is of particular interest because it would increase the resilience in a crisis of government borrowing, not least of smaller and weaker economies. Furthermore, the introduction of a Blue Bond with liquidity on a par with US Treasury bonds could help to promote the more widespread use of the euro as a reserve

A Blue Bond with liquidity on a par with US treasuries could help to promote the euro as a reserve currency.

1. This 30 basis-point premium is derived from the swaps spreads (ie the difference between swaps rates and government bond rates at 10-year maturity). Before 2007, the swaps spread was larger in the US than in Germany by 30 basis points on average. Assuming that the underlying risk (ie the banking sector) in swaps is about the same in Germany and in the US, we can use this 30 basis-point differential as a proxy for the liquidity premium of the US government bond market, due to the US dollars status as reserve currency.

bruegelpolicybrief

05

THE BLUE BOND PROPOSAL

bruegelpolicybrief

06

illustrates the non-negligible scale of the liquidity gain that one could hope to generate. It is worth noting that, by the same token, it may be possible for individual member states to reap additional savings by pooling borrowing that is presently fragmented between various state agencies, regional and local governments. In the spirit of our proposal, this could even be achieved without substantially reducing the autonomy of these different state actors. 3 INSTITUTIONAL SET-UP Returning to the European level, it is of course not enough to find that a substantial economic gain could be reaped by pooling liquidity. In order to realise the gain, its distribution between member states would have to be calibrated appropriately to ensure that the countries involved feel it is in their best interests to participate. One possibility would be to introduce differentiated membership fees for countries issuing Blue Bonds, with fiscally stronger countries paying lower fees than fiscally weaker countries, as proposed by De Grauwe and Moesen (2009). However, such pricing would to some extent be arbitrary since the different national yields for red debt will only ever be a rather imperfect proxy for the risk of default on the senior debt. Also, as a general rule, it is politically difficult in the EU to organise explicit redistribution from weaker to stronger countries, even if the total effect, taking the lower debt-refinancing costs into account, would also remain

positive for weaker countries. Instead, we favour an approach that uses the Blue Bond rent as a carrot to incentivise countries with high debt levels to become more disciplined fiscally in the aftermath of the crisis. This would be in the interest of the weaker countries themselves, but could also provide substantial benefits to stronger countries, because it would help to re-establish the credibility of the Stability and Growth Pact and would reduce the risk that a bail-out of weaker countries might become necessary.

engineering to borrow against specific future revenues. To prevent the emergence of such black debt, all countries participating in the Blue Bond scheme would need to enter an agreement voiding any special collateral offered for black debt, thereby automatically converting it into red debt.

But would the Blue Bond scheme be compatible with the no-bailout clause in Article 125 of the EU Treaty? In economic substance, we argue that it would, because the joint and several guarantee would at most apply to senior debt amounting (up) to 60 percent of To strengthen fiscal discipline, we GDP, which is a debt level deemed propose a differentiated allocation sustainable for any EU member of Blue Bond borrowing quotas by state according to the Maastricht country. Those countries with Treaty. Therefore, the guarantee credible fiscal policies should be would not apply to debt crises allowed to borrow up to the full 60 caused by unsustainable fiscal percent of GDP, while countries policies leading to excessively with a weaker fiscal position would high debt levels. To the extent that only be able to borrow a lower pro- situations where debt-to-GDP portion of GDP in Blue Bonds. In the ratios of less than 60 percent are extreme, if a particionly unsustainable pating country was The Blue Bond would in exceptional situaconsistently to tions (article 100 of reduce the risk that pursue unsustainthe Treaty), such as bail-outs of weaker able fiscal policies, natural disasters countries might this mechanism where a bailout would even allow for become necessary. would be allowed, a a gradual eviction legal conflict would from the scheme by means of an not arise. This differentiates the ever-shrinking Blue Bond Blue Bond from more radical proallocation. posals to pool the entirety of the EUs public debt, in which case When borrowing in red debt be- changes to the spirit if not the comes expensive for a country, the letter of the treaty would appear temptation to find cheaper ways of unavoidable. borrowing on the side can become very strong. Typically, this would Next, the question arises of who involve some form of financial should be in charge of the

THE BLUE BOND PROPOSAL

However, other more generous and more rapid transition scenarios are conceivable, for example as part of a debt restructuring process that may become necessary during the current sovereign debt crisis. 4 COUNTRY PERSPECTIVES Even if our proposal achieves overall welfare gains, it is not a priori obvious if different countries would have an incentive to participate in this voluntary scheme. Therefore, we need to explore why different groups of countries could indeed benefit from the scheme. There are three important benefits. First, smaller countries with relatively illiquid sovereign bonds stand to benefit more from the extra liquidity of the Blue Bond than larger countries. For example, Austria and Luxembourg would benefit more than France and Germany although even for Germany borrowing costs under the Blue Bond scheme might fall below current levels. Second, countries with high debtto-GDP ratios would have the strongest incentive for fiscal adjustment. For example, Greece and Portugal would have to undertake a greater effort than, say, Finland or the Netherlands to bring down

bruegelpolicybrief

allocation of Blue Bonds? Since each Blue Bond implies a guarantee by all the participating nations and their taxpayers, the ultimate decision on the allocation of Blue Bonds and their corresponding guarantees will have to be taken by the national parliaments of all the participating countries.

expertise. Once the council has made a proposal, it would be voted on by the national parliaments of all participating countries. Failure to adopt the proposal would simply lead to a leave of absence of the country in question from the Blue Bond scheme, during which no new Blue Bonds could be issued and no new guarantees for the So that there will be Blue Bonds of an orderly and Participating countries other countries stable process for should establish an would be provided. preparing these A leave of absence Independent Stability parliamentary deover several years cisions, we propose Council to propose anwould thereby lead nually an allocation for that participating to a gradual exit countries establish the Blue Bond, in effect a from the scheme. an Independent take-it-or-leave-it offer. However, since the Stability Council decision of any (ISC) with the responsibility annu- major participating country to ally to propose an allocation for ease itself out could undermine the Blue Bond, in effect amounting confidence in the entire scheme, to a take-it-or-leave-it offer. The the ISC would have a strong incenfiscal credibility of this council tive to err on the side of caution, would be key to establishing the fi- thereby safeguarding the interests nancial markets' trust in the Blue of the European taxpayer. Bond, as the historical experience of the Australian Loan Council sug- An inevitably delicate question is gests. In order to be admitted to how to best handle the transition the Blue Bond scheme, countries to the Blue Bond scheme. We would have to convince the ISC favour an approach where all the that their fiscal policy is credible legacy government debt (ie issued enough to be insured (via the joint before the beginning of the Blue and several liability) by the most Bond scheme) is treated as senior credible countries of the euro area. to the red debt but junior (one way For example, one could imagine or the other) to the blue debt. This that a country would not be al- legacy debt would then be graduallowed into the Blue Bond pool if it ly replaced by the senior blue debt did not have a binding fiscal rule, and the junior red debt as the exanalogous to the one inserted by isting debt stock is rolled over. For each country, the annual Blue Germany into its constitution. Bond allocation would determine The Stability Council would be sup- which proportion of the debt could ported by a secretariat with the be issued as Blue Bonds and necessary economic and fiscal which would have to be issued as

more costly red debt. Since most countries commonly issue bonds with maturities of 10 years but usually not more, the transition should in effect be completed after a decade.

07

THE BLUE BOND PROPOSAL

bruegelpolicybrief

08

borrowing costs in red debt through a strengthened commitment to fiscal discipline that is credible to market participants. We would expect that many countries with high debt levels may in fact welcome this opportunity to commit to stronger fiscal discipline after the present crisis. But some may not. Third, countries that worry most about having to foot the bill for a sovereign bailout in the present REFERENCES:

crisis or in future crises stand to benefit most from the strengthened discipline of the Blue Bond scheme. However, this last observation crucially depends on the quality of the Blue Bonds institutional set-up. Overall, we are optimistic that it would be in the self-interest of a sufficient number of countries to participate in the proposed scheme, on the basis that institutional safeguards are robust.

Should the scheme go ahead, even countries that are hesitant about the additional fiscal discipline that participation in the scheme would entail may ultimately find it difficult to stay outside for the simple reason that markets could perceive a decision not to participate as a bad signal. Research assistance by David Saha and Mauricio Nakahodo is gratefully acknowledged.

Amihud, Yakov, Haim Mendelson and Lasse Heje Pedersen (2005) 'Liquidity and Asset Prices', Foundations and Trends in Finance 1, 269-364 Amihud, Yakov and Haim Mendelson (1991) 'Liquidity, maturity and the yields on U.S. government securities', Journal of Finance 46, 1411-1426 Bonnevay, Frdric (2010) Pour un Eurobond Une stratgie coordonne pour sortir de la crise, Institut Montaigne De Grauwe, Paul and Wim Moesen (2009) 'Gains for All: A proposal for a common Eurobond', Intereconomics, May/June Gourinchas, Pierre-Olivier and Hlne Rey (2007) 'From World Banker to World Venture Capitalist: The US External Adjustment and The Exorbitant Privilege', in Richard Clarida (ed) G7 Current Account Imbalances: Sustainability and Adjustment, University of Chicago Press Issing, Ottmar (2009) 'Why a common eurozone bond isnt such a good idea', Europes World, summer 2009, 77-79 Jochimsen, Beate und Kai Konrad (2006) 'Anreize statt Haushaltsnotlagen', in Kai A. Konrad and Beate Jochimsen (eds) Finanzkrise im Bundesstaat, Peter Lang Verlag, 11-28 Leterme, Yves (2010) 'Pour une Agence europenne de la Dette', Le Monde, 25 February Longstaff, Francis (2004) 'The Flight-to-Liquidity Premium in US Treasury Bond Prices', Journal of Business 77, 511-526 Schwarz, Krista (2009) Mind the gap: Disentangling credit and liquidity in risk spreads, Graduate School of Business, Columbia University

Bruegel 2010. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted in the original language without explicit permission provided that the source is acknowledged. The Bruegel Policy Brief Series is published under the editorial responsibility of Jean Pisani-Ferry, Director. Opinions expressed in this publication are those of the author(s) alone. Visit www.bruegel.org for information on Bruegel's activities and publications. Bruegel - Rue de la Charit 33, B-1210 Brussels - phone (+32) 2 227 4210 info@bruegel.org

You might also like

- ΝΟΜΙΣΜΑΤΙΚΗ ΠΟΛΙΤΙΚΗ - ΕΝΔΙΑΜΕΣΗ ΕΚΘΕΣΗ - ΝΟΕ.2012 - ΤΡΑΠΕΖΑ ΤΗΣ ΕΛΛΑΔΟΣDocument234 pagesΝΟΜΙΣΜΑΤΙΚΗ ΠΟΛΙΤΙΚΗ - ΕΝΔΙΑΜΕΣΗ ΕΚΘΕΣΗ - ΝΟΕ.2012 - ΤΡΑΠΕΖΑ ΤΗΣ ΕΛΛΑΔΟΣTheoTheodoridesNo ratings yet

- Έκθεση της Τρόικα 12/11/2012Document127 pagesΈκθεση της Τρόικα 12/11/2012Yannis FelemegkasNo ratings yet

- Greece-Memorandum of Understanding On Specific Economic Policy Conditionality, 9 Feb 2012Document51 pagesGreece-Memorandum of Understanding On Specific Economic Policy Conditionality, 9 Feb 2012AthensNewsNo ratings yet

- Puncturing Greece's Dream For Sharing Its Pain - NYTimesDocument5 pagesPuncturing Greece's Dream For Sharing Its Pain - NYTimesTheoTheodoridesNo ratings yet

- Memorandum of Understanding On Specific Economic Policy ConditionalityDocument50 pagesMemorandum of Understanding On Specific Economic Policy ConditionalityTheoTheodoridesNo ratings yet

- ΔΕΛΤΙΟ ΔΗΜΟΣΙΟΥ ΧΡΕΟΥΣ - Νο65 - Μάρτιος 2012-englishDocument4 pagesΔΕΛΤΙΟ ΔΗΜΟΣΙΟΥ ΧΡΕΟΥΣ - Νο65 - Μάρτιος 2012-englishTheoTheodoridesNo ratings yet

- What Kind of European Banking Union - BruegelDocument20 pagesWhat Kind of European Banking Union - BruegelTheoTheodoridesNo ratings yet

- Reforming GreeceDocument148 pagesReforming GreeceTheoTheodoridesNo ratings yet

- The Greek Debt Trap 01Document22 pagesThe Greek Debt Trap 01BruegelNo ratings yet

- Paths To Eurobonds (English) (English)Document40 pagesPaths To Eurobonds (English) (English)TheoTheodoridesNo ratings yet

- Issues of Secession and Expulsion From The EU and EMUDocument50 pagesIssues of Secession and Expulsion From The EU and EMUTheoTheodoridesNo ratings yet

- Greece Memorandum Nr.3Document38 pagesGreece Memorandum Nr.3Michail KyriakidisNo ratings yet

- European Economic Forecast - Nov2012Document191 pagesEuropean Economic Forecast - Nov2012TheoTheodoridesNo ratings yet

- IMF - Third Review Under The Stand-By ArrangementDocument129 pagesIMF - Third Review Under The Stand-By ArrangementTheoTheodoridesNo ratings yet

- IMF WP The Costs of Sovereign DefaultDocument52 pagesIMF WP The Costs of Sovereign DefaultTheoTheodoridesNo ratings yet

- Framework For Recovery and Resolution of Financial InstitutionsDocument171 pagesFramework For Recovery and Resolution of Financial InstitutionsEKAI CenterNo ratings yet

- IMF February 28, 2011 GreeceDocument60 pagesIMF February 28, 2011 Greecemarket-talkNo ratings yet

- Four Reasons Why The Euro Is Not CrashingDocument6 pagesFour Reasons Why The Euro Is Not CrashingTheoTheodoridesNo ratings yet

- Druckversion - Troika Report - Greece Needs A New Bailout - SPIEGEL ONLINE - News - InternationalDocument4 pagesDruckversion - Troika Report - Greece Needs A New Bailout - SPIEGEL ONLINE - News - InternationalTheoTheodoridesNo ratings yet

- ΠΡΟΒΛΕΨΕΙΣ ΤΗΣ ΕΥΡΩΠΑΪΚΗΣ ΕΠΙΤΡΟΠΗ ΓΙΑ ΤΗΝ ΕΛΛΗΝΙΚΗ ΟΙΚΟΝΟΜΙΑDocument2 pagesΠΡΟΒΛΕΨΕΙΣ ΤΗΣ ΕΥΡΩΠΑΪΚΗΣ ΕΠΙΤΡΟΠΗ ΓΙΑ ΤΗΝ ΕΛΛΗΝΙΚΗ ΟΙΚΟΝΟΜΙΑYannis FelemegkasNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shariah Issue in Ijarah ContractDocument20 pagesShariah Issue in Ijarah ContractSapna MananNo ratings yet

- Ebook Ebook PDF Personal Finance 12th Edition by Jack Kapoor PDFDocument41 pagesEbook Ebook PDF Personal Finance 12th Edition by Jack Kapoor PDFwarren.beltran184100% (38)

- Practice Questions For Exam 1Document5 pagesPractice Questions For Exam 1Sherene 亻可No ratings yet

- Investment Analysis and Portfolio Management GuideDocument55 pagesInvestment Analysis and Portfolio Management Guidesarakhan06220% (1)

- Chapter 09 PPT - Holthausen & Zmijewski 2019Document103 pagesChapter 09 PPT - Holthausen & Zmijewski 2019royNo ratings yet

- Managerial Investment Decisions: Tools and AnalysisDocument40 pagesManagerial Investment Decisions: Tools and AnalysisRNo ratings yet

- Ucc Chattel N Notice Asn Colb MwmsDocument13 pagesUcc Chattel N Notice Asn Colb MwmsMicheal100% (4)

- Financial accounting problems preboard examDocument12 pagesFinancial accounting problems preboard examClaudine DuhapaNo ratings yet

- Deutsche Telekom's Financial Strategy Focuses on Shareholder ReturnsDocument32 pagesDeutsche Telekom's Financial Strategy Focuses on Shareholder ReturnsDea ElmasNo ratings yet

- Full Collection Nomad LettersDocument218 pagesFull Collection Nomad LettersbhupiscribdNo ratings yet

- Financial Markets and InstitutionsDocument4 pagesFinancial Markets and InstitutionsRA T UL100% (1)

- INDEXATION OF FINANCIAL ASSETS An Islamic Evaluation PDFDocument118 pagesINDEXATION OF FINANCIAL ASSETS An Islamic Evaluation PDFPddfNo ratings yet

- KASDocument83 pagesKASJALALUDHEEN V KNo ratings yet

- Confidential Offering of Senior NotesDocument270 pagesConfidential Offering of Senior Noteswidyo saptotoNo ratings yet

- Assignment 1 Answer KeyDocument2 pagesAssignment 1 Answer Key姜越No ratings yet

- Edmond de Rothschild Fund: Annual Report and Audited Financial Statements As at March 31, 2018Document558 pagesEdmond de Rothschild Fund: Annual Report and Audited Financial Statements As at March 31, 2018M WildanNo ratings yet

- Comprehensive Agrarian Reform Law of 1988Document63 pagesComprehensive Agrarian Reform Law of 1988anon_226051796No ratings yet

- Factors To Four Decimal Places.)Document2 pagesFactors To Four Decimal Places.)EmersonNo ratings yet

- HLL Bblil MergerDocument12 pagesHLL Bblil MergerBhudev Kumar SahuNo ratings yet

- What is Bond DurationDocument4 pagesWhat is Bond DurationBhowmik DipNo ratings yet

- Brealey - Principles of Corporate Finance - 13e - Chap18 - SMDocument10 pagesBrealey - Principles of Corporate Finance - 13e - Chap18 - SMShivamNo ratings yet

- Proprac ReportDocument201 pagesProprac ReportJames Jr BalaNo ratings yet

- MGMT S-2000 Harvard University Summer School Principles of Finance Summer, 2016Document14 pagesMGMT S-2000 Harvard University Summer School Principles of Finance Summer, 2016David MorganNo ratings yet

- Impact of Basel III On Financial MarketsDocument4 pagesImpact of Basel III On Financial MarketsAnish JoshiNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Mid-Year Investment Outlook For 2023Document14 pagesMid-Year Investment Outlook For 2023ShreyNo ratings yet

- PAD104Document21 pagesPAD104NUR AHLAM FAIQAH MOHD ROSDINo ratings yet

- Stulz 2013Document11 pagesStulz 2013esp_414159046100% (1)

- Core Banking - Data Migration Strategy - BankingDocument23 pagesCore Banking - Data Migration Strategy - Bankingh4ppym34l100% (3)

- Reading The Markets Norway: Steeper Norwegian Swap Curve On Higher Wage GrowthDocument10 pagesReading The Markets Norway: Steeper Norwegian Swap Curve On Higher Wage GrowthJaviera Muñoz CarreñoNo ratings yet