Professional Documents

Culture Documents

Priti Patel Letter

Uploaded by

Harry ColeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Priti Patel Letter

Uploaded by

Harry ColeCopyright:

Available Formats

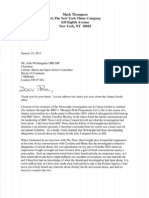

HOUSE OF COMMONS

LONDON S\T1A

OAA

The Rt Hon Lady Hodge MBE MP House of Commons

London

SW1A OAA

19th

November 2012

3e. oL",ty +JJe,

I am writing to regist{

Holdings Ltd.

^y Public Accounts Committee (PAC) and the ongoing PAC inquiry into international tax avoidance in relation to your family's company Stemcor

On 9 November 2012, you told the Daily Telegraph that you were only a'very small shareholder' in Stemcor. You repeated this assertion to Channel 4 News, when you said: 'I'rr. a tiny, tiny, tiny shareholder'. In light of these comments, I would like to raise the two points outlined below:

serious concern over your position as Chair of the

The extent of your shareholdings. According to the most recent Annual Return submitted on L8 September 2012, you own 17,004,600 shares. The company has 189,284,825 shares in total. This means 9 per cent of the total

number of shares are in your name.

Your shareholdings have an estimated worth of more than f,20 million. According to Stemcor's balance sheet as at 31 December 201'J., the shareholders' funds are worth f242 million, giving your shares an estimated worth of more tharrf2} million.

In addition, you commented to the Dnily Telegraph:'They [Stemcor] have always promised that they do absolutely nothing to avoid tax'. You reiterated this to Channel 4 when you said: 'Time and time again I have sought assurances to ensure they [Stemcor] do it by the books. And I wouldn't be doing this if they weren't. I've sought assurances all the time'.

But I would note the point below:

. Only 3 per cent of tax paid on 33 per cent of turnover in UK. The 2011

Report and Accounts show Stemcor Holdings Ltd UK turnover to have been f2.1billion. Stemcor's total turnover was f6.3 billion. Stemcor's business in the UK therefore accounts for 33 per cent of Stemcor's total turnover. Yet the same accounts show that Stemcor Holdings paid f743,000 in UK corporation tax. The same accounts show that the level of overseas tax was f26.5 million. Stemcor's tax contribution in the UK therefore accounts for only 3 per cent of its total tax contribution.

While questioning Google, Starbucks and Amazon over their international tax structures, lou said: 'We are not accusing you of being illegal. We are accusing you of being immoral'.

The statement released by Stemcor on 10 November 2012 admits to using 'transfer pricing' and annual reports show extensive trading between various subsidiaries of the company. Given the very serious accusation you made of

Starbucks that they were 'exporting profits to minimise tax', a seemingly similar approach taken by Stemcor, these points raise serious concerns.

My priority is that the PAC inquiry is carried out as thoroughly as possible. As Chair of the PAC, you have to be able to hold people to account for their decisions and judgement. My primary concern is that without answers to these questions, you would not be able to carry out your role. There is legitimate concern that your leadership might detract from the objectivity of the inquiry, and could undermine both the authority and integrity of the Committee as it

produces its report.

In light of these concerns, I am writing to ask for a full explanation of the points above. Until we have this explanation, people will question your role as Chair of this inquiry. Ultimately, as Chair of the PAC, I believe that you must both meet and be seen to meet the standards to which you hold others to account. In the interesls of transparency I am making this letter available to the public.

Priti Patel Member of Parliament for Witham

ry,7'

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Civil Servant GuideDocument4 pagesCivil Servant GuideHarry ColeNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Full H5 SlideshowDocument31 pagesFull H5 SlideshowHarry ColeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The UKIP Manifesto 2015Document76 pagesThe UKIP Manifesto 2015Harry ColeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Filename: Liberal - Democrat - General - Election - Manifesto - 2015 PDFDocument158 pagesFilename: Liberal - Democrat - General - Election - Manifesto - 2015 PDFHarry ColeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Yeo Letter To The MetDocument1 pageYeo Letter To The MetHarry ColeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Savile Interview Part2Document0 pagesSavile Interview Part2Harry ColeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Note On The Clerk of The House of Commons 250814Document13 pagesNote On The Clerk of The House of Commons 250814Harry ColeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Lord Fink To Miliband: Bring It OnDocument1 pageLord Fink To Miliband: Bring It OnHarry ColeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Cost Analysis of Labour Party Policy For 2015-2016Document86 pagesA Cost Analysis of Labour Party Policy For 2015-2016Harry ColeNo ratings yet

- Editorial Pay Audit Roles and Minimum SalariesDocument1 pageEditorial Pay Audit Roles and Minimum SalariesHarry ColeNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Keeping It in The FamilyDocument7 pagesKeeping It in The FamilyHarry ColeNo ratings yet

- BPR - Draft Referendum BillDocument1 pageBPR - Draft Referendum BillHarry ColeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Labour Gala Dinner Auction GuideDocument20 pagesLabour Gala Dinner Auction GuideHarry ColeNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Savile Interview Part 1Document0 pagesSavile Interview Part 1Harry ColeNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- PCS LeafletDocument2 pagesPCS LeafletHarry ColeNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Turc LetterDocument1 pageTurc LetterHarry ColeNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Afriyie LetterDocument1 pageAfriyie LetterHarry ColeNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- 18 March 2013 Royal Charter On Self-Regulation of The Press For PublicationDocument22 pages18 March 2013 Royal Charter On Self-Regulation of The Press For PublicationHarry ColeNo ratings yet

- Editorial Announcement ESL & IPL 12th Feb 2013Document2 pagesEditorial Announcement ESL & IPL 12th Feb 2013Harry ColeNo ratings yet

- Tory Points To Make On EuropeDocument1 pageTory Points To Make On EuropeHarry ColeNo ratings yet

- News Int Letter To MPsDocument2 pagesNews Int Letter To MPsHarry ColeNo ratings yet

- RC Draft Royal Charter 12 February 2013Document19 pagesRC Draft Royal Charter 12 February 2013Harry ColeNo ratings yet

- Letter From Mark Thompson To Culture Media Sport Select CommitteeDocument2 pagesLetter From Mark Thompson To Culture Media Sport Select CommitteeHarry ColeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coalition AuditDocument122 pagesCoalition AuditpoliticshomeukNo ratings yet

- Dave LetterDocument1 pageDave LetterHarry ColeNo ratings yet

- Lord S Resig LetterDocument2 pagesLord S Resig LetterHarry ColeNo ratings yet

- Pollard ReviewDocument186 pagesPollard ReviewHarry ColeNo ratings yet

- Letter From ComRes1Document1 pageLetter From ComRes1Harry ColeNo ratings yet

- Letter From Comres2Document1 pageLetter From Comres2Harry ColeNo ratings yet

- Taxation UPDocument28 pagesTaxation UPmarkbagzNo ratings yet

- 3 6int 2006 Dec QDocument9 pages3 6int 2006 Dec QHannan SalimNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Tax 1 Primer PDFDocument112 pagesTax 1 Primer PDFFloresEncio100% (1)

- COPQ: Cost of Poor QualityDocument24 pagesCOPQ: Cost of Poor Qualityrrvalero0% (1)

- Bank Muscat Oryx FundDocument31 pagesBank Muscat Oryx FundCurtis BrittNo ratings yet

- Moylan IndictmentDocument10 pagesMoylan IndictmentRyan BriggsNo ratings yet

- 1Q 2020 AKSI Maming+Enam+Sembilan+Mineral+TbkDocument62 pages1Q 2020 AKSI Maming+Enam+Sembilan+Mineral+Tbka8yssNo ratings yet

- Bab 14Document83 pagesBab 14Dias Farenzo PuthNo ratings yet

- De Grey MiningDocument30 pagesDe Grey MiningSergey KNo ratings yet

- Revenue Management of Gondolas Maintaining The Balance Between Tradition and RevenueDocument7 pagesRevenue Management of Gondolas Maintaining The Balance Between Tradition and Revenuebahalwan100% (2)

- Universal Life Insurance Fact SheetDocument2 pagesUniversal Life Insurance Fact Sheetket_nguyen003No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- International Valuation Application 1 Valuation For Financial Reporting (Revised 2005)Document18 pagesInternational Valuation Application 1 Valuation For Financial Reporting (Revised 2005)KismetNo ratings yet

- Leasing RossDocument15 pagesLeasing Rosstinarosa13No ratings yet

- Econ1 Fall2009 Midterm2Document9 pagesEcon1 Fall2009 Midterm2Michael LungNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal RevenueJenny Amante-BesasNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document11 pagesGenerally Accepted Accounting Principles (GAAP)Ram BhogtaNo ratings yet

- Explaining tax doctrines and assessing tax liability issuesDocument4 pagesExplaining tax doctrines and assessing tax liability issuesSheena PalmaresNo ratings yet

- Suzlon's CRM Impact on EfficiencyDocument68 pagesSuzlon's CRM Impact on Efficiencymohittandel100% (1)

- Partnership Firm Trading and Profit Loss AccountsDocument23 pagesPartnership Firm Trading and Profit Loss Accountskunjap0% (1)

- Applied EconomicsDocument19 pagesApplied EconomicsYdnas Nabugbul Aznanobmaer100% (1)

- Sample Letter of Offer Project AssistantDocument5 pagesSample Letter of Offer Project AssistantSatish VengatesanNo ratings yet

- Icis Top 100Document6 pagesIcis Top 100GhanshyamNo ratings yet

- Indian Fiscal PolicyDocument2 pagesIndian Fiscal PolicyBhavya Choudhary100% (1)

- INDIA INCOME TAX - Doble Taxation Avoidance Agreement With UKDocument22 pagesINDIA INCOME TAX - Doble Taxation Avoidance Agreement With UKDr.SagindarNo ratings yet

- Industrial Management Workbook (2018)Document175 pagesIndustrial Management Workbook (2018)Trí TừNo ratings yet

- Mineral Economics An IntroductionDocument4 pagesMineral Economics An IntroductionFrancisco Javier Villaseca AhumadaNo ratings yet

- ICICI Future Perfect - BrochureDocument11 pagesICICI Future Perfect - BrochureChandan Kumar SatyanarayanaNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryEJ BuanNo ratings yet

- 8610Document4 pages8610saffar12No ratings yet

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooFrom EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooRating: 5 out of 5 stars5/5 (887)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet