Professional Documents

Culture Documents

FR Sec1a FCMsAsCounterpartyToOffExchangeForeignCurrencyTrans111512

Uploaded by

forexmagnatesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FR Sec1a FCMsAsCounterpartyToOffExchangeForeignCurrencyTrans111512

Uploaded by

forexmagnatesCopyright:

Available Formats

November 20, 2012

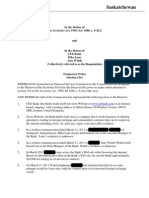

Via Federal Express Ms. Sauntia Warfield Assistant Secretary Office of the Secretariat Commodity Futures Trading Commission Three Lafayette Centre 1155 21st Street, N.W. Washington, DC 20581 Re: National Futures Association: NFA Member FCMs Acting as a Counterparty to Off-Exchange Foreign Currency Transactions With Eligible Contract Participants Proposed Amendments to NFA Financial Requirements Section 1(a)

Dear Ms. Warfield: Pursuant to Section 17(j) of the Commodity Exchange Act, as amended, National Futures Association (NFA) hereby submits to the Commodity Futures Trading Commission (CFTC or Commission) the proposed amendments to NFA Financial Requirements Section 1(a) regarding NFA Member FCMs acting as a counterparty to off-exchange foreign currency transaction with eligible contract participants. NFAs Board of Directors (Board) approved the proposal on November 15, 2012, and NFA respectfully requests Commission review and approval of the proposal. PROPOSED AMENDMENTS (additions are underscored and deletions are stricken through) FINANCIAL REQUIREMENTS SECTION 1. FUTURES COMMISSION MERCHANT FINANCIAL REQUIREMENTS (a) Each NFA Member that is registered or required to be registered with the Commodity Futures Trading Commission (hereinafter "CFTC") as a Futures Commission Merchant (hereinafter "Member FCM") must maintain "Adjusted Net Capital" (as defined in CFTC Regulation 1.17) equal to or in excess of the greatest of: (i) $1,000,000;

Ms. Sauntia Warfield

November 20, 2012

(ii) For Member FCMs with less than $2,000,000 in Adjusted Net Capital, $6,000 for each remote location operated (i.e., proprietary branch offices, main office of each guaranteed IB and branch offices of each guaranteed IB); (iii) For Member FCMs with less than $2,000,000 in Adjusted Net Capital, $3,000 for each AP sponsored (including APs sponsored by guaranteed IBs); (iv) For securities brokers and dealers, the amount of net capital specified in Rule 15c3-1(a) of the Regulations of the Securities and Exchange Commission (17 CFR 240.15c3-1(a)); (v) Eight (8) percent of domestic and foreign domiciled customer and noncustomer (excluding proprietary) risk maintenance margin/performance bond requirements for all domestic and foreign futures, options on futures contracts and cleared over-the counter derivatives positions excluding the risk margin associated with naked long option positions; (vi) For a Member FCMs that are acts as counterpartyies to a forex options transactions (as forex isn defined in Bylaw 1507(b) but excluding the counterparty limitation contained in Bylaw 1507(b)(2)), $520,000,000, except that Forex Dealer Members must meet the higher requirements in Financial Requirements Section 11. * * * EXPLANATION OF PROPOSED AMENDMENTS Over the past ten years, NFA has created a regulatory framework and requirements to address issues posed by NFA's Forex Dealer Members (FDMs). Pursuant to NFA Bylaw 306, Members are FDMs if they act as counterparty to forex transactions, as defined in NFA Bylaw 1507(b). Pursuant to NFA Bylaw 1507(b)(2), for a counterparty to be an FDM, the "forex transactions" must be offered to or entered into with persons that are not eligible contract participants (ECPs). In other words, an FDM acts as a counterparty to retail forex transactions. Once a Member firm is an FDM, then NFA Financial Requirements Section 11(a) imposes a minimum adjusted net capital requirement of $20 million upon the firm.

Ms. Sauntia Warfield

November 20, 2012

Over the past year or so, we have observed that several NFA Member FCMs are almost exclusively acting as counterparty in forex transactions with ECPs. Because these FCMs are not FDMs (i.e. they do not act as a counterparty to retail forex transactions), they only must meet the minimum adjusted net capital requirement of $1 million pursuant to NFA Financial Requirements Section 1. Furthermore, the vast majority of ECPs doing business with these thinly-capitalized FCMs are not typical institutional customers. Specifically, three FCM Members have ceased acting as FDMs but continue to act as counterparty to forex transactions with ECPs. One firm's ECP forex counterparties include a Hong Kong based bullion investment company, a jewelry company in the United Arab Emirates, an investment company based in Lebanon, and three foreign retail forex affiliates1 of the FCM. This NFA Member FCM was subject to two NFA enforcement actions while it was an FDM. The second FCM Member introduces retail forex customers to another NFA FDM, and also acts itself as counterparty to two ECPs. One of the ECP counterparties is a foreign retail forex affiliate and the other is a financial institution located in Japan. NFA also brought two enforcement actions against this FCM while it was an FDM. The third FCM Member has approximately 30 ECP counterparties, several of which are omnibus accounts from Korea and other parts of Asia. NFA has also brought an enforcement action against this FCM while it was an FDM. In addition to these three FCMs, one other current FDM has recently informed NFA that it is in the process of winding down its retail forex business, and plans to only act as counterparty to forex transactions with ECPs. Lastly, NFA recently approved an FCM Member that indicated it plans to act as counterparty to forex transactions with ECPs; however, this firm has not yet commenced business. All of these FCMs will only have to meet the FCM minimum net capital requirement of $1 million. Given the counterparty nature of these FCMs' forex activities, NFA is extremely concerned that these firms are currently subject to inadequate capital requirements. Specifically, from a financial safeguard perspective, it makes absolutely no sense that an FDM that acts as counterparty to a single retail forex transaction must maintain at least $20 million in adjusted net capital; however, an FCM that engages in an identical type transaction with an ECP must only maintain at least $1 million in capital. Moreover, although other NFA Member FCMs currently act as counterparties to forex transactions with ECPs, all of those FCMs also engage in a substantial exchange

1

NFA does not believe that these foreign affiliates are subject to requirements similar to NFAs with respect to the type of entities that can be used to offset risk and to deposit customer funds.

Ms. Sauntia Warfield

November 20, 2012

traded business and have capital requirements that exceed $20,000,000. NFA staff confirmed with CME Group staff that none of the FCMs for which it is the DSRO have less than $20 million in adjusted net capital if they engage in forex activities with ECPs. NFA also discussed this proposal with NFA's FCM Advisory Committee, which supported the proposal. To address these financial safeguard concerns, the proposed amendments to NFA Financial Requirements Section 1 will include a provision that requires an FCM that acts as counterparty to a forex transaction with an ECP to maintain adjusted net capital of at least $20,000,000. Certainly, NFA may have to address other rulemaking issues in the future with regard to FCMs engaging in these types of forex transactions but the financial integrity of these firms is paramount and must be addressed first. NFA respectfully requests that the Commission review and approve the proposed amendments to NFA Financial Requirements Section 1(a) regarding NFA Member FCMs acting as a counterparty to off-exchange foreign currency transactions with ECPs. Respectfully submitted,

Thomas W. Sexton Senior Vice President and General Counsel

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 609 Credit Repair FAQDocument14 pages609 Credit Repair FAQCarol71% (7)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- CH 07 Hull Fundamentals 8 The DDocument47 pagesCH 07 Hull Fundamentals 8 The DjlosamNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PROJECT PROFILE ON SPINNING MILL (14400 SPINDLESDocument6 pagesPROJECT PROFILE ON SPINNING MILL (14400 SPINDLESAnand Arumugam0% (1)

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateMANJUNATH GOWDANo ratings yet

- The Cold War - David G. Williamson - Hodder 2013 PDFDocument329 pagesThe Cold War - David G. Williamson - Hodder 2013 PDFMohammed Yousuf0% (1)

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocument1 pageShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNo ratings yet

- Business PeoplesDocument2 pagesBusiness PeoplesPriya Selvaraj100% (1)

- Onezero Releases G3 Advanced Bridging PlatformDocument2 pagesOnezero Releases G3 Advanced Bridging PlatformforexmagnatesNo ratings yet

- MRA PeregrineFinancialGroupInc& PeregrineAssetManagementInc 2012 0709Document6 pagesMRA PeregrineFinancialGroupInc& PeregrineAssetManagementInc 2012 0709forexmagnatesNo ratings yet

- CFTC Sues Halifax Investment ServicesDocument11 pagesCFTC Sues Halifax Investment ServicesforexmagnatesNo ratings yet

- Announcement 01 31 2013 Regarding A Compromise Reached With Company Reliantco Investments LTDDocument1 pageAnnouncement 01 31 2013 Regarding A Compromise Reached With Company Reliantco Investments LTDforexmagnatesNo ratings yet

- 2012 Shareholder Meeting Presentation Gain CapitalDocument19 pages2012 Shareholder Meeting Presentation Gain CapitalforexmagnatesNo ratings yet

- Eastern Europe Forex Country Reports PreviewDocument9 pagesEastern Europe Forex Country Reports PreviewforexmagnatesNo ratings yet

- Media Release Q3 2012 - EN - 2 PDFDocument4 pagesMedia Release Q3 2012 - EN - 2 PDFforexmagnatesNo ratings yet

- Forex Magnates 2012 Year SummaryDocument32 pagesForex Magnates 2012 Year SummaryforexmagnatesNo ratings yet

- Media Release Q3 2012 - EN - 2 PDFDocument4 pagesMedia Release Q3 2012 - EN - 2 PDFforexmagnatesNo ratings yet

- Swissquote h1 2012 ResultsDocument4 pagesSwissquote h1 2012 ResultsforexmagnatesNo ratings yet

- Complaint FxDirectDealerLLC& JamesGreen 2012 1013Document22 pagesComplaint FxDirectDealerLLC& JamesGreen 2012 1013forexmagnatesNo ratings yet

- FXCM Lucid PresentationDocument6 pagesFXCM Lucid PresentationforexmagnatesNo ratings yet

- Decision ForexClub LLC&PeterTatarnikov 2012 1025Document5 pagesDecision ForexClub LLC&PeterTatarnikov 2012 1025forexmagnatesNo ratings yet

- Forex Magnates Q3 2012 PreviewDocument12 pagesForex Magnates Q3 2012 PreviewforexmagnatesNo ratings yet

- Complaint Alpari US LLC&JermaineHarmon&RichardLani 2012 0629Document17 pagesComplaint Alpari US LLC&JermaineHarmon&RichardLani 2012 0629forexmagnatesNo ratings yet

- Ig Group Annualres - Jul12Document39 pagesIg Group Annualres - Jul12forexmagnatesNo ratings yet

- LATAM Forex Industry PreviewDocument5 pagesLATAM Forex Industry PreviewforexmagnatesNo ratings yet

- Shaffer Et Al V Interbank FX eDocument23 pagesShaffer Et Al V Interbank FX eforexmagnatesNo ratings yet

- Swiss Quote Press Release Q1 2012 eDocument3 pagesSwiss Quote Press Release Q1 2012 eforexmagnatesNo ratings yet

- Ufx Bank Et Al Temp Order February 22 2012 RedactedDocument3 pagesUfx Bank Et Al Temp Order February 22 2012 RedactedforexmagnatesNo ratings yet

- Complaint FxDirectDealerLLC& JamesGreen 2012 0629Document27 pagesComplaint FxDirectDealerLLC& JamesGreen 2012 0629forexmagnatesNo ratings yet

- Gain Capital Q1 2012 Earnings PresentationDocument26 pagesGain Capital Q1 2012 Earnings PresentationforexmagnatesNo ratings yet

- Decision PeregrineFinancialGroupInc& RussellWasendorf& SusanOmeara& NolanSchiff 2012 0208Document8 pagesDecision PeregrineFinancialGroupInc& RussellWasendorf& SusanOmeara& NolanSchiff 2012 0208forexmagnatesNo ratings yet

- Complaint PeregrineFinancialGroupInc&RussellWasendorf&SusanOmeara&NolanSchiff 2012 0208Document15 pagesComplaint PeregrineFinancialGroupInc&RussellWasendorf&SusanOmeara&NolanSchiff 2012 0208forexmagnatesNo ratings yet

- Complaint PeregrineFinancialGroupInc&RussellWasendorf&SusanOmeara&NolanSchiff 2012 0208Document15 pagesComplaint PeregrineFinancialGroupInc&RussellWasendorf&SusanOmeara&NolanSchiff 2012 0208forexmagnatesNo ratings yet

- FXStreet Person of The Year 2011Document2 pagesFXStreet Person of The Year 2011forexmagnatesNo ratings yet

- Forex Magnates Q4 2011 PreviewDocument12 pagesForex Magnates Q4 2011 PreviewforexmagnatesNo ratings yet

- Forex Summary 2011 FFDocument29 pagesForex Summary 2011 FFforexmagnatesNo ratings yet

- Forex Summary 2011 FFDocument29 pagesForex Summary 2011 FFforexmagnatesNo ratings yet

- 2nd Annual Latin America Rail Expansion SummitDocument16 pages2nd Annual Latin America Rail Expansion SummitenelSubteNo ratings yet

- Recitation 1 Notes 14.01SC Principles of MicroeconomicsDocument3 pagesRecitation 1 Notes 14.01SC Principles of MicroeconomicsDivya ShahNo ratings yet

- (Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)Document165 pages(Maria Lipman, Nikolay Petrov (Eds.) ) The State of (B-Ok - Xyz)gootNo ratings yet

- ISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESDocument1 pageISLAMIYA ENGLISH SCHOOL MONEY CHAPTER EXERCISESeverly.No ratings yet

- Fingal Housing Strategy AppendixDocument156 pagesFingal Housing Strategy Appendixdi TalapaniniNo ratings yet

- Financial Planning For Salaried Employee and Strategies For Tax SavingsDocument8 pagesFinancial Planning For Salaried Employee and Strategies For Tax SavingsNivetha0% (2)

- Kanpur TOD Chapter EnglishDocument27 pagesKanpur TOD Chapter EnglishvikasguptaaNo ratings yet

- December 2011Document117 pagesDecember 2011Irfan AhmedNo ratings yet

- Nepal submits TFA ratification documents to WTODocument1 pageNepal submits TFA ratification documents to WTOrajendrakumarNo ratings yet

- Beli TGL 21 Sep 2021Document1 pageBeli TGL 21 Sep 2021Putri Marissa DilaNo ratings yet

- Mahanagar CO OP BANKDocument28 pagesMahanagar CO OP BANKKaran PanchalNo ratings yet

- 25818Document273 pages25818Amir KhanNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet

- Manual Book Vibro Ca 25Document6 pagesManual Book Vibro Ca 25Muhammad feri HamdaniNo ratings yet

- Government Sanctions 27% Interim Relief for PensionersDocument4 pagesGovernment Sanctions 27% Interim Relief for PensionersThappetla SrinivasNo ratings yet

- Public Finance Exam A2 JHWVLDocument3 pagesPublic Finance Exam A2 JHWVLKhalid El SikhilyNo ratings yet

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaNo ratings yet

- TransportPlanning&Engineering PDFDocument121 pagesTransportPlanning&Engineering PDFItishree RanaNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- Accounting Chapter 10Document4 pagesAccounting Chapter 1019033No ratings yet

- Aviation EconomicsDocument23 pagesAviation EconomicsAniruddh Mukherjee100% (1)

- UberPOOL AddendumDocument4 pagesUberPOOL AddendumEfrRireNo ratings yet

- 2013 Factbook: Company AccountingDocument270 pages2013 Factbook: Company AccountingeffahpaulNo ratings yet