Professional Documents

Culture Documents

Government T-Bills in Bangladesh

Uploaded by

raihans_dhk3378Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Government T-Bills in Bangladesh

Uploaded by

raihans_dhk3378Copyright:

Assignment on

GOVERNMENT TREASURY BILLS IN BANGLADESH

Semester- Spring 2012 F403: Financial Markets and Institutions MBA Program

Prepared for: Syeda Mahrufa Bashar Lecturer Institute of Business Administration

Prepared by: Md. Raihan Shourov Roll-139 Batch-MBA 46D

November 21, 2012

INSTITUTE OF BUSINESS ADMINISTRATION UNIVERSITY OF DHAKA

Money Market: The primary money market is comprised of banks, FIs and primary dealers as intermediaries and savings & lending instruments, treasury bills as instruments. There are currently 15 primary dealers (12 banks and 3 FIs) in Bangladesh. The only active secondary market is overnight call money market which is participated by the scheduled banks and FIs. The money market in Bangladesh is regulated by Bangladesh Bank (BB), the Central Bank of Bangladesh. Government Treasury Bills: Treasury bills and T-bonds are short-term and long term obligations issued by Bangladesh Bank on behalf of the government of Bangladesh. Pro-rata partial allotments are made for bids at the cut-off-yield. 15 primary dealers (PDs) are acted as underwriters and market makers with commitments to bid in auctions. Weekly auctions of 91-day, 182-day and 364-day treasury bills continued to be the main instruments for monetary policy management during the year under report. The objectives for issuing these securities are twofold. The first is to provide a mechanism for financing government deficit at a low cost and to use as a mopping-up instrument of excess liquidity prevailing in the market. T-Bills in Fiscal Year 2010-2011:

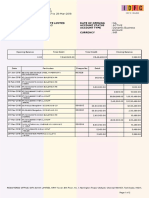

Table 1: Auctions of Government treasury bills - FY11

Bids offered Tenor of bills No. 334 345 372 Face value (billion Taka) No. 84.0 76.7 64.1 211 223 232 Bids accepted Outstanding bills as of end June Face value (billion 11 Taka) (Billion Taka) 58.5 54.4 40.2 53.3 1051 224.8 666 206.3 131.7 1.11-5.42 2.43-7.55 28.8 43.3 59.6 Yield range* (%) FY10 1.11-2.54 3.36-4.04 4.08-5.42 FY11 2.43-7.00 3.49-7.25 4.24-7.55

91-Day 182-Day 364-Day Devolvement to BB/PD Total

Source: Monetary Policy Department, Bangladesh Bank. * Range of the weighted average annual yield of the accepted bids.

The results of treasury bills auction in FY11 are summarised at Table 1. The auctions of 91-day, 182-day and 364-day tenor bills were mostly over-subscribed with bids, whereas the volume of devolvement to Bangladesh Bank/PDs decreased. The cut-off rate of most of the treasury bills increased during FY11. Depending on the liquidity conditions in the money market, the cut off yields of treasury bills of different maturities varied within wide ranges. The yields for various tenors as of end June 2011 depicted somewhat a moderate range than the yields as of end June 2010 (Table 1). A total of 1051 bids amounting to Taka 224.8 billion were received, of which 666 bids amounting to Taka 206.3 billion (including Taka 53.3 billion as devolved amount) were accepted. The weighted average yield-to maturity against the accepted bids ranged from 2.43 percent to 7.55 percent. In FY10 a total of 1476 bids amounting to Taka 417.0 billion were received, of which Taka 210.8 billion was accepted.

Current Scenario of T-Bill Auction:

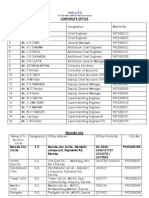

Auction of T-Bills (As of November 2012):

Graphical Representation of cut off yield of accepted Govt. T-bills:

T-Bill Yield over the years:

Upcoming T-Bill Auction:

You might also like

- Determining Factors of Profitability of NBFIsDocument30 pagesDetermining Factors of Profitability of NBFIsraihans_dhk3378100% (1)

- LiborDocument3 pagesLiborraihans_dhk3378No ratings yet

- Blades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)Document8 pagesBlades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)raihans_dhk337894% (18)

- Marketing Mix of Eastern Bank LimitedDocument3 pagesMarketing Mix of Eastern Bank Limitedraihans_dhk33780% (1)

- Vision, Mission and Value StatementDocument9 pagesVision, Mission and Value Statementraihans_dhk3378100% (5)

- Learning CurveDocument3 pagesLearning Curveraihans_dhk3378No ratings yet

- Project Proposal - Employment Generation in Bangladesh: Role of ICTDocument3 pagesProject Proposal - Employment Generation in Bangladesh: Role of ICTraihans_dhk3378No ratings yet

- Decade-Wise Sectoral Contribution To GDP of BangladeshDocument4 pagesDecade-Wise Sectoral Contribution To GDP of Bangladeshraihans_dhk337891% (11)

- Employment Generation in Bangladesh: Role of ICTDocument27 pagesEmployment Generation in Bangladesh: Role of ICTraihans_dhk3378No ratings yet

- Stock Market Anomaly-BangladeshDocument12 pagesStock Market Anomaly-Bangladeshraihans_dhk3378No ratings yet

- Top Business Schools in South Asia and ComparisonDocument4 pagesTop Business Schools in South Asia and Comparisonraihans_dhk3378No ratings yet

- Banking Acts-Causes and EffectsDocument5 pagesBanking Acts-Causes and Effectsraihans_dhk3378No ratings yet

- Memorandum and Articles of Association-Companies Act 1994, BangladeshDocument8 pagesMemorandum and Articles of Association-Companies Act 1994, Bangladeshraihans_dhk337882% (11)

- Case Study - Companies Act 1994Document9 pagesCase Study - Companies Act 1994raihans_dhk3378No ratings yet

- British American Tobacco Bangladesh-Corporate Social ResponsibilityDocument10 pagesBritish American Tobacco Bangladesh-Corporate Social Responsibilityraihans_dhk3378No ratings yet

- Web Marketing: A New Horizon in Communicating With The Target MarketDocument31 pagesWeb Marketing: A New Horizon in Communicating With The Target Marketraihans_dhk3378No ratings yet

- Factors Affecting BankingDocument2 pagesFactors Affecting Bankingraihans_dhk3378No ratings yet

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocument16 pagesNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- Shahjalal Islami Bank-Performance AnalysisDocument21 pagesShahjalal Islami Bank-Performance Analysisraihans_dhk3378100% (4)

- Non-Banking Financial InstitutionsDocument3 pagesNon-Banking Financial Institutionsraihans_dhk3378No ratings yet

- Performance Analysis of BATB (2004-2008)Document21 pagesPerformance Analysis of BATB (2004-2008)raihans_dhk3378No ratings yet

- Factors Affecting Customer Satisfaction in Bangladesh Telecom IndustryDocument93 pagesFactors Affecting Customer Satisfaction in Bangladesh Telecom Industryraihans_dhk3378100% (16)

- BIMSTEC cooperation on trade and investmentDocument14 pagesBIMSTEC cooperation on trade and investmentraihans_dhk3378No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Document18 pagesTD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Stan J. CaterboneNo ratings yet

- Putin's Revenge!Document3 pagesPutin's Revenge!eTradingPicksNo ratings yet

- Kaya 2011Document19 pagesKaya 2011Armeiko TanayaNo ratings yet

- IDFC Bank StatementDocument2 pagesIDFC Bank StatementSURANA197367% (3)

- Tambahan HPM Lahat Agustus 2023Document31 pagesTambahan HPM Lahat Agustus 2023veiNo ratings yet

- Contact UsDocument12 pagesContact UsShital KiranNo ratings yet

- Lesson 3 App EcoDocument63 pagesLesson 3 App EcoTricxie DaneNo ratings yet

- Financial Accounting 1 - Cash and Cash Equivalents Part 2Document1 pageFinancial Accounting 1 - Cash and Cash Equivalents Part 2Ryan Jay BanaoNo ratings yet

- Construction Industry in PakistanDocument7 pagesConstruction Industry in Pakistansajjadmubin75% (4)

- Monetary PolicyDocument20 pagesMonetary PolicynitikaNo ratings yet

- The Finance Sector Reforms in India Economics EssayDocument4 pagesThe Finance Sector Reforms in India Economics EssaySumant AlagawadiNo ratings yet

- Learn large numbers and place value system in Indian currencyDocument17 pagesLearn large numbers and place value system in Indian currencyVijayalakshmi ISAMNo ratings yet

- Ramoso vs Court of Appeals ruling on piercing corporate veilDocument1 pageRamoso vs Court of Appeals ruling on piercing corporate veilBernadetteNo ratings yet

- Keeping in Touch With Rural IndiaDocument4 pagesKeeping in Touch With Rural Indiasaurabh shekharNo ratings yet

- RMesh Brochure - March 2021Document2 pagesRMesh Brochure - March 2021WilfredoJrReyNo ratings yet

- Bao Cao N100 91332-06020Document2 pagesBao Cao N100 91332-06020anhthoNo ratings yet

- Vactor Used Dealers 6.16.20 V2 UPLOADED 06.22.20 PDFDocument1 pageVactor Used Dealers 6.16.20 V2 UPLOADED 06.22.20 PDFJohn MkCito KINo ratings yet

- Financial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDocument25 pagesFinancial Statements, Taxes, and Cash Flow: Mcgraw-Hill/IrwinDani Yustiardi MunarsoNo ratings yet

- The ABC's of VSADocument21 pagesThe ABC's of VSAcarmenyeo80% (5)

- Futurology in PerspectiveDocument10 pagesFuturology in Perspectivefx5588No ratings yet

- BRIU Weekend Watch.01Document7 pagesBRIU Weekend Watch.01JenniferNo ratings yet

- Independent Distributor Price List: DXN Bolivia S.R.LDocument1 pageIndependent Distributor Price List: DXN Bolivia S.R.LAdalid Llusco QuispeNo ratings yet

- Cfa 0324316666 101878Document13 pagesCfa 0324316666 101878Pepe La PagaNo ratings yet

- Totem Thread CatalogueDocument28 pagesTotem Thread CataloguePushpender SinghNo ratings yet

- BTD Golf TournamentDocument4 pagesBTD Golf TournamentJordanNo ratings yet

- Design and Fabrication of Agricultural Waste Shredder MachineDocument8 pagesDesign and Fabrication of Agricultural Waste Shredder MachineMahabub AlamNo ratings yet

- GROUP PROJECT Econ FinalDocument28 pagesGROUP PROJECT Econ FinalHazelNo ratings yet

- Chapter 13 - GlobalizationDocument37 pagesChapter 13 - GlobalizationbawardiaNo ratings yet

- CH 5 Market StructureDocument33 pagesCH 5 Market StructureEstifanos DefaruNo ratings yet

- Ekurhulen North District Technology Grade 8 PaperDocument10 pagesEkurhulen North District Technology Grade 8 Papersiyabonga mpofu100% (2)