Professional Documents

Culture Documents

2007 MESSA Net Assets

Uploaded by

Rob LawrenceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007 MESSA Net Assets

Uploaded by

Rob LawrenceCopyright:

Available Formats

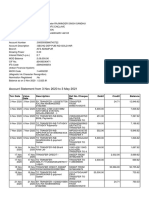

MICIDGAN EDUCATION SPECIAL SERVICES ASSOCIATION

STATEMENTS OF NET ASSETS AVAILABLE

FOR BENEFITS AND BENEFIT OBLIGATIONS

JUNE 30, 2007 AND 2006

2007 2006

ASSETS:

Cash and cash equivalents $ 24,389,194 $ 34,612,377

Investments (Note 3) 237,727,138 188,722,343

Contributions receivable from or on behalf of members 11,377,113 7,464,240

Rate stabilization reserves with underwriters (Note 4) 137,614,788 87,288,606

Miscellaneous receivables and prepayments 1,393,476 1,114,199

Deferred compensation deposits (Note 5) 724,468 822,963

Property and equipment, less accumulated

depreciation (Note 6) 17,723,280 20,340,970

Intangible pension asset (Note 8) 655,833

Prepaid retiree healthcare benefits (Note 9) 744,772

TOTAL ASSETS 430,949,457 341,766,303

LIABILITIES:

Claims drafts outstanding 4,926,123 6,232,059

Accounts payable 2,080,311 1,935,876

Due to insurance companies 13,398,648 10,989,056

Accrued payroll and related items 4,722,842 5,066,856

Accrued claims processing expenses 1,750,500 1,750,500

Members' contributions received in advance 23,040,693 28,065,520

Deferred compensation payable 724,468 822,963

Accrued pension liability (Note 8) 1,214,939 3,010,404

Accrued retiree healthcare benefits (Note 9) 11,923,933

Notes payable (Note 10) 7,787,500 8,645,834

TOTAL LIABILITIES 71,569,957 66,519,068

NET ASSETS AVAILABLE FOR BENEFITS 359,379,500 275,247,235

BENEFIT OBLIGATIONS:

Experience rating deficit (Note 4) 6,464,194

NET ASSETS AVAILABLE FOR BENEFITS IN

EXCESS OF BENEFIT OBLIGATIONS $ 359,379,500 $ 268,783,041

See notes to financial statements. 2

You might also like

- Comparative MEA Salaries 2018 To 2019Document3 pagesComparative MEA Salaries 2018 To 2019Rob LawrenceNo ratings yet

- MEA Top 10 Pay 2020Document1 pageMEA Top 10 Pay 2020Rob LawrenceNo ratings yet

- Comparative Salaries of MEA 2015 To 2016Document4 pagesComparative Salaries of MEA 2015 To 2016Rob LawrenceNo ratings yet

- Top Ten MEA Earners 2017Document1 pageTop Ten MEA Earners 2017Rob LawrenceNo ratings yet

- Compare MEA Salaries 2016 To 2017Document4 pagesCompare MEA Salaries 2016 To 2017Rob LawrenceNo ratings yet

- Comparative MEA Salaries 2017 To 2018Document4 pagesComparative MEA Salaries 2017 To 2018Rob LawrenceNo ratings yet

- Comparative MEA Salareis 2019 To 2020Document3 pagesComparative MEA Salareis 2019 To 2020Rob LawrenceNo ratings yet

- MEA Top Ten Pay 2015Document1 pageMEA Top Ten Pay 2015Rob LawrenceNo ratings yet

- MEA Top Ten Wage EarnersDocument1 pageMEA Top Ten Wage EarnersRob LawrenceNo ratings yet

- 2013 MEA LM2 ReportDocument83 pages2013 MEA LM2 ReportRob LawrenceNo ratings yet

- MEA 2015 Top Ten SalariesDocument1 pageMEA 2015 Top Ten SalariesRob LawrenceNo ratings yet

- MEA Salaries 2013 Vs 2014Document4 pagesMEA Salaries 2013 Vs 2014Rob LawrenceNo ratings yet

- MEA Salaries 2015Document4 pagesMEA Salaries 2015Rob LawrenceNo ratings yet

- MEA Salaries 2013Document5 pagesMEA Salaries 2013Rob LawrenceNo ratings yet

- MPSERS 2011 Investment Return pg59Document1 pageMPSERS 2011 Investment Return pg59Rob LawrenceNo ratings yet

- MEA Top Ten Salaries 2013Document1 pageMEA Top Ten Salaries 2013Rob LawrenceNo ratings yet

- 2012 MEA LM2 Full ReportDocument126 pages2012 MEA LM2 Full ReportRob LawrenceNo ratings yet

- MEA Top Ten Salaries 2012Document1 pageMEA Top Ten Salaries 2012Rob LawrenceNo ratings yet

- MPSERS 2011 Actuarial Assumptions pg79Document1 pageMPSERS 2011 Actuarial Assumptions pg79Rob LawrenceNo ratings yet

- MCRGO Survey SentDocument1 pageMCRGO Survey SentRob LawrenceNo ratings yet

- MEA Salaries 2012Document5 pagesMEA Salaries 2012Rob LawrenceNo ratings yet

- MPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceDocument1 pageMPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceRob LawrenceNo ratings yet

- MPSERS 2011 Assets Pg23Document1 pageMPSERS 2011 Assets Pg23Rob LawrenceNo ratings yet

- MPSERS 2011 Investment Section pg68Document1 pageMPSERS 2011 Investment Section pg68Rob LawrenceNo ratings yet

- MEA Salaries 10-11Document5 pagesMEA Salaries 10-11Rob LawrenceNo ratings yet

- MEA Salaries 07-08Document5 pagesMEA Salaries 07-08Rob LawrenceNo ratings yet

- MEA Top Ten Salaries 2011Document1 pageMEA Top Ten Salaries 2011Rob LawrenceNo ratings yet

- MPSERS 2011 Financial Assumptions Pg36Document1 pageMPSERS 2011 Financial Assumptions Pg36Rob LawrenceNo ratings yet

- Increae Base (+$100k) From '06 Increae Total (+$100k) From '06Document6 pagesIncreae Base (+$100k) From '06 Increae Total (+$100k) From '06Rob LawrenceNo ratings yet

- MEA Salaries 08-09Document5 pagesMEA Salaries 08-09Rob LawrenceNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyDocument22 pages25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyHema and syedNo ratings yet

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNo ratings yet

- Journal of Rock Mechanics and Geotechnical EngineeringDocument13 pagesJournal of Rock Mechanics and Geotechnical EngineeringMichael TiconaNo ratings yet

- Profile Guide: Corrugated Sheet & Foam FillersDocument275 pagesProfile Guide: Corrugated Sheet & Foam FillersnguyenanhtuanbNo ratings yet

- 1 Plastics Give A Helpful HandDocument10 pages1 Plastics Give A Helpful HandNIranjanaNo ratings yet

- Operation Flood White Revolution Muhammad Ali 2007-Va-378 Bs (Hons) Dairy TechnologyDocument23 pagesOperation Flood White Revolution Muhammad Ali 2007-Va-378 Bs (Hons) Dairy TechnologyShawn MathiasNo ratings yet

- Revised Scheme of Studyb - SC (Hons.) Agri Economics (UAF)Document15 pagesRevised Scheme of Studyb - SC (Hons.) Agri Economics (UAF)Irfy BegNo ratings yet

- LAVA - Mobile - Case StudyDocument3 pagesLAVA - Mobile - Case StudySatyesh.s100% (1)

- Bilo GraphyDocument9 pagesBilo Graphyvimalvijayan89No ratings yet

- Wind & Storm Proof UmbrellaDocument17 pagesWind & Storm Proof UmbrellaIbrahim KhanNo ratings yet

- Notes On Fundamentals of Property OwnershipDocument17 pagesNotes On Fundamentals of Property OwnershipNeil MayorNo ratings yet

- Atienza v. de CastroDocument3 pagesAtienza v. de CastroAprilMartelNo ratings yet

- Mind Map Cost of ProductionDocument1 pageMind Map Cost of ProductionDimas Mahendra P BozerNo ratings yet

- Acctg 1 PS 1Document3 pagesAcctg 1 PS 1Aj GuanzonNo ratings yet

- Cfdcir 04Document3 pagesCfdcir 04subodhmallyaNo ratings yet

- MSC Chain of Custody StandardDocument10 pagesMSC Chain of Custody StandardIMMASNo ratings yet

- The Business Model CanvasDocument2 pagesThe Business Model CanvasJohn HowardNo ratings yet

- Import - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalDocument2 pagesImport - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalNguyễn Thanh LongNo ratings yet

- Contemporary Issues of GlobalizationDocument22 pagesContemporary Issues of GlobalizationAyman MotenNo ratings yet

- The Great South African Land ScandalDocument158 pagesThe Great South African Land ScandalTinyiko S. MalulekeNo ratings yet

- How To Start A Travel and Tour BusinessDocument3 pagesHow To Start A Travel and Tour BusinessGrace LeonardoNo ratings yet

- National Income QuestionsDocument9 pagesNational Income QuestionsPetronella BrownNo ratings yet

- Competition ActDocument25 pagesCompetition ActAnjali Mishra100% (1)

- MKTG 361 Phase 2Document10 pagesMKTG 361 Phase 2api-486202971No ratings yet

- 184 History of AgricultureDocument25 pages184 History of AgricultureBhupendra PunvarNo ratings yet

- Certificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Document3 pagesCertificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Habibie MikhailNo ratings yet

- Uber MarketingDocument23 pagesUber MarketingKavya SathishNo ratings yet

- Capital Weekly 018 OnlineDocument20 pagesCapital Weekly 018 OnlineBelize ConsulateNo ratings yet

- Mixed Use Traffic Impact StudyDocument77 pagesMixed Use Traffic Impact StudyusamaNo ratings yet

- Eldorado DredgeDocument2 pagesEldorado DredgeNeenNo ratings yet