Professional Documents

Culture Documents

Mvela Group

Uploaded by

sizwehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mvela Group

Uploaded by

sizwehCopyright:

Available Formats

MVELAPHANDA GROUP LIMITED

Combining quality investments with cash-generative operations

2006 Annual Report

MVELAPHANDA GROUP LIMITED ANNUAL REPORT 2006

Contents, Vision and Values

MVELAPHANDA GROUP LIMITED

1 Highlights of the 2006 Financial Year 2 Group at a Glance 4 A Decade of Successful Growth 6 Ten-year Financial Review 8 Executive Directors 9 Non-executive Directors 10 Chairmans Review 14 Chief Executives Review 26 Financial Review 30 Sustainability Report 36 Corporate Governance 40 Value Added Statement 41 Segmental Information 42 Report of the Independent Auditors 43 Directors Responsibility Statement 43 Statement of Compliance by the Company Secretary 44 Directors Report 47 Accounting Policies 52 Balance Sheets 53 Income Statements 54 Cash Flow Statements 55 Statements of Changes in Equity 56 Notes to the Financial Statements 78 Principal Subsidiaries 79 Principal Investments 80 Analysis of Ordinary Shareholders 81 Administration 82 Notice to Shareholders 87 Proxy Form for Ordinary Shareholders 89 Proxy Form for Preference Shareholders ibc Glossary of Terms

Vision

To be South Africas leading black-controlled, owned and managed diversied industrial group through the combination of quality investments and cashgenerative operations.

Values

Shareholder value

Balancing growth, risk and returns to strategies which sustain shareholder condence and meet investor expectations.

Customer value

Meeting or exceeding customer expectations at a price no higher than their perception of the services value.

People value

Satisfying human needs in the workplace to maximise the commitment of sta to corporate goals.

Registration number: 1995/004153/06

Highlights of the 2006 Financial Year

page one

Intrinsic net asset value per ordinary share at 30 June 2006 up 41% to R11,77 Total assets at 30 June 2006 exceed R6 billion Net profit attributable to ordinary shareholders of R1,145 billion Profit from operations up 30% to R262 million Cash distribution/dividend per ordinary share up 80% to 18 cents R547 million capital raising successfully concluded Acquisition of a further effective interest of 2,47% in Absa Disposal of interest in Mvelaphanda Resources for R1,183 billion in cash implemented on 28 August 2006

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page two

Group at a Glance

Investments

Mvelaphanda Group is invested in a range of companies operating in the nancial services and industrial sectors.

MVELAPHANDA RESOURCES

Process 00c72m38b 00m91y

Process 100c72m38b 100m91y

4,47% effective interest in Absa, one of South Africas largest financial services groups and a subsidiary of Barclays Bank plc

18,1% effective interest in Life Healthcare, one of the largest providers of integrated healthcare and medical services in South Africa(1)

22,9% interest in Mvelaphanda Resources, a mining and resources investment company listed on the JSE(2)

10,8% interest in Group Five, a leading construction group listed on the JSE

1. Effective interest increased to 23,7% after 30 June 2006. 2. Disposal implemented after 30 June 2006.

Operations

Mvelaphanda Groups operations comprise a range of businesses in the areas of facilities management and professional services, food services and support services. Food Services

Facilities Management and Professional Services

Africas largest facilities management company

Asset management Monitoring services and consulting provided to the services gaming industry

Contract catering services

Distributor of dry goods and packaging

page three

MVELAPHANDA PRIVATE EQUITY

MVELAPHANDA CAPITAL MVELAPHANDA CAPITAL

4,5% effective interest in Unitrans Limited, a logistics group listed on the JSE

39,2% interest in Swissport South Africa, a provider of logistic services at major airports in South Africa and a subsidiary of Swissport International

30% effective interest in Abvest Associates, the institutional investment management business of the Absa Group(2)

Investment holding companies for the Groups investments in the transportation, information technology, engineering and property sectors

Support Services

Comprehensive Guarding and Contract cleaning International Opencast mining range of security technology-based services freight forwarding services services security services and clearing agent Franchisor of the Blacksteer and King Pie brands

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page four

A Decade of Successful Growth

Milestones

Rebhold listed on

the JSE on 16 October 1996

Acquisition of Acquisition of Royal

Food Services first services business Jumbo Cash and Carry

Acquisition of Coin Security,

and certain businesses from Molope Group

1996 1997

Acquisition of wholesale

Mineworkers Investment Company acquires 20% of Rebhold in a major BEE transaction

1998 1999

Acquisition of Browns Rebserve formed and Weirs cash and to hold the carry joint venture with Groups services Tiger Brands interests

2000

and distribution businesses in food and beverages sector

TFMC facilities

management contract with Telkom commences

page ve

Disposal of

H O L D I N G S L I M IT E D

wholesale division, name changed to Rebserve Holdings

Merger with Focus on operational

excellence and cash generation Mvelaphanda Holdings

Acquisition of

18,1% effective interest in Life Healthcare

Acquisition

of a further effective interest of 2,47% in Absa

Net profit after taxation exceeds R1 billion for the first time

2002 2001 2003

2004 2005

MVELAPHANDA GROUP LIMITED

2006

Acquisition of Berco

Cleaning Services to form Rebserve Cleaning Services

Name changed to Mvelaphanda Group Limited on implementation of the Merger

Issue of preference shares to raise R547 million of new capital

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page six

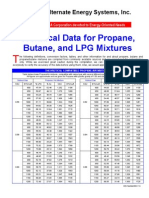

Ten-year Financial Review year ended 30 June

2006 Revenue (R000) Profit from operations (R000) Fair value adjustments and profit from investments (R000) Cash generated from operations (R000) Net profit after taxation (R000) Headline net profit after taxation (R000) Headline attributable net profit (R000) Diluted headline earnings per ordinary share (cents) Headline earnings per ordinary share (cents) Distribution/dividend per ordinary share (cents) Dividend per preference share (cents) Net tangible asset value per ordinary share (cents) Intrinsic net asset value per ordinary share (rands) Number of employees Number of ordinary shares in issue (000) Annual compound growth rate in headline earnings per ordinary share since 1995 Operating margin Return on average shareholders funds 3 102 432 262 204 849 777 336 575 1 162 300 1 381 320 1 363 953 285,3 322,1 18,0 36,0 760,9 11,77 22 609 443 000 40,2% 8,5% 31,6%

(3)

2005 3 221 310 201 019 268 088 435 511 412 811 448 739 439 542 143,5 143,5 10,0 n/a 483,1 8,35 22 560 409 103 33,0% 6,2% 22,0%

2004 3 487 126 270 523 n/a 356 538 203 980 221 209 198 118 111,5 111,8 175,0(2) n/a 388,6 7,00 31 822 193 730 34,0% 7,8% 18,6%

Notes 1. Results for the years ended 30 June 2005 and 2006 have been prepared in accordance with IFRS. Results for the years ended 30 June 1997 to 2004 were prepared in accordance with SA GAAP. 2. Includes the special dividend of R1,10 per ordinary share and the capitalisation share award, equivalent in value to 50 cents per ordinary share, distributed to ordinary shareholders pursuant to the Merger. 3. Includes the cash distribution out of share premium in lieu of a final ordinary dividend, of 13 cents per ordinary share.

page seven

2003 3 189 576 276 394 n/a 288 363 218 889 233 913 208 724 114,0 116,2 35,0 n/a 355,7 n/a 35 810 193 730 41,0% 8,7% 21,5%

2002 2 911 107 255 232 n/a 269 088 218 184 232 136 208 589 109,6 110,6 30,0 n/a 295,3 n/a 33 327 193 730 46,0% 8,8% 22,0%

2001 5 559 588 352 221 n/a 303 761 353 113 299 802 260 740 134,6 134,6 20,5 n/a 256,7 n/a 30 764 193 730 61,0% 6,3% 40,0%

2000 4 496 959 307 241 n/a 240 118 274 268 274 268 247 467 133,0 137,0 20,0 n/a 197,4 n/a 30 521 180 630 77,0% 6,8% 40,5%

1999 3 374 182 190 036 n/a 169 367 520 292 211 673 191 500 105,6 110,2 17,0 n/a 326,4 n/a 5 579 173 818 94,0% 5,6% 74,6%

1998 1 471 250 96 241 n/a 94 499 95 762 95 762 94 508 62,0 64,9 13,0 n/a 172,9 n/a 3 243 163 070 103,0% 6,5% 19,2%

1997 870 025 50 107 n/a 86 486 38 105 38 105 37 852 n/a 33,1 8,0 n/a 102,0 n/a 2 152 133 215 106,0% 5,8% 21,0%

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page eight

Executive Directors

Tokyo Sexwale Executive Chairman Mark Willcox Chief Investment Ocer

Stephen Levenberg Chief Executive Ocer Mikki Xayiya Executive Deputy Chairman

Yolanda Cuba Deputy Chief Executive Ocer Brett Till Chief Financial Ocer Vusi Mavimbela Executive director Business strategy and African expansion

Jackie Mphafudi Chief Operating Ocer

Tokyo Sexwale

Cert Bus Studies (University Botswana, Lesotho, Swaziland)

Vusi Mavimbela

BSoc (Natal)

Mikki Xayiya

BA (Unisa), Cert of Defence Management (Wits), Emerging Market Leadership Programme (University of Pennsylvania)

Tokyo Sexwale has held various senior positions in the African National Congress and was elected as the rst Premier of Gauteng province in 1994. He left public political oce in 1998 for the corporate sector and established Mvelaphanda Holdings in late 1998. He also serves on the boards of various companies including, inter alia, Gold Fields, Absa and Mvelaphanda Resources.

Vusi Mavimbela is currently the director of Mvelaphanda Group with responsibility for business strategy and African expansion. Prior to joining Mvelaphanda Group he held various senior positions in the oce of the Deputy President, including having been special advisor to the President on intelligence and security matters.

Mikki Xayiya has served in various capacities in the African National Congress since 1977. In 1995, he was appointed as a Policy Advisor Oce of the Premier, Gauteng Provincial Government. He left public oce in 1998 and joined Mawenzi Asset Managers as Managing Director. In 1998 he co-founded Mvelaphanda Holdings.

Stephen Levenberg

BA, LLB, HDip Co Law (Wits)

Brett Till

BCom, BAcc (Wits), CA(SA)

Jackie Mphafudi

MBChB (Natal), DCH (SA), FCP (Paeds) (SA)

After qualifying as a chartered accountant in 1993, Brett Till spent 18 months working in London and became a partner of PKF in 1996. He joined Rebserve in 1998 and was appointed Financial Director in 1999.

Prior to founding Rebserve, Stephen Levenberg was a senior partner and head of corporate law at Werksmans Attorneys, having gained extensive experience in corporate nance, mergers and acquisitions and other transactions. He has served as a director of various companies, both listed and unlisted.

Dr Jackie Mphafudi is a paediatrician by training, having practised from 1989 to 1998. He has served on various boards, including being the founder member of Kilimanjaro Investments (Proprietary) Limited, which successfully listed on the JSE in 1994.

Mark Willcox

BA, LLB, Post-grad Dip (Tax) (UCT)

Yolanda Cuba

BCom (Statistics) (UCT), BCom Hons (Accounting) (Natal), CA(SA)

Upon completing his studies, Mark Willcox worked for an investment bank based in the USA. During this period he was exposed to various signicant mining and property transactions in the USA, the Far East and Africa. Mark is also the Chief Executive Ocer of Mvelaphanda Holdings.

Yolanda Cuba joined Mvelaphanda Holdings corporate nance division in January 2003. She has worked in a wide range of companies, including Robertsons Foods and Metropolitan Life, and has also been involved in a number of development companies where she gives assistance and advice on nancial matters and strategic investment.

Non-executive Directors

page nine

Kuseni Dlamini Independent non-executive director

Bryan Hopkins Independent non-executive director

John Moxon Independent non-executive director

Carl Stein Non-executive director

Ramesh Patel Independent non-executive director

Mpumi Mpofu Independent non-executive director

Oyama Mabandla Independent nonexecutive director

David Moshapalo Independent nonexecutive director

Kuseni Dlamini

MPhil (Oxford)

Mpumi Mpofu

BA (University of Coventry), Post-graduate Degree Town Planning (University of Coventry)

Oyama Mabandla

BA (University of California), Juris Doctor (Columbia University)

Kuseni Dlamini is the Executive Chairman of Richards Bay Coal Terminal. Previously he has held senior appointments at De Beers in South Africa and in the United Kingdom, and at AngloGold Ashanti. He is also a non-executive director of the National Business Initiative (NBI), Massmart Holdings Limited and Teba Limited, and sits on the council of the South African Institute of International Aairs (SAIIA).

Mpumi Mpofu is the Director-General in the Department of Transport and prior to that in the Department of Housing. She has also held a number of other senior positions including having been a member of the Gauteng Development Tribunal, a board member of the National Housing Finance Corporation and a board member of the South African Housing Trust.

Oyama Mabandla is Chairman of Vodacom Limited and also Executive Chairman of Langa Group (Proprietary) Limited, an investment holding company. He was previously Deputy Chief Executive of South African Airways. Prior to joining South African Airways, he held various positions within the legal and investment banking professions.

Ramesh Patel

Ramesh Patel is the Chairman and Chief Executive Ocer of the MLP group of companies which has interests in a range of businesses in the nancial services, tobacco, paint and plastics industries. He has also been instrumental in the formation of several BEE groups.

John Moxon

FCA, MBA (Cape Town)

Carl Stein

BCom, LLB, HDip Tax Law (Wits)

John Moxon is currently the Chairman of Meikles Africa Limited, a Zimbabwe-based company which is listed on the Harare and London Stock Exchanges, with interests in the hotel and retail sectors.

Bryan Hopkins

BCom (Hons), CA(SA)

Carl Stein is a practising attorney, being a director of the law rm Bowman Gilllan Inc, and is a non-executive director of several listed companies. He is regarded as one of South Africas leading corporate lawyers, specialising in mergers and acquisitions, stock exchange and crossborder transactions.

David Moshapalo

David Moshapalo is currently a member of Bombela Concession (Proprietary) Limited, Chairman of Gobodo Inc. and a board member of the Black Business Council. His previous positions include having been the convenor of the State Presidents Black Business Working Group, a member of Nedlac Council, an executive member of Business South Africa, Vice-chairperson of the Gauteng Tender Board and an alternate director of MTN Group Limited.

Bryan Hopkins is currently an independent nonexecutive director of Pangbourne Properties Limited and a member of its audit committee. He is also serving a three-year term on the Directorate of Market Abuse. He was previously an executive director and CIO of Abvest Associates and Old Mutual Asset Managers. Prior to that he was Professor of Accounting at the University of Cape Town.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page ten

Chairmans Review

Tokyo Sexwale

Executive Chairman

Ten years after listing as Rebhold Limited in 1996, Mvelaphanda Group is today one of South Africas leading BEE groups. Good growth was achieved in all areas of activity in the nancial year ended 30 June 2006. The Groups investments and operations are well-positioned to benet from the favourable economic conditions and the positive economic outlook.

page eleven

A decade of success

The 2006 nancial year is Mvelaphanda Groups rst full nancial year since the Merger was implemented in December 2004. It is also the tenth year since Mvelaphanda Group listed on the JSE on 16 October 1996 as Rebhold Limited. It is a credit to all those who have been involved in the Groups ten-year history that the Group has grown and ourished over this period. The Group commenced operations in 1995 and rapidly expanded after its listing into a variety of wholesale and distribution activities. By October 1998 the Groups market capitalisation had reached R4 billion, only two years after listing with an initial market capitalisation of R250 million. This growth was driven mainly by the acquisition of businesses in the wholesale and distribution sectors. In 1999, the Group expanded into the services sector with the acquisition of Coin Security and certain businesses from the former Molope Group. By 2001 Mvelaserve, the Groups major operating subsidiary, had become one of South Africas leading services groups, providing a comprehensive range of facilities management, mining, food and support services to corporate South Africa. At its peak Mvelaserve employed over 35 000 employees. In 2004, Mvelaphanda Holdings merged certain of its assets and businesses with Rebserve to create Mvelaphanda Group. One of the main rationales for the Merger, and an important part of Mvelaphanda Groups strategy, is to combine quality investments with cash-generative operations, in order to avoid certain of the pitfalls which have caused many of the early BEE transactions to fail, including in particular a lack of access to liquidity on the part of certain of the BEE partners historically. Today Mvelaphanda Group is proud to be a leading BEE and truly South African group, comprising a microcosm of the diversity, opportunity and success which South Africa has to oer.

Economic environment

For most of the 2006 nancial year economic conditions remained favourable. The Governments monetary and scal disciplines have yielded good results, and notwithstanding recent concerns over ination levels and increases in interest rates, market conditions remain largely positive. Government has outlined its infrastructural development plans for the next four to ve years with hundreds of billions of rands to be spent on various projects. These projects will be the driving force behind the growth in our economy over the next few years and will present numerous opportunities for our operations and investment companies. Close cooperation between government and the private sector remains an imperative for South African business. Our operations and investment companies are already involved in public-private partnerships and we will continue to pursue such partnerships where possible. Much has already been said about the FIFA World Cup which will be hosted in South Africa in 2010. As the largest sporting event in the world, it will create opportunities for South African business on an unprecedented scale. Now is the time for making plans to harness the vast opportunities which the FIFA World Cup will bring to our country in 2010.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twelve

Chairmans Review (continued)

Financial results

The results for the year ended 30 June 2006 are very pleasing. Good growth was achieved in all areas of activity, particularly in our investments. Net prot after taxation exceeded R1 billion for the rst time in the Groups history. At 30 June 2006 the Groups total assets exceeded R6 billion, including R1,5 billion in cash (calculated on the assumption that the disposal of the Groups interest in Mvelaphanda Resources had been implemented on 30 June 2006). Intrinsic net asset value, which we regard as the primary measure of our success, increased 41%, from R8,35 at 30 June 2005, to R11,77 at 30 June 2006. Other highlights for the year include the raising of R547 million in new capital through the issue of preference shares, which allowed the Group to raise capital while still preserving its BEE shareholder credentials, and the acquisition of a further 2,47% eective interest in Absa. The total dividend/distribution to ordinary shareholders for the year was 18 cents per ordinary share, an increase of 80% compared to the previous nancial year, and a strong indicator of our condence in the future of the Group and its ability to sustain strong cash ows.

Governance

As a participant in the global community, South Africa has accepted the need to conduct itself in the highly regulated manner which has become the international norm. This has seen an increase over the past few years in the legislative and other regulatory requirements with which businesses are required to comply. The primary objective of our Group is to achieve sustained protability and increased returns for our shareholders. This is premised on the fundamental principle of good corporate governance. Good corporate governance is not merely about compliance with regulations, but rather a reection of our organisations approach to conducting business in the interests of all of its stakeholders. Mvelaphanda Group subscribes to the highest standards of corporate governance. Our governance structures are continually being evaluated in the context of the increasing expectations of the investment community and the business environment in which the Group operates.

Black Economic Empowerment

BEE is an evolving process with the broad-based BEE codes of practice in the process of being nalised by the Department of Trade and Industry. These BEE codes of practice address the challenges of BEE, in order to ensure that commercial and sustainable solutions are found. With less than 10% of companies listed on the JSE being black-controlled, there is still a long way to go to achieve the economic balance which the BEE initiatives were originally designed to do. Mvelaphanda Group remains committed to going beyond the minimum requirements of the BEE codes and the industry charters, but also to creating a truly non-racial South African company where opportunities exist for all stakeholders. Broad-based BEE is not an end in itself, but rather a means to an end. Our board is mindful that our practices and actions must be aimed at improving returns for all our stakeholders, not only our shareholders. Our BEE credentials remain a competitive advantage for the Group. Continued focus will be given to the areas of employment equity, training and development of our people, and targeted procurement from BEE suppliers, to broaden the inuence and eect which Mvelaphanda Group can have on the broader communities and other stakeholders who are critical to our overall success.

page thirteen

Acknowledgements

My thanks and appreciation go to all the directors, executives and employees of all our operations and investment companies. Without their hard work and dedication we would not have achieved the success we have, not only in the current nancial year, but also over the past decade.

Prospects

As a group we have much to be thankful for and a lot to look forward to. Our operations and investment companies are well-positioned to benet from the growing economy, which growth is expected to continue in the short to medium term. We have a strong balance sheet and the nancial resources to pursue the new opportunities which we are condent will arise as the Group expands within South Africa and across Africa. We look forward to the next decade of growth and success as Mvelaphanda Group.

Tokyo Sexwale

Executive Chairman

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page fourteen

Chief Executives Review

SIGNATURE

Stephen Levenberg

Chief Executive Ocer

The Groups investment strategy was rened to concentrate on the nancial and industrial sectors. A solid base for future growth and value creation has been established. Cash resources of R1,5 billion will allow Mvelaphanda Group to conclude major BEE and other corporate transactions.

page fteen

Overview

Mvelaphanda Group is pleased to report highly satisfactory results for the nancial year ended 30 June 2006, being the Groups rst full nancial year of activity since the merger of the businesses and assets of Mvelaphanda Holdings and Rebserve was implemented. While Mvelaphanda Group continued to rene its investment strategy to concentrate on the industrial and nancial sectors, signicant strides were made in establishing a solid base for future growth and value creation. This was achieved through major corporate activity during the year, including the raising of R547 million of preference share capital on favourable terms, the acquisition of a further material interest in Absa, the successful investment in Group Five, and the shedding of the Groups investment in the non-core mining and resources sector. Mvelaphanda Groups investments comprise a range of quality companies operating in the nancial and industrial sectors. The sound performance of the underlying companies in which Mvelaphanda Group is invested is reected in the increase in the value of these investments by R850 million in the year under review. The Groups operating businesses also performed well, increasing prot from operations by 30%, from R201 million for the year ended 30 June 2005, to R262 million for the year under review. Cash generated by the operating businesses for the year remained strong at R337 million. Intrinsic net asset value per ordinary share, which is considered to be the most insightful measure of the Groups overall performance, increased by 41% from R8,35 at 30 June 2005 to R11,77 at 30 June 2006. Details of the calculation of the intrinsic net asset value per share are set out in the nancial review. Following the disposal by Mvelaphanda Group of its investment in Mvelaphanda Resources referred to below, for a cash consideration of R1,183 billion, Mvelaphanda Group has approximately R1,5 billion in cash, making it one of very few companies in South Africa with strong BEE credentials, proven transactional and management expertise, and major nancial resources to conclude large-scale investment transactions. The results and activities of the Group, including segmental information, are presented for its two areas of activity operations and investments. This is in line with the manner in which Mvelaphanda Groups activities are now structured and managed, and the increased value and importance of the investment activities of the Group.

Investments

Mvelaphanda Groups investment strategy is to acquire meaningful strategic stakes (measured in terms of value to Mvelaphanda Group) in large South African corporates across a range of market sectors, which have good growth prospects in the medium term as a result of their strong market position, dynamic and entrepreneurial management, and industry fundamentals. Investment activities are focused on the management of investments and the provision of support, leadership and strategic guidance to these companies, rather than being involved in the day-to-day operations of these companies. Mvelaphanda Groups investment strategy was rened during the year to concentrate on the nancial and industrial sectors, as evidenced by the acquisition during the year ended 30 June 2006 of a further 2,47% eective interest in Absa and of a 10,8% interest in Group Five. Subsequent to the year ended 30 June 2006, the Group disposed of its 22,9% interest in Mvelaphanda Resources and acquired a further 5,6% eective interest in Life Healthcare. At 30 June 2006, Mvelaphanda Groups investments comprised a range of companies in the nancial services, mining and resources, property, healthcare and general industrial sectors. The largest of these investments were:

an eective 4,47% interest in Absa; an eective 18,1% interest in Life Healthcare; a 10,8% interest in Group Five; a 22,9% interest in Mvelaphanda Resources (which was sold after 30 June 2006); and an eective 30% interest in Abvest Associates (which was sold after 30 June 2006).

Mvelaphanda Groups investments performed extremely well in the year under review. Prot from investments, which includes the unrealised gains on the revaluation of investments (net of costs relating to the investment activities), increased by 218% from R268 million for the year ended 30 June 2005 to R850 million for the year under review. This performance was largely as a result of the performance of the Groups strategic investments in Absa, Life Healthcare and Group Five.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page sixteen

Chief Executives Review Investments

100m91y Process 30 June 2006, Mvelaphanda Group owned an eective 44,7% interest in Batho Bonke, which At 100c72m38b 100m91y preference shares and options equating to an eective 10% stake in Absa. Mvelaphanda owns

100c72m38b Absa Group Limited

Process

Group therefore has an eective interest of 4,47% in Absa. Absa is one of South Africas largest nancial services groups and is a subsidiary of Barclays Bank plc. Barclays Bank is an international nancial services group engaged in retail and commercial banking, credit card issuing, investment banking, wealth management and investment management services. Absa oers a complete range of banking, bancassurance and wealth management products and services. Absas business is conducted primarily in South Africa and on the African continent, where it has equity holdings in banks in Mozambique, Angola, Tanzania, Namibia and Zimbabwe. At 30 June 2006, Absa had assets of R467 billion, more than 720 physical outlets, 8,1 million customers and approximately 34 700 employees. In December 2005, Mvelaphanda Group acquired a further 2,47% eective interest in Absa (an eective interest of 24,7% in Batho Bonke) for R461 million, which price represented a discount of approximately 30% (equivalent in value to R200 million) to the market value of the Batho Bonke shares at the time of concluding the acquisition. The purchase price was settled by the issue of 33,9 million new Mvelaphanda Group ordinary shares and the payment of R190 million in cash. Mvelaphanda Groups investment in Absa performed well during the year under review as a result of the increase in the Absa share price from R82 per share at 30 June 2005 to R100 per share at 30 June 2006, and the leveraged eect of this investment as a result of the Absa

options held by Batho Bonke. At 30 June 2006, Mvelaphanda Groups investment in Absa was valued at approximately R1,256 billion after providing for capital gains tax, making it the single largest investment held by Mvelaphanda Group. Positive forecasts in respect of the future performance of Absa suggest that there is strong upside potential in the performance of this investment for Mvelaphanda Group. This, coupled with the leverage that results from the Absa options held by Batho Bonke, makes Absa an attractive investment for the Group.

4,47% eective interest in Absa. Positive forecasts in respect of the future performance of Absa. Strong correlation between Absa and Mvelaphanda Group share prices.

page seventeen

Life Healthcare Life Healthcare is one of the largest private hospital operations outside the United States with its primary business being the provision of acute hospital care. High-tech private hospitals are complemented by related healthcare services businesses which provide an integrated healthcare delivery system covering the full range of medical care. Life Healthcare operates 62 acute care facilities across South Africa and enjoys the support of 2 700 doctors and specialists. Other services oered include providing long-term care to chronically ill patients (through the Life Esidimeni public-private partnership), physical and cognitive rehabilitation for patients disabled by strokes, brain, spinal and other disabling injuries, and occupational and primary healthcare services to over 120 000 employees of large employer groups through 186 clinics. Through the Partnership Health Group UK, a joint venture with London-listed Care UK, Life Healthcare provides a range of nursing and management services at treatment centres in the United Kingdom. At 30 June 2006, Mvelaphanda Group held an eective 18,1% interest in Life Healthcare and is one of only two listed entities which provide a signicant exposure to Life Healthcare for investors who wish to invest in the high-growth private healthcare sector. Since its delisting in March 2005, the Life Healthcare business has performed well, achieving strong growth in its operating performance and operating cash ows. Performance of the business is ahead of expectations at the time of the BEE-led leveraged buyout of the Life

Healthcare business from African Oxygen, which was implemented in March 2005. On 6 September 2006, Mvelaphanda Group acquired an additional 5,6% eective economic interest in Life Healthcare for a purchase price of R223 million (the Life Healthcare acquisition) pursuant to the exercise of an existing option held by Mvelaphanda Group and certain of the other shareholders in Life Healthcare. The purchase price of R223 million represents a discount of 37% to the Mvelaphanda Group directors valuation of Life Healthcare (calculated with reference to Mvelaphanda Groups valuation of its 18,1% eective interest in Life Healthcare at 30 June 2006) and was paid in cash on 29 September 2006 from Mvelaphanda Groups existing cash resources. Depending on the outcome of certain other transactions which Life Healthcare is currently considering, the 5,6% eective interest acquired by Mvelaphanda Group may be reduced to an eective interest of 4,4%, with a corresponding reduction in the purchase price payable by Mvelaphanda Group. Pursuant to the Life Healthcare acquisition, Mvelaphanda Groups eective interest in Life Healthcare will increase to 23,7%. Had the Life Healthcare acquisition been concluded on 30 June 2006, this would have resulted in an increase in Mvelaphanda Groups intrinsic net asset value per ordinary share at 30 June 2006 from R11,77 to R12,00. Mvelaphanda Group regards Life Healthcare as a strategic investment with substantial growth potential. Life Healthcare is expected to be a signicant contributor to Group performance in the future.

Mvelaphanda Group is one of only two listed groups which provide material exposure to Life Healthcare. Additional 5,6% eective interest in Life Healthcare acquired on 6 September 2006. Life Healthcare is expected to be a signicant contributor to Group performance in the future.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page eighteen

Chief Executives Review Investments (continued)

Group Five In November 2005, Mvelaphanda Group acquired 10,4 million Group Five ordinary shares (an eective interest of 10,8% in Group Five) at par value. Mvelaphanda Group has an obligation to sell back to Group Five, also at par value, such number of Group Five shares (calculated based on the Group Five share price in 2011) as is equivalent in value to a notional loan amount in 2011. The notional loan amount is calculated based on an initial value per Group Five share of R14,43 plus notional interest at a rate of 12% per annum. The balance of the Group Five shares may be retained by Mvelaphanda Group. The Groups investment in Group Five is eectively equivalent to an option to acquire a 10,8% interest in Group Five. Group Five is a leading construction group listed on the JSE with operations in South Africa, the rest of Africa, the Middle East and Eastern Europe. Approximately 63% of Group Fives revenue is generated in South Africa. Group Fives principal activities include general construction (which encompasses commercial, industrial and domestic building, civil engineering and road, earthworks and engineering projects), manufacturing of a wide range of bre-cement building products and piping, and infrastructural developments, including large-scale public-private partnership infrastructure concessions. For its nancial year ended 30 June 2006, Group Five achieved its sixth consecutive year of double-digit earnings growth as a result of reorganising its operations into focused business streams under strong leadership, supported by solid service functions, risk management and continuous improvement projects. Total revenue for the year ended 30 June 2006 increased by 30% to R5,9 billion, with Group Fives net prot after tax from continuing operations for the year ended 30 June 2006 increasing by 57% to R169 million. Earnings per share from Group Fives continuing operations increased by 49% to 224 cents per share for the year ended 30 June 2006. The strong operational performance of Group Five underpinned the increase in the Group Five share price from R20 per share in November 2005, when the investment in Group Five was acquired by Mvelaphanda Group, to R29 per share at 30 June 2006. This has resulted in a substantial increase in the value of Mvelaphanda Groups investment in Group Five over the period. Prospects for Group Five remain good, particularly in the context of Governments planned R400 billion infrastructure programme, and the 2010 FIFA Soccer World Cup. Demand in the construction sector could well exceed supply over the next ve years, improving prospects for expansion, growth and strong job creation. Group Five is well-positioned and focused to benet from these favourable market conditions.

Mvelaphanda Groups interest in Group Five is eectively equivalent to an option to acquire a 10,8% interest is Group Five. Strong operational performance for the year ended 30 June 2006 by Group Five underpinned the increase in Group Fives share price. Group Five is well-positioned to benet from Governments infrastructure development programmes.

page nineteen

MVELAPHANDA RESOURCES

Mvelaphanda Resources Mvelaphanda Resources is a broad-based empowerment mining and minerals company with investments in mining assets in the gold, platinum and diamond sectors, as well as exploration and development joint ventures in sub-Saharan Africa, with a focus on South Africa. Mvelaphanda Resources primary assets consist of:

a 15% interest in GFI Mining South Africa (Proprietary) Limited (GFI), which owns the South African assets of Gold Fields Limited, the fourth largest gold producer in the world. The 15% interest in GFI is equivalent to an approximate 9% interest in Gold Fields Limited;

a 22,3% interest in Northam Platinum Limited, South Africas fourth largest producer of platinum group metals; and a 20,7% interest in Trans Hex Group Limited, an integrated diamond producer,

each of which is listed on the JSE. Mvelaphanda Resources also holds strategic interests in various joint ventures engaged in exploring for precious metals and minerals with partners, including GFL Mining Services Limited, De Beers Consolidated Mines Limited, Southern Era (Proprietary) Limited and Trans Hex Group Limited. As a result of, inter alia, the relatively illiquid nature of the investments held by Mvelaphanda Resources, the restrictions imposed on such investments, and the complex structuring of

certain of these investments, Mvelaphanda Resources shares have historically traded on the JSE at a discount to its underlying net asset value. Furthermore, the volatility of the nancial and share price performance of Mvelaphanda Resources is not consistent with Mvelaphanda Groups investment strategy. As a result of the abovementioned factors, the board of directors of Mvelaphanda Group concluded that it was in the best interests of Mvelaphanda Group to dispose of its interest in Mvelaphanda Resources. On 30 June 2006, Mvelaphanda Group received a written oer from Mvelaphanda Holdings to dispose of its 22,9% interest in Mvelaphanda Resources to Mvelaphanda Holdings (the Mvelaphanda Resources disposal). The purchase consideration payable by Mvelaphanda Holdings to Mvelaphanda Group amounted to R1,183 billion. The Mvelaphanda Resources disposal was approved by Mvelaphanda Group ordinary shareholders at a general meeting on 28 August 2006 and has been implemented. The purchase price payable in terms of the Mvelaphanda Resources disposal was received by Mvelaphanda Group in cash on 28 August 2006.

Financial and share price performance of Mvelaphanda Resources is not consistent with Mvelaphanda Groups investment strategy. 22,9% interest in Mvelaphanda Resources disposed of on 28 August 2006 for R1,183 billion. Sale proceeds received in cash on 28 August 2006.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twenty

Chief Executives Review Investments, Operations (continued)

Other investments

As part of the ongoing process of rening Mvelaphanda Groups investment strategy, certain of the smaller investments held by Mvelaphanda Group have been restructured and/or sold, and other new investments were acquired. Mvelaphanda Group holds an eective 4,5% interest in Unitrans Limited, a diversied transportation, distribution and logistics, motor retailing and car rental company, which is listed on the JSE. Unitrans has many diverse and complementary business interests in logistics and associated industries. These include freight and passenger transport, warehousing, distribution and logistics services, express freight, vehicle retailing, eet management, vehicle leasing and insurance, and car rental. Notwithstanding the increase in the Unitrans share price from R33 to R37 per Unitrans share between 30 June 2005 and 30 June 2006, the value of Mvelaphanda Groups investment in Unitrans remains relatively small due to the nature of the funding arrangements concluded to nance this investment. In July 2005, Mvelaphanda Group acquired an eective 39,2% interest in Swissport South Africa (Proprietary) Limited. Swissport South Africa provides logistics services at major airports in South Africa and is a subsidiary of Swissport International Limited, the leading service provider in the global ground and cargo handling sector, with operations in 41 countries, mainly in Europe, North America and Africa. The acquisition was nanced entirely with bank funding, supported by security and undertakings from Swissport International and Swissport South Africa. Mvelaphanda Groups other investments performed in line with expectations. In December 2005, Mvelaphanda Group disposed of its 5,5% eective interest in African Life to Sanlam Limited (Sanlam) as part of the takeover of African Life by Sanlam. The sale proceeds received by Mvelaphanda Group were in line with Mvelaphanda Groups valuation of the investment in African Life in the previous nancial year. The Groups investments in Arcus Gibb Holdings (Proprietary) Limited, Rewards Company (Proprietary) Limited and Fridge Foods Group (Proprietary) Limited were also disposed of during the year. Subsequent to 30 June 2006, Mvelaphanda Group disposed of its interests in Abvest Associates pursuant to the reorganisation and relocation of the Abvest Associates business from Cape Town to Johannesburg, and Broll Property Group (Proprietary) Limited, which was held jointly with Absa through Mvelaphanda Investments. The sale proceeds received by Mvelaphanda Group for the sale of these investments were in line with the valuations of these investments at 30 June 2006.

39,2% interest in Swissport South Africa acquired in July 2005. 5,5% eective interest in African Life sold to Sanlam in December 2005. 30% eective interest in Abvest Associates sold after 30 June 2006.

page twenty-one

Operations

Mvelaphanda Groups operating strategy is based on a decentralised operating structure with individual subsidiary directors having full responsibility for the operational performance and strategic development of their businesses. Intervention from head oce is assessed on a regular basis in terms of a balanced set of performance and development criteria to ensure that sucient attention is given to short-, medium- and long-term objectives. Mvelaphanda Group also provides assistance wherever necessary to ensure the achievement of the Groups objectives. The focus of the Groups operating businesses is in the services sector. Mvelaserve Limited, the major operating subsidiary of Mvelaphanda Group, is one of South Africas leading services businesses. The Groups services businesses operate in three broad areas facilities management and professional services, foods services and support services. Revenue for the year under review decreased by 4% from the prior year to R3,102 billion as a result of the disposal of the JIC Mining Services business in the second half of the 2005 nancial year. Prot from operations increased by 30% from R201 million for the year ended 30 June 2005 to R262 million for the year ended 30 June 2006. The operating margin increased to 8,5% from 6,2% in the prior year. Cash generated from operations for the year was R337 million and conrms the highly cash-generative nature of the Groups operations. Facilities management and professional services Total Facilities Management Company (TFMC) is the leading facilities management company in Africa. Its largest client is Telkom, to which comprehensive facilities management services are provided in respect of 6 500 properties, 14 000 masts and all ancillary telecommunications infrastructure, totalling in excess of 3 million square metres. Many of these facilities are mission critical for Telkom and are maintained on a 24-hour, 365-days per year basis. TFMC continued to perform well, having reached the halfway stage in its ten-year facilities management contract with Telkom. Negotiations between TFMC and Telkom on the possible extension of the Telkom facilities management contract beyond 2011 have commenced. In June 2006, TFMC completed the installation and implementation of a new SAP software system, substantially enhancing TFMCs already world-class operating systems. This new SAP system will assist in improving operating procedures and eciency, work ow and management of maintenance programmes, and will also increase the value of the intellectual property which has been developed by TFMC. During the year, Mvelaphanda Group exercised an existing option to acquire a further 25,1% interest in Novare Actuaries and Consultants (Proprietary) Limited and Novare Investments (Proprietary) Limited (the Novare companies) from the management shareholders in each of the Novare companies, thereby increasing the Groups interest in the Novare companies to 50,1%. The Novare companies have been incorporated into the Groups operating structures and are managed in accordance with the Groups operating procedures and policies.

Prot from operations increased 30% to R262 million. Cash generated from operations of R337 million. New SAP software system implemented by TFMC in June 2006 increases the value of TFMCs intellectual property.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twenty-two

Chief Executives Review Operations (continued)

Novare Actuaries and Consultants engineers and implements investment solutions for key South African clients, mainly retirement, pension, medical continuation and other trust funds, while assisting and supporting investment decision-makers in the execution of their duciary responsibilities regarding investments. The value of the assets of the various funds to which the Novare companies provide consulting services is approximately R10 billion. Novare Investments employs a dedicated team of professionals who specialise in the risk management, monitoring and reporting of local hedge funds and absolute return funds in South Africa. Novare Investments is also the asset manager to various funds of hedge funds, including the Mayibentsha Fund of Funds which was one of the rst funds of hedge funds launched in South Africa (in April 2003) and one of the leading funds in the alternative investment market in South Africa. These funds have grown substantially over the past three years and are being well-supported by the growing number of private banks and wealth management service providers. The Novare companies have achieved compound annual growth in prot from operations of more than 150% since Mvelaphanda Holdings originally invested in the Novare companies in 2002. Zonke Monitoring Systems (Proprietary) Limited (Zonke) is the sole provider of the Central Electronic Monitoring System (CEMS) for the limited payout machine (LPM) industry in South Africa. The monitoring of LPMs became eective in June 2003, with Mpumalanga being the rst province in South Africa to license LPMs. To date, two more provinces, namely Western Cape and Eastern Cape, are live on the CEMS, with three more provinces expected to start with the rollout of LPMs in the foreseeable future. Zonkes revenue is dependent mainly on the number of LPMs which are monitored by Zonke. Since 2003, the number of LPMs which have been licensed by the provincial gaming boards has increased to approximately 2 350, with the total number of LPMs which will eventually be licensed by the various provincial gaming boards estimated to be in excess of 25 000. Zonke has become a protable business in the current nancial year and is poised for substantial growth as the number of licensed LPMs continues to increase. Food Services RoyalSechaba, whose core business is to provide contract catering services to, inter alia, the healthcare, tertiary education, mining, industrial and corporate sectors across southern Africa, experienced competitive trading conditions, mainly as a result of delays in the awarding of new contracts, particularly in the mining sector.

Additional 25,1% interest in the Novare companies acquired. Compound annual growth in prot from operations of the Novare companies since 2002 of 150%. Zonke Monitoring Systems poised for substantial growth.

page twenty-three

RoyalSechabas focus for the year was on achieving operational excellence in all areas. New computerised management and operations systems were implemented to improve eciencies and operational controls at contracts. Improvements in procurement processes resulted in better buying and contributed positively to margins. More recently, a formalised programme to implement Hazard Analysis Critical Control Points (HACCP), an internationally recognised process to prevent food contamination, has been started and will be implemented at selected contracts. Stamford Sales, which specialises in the distribution of packaging, dry goods, bakery products and cleaning materials to the hospitality, food service, franchise and retail markets, returned to protability during the year under review after incurring a loss for the year ended 30 June 2005. Revenue growth, improved gross margins and operating eciencies, as well as signicant reductions in overhead and operating expenses, all contributed to this turnaround. Customer service levels have been improved such that most customer orders are delivered within 24 hours of receipt making Stamford Sales one of only a few operators in its market capable of such service levels. These improved service levels are attracting new customers, and revenue is increasing. In April 2006, Stamford Sales acquired an additional 26% of Ndlovu Corporate Supplies (Ndlovu), its former BEE joint venture, thereby increasing its eective interest in Ndlovu to 75%. Ndlovu has a national contract to supply tea, coee and related products to Government departments and is expected to provide new areas of growth for Stamford Sales. King Pie and Blacksteer, Mvelaphanda Groups two franchise operations, have been reorganised under a new holding company, Khuseti Holdings. With over 300 stores nationally, the King Pie franchise is relatively mature and provides a steady royalty income stream and cash ow to the Group. New King Pie stores were opened in Malaysia, Australia and Canada during the year under review. Following the rebranding of Blacksteer in the rst quarter of the nancial year, eight Blacksteer restaurants were opened during the year, increasing the total number of Blacksteer restaurants to 32. With a further 15 new Blacksteer restaurants planned to be opened in the 2007 nancial year, prospects for growth in Mvelaphanda Groups franchise operations are good. Support Services The Groups support services businesses comprise its security, cleaning, freight forwarding and mining services businesses. The performance of the security services businesses, namely Coin Security and Protea Security, was impacted by the three-month strike by security guards between April 2006 and June 2006, and the increase in the number of armed attacks on assets-in-transit vehicles. The estimated cost to Coin Security of these increased number of armed attacks is R15 million to R20 million for the year under review, which estimate includes the cost of replacing and repairing vehicles, increased cash losses and increased insurance costs. Trading conditions in the assets-in-transit industry remain very dicult.

HACCP processes to be implemented by RoyalSechaba. Stamford Sales business returns to protability. Eight new Blacksteer restaurants opened, with 15 further new restaurants planned for 2007.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twenty-four

Chief Executives Review Operations (continued)

In line with the strategies being followed by international asset-in-transit companies, Coin Security has expanded its range of activities to include a wider range of cash-processing services, including counting, sorting and reconciling of cash, packing of payrolls and wages, providing in-house cash-counting facilities for clients, vault and inventory maintenance, ATM services, electronic cash-deposit devices (drop-safes), electronic funds transfers, electronic cash reconciliation and real-time, secure, web-based electronic cash-management information. These activities have been bolstered by the acquisition during the year of a 74,9% interest in Coin-Cameos (Proprietary) Limited, which provides an all-inclusive electronic cash-handling, banking and transaction-tracking solution developed specically to meet the unique needs of cash-intensive businesses. The technology developed and utilised by Coin-Cameos will provide Coin Security with a competitive advantage and should be the catalyst for growth in the assetsin-transit division of Coin Security in the future. Coin Securitys risk management division acquired a 40% interest in Resolution Insurance Company (Proprietary) Limited during the year. Resolution Insurance will, inter alia, sell insurance cover to Coin Securitys clients as part of Coin Securitys strategy to cross-sell insurance products to clients of its assets-in-transit, guarding and armed response divisions. Protea Security is a security industry leader in the provision of integrated security solutions, including guarding and asset protection, canine and horse-mounted services, aviation security, critical-situation security, technology-based security solutions and VIP protection. The performance of Protea Security for the year ended 30 June 2006 was excellent. Revenue increased by 23% and prot from operations increased by 34% compared to the previous year. For the ve-year period ended 30 June 2006, Protea Security has achieved compound annual growth in prot from operations of 43%. Protea Security remains focused on its core business the provision of guarding services. Growth in the business has been driven by its strong reputation in the market for superior service levels, the integration of complementary security solutions into one service oering for its clients, and the expansion into technology-based security services. Included in the list of Protea Securitys clients are most of South Africas major mining houses in the gold, platinum and diamond sectors, major retail, industrial and commercial groups, and local and national government bodies. Rebserve Cleaning Services performed in line with expectations. Existing activities in the commercial, industrial, retail, hospitality and healthcare sectors have been supplemented with the establishment of a new laundry services division and an industrial cleaning division. These new divisions earn relatively attractive margins and will provide new areas for growth and diversication for Rebserve Cleaning Services. Contract Forwarding performed well, beneting from the stable rand exchange rate during the year. Improved credit control procedures and cash management added positively to the overall performance of the business. Contract Forwarding was also appointed as one of two representatives in South Africa of Feta Freight Systems International (FFSI), one of the

Estimated cost to Coin Security of increased attacks on its assets in transit vehicles of R15 to 20 million for the year. Excellent performance by Protea Security, increasing prot from operations by 30%. New laundry and industrial cleaning divisions started by Rebserve Cleaning Services.

page twenty-ve

leading international associations of independent freight forwarding and clearing agents. FFSI is based in Hong Kong and has strong ties to exporters in the Far East and Indian subcontinent. Trollope Mining Services, which is the Groups only remaining direct exposure to the mining sector, continued to experience dicult trading conditions. As a result of pressure on contract rates from clients, strict pricing policies were implemented. Several potential long-term contracts were turned down as a result of the unattractive returns which these contracts would have yielded for Trollope Mining Services.

Prospects

A solid platform has now been established to nurture and grow an industrial and nancial group of magnitude, which group, while possessing impeccable BEE credentials which aord the Group a competitive advantage, should be measured on its investment merits. The Groups cash resources of R1,5 billion (after receipt of the proceeds from the Mvelaphanda Resources disposal) will provide the necessary nancial resources to allow Mvelaphanda Group to conclude major BEE and other corporate transactions in pursuit of Mvelaphanda Groups strategy of investing in quality investments and cash-generative operations. Should such opportunities not present themselves within a reasonable period, the board of Mvelaphanda Group will review the use of such cash resources in the context of maintaining and enhancing shareholder value. Provided that the current favourable market conditions persist, Mvelaphanda Group is condent of its ability to continue to achieve sound and steady growth in its intrinsic net asset value per share.

Acknowledgements

My thanks and appreciation go to my co-directors for their support, the executives and management of the various operating businesses in the Group, and the investment companies who have chosen to partner with us, for their continued loyalty and diligence, and to the 22 609 employees of the Group for their hard work over the past year. Also, to our professional advisors, accountants, attorneys, bankers and all others who have played a role in the success of the Group over its ten years of existence as a successful listed company, your contributions are greatly appreciated.

Stephen Levenberg

Chief Executive Ocer

Solid platform established to nurture and grow an industrial and nancial group of magnitude. Groups BEE credentials are a competitive advantage. Investment merits remain solid.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twenty-six

Financial Review

Brett Till

Chief Financial Ocer

Intrinsic net asset value per ordinary share increased by 41%, from R8,35 at 30 June 2005 to R11,77 at 30 June 2006. Return on average shareholders funds for the year ended 30 June 2006 of 31,6%. Cash resources (after the Mvelaphanda Resources disposal) of R1,5 billion.

page twenty-seven

Mvelaphanda Groups results for the year ended 30 June 2006 have been prepared in accordance with IFRS. In accordance with IFRS1 First-time Adoption of IFRS, Mvelaphanda Group has prepared an opening IFRS balance sheet at the date of transition to IFRS, being 1 July 2004. Comparative gures for the year ended 30 June 2005 have been restated accordingly. Adjustments which reect the major dierences between SA GAAP and IFRS are contained in note 31 to the nancial statements.

Financial performance

Revenue for the year under review decreased by 4% from the prior year to R3,102 billion as a result of the disposal of the JIC Mining Services business in the second half of the 2005 nancial year. On a like-for-like basis, revenue increased by 13% for the year ended 30 June 2006 compared to the year ended 30 June 2005. Prot from operations increased by 30% from R201 million for the year ended 30 June 2005 to R262 million for the year ended 30 June 2006. The operating margin increased to 8,5% from 6,2% in the prior year. All operating businesses reported protable operating results for the year under review. Fair value adjustments and prot from investments increased by R582 million to R850 million for the year ended 30 June 2006. This amount comprises the revaluation gains and losses arising on marking to market the Groups investments (including associated debt where applicable), the discount of R112 million (calculated in terms of IFRS) arising on the acquisition of the additional 2,47% eective interest in Absa and prots/losses on disposal of investments. This substantial increase is mainly as a result of the performance of the Groups investments in Absa, Life Healthcare and Group Five. The results for Mvelaphanda Resources have been equity accounted in the period under review and comprise the major portion of the income from associates of R280 million. This amount is net of a provision for impairment of the carrying value of the investment in Mvelaphanda Resources at 30 June 2006 amounting to R334 million, such that the investment in Mvelaphanda Resources is carried at an amount equal to the net value realised (after deducting costs) in terms of the Mvelaphanda Resources disposal. Net prot attributable to ordinary shareholders increased by R741 million, from R404 million for the year ended 30 June 2005 to R1 145 million, mainly as a result of the performance of the Groups investments. Earnings per ordinary share and headline earnings per ordinary share increased by 105% and 124% to 270,4 cents and 322,1 cents respectively, as a result of the substantial increase in net prot attributable to ordinary shareholders. Net tangible asset value per ordinary share, which includes the investments at the directors valuations, increased by 58% from R4,83 at 30 June 2005 to R7,61 at 30 June 2006.

Intrinsic net asset value

Intrinsic net asset value per ordinary share is considered to be the most insightful measure of the Groups overall performance. Intrinsic net asset value per ordinary share, calculated based on the market value or directors valuation of investments (net of capital gains taxation and associated debt) and operations, increased by 41% from R8,35 at 30 June 2005 to R11,77 at 30 June 2006. Details of the calculation of the intrinsic net asset value per ordinary share at 30 June 2006 are set out in the table below: Before the Mvelaphanda Resources disposal Intrinsic net asset value Per ordinary share(1) R million R Absa Mvelaphanda Resources Life Healthcare Group Five Other investments Operations Net cash Total 1 256 1 097 812 102 26 2 081 474 5 848 2,53 2,21 1,63 0,21 0,05 4,19 0,95 11,77 After the Mvelaphanda Resources disposal(2) Intrinsic net asset value Per ordinary share(1) R million R 1 256 812 102 26 2 081 1 571 5 848 2,53 1,63 0,21 0,05 4,19 3,16 11,77

Notes 1. Based on 497 million ordinary shares assuming that all the preference shares will be converted into ordinary shares after 4 November 2009. 2. Calculated on the assumption that the Mvelaphanda Resources disposal had been implemented on 30 June 2006 and the net cash proceeds received on that date.

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page twenty-eight

Financial Review (continued)

In calculating the intrinsic net asset values above, the following valuation methodologies have been used: Investment/asset Absa Valuation methodology Option pricing model based on the closing Absa price of R100,30 per share on the JSE on 30 June 2006 (after deducting costs) in terms of the Mvelaphanda Resources disposal Life Healthcare Group Five Other investments Operations Net cash EBITDA multiple based on historic nancial results, less associated debt Option pricing model based on the closing Group Five price of R28,75 per share on the JSE on 30 June 2006 Market values of listed shares, discounted cash ow, PE multiple or net asset value methodologies, less associated debt PE multiple based on actual prot from operations for the year ended 30 June 2006, less debt in operating subsidiaries Cash balances at 30 June 2006 at fair value, less debt not associated with specic investments or operations

Mvelaphanda Resources Equity-accounted value less provision for impairment, such that the carrying value is equal to the net value realised

The intrinsic net asset value per ordinary share of R11,77 at 30 June 2006 includes 95 cents in cash. Following the disposal of Mvelaphanda Groups shareholding in Mvelaphanda Resources, the cash component of the Groups intrinsic net asset value per ordinary share has increased to R3,16 subsequent to year-end. This implies that the discount to intrinsic net asset value (excluding the cash component thereof ) at which Mvelaphanda Group ordinary shares traded on the JSE had increased to approximately 40%, calculated with reference to the Mvelaphanda Group ordinary share price of R8,40 on 1 September 2006 (being the last practicable date prior to the publication of the preliminary results for the year ended 30 June 2006).

Cash ow

Cash generated from operations for the year was R337 million and conrms the highly cash-generative nature of the Groups operations. The net investment in working capital of R23 million equates to 6% of the increase in revenue (calculated on a like-for-like basis) and is within acceptable limits. Net capital expenditure was R150 million and was funded largely from operating cash ow. Alternative methods of nancing this capital expenditure, including increased gearing, are being considered in order to increase the Groups free cash ow and reduce the Groups weighted average cost of capital. Proceeds from the disposal of investments relate mainly to the disposal of the Groups investment in African Life, as well as the investments in Fridge Foods, Arcus Gibb and Rewards Company which were disposed of during the year. Cash paid for new investments concluded during the year includes R190 million paid for the additional eective 2,47% interest in Absa, R30 million in relation to the 38,2% interest in Swissport South Africa, R15 million paid pursuant to the exercise of the option to acquire an additional 25,1% interest in the Novare companies, and the investments in the new ventures by certain of the Groups operating businesses. Net cash proceeds (after deducting share issue expenses) from the issue of new preference shares amounted to R524 million.

Capital structure

The weighted average number of ordinary shares in issue increased from 306,3 million ordinary shares for the year ended 30 June 2005 to 423,4 million ordinary shares, as a result of the inclusion of the ordinary shares issued pursuant to the Merger for the full period, and the issue of 33,9 million new ordinary shares in partial settlement of the purchase consideration for the acquisition of the additional eective interest of 2,47% in Absa in December 2005. In November 2005, Mvelaphanda Group issued 54,7 million convertible perpetual cumulative preference shares (the preference shares), raising R547 million (before costs) of permanent capital for Mvelaphanda Group on market-related terms, without prejudicing Mvelaphanda Groups BEE credentials. The preference shares earn dividends at a rate of 5,5% per annum until 4 November 2010. After 4 November 2010, the rate becomes a variable rate of 80% of the prime overdraft rate of interest. Each preference share is convertible at the instance of the holder into one ordinary share between 4 November 2009 and 4 November 2010. If not converted into ordinary shares by 4 November 2010, thereafter the preference shares are redeemable at the instance of Mvelaphanda Group or will remain as perpetual preference shares.

page twenty-nine

The net prot attributable to minority shareholders of R13 million, and the minority shareholders reected on the balance sheet of R218 million, relate to the minority shareholders in the Batho Bonke consortium where certain of the special-purpose entities comprising the Batho Bonke consortium have been consolidated pursuant to the acquisition of the further eective interest of 2,47% in Absa and in terms of IFRS, and the minority shareholders in certain of the operating subsidiaries. With total interest-bearing debt recognised on the balance sheet of R453 million, the Groups debt to equity ratio remains low at 9,5%. The Groups attributable share of the o-balance-sheet debt contained in special purpose entities relating to the nancing of certain of the Groups investments amounted to R535 million. The majority of this debt has no recourse to Mvelaphanda Group and has no short-term cash ow requirements.

Financial returns

Intrinsic net asset value per ordinary share is considered to be the most insightful measure of the Groups overall performance. As noted above, intrinsic net asset value per ordinary share increased by 41% from R8,35 at 30 June 2005 to R11,77 at 30 June 2006. Other nancial returns, as calculated by Mvelaphanda Group, are set out in the table below: 2006 Operating margin Cash generated from operations as a percentage of operating prot Cash earnings ordinary share (cents) Free cash ow (R000) Debt: equity ratio (%) Return on shareholders funds Return on net operating assets Return on net investments Weighted average cost of capital Economic value added Economic value added (R000) Earnings yield (based on ordinary share price at 30 June 2006) Dividend yield (based on ordinary share price at 30 June 2006) Dividend cover (times) Cash dividend cover (times) 8,5% 128,4% 58,4 106 417 9,5% 31,6% 19,8% 35,4% 13,0% 18,6% 673 967 35,6% 2,4% 15,0 3,2 2005 6,2% 216,7% 68,2 247 580 13,5% 22,0% 11,0% 34,7% 11,4% 10,6% 194 263 19,4% 1,5% 13,2 6,8

Cash distribution and dividends

For the year ended 30 June 2006, Mvelaphanda Group reverted to a policy of declaring an interim and a nal dividend. Total dividends/ distributions to ordinary shareholders for the year ended 30 June 2006 increased by 80% to 18 cents per ordinary share (comprising an interim ordinary dividend of 5 cents per ordinary share and a cash distribution out of share premium in lieu of a nal ordinary dividend of 13 cents per ordinary share), from 10 cents per ordinary share in the previous year. The total preference dividend for the period 4 November 2005 (being the date of issue of the preference shares) to 30 June 2006 was 36 cents per preference share.

Conclusion

Mvelaphanda Group is in a strong nancial position as a result of its highly protable and cash-generative operations and solid investments. With cash resources of R1,5 billion (after the Mvelaphanda Resources disposal), the Group has the necessary re-power to conclude major BEE and other transactions. The Group remains committed to maintaining a high level of nancial discipline, underpinned by strong working capital and cash ow management, and a conservative level of gearing.

Brett Till

Chief Financial Ocer

Mvelaphanda Group Limited Annual Report for the year ended 30 June 2006

Mvelaphanda Group Limited page thirty

Sustainability Report

Mvelaphanda Group is one of South Africas leading black-owned, controlled and managed diversied industrial groups. The Groups ongoing development as a black-owned corporation takes cognisance of its responsibilities as a result of the legislative requirements, including those contained in the BEE charters being implemented throughout South African industry, as well as the Groups responsibilities to its stakeholders. Particular emphasis is given to the principles and objectives of broad-based black economic empowerment. The Groups sustainability reporting focuses on the activities of Mvelaphanda Group and its wholly owned subsidiaries. Detailed sustainability information for the companies in which Mvelaphanda Group holds investments can be obtained from the annual reports of the companies concerned.

Stakeholder relationships

Mvelaphanda Group has identied the following major groups as stakeholders in the Group:

Our shareholders and the investment community. Our customers. Our suppliers. Our people directors, executives and sta. Our investment companies. The communities which are impacted on by the activities of the Group, its investments and operations.

The Groups philosophy towards its shareholders, customers and people is embodied in its three values, which are: Shareholder value:

balancing growth, risk and returns to strategies that sustain shareholder condence and meet investor expectations;

Customer value:

meeting or exceeding customer expectations at a price no higher than their perception of the services value;

People value:

satisfying human needs in the workplace to maximise the commitment of sta to corporate goals.

The Group supports a policy of open communication with all stakeholders on matters of both a nancial and non-nancial nature. Regular communication sessions are held internally with management and senior executives, and externally with institutional shareholders and investment analysts. Information is also made available to stakeholders on the Groups website, which includes notication to stakeholders of corporate actions and public announcements via electronic communication media.

Shareholders and equity ownership

Mvelaphanda Holdings, the controlling shareholder of Mvelaphanda Group, has an inclusive philosophy towards empowerment and believes that community participation is critical to its future success. The shareholder prole of Mvelaphanda Holdings reects its commitment to ensuring that grassroots communities benet from its assets and investments. Direct and indirect shareholders of Mvelaphanda Holdings reect a broad base of historically disadvantaged South Africans, including womens groups and broad-based non-prot, communityorientated and charitable organisations. This inclusive philosophy is based on the principle that these organisations can improve their income by participating directly in the investment and other opportunities obtained by Mvelaphanda Holdings and Mvelaphanda Group. In this manner these organisations and the communities they serve benet directly from the investment gains achieved by Mvelaphanda Holdings and Mvelaphanda Group, rather than only from the charitable donations which may be made to them from time to time. This direct participation improves the sustainability of these organisations and is providing greater benets than if they were solely dependent on donations.

page thirty-one

In line with Mvelaphanda Groups stated intention of being a consolidator of BEE transactions, Mvelaphanda Group acquired a further 2,47% eective interest in Absa (an eective interest of 24,7% in Batho Bonke) for R461 million in December 2005. The purchase price was settled in part by the issue of 33,9 million new Mvelaphanda Group ordinary shares, which ordinary shares were issued to members of the Batho Bonke consortium, thereby enhancing Mvelaphanda Groups BEE shareholder credentials. Other major shareholders in Mvelaphanda Group comprise large nancial institutions, asset managers in South Africa and overseas, pension and retirement funds, public investment bodies and the general public. Details of the composition of these shareholders are given on page 80. Regular presentations are made to institutional shareholders and other members of the investment community including following the publication of the Groups interim and year-end nancial results, and as might otherwise be required in the context of corporate actions or other developments within the Group.

Human resources