Professional Documents

Culture Documents

MB0051

Uploaded by

Azimul Hasnain ZaidiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MB0051

Uploaded by

Azimul Hasnain ZaidiCopyright:

Available Formats

Q1. Discuss the nature and significance of business law?

Ans:- The term law is used in many senses: you may speak of the law of physics, mathematics, science, or the laws of the football or health. In its widest sense, law means any rule of conduct, standard or pattern, to which actions are required to conform; if not conformed, sanctions are imposed. When we speak of the law of a State, we use the term law in a special and strict sense Significance of law 1. Law is a body of rules:- These rules prescribe the conduct, standard or pattern to which actions of the persons in the state are required to conform. However, all rules of conduct do not become law in the strict sense. We resort to various kinds of rules to guide our lives. For example, our conduct may be guided by a rule such as do not be arrogant or do not be disrespectful to elders or women. These are ethical or moral rules by which our daily lives are guided. If we do not follow them, we may lose our friends and their respect, but no legal action can be taken against us. 2. Law is for the guidance or conduct of persons : both human and artificial. The law is not made just for the sake of making it. The rules embodied in the law are made, so as to ensure that actions of the persons in the society conform to some predetermined standard or pattern. This is necessary so as to ensure continuance of the society. No doubt, if citizens are self-enlightened or self-controlled, disputes may be minimized, but will not be eliminated. Rules are, therefore, drawn up to ensure that members of the society may live and work together in an orderly manner. Therefore, if the rules embodied in the law are broken, is used to enforce obedience, and certain consequences ensue. 3. Law is imposed :- Law is imposed on the members to bring about an order in the group, enabling it to continue and prosper. It is not something which may or may not be obeyed at the sweet will of the members of society. If you cannot impose a rule it is better not to have it. Thus, law is made obligatory on the members of the society.

4. Law is enforced by the executive :- Obviously, unless a law is enforced it ceases to be a law and those persons subject to it will regard it as dead. For example, if A steals Bs bicycle, he may be prosecuted by a court and may be punished. Also, the court may order the restitution of the bicycle to its rightful owner i.e., B. If the government passes many laws but does not attempt to enforce them, the citizens lose their respect for government and law, and society is greatly weakened. The force used is known as sanction which the state administers to secure obedience to its laws. 5. The state :- A state is a territorial division, with people therein subject to a uniform system of law administered by some authority of the state. Thus, law presupposes a state.

6. Content of law :- The law is a living thing and changes throughout the course of history. Law responds to public opinion and changes accordingly. Law can never be static. Therefore, amendments are made in different laws from time to time. For example, the Monopolistic and Restrictive Trade Practices Act, 1969, has been subjected to many amendments since its inception in 1969. 7. Two basic ideas involved in law :- The two basic ideas involved in any law are: (i) to maintain some form of social order in a group and (ii) to compel members of the group to be within that order. These basic ideas underlie formulation of any rules for the members of a group. A group is created because first, there is a social instinct in the people to live together and secondly, it helps them in self-preservation. Rules are made by the members of the group, so that the group doesnt whither away. 8. Law is made to serve some purpose which may be social, economic or political :- Some examples of law in the widest sense of the term. Law in its widest sense may include: (i) Moral rules or etiquettes, the non-observance of which may lead to public ridicule, Law of the Land the non-observance of which may lead to arrest, imprisonment, fines, etc., Rules of international law, the non-observance of which may lead to social boycott, trade-sanctions, cold war, hot war, proxy war, etc.

(ii) (iii)

Q2. What is Partnership? Briefly state special features of a partnership on the basis of which its existence can be determined under the Indian Partnership Act? Ans:-- Partnership is defined as the relationship between persons who have agreed to share profits of a business carried on by all, or by any of them acting for all. On analysis of the definition, certain essential elements of partnership emerge. These elements must be present so as to form a partnership and are discussed below. 1. Partnership is an association of two or more than two persons:- There must be at least two persons who should join together to constitute a partnership, because one person cannot become a partner with himself. These persons must be natural persons having legal capacity to contract. Thus, a company (which is an artificial person) cannot be a partner. Similarly, a partnership firm cannot be a partner of another partnership firm. As regards maximum number of partners in a partnership firm, Sec.11 of the Companies Act, 1956, puts the limit at 10 in case of banking business and 20 in case of any other business. 2. Partnership must be the result of an agreement between two or more persons:- An agreement presupposes a minimum number of two persons. As mentioned above, a partnership to arise, at least two persons must make an agreement. Partnership is the result of an agreement between two or more persons (who are known as partners after the partnership comes into existence) .

3. The agreement must be to carry on some business:- The term business includes every trade, occupation or profession [Sec.2(b)]. Though the word business generally conveys the idea of numerous transactions, a person may become a partner with another even in a particular adventure or undertaking (Sec.8). Unless the person joins for the purpose of carrying on a business, it will not amount to partnership. 4. The agreement must be to share profits of the business:- The joint carrying on of a business alone is not enough; there must be an agreement to share profits arising from the business. Unless otherwise so agreed, sharing of profits also involves sharing of losses. But whereas the sharing of profits is an essential element of partnership, sharing of losses is not.

Example: A, a trader, owed money to several creditors. He agreed to pay his creditors out of

the profits of his business (run under the creditors supervision) what he owed to them. Held, the arrangement did not make creditors partners with A in business [Cox v. Hickman, (1860) 8 H.L.C., 268]. Formation of partnerships All the essential elements of a valid contract must be present in a partnership as it is based on an agreement. Therefore, while constituting a partnership. The following points must be kept in mind: 1. The Act provides that a minor may be admitted to be benefits of partnership. 2. No consideration is required to create partnership. A partnership is an extension of agency for which no consideration is necessary. 3. The partnership agreement may be express (i.e., oral or writing) or implied and the latter may be inferred from the conduct or the course of dealings of the parties or from the circumstances of the case. However, it is always advisable to have the partnership agreement in writing. 4. An alien friend can enter into partnership, an alien enemy cannot. 5. A person of unsound mind is not competent to enter into a partnership. 6. A company, incorporated under the Companies Act, 1956 can enter into a contract of partnership. Duration of partnership The duration of partnership may or may not be fixed. It may be constituted even for a particular adventure. Partnership at will In accordance with Sec.7, a partnership is called a partnership at will where; (i) it is not constituted for a fixed period of time and (ii) there is no provision made as to the determination of partnership in any other way. Therefore such a partnership has no fixed or definite date of termination. Accordingly death or retirement of a partner does not affect the continuance of such a partnership. Particular partnership In accordance with Sec.8 a particular partnership is one which is formed for a particular adventure or a particular undertaking. Such a partnership is usually dissolved on the completion of the adventure or undertaking.

Limited partnership In this type of partnership, the liability of certain partners is limited to the amount of capital which they have agreed to contribute to the business. In a limited partnership, there will be at least one general partner whose liability is unlimited and one or more special partners whose liability is limited. Q3. Examine the rights of a consumer enshrined under the Consumer Protection Act, 1986. Ans:-- Rights of Consumers For the first time in the history of consumer legislation in India, the Consumer Protection Act, 1986 extended a statutory recognition to the rights of consumers. Sec.6 of the Act recognizes the following six rights of consumers: 1. Right to safety, i.e., the right to be protected against the marketing of goods and services which are hazardous to life and property. 2. Right to be informed, i.e., the right to be informed about the quality, quantity, potency, purity, standard and price of goods or services, as the case may be, so as to protect the consumer against unfair trade practices. 3. Right to choose: It means right to be assured, wherever possible, access to a variety of goods and services at competitive prices. In case of monopolies, say, railways, telephones, etc., it means right to be assured of satisfactory quality and service at a fair price. 4. Right to be heard, i.e., the consumers interests will receive due consideration at appropriate forums. It also includes right to be represented in various forums formed to consider the consumers welfare. 5. Right to seek redressal: It means the right to seek redressal against unfair practices or restrictive trade practices or unscrupulous exploitation of consumers. It also includes right to fair settlement of the genuine grievances of the consumers. 6. Right to consumer education: It means the right to acquire the knowledge and skill to be an informed consumer. Q4. What do you mean by bailment? What are the requisites of a contract of bailment? Explain. Ans:-- Definition of bailment (Sec.148) Bailment is defined as the delivery of goods by one to another person for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of person delivering them. The person delivering the goods is called the bailor and the person to whom the goods are delivered is called the bailee. The explanation to the above Section points out that delivery of possession is not necessary, where one person, already in possession of goods contracts to hold them as bailee.

The bailee is under an obligation to re-deliver the goods, in their original or altered form, as soon as the time of use for, or condition on which they were bailed, has elapsed or been performed. Lets illustrate, (i) (ii) (iii) (iv) (v) (vi) (vii) A delivers some clothes to B, a dry cleaner, for dry cleaning. A delivers a wrist watch to B for repairs. A lends his book to B for reading. A delivers a suit-length to a tailor for stitching. A delivers some gold biscuits to B, a jeweller, for making jewellery. Delivery of goods to a carrier for the purpose of carrying them from one place to another. Delivery of goods as security for the repayment of loan and interest thereon, i.e., pledge.

From the definition of bailment, the following characteristics should be noted: 1. Delivery of goods. The essence of bailment is delivery of goods by one person to another for some temporary purpose. Delivery of goods may, however, be actual or constructive. Actual delivery may be made by handing over goods to the bailee. Constructive delivery may be made by doing something which has the effect of putting the goods in the possession of the intended bailee or any person authorised to hold them on his behalf (Sec.149). Example: A holding goods on behalf of B, agrees to hold them on behalf of C, there is a constructive transfer of possession from C to A. 2. Bailment is based on a contract. In bailment, the delivery of goods is upon a contract that when the purpose is accomplished, they shall be returned to the bailor. For example, where a watch is delivered to a watch repairer for repair, it is agreed that it will be returned, after repair, on the receipt of the agreed or reasonable charges. 3. Return of goods in specie. The goods are delivered for some purpose and it is agreed that the specific goods shall be returned. Return of specific goods (in specie) is an essential characteristic of bailment. Thus, where an equivalent and not the same is agreed to be returned, there is no bailment. 4. Ownership of goods. In a bailment, it is only the possession of goods which is transferred and not the ownership thereof, therefore the person delivering the possession of goods need not be the owner; his business is to transfer possession and not ownership.

Q5. Name the instruments which are recognized as negotiable instruments by the Negotiable Instruments Act, 1881.

Ans:-- An Instrument as referred to in the Act is a legally recognised written document, whereby rights are created in favour of one and obligations are created on the part of another. The word negotiable means transferable from one person to another either by mere delivery or by endorsement and delivery, to enable the transferee to get a title in the instrument. An instrument may possess the characteristics of negotiability either by statute or by usage. Promissory note, bill of exchange and cheque are negotiable instruments by statute as they are so recognised by Sec.13. There are certain instruments which are recognised as negotiable instruments by usage. Thus, bank notes, bank drafts, share warrants, bearer debentures, dividend warrants, scripts and treasury bills are negotiable by usage. An instrument is called negotiable if it possesses the following features: 1. Freely transferable. Transferability may be by (a) delivery, or (b) by endorsement and delivery. 2. Holders title free from defects. The term negotiability means that not only is the instrument transferable by endorsement and/or delivery, but that its holder in due course acquires a good title notwithstanding any defects in a previous holders title. A holder in due course is one who receives the instrument for value and without any notice as to the defect in the title of the transferor. 3. The holder can sue in his own name. Another feature of a negotiable instrument is that its holder in due course can sue on the instrument in his own name. 4. A negotiable instrument can be transferred infinitum, i.e., can be transferred any number of times, till its maturity.

5. A negotiable instrument is subject to certain presumptions. An instrument, which does not have these characteristics, is not negotiable, but is assignable, i.e., the transferee takes it subject to all equities and liabilities of the transferor. Promissory note A promissory note is an instrument in writing (not being a bank or a currency note) containing an unconditional undertaking, signed by the maker to pay a certain sum of money to, or to the order of, a certain person or to the bearer of the instrument (Sec.4). The following are two illustrations of promissory notes. Where A signs instruments in the following terms: (i) I promise to pay B or order Rs 500. (ii) I acknowledge myself to be indebted to B in Rs 1000, to be paid on demand, for value received. But, the following are NOT promissory notes: (i) Mr B, I.O.U. (I owe you) Rs 1000. (ii) I am liable to pay you Rs 500. (iii) I promise to pay B Rs 500 and all other sums which shall be due to him. (iv) I promise to pay B Rs 500, first deducting there out any money which he may owe me.

(v) (vi) (vii) (viii) (ix) (x) (xi) (xii) (xiii) (xiv)

I promise to pay B Rs 1500 on Ds death, provided he leaves me enough to pay that sum. I promise to pay B Rs 500 seven days after my marriage with C. I promise to pay B Rs 500 and to deliver to him my white Maruti Car 1 January next.

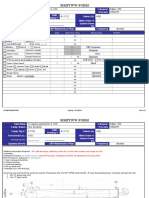

Specimen of a promissory note

Rs 10,000 New Delhi 1100 01 Jan. 10, 2006 On demand [or six months after date] I promise to pay X or order the sum of rupees ten thousand with interest at 12 per cent per annum only for value received. To X Sd/-A Address ____________________________ Stamp ____________________________

Parties to a promissory note 1. The maker the person who makes the note promising to pay the amount stated therein. 2. The payee the person to whom the amount of the note is payable. 3. The holder is either the original payee or any other person in whose favour the note has been endorsed. 4. The endorser the person who endorses the note in favour of another person. 5. The endorsee the person in whose favour the note is negotiated by indorsement. Bill of exchange A bill of exchange is defined by Sec.5 as an instrument in writing, containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to or to the order of, a certain person, or to the bearer of the instrument. Specimen of a bill of exchange Rs 10, 000 New Delhi 110 016 Jan. 13, 2006 Six months after date pay to A or order/bearer the sum of ten thousand rupees only for value received. To X Sd/-Y Address _______________________________ Stamp _______________________________ Here Y is the drawer, A is the payee and X is the drawee. X will express his willingness to pay accepting the bill by writing words somewhat as below across the face of the bill: ACCEPTED Sd-X Jan. 16, 2006. The specimen given above is of a usance bill, payable after a specified period of time. A bill of exchange may be drawn payable at sight, i.e., on demand or payable after certain time after sight also. Parties to a bill of exchange The parties of bill of exchange are:

The drawer: The person to whom the amount of the bill is payable. The drawee: The person on whom the bill is drawn. Thus, drawee is the person responsible for acceptance and payment of the bill. In certain cases however a stranger may accept the bill on behalf of the drawee. The payee: The person to whom amount of the bill is payable. It may be the drawer himself or any other person. The holder: It is the original payee but where the bill has been endorsed, the endorsee. In case of a bearer bill, the bearer or possessor is the holder. The endorser: It is the person who endorses a bill. The endorsee: It is the person to whom the bill is negotiated by endorsement. Drawee in case of need. Acceptor for honour.

Cheques A cheque is the usual method of withdrawing money from a current account with a banker. Savings bank accounts are also permitted to be operated by cheques provided certain minimum balance is maintained. A cheque, in essence, is an order by the customer of the bank directing his banker to pay on demand, the specified amount, to or to the order of the person named therein or to the bearer. Sec.6 defines a cheque. The Amendment Act 2002 has substituted new section for Sec.6. It provides that a cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and it includes the electronic image of a truncated cheque and a cheque in the electronic from. A cheque in the electronic form means a cheque which contains the exact mirror image of a paper cheque, and is generated, written and signed in a secure system ensuring the minimum safety standards with the use of digital signature and asymmetric crypto system.

Specimen of a cheque

Every bank has its own printed cheque forms which are supplied to the account holders at the time of opening the account as well as subsequently whenever needed. These forms are printed on special security paper which is sensitive to chemicals and makes any chemical alterations noticeable. Although, legally, a customer may withdraw his money even by writing his directions to the banker on a plain paper but in practice bankers honour only those orders which are issued on the printed forms of cheques. Requisites of a cheque The requisites of a cheques are: 1. Written instrument. A cheque must be an instrument in writing. Regarding the writing materials to be used, law does not lay down any restrictions and therefore cheque may be written either with (a) pen (b) type writer or may be (c) printed. 2. Unconditional order. A cheque must contain an unconditional order. It is, however, not necessary that the word order or its equivalent must be used to make the document a cheque., Generally, the order to bank is expressed by the word pay. If the word please precedes pay the document will not be regarded as invalid merely on this account. 3. On a specified banker only. A cheque must be drawn on a specified banker. To avoid any mistake, the name and address of the banker should be specified. 4. A certain sum of money. The order must be only for the payment of money and that too must be specified. Thus, orders asking the banker to deliver securities or certain other things cannot be regarded as cheques. Similarly, an order asking the banker to pay a specified amount with interest, the rate of interest not specified, is not a cheque as the sum payable is not certain. 5. Payee to be certain. A cheque to be valid must be payable to a certain person. Person should not be understood in a limited sense including only human beings. The term in fact includes legal persons also. Thus, instruments drawn in favour of a body corporate, local authorities, clubs, institutions, etc., are valid instruments being payable to legal persons. 6. Payable on demand. A cheque to be valid must be payable on demand and not otherwise. Use of the words on demand or their equivalent is not necessary. When the drawer asks the banker to pay and does not specify the time for its payment, the instrument is payable on demand (Sec.19). 7. Dating of cheques. The drawer of a cheque is expected to date it before it leaves his hands. A cheque without a date is considered incomplete and is returned unpaid by the banks. The drawer can date a cheque with the date earlier or later than the date on which it is drawn. A cheque bearing an earlier date is antedated and the one bearing the later date is called post-dated. A post-dated cheque cannot be honoured, except at the

personal risk of the banks manager, till the date mentioned. A post-dated cheque is as much negotiable as a cheque for which payment is due, i.e., the transferee of a postdated cheque, like that of the cheque on which payment is due, acquires a better title than its transferor, if he is a holder in due course. A cheque that bears a date earlier than six months is a stale cheque and cannot be claimed for.

INTELLECTUAL PROPERTY RIGHTS General The importance of intellectual property in India is well established at all levels- statutory, administrative and judicial. India ratified the agreement establishing the World Trade Organisation (WTO). This Agreement, interalia, contains an Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) which came into force from 1st January 1995. It lays down minimum standards for protection and enforcement of intellectual property rights in member countries which are required to promote effective and adequate protection of intellectual property rights with a view to reducing distortions and impediments to international trade. The obligations under the TRIPS Agreement relate to provision of minimum standard of protection within the member countries legal systems and practices. The Agreement provides for norms and standards in respect of following areas of intellectual property

Patents Trade Marks Copyrights Geographical Indications Industrial Designs

Patents The basic obligation in the area of patents is that, invention in all branches of technology whether products or processes shall be patentable if they meet the three tests of being new involving an inventive step and being capable of industrial application. In addition to the general security exemption which applied to the entire TRIPS Agreement, specific exclusions are permissible from the scope of patentability of inventions, the prevention of whose commercial exploitation is necessary to protect public order or morality, human, animal, plant life or health or to avoid serious prejudice to the environment. Further, members may also exclude from patentability of diagnostic, therapeutic and surgical methods of the treatment of human and animals and plants and animal other than micro-

organisms and essentially biological processes for the production of plants and animals. more... The TRIPS Agreement provides for a minimum term of protection of 20 years counted from the date of filing. India had already implemented its obligations under Articles 70.8 and 70.9 of TRIP Agreement. To view Trade Related Aspects of Intellectual Property Rights (TRIP) Agreement Click here Acts related to Patents The The The Patents Patents Patents (amendment) (amendment) Act, Act, Act, 1970 1999 2002

The Patents (amendment) Act, 2005 Rules pertaining to Patents The Patents Rules 2003 The Patents (Amendment) Rules 2005 The Patents (Amendment) Rules 2006 Trade Marks Trade marks have been defined as any sign, or any combination of signs capable of distinguishing the goods or services of one undertaking from those of other undertakings. Such distinguishing marks constitute protectable subject matter under the provisions of the TRIPS Agreement. The Agreement provides that initial registration and each renewal of registration shall be for a term of not less than 7 years and the registration shall be renewable indefinitely. Compulsory licensing of trade marks is not permitted. Keeping in view the changes in trade and commercial practices, globalisation of trade, need for simplification and harmonisation of trade marks registration systems etc., a comprehensive review of the Trade and Merchandise Marks Act, 1958 was made and a Bill to repeal and replace the 1958 Act has since been passed by Parliament and notified in the Gazette on 30.12.1999. This Act not only makes Trade Marks Law, TRIPS

compatibility but also harmonises it with international systems and practices. Work is underway to bring the law into force. more... Trade Marks Acts Trade Marks Act, 1999 New Elements in the Trade Marks Act, 1999 Copyrights Indias copyright law, laid down in the Indian Copyright Act, 1957 as amended by Copyright (Amendment) Act, 1999, fully reflects the Berne Convention on Copyrights, to which India is a party. Additionally, India is party to the Geneva Convention for the Protection of rights of Producers of Phonograms and to the Universal Copyright Convention. India is also an active member of the World Intellectual Property Organisation (WIPO), Geneva and UNESCO. The copyright law has been amended periodically to keep pace with changing requirements. The recent amendment to the copyright law, which came into force in May 1995, has ushered in comprehensive changes and brought the copyright law in line with the developments in satellite broadcasting, computer software and digital technology. The amended law has made provisions for the first time, to protect performers rights as envisaged in the Rome Convention Several measures have been adopted to strengthen and streamline the enforcement of copyrights. These include the setting up of a Copyright Enforcement Advisory Council, training programs for enforcement officers and setting up special policy cells to deal with cases relating to infringement of copyrights. more.... Rules and Acts related to Copyrights The Copyright (Amendment) Act, 2012 Copyright, Act 1957 Copyright Rules, 1958 Copyright Handbook International Copyright Order, 1999 Copyright Piracy in India Amendments in the Act

Geographical Indications The agreement contains a general obligation that parties shall provide the legal means for interested parties to prevent the use of any means in the designation or presentation of a good that indicates or suggests that the good in question originates in a geographical area other than the true place of origin in a manner which misleads the public as to the geographical origin of the goo. There is no obligation under the Agreement to protect geographical indications which are not protected in their country or origin or which have fall en into disuse in that country. A new law for the protection of geographical indications, viz. the Geographical Indications of Goods (Registration and the Protection) Act, 1999 has also been passed by the Parliament and notified on 30.12.1999 and the rules made there under notified on 8-3-2002. more... Industrial Designs Industrial designs refer to creative activity which result in the ornamental or formal appearance of a product and design right refers to a novel or original design that is accorded to the proprietor of a validly registered design. Industrial designs are an element of intellectual property. Under the TRIPS Agreement, minimum standards of protection of industrial designs have been provided for. As a developing country, India has already amended its national legislation to provide for these minimal standards. The essential purpose of design law it to promote and protect the design element of industrial production. It is also intended to promote innovative activity in the field of industries. The existing legislation on industrial designs in India is contained in the New Designs Act, 2000 and this Act will serve its purpose well in the rapid changes in technology and international developments. India has also achieved a mature status in the field of industrial designs and in view of globalization of the economy, the present legislation is aligned with the changed technical and commercial scenario and made to conform to international trends in design administration. This replacement Act is also aimed to inact a more detailed classification of design to conform to the international system and to take care of the proliferation of design related activities in various fields. Obligations envisaged in respect of industrial designs are that independently created designs that are new or original shall be protected. Individual governments have been given the option to exclude from protection, designs dictated by technical or functional considerations, as against aesthetic consideration which constitutes the coverage of industrial designs. The right accruing to the right holder is the right to

prevent third parties not having his consent from making, selling or importing articles being or embodying a design, which is a copy or substantially a copy of the protected design when such acts are undertaken for commercial purposes. The duration of protection is to be not less than 10 years.

Question No 6b:- A leaves a cow in the custody of B to be taken care of. The cow gives birth to a calf. Who will take the calf and why? Answer: - The answer is A It is as per the below section s 1. To return the goods bailed (Section 160). It is the duty of the bailee to return, or 9 deliver, according to the bailors directions, the goods bailed, Without demand, As soon as the time for which they were bailed has expired, or the purpose, for which they were bailed has been accomplished. If the bailee fails to return the goods at the proper time, he is responsible to the bailor for any loss, destruction or deterioration of the goods from that time (Section 161). 2. To return any accretion to the goods bailed (Section 163). In the absence of any contract to the contrary, the bailee is bound to deliver to the Baylor, or according to his directions, any increase or profit which may have accrued from the goods bailed.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Mi0039Document14 pagesMi0039Azimul Hasnain ZaidiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Master of Business Administration-MBA Semester 3 Assignment Set - 1 Research Methodology - Mb0034Document16 pagesMaster of Business Administration-MBA Semester 3 Assignment Set - 1 Research Methodology - Mb0034Sudha Amit ThakurNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- WPAR Student MaterialDocument142 pagesWPAR Student MaterialAzimul Hasnain Zaidi100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- MB0050Document12 pagesMB0050Azimul Hasnain ZaidiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 28Document2 pages28Ayub ShaikhNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Aix QDocument34 pagesAix QAzimul Hasnain ZaidiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Aix Updates Using MultibosDocument11 pagesAix Updates Using MultibosAzimul Hasnain ZaidiNo ratings yet

- UntitledDocument9 pagesUntitledAzimul Hasnain ZaidiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Aix TL Upgrade - OdtDocument9 pagesAix TL Upgrade - OdtAzimul Hasnain ZaidiNo ratings yet

- Ivan PavlovDocument55 pagesIvan PavlovMuhamad Faiz NorasiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Financial Accounting and ReportingDocument31 pagesFinancial Accounting and ReportingBer SchoolNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Adorno - Questions On Intellectual EmigrationDocument6 pagesAdorno - Questions On Intellectual EmigrationjimmyroseNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- (Evolutionary Psychology) Virgil Zeigler-Hill, Lisa L. M. Welling, Todd K. Shackelford - Evolutionary Perspectives On Social Psychology (2015, Springer) PDFDocument488 pages(Evolutionary Psychology) Virgil Zeigler-Hill, Lisa L. M. Welling, Todd K. Shackelford - Evolutionary Perspectives On Social Psychology (2015, Springer) PDFVinicius Francisco ApolinarioNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- MID Term VivaDocument4 pagesMID Term VivaGirik BhandoriaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Network Profiling Using FlowDocument75 pagesNetwork Profiling Using FlowSoftware Engineering Institute PublicationsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Office of The Court Administrator v. de GuzmanDocument7 pagesOffice of The Court Administrator v. de GuzmanJon Joshua FalconeNo ratings yet

- Batman Vs Riddler RiddlesDocument3 pagesBatman Vs Riddler RiddlesRoy Lustre AgbonNo ratings yet

- Computer Conferencing and Content AnalysisDocument22 pagesComputer Conferencing and Content AnalysisCarina Mariel GrisolíaNo ratings yet

- Risc and Cisc: Computer ArchitectureDocument17 pagesRisc and Cisc: Computer Architecturedress dressNo ratings yet

- Final DSL Under Wire - FinalDocument44 pagesFinal DSL Under Wire - Finalelect trsNo ratings yet

- Iso 30302 2022Document13 pagesIso 30302 2022Amr Mohamed ElbhrawyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jillian's Student Exploration of TranslationsDocument5 pagesJillian's Student Exploration of Translationsjmjm25% (4)

- FraudDocument77 pagesFraudTan Siew Li100% (2)

- Chess Handbook For Parents and Coaches: Ronn MunstermanDocument29 pagesChess Handbook For Parents and Coaches: Ronn MunstermanZull Ise HishamNo ratings yet

- CV Finance GraduateDocument3 pagesCV Finance GraduateKhalid SalimNo ratings yet

- Entrepreneurship and Small Business ManagementDocument29 pagesEntrepreneurship and Small Business Managementji min100% (1)

- 0807 Ifric 16Document3 pages0807 Ifric 16SohelNo ratings yet

- Marikina Polytechnic College Graduate School Scientific Discourse AnalysisDocument3 pagesMarikina Polytechnic College Graduate School Scientific Discourse AnalysisMaestro Motovlog100% (1)

- Simptww S-1105Document3 pagesSimptww S-1105Vijay RajaindranNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- MEE2041 Vehicle Body EngineeringDocument2 pagesMEE2041 Vehicle Body Engineeringdude_udit321771No ratings yet

- Ten Lessons (Not?) Learnt: Asset AllocationDocument30 pagesTen Lessons (Not?) Learnt: Asset AllocationkollingmNo ratings yet

- RFID Sticker and and Card Replacement 2019 PDFDocument1 pageRFID Sticker and and Card Replacement 2019 PDFJessamyn DimalibotNo ratings yet

- Balochistan Conservation Strategy VDocument388 pagesBalochistan Conservation Strategy VHãšãñ Trq100% (1)

- TOPIC - 1 - Intro To Tourism PDFDocument16 pagesTOPIC - 1 - Intro To Tourism PDFdevvy anneNo ratings yet

- Understanding Learning Theories and Knowledge AcquisitionDocument38 pagesUnderstanding Learning Theories and Knowledge AcquisitionKarl Maloney Erfe100% (1)

- Elliptic FunctionsDocument66 pagesElliptic FunctionsNshuti Rene FabriceNo ratings yet

- Cover Me: Music By: B. Keith Haygood Arranged By: BKH Lyrics By: Based On Exodus 33Document8 pagesCover Me: Music By: B. Keith Haygood Arranged By: BKH Lyrics By: Based On Exodus 33api-66052920No ratings yet

- Lesson Plan Maam MyleenDocument7 pagesLesson Plan Maam MyleenRochelle RevadeneraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Criteria For RESEARCHDocument8 pagesCriteria For RESEARCHRalph Anthony ApostolNo ratings yet