Professional Documents

Culture Documents

Ron Book

Uploaded by

My-Acts Of-SeditionCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ron Book

Uploaded by

My-Acts Of-SeditionCopyright:

Available Formats

City of Lauderdale Lakes - Talking Points - Response to SR Correspondence

1 message

From: Celestine Dunmore </O=CITYOFLAUDERDALELAKES/OU=EARTH/CN=RECIPIENTS/CN=CELESTINED> To: Ron@rlbookpa.com <Ron@rlbookpa.com> Cc: Jonathan Allen </O=CITYOFLAUDERDALELAKES/OU=EARTH/cn=Recipients/cn=JonathanA> Date: Thursday, January 31, 2013 6:56:58 PM Subject: City of Lauderdale Lakes - Talking Points - Response to SR Correspondence

Good Afternoon Ron, On behalf of Mr. Allen, I am forwarding Talking Points to assist in responding to concerns raised about the referenced subject. Let us know if you need additional information. THANKS MUCH

Celestine Dunmore , MPA

Economic Development Mgr | Special Assistant to the City Manager

City of Lauderdale Lakes 4300 NW 36th Street | Lauderdale Lakes , FL 33319 V: 954-535-2491 F: 954-731-4564 CelestineD@lauderdalelakes.org www.lauderdalelakes.org City Operating Hours Monday - Friday 8:00 a.m. - 5:00 p.m.

The City of Lauderdale Lakes is a public entity subject to Chapter 119 of the Florida Statutes concerning public records. E-mail messages are covered under such law and thus subject to disclosure. All E-mails sent and received are captured by our servers and kept as public record.

CITY OF LAUDERDALE LAKES TALKING POINTS January 29, 2013 The following correspondence addresses concerns outlined in a letter written by County Commissioner Stacy Ritter. Citys Use of CRA funds In 2010, the City utilized CRA funds in excess of $2.5 Million without proper approval by the Community Redevelopment Agency (CRA) and in conflict with Florida Statute (FS) Chapter 163. In 2011, this issue was investigated through an independent CRA Forensic Audit that was requested by the CRA Board of Directors. In 2011, the issue was also investigated further by the Broward County Office of the Inspector General (OIG). According to the OIG Report, there were three City employees who played a possible role in the documented improper utilization of CRA funds all of whom were no longer employed by the City at the time the report findings were finalized and released. In response, a repayment agreement (i.e. Forbearance Agreement) between the City and CRA was prepared and executed to ensure that the City would repay the CRA for all funds due. The City and CRA acted and initiated corrective actions for all the major findings listed in the independent CRA Forensic Audit and the OIG Report. City/CRA Forbearance Agreement Prior to the completion of the OIG report, the City and CRA negotiated, approved and executed a binding Forbearance Agreement under which the City will, over time, repay the CRA all monies owed to the agency. The repayment of funds by the City to the CRA will ensure that the CRA and Broward County residents receive the benefits intended under the CRA plan through the utilization of these funds for approved CRA activities in the future. All actions taken by both the City and the CRA in investigating/documenting/reporting and structuring the Forbearance Agreement were initiated with public notice and with proper published agendas and recorded minutes of all proceedings. Rollover of Funds and Waiver of Interest The CRA, in accordance with FS 163 Part III, properly adopts annual budgets, including the re-appropriation of prior year fund balance amounts, and follows all required standards for the reallocation of CRA funds remaining unspent at the close of each Fiscal Year. Waivers of interest amounts due have not taken place although the Forbearance Agreement is structured and was properly approved and executed to require principal payments only. The CRA Board has, in accordance with FS 163, approved the waiver of late payment penalties in relation to receiving the annual CRA Tax Increment Fund (TIF) payment from the City after the required payment due date of January 1st. This is proper conduct for a CRA and the approval was provided at a noticed public meeting as well.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionNo ratings yet

- Premiere Dev't. vs. Central SuretyDocument42 pagesPremiere Dev't. vs. Central SuretyRafie BonoanNo ratings yet

- Causes of Separation of East PakistanDocument5 pagesCauses of Separation of East Pakistantanvir91% (35)

- English Standard - Shoe Horn Sonata Study GuideDocument14 pagesEnglish Standard - Shoe Horn Sonata Study GuideVincent BuiNo ratings yet

- Crim2 Digests Babanto V Zosa Perez V CADocument2 pagesCrim2 Digests Babanto V Zosa Perez V CASapere AudeNo ratings yet

- 4375.201.125 Fy 22-23Document99 pages4375.201.125 Fy 22-23Star ColourparkNo ratings yet

- Unlawful Detainer Judicial AffidavitDocument6 pagesUnlawful Detainer Judicial AffidavitNicole100% (1)

- Savita Parashar MAINETEANANCE Application For Early HearingDocument5 pagesSavita Parashar MAINETEANANCE Application For Early Hearingprakhar srivastavNo ratings yet

- Maos Chaz Stevens Suck On This: L L L LDocument3 pagesMaos Chaz Stevens Suck On This: L L L LMy-Acts Of-SeditionNo ratings yet

- Sasser Decision - 022315Document7 pagesSasser Decision - 022315My-Acts Of-SeditionNo ratings yet

- Delrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMDocument1 pageDelrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMMy-Acts Of-SeditionNo ratings yet

- Chaz - Misuse Seal DonnellyDocument3 pagesChaz - Misuse Seal DonnellyMy-Acts Of-SeditionNo ratings yet

- Coddington - 106.071 - Sign - ElecCommDocument2 pagesCoddington - 106.071 - Sign - ElecCommMy-Acts Of-SeditionNo ratings yet

- RedactedDocument2 pagesRedactedMy-Acts Of-SeditionNo ratings yet

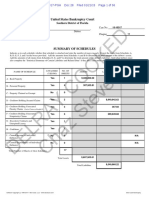

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- Waste ManagementDocument38 pagesWaste ManagementMy-Acts Of-SeditionNo ratings yet

- Maos Cease and Desist RobbDocument2 pagesMaos Cease and Desist RobbMy-Acts Of-SeditionNo ratings yet

- BinderDocument17 pagesBinderMy-Acts Of-SeditionNo ratings yet

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- Coffey Wheelbrator BullshitDocument1 pageCoffey Wheelbrator BullshitMy-Acts Of-SeditionNo ratings yet

- Suggestion of BankruptcyDocument5 pagesSuggestion of BankruptcyMy-Acts Of-SeditionNo ratings yet

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Document13 pagesCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNo ratings yet

- Binder 2Document12 pagesBinder 2My-Acts Of-SeditionNo ratings yet

- Unpaid LienDocument1 pageUnpaid LienMy-Acts Of-SeditionNo ratings yet

- H Inners SettlementDocument18 pagesH Inners SettlementMy-Acts Of-SeditionNo ratings yet

- Ron Gilinsky EvictionDocument4 pagesRon Gilinsky EvictionMy-Acts Of-SeditionNo ratings yet

- Gha Oig Letter 10 2014Document47 pagesGha Oig Letter 10 2014My-Acts Of-Sedition100% (1)

- Appeal Letter Purchasing AgentDocument7 pagesAppeal Letter Purchasing AgentMy-Acts Of-SeditionNo ratings yet

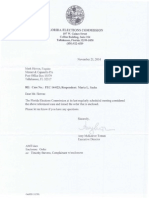

- Florida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539Document4 pagesFlorida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539My-Acts Of-SeditionNo ratings yet

- RE: Donation of Pabst Blue Ribbon Festivus PoleDocument1 pageRE: Donation of Pabst Blue Ribbon Festivus PoleMy-Acts Of-SeditionNo ratings yet

- BTAL PDF (BTAL Act 1948 Amendments 1994 and 2005)Document15 pagesBTAL PDF (BTAL Act 1948 Amendments 1994 and 2005)Pramod PatilNo ratings yet

- Ady ResponseDocument7 pagesAdy ResponseDan LehrNo ratings yet

- Cloe Ii Eu Institutions Octombrie 2022Document62 pagesCloe Ii Eu Institutions Octombrie 2022clementmihaiNo ratings yet

- 1984 Book 3Document4 pages1984 Book 3Savannah DanaheyNo ratings yet

- 7 - ED Review Test 7Document3 pages7 - ED Review Test 7huykiet2002No ratings yet

- Flags of The World CupDocument4 pagesFlags of The World CupJéssica OliveiraNo ratings yet

- The Broken Wave: Evangelicals and Conservatism in The Brazilian CrisisDocument9 pagesThe Broken Wave: Evangelicals and Conservatism in The Brazilian CrisistiagodearagaoNo ratings yet

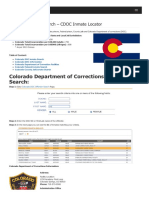

- Colorado Inmate Search Department of Corrections LookupDocument9 pagesColorado Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- Tamil Nadu Occupants of Kudiyiruppu (Protection From Eviction) Re PDFDocument3 pagesTamil Nadu Occupants of Kudiyiruppu (Protection From Eviction) Re PDFLatest Laws TeamNo ratings yet

- A. Bhattacharya - The Boxer Rebellion I-1Document20 pagesA. Bhattacharya - The Boxer Rebellion I-1Rupali 40No ratings yet

- Book Red CatDocument7 pagesBook Red CatHuseyn AliyevNo ratings yet

- MORGAN SECURITIES v. MODI RUBBER (2006)Document3 pagesMORGAN SECURITIES v. MODI RUBBER (2006)mb11.3No ratings yet

- American English File Second Edition PDFDocument169 pagesAmerican English File Second Edition PDFKamila CerqueiraNo ratings yet

- Deerfield - 2016Document265 pagesDeerfield - 2016DJ EntropyNo ratings yet

- Fundamental Principles of LaborDocument3 pagesFundamental Principles of LaborKristina Marinela G. RamosNo ratings yet

- The Marxism Behind Bong Joon-Ho's SnowpiercerDocument6 pagesThe Marxism Behind Bong Joon-Ho's SnowpierceruaenaNo ratings yet

- Javier Ortiz Villegas, A200 975 995 (BIA July 1, 2016)Document4 pagesJavier Ortiz Villegas, A200 975 995 (BIA July 1, 2016)Immigrant & Refugee Appellate Center, LLC100% (1)

- 2023 - Altered - TCG - Deck - Axiom - PRINT - PLAY - LETTERDocument8 pages2023 - Altered - TCG - Deck - Axiom - PRINT - PLAY - LETTERalfonsoguisadog2211No ratings yet

- Course Outline in Administrative Law: Every Wednesday, 6:00 PM - 9:00 PM)Document7 pagesCourse Outline in Administrative Law: Every Wednesday, 6:00 PM - 9:00 PM)asfaedNo ratings yet

- Town of Midland Bylaw 98-42Document2 pagesTown of Midland Bylaw 98-42Midland_MirrorNo ratings yet

- 13-4178 Amicus Brief of Robert George, Et Al.Document45 pages13-4178 Amicus Brief of Robert George, Et Al.Equality Case FilesNo ratings yet

- The Sustainability of Restorative JusticeDocument18 pagesThe Sustainability of Restorative JusticeAnggaNo ratings yet

- Verb + - Ing (Enjoy Doing / Stop Doing Etc.) : Stop Finish Recommend Consider Admit Deny Avoid Risk Imagine FancyDocument12 pagesVerb + - Ing (Enjoy Doing / Stop Doing Etc.) : Stop Finish Recommend Consider Admit Deny Avoid Risk Imagine FancyНадіяNo ratings yet