Professional Documents

Culture Documents

Us Economic Outlook Bowed But Not Broken

Uploaded by

Varun Prasad AOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Economic Outlook Bowed But Not Broken

Uploaded by

Varun Prasad ACopyright:

Available Formats

North America U.S.

Economics

04 May 2012

research@Briefing.com

U.S. Economic Outlook: Bowed but Not Broken

Weaker inventory growth and a slight pullback in durable goods consumption are expected to cause a

deceleration in GDP growth in the second quarter. Real final sales, however, will be boosted by a natural pickup in investment spending as the negative effects of the accelerated depreciation tax credit wane.

Recent developments, including a deceleration in payroll growth and a slight pullback in home

construction, combined with long-run uncertainties from Europe and the U.S. fiscal cliff that will appear in January 2013 have raised alarms and have caused many economists to return to their pessimistic views.

The structural problems that hindered growth over the past few years, however, started to abate in

the first quarter and have not been disrupted by the softening economic numbers. Therefore, we continue to think overall growth rates can exceed expectations.

Consumption will hinge on how confident consumers are in the stability of the economic recovery.

Jeffrey S. Rosen, Ph.D. Chief Economist

jrosen@Briefing.com Briefing Research is an independent investment research group with a concentration in macro, thematic, and nonconsensus research. www.BriefingResearch.com Briefing.com Inc. 401 N. Michigan Ave Suite 2910 Chicago, IL 60611

Normally, we view sentiment readings as a nonfactor in consumption growth and rely solely on income gains. In this case, however, the expectations indices are the only source of data that explains how consumers feel about future economic conditions and how they may respond if income growth softens for another quarter.

Businesses are still in a prime position to focus on investment spending. With a glut of savings

earning low returns, investment returns do not need to be that high to prompt a shift from savings to investing.

Quarterly conference call on the economy: Tuesday, May 15, at 2:00 p.m. ET. Register here.

Disclaimer: Briefing.com, Inc. ("Briefing.com") is not a registered investment adviser. This document does not constitute an offer or solicitation to buy or sell any securities discussed herein, or to offer for compensation any investment advisory services or any securities brokerage services. No person other than a current subscriber in good standing of Briefing.com, Inc. or Briefing Research may rely on any information contained herein. Briefing.com is not acting as a broker or dealer under any federal or state securities laws. Copyright 2012 Briefing.com, Inc. All rights reserved. The Investorside Research Association certifies its members have no investment banking conflicts.

04 May 2012

Page 1 of 27

North America U.S. Economics

Table of Contents

Forecast Assumptions ................................................................................................................................................................................................ 3 Economic Overview ................................................................................................................................................................................................... 5 Personal Consumption Expenditures .......................................................................................................................................................... 8 Nonresidential Investment Equipment and Software ..........................................................................................................................11 Nonresidential Investment Structures ....................................................................................................................................................12 Residential In vestment ................................................................................................................................................................................14 Inventory Investment...................................................................................................................................................................................16 Net Exports ...................................................................................................................................................................................................17 Government Spending .................................................................................................................................................................................19 Business Activity Indicators.....................................................................................................................................................................................21 Employment Situation .................................................................................................................................................................................21 Inflation..........................................................................................................................................................................................................23 Monetary Policy ............................................................................................................................................................................................25

04 May 2012

www.BriefingResearch.com

Page 2 of 27

North America U.S. Economics

Forecast Assumptions

Sequestration: The failure of the so-called Super Committee to reach an agreement on cutting debt triggered an automatic $1.2 tln reduction in government spending from 2013 to 2021, split between defense and nondefense sectors. Estimates from the Congressional Budget Office on government outlays due to the sequestration for 2013 are used in our model. Bush Tax Cuts: The Bush-era tax cuts are set to expire at the end of 2012. The economy is fragile and failure to do anything could send the U.S. back to recession. With the assumption that tax cuts are extended, it will not make a difference economically if legislative action that extends tax cuts is delayed to early 2013 so long as people believe that the retroactive action will occur. Stable Short-term Interest Rates: The Federal Reserve announced that economic conditions are likely to warrant an exceptionally low level for the fed funds rate through at least late 2014. Operation Twist: The Fed is driving a Treasury curve flattening by selling short-term securities and buying long-term bonds. Rates on the 10-year Note have fallen below 2.00%. With no movement in short-term rates expected for another two years, the 10-year Treasury rate should remain low through 2013. Slight Uptick in Commodity Prices: Crude prices will continue to inch higher as the U.S. recovery continues to expand. Demand from Asia will offset weakness in Europe. Other commodities, including precious metals, industrial metals, and foodstuffs will keep pace. Equity Market: Fundamental factors continued earnings growth, low inflation, and low interest rates provide a reasonable basis to conclude the equity market has good potential to achieve a double-digit percentage gain in 2012 barring an unforeseen shock. Weaker Home Prices: While the rate of foreclosures should decelerate as the economy picks up in 2012, the number of real estate owned (REO) properties will continue to expand and will add inventory to an already overstocked housing market. Home prices, therefore, are likely to suffer downward pressure through 2012.

04 May 2012

www.BriefingResearch.com

Page 3 of 27

North America U.S. Economics

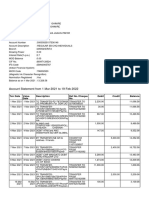

FORECAST GDP Personal Consumption Fixed Investment Inventory Investment* Net Exports* Exports Imports Government Spending Housing Starts (000s) Vehicle Sales (mln units) Industrial Production** Capacity Utilization Unemployment Rate GDP Deflator CPI Headline CPI Core PCE Core PPI Headline Crude Oil ($/bl)*** Trade-Weighted FX Fed Funds Rate 3-Month Treasury 10-Year Treasury Disposable Income Consumer Credit Household Net Worth**

Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Real GDP and Components (Quarter-over-Quarter Annualized, Unless Noted) 3.0 2.2 1.4 2.2 2.5 2.2 2.1 2.0 2.1 2.9 1.9 2.4 2.4 2.5 2.4 2.6 6.3 1.4 12.2 9.0 7.2 7.7 5.9 6.3 52 70 29 25 30 22 23 20 -412 -411 -407 -412 -413 -416 -421 -425 2.7 5.4 1.8 2.6 3.5 3.0 3.0 3.0 3.7 4.3 0.4 3.0 3.2 3.0 3.2 3.3 -4.2 -3.0 -1.2 -1.7 -1.0 -1.0 -1.7 -1.7 Business Activity (Quarterly Average, Unless Noted) 670 687 675 690 690 700 700 700 13.4 14.5 14.4 14.4 14.3 14.7 14.9 15.1 1.2 1.3 0.7 1.5 0.6 0.6 -0.2 0.0 77.8 78.7 78.7 79.0 79.1 79.1 79.2 79.3 8.7 8.2 8.1 8.1 8.1 7.9 8.0 7.8 Prices (Year-over-Year, Unless Noted) 2.1 1.9 1.8 1.6 2.0 2.1 2.2 2.2 3.3 2.8 2.5 2.2 2.8 2.7 2.8 2.8 2.2 2.2 2.0 2.1 2.2 2.3 2.5 2.3 1.8 1.9 1.9 1.7 1.8 1.8 1.7 1.9 5.5 3.4 3.0 3.4 3.0 2.9 2.7 3.5 94.2 102.9 102.7 100.0 102.0 105.0 109.0 113.0 1.7 1.2 2.2 3.6 4.6 3.1 7.4 3.5 Interest Rates (Quarterly Average) 0.08 0.10 0.19 0.18 0.12 0.12 0.12 0.12 0.01 0.07 0.16 0.15 0.15 0.20 0.22 0.24 2.04 2.03 2.10 2.20 2.20 2.20 2.30 2.30 Real Income (Quarter-over-Quarter Annualized, Unless Noted) 1.7 0.4 1.5 0.9 2.8 1.0 0.7 0.9 3.3 4.2 0.5 1.2 0.6 0.6 0.6 0.6 1.8 3.5 -0.3 -0.2 0.9 2.5 2.8 1.9

2010 3.0 2.0 2.6 59 -422 11.3 12.6 0.7 585 11.6 5.4 73.7 9.6 1.2 1.6 1.0 1.4 4.2 79.5 -4.9 0.18 0.14 3.22 1.8 -5.4 5.4

2011 2012 (Year-over-Year) 1.7 2.1 2.2 2.2 6.8 7.5 35 38 -414 -409 6.7 3.5 4.9 2.6 -2.1 -2.1 (Yearly Average) 610 686 12.7 14.4 4.1 4.5 76.8 78.9 8.9 8.2 (Year-over-Year) 2.1 1.8 3.1 2.6 1.7 2.1 1.4 1.9 6.0 3.2 95.1 101.9 -4.3 2.9 (Yearly Average) 0.10 0.15 0.05 0.13 2.78 2.13 (Year-over-Year) 1.3 1.1 -1.1 2.0 1.3 2.0

2013 2.2 2.4 7.5 20 -421 2.9 3.0 -1.4 703 15.0 1.6 79.2 7.8 2.2 2.7 2.4 1.8 3.5 110.8 4.0 0.12 0.22 2.28 1.4 0.7 6.3

* Billions of chained (2005) dollars ** Percent change quarterly (yearly) rate *** Quarterly (yearly) average

04 May 2012

www.BriefingResearch.com

Page 4 of 27

North America U.S. Economics

Economic Overview

Recent developments, including a deceleration in payroll growth and a slight

GDP Growth

(q/q % annualized)

history 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

forecast

pullback in home construction, combined with long-run uncertainties from Europe and the U.S. fiscal cliff that will appear in January 2013 have raised alarms and have caused many economists to return to their pessimistic views.

The structural problems that hindered growth over the past few years,

however, started to abate in the first quarter and have not been disrupted by the softening economic numbers. Therefore, we continue to think overall growth rates can exceed expectations.

Monetary policy remains extremely accommodative. Businesses could take

advantage of the potentially stronger consumption rates with increased capital spending. In our last U.S. Economic Outlook, Growth Prospects, Full Speed Ahead, we pointed out that the structural problems that have faced the economy since the start of the recession including higher unemployment, elevated debt, and weak housing demand were beginning to abate. This led us to believe that U.S. growth prospects in 2012 could easily exceed the modest expectations of 2.0% growth that many economists projected at the beginning of the year. For the first two months of 2012, the economy looked to be following that track.

Contribution to GDP Growth

(percentage points)

GDP Structures Imports 3% 2% 1% 0% -1% -2% Q2-12 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13

Source: Briefing Research

PCE Inventories Exports

Equipment Residential Government

04 May 2012

www.BriefingResearch.com

Page 5 of 27

North America U.S. Economics

Businesses added more than 200,000 jobs each month. Motor vehicle sales surpassed 15.0 mln SAAR for the first time since the Cash for Clunkers tax rebate inflated sales levels. Both housing starts and sales showed renewed strength. Growth was not only poised to exceed expectations but was on pace to exceed potential for a second consecutive quarter for the first time since the first and second quarters of 2010. The data suddenly weakened in March, however, and renewed fears that growth could mirror the lackluster performance seen in the spring and summer of 2011. Payrolls barely topped normal labor force growth and aggregate wages softened. Housing starts and sales reversed directions, striking fear that the gains in January and February were the result of temperate weather conditions and not newfound demand. Manufacturing production contracted for the first time since November 2011. On top of the sudden slowdown in the hard data, the long-term economic outlook became a bit murkier.

1.0% 0.5% 0.0% -0.5% -1.0% -1.5% 2009

Source: BLS

Aggregate Wages

(m/m)

2010

2011

2012

Manufacturing Production

(m/m)

2.0% 1.5% 1.0%

0.5%

0.0% -0.5% -1.0% Jan-10

Jul-10

Jan-11

Jul-11

Jan-12

Source: Federal Reserve

04 May 2012

www.BriefingResearch.com

Page 6 of 27

North America U.S. Economics

Ten European countries (and counting) are currently in a recession. Many of these countries are advocating for more austerity, which will likely deepen their respective recessions. This will cut into potential U.S. exports and feed concerns about earnings prospects that could weigh on the equity market. The U.S. is set to experience a severe fiscal contraction on par with a 3% - 5% decline in GDP if Congress does not extend the Bush-era tax cuts, payroll tax cuts, and/or eliminate the automatic sequestration. Without a compromise in Congress, the U.S. faces a strong chance of falling back into a recession in 2013. With all of these potential problems, it is no wonder that economic pessimism has returned. We do not think the economic situation has changed enough to warrant such pessimism. Everything we highlighted in our prior outlook, which discussed the potential for stronger-than-expected growth, remains intact. The only real change since that report was published is that the possible negative outcomes have become more pronounced than before. Still, we feel the upside potential for the U.S. economy remains greater than the downside risk.

Consecutive Quarters of Negative Real GDP Growth

Portugal Slovenia

Greece

Czech Republic Italy Ireland Denmark United Kingdom Spain Netherlands

Source: OECD

04 May 2012

www.BriefingResearch.com

Page 7 of 27

North America U.S. Economics

Personal Consumption Expenditures

Consumption growth is expected to be a leader in economic growth

Personal Consumption Expenditures Growth

(q/q % annualized)

history 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

throughout the forecast.

Growth in the first quarter hinged on consumers dipping into savings to

forecast

support consumption. Another quarter of weak income growth, however, could cause consumers to pull back on spending. For the second consecutive quarter, consumption growth hinged on pent up demand for durable goods. Spending in this sector grew by 15.3% in Q1 2012 after increasing 16.1% in Q4 2011. The difference between the two quarters is where consumers received the funds that fueled the spending growth. In Q4 2011, real income levels increased 2.1%, which was nearly equal to total real consumption growth that quarter. In the first quarter, real income growth slowed to 1.2%. That was not enough to support a 2.9% increase in consumption. In order for overall consumption spending to rise 2.9%, consumers dipped into their savings and pushed the personal savings rate from 4.5% in the fourth quarter to 3.9% in the first quarter. That was the first time the savings rate dipped below 4.0% since Q4 2007. Dipping into savings is normally viewed as a good response to the recovery. Consumers try to smooth their consumption levels over time. The usage of savings signals that consumers believe income growth will pick up in the near future and allow them to replenish their savings with stronger future income gains. The household financial debt obligations ratio, which is the percentage of disposable income required to meet minimum monthly debt payments, reached

Real Disposable Income

(q/q % annualized)

History 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

Forecast

04 May 2012

www.BriefingResearch.com

Page 8 of 27

North America U.S. Economics

its lowest level since 1984. Consumers have more money in their pocket, and, more importantly, have the ability and the means to take on more debt. That was an added incentive for consumers to smooth their consumption levels in the face of weak income growth. It was also one of the reasons why we suspected that personal consumption growth could exceed expectations. Looking at the second quarter, however, consumption growth will most likely slow. While all durable sectors showed strong growth, motor vehicles and parts spending, which had languished during the recession and most of the recovery, provided the bulk of the gain with a 28.7% increase. Motor vehicle demand should remain elevated in the second quarter, but levels most likely will dip. The rest of consumption will be reliant upon how confident consumers are in the stability of the economic recovery. As long as the perception remains that future income growth will be enough to subsidize current consumption, consumption growth should continue to expand in the face of another quarter of soft income gains. The converse, however, is also true. If future income growth is expected to trend lower, consumers will hold back on spending and keep savings elevated. Normally, we view sentiment readings as a nonfactor in consumption growth and rely solely on income gains. In this case, however, the expectations indices are the only source of data that explains how consumers feel about future economic conditions and how they may respond if income growth softens for another quarter. Unfortunately, the indices point in different directions. The initial claims level reversed directions and turned higher in April, which is a potential sign that the recovery may be softening. The participants in the

04 May 2012 www.BriefingResearch.com 19.5% 19.0% 18.5% 18.0% 17.5% 7% 6% 5% 4% 3% 2% 1% 0% 2006

Source: BEA

Personal Savings Rate

2007

2008

2009

2010

2011

2012

Financial Obligations Ratio

17.0%

16.5% 16.0% 15.5% 15.0% 1980

Source: FactSet

1985

1990

1995

2000

2005

2010

Page 9 of 27

North America U.S. Economics

University of Michigan Consumer Sentiment Survey discounted the long-term impact of the rise in claims and showed stronger positive future expectations. On the other hand, the Conference Boards Consumer Confidence Survey showed a notable pullback in long-term expectations. If the Consumer Sentiment Survey is the more accurate gauge of consumer attitudes about the recovery, then another quarter of weak income levels will likely not have a bearing on consumption. If the Consumer Confidence Survey is the correct gauge, consumption levels most likely will underperform expectations. Risks to Personal Consumption Forecast

A disorderly default in Europe could cause banks in the U.S. to tighten

Consumer Expectations

Sentiment 120 100 80 Confidence

60

40 20 0 2009

Source: FactSet

credit standards and choke off a potential increase in consumer demand.

Businesses may launch another round of layoffs if demand does not meet

2010

2011

2012

initial 2012 expectations. Consumers would again worry about job security and revert to higher savings rates.

The government sector makes up nearly 17% of total nonfarm payrolls.

There may be significant payroll losses that could have detrimental effects on our longer-term consumption expectations if numerous government programs are slashed in the next round of deficit reduction negotiations.

04 May 2012

www.BriefingResearch.com

Page 10 of 27

North America U.S. Economics

Nonresidential Investment Equipment and Software

Most sales forecasts assume a constrained consumer with limited demand

Equipment and Software Growth

(q/q % annualized)

history 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

growth. There is little reason, from a companys point of view, to speed up the transition from replacement of obsolete equipment to expansion until the economic recovery gains more traction.

Business balance sheets are showing near record cash surpluses. Given the

forecast

low returns on business savings especially considering the Fed does not expect to increase the fed funds rate until at least late 2014 it would not take a sizable shift in demand to justify large capital projects. Nonresidential investment in equipment and software in the first quarter was disappointing, increasing by the smallest amount (1.7%) since Q2 2009. The lackluster gain, however, was most likely the result of timing issues rather than the start of a new low-growth trend. Congress passed an accelerated depreciation tax credit in 2011 that expired last December. That action likely caused businesses to pull forward investment purchases that normally would have been made in Q1 2012 into Q4 2011. Investment spending most likely will return to normal in the second quarter and growth in the neighborhood of 15% is likely. There is room for upward potential in that forecast too. Even as profit growth has slowed, business balance sheets continue to show a glut of savings. Since interest rates are at all-time lows, the return on savings is extremely low. Alternatively, the costs for investment are also low. The return on investment does not have to be very high to justify a shift to investment spending from savings. When businesses decide to make the shift is unknown.

04 May 2012 www.BriefingResearch.com

Domestic Business Balance Sheet

Gross Savings minus Gross Investment (blns)

$800 $600 $400 $200 0 -$200 -$400 2000

Source: FactSet

2002

2004

2006

2008

2010

Page 11 of 27

North America U.S. Economics

Businesses still face considerable uncertainty about future demand that makes it difficult for companies to start an investment cycle. In the U.S. fiscal headwinds from a sharp drop in government spending and the potential for severe tax increases could have a detrimental effect on disposable income levels and cut deep into demand growth. At the same time, new regulations stemming from Dodd-Frank, the Affordable Care Act, and the EPA make it difficult for firms to know the true cost of doing business. Separately, export-centric firms that do businesses with Europe have to deal with multiple recessions there and the possibility of more demand loss from further austerity. Until the tax and regulatory situation in the U.S. is made clearer and Europe makes progress in fighting recessions, businesses may be content to hold cash even though the returns are extremely low. Risks to the Forecast for Investment in Equipment and Software

Stronger (weaker) than expected consumption will have an outsized positive

Single Most Important Problem Facing Small Businesses

Poor Sales Taxes Government Regulations Inflation Competition from Large Insurance Costs Quality of Labor Other Cost of Labor Interest Rates 0 10 20 30

Source: NIFB Small Business Economic Trends

Nonresidential Structures Growth

(q/q % annualized)

history 25% forecast

(negative) effect on investment.

Nonresidential Investment Structures

Nonresidential construction has suffered from an excess supply of

20% 15% 10% 5% 0% -5% -10% -15%

Source: BEA, Briefing Research

commercial, office, and other structures.

Instead of following oil prices higher, mining construction has turned down

the last two quarters. Mining may be following weaker natural gas prices. Our outlook for investment in nonresidential structures has not changed over the previous few quarters.

04 May 2012 www.BriefingResearch.com

Q2-11

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

Page 12 of 27

North America U.S. Economics

Growth in the sector is split between mining construction and normal nonresidential buildings. Mining development has been the predominant growth factor as high energy prices have led to an expansion in oil and gas exploration. The correlation between oil prices and structures spending was extremely close-knit. That correlation, however, broke down over the last two quarters as higher oil prices failed to bring about an increase in mining investment. Instead, mining investment growth is becoming more reliant upon natural gas prices. Unfortunately for investment, natural gas prices are at historic lows. Even though the cost for undertaking an investment project is at historic lows, the returns specifically to the mining sector may still not be enough to justify new construction growth. The supply of normal nonresidential structures remains abundant. There is little reason for builders to boost construction significantly in these areas over the next few years. As a result, construction spending growth will be predicated on higher energy prices. Risks to the Nonresidential Investment in Structures Forecast

Given the strong correlations between mining construction and natural gas

Mining Construction and Energy Prices

(indexed; 2005 = 100)

Mining 300 250 200 150 100 50 0 2005

Source: BEA, FactSet

Oil

Natural Gas

2007

2009

2011

prices recently, volatility (up or down) in natural gas prices could cause big shifts in construction growth.

Relief in the commercial real estate securitization markets would increase the

amount of potential buyers in the marketplace and have a gradual, positive effect on prices.

04 May 2012

www.BriefingResearch.com

Page 13 of 27

North America U.S. Economics

Residential Investment

Inventories of new homes have stabilized and demand expectations have

Residential Investment Expenditures

(q/q % annualized)

History 20% 15% 10% 5% 0% -5% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

improved. For the first time since the peak in residential construction in 2005, there is a clear trend developing that suggests builders will be better off producing more homes in the coming year.

Residential investment has the potential to be the most important sector for

Forecast

economic growth in 2012. In the immediate term, it is unclear if the drop in starts in March was the result of a payback period following temperate weather conditions in January and February. Warmer-than-normal temperatures may have caused builders to move up production to take advantage of the weather conditions. That could mean another month or two of weak housing starts and lackluster residential investment growth before starts return to a normal production schedule. The construction spending levels failed to confirm this theory. Residential construction spending actually declined substantially in February before rebounding in March. This suggests that builders are being cautious on which luxuries to include in new homes and are keeping costs in check with expected demand. Thus, starts can rise, but overall spending growth may remain muted. In the long term, our forecast for residential investment has not changed since last quarter. A combination of modestly stronger sales coupled with a continued pullback in home construction has brought inventory levels, especially in the single-family sector, down to a manageable level.

Housing Starts

('000s)

History 800 700 600 500 400 300 200 100 0 Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: FactSet, Briefing Research

Forecast

04 May 2012

www.BriefingResearch.com

Page 14 of 27

North America U.S. Economics

At the same time, weak home prices coupled with low interest rates have brought home affordability levels to their all-time high. Home sales should start trending higher. That means, for the first time in a long time, new home inventories may be too low for demand expectations. That should result in a spurt of homebuilding growth that lasts years, not months. The question is how risk averse are builders going to be? After suffering some of the largest losses from any economic sector, builders may not be willing to move ahead in a significant manner until they are absolutely sure that demand is stable. Construction growth may remain deflated relative to expected inventory/sales levels. There is also still a large supply of shadow inventory with many held by banks as REOs in the marketplace. As banks liquidate their holdings, pricing pressures will remain to the downside. Builders will have to compete against this low-priced distressed housing. That could cause smaller profit margins.

6 5 4 3 2 1 0 170 160 150 140 130 120 110 100 90 80 2000

Source: FactSet

Home Affordability Index

(indexed; 1990 = 100, SA)

2002

2004

2006

2008

2010

2012

Total Home Sales

(mlns of homes)

History Forecast

Source: FactSet, Briefing Research

Q2-11

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

04 May 2012

www.BriefingResearch.com

Page 15 of 27

North America U.S. Economics

Risks to Residential Investment Forecast

Homebuyers may shrink from the marketplace as there is no incentive to

Change in Inventories

(blns of chained (2005) dollars)

history 80 70 60 50 40 30 20 10 0 -10

Source: BEA, Briefing Research

trade up for a new home if prices continue to trend lower.

New home inventories are at historic lows. There is a large shadow

forecast

inventory of distressed properties that have not yet been repossessed or put up for sale. With distressed properties still selling at a notable discount to both existing and new homes, the gains in overall sales may not translate into stronger new home sales unless prices decline. This could lead to weaker production levels if homebuilders cannot meet those lower price points.

Inventory Investment

Inventory levels will remain volatile, but the net contribution to 2012 and

Q2-11

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

2013 GDP is expected to be only +0.02 and +0.15 percentage points, respectively. Historically, the contribution to GDP from inventory changes has averaged about zero each quarter, but the variance is quite large. Therefore, on a quarterto-quarter basis, the contribution to GDP is quite volatile as strong positive contributions one quarter are followed with equally strong negative contributions the next. After a strong increase in inventories in Q4 2011, inventories failed to contract in Q1 2012. That means the 1.94 percentage point contribution to fourth quarter GDP has not yet been offset. We suspect that inventories will contract in the second quarter and weigh down GDP growth.

Final Sales to Total Inventory Stock Ratio

history 0.60 0.59 0.58 0.57 0.56 0.55 0.54 0.53 0.52 0.51 0.50 2001 forecast

2003

2005

2007

2009

2011

Source: BEA, Briefing Research

04 May 2012

www.BriefingResearch.com

Page 16 of 27

North America U.S. Economics

While we are confident that inventories will not have a large impact on 2012 or 2013 GDP overall, it is possible that the quarterly inventory movements cause wide variation in our quarterly forecasts. Risks to Inventory Forecast

Inventory growth is based upon steady growth in expected demand levels.

2400 2300 2200 2100 2000 1900 1800 1700 Q2-11

Net Exports

(mlns of chained (2005) dollars)

Exports Import

If businesses believe demand is going to be weaker, inventory growth may deteriorate.

Net Exports

A stronger dollar, as a result of relatively stronger U.S. growth compared to

the rest of the developed world, will keep upward pressure on import demand and weigh down GDP. Slowing growth in Europe will constrain U.S. export growth.

The trade balance is expected to widen slightly over the coming quarters.

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

Source: BEA, Briefing Research

The trade deficit flattened in the first quarter and growth may remain muted in the near term. On the export side, European countries are expected to struggle in 2012. That should result in weaker demand for U.S. exports. European demand, however, only makes up 22% of total U.S. exports. Even if Europe suffers a severe contraction, it will not have much of an effect on overall U.S. exports. On the import side, elevated commodity prices, chiefly oil, will put upward pressure on import growth. At the same time, however, a shift to lower inventory levels will reduce pressure on imports of consumer goods. In the long term, the big concern is how the dollar will react to the European debt crisis.

04 May 2012 www.BriefingResearch.com 92 90 88 86 84 82 80 78 76

Real Trade-Weighted Broad Foreign Exchange Index

history forecast

Q2-11

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

Source: Fed, Briefing Research

Page 17 of 27

North America U.S. Economics

In real terms, the Feds broad trade-weighted dollar index has deteriorated slightly from December 2011 and has increased only 4.3% since reaching an alltime low in July 2011. The index remains 4.4% below its level from December 2007 at the start of the recession. The dollar has room to appreciate over the next few months, especially considering the U.S. economy is expected to outperform most developed countries, even when using a pessimistic U.S. viewpoint as the source of the comparison. Since the export trends lag movements in the dollar by approximately six months, a return to pre-recessionary levels most likely will not impact export demand until 2013 when the downturn in Europe will have hopefully reversed course. The improvement in demand should offset the losses caused by the stronger dollar. At the same time, a stronger dollar combined with an improving economy will increase demand for imports. As a result, the U.S. trade deficit will likely widen toward the end of the year.

U.S. Dollar Index

95 90 85

80

75 70 2005

2006

2007

2008

2009

2010

2011

2012

Source: FactSet

04 May 2012

www.BriefingResearch.com

Page 18 of 27

North America U.S. Economics

Risks to the Net Export Forecast

There have been grumblings in export-driven countries that the devaluation

Government Spending Growth

(q/q % annualized)

history 0% -1% -2% -3% -4% -5% -6% forecast

of the dollar will harm their interests, and they are becoming increasingly worried about asset inflation being driven by foreign capital. Foreign countries may implement stronger capital controls in an effort to stem the appreciation of local currencies.

Austerity measures in Europe combined with weakening growth

expectations in many Asian countries could cause a larger-than-expected deceleration in world growth and lead to lower-than-expected demand for U.S. goods.

Government Spending

The CBO said federal government spending is expected to contract in 2012

Q2-11

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

Source: BEA, Briefing Research

and 2013 as spending cuts begin to take hold.

State and local government budgets have stabilized, leaving room for some

upside growth.

Total government spending is expected to fall 1.9% in 2012 and 1.5% in

2013. The CBO recently released its revised long-term forecast. It showed discretionary outlays falling 2.8% and 6.7% in 2012 and 2013, respectively. The drop in spending is the result of agreed-upon cuts from the 2011 debt ceiling negotiations and the automatic sequestration from the failure of the Congressional Super Committee to compromise on a long-term deficit reduction plan.

04 May 2012

www.BriefingResearch.com

Page 19 of 27

North America U.S. Economics

Estimates show that the effects of the austerity measures combined with the expiration of the Bush-era tax cuts and the payroll taxes could contribute to a 3% - 5% contraction in GDP. That type of contraction would drive the U.S. back into a recession. Congress will have to come up with a compromise that limits the effects of the sequestration and the tax cut expiration by either reworking the amount of austerity and/or extending the tax cuts. State and local governments remain over indebted but increased revenues from property and sales taxes have stabilized government budgets. State and local government spending should rise gently in the coming quarters. Risks to the Government Forecast

Unless Congress is able to compromise on smaller austerity measures, the

CBO estimates that automatic sequestration will lower federal spending by 6.7% in 2013. That would reduce GDP below our expectations.

A stronger-than-expected economic recovery could result in higher tax

revenues and lead to stronger state and local government spending.

04 May 2012

www.BriefingResearch.com

Page 20 of 27

North America U.S. Economics

Business Activity Indicators

Employment Situation

The initial claims level reversed directions and began trending higher in

9.5% 9.0% 8.5% 8.0% 7.5% 7.0% Q2-11

Unemployment Rate

history forecast

April.

Uncertainty at both the fiscal level and with immediate consumer demand

will weigh heavily on business expansion in the near term.

A pickup in consumption could have an oversized effect on hiring.

The employment sector looked like it was on firm footing for most of Q4 2011 and Q1 2012. Payroll gains in excess of 200,000 were the norm and layoffs were beginning to peter out. The sector suddenly switched gears in March and April. Nonfarm payrolls barely exceeded normal labor force growth and the initial claims level began to rise. There are some analysts who pinned the weakness in the labor sector as a temporary correction from seasonal adjustments paring down the weatherrelated hires from earlier. While that is a logical conclusion, the data does not give it much support. Sectors with large labor forces that work primarily outside, such as construction, saw modest gains that were not enough to support the overall improvement in employment. Furthermore, the downturn in the March payroll numbers did not come from those sectors. Both the acceleration and deceleration in payroll growth over the past few months was widespread and distributed among multiple sectors. This suggests

Q4-11

Q2-12

Q4-12

Q2-13

Q4-13

Source: BLS, Briefing Research

Initial Claims

('000s, 4-wk MA)

500 480 460 440 420 400 380 360 340 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12

Source: FactSet

04 May 2012

www.BriefingResearch.com

Page 21 of 27

North America U.S. Economics

the recent downturn may not be a temporary seasonal effect but is instead caused by business uncertainty about the future. Like last quarter, many corporations discussed the potential for weak sales/demand growth in their earnings calls. A deceleration in hiring would be a normal response to potentially slowing sales. Beyond consumer demand, businesses are also concerned about future fiscal policy. As we mentioned previously, the Bush-era tax cuts and the payroll tax cuts are set to expire at the end of the year. If Congress fails to pass an extension, personal disposable income will fall significantly and have a sizable negative impact on consumer demand. Thus, sales growth may weaken further. At the same time, a substantial cutback in fiscal spending as a result of the automatic sequester will cause government payrolls to shrink and lower aggregate income. Like the tax policies, this will result in a downward shock to consumer demand. Businesses may be waiting for some of the fiscal uncertainty to pass before hiring demand starts to pickup. Risks to the Employment Forecast

As we showed in the nonresidential investment forecast, businesses are flush

with cash. The opportunity cost for hiring an extra worker has declined.

Budgetary cuts are expected to shave approximately 25,000 government

workers per month from total payrolls through 2012. Further budget cuts could result in an accelerated layoff program where government payrolls decline by 35,000 - 40,000 per month.

04 May 2012

www.BriefingResearch.com

Page 22 of 27

North America U.S. Economics

Inflation

Recent commodity spikes have driven headline inflation rates above Fed

PCE Prices Growth Rates

(y/y)

Headline 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% Core

target levels.

Firms have been reluctant to pass on these higher costs into general prices

and risk alienating customers, yet more companies have indicated that they expect to pass higher commodity costs on to the consumer in the near future.

Slack in the labor market should keep inflation growth well contained

throughout the forecast.

Our model suggests core PCE will average 1.8% in 2012 and 2.0% in 2013,

0.5%

0.0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BLS, Briefing Research

within the Feds target of 1.5% - 2.0% yearly growth. Our inflation outlook has not changed materially over the past few quarters. The surge in commodity prices over the past several months has had limited effect on consumer inflation rates. The pass-through to core consumer prices has been even smaller. The key to inflation growth is income growth. If incomes increase, firms have the ability to pass on higher prices with minimal demand loss. In a low-growth environment, income growth does not increase fast enough to spur inflation. Thus, firms are pressured to hold prices low or risk the possibility that consumers switch to competing products. Passing through prices to the consumer too soon may be detrimental to a firms revenue potential. Weak economies beget weak inflation rates.

Commodity Spot Prices and Inflation

(indexed; 2005 = 100)

Raw Industrials Energy 225 200 175 Foodstuffs CPI - Headline

150

125 100 75 50 2005 2006 2007 2008 2009 2010 2011

Source: CRB, BLS

04 May 2012

www.BriefingResearch.com

Page 23 of 27

North America U.S. Economics

Even if the economy rebounds beyond our expectations in 2012, the amount of slack in both the capital and labor markets will constrain inflation growth. It would take the economy growing well above 3.0% for several consecutive quarters before inflation growth is sustained above the Feds target.

3.0%

GDP Deflator

(y/y)

History Forecast

Risks to the Inflation Forecast

Given the spike in oil prices in 2008, when the world was in a recessionary

2.5% 2.0% 1.5% 1.0% 0.5% 0.0% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: BEA, Briefing Research

environment, there is no guarantee that oil price growth will remain stable during the forecast. While a spike would not affect core prices or our monetary policy forecasts, it could raise headline growth more than we expect.

Rising commodity prices coupled with a strengthening labor sector could

give producers the incentive to pass on higher prices earlier in the business recovery than the output gap would normally suggest.

Financial firms have ample excess reserves. If banks decide that the

economy is stabilizing, we could see a rise in lending. This would add inflationary pressures to the economic system.

04 May 2012

www.BriefingResearch.com

Page 24 of 27

North America U.S. Economics

Monetary Policy

The FOMC reiterated that economic conditions are likely to warrant an

Fed Funds Rate Prediction

(Taylor Rule)

0% -1% -2% -3% -4% -5% -6% Q2-11 Q4-11 Q2-12 Q4-12 Q2-13 Q4-13

Source: Briefing Research

exceptionally low level for the federal funds rate at least through late 2014.

High unemployment and low inflation should deter the Fed from raising

rates. As a result, our estimates show normal monetary policy mechanisms will not be reactivated until mid-2015 at the earliest.

As the economy recovers, we could see the Fed removing some of the

excess liquidity by eliminating some of the quantitative easing measures enacted during the financial crisis. This may include the selling of assets purchased during the last year. The FOMC reiterated at its last meeting that it believes economic conditions are likely to warrant an exceptionally low level for the federal funds rate at least through late 2014. According to our estimates of the Taylor Rule a forecast of the fed funds rate given inflation rates and unemployment the fed funds rate should be negative for the next few years. The Taylor Rule had never projected a negative fed funds rate prior to the Great Recession. This estimate fits with the Feds current projections that the fed funds rate will remain low until at least late 2014. The more immediate concern is the path long-term rates will take after Operation Twist ends in June. As we pointed out in our April 26 report, Unconventional Wisdom: How Long Can the Twist-a-thon Last?, the Fed does not have enough maturing shortterm securities to extend Operation Twist beyond the first half of 2013.

Federal Reserve Balance Sheet

(blns)

$3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 2008

2009

2010

2011

2012

Source: Federal Reserve

04 May 2012

www.BriefingResearch.com

Page 25 of 27

North America U.S. Economics

If Treasury rates start rising following the end of Operation Twist, the Fed may start looking into selling its MBS or agency holdings to keep long-term Treasury rates down. Otherwise, the only option for the Fed would be a nonsterilized action (i.e., QE3). As long as the recovery continues to follow on an upward path, the Fed will most likely not go in this direction. Risks to the Monetary Policy Forecast

An unexpected, sustained increase in inflation or inflation expectations

could lead the Fed to increase the fed funds rate before 2014.

04 May 2012

www.BriefingResearch.com

Page 26 of 27

North America U.S. Economics

Briefing Research Sales

Jason Green Director, Institutional Sales 312-281-5484 jgreen@Briefing.com

U.S. Offices

Chicago Headquarters 401 North Michigan, Suite 2910 Chicago, IL 60611 800-752-3013 California Office 577 Airport Boulevard Suite 150 Burlingame, CA 94010

Full Disclaimer Briefing.com, Inc. ("Briefing.com") is not a registered investment adviser. This document does not constitute an offer or solicitation to buy or sell any securities discussed herein, or to offer for compensation any investment advisory services or any securities brokerage services. No person other than a current subscriber in good standing of Briefing.com, Inc. or Briefing Research may rely on any information contained herein. Briefing.com is not acting as a broker or dealer under any federal or state securities laws. This report is for the institutional clients and prospective clients of Briefing.com and Briefing Research. Reproduction or editing by any means, in whole or in part, or any unauthorized use, disclosure or redistribution of the contents without the express written permission of Briefing.com is strictly prohibited. The information contained in this report has been obtained from sources which Briefing.com believes to be reliable; however, Briefing.com does not guarantee the accuracy, completeness or timeliness of any information or analysis contained in the report. The information and analysis herein are provided "as is" and without warranty of any kind, either expressed or implied. The performance of Briefing.com's past recommendations and model results are not a guarantee of future results. Users assume the entire cost and risk of any investment decision they choose to make, Briefing.com shall not be liable for any loss or damages resulting from the use of the information contained in the report, or for error of transmission of information, or for any third party claims of any nature. Nothing herein shall constitute a waiver or limitation of any person's rights under relevant federal or state securities laws. Copyright 2012 Briefing.com, Inc. All rights reserved.

04 May 2012

www.BriefingResearch.com

Page 27 of 27

You might also like

- Sales Compensation and Incentive Plan Principles For Enterprise Saas and Cloud TeamsDocument4 pagesSales Compensation and Incentive Plan Principles For Enterprise Saas and Cloud TeamsVarun Prasad ANo ratings yet

- Accounting 3 - 4 CambridgeDocument550 pagesAccounting 3 - 4 Cambridgebob100% (2)

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- U.S. Market Update August 12 2011Document6 pagesU.S. Market Update August 12 2011dpbasicNo ratings yet

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- BlackRock 2014 OutlookDocument8 pagesBlackRock 2014 OutlookMartinec TomášNo ratings yet

- Weekly Market Commentary 3-512-2012Document4 pagesWeekly Market Commentary 3-512-2012monarchadvisorygroupNo ratings yet

- What Is GDP?: Kimberly AmadeoDocument44 pagesWhat Is GDP?: Kimberly AmadeobhupenderkamraNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- The 10 Key Points of Management ControlDocument20 pagesThe 10 Key Points of Management ControlJoseph Mamy100% (1)

- Simple Discount InterestDocument16 pagesSimple Discount InterestVivian100% (2)

- Outlook 2012 - Raymond JamesDocument2 pagesOutlook 2012 - Raymond JamesbubbleuppNo ratings yet

- BIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Document3 pagesBIMBSec - Economics - OPR at 4th MPC Meeting 2012 - 20120706Bimb SecNo ratings yet

- July 15 Market CommentaryDocument4 pagesJuly 15 Market CommentaryIncome Solutions Wealth ManagementNo ratings yet

- MFM Jul 15 2011Document13 pagesMFM Jul 15 2011timurrsNo ratings yet

- Ficc Times HTML HTML: The Key Events of Last WeekDocument6 pagesFicc Times HTML HTML: The Key Events of Last WeekMelissa MillerNo ratings yet

- November Econ OutlookDocument13 pagesNovember Econ OutlookccanioNo ratings yet

- Global Insurance+ Review 2012 and Outlook 2013 14Document36 pagesGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraNo ratings yet

- Weekly Economic Commentary 8/26/2013Document5 pagesWeekly Economic Commentary 8/26/2013monarchadvisorygroupNo ratings yet

- Monthly Economic Outlook 06082011Document6 pagesMonthly Economic Outlook 06082011jws_listNo ratings yet

- The Pensford Letter - 2.11.13Document4 pagesThe Pensford Letter - 2.11.13Pensford FinancialNo ratings yet

- March 2013 NewsletterDocument2 pagesMarch 2013 NewslettermcphailandpartnersNo ratings yet

- Weekly Economic Commentary 5/13/2013Document5 pagesWeekly Economic Commentary 5/13/2013monarchadvisorygroupNo ratings yet

- An Smu Economics Intelligence Club ProductionDocument10 pagesAn Smu Economics Intelligence Club ProductionSMU Political-Economics Exchange (SPEX)No ratings yet

- Weekly Trends: The Boc Cuts Rates AgainDocument4 pagesWeekly Trends: The Boc Cuts Rates AgaindpbasicNo ratings yet

- Anz Research: Global Economics & StrategyDocument14 pagesAnz Research: Global Economics & StrategyBelinda WinkelmanNo ratings yet

- U.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To ExhaleDocument17 pagesU.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To Exhaleapi-227433089No ratings yet

- Sarasin EM Bond OutlookDocument20 pagesSarasin EM Bond OutlookabbdealsNo ratings yet

- Where Do They Stand?: PerspectiveDocument8 pagesWhere Do They Stand?: Perspectiverajesh palNo ratings yet

- Market Outlook - Structural Transformation UnderwayDocument27 pagesMarket Outlook - Structural Transformation Underwaysathiaseelans5356No ratings yet

- Weekly Commentary January 22, 2013: The MarketsDocument4 pagesWeekly Commentary January 22, 2013: The MarketsStephen GierlNo ratings yet

- Janupd2013 With BannerDocument4 pagesJanupd2013 With BannerBaird HelgesonNo ratings yet

- Capital Watch (LR)Document5 pagesCapital Watch (LR)Scott TranNo ratings yet

- Weekly Commentary 4-30-12Document3 pagesWeekly Commentary 4-30-12Stephen GierlNo ratings yet

- Crux 3.0 - 12Document10 pagesCrux 3.0 - 12Neeraj GargNo ratings yet

- Market Commentary 11-26-12Document3 pagesMarket Commentary 11-26-12CLORIS4No ratings yet

- 2012 ThemesDocument19 pages2012 Themesmatt1890No ratings yet

- The Global Outlook Isn't Bad. But When Will It Be Good?Document6 pagesThe Global Outlook Isn't Bad. But When Will It Be Good?api-227433089No ratings yet

- 2022 Fef Semi Annual LetterDocument8 pages2022 Fef Semi Annual LetterDavidNo ratings yet

- Weekly Market Commentary 7/1/2013Document4 pagesWeekly Market Commentary 7/1/2013monarchadvisorygroupNo ratings yet

- Rbi Annual Policy 2013-14Document41 pagesRbi Annual Policy 2013-14Chhavi BhatnagarNo ratings yet

- Fiscal Policy Nov 2013 FINALDocument7 pagesFiscal Policy Nov 2013 FINALkunalwarwickNo ratings yet

- The Fed Is TrappedDocument25 pagesThe Fed Is TrappedYog MehtaNo ratings yet

- GI Report January 2012Document3 pagesGI Report January 2012Bill HallmanNo ratings yet

- The Pensford Letter - 7.9.12Document5 pagesThe Pensford Letter - 7.9.12Pensford FinancialNo ratings yet

- Weekly Commentary 11-27-12Document4 pagesWeekly Commentary 11-27-12Stephen GierlNo ratings yet

- The Pensford Letter - 11.11.13 PDFDocument4 pagesThe Pensford Letter - 11.11.13 PDFPensford FinancialNo ratings yet

- Weekly Economic Commentary 7-19-2012Document7 pagesWeekly Economic Commentary 7-19-2012monarchadvisorygroupNo ratings yet

- Deutsche Bank - The Markets in 2012-Foresight With InsightDocument60 pagesDeutsche Bank - The Markets in 2012-Foresight With InsightDaniel GalvezNo ratings yet

- Jul 16 Erste Group Macro Markets UsaDocument6 pagesJul 16 Erste Group Macro Markets UsaMiir ViirNo ratings yet

- Weekly Economic Commentary 5-09-12Document9 pagesWeekly Economic Commentary 5-09-12monarchadvisorygroupNo ratings yet

- RBA October 2012Document5 pagesRBA October 2012Belinda WinkelmanNo ratings yet

- Market Review Future Outlook Feb2012-SbiDocument6 pagesMarket Review Future Outlook Feb2012-SbiSaurav MandhotraNo ratings yet

- SYZ & CO - SYZ Asset Management - Market Outlook 18 January 2013Document7 pagesSYZ & CO - SYZ Asset Management - Market Outlook 18 January 2013SYZBankNo ratings yet

- Atwel - Global Macro 6/2011Document15 pagesAtwel - Global Macro 6/2011Jan KaskaNo ratings yet

- BondMarketPerspectives 060215Document4 pagesBondMarketPerspectives 060215dpbasicNo ratings yet

- Weekly Market Commentary 10/21/2013Document3 pagesWeekly Market Commentary 10/21/2013monarchadvisorygroupNo ratings yet

- Bond Market Perspectives 03032015Document4 pagesBond Market Perspectives 03032015dpbasicNo ratings yet

- Lane Asset Management Stock Market Commentary September 2015Document10 pagesLane Asset Management Stock Market Commentary September 2015Edward C LaneNo ratings yet

- ValuEngine Weekly Newsletter January 27, 2012Document12 pagesValuEngine Weekly Newsletter January 27, 2012ValuEngine.comNo ratings yet

- Barclays - The Emerging Markets Quarterly - Vietnam - Sep 2012Document3 pagesBarclays - The Emerging Markets Quarterly - Vietnam - Sep 2012SIVVA2No ratings yet

- Lane Asset Management 2014 Review and 2015 Fearless ForecastDocument16 pagesLane Asset Management 2014 Review and 2015 Fearless ForecastEdward C LaneNo ratings yet

- Nordic Region Out Look 2013Document15 pagesNordic Region Out Look 2013Marcin LipiecNo ratings yet

- Semiconductor industry stock analysis: P/TBV, EV/S, cash levels at cyclical lowsDocument3 pagesSemiconductor industry stock analysis: P/TBV, EV/S, cash levels at cyclical lowsVarun Prasad ANo ratings yet

- Temples in IndiaDocument27 pagesTemples in IndiaVarun Prasad ANo ratings yet

- NJ Driver's ManualDocument224 pagesNJ Driver's ManualSonapethalNo ratings yet

- Bibek Pashu Tatha Machha PalanDocument44 pagesBibek Pashu Tatha Machha PalanBIBUTSAL BHATTARAINo ratings yet

- CF Final Group 3Document8 pagesCF Final Group 3Armyboy 1804No ratings yet

- Principles of Managerial Finance 15th Edition Zutter Test BankDocument35 pagesPrinciples of Managerial Finance 15th Edition Zutter Test Bankdemivoltnotpatedf6u2ra100% (23)

- Commentary JANUARY 2018: Grid Connected Solar Power ProjectsDocument3 pagesCommentary JANUARY 2018: Grid Connected Solar Power ProjectsTrần Thục UyênNo ratings yet

- Concept of InsuranceDocument4 pagesConcept of InsuranceNazrul HoqueNo ratings yet

- BFMDocument28 pagesBFMPratik RambhiaNo ratings yet

- Grace Hesketh Is The Owner of An Extremely Successful DressDocument2 pagesGrace Hesketh Is The Owner of An Extremely Successful DressAmit PandeyNo ratings yet

- Chapter 1. L1.4 Nature of Securities and Risks InvolvedDocument3 pagesChapter 1. L1.4 Nature of Securities and Risks InvolvedvibhuNo ratings yet

- Institution of Valuers: Orissa BranchDocument4 pagesInstitution of Valuers: Orissa Branchbiswashree10No ratings yet

- Governmental and Nonprofit Accounting 10th Edition Smith Solution ManualDocument27 pagesGovernmental and Nonprofit Accounting 10th Edition Smith Solution Manualconsuelo100% (21)

- Cost of Capital - HimaksheeDocument38 pagesCost of Capital - HimaksheeHimakshee BhagawatiNo ratings yet

- Fintech Comparison Tool - Dentons Publisher - GlobalDocument84 pagesFintech Comparison Tool - Dentons Publisher - GlobalOlegNo ratings yet

- Section 14 Unab Rid Dged Written VersionDocument17 pagesSection 14 Unab Rid Dged Written VersionPrashant TrivediNo ratings yet

- Go Sinco vs. CADocument6 pagesGo Sinco vs. CAAnonymous oDPxEkdNo ratings yet

- Flirting With Risk: Get Custom PaperDocument2 pagesFlirting With Risk: Get Custom PaperAkash PandeyNo ratings yet

- Discuss The Qualifications and Disqualifications of Auditor of The CompanyDocument9 pagesDiscuss The Qualifications and Disqualifications of Auditor of The CompanyDebabrata DasNo ratings yet

- Financial Inclusion DeclarationDocument58 pagesFinancial Inclusion DeclarationAarti KatochNo ratings yet

- Financial Times UK. September 06, 2022Document24 pagesFinancial Times UK. September 06, 2022Mãi Mãi LàbaoxaNo ratings yet

- ZFVOq FVIDt 2 Flru YDocument15 pagesZFVOq FVIDt 2 Flru Ybhairav ghimireNo ratings yet

- Dr. Amitabh MishraDocument36 pagesDr. Amitabh MishrameenasarathaNo ratings yet

- The Professional CPA Review SchoolDocument10 pagesThe Professional CPA Review SchoolKriztleKateMontealtoGelogoNo ratings yet

- Verizon Investment ThesisDocument7 pagesVerizon Investment Thesisafksooisybobce100% (2)

- Prize Bond ScheduleDocument5 pagesPrize Bond Schedulehati1No ratings yet

- 2011 Q3 Call TranscriptDocument21 pages2011 Q3 Call TranscriptcasefortrilsNo ratings yet

- A Study On The Challenges in Banking Sector in 21ST Century Due To E-CommerceDocument10 pagesA Study On The Challenges in Banking Sector in 21ST Century Due To E-CommercepramrutaNo ratings yet

- APPLIED AUDITING INVENTORIESDocument6 pagesAPPLIED AUDITING INVENTORIESMicaela Betis100% (1)