Professional Documents

Culture Documents

Joseph Lorigo's 4/19/12 West Seneca Bee Column

Uploaded by

Alan BedenkoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joseph Lorigo's 4/19/12 West Seneca Bee Column

Uploaded by

Alan BedenkoCopyright:

Available Formats

Revisions necessary to best reflect needs of county taxpayers | www.westsenecabee.com | ...

Page 1 of 4

Newspaper web site content management software and services

2012-04-19 / Editorial

Revisions necessary to best reflect needs of county taxpayers

JOSEPH LORIGO Erie County Legislator A s a rule, predicting exactly what will happen down the road is impossible. But each year, through analysis of trends and forecasting changes in the economy, the Countys Executive and Legislative branches predict expenditures and revenues to create an annual budget reflecting what is anticipated in the coming year. In addition, the county executive creates a four-year plan, predicting which expenses or revenue will grow and which wont in order for the county to best prepare its long-range goals. This is especially important in dealing with large projects, such as reconstruction of roadways and bridges that can cost millions of dollars. The past few years saw a reduction in the county workforce, a growth in surplus and the elimination of long-term debt all positive changes for the taxpayers. This allowed the county to maintain its operating budget while providing sound financial planning for the capital budget. As the new county executive, Mark Poloncarz recently applied his foresight into a four-year plan. While the basic information discussed in the proposal appears straightforward and balanced, the plan seems to lack pertinent details that could have a major bearing on the countys economic future. For starters, the plan calls for $5.4 million of reserves to be used in 2013 without explanation as to where the money will be used. Dipping into reserves for recurring expenses would rapidly deplete the savings previously built through costcutting initiatives. The plan should outline exactly why these funds are being used. Also missing is an increase reflecting union contract settlements. One would reason that settling the seven contracts some that expired more than five years ago will cost taxpayers a significant amount in retroactive wage increases.

http://www.westsenecabee.com/news/2012-04-19/Editorial/Revisions_necessary_to_best_r... 3/19/2013

Revisions necessary to best reflect needs of county taxpayers | www.westsenecabee.com | ... Page 2 of 4

According to one report, the countys payroll for CSEA members is currently $120 million, so even a small increase will take a toll on the countys bottom line. The plan to remove only 50 county jobs through attrition should also cause taxpayers to pause. The main concern is that pension and health insurance costs surpass $83 million a year. Erie County is one of the areas largest employers, and maintaining an excessive workforce is a large burden on all taxpayers who not only pay public employees salaries but benefits as well. Reducing the county workforce by only 50 employees over four years, while being mindful of the jobs added back into the 2012 budget, leaves the county workforce larger then it was at the end of 2011. In addition, the county executives plan assumes every retiree is a position that does not need to be replaced. That is flawed thinking. Some positions in government are mandatory, and the county executive cant control who files for retirement and when. The plan needs a real solution that will decrease the taxpayers responsibility for paying public sector pensions. The 2012 pension cost for Erie County is $34,052,515; which amounts to 19 percent of the county payroll. In 2008, the cost of medical insurance was $46,499,000. Health insurance costs in 2012 are $53,486,881 a 15 percent increase substantially more than the 5 percent projection in the county executives plan. Health insurance should not be projected to decrease. To best reflect the needs of taxpayers, aspects of the four-year plan should be altered and explained in greater detail.

Return to top

Search

Browse Archives

Pamela's Electrolysis - Save 76% on Facial Hair Removal or Guided Medi...

BIG Bee Deal$ Email Get FREE email alerts Subscribe

http://www.westsenecabee.com/news/2012-04-19/Editorial/Revisions_necessary_to_best_r... 3/19/2013

Revisions necessary to best reflect needs of county taxpayers | www.westsenecabee.com | ... Page 3 of 4

http://www.westsenecabee.com/news/2012-04-19/Editorial/Revisions_necessary_to_best_r... 3/19/2013

Revisions necessary to best reflect needs of county taxpayers | www.westsenecabee.com | ... Page 4 of 4

http://www.westsenecabee.com/news/2012-04-19/Editorial/Revisions_necessary_to_best_r... 3/19/2013

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Letters Filed Jan 16, 2020 Re: Collins SentencingDocument4 pagesLetters Filed Jan 16, 2020 Re: Collins SentencingAlan BedenkoNo ratings yet

- Submissions Requested by Judge BroderickDocument3 pagesSubmissions Requested by Judge BroderickAlan BedenkoNo ratings yet

- Submissions Requested by Judge Broderick - BDocument11 pagesSubmissions Requested by Judge Broderick - BAlan BedenkoNo ratings yet

- Could Big Black Cock' Be Niagara Falls' Next Economic Development StrategyDocument2 pagesCould Big Black Cock' Be Niagara Falls' Next Economic Development StrategyAlan BedenkoNo ratings yet

- Submissions Requested by Judge Broderick - ADocument6 pagesSubmissions Requested by Judge Broderick - AAlan BedenkoNo ratings yet

- Chris Collins Letters in OppositionDocument89 pagesChris Collins Letters in OppositionTom DinkiNo ratings yet

- Add'l Letters Filed Jan 16, 2020 Re: Collins SentencingDocument75 pagesAdd'l Letters Filed Jan 16, 2020 Re: Collins SentencingAlan BedenkoNo ratings yet

- Collins Sentencing Letters Filed 1/16/20Document7 pagesCollins Sentencing Letters Filed 1/16/20Alan BedenkoNo ratings yet

- Collins Sentencing Letters Filed 1/13/20Document14 pagesCollins Sentencing Letters Filed 1/13/20Alan BedenkoNo ratings yet

- Felony Complaint Against Pigeon, Mazurek and PfaffDocument15 pagesFelony Complaint Against Pigeon, Mazurek and PfaffAaronBesecker100% (1)

- Collins SentencingDocument11 pagesCollins SentencingWGRZ-TVNo ratings yet

- Sentencing Letters Re: Cameron CollinsDocument35 pagesSentencing Letters Re: Cameron CollinsAlan BedenkoNo ratings yet

- United States District Court Western District of New York: IoewengylliDocument32 pagesUnited States District Court Western District of New York: Ioewengylliamber healyNo ratings yet

- Lake Effect V Lake EffectDocument23 pagesLake Effect V Lake EffectAlan BedenkoNo ratings yet

- ChainDocument5 pagesChainAlan BedenkoNo ratings yet

- Notice of ClaimDocument62 pagesNotice of ClaimAlan BedenkoNo ratings yet

- Chris Collins SecDocument22 pagesChris Collins SecHeavyNo ratings yet

- Caputi v. Pigeon Exhibit ADocument1 pageCaputi v. Pigeon Exhibit AAlan BedenkoNo ratings yet

- Request For Investigation Price CollinsDocument17 pagesRequest For Investigation Price CollinsAlan BedenkoNo ratings yet

- Mazurek ComplaintDocument63 pagesMazurek ComplaintAlan BedenkoNo ratings yet

- The Invasion of BuffaloDocument5 pagesThe Invasion of BuffaloAlan BedenkoNo ratings yet

- Nolley v. Trump Et AlDocument5 pagesNolley v. Trump Et AlAlan BedenkoNo ratings yet

- Caputi v. Pigeon ComplaintDocument5 pagesCaputi v. Pigeon ComplaintAlan BedenkoNo ratings yet

- Caputi v. Pigeon: Exhibit BDocument22 pagesCaputi v. Pigeon: Exhibit BAlan BedenkoNo ratings yet

- Caputi v. Pigeon: Affidavit of ServiceDocument1 pageCaputi v. Pigeon: Affidavit of ServiceAlan BedenkoNo ratings yet

- Caputi v. Pigeon Affidavit of ServiceDocument1 pageCaputi v. Pigeon Affidavit of ServiceAlan BedenkoNo ratings yet

- Caputi v. Pigeon Exhibit DDocument1 pageCaputi v. Pigeon Exhibit DAlan BedenkoNo ratings yet

- Caputi v. Pigeon US AttyDocument2 pagesCaputi v. Pigeon US AttyAlan BedenkoNo ratings yet

- Caputi v. Pigeon: Exhibit EDocument1 pageCaputi v. Pigeon: Exhibit EAlan BedenkoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Comparing Life Insurance Plans of ICICI Prudential and Other CompaniesDocument90 pagesComparing Life Insurance Plans of ICICI Prudential and Other CompaniesParveen Singh100% (1)

- Designing An Income Only Irrevocable TrustDocument15 pagesDesigning An Income Only Irrevocable TrusttaurushoNo ratings yet

- CIR Vs Isabela Cultural Corp.Document3 pagesCIR Vs Isabela Cultural Corp.Anonymous MikI28PkJcNo ratings yet

- Asset Allocation For Non Profits A Fiduciarys GuidebookDocument174 pagesAsset Allocation For Non Profits A Fiduciarys GuidebookAlex EngerNo ratings yet

- Philippine School of Business Administration Financial Accounting and Reporting Problems Final ExamDocument11 pagesPhilippine School of Business Administration Financial Accounting and Reporting Problems Final ExamNicole Aragon0% (1)

- Salaries and WagesDocument3 pagesSalaries and WagesAndrea OrbisoNo ratings yet

- Sample MCQ For Unit 2Document8 pagesSample MCQ For Unit 2varunendra pandey100% (1)

- Pension Calculation SheetDocument1 pagePension Calculation SheetNagamahesh100% (2)

- MSC Statistics Syl Lab UsDocument29 pagesMSC Statistics Syl Lab UssaniljayamohanNo ratings yet

- Double Taxation - Rates of WithholdingDocument6 pagesDouble Taxation - Rates of Withholdingunderstated1313100% (1)

- Ticf KKDDV: Kerala GazetteDocument28 pagesTicf KKDDV: Kerala GazetteVivek KakkothNo ratings yet

- Finnish-Tax-Administration Form6148ev18 7.2.2020Document2 pagesFinnish-Tax-Administration Form6148ev18 7.2.2020agustin domecqNo ratings yet

- DBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Document1 pageDBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Rej Francisco100% (1)

- Disability Class ActionDocument36 pagesDisability Class ActionJeff NixonNo ratings yet

- Resident Income Tax Return: Warning: Please Use A Different PDF ViewerDocument5 pagesResident Income Tax Return: Warning: Please Use A Different PDF ViewermattNo ratings yet

- June 2012Document64 pagesJune 2012Eric SantiagoNo ratings yet

- 1932 AutumnDocument27 pages1932 AutumnRAPC AssociationNo ratings yet

- HRPPM s12.01Document448 pagesHRPPM s12.01Waqas PervezNo ratings yet

- Department of Labor: 96 19484Document5 pagesDepartment of Labor: 96 19484USA_DepartmentOfLaborNo ratings yet

- Question 2: Ias 19 Employee Benefits: Page 1 of 2Document2 pagesQuestion 2: Ias 19 Employee Benefits: Page 1 of 2paul sagudaNo ratings yet

- Pension 2018status PDFDocument1 pagePension 2018status PDFA SanthakumaranNo ratings yet

- P2Mindmap (JoeFang)Document41 pagesP2Mindmap (JoeFang)Mubashar HussainNo ratings yet

- AuctusDocument13 pagesAuctusPlacement Cell SRCCNo ratings yet

- Incomes Which Does Not Form Part of Total IncomeDocument5 pagesIncomes Which Does Not Form Part of Total IncomeRupesh 1312No ratings yet

- Registered Savings Plans: RRSP - Tfsa - LiraDocument8 pagesRegistered Savings Plans: RRSP - Tfsa - LiraJayasri CimbaNo ratings yet

- Cash Balance PlansDocument11 pagesCash Balance Plansmphillips36111No ratings yet

- WEEKLY HOME LEARNING PLAN IN Quarter 2 General Math DJDocument2 pagesWEEKLY HOME LEARNING PLAN IN Quarter 2 General Math DJDaniel Jars100% (1)

- BSP V COADocument12 pagesBSP V COAJuan AlatticaNo ratings yet

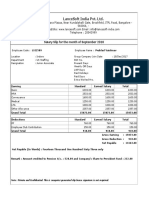

- LanceSoft September Salary SlipDocument1 pageLanceSoft September Salary SlipPRAHLAD VAISHNAV100% (1)

- Mathematics Internal Assessment OoDocument7 pagesMathematics Internal Assessment OoSigne Sofia PersdotterNo ratings yet