Professional Documents

Culture Documents

Memorandum

Uploaded by

Jane ChungCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memorandum

Uploaded by

Jane ChungCopyright:

Available Formats

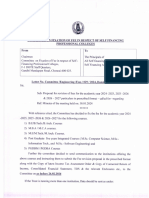

MEMORANDUM

TO: FROM: Ray Ishii Anh Chung

SUBJECT: Tax Research

I.

RELEVENT FACTS

Jeremiah bought a land in 2000 for $20,000. He invested $35,000 for winter wheat-crop on the land in 2011. Later on, he deducted $20,000 of planting expenses that he paid on 2011. He pays the remaining $15,000 of expenses in 2012. He then sells the land together with the unharvested wheat crop for $110,000 in 2012. II. TAX ISSUE

Issue at hand is when Jeremiah sold the land with the unharvested wheat-crop. III. CONCLUSION

According to Section 1231 property, the sales of the land and the including unharvested crops is a long term capital gain. Jeremiah has to fill out an amended return to eliminate the expenses amount that he deducted on 2011 ($20,000). IV. RESOLUTION/RULING

The general Sec. 1231 states that unharvested crops are subjected to the gainordinary loss rule. Code Sec. 1231(b)(4) states that in the case of an unharvested crop on land used in the trade or business and held for more than 1 year, if the crop and the land are sold or exchanged (or compulsorily or involuntarily converted) at the same time and the same person, the crop shall be considered as property used in the trade or business. Code Sec. 1016(A)(ii) states that items attributable to the production of the crop are included in the basis for gain. Code Sec. 268 and Reg. Sec 1.268-1 indicate that unharvested crop sold by the taxpayer is not allowed for deduction in computing taxable income. If the taxable year involved is not that of the sale, exchange, or conversion of such crop, a recomputation of the tax liability for such year shall be made; such recomputation should be in the form an amended return if necessary.

In Teget v U.S., Cite as 37 AFTR 2d 76-864 (U.S. District Court, Dist. Of South Dakota, Southern Div.), the Court held that the shareholder of liquidating Sub S seed and mail order nursery corp. couldnt deduct cost of unharvested crop inventory. V. ANALYSIS

Under the Code Sec. 1231 (b)(4), Jeremiah had used the land in business for more than 1 year (from 2000 to 2012). And he sold the land and the unharvested crops at the same time. Therefore, Jeremiah gains for selling the land is long term-capital gain. In 2011, Jeremiah had deducted $20,000 from his winter-wheat crop investment, and according to Code Sec, 268 and Reg. Sec 1.268-1, he is not allowed to take a deduction from his unharvested crop that he sold. Since the deduction is occurred before the sale happen, Jeremiah must fill out an amended return. Also, the decision from the U.S. District Court in Teget v. U.S. case also ruled that it is not allowed to deduct cost of unharvested crop inventory. When the sale occurred, Jeremiahs basis in the land had increased from $20,000 (the amount that he bought the land with) to $55,000 (plus $30,000 that he invested in 2011). Therefore, Jeremiah has a gain on his sales of the land, which is a long-term capital gain. Also, since he took $20,000 deduction from the invested amount in 2011, Jeremiah must fill an amended return to eliminate that $20,000 of expense.

Citation Code Sec. 1231(b)(4) Code Sec. 1016(A)(ii) Code Sec. 268 Reg. Sec 1.268-1 Teget v U.S., Cite as 37 AFTR 2d 76-864 (U.S. District Court, Dist. Of South Dakota, Southern Div.)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- General Principles of TaxationDocument171 pagesGeneral Principles of TaxationAlexis Von TeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- TAX EXCLUSIONS UNDER 40Document13 pagesTAX EXCLUSIONS UNDER 40Dea Lyn BaculaNo ratings yet

- What Is TaxationDocument5 pagesWhat Is TaxationvimalabharathNo ratings yet

- Input vs. Output VAT definedDocument2 pagesInput vs. Output VAT definedCaroline A. LegaspinoNo ratings yet

- Personal Finance 8th Edition Keown Test BankDocument19 pagesPersonal Finance 8th Edition Keown Test BankDrAnnaHubbardDVMitaj100% (42)

- Davao Light Power Bill DetailsDocument2 pagesDavao Light Power Bill DetailsRookie Thursday Orquia100% (1)

- Revise Exam 1 FN - PhilosophyDocument4 pagesRevise Exam 1 FN - PhilosophyJane ChungNo ratings yet

- 1 Altprob 6eDocument3 pages1 Altprob 6eJane ChungNo ratings yet

- Review Notes2Document2 pagesReview Notes2Jane ChungNo ratings yet

- Social Change EssaryDocument3 pagesSocial Change EssaryJane ChungNo ratings yet

- Hanson Industries B Case Solution Master SheetDocument5 pagesHanson Industries B Case Solution Master SheetJane ChungNo ratings yet

- Chapter 21 HWDocument3 pagesChapter 21 HWJane ChungNo ratings yet

- Acct 330 - Hwch6 - ChungDocument2 pagesAcct 330 - Hwch6 - ChungJane ChungNo ratings yet

- IntroductionDocument4 pagesIntroductionJane ChungNo ratings yet

- Frank's sustainable competitive advantage strategyDocument2 pagesFrank's sustainable competitive advantage strategyJane ChungNo ratings yet

- Final ExamDocument21 pagesFinal ExamJane ChungNo ratings yet

- Buygasco 1Document6 pagesBuygasco 1Jane ChungNo ratings yet

- ZOOM SnowbooardsDocument21 pagesZOOM SnowbooardsJane Chung0% (1)

- Justice - Element + ApplicationDocument3 pagesJustice - Element + ApplicationJane ChungNo ratings yet

- Care Theory - Element + ApplicationDocument2 pagesCare Theory - Element + ApplicationJane ChungNo ratings yet

- The Over Achievers' Team Agenda For MeetingDocument1 pageThe Over Achievers' Team Agenda For MeetingJane ChungNo ratings yet

- Care Theory - Element + ApplicationDocument2 pagesCare Theory - Element + ApplicationJane ChungNo ratings yet

- Practice Exam Chapters 1-5 Adjusting EntriesDocument7 pagesPractice Exam Chapters 1-5 Adjusting Entriesswoop9No ratings yet

- Descartes and Sartre For DinnerDocument2 pagesDescartes and Sartre For DinnerJane ChungNo ratings yet

- Carroll - Alice's Adventures in WonderlandDocument80 pagesCarroll - Alice's Adventures in WonderlandJane ChungNo ratings yet

- Bohol Limestone Corporation - Quick FactsDocument5 pagesBohol Limestone Corporation - Quick FactsJana Mae Catot AcabalNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Buy Vs Lease CarDocument6 pagesBuy Vs Lease Caraftab_sweet3024No ratings yet

- 21 Useful Charts For Service TaxDocument24 pages21 Useful Charts For Service Taxashish692No ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- PayablesUnaccountedTransactions - Payables Unaccounted Transactions and Sweep ReportDocument3 pagesPayablesUnaccountedTransactions - Payables Unaccounted Transactions and Sweep ReportLeonardo MenesesNo ratings yet

- Tax1 SummaryDocument8 pagesTax1 SummarychimchimcoliNo ratings yet

- Village Codes SelaiyurDocument1 pageVillage Codes Selaiyurrajasekhar_vkNo ratings yet

- US Internal Revenue Service: I8615Document4 pagesUS Internal Revenue Service: I8615IRSNo ratings yet

- Multiple Choice Questions 1 Which If Any of The Following StatementsDocument2 pagesMultiple Choice Questions 1 Which If Any of The Following StatementsTaimour HassanNo ratings yet

- Target recovery arrears CGST Central Excise Division JabalpurDocument3 pagesTarget recovery arrears CGST Central Excise Division JabalpurAshish KhandelwalNo ratings yet

- Wey FinMan 4e TB AppI Payroll-AccountingDocument15 pagesWey FinMan 4e TB AppI Payroll-AccountingJim AxelNo ratings yet

- LEO CopiesDocument18 pagesLEO CopiesSuneethaaNo ratings yet

- Answers 10Document5 pagesAnswers 10Ash KaiNo ratings yet

- Atd TaxDocument4 pagesAtd TaxKafonyi JohnNo ratings yet

- BI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareDocument1 pageBI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareJanet CafrancaNo ratings yet

- F6 Midterm Test QuestionDocument11 pagesF6 Midterm Test QuestionChippu AnhNo ratings yet

- Cir Vs Pilipinas ShellDocument13 pagesCir Vs Pilipinas ShellJeff GomezNo ratings yet

- Weekly Payroll SampleDocument1 pageWeekly Payroll SampleCarmila Donita SangalangNo ratings yet

- Fee Revision Letter - Engineering - 0001Document2 pagesFee Revision Letter - Engineering - 0001Prem KumarNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- Rmo 19-2007Document3 pagesRmo 19-2007Jema Abreu0% (1)

- Parcel Account Number Alt Key Exemption Codes Escrow CD: Mailing Address: PO BOX 422105 - KISSIMMEE, FL 34742-2105Document1 pageParcel Account Number Alt Key Exemption Codes Escrow CD: Mailing Address: PO BOX 422105 - KISSIMMEE, FL 34742-2105saharaReporters headlinesNo ratings yet