Professional Documents

Culture Documents

Domondon S MCQ

Uploaded by

Lani LauretteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Domondon S MCQ

Uploaded by

Lani LauretteCopyright:

Available Formats

Domondons MCQs 1. Among the nature of taxation is that it is an inherent power being an attribute of sovereignty.

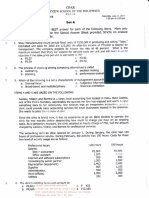

Which among the following is not among its manifestation as such inherent power? Ans: B There should be no improper delegation of the power to tax. Because it is a manifestation of the nature of taxation being a legislative power. 2. Consider the ff. statements: I. The power of taxation involves the promulgation of rules. II. The state has the power to impose taxes even without a constitutional grant. III. Taxes are based upon the lifeblood theory. IV. There should be no improper delegation of the power to tax. Choose the correct answer from among the following choices: Ans: D Statements II and III are both manifestations of the inherent nature of taxation. Because they are manifestations of the legislative nature of taxation. 3. Taxes are assessed for the purpose of generating revenues to be used for publice needs. Taxation itself is the power by which the State raises revenue to defray the expenses of government. A jurist said that a tax is what we pay for civilization. Justify your answer briefly. Ans: D Taxes are levied by the legislative branch of government. Because it is part of the nature of taxation that it is legislative in character because tax laws are rules, and the constitution has allocated to the legislative department the enactment of laws. 4. Marshal said that the power to tax involves the power to destroy while Holmes maintains that the power to tax is not the power to destroy. Which among the following statements does not reconcile the two seemingly inconsistent opinions? Ans: B The power to tax could not be the subject of compensation and set-off. Because this is an illustration of the lifeblood doctrine. 5. Statement 1. Symbiotic relation is the reason why the government could impose taxes on the incomes of resident citizens derived from sources outside the Philippines. Statement 2. Jurisdiction is the reason why citizens must provide support to the state so the latter could continue to give protection. Ans: B Both of the statements are false. Statement 1 refers to jurisdiction while statement 2 refers to the symbiotic relation. 6. Your 2 classmates are engaged in a discussion as to what are included in the inherent limitations on the power of taxation. They decided to make you their referee in order to enlighten them on which of the following is generally not included among the inherent limitations. What should you choose from among the following? Ans: A Double taxation. Because it is a constitutional limitation for it violates the equal protection clause. 7. An annual tax of P500.00 was imposed upon all residents of the Philippines, who are above 21 years of age, with gross annual income of P250,000.00, whether or

not they send their children to public schools, for the purpose of raising funds in order to improve public school buildings. The tax is: Ans: C For public purpose. 8. A tax does not meet the public purpose limitation if it: Ans: C Is for the benefit principally of limited subjects or objects. 9. A group of concerned citizens desire to bring suit in order to question the validity of a tax measure. They seek your advise on who has locus standi to bring such suit. You would tell them that one of the following could not bring such suit. Ans: D A non-governmental organization. 10. The proposed amendments to the VAT law has spawned a lot of controversy. However, the issue of validity of the imposition of VAT is not one of first impression. Tolentino vs. Secretary of Finance, ruled that the VAT law was valid for various reasons. Which among the following statements is not among the reasons mentioned in the decision for upholding the validity of the VAT law? Ans: B There was no improper delegation of the legislative authority to tax when Congress imposed the VAT. 11. That there should be no improper delegation of the legislative authority to tax is: Ans: D Both a constitutional and inherent limitation on the power of taxation. 12. A law was passed by Congress which granted tax amnesty to those who have not paid income taxes for a certain year without at the same time providing for the refund of taxes to those who have already paid them. The law is: Ans: A Valid because there is a valid classification. 13. Which among the following statements captures the essence of Supreme Court doctrinal rulings on the subject? Ans: D Certain subjects need not be reflected in the title of a tax bill provided such are germane to the subject matter expressed in the title of the tax bill. 14. A person may be imprisoned for: Ans: C non-payment of his income tax. 15.

You might also like

- Taxation Module 1 Principles WaDocument17 pagesTaxation Module 1 Principles WaPdf Files100% (1)

- Tax Remedies QuizDocument5 pagesTax Remedies QuizAnonymous 03JIPKRkNo ratings yet

- May 2020 - Tax Drill 2 (Individuals) - Answer KeyDocument5 pagesMay 2020 - Tax Drill 2 (Individuals) - Answer KeyROMAR A. PIGANo ratings yet

- SW06Document6 pagesSW06Nadi HoodNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationTyra Joyce Revadavia100% (1)

- Taxation 2nd PreboardDocument17 pagesTaxation 2nd PreboardJaneNo ratings yet

- Report 29Document9 pagesReport 29Pran piya100% (1)

- Numbers 19, 20 and 21 (Corporate Liquidation)Document2 pagesNumbers 19, 20 and 21 (Corporate Liquidation)Tk KimNo ratings yet

- Act 3Document8 pagesAct 3Memey C.No ratings yet

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresNo ratings yet

- Quiz On OPTDocument9 pagesQuiz On OPTJustine Maureen Andal100% (1)

- Ch28 Test Bank 4-5-10Document9 pagesCh28 Test Bank 4-5-10bluephoe100% (1)

- Removal/Qualifying ExaminationDocument12 pagesRemoval/Qualifying ExaminationMiljane PerdizoNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Elimination Round QuestionnairesDocument5 pagesElimination Round Questionnairesmitakumo uwuNo ratings yet

- Chapter 09 - Profit Planning and Activity-Based BudgetingDocument105 pagesChapter 09 - Profit Planning and Activity-Based BudgetingNijeshkumar PcNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- BSA 23C-AFAR ReviewerDocument102 pagesBSA 23C-AFAR ReviewerKlint HandsellNo ratings yet

- Chapter 8 Output Vat Zero Rated SalesDocument29 pagesChapter 8 Output Vat Zero Rated SalesChristian PelimcoNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Docx 1Document10 pagesDocx 1Anna Marie AlferezNo ratings yet

- Set ADocument11 pagesSet ALizi100% (1)

- Mas MockboardDocument8 pagesMas MockboardMarizza WapinNo ratings yet

- 90-15 Filing, Penalties, RemediesDocument6 pages90-15 Filing, Penalties, RemediesAljur SalamedaNo ratings yet

- Agamata Chapter 6Document18 pagesAgamata Chapter 6Abigail Faye Roxas100% (1)

- TAX - LEAD BATCH 3 - Preweek 1 PDFDocument28 pagesTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- Midterm ExamDocument9 pagesMidterm ExamElla TuratoNo ratings yet

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- RFP LyricsDocument1 pageRFP LyricsJoshua MongcalNo ratings yet

- Variance AnalysisDocument21 pagesVariance Analysismark anthony espiritu0% (1)

- Chapter 4 Multiple ChoicesDocument11 pagesChapter 4 Multiple ChoicesAurcus JumskieNo ratings yet

- Audit of ReceivablesDocument29 pagesAudit of ReceivablesJoseph SalidoNo ratings yet

- Sample Income Tax Computation Self Employed and ProfessionalDocument30 pagesSample Income Tax Computation Self Employed and ProfessionalCasimirPampoNo ratings yet

- Far by 11 SupernovaDocument17 pagesFar by 11 SupernovaMaybellene VillacastinNo ratings yet

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Econ2 - No.1Document2 pagesEcon2 - No.1Junvy AbordoNo ratings yet

- Income Tax Tabag 2018 Solman PDFDocument34 pagesIncome Tax Tabag 2018 Solman PDFjazonvaleraNo ratings yet

- NegoDocument16 pagesNegolaizaNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- Acctg. QB 1-1Document8 pagesAcctg. QB 1-1Jinx Cyrus RodilloNo ratings yet

- Magic Notes - TaxDocument5 pagesMagic Notes - TaxJeanette PareNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- 20 Regional Mid-Year Convention - Academic League Basic Accounting CupDocument11 pages20 Regional Mid-Year Convention - Academic League Basic Accounting CupLizza Marie CasidsidNo ratings yet

- Chapter 1-Introduction To Cost Accounting: Multiple ChoiceDocument535 pagesChapter 1-Introduction To Cost Accounting: Multiple ChoiceAleena AmirNo ratings yet

- BFJPIA Cup 4 Business Law and TaxationDocument8 pagesBFJPIA Cup 4 Business Law and TaxationJerecko Ace ManlangatanNo ratings yet

- ATDocument8 pagesATNoemi MacatangayNo ratings yet

- Midterm Exam - TaxationDocument5 pagesMidterm Exam - TaxationGANNLAUREN SIMANGANNo ratings yet

- 1st PBDocument12 pages1st PBDin Rose Gonzales100% (2)

- Bustax Compilation ExamsDocument194 pagesBustax Compilation ExamsRialeeNo ratings yet

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsDocument8 pagesNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingNo ratings yet

- P3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Document8 pagesP3.37 P3.s9 Controlling B.planning - D.pedormanceevaluation Focus C'Maria LopezNo ratings yet

- Bustax Answer KeyDocument18 pagesBustax Answer KeyMarchelle CaelNo ratings yet

- INTGR TAX 009 DeductionsDocument6 pagesINTGR TAX 009 DeductionsJohn Paul SiodacalNo ratings yet

- CMPC Quiz 2Document5 pagesCMPC Quiz 2Mae-shane Sagayo50% (2)

- Tax 2 Part 3 Estate TaxDocument25 pagesTax 2 Part 3 Estate TaxShane TorrieNo ratings yet

- Pritax Midterm Summer 2021Document10 pagesPritax Midterm Summer 2021Sassy BitchNo ratings yet

- Taxation MCQ Part 2Document17 pagesTaxation MCQ Part 2Deb Bie100% (1)

- Tax QuestionsDocument203 pagesTax QuestionsReymond PacaldoNo ratings yet

- DAY 1 Part 1 - Fundamental Principles of Taxation - Teacher'sDocument8 pagesDAY 1 Part 1 - Fundamental Principles of Taxation - Teacher'sdgdeguzmanNo ratings yet

- Tax 01-General PrinciplesDocument9 pagesTax 01-General PrinciplesDin Rose Gonzales0% (1)

- Pick Up FormDocument1 pagePick Up FormAmer Hassan Guiling GuroNo ratings yet

- Breathe Easy InstructionsDocument1 pageBreathe Easy InstructionsAmer Hassan Guiling GuroNo ratings yet

- REPUBLIC ACT 7832 Reading MaterialsDocument2 pagesREPUBLIC ACT 7832 Reading MaterialsAmer Hassan Guiling Guro100% (1)

- FAQ Essential Rewards Philippines - For ReleaseDocument5 pagesFAQ Essential Rewards Philippines - For ReleaseAmer Hassan Guiling GuroNo ratings yet

- Xmas Party TeaserDocument1 pageXmas Party TeaserAmer Hassan Guiling GuroNo ratings yet

- OmarDocument4 pagesOmarAmer Hassan Guiling GuroNo ratings yet

- Magis AwardDocument1 pageMagis AwardAmer Hassan Guiling GuroNo ratings yet

- PhilippinesDocument15 pagesPhilippinesAmer Hassan Guiling GuroNo ratings yet

- Nachura Notes Public OfficersDocument26 pagesNachura Notes Public OfficersNowhere Man100% (13)

- Volenti Non Fit InjuriaDocument1 pageVolenti Non Fit InjuriaAmer Hassan Guiling GuroNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- CIR V GoodyearDocument2 pagesCIR V GoodyearAnn QuebecNo ratings yet

- DTC Agreement Between Ukraine and BelgiumDocument34 pagesDTC Agreement Between Ukraine and BelgiumOECD: Organisation for Economic Co-operation and Development100% (1)

- EVAQ8Document1 pageEVAQ8dinuNo ratings yet

- Tax Issues in Demarger & AmalgamationDocument25 pagesTax Issues in Demarger & AmalgamationMohit MishuNo ratings yet

- GST MSOP Project FinalDocument19 pagesGST MSOP Project FinalAnjli SampatNo ratings yet

- For The Period NOVEMBER 2020: (With Year End Bonus & Cash Gift 2020)Document8 pagesFor The Period NOVEMBER 2020: (With Year End Bonus & Cash Gift 2020)Allen Rey YeclaNo ratings yet

- Hilado vs. CIRDocument1 pageHilado vs. CIRAlan GultiaNo ratings yet

- CS Professional Income Tax Handwritten Class NotesDocument240 pagesCS Professional Income Tax Handwritten Class Notesmittalansh899No ratings yet

- Revocable vs. Irrevocable Trust AgreementDocument3 pagesRevocable vs. Irrevocable Trust AgreementJfm A DazlacNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- GST PIL by DR Pillai RevisedDocument33 pagesGST PIL by DR Pillai Revisedaditya vermaNo ratings yet

- M 14 IPCC Taxation Guideline AnswersDocument14 pagesM 14 IPCC Taxation Guideline Answerssantosh barkiNo ratings yet

- Finals Exam Tax PDFDocument3 pagesFinals Exam Tax PDFSittieAyeeshaMacapundagDicali100% (1)

- Pay Slip For July 2021Document1 pagePay Slip For July 2021THE TECHNOSNo ratings yet

- Subcontractor's Statement PDFDocument2 pagesSubcontractor's Statement PDFAnonymous M4DMq2CZXNo ratings yet

- France Tax LawDocument22 pagesFrance Tax LawGary SinghNo ratings yet

- Greek CrisisDocument3 pagesGreek CrisisΕυα ΕυαNo ratings yet

- Archive 4Document2 pagesArchive 4B N SRIVIDYANo ratings yet

- 415 Baldwin Ave, APT 7, Jersey City, NJ 07306Document5 pages415 Baldwin Ave, APT 7, Jersey City, NJ 07306Estrada Pence HoseaNo ratings yet

- ECC4 Example FormsDocument9 pagesECC4 Example FormsDavisNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Proof of IncomeDocument3 pagesProof of IncomeKenan DuranNo ratings yet

- TAXATION (Autosaved)Document27 pagesTAXATION (Autosaved)Caranay BillyNo ratings yet

- Tax 10986Document2 pagesTax 10986Maikeru ShogunnateMusa MNo ratings yet

- Solved Marcy Tucker Received The Following Items This Year Determine ToDocument1 pageSolved Marcy Tucker Received The Following Items This Year Determine ToAnbu jaromiaNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanVaghasiyaBipinNo ratings yet

- CIR Vs IRONCON Refund Tax Credit Carry OverDocument3 pagesCIR Vs IRONCON Refund Tax Credit Carry Overfrancis_asd2003No ratings yet