Professional Documents

Culture Documents

PDF: Vermont Health Exchange Rates Release

Uploaded by

Philip TortoraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF: Vermont Health Exchange Rates Release

Uploaded by

Philip TortoraCopyright:

Available Formats

EMBARGOED UNTIL 9:30AM EST, MONDAY, APRIL 1, 2013 Contact: Sean Sheehan Contact Phone Number: (802) 585-6339

Contact E-mail Address: sean.sheehan@state.vt.us Licensed Vermont Health Insurance Carriers Submit Proposed Rates for Plans to be made Available through Vermont Health Connect Proposed Rates to Undergo Review Process, Filed Rates Comparable to Current Rates April 1, 2013 - MONTPELIER Today, Vermont became the first state in the nation to release proposed rates for the states federally-mandated Health Benefits Exchange, Vermont Health Connect. Vermont is the only state in the nation to consolidate purchasing of insurance products for small employers and individuals through Vermont Health Connect, which ensures there is an incentive for insurers to file competitive rate proposals. The proposed rates were filed with the Department of Financial Regulation (DFR) by Blue Cross Blue Shield of Vermont (BCBSVT) and MVP Healthcare (MVP) and are subject to review by both DFR and the Green Mountain Care Board (GMCB). Following a public input period, the GMCB has final authority to approve, modify or reject the rates. In addition to BCBS and MVP, a company seeking a license to become a health insurer, Vermont Health Coop, has submitted conditional proposed rates to the Department of Vermont Health Access. These rates will be made available publicly if the company receives regulatory approval to sell health insurance in Vermont. The rates filed by BCBSVT and MVP are comparable to current rates paid by small employers and their employees, but the plans filed generally include better health benefits. Governor Shumlin heralded this milestone: We are the first state to make this information available. While the rates must go through regulatory review, I am very pleased to see that they are roughly comparable to what people currently pay, but for better coverage. I view the federally-mandated Exchange as a part of the path to health care reform in Vermont. We are driving toward better coverage for lower cost for all Vermonters. This is a step in the right direction. All health plans offered through Vermont Health Connect will meet strict benefit and quality standards to ensure all the essentials are covered, including visits to the doctor and emergency room, prescriptions, maternity care, and preventive care like cancer screenings and immunizations. Whether a parent in a family of four or a small business owner, Vermonters are eager to learn more about their future health coverage options, said Mark Larson, Commissioner of the Department of Vermont Health Access. In October, Vermonters will be able to compare plans and find the health coverage thats right for them. Financial help will be available to 40,000 Vermonters to cover the cost of premiums and deductibles and put the cost of health insurance within reach. Carriers interested in serving Vermonters through Vermont Health Connect were required to submit their rates, actuarial memo and several other documents required by Vermont law and the Affordable Care Act by March 25, 2013. The plans are structured with design levels set by the federal health care law: Platinum, Gold, Silver, Bronze and Catastrophic. The levels vary in the amount of premium and outof-pocket costs members pay. The average rates proposed for an individual at each of these levels are: $365.76 for Bronze, $441.09 for Silver, $527.95 for Gold and $609.47 for Platinum. These rates are similar to what is available on the current market today. For example, the average proposed rates for an individual purchasing a Silver level plan is $441.09 compared to $455.56 for Catamount Health.

Vermont Health Connect will also be the one place for income-eligible individuals those earning up to $94,000 for a family of four who dont have access to health coverage at work to access financial assistance for private health plans in the form of tax credits to help pay for premiums and cost-sharing, as well as public health programs including Medicaid and Dr. Dynasaur. For example, a family of four with a household income of $75,000 per year will pay a little under $600 per month for family coverage with a federal premium tax credit. This is compared to over $900 for the lowest cost small group plans available today. Or for a couple making $32,000 per year, they would pay a total of $134 per month in premiums and receive about $761 per month in federal and state premium assistance. The filings are posted on the DFR website. Beginning April 1, 2013 the public is invited to submit comments on the proposed rates to DFR or contact the Department directly at 802-828-3301. Following review by DFR, recommendation will be sent to the Green Mountain Care Board (GMCB) and posted on the GMCB website. The GMCB invites the public to comment on the rate filings during public hearings, online, by calling 802-828-2177, or sending a letter to Green Mountain Care Board, 89 Main Street, Montpelier, VT 05620. Final decisions on the rates are expected from the GMCB during the summer. Typically, rates are available in the late fall for January 1st. For more information, visit the DFR Health Insurance Rate Review website at: http://www.dfr.vermont.gov/insurance/rates-forms/health-insurance-rate-review-data or the GMCB website at: http://gmcboard.vermont.gov/rate_review. ###

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Woolf: Number of Vermont Married CouplesDocument1 pageWoolf: Number of Vermont Married CouplesPhilip TortoraNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- PDF: Northfield Fatal Fire Search Warrant ApplicationDocument10 pagesPDF: Northfield Fatal Fire Search Warrant ApplicationPhilip TortoraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Woolf: Inflation-Adjusted Spending Per Vermont PupilDocument1 pageWoolf: Inflation-Adjusted Spending Per Vermont PupilPhilip TortoraNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Woolf: Vermont Family Characteristics by CountyDocument1 pageWoolf: Vermont Family Characteristics by CountyPhilip TortoraNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

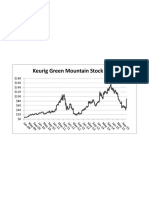

- Woolf: Keurig Green Mountain Stock PriceDocument1 pageWoolf: Keurig Green Mountain Stock PricePhilip TortoraNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Woolf: Vermont Gasoline and Fuel Oil PricesDocument1 pageWoolf: Vermont Gasoline and Fuel Oil PricesPhilip TortoraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Quinnipiac Presidential PollDocument9 pagesQuinnipiac Presidential PollPhilip TortoraNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Woolf: Vermont Earned Income Tax CreditDocument1 pageWoolf: Vermont Earned Income Tax CreditPhilip TortoraNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

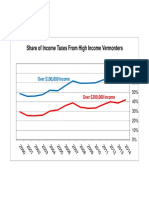

- Woolf: Share of Income Taxes From High Income VermontersDocument1 pageWoolf: Share of Income Taxes From High Income VermontersPhilip TortoraNo ratings yet

- Woolf: Initial Claims For Unemployment InsuranceDocument1 pageWoolf: Initial Claims For Unemployment InsurancePhilip TortoraNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

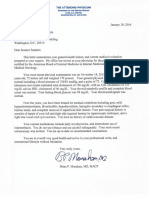

- Bernie Sanders Medical ReportDocument1 pageBernie Sanders Medical ReportPhilip TortoraNo ratings yet

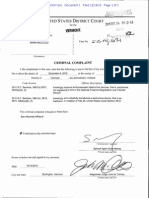

- Affidavit: United States vs. Mark McLoudDocument9 pagesAffidavit: United States vs. Mark McLoudPhilip TortoraNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Woolf: Vermont Labor Force and JobsDocument1 pageWoolf: Vermont Labor Force and JobsPhilip TortoraNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Woolf: Vermont Median Family Income Jan 2016Document1 pageWoolf: Vermont Median Family Income Jan 2016Philip TortoraNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Woolf: Vermont PopulationDocument1 pageWoolf: Vermont PopulationPhilip TortoraNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Woolf: Vermont Skier DaysDocument1 pageWoolf: Vermont Skier DaysPhilip TortoraNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- November 2012 Vaughan Real Estate Market UpdateDocument5 pagesNovember 2012 Vaughan Real Estate Market Updateinfo7761No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Woolf: Vermont Labor Force & JobsDocument1 pageWoolf: Vermont Labor Force & JobsPhilip TortoraNo ratings yet

- Art Woolf: Vermont Percent of Under 65 Population Without Health InsuranceDocument1 pageArt Woolf: Vermont Percent of Under 65 Population Without Health InsurancePhilip TortoraNo ratings yet

- Art Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedDocument1 pageArt Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedPhilip TortoraNo ratings yet

- Woolf: Vermont Media Income by Household TypeDocument1 pageWoolf: Vermont Media Income by Household TypePhilip TortoraNo ratings yet

- The Danforth PewterersDocument1 pageThe Danforth PewterersPhilip TortoraNo ratings yet

- Art Woolf: FY12 Vermont Government SpendingDocument1 pageArt Woolf: FY12 Vermont Government SpendingPhilip TortoraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Art Woolf: State and Local Taxes As A Share of Personal IncomeDocument1 pageArt Woolf: State and Local Taxes As A Share of Personal IncomePhilip TortoraNo ratings yet

- Art Woolf: Vermont Construction EmploymentDocument1 pageArt Woolf: Vermont Construction EmploymentPhilip TortoraNo ratings yet

- Art Woolf: Vermont Payroll EmploymentDocument1 pageArt Woolf: Vermont Payroll EmploymentPhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Randy Quaid CaseDocument18 pagesPDF: Court Papers Filed in Randy Quaid CasePhilip TortoraNo ratings yet

- Art Woolf: Vermont Employment Change Since RecessionDocument1 pageArt Woolf: Vermont Employment Change Since RecessionPhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Evi Quaid CaseDocument23 pagesPDF: Court Papers Filed in Evi Quaid CasePhilip TortoraNo ratings yet

- Vermont State Police AMBER Alert ReviewDocument5 pagesVermont State Police AMBER Alert ReviewPhilip TortoraNo ratings yet

- Regional Memorandum Re Guidance On The Conduct of CSO ConferenceDocument2 pagesRegional Memorandum Re Guidance On The Conduct of CSO ConferenceDILG IBAJAYNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Danilo E Paras Vs Commission On Elections COMELEC 264 SCRA 49Document4 pagesDanilo E Paras Vs Commission On Elections COMELEC 264 SCRA 49joshemmancarinoNo ratings yet

- Crime and Punishment Around The World Volume 1 Africa and The Middle East PDFDocument468 pagesCrime and Punishment Around The World Volume 1 Africa and The Middle East PDFAnnethedinosaurNo ratings yet

- Leave & License AgreementDocument2 pagesLeave & License AgreementThakur Sarthak SinghNo ratings yet

- Checklist and Information Booklet For Surrender CertificateDocument3 pagesChecklist and Information Booklet For Surrender CertificateSasmita NayakNo ratings yet

- Uson v. Del RosarioDocument4 pagesUson v. Del RosarioPrincess Trisha Joy UyNo ratings yet

- Rules of EngagementDocument3 pagesRules of EngagementAlexandru Stroe100% (1)

- Full Current Address: Name of Company #1Document2 pagesFull Current Address: Name of Company #1Saurabh ChoudharyNo ratings yet

- Goals of Civil Justice and Civil Procedure in Contemporary Judicial SystemsDocument262 pagesGoals of Civil Justice and Civil Procedure in Contemporary Judicial Systems* BC *No ratings yet

- The Philippine Human Rights SystemDocument34 pagesThe Philippine Human Rights Systemfsed2011No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Maloles Vs Phillips, CADocument14 pagesMaloles Vs Phillips, CAMariz D.R.No ratings yet

- Labrel Module 3 DigestsDocument4 pagesLabrel Module 3 DigestsAdriannaNo ratings yet

- AP Govt CH 8 Test Political Participationtest 8Document6 pagesAP Govt CH 8 Test Political Participationtest 8spatadia14No ratings yet

- Cyber PdpaDocument30 pagesCyber PdpaSyafiq AffandyNo ratings yet

- in Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Document6 pagesin Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Christia Sandee SuanNo ratings yet

- Comfort Women Seek Official Apology from JapanDocument4 pagesComfort Women Seek Official Apology from JapanCistron ExonNo ratings yet

- PT Askrindo President Director Speech FinalDocument4 pagesPT Askrindo President Director Speech Finalrizky ibnuNo ratings yet

- Red Tape Report: Behind The Scenes of The Section 8 Housing ProgramDocument7 pagesRed Tape Report: Behind The Scenes of The Section 8 Housing ProgramBill de BlasioNo ratings yet

- United States v. Theresa Mubang, 4th Cir. (2013)Document3 pagesUnited States v. Theresa Mubang, 4th Cir. (2013)Scribd Government DocsNo ratings yet

- KATIBADocument145 pagesKATIBAmaliki20 saidiNo ratings yet

- Transpo DIGESTDocument5 pagesTranspo DIGESTJesterNo ratings yet

- Notice of Pre Trial ConferenceDocument2 pagesNotice of Pre Trial Conferencesitty hannan mangotara100% (1)

- Amanquiton v. PeopleDocument4 pagesAmanquiton v. PeopleKeel Achernar DinoyNo ratings yet

- Public Interest Litigation and Judicial ActivismDocument15 pagesPublic Interest Litigation and Judicial ActivismSubhadeep DhangNo ratings yet

- People Vs UmawidDocument1 pagePeople Vs UmawidSophiaFrancescaEspinosa100% (1)

- Sponsor Change: Three Upline Approval FormDocument1 pageSponsor Change: Three Upline Approval FormClaudiamar CristisorNo ratings yet

- Memorandum For The AccusedDocument3 pagesMemorandum For The AccusedKen AbuanNo ratings yet

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- Taxation and Government Intervention On The BusinessDocument33 pagesTaxation and Government Intervention On The Businessjosh mukwendaNo ratings yet

- Firearms Protection Act (Review Of)Document63 pagesFirearms Protection Act (Review Of)ArchdukePotterNo ratings yet

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)