Professional Documents

Culture Documents

Constitutional Soup How To Defraud The World.

Uploaded by

A. CampbellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Constitutional Soup How To Defraud The World.

Uploaded by

A. CampbellCopyright:

Available Formats

Constitutional Soup

The old saying goes that if a frog begins a journey in cold water and as the heat rises, death will unknowingly occur, however if the water has become heated, the frog entering heated water will jump for survival.

This writer has never touched the United States Constitution but such lack of touch does not mean the words are not to be. Similar, this writer has never touched the stone(s) that carries the Ten Commandments, but the lack of touch does not mean the words are not to be.

Similarly, occurrences currently taking place throughout the world are all too visual to not be ignored. For most of history, population grew at near 3 percent. Logic also provides that creation of money needs to be injected at near the same percentage for the world to grow and prosper efficiently.

In turning attention to the Central Banks of the world, the continuous introduction of money is without tangible backing of the people. With a slow-down in the growth of world population industrial output was certain to reach a level of market saturation. As saturation was reached and with lack of tangible money in the hands of the people the power to purchase product is lost. There is another factor to the equation that is even more damning that the two already mentioned, the accelerated rate of intangible value. Most of the big banks and many of the special investment houses depend upon the numbers returned in this intangible market. A serious question has to be asked in regards to the intangible market, was intent for the intangible market to reach a level of value and utilizing scare tactics was one day the value to be great enough to absolve the need for tangible money? If such is true, then the power of the governments to print and inject monetary value into a countries economy has become obsolete, not to mention the worlds

economy. At this point the central banks of the world would no longer be needed but the question to be asked, have the central banks of the world not realized they are just an ingredient (method and means) or is it they are just as dumb as the frog that began his finals hours in the boiling pot.

Financial leaders in fashion cannot touch the reality of the circumstances but they believe in the words spoken to them by those that would if allowed place the world deeper into servitude.

Millions if not billions of people are asking what is it that the leaders will do for their country, for if these frog headed leaders keep on with their soup minded ways, the people should and will hopefully act appropriately.

Maybe the crimes against humanity no longer take tangible fashion and form that Hitler used, but the intangible crimes being committed would in this writers opinion make Hitler look like a choir boy.

Ask not what your country can do for you. The lack of action of elected leaders have place the people into a position that justice is demanded which was granted by God and guaranteed by the United States Constitution.

Are the people looking at a Reps and Warrant violation, elections forthcoming, trial and error and there have so far been too many errors.

Speak softly, not any more, and carry a BIG pen.

You might also like

- 2016-03-21 - MTD Unconsionable ContractDocument9 pages2016-03-21 - MTD Unconsionable ContractA. CampbellNo ratings yet

- Unconscionable ContractDocument2 pagesUnconscionable ContractA. Campbell100% (1)

- Bananas, Bikinis, GirlsDocument3 pagesBananas, Bikinis, GirlsA. CampbellNo ratings yet

- Squirrelly Two StepDocument13 pagesSquirrelly Two StepA. Campbell100% (1)

- Holder V OwnerDocument1 pageHolder V OwnerA. CampbellNo ratings yet

- Go FigureDocument1 pageGo FigureA. CampbellNo ratings yet

- Part 2Document3 pagesPart 2A. CampbellNo ratings yet

- Opinion For Paatalo MTD DeniedDocument18 pagesOpinion For Paatalo MTD DeniedA. Campbell100% (1)

- Mammon or GodDocument1 pageMammon or GodA. CampbellNo ratings yet

- 179124259801Document22 pages179124259801A. CampbellNo ratings yet

- Supreme Court Rules Mortgage Registration Business Has No Constitutionally Protected Interest in PropertyDocument34 pagesSupreme Court Rules Mortgage Registration Business Has No Constitutionally Protected Interest in PropertyA. CampbellNo ratings yet

- Star of BethlehemDocument8 pagesStar of BethlehemA. CampbellNo ratings yet

- 179124259513Document17 pages179124259513A. CampbellNo ratings yet

- 179124259822Document25 pages179124259822A. CampbellNo ratings yet

- 179124259410Document2 pages179124259410A. CampbellNo ratings yet

- Cream NoteDocument1 pageCream NoteA. CampbellNo ratings yet

- FTC Amicus BriefDocument25 pagesFTC Amicus BriefA. Campbell100% (1)

- Writ Quo WarrantoDocument15 pagesWrit Quo WarrantoA. CampbellNo ratings yet

- Promise and PledgeDocument2 pagesPromise and PledgeA. CampbellNo ratings yet

- Joey Rodriguez Petition For Writ of Certiorari (June 11 2015)Document74 pagesJoey Rodriguez Petition For Writ of Certiorari (June 11 2015)A. CampbellNo ratings yet

- You Foot The Bill, SuckerDocument7 pagesYou Foot The Bill, SuckerA. Campbell100% (2)

- Playing The Field: Geomagnetic Storms and The Stock MarketDocument53 pagesPlaying The Field: Geomagnetic Storms and The Stock MarketPaolo100% (1)

- Common StatutoryDocument3 pagesCommon StatutoryA. Campbell100% (1)

- 26 Usc 6323Document2 pages26 Usc 6323A. CampbellNo ratings yet

- Rights of TitleDocument1 pageRights of TitleA. CampbellNo ratings yet

- Ripley, Believe It or Not. It Happened.Document8 pagesRipley, Believe It or Not. It Happened.A. CampbellNo ratings yet

- Zero SumDocument2 pagesZero SumA. CampbellNo ratings yet

- PermissiveDocument2 pagesPermissiveA. CampbellNo ratings yet

- Security Promise 524Document7 pagesSecurity Promise 524A. CampbellNo ratings yet

- Nolo Contenderé Hearsay SacrificedDocument1 pageNolo Contenderé Hearsay SacrificedA. CampbellNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 15Document7 pagesChapter 15Christine GorospeNo ratings yet

- Licensing HandbookDocument75 pagesLicensing HandbookTan YLunNo ratings yet

- Test Paper CA Final TpdtaaDocument3 pagesTest Paper CA Final TpdtaayeidaindschemeNo ratings yet

- Key Smart Checking: Account SummaryDocument4 pagesKey Smart Checking: Account SummaryDemetrius Diamond IINo ratings yet

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

- SGX-Listed Sapphire Sells Entire PRC Steel-Making Business for S$70 Million and Gain on Divestment; Proceeds Will Be Used To Support Resource Business and Chart New Direction in Value-Added Engineering ServicesDocument2 pagesSGX-Listed Sapphire Sells Entire PRC Steel-Making Business for S$70 Million and Gain on Divestment; Proceeds Will Be Used To Support Resource Business and Chart New Direction in Value-Added Engineering ServicesWeR1 Consultants Pte LtdNo ratings yet

- International Money Market GuideDocument2 pagesInternational Money Market GuideKainat TanveerNo ratings yet

- Technical Perspective STP : StradivariDocument10 pagesTechnical Perspective STP : StradivariUwe TruppelNo ratings yet

- Fresh IT 320206 Opening On 06-12-16Document21 pagesFresh IT 320206 Opening On 06-12-16maher0zainNo ratings yet

- Finance is the Lifeblood of BusinessDocument23 pagesFinance is the Lifeblood of BusinessGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Restructuring Bulong Debt - 3Document7 pagesRestructuring Bulong Debt - 3Kumar Abhishek100% (1)

- Lazada seller account adjustment typesDocument4 pagesLazada seller account adjustment typesĐỗ Linh Nam100% (1)

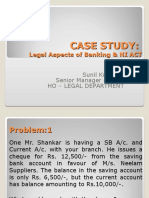

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- Statement of Axis Account No:911010054508431 For The Period (From: 08-06-2021 To: 07-07-2021)Document1 pageStatement of Axis Account No:911010054508431 For The Period (From: 08-06-2021 To: 07-07-2021)seshu 2010No ratings yet

- Redeemable Debenture - Features, Advantages and DisadvantagesDocument8 pagesRedeemable Debenture - Features, Advantages and DisadvantagesLakshya SharmaNo ratings yet

- Mathematics of Investments - Ordinary Simple AnnuitiesDocument2 pagesMathematics of Investments - Ordinary Simple AnnuitiesBrando MoloNo ratings yet

- Duties and Obligations of Paying Bankers and Collecting BankersDocument27 pagesDuties and Obligations of Paying Bankers and Collecting Bankersrajin_rammstein70% (10)

- QII.W6.D3.Annuity DueDocument16 pagesQII.W6.D3.Annuity DueSophia GalagarNo ratings yet

- Vendor Payments F-53Document2 pagesVendor Payments F-53Promoth JaidevNo ratings yet

- (+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, OmanDocument3 pages(+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, Omanfaiza minhasNo ratings yet

- BO080 38230 MAKENA 1 HoldDocument1 pageBO080 38230 MAKENA 1 HoldSarie Jordaan FivazNo ratings yet

- pp16Document64 pagespp16Mousami BanerjeeNo ratings yet

- PP For Chapter 6 - Financial Statement Analysis - FinalDocument67 pagesPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNo ratings yet

- BrandywineDocument4 pagesBrandywineAnonymous Feglbx5No ratings yet

- Engineering Economics ModuleDocument56 pagesEngineering Economics ModulePaul NipasNo ratings yet

- Joe Malvasio Closes A $6,000,000 World-Class Resort Construction DealDocument3 pagesJoe Malvasio Closes A $6,000,000 World-Class Resort Construction DealPR.comNo ratings yet

- Prepared By: Hrishabh Singh Somu KapoorDocument7 pagesPrepared By: Hrishabh Singh Somu KapoorAanchal MehrotraNo ratings yet

- Cryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezDocument75 pagesCryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezgfgfgfgNo ratings yet

- Interactive CH 36 Six Debates Over Macroeconomic Policy 9eDocument33 pagesInteractive CH 36 Six Debates Over Macroeconomic Policy 9eMohammad NurzamanNo ratings yet