Professional Documents

Culture Documents

The Unexpected Rise of Fixed Income SMAs - Fund Fire March 2012

Uploaded by

Mark ElzweigOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Unexpected Rise of Fixed Income SMAs - Fund Fire March 2012

Uploaded by

Mark ElzweigCopyright:

Available Formats

Opinion

The Unexpected Rise of Fixed Income SMAs

March 22, 2012

Mark Elzweig is president and founder of the executive search firm Mark Elzweig Company.

Separately managed account managers that oversee fixed income assets have momentum on their side. Traditionally, advisors would choose separate account managers for only their stock-picking prowess, and many advisors viewed utilizing a manager for fixed income assets as a redundancy. After all, most advisors were perfectly capable of laddering their own muni bond portfolios and selecting their own corporates. There was simply no need to pay an outside manager for that service. But, as with so many other things on Wall Street, the 2008 crash changed all that. BlackRock, the largest SMA manager, with $51.2 billion in SMA assets under management as of Dec. 31, managed about 70% equities and 30% fixed income in 2006, after it acquired Merrill Lynch Investment Management. Today, those percentages have nearly reversed, with 60% of BlackRocks business now in fixed income, as reported. This breakdown is not unique to BlackRock. For the industry as a whole, management of municipal and taxable SMA portfolios has jumped from 29% of total SMA assets in the fourth quarter of 2008 to 45% in the fourth quarter of 2011, data provided by Dover

Financial Research shows. Cerulli Associates data, meanwhile, shows a 120% increase in SMA fixed income assets from 2007 through the end of 2010. Sales credits on fixed income trades dont fully explain why brokerage advisors are handing off fixed income investments. Its the fallibility of the rating agencies. Commissions on bonds have been falling for some time to just 25 bps to 50 bps on short-term maturities, down from 3% to 3.5% in the 1980s. But the agencies have had a bad run this century, and advisors arent so sure they can rely on the guidance of rating agencies in selecting bonds for their clients. Advisors, and indeed the investment community at large, remember all too well how Moodys, S&P and Fitch all rated Enrons bonds as investment grade until just four days before the companys collapse in 2001. The rating agencies were not any savvier in their assessment of WorldCom and other epic frauds. Werent these the same guys who mistakenly thought that subprime junk could be magically transformed by securitization into CDOs with AAA-rated tranches? Clearly, many advisors have concluded that they need the serious, credible fixed income due diligence that asset managers can provide. Numerous industry insiders view rating agency research as largely stale, after-the-fact pronouncements on information that has already been out there for a while. The scarcity of municipal inventory has also strengthened the hand of fixed income SMA managers. Securities Industry and Financial Markets Association data show that municipal issuance plummeted from $429.3 billion in 2007 to only $294.6 billion in 2011, a 31% drop. Some municipalities have either already maxed out their borrowing capacity or are in such poor financial shape that they dont dare come to market with new bond issues. Asset managers can often buy blocks of bonds at more favorable institutional prices. They may have access to inventory that wirehouse advisors never see. For example, suppose a small hospital comes out with a $20 million new issue. That paper may be snapped up entirely by one or two asset managers. The dramatic decline in the number of insured municipal bonds from 45% in 2007 to 5% in 2011 has also made advisors more inclined to seek out professional fixed income mangers to help them navigate credit risk. This isnt a passing trend. Advisors of all stripes will continue to recognize for years to come the value that quality fixed income managers can add even without the doomsday scenarios of analyst Meredith Whitney hanging over the marketplace.

Mark Elzweig Company Executive Search Consultants 212-685-7070

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Opinion: Downturn Concerns Should Spark Career ReviewDocument2 pagesOpinion: Downturn Concerns Should Spark Career ReviewMark ElzweigNo ratings yet

- Advisors See Double in Sunset Bonus OffersDocument3 pagesAdvisors See Double in Sunset Bonus OffersMark ElzweigNo ratings yet

- Fund Industry Marred by NepotismDocument3 pagesFund Industry Marred by NepotismMark ElzweigNo ratings yet

- Fund Industry Marred by NepotismDocument3 pagesFund Industry Marred by NepotismMark ElzweigNo ratings yet

- Era of Singing Bonuses Not DeadDocument2 pagesEra of Singing Bonuses Not DeadMark ElzweigNo ratings yet

- Why RIAs and Wirehouse Advisors Will Never Partner - Investment News February 2011Document3 pagesWhy RIAs and Wirehouse Advisors Will Never Partner - Investment News February 2011Mark ElzweigNo ratings yet

- Wirehouse Recruitng Bonuses Are Lofty But LevelingDocument1 pageWirehouse Recruitng Bonuses Are Lofty But LevelingMark ElzweigNo ratings yet

- Fund Industry Marred by NepotismDocument3 pagesFund Industry Marred by NepotismMark ElzweigNo ratings yet

- Eight Things Advisors Need To Know About UMA's - AdvisorOne May 2011Document3 pagesEight Things Advisors Need To Know About UMA's - AdvisorOne May 2011Mark ElzweigNo ratings yet

- Don't Bet On An Aggregator Deal - Investment News December 2011Document3 pagesDon't Bet On An Aggregator Deal - Investment News December 2011Mark ElzweigNo ratings yet

- Uniform Standard May Not Be A Win For RIA's Investment News July 2012Document3 pagesUniform Standard May Not Be A Win For RIA's Investment News July 2012Mark ElzweigNo ratings yet

- Why Rep As Portfolio Manager Programs Are Here To Stay - Advisorone Feb 2012Document2 pagesWhy Rep As Portfolio Manager Programs Are Here To Stay - Advisorone Feb 2012Mark ElzweigNo ratings yet

- Morgan Stanley Financial Advisors Unlikely To Win On Retention Deals - FundFire, Sep 2012Document2 pagesMorgan Stanley Financial Advisors Unlikely To Win On Retention Deals - FundFire, Sep 2012Mark ElzweigNo ratings yet

- Why Do Financial Advisers, SMAs Love To Hate UMAs? - AdvisorOne Dec 2012Document3 pagesWhy Do Financial Advisers, SMAs Love To Hate UMAs? - AdvisorOne Dec 2012Mark ElzweigNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Overview of Financial System: Prof. Mishu Tripathi Asst. Professor-FinanceDocument16 pagesOverview of Financial System: Prof. Mishu Tripathi Asst. Professor-FinanceAashutosh SinghNo ratings yet

- Corvex Capital - Restoring The Health To Commonwealth - 2013.02.26Document69 pagesCorvex Capital - Restoring The Health To Commonwealth - 2013.02.26Wall Street WanderlustNo ratings yet

- Midland Energy F13Document33 pagesMidland Energy F13Juan Ramon Aguirre RondinelNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- Indian Ladies Handbag Industry ReportDocument38 pagesIndian Ladies Handbag Industry ReportReevolv Advisory Services Private LimitedNo ratings yet

- EPD Handbook 2012electronic VersionDocument265 pagesEPD Handbook 2012electronic VersionAnonymous iVNvuRKGVNo ratings yet

- Foreign Exchange Risk Management in Commercial Banks in PakistanDocument65 pagesForeign Exchange Risk Management in Commercial Banks in PakistanMaroof Hussain Sabri100% (5)

- Supply and Demand Trading Rules PDF - UnBrick - IdDocument18 pagesSupply and Demand Trading Rules PDF - UnBrick - IdEric Woon Kim Thak25% (4)

- Indiabulls ThesisDocument5 pagesIndiabulls Thesisdivyanshu kumarNo ratings yet

- International Capital Market Equilibrium TutorialDocument2 pagesInternational Capital Market Equilibrium TutorialAlex WuNo ratings yet

- Accounting Top 50 QuestionsDocument152 pagesAccounting Top 50 QuestionsDeep Mehta0% (1)

- PitchBook All Columns 2023 09 26 08 45 41Document61 pagesPitchBook All Columns 2023 09 26 08 45 41lilianasher2610No ratings yet

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- Evaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXDocument30 pagesEvaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXRhizhail MortallaNo ratings yet

- Abfm Formula PDFDocument20 pagesAbfm Formula PDFSandeep KumarNo ratings yet

- Responsibility AccountingDocument14 pagesResponsibility AccountingJignesh TogadiyaNo ratings yet

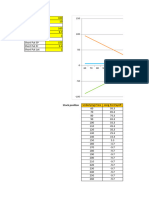

- Bear Spread Payoff Strategy CalculationDocument3 pagesBear Spread Payoff Strategy CalculationMukund KumarNo ratings yet

- Mbfs With 16 MarkDocument16 pagesMbfs With 16 MarkPadmavathiNo ratings yet

- Foreign Capital Inflows and Stock Market Development in PakistanDocument10 pagesForeign Capital Inflows and Stock Market Development in PakistanSadaf KazmiNo ratings yet

- CH 4 - The Meaning of Interest RatesDocument46 pagesCH 4 - The Meaning of Interest RatesAysha KamalNo ratings yet

- 098 Fmbo-1Document9 pages098 Fmbo-1KetakiNo ratings yet

- Simualtion BancoDocument24 pagesSimualtion BancoJaison Mendez AlvaradoNo ratings yet

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Document5 pagesDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssNo ratings yet

- Post Qualification FormDocument25 pagesPost Qualification FormLalit Trivedi100% (1)

- Analysis of Bfsi Industry in India: Prepared by Devansh VermaDocument4 pagesAnalysis of Bfsi Industry in India: Prepared by Devansh VermaDevansh VermaNo ratings yet

- Portfolio Investment Management Specialist in Stamford CT Resume Michael BizzarioDocument1 pagePortfolio Investment Management Specialist in Stamford CT Resume Michael BizzarioMichaelBizzarioNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectmohanchinnaiya7No ratings yet

- Getting Started Tech AnalysisDocument42 pagesGetting Started Tech Analysiszubair latif100% (1)

- 01, Data CentersDocument36 pages01, Data CentersMahmoud AzabNo ratings yet

- 101 Profit & Loss Type 1 BY 854×480@AsurReborn BotDocument7 pages101 Profit & Loss Type 1 BY 854×480@AsurReborn BotYash SharmaNo ratings yet