Professional Documents

Culture Documents

Thesis Final S

Uploaded by

divzkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesis Final S

Uploaded by

divzkCopyright:

Available Formats

DIVYA KOTHIWAL

INDIAN INSTITUTE OF PLANNING AND MANAGEMENT NEW DELHI

THESIS REPORT ON STUDY OF INVESTMENT PATTERNS OF SMALL AND MEDIUM ENTERPRISES (SMEs)

SUBMITTED TO: PROF.SUMANTA SHARMA PROF. VIJAY KR.BODDU EXTERNAL GUIDE: MR.ANIRUDH SHARMA

SUBMITTED BY: DIVYA KOTHIWAL PGP-FW-2008-2010 ALUMNI ID NO.: DF/08/10-F-579

ABSTRACT

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Starting with the acknowledgement, I have presented with the background of the Mutual Fund Industry. There is information on mutual fund comprising of things like as to what mutual fund is: its history, types of mutual funds etc. Next there is information of study etc., actual analysis but firstly starting with giving some information on the type of questionnaire design used, sampling technique, research design etc., The primary objective of the report is to study the investment patterns of Small and Medium Enterprises and to further establish if the type of trade they are in affects the investment decisions in Mutual Funds. We did a market research by making the company fill a structured questionnaire and find out their exposure to Mutual Funds.

SIGNATORY PAGE

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

This is to certify that the thesis titled Study of investment patterns of Small and Medium Enterprises(SMEs) prepared by Ms. Divya Kothiwal for the award of degree in Master of Business Administration has been completed under my supervision & guidance. It is an original piece of work based on primary as well as secondary data. This work is satisfactory and complete in every respect. I wish her all the success for her future endeavour. Thanking you Yours Sincerely

ANIRUDH SHARMA

THESIS APPROVAL LETTER Dear Divya Kothiwal,

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

This is to inform that your thesis proposal on Study of Investment Patterns of Small & Medium Enterprises, to be conducted under the guidance of Mr. Anirudh Sharma is hereby approved and the topic registration id number is DF/08/10-F-579 Make it a comprehensive thesis by ensuring that all the objectives as stated by you in your synopsis are met using appropriate research design; a thesis should aim at adding value to the existing knowledge base. You are required to correspond with your internal guide Prof. Vijay Kr. Boddu at boddu.vijay@iipm.edu Ph.-0124-3350714 by sending at least four response sheets (attached along with this mail) at regular intervals before the last date of thesis submission.

NB: 1) A thesis would be rejected if there is any variation in the topic/title from the one approved and registered with us. 2) The candidate needs to handwrite at least 1200 to 1500 words on the summary of thesis at the time of viva.

Regards, Prof .Sumanta Sharma Dean (Projects) IIPM Sumanta.sharma@iipm.edu Phone: +91 0124 3350701 (D) +91 0124 3350715 (Board)

SYNOPSIS Name: Divya Kothiwal

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Section:

F.7

Batch:

Fall/Winter 2008-2010

Phone Number:

9818593910

E-mail Id:

kothiwaldivya@gmail.com

Thesis Topic:

Study of Investment Enterprises

Patterns

of

Small

&

Medium

Specialization Area:

Finance

Introduction: I will be focusing primarily on the small and medium enterprises in New Delhi, NCR analyzing their investment patterns. My External Guide, Mr. Anirudh Sharma (Manager, ICICI Bank) will be helping me in the research and the study. The basic aim of the research in the initial stages will be to analyze the trend of the mutual fund industry. Later, followed by the primary research and by forecasting with and without the two external forces or factors and finally coming up with a solution in the final stage.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Research Objectives: 1. To study and understand the investment patterns of SMEs. 2. To further establish that if the type of trade affects the investment decisions in Mutual funds. Hypothesis: Mapping the concerned area to do a market research study with the help of the questionnaires and find out their exposure to the Mutual Funds. Research Methodology: Secondary Data: This form of methodology will be used for finding the trend followed by the enterprises and forecasting the possible outcome in the coming years. The sources for the same will consist of internet, relevant study papers, newspaper articles, books and so on. Hence, an analysis of pre-existing data in a different way to answer the questions or else to answer a separate question than the originally intended one will help with the use of secondary data. Primary Data: This form of data will be used to in the form of questionnaires which will be filled by the top management and officials of various enterprises and set- ups involved in this business. Mostly, the questions will be open ended but will make sure that the information that will be extracted from the same should be very effective in coming to conclusions. Scope of the Work: The scope for this study is to gather information from the various sources, understand it and derive the factors that are responsible or affect the investment patterns of SMEs in relation to the mutual fund industry. A primary research will help show (in which I would be visiting officials of various companies in this business) the forecasting in which I would be using all the tools possible to forecast what could go wrong and what can possibly be the effects and after effects?

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Justification for choosing the topic : Mutual funds industry has been moving up and a growing sector recently. It is very important to understand how the various enterprises work towards handling the mutual funds in their respective companies? Depending, on the market conditions and the various ups and downs, the fund value changes. I would study all that affects these changes.

Details of External Guide:

Name:

Mr.Anirudh Sharma

Qualification: MBA

Designation: Manager

Company:

ICICI Bank Ltd

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

ACKNOWLEDGEMENT I sincerely feel that the guidance and support extended towards me by all the members of ICICI was more than I could expect. I express my immense gratitude towards all the members of this organization. They really made my learning experience the most memorable and respectable one. It was a great honour to be associated with a company. I take the opportunity to express my sincere gratitude to my project guide Mr. Anirudh Sharma, without whose guidance and support I could not have completed my project. I am also thankful to all the other managers and employees for taking out time from their busy schedule and guiding me in order to make this project a success.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

TABLE OF CONTENTS 1. Acknowledgement 2. Background 3. Mutual Funds 3.1 Returns 3.2 Advantages 3.3 Disadvantages 3.4 Risks 3.5 Mutual fund types 3.6 Procedure of opening a folio 4. Mutual fund companies in India 5. The study 5.1 Purpose 5.2 Scope 5.3 Data collection and job requirement 5.4 Limitations 5.5 About Small and Medium enterprises 5.6 Current investment patterns 5.7 Instruments in Indian debt market 6. The analysis 6.1 Sources of data 6.2 Sampling 6.3 Scope of study

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

6.4 Research design 6.5 Questionnaire design 6.6 Procedure of data collection 7. Results and interpretation 7.1 Findings 8. Conclusion 9. Annexures 10. References

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

BACKGROUND My work involved two tasks: I. II. Lead generation through series of appointments with the prospective company. Marketing Research and data collection which involved mapping the allotted area, getting the required information by asking the company to fill the questionnaire. Here is a little background on marketing research:

Marketing research is defined as the systematic and objective identification, collection, analysis, and dissemination of information for the purpose of assisting management in decision making related to the identification and solution of problems (and opportunities) in marketing.

1) Identification: Involves defining the marketing research problem (or opportunity) and determining the information that is needed to address it.

2) Collection: Data must be obtained from relevant sources.

3) Analysis: Data are analyzed, interpreted, and inferences are drawn.

4) Dissemination of information: The findings, implications, and recommendations are provided in a format that makes this information actionable and directly useful as an input into decision making.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Mutual Funds A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal. It is essentially a diversified portfolio of financial instruments - these could be equities, debentures / bonds or money market instruments. The corpus of the fund is then deployed in investment alternatives that help to meet predefined investment objectives. The income earned through these investments and the capital appreciation realised are shared by its unit holders in proportion to the number of units owned by them. Thus a Mutual Fund is a suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. One could make money from a mutual fund in three ways: 1) Income is earned from dividends declared by mutual fund schemes from time to time. 2) If the fund sells securities that have increased in price, the fund has a capital gain. This is reflected in the price of each unit. When investors sell these units at prices higher than their purchase price, they stand to make a gain. 3) If fund holdings increase in price but are not sold by the fund manager, the fund's unit price increases. You can then sell your mutual fund units for a profit. This is tantamount to a valuation gain. Every mutual fund has a goal - either growing its assets (capital gains) and/or generating income (dividends) for its investors. Distributions in the form of capital gains (short-term and long-term) and dividends may be passed on (paid) to shareholders as income or reinvested to purchase more shares. Like any business, mutual funds have risks and costs associated with returns. As a shareholder, the risks of a fund and the expenses associated with fund's operation directly impact your return. You can look at the flowchart to understand in brief as to how mutual funds work.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

A. Returns on Mutual Funds As an investor, you want to know the fund's return-its track record over a specified period of time. So what exactly is "return?" A mutual fund's return is the rate of increase or decrease in its value over a specific period of time usually expressed in the following increments: one, three, five, and ten year, year to date, and since the inception of the fund. Since return is a common measure of performance, you can use it to evaluate and compare mutual funds within the same fund category. Generally expressed as an annualized percentage rate, return is calculated assuming that all distributions from the fund are reinvested. Since average returns can sometimes "hide" short-term highs and lows, you should evaluate returns for a time period of several years-not just one year or less. A fund that has a high return in one year may have experienced losses in other years-these fluctuations may not be apparent in its average return. While a fund's return shows its track record, keep in mind that past performance is no guarantee of future results.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

B. Advantages of Mutual Funds What are the key advantages of mutual fund investing? Diversification

Using mutual funds can help an investor diversify their portfolio with a minimum investment. When investing in a single fund, an investor is actually investing in numerous securities. Spreading your investment across a range of securities can help to reduce risk. A stock mutual fund, for example, invests in many stocks - hundreds or even thousands. This minimizes the risk attributed to a concentrated position. If a few securities in the mutual fund lose value or become worthless, the loss maybe offset by other securities that appreciate in value. Further diversification can be achieved by investing in multiple funds which invest in different sectors or categories. This helps to reduce the risk associated with a specific industry or category. Diversification may help to reduce risk but will never completely eliminate it. It is possible to lose all or part of your investment Professional Management

Mutual funds are managed and supervised by investment professionals. As per the stated objectives set forth in the prospectus, along with prevailing market conditions and other factors, the mutual fund manager will decide when to buy or sell securities. This eliminates the investor of the difficult task of trying to time the market. Furthermore, mutual funds can eliminate the cost an investor would incur when proper due diligence is given to researching securities. This cost of managing numerous securities is dispersed among all the investors according to the amount of shares they own with a fraction of each dollar invested used to cover the expenses of the fund. What does this mean? Fund managers have more money to research more securities more in depth than the average investor. Convenience

With most mutual funds, buying and selling shares, changing distribution options, and obtaining information can be accomplished conveniently by telephone, by mail, or online. Although a fund's shareholder is relieved of the day-to-day tasks involved in researching, buying, and selling securities, an investor will still need to evaluate a mutual fund based on investment goals and risk tolerance before making a

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

purchase decision. Investors should always read the prospectus carefully before investing in any mutual fund. Liquidity

Mutual fund shares are liquid and orders to buy or sell are placed during market hours. However, orders are not executed until the close of business when the NAV (Net Average Value) of the fund can be determined. Fees or commissions may or may not be applicable. Fees and commissions are determined by the specific fund and the institution that executes the order.

C. Disadvantages Risks and Costs Changing market conditions can create fluctuations in the value of a mutual fund investment. There are fees and expenses associated with investing in mutual funds that do not usually occur when purchasing individual securities directly. As with any type of investment, there are drawbacks associated with mutual funds.

No Guarantees

The value of your mutual fund investment, unlike a bank deposit, could fall and be worth less than the principle initially invested. And, while a money market fund seeks a stable share price, its yield fluctuates, unlike a certificate of deposit. In addition, mutual funds are not insured or guaranteed by an agency of the U.S. government. Bond funds, unlike purchasing a bond directly, will not re-pay the principle at a set point in time.

The Diversification Penalty

Diversification can help to reduce your risk of loss from holding a single security, but it limits your potential for a "home run" if a single security increases dramatically in value. Remember, too, that diversification does not protect you from an overall decline in the market.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Costs

In some cases, the efficiencies of fund ownership are offset by a combination of sales commissions, redemption fees, and operating expenses. If the fund is purchased in a taxable account, taxes may have to be paid on capital gains. Keep track of the cost basis of your initial purchase and new shares that are acquired by reinvesting distributions. It's important to compare the costs of funds you are considering. D. Risk Every type of investment, including mutual funds, involves risk. Risk refers to the possibility that you will lose money (both principal and any earnings) or fail to make money on an investment. A fund's investment objective and its holdings are influential factors in determining how risky a fund is. Reading the prospectus will help you to understand the risk associated with that particular fund. Generally speaking, risk and potential return are related. This is the risk/return trade-off. Higher risks are usually taken with the expectation of higher returns at the cost of increased volatility. While a fund with higher risk has the potential for higher return, it also has the greater potential for losses or negative returns. The school of thought when investing in mutual funds suggests that the longer your investment time horizon is the less affected you should be by short-term volatility. Therefore, the shorter your investment time horizon, the more concerned you should be with short-term volatility and higher risk.

Defining Mutual fund risk

Different mutual fund categories as previously defined have inherently different risk characteristics and should not be compared side by side. A bond fund with below-average risk, for example, should not be compared to a stock fund with below average risk. Even though both funds have low risk for their respective categories, stock funds overall have a higher risk/return potential than bond funds. Of all the asset classes, cash investments (i.e. money markets) offer the greatest price stability but have yielded the lowest long-term returns. Bonds typically experience more short-term price swings, and in turn have generated higher long-term returns. However, stocks historically have been subject to the greatest short-term price fluctuationsand have provided the highest long-term returns. Investors looking for a fund which incorporates all asset classes may consider a balanced or hybrid mutual fund. These funds can be very conservative or very aggressive. Asset allocation portfolios are mutual funds that invest in other mutual funds with different asset classes. At the discretion of the manager(s),

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

securities are bought, sold, and shifted between funds with different asset classes according to market conditions. Mutual funds face risks based on the investments they hold. For example, a bond fund faces interest rate risk and income risk. Bond values are inversely related to interest rates. If interest rates go up, bond values will go down and vice versa. Bond income is also affected by the change in interest rates. Bond yields are directly related to interest rates falling as interest rates fall and rising as interest rise. Income risk is greater for a short-term bond fund than for a longterm bond fund. Similarly, a sector stock fund (which invests in a single industry, such as telecommunications) is at risk that its price will decline due to developments in its industry. A stock fund that invests across many industries is more sheltered from this risk defined as industry risk. Following is a glossary of some risks to consider when investing in mutual funds.

Call Risk: The possibility that falling interest rates will cause a bond issuer to redeemor callits high-yielding bond before the bond's maturity date. Country Risk: The possibility that political events (a war, national elections), financial problems (rising inflation, government default), or natural disasters (an earthquake, a poor harvest) will weaken a country's economy and cause investments in that country to decline. Credit Risk: The possibility that a bond issuer will fail to repay interest and principal in a timely manner. Also called default risk. Currency Risk: The possibility that returns could be reduced for Americans investing in foreign securities because of a rise in the value of the U.S. dollar against foreign currencies. Also called exchange-rate risk. Income Risk: The possibility that a fixed-income fund's dividends will decline as a result of falling overall interest rates. Industry Risk: The possibility that a group of stocks in a single industry will decline in price due to developments in that industry. Inflation Risk: The possibility that increases in the cost of living will reduce or eliminate a fund's real inflation-adjusted returns. Interest Rate Risk: The possibility that a bond fund will decline in value because of an increase in interest rates.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Manager Risk: The possibility that an actively managed mutual fund's investment adviser will fail to execute the fund's investment strategy effectively resulting in the failure of stated objectives. Market Risk: The possibility that stock fund or bond fund prices overall will decline over short or even extended periods. Stock and bond markets tend to move in cycles, with periods when prices rise and other periods when prices fall.

Principal Risk: The possibility that an investment will go down in value, or "lose money," from the original or invested amount.

E. Mutual Fund Types Wide varieties of Mutual Fund Schemes exist to cater to the needs such as financial position, risk tolerance and return expectations etc. The table below gives an overview into the existing types of schemes in the Industry. TYPES OF MUTUAL FUND SCHEMES

By Structure o Open - Ended Schemes

o o

Close - Ended Schemes Interval Schemes

By Investment Objective

o o o o

Growth Schemes Income Schemes Balanced Schemes Money Market Schemes

Other Schemes

o o

Tax Saving Schemes Special Schemes

Index Schemes Sector Specific Schemes

DF/08/10-F-579

PGP/FW/08-10

DIVYA KOTHIWAL

Mutual Funds by Structure

Open-Ended Schemes: An open-ended fund or scheme is one that is available for subscription and repurchase on a continuous basis. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices which are declared on a daily basis. The key feature of open-end schemes is liquidity.

Close-Ended Schemes: A close-ended fund or scheme has a stipulated maturity period e.g. 5-7 years. The fund is open for subscription only during a specified period at the time of launch of the scheme. Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges. These mutual funds schemes disclose NAV generally on weekly basis.

Mutual Funds by Investment Objective

Growth / Equity Scheme: The aim of growth funds is to provide capital appreciation over the medium to long-term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

Income / Debt Oriented Scheme: The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities and money market instruments. Such funds are less risky compared to equity

PGP/FW/08-10 DF/08/10-F-579

DIVYA KOTHIWAL

schemes. These funds are not affected because of fluctuations in equity markets. However, opportunities of capital appreciation are also limited in such funds.

Balanced Funds: The aim of balanced funds is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 4060% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds.

Money Market / Liquid Schemes: These funds are also income funds and their aim is to provide easy liquidity, preservation of capital and moderate income. These schemes invest exclusively in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared to other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods.

Risk Hierarchy of Different Mutual Funds

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Others:

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Gilt Funds: These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as is the case with income or debt oriented schemes. Index Funds: Index Funds replicate the portfolio of a particular index such as the BSE Sensitive index, S&P NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage. Sector-Specific Schemes: These are the funds/schemes which invest in the securities of only those sectors or industries as specified in the offer documents E.g. Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are more risky compared to diversified funds. Tax Saving Schemes: These schemes offer tax rebates to the investors under specific provisions of the Income Tax Act, 1961 as the Government offers tax incentives for investment in specified avenues. E.g. Equity Linked Savings Schemes (ELSS). Pension Schemes launched by the mutual funds also offer tax benefits. These schemes are growth oriented and invest pre-dominantly in equities. Their growth opportunities and risks associated are like any equity-oriented scheme. Load or No Load Funds: Load Fund is one that charges a percentage of NAV for entry or exit. That is, each time one buys or sells units in the fund, a charge will be payable. This charge is used by the mutual fund for marketing and distribution expenses. The investors should take the loads into consideration while making investment as these affect their yields/returns. However, the investors should also consider the performance track record and service standards of the mutual fund which are more important. A no-load fund is one that does not charge for entry or exit. It means the investors can enter the fund/scheme at NAV and no additional charges are payable on purchase or sale of units.

Here is a sales sheet of various types of mutual funds as on April 2008:

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

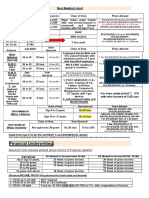

Sales during the month of April, 2008 Amount in Rs. Crores Structure Open End Close End No. of Amount No. of Amount Schemes Schemes 31 370 6 30 271 11 179 6 143 30 5 222 152 57 8 541 157 33 4071 118553 386820 352 510770 49 265 331 29 4222 4430

Nature

Balanced ELSS FOF Investing Overseas Gilt GOLD ETF Growth Income Liquid/Mone y Market Other ETF Total

Total No. of Amount Schemes 37 370 41 450 6 143 30 5 271 417 57 8 872 157 33 4100 122775 386820 352 515200

F. Procedure of Opening up a Folio Fresh Purchase: After deciding on the type of scheme, the investor will have to fill in the Application form, attach a payment instrument and submit it at any of the funds' collection centers before the cut off time. The investor has to invest in rupees and units will be allotted to him in fractions depending upon the NAV.

Additional Purchase: Buying more units either of the same scheme or of a different scheme under the SAME FOLIO is an additional purchase, which can be done through Additional Purchase slips provided along with the account statement. After filling the same, the investor will have to attach a cheque with it and submit it at any of the collection centers before the cut-off time.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Switch Units: A switch request will have to be filled in and submitted at any of the collection centers before the cut off time. SWITCH can be done with either partial or all units under a particular scheme to another scheme as specified by him under the same folio.

Redeem / Repurchase Units: If the fund is open ended, the investor has to send the repurchase requisition slip, duly completed and signed, to any of our branches. It is possible to lodge repurchase requests on the Internet also. The redemption can be done for all units, partial units, or for an amount.

Mutual Fund Companies in India ABN AMRO Mutual Fund ABN AMRO Mutual Fund was setup on April 15, 2004 with ABN AMRO Trustee (India) Pvt. Ltd. as the Trustee Company. The AMC, ABN AMRO Asset Management (India) Ltd. was incorporated on November 4, 2003. Deutsche Bank A G is the custodian of ABN AMRO Mutual Fund. Birla Sun Life Mutual Fund Birla Sun Life Mutual Fund is the joint venture of Aditya Birla Group and Sun Life Financial. Sun Life Financial is a golbal organisation evolved in 1871 and is being represented in Canada, the US, the Philippines, Japan, Indonesia and Bermuda apart from India. Birla Sun Life Mutual Fund follows a conservative long-term approach to investment. Recently it crossed AUM of Rs. 10,000 crores. Bank of Baroda Mutual Fund (BOB Mutual Fund) Bank of Baroda Mutual Fund or BOB Mutual Fund was setup on October 30, 1992 under the sponsorship of Bank of Baroda. BOB Asset Management

PGP/FW/08-10 DF/08/10-F-579

DIVYA KOTHIWAL

Company Limited is the AMC of BOB Mutual Fund and was incorporated on November 5, 1992. Deutsche Bank AG is the custodian. HDFC Mutual Fund HDFC Mutual Fund was setup on June 30, 2000 with two sponsorers nemely Housing Development Finance Corporation Limited and Standard Life Investments Limited. HSBC Mutual Fund HSBC Mutual Fund was setup on May 27, 2002 with HSBC Securities and Capital Markets (India) Private Limited as the sponsor. Board of Trustees, HSBC Mutual Fund acts as the Trustee Company of HSBC Mutual Fund. ING Vysya Mutual Fund ING Vysya Mutual Fund was setup on February 11, 1999 with the same named Trustee Company. It is a joint venture of Vysya and ING. The AMC, ING Investment Management (India) Pvt. Ltd. was incorporated on April 6, 1998.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Prudential ICICI Mutual Fund The mutual fund of ICICI is a joint venture with Prudential Plc. of America, one of the largest life insurance companies in the US of A. Prudential ICICI Mutual Fund was setup on 13th of October, 1993 with two sponsorers, Prudential Plc. and ICICI Ltd. The Trustee Company formed is Prudential ICICI Trust Ltd. and the AMC is Prudential ICICI Asset Management Company Limited incorporated on 22nd of June, 1993. Sahara Mutual Fund Sahara Mutual Fund was set up on July 18, 1996 with Sahara India Financial Corporation Ltd. as the sponsor. Sahara Asset Management Company Private Limited incorporated on August 31, 1995 works as the AMC of Sahara Mutual Fund. The paid-up capital of the AMC stands at Rs 25.8 crore. State Bank of India Mutual Fund State Bank of India Mutual Fund is the first Bank sponsored Mutual Fund to launch offshor fund, the India Magnum Fund with a corpus of Rs. 225 cr. approximately. Today it is the largest Bank sponsored Mutual Fund in India. They have already launched 35 Schemes out of which 15 have already yielded handsome returns to investors. State Bank of India Mutual Fund has more than Rs. 5,500 Crores as AUM. Now it has an investor base of over 8 Lakhs spread over 18 schemes. Tata Mutual Fund Tata Mutual Fund (TMF) is a Trust under the Indian Trust Act, 1882. The sponsorers for Tata Mutual Fund are Tata Sons Ltd., and Tata Investment Corporation Ltd. The investment manager is Tata Asset Management Limited and its Tata Trustee Company Pvt. Limited. Tata Asset Management Limited's is one of the fastest in the country with more than Rs. 7,703 crores (as on April 30, 2005) of AUM. Kotak Mahindra Mutual Fund Kotak Mahindra Asset Management Company (KMAMC) is a subsidiary of KMBL. It is presently having more than 1,99,818 investors in its various schemes. KMAMC started its operations in December 1998. Kotak Mahindra Mutual Fund offers schemes catering to investors with varying risk - return profiles. It was the first company to launch dedicated gilt scheme investing only in government securities

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Unit Trust of India Mutual Fund UTI Asset Management Company Private Limited, established in Jan 14, 2003, manages the UTI Mutual Fund with the support of UTI Trustee Company Private Limited. UTI Asset Management Company presently manages a corpus of over Rs.20000 Crore. The sponsorers of UTI Mutual Fund are Bank of Baroda (BOB), Punjab National Bank (PNB), State Bank of India (SBI), and Life Insurance Corporation of India (LIC). The schemes of UTI Mutual Fund are Liquid Funds, Income Funds, Asset Management Funds, Index Funds, Equity Funds and Balance Funds. Reliance Mutual Fund Reliance Mutual Fund (RMF) was established as trust under Indian Trusts Act, 1882. The sponsor of RMF is Reliance Capital Limited and Reliance Capital Trustee Co. Limited is the Trustee. It was registered on June 30, 1995 as Reliance Capital Mutual Fund which was changed on March 11, 2004. Reliance Mutual Fund was formed for launching of various schemes under which units are issued to the Public with a view to contribute to the capital market and to provide investors the opportunities to make investments in diversified securities. Standard Chartered Mutual Fund Standard Chartered Mutual Fund was set up on March 13, 2000 sponsored by Standard Chartered Bank. The Trustee is Standard Chartered Trustee Company Pvt. Ltd. Standard Chartered Asset Management Company Pvt. Ltd. is the AMC which was incorporated with SEBI on December 20,1999. Franklin Templeton India Mutual Fund The group, Frnaklin Templeton Investments is a California (USA) based company with a global AUM of US$ 409.2 bn. (as of April 30, 2005). It is one of the largest financial services groups in the world. Investors can buy or sell the Mutual Fund through their financial advisor or through mail or through their website. They have Open end Diversified Equity schemes, Open end Sector Equity schemes, Open end Hybrid schemes, Open end Tax Saving schemes, Open end Income and Liquid schemes, Closed end Income schemes and Open end Fund of Funds schemes to offer. Morgan Stanley Mutual Fund India Morgan Stanley is a worldwide financial services company and its leading in the market in securities, investment management and credit services. Morgan Stanley Investment Management (MISM) was established in the year 1975. It provides customized asset management services and products to governments, corporations, pension funds and non-profit organisations. Its services are also

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

extended to high net worth individuals and retail investors. In India it is known as Morgan Stanley Investment Management Private Limited (MSIM India) and its AMC is Morgan Stanley Mutual Fund (MSMF). This is the first close end diversified equity scheme serving the needs of Indian retail investors focussing on a long-term capital appreciation. Escorts Mutual Fund Escorts Mutual Fund was setup on April 15, 1996 with Escorts Finance Limited as its sponsor. The Trustee Company is Escorts Investment Trust Limited. Its AMC was incorporated on December 1, 1995 with the name Escorts Asset Management Limited. Alliance Capital Mutual Fund Alliance Capital Mutual Fund was setup on December 30, 1994 with Alliance Capital Management Corp. of Delaware (USA) as sponsorer. The Trustee is ACAM Trust Company Pvt. Ltd. and AMC, the Alliance Capital Asset Management India (Pvt) Ltd. with the corporate office in Mumbai. Benchmark Mutual Fund Benchmark Mutual Fund was setup on June 12, 2001 with Niche Financial Services Pvt. Ltd. as the sponsorer and Benchmark Trustee Company Pvt. Ltd. as the Trustee Company. Incorporated on October 16, 2000 and headquartered in Mumbai, Benchmark Asset Management Company Pvt. Ltd. is the AMC. Canbank Mutual Fund Canbank Mutual Fund was setup on December 19, 1987 with Canara Bank acting as the sponsor. Canbank Investment Management Services Ltd. incorporated on March 2, 1993 is the AMC. The Corporate Office of the AMC is in Mumbai. Chola Mutual Fund Chola Mutual Fund under the sponsorship of Cholamandalam Investment & Finance Company Ltd. was setup on January 3, 1997. Cholamandalam Trustee Co. Ltd. is the Trustee Company and AMC is Cholamandalam AMC Limited. LIC Mutual Fund Life Insurance Corporation of India set up LIC Mutual Fund on 19th June 1989. It contributed Rs. 2 Crores towards the corpus of the Fund. LIC Mutual Fund was constituted as a Trust in accordance with the provisions of the Indian Trust Act, 1882. . The Company started its business on 29th April 1994. The Trustees of

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

LIC Mutual Fund have appointed Jeevan Bima Sahayog Asset Management Company Ltd as the Investment Managers for LIC Mutual Fund. GIC Mutual Fund GIC Mutual Fund, sponsored by General Insurance Corporation of India (GIC), a Government of India undertaking and the four Public Sector General Insurance Companies, viz. National Insurance Co. Ltd (NIC), The New India Assurance Co. Ltd. (NIA), The Oriental Insurance Co. Ltd (OIC) and United India Insurance Co. Ltd. (UII) and is constituted as a Trust in accordance with the provisions of the Indian Trusts Act, 1882.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

The Study Purpose of the study The purpose of the study is to evaluate how much SMEs have an exposure to mutual funds and what are their investment patterns.

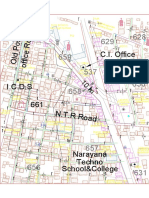

Scope of the Study The scope of study is limited to studying the investment patterns and exposure to mutual funds of SMEs in Nehru Place.

Data Collection and Job Requirement The methods that I have employed in collecting data are:

a. Online Directories like Just dial, Fundoodata etc. b. Existing database given by Reliance ( small proportion) c. Mapping the areas given to us which involves fieldwork and in turn involves gathering information like company name, financial heads name, companys contact number, companys line of work etc. d. Telephonic calls to fix an appointment with the concerned person. e. Relationship management

Limitations of the Study a. Not getting enough appointments as the financial heads may refuse to talk to us. b. Sometimes you cant reach the right person who is actually the decision maker in the organization. c. Cold calling sometimes doesnt yield the desired results d. Database sometimes given on the net is not updated which leads to wastage of time and effort.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

e. Corporates not revealing true information sometimes f. Small sample size

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

About Small and Medium Enterprises (SMEs)

With the advent of planned economy from 1951 and the subsequent policy followed by government of India, both planners and government earmarked a special role for small-scale industries and medium scale industries in the Indian economy. Due protection was accorded to both sectors, and particularly for small scale industries from 1951 to 1991, till the nation adopted a policy of liberalization and globalization. Certain products were reserved for small-scale units for a long time, though this list of products is decreasing due to change in industrial policies and climate. It can be observed that by and large, SMEs in India met the expectations of the government and developed in a manner, which made it possible for them to achieve the following objectives: High contribution to domestic production Significant export earnings Low investment requirements Operational flexibility Location wise mobility Low intensive imports Capacities to develop appropriate indigenous technology Import substitution Technology oriented industries Competitiveness in domestic and export markets

At the same time one has to understand the limitations of SMEs, which are: Low capital base Inadequate exposure to international environment Inability to face impact of WTO regime

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Inadequate contribution towards R&D Lack of professionalism

In spite of these limitations, the SMEs have made significant contribution towards technological development and exports. SMEs have been established in almost all major sectors in the Indian industry such as: Food processing Agricultural inputs Chemicals & pharmaceuticals Electronics Textiles and Garments Leather and leather goods Meat products Bio-engineering Sports goods Plastics products Computer software, etc.

The following points more clearly brings out why banks and mutual fund companies should focus on SMEs: Government and RBI pushing for SME funding in urban and semi urban areas. Large corporate are accessing funds directly from the capital markets. SMEs have become big producers and exporters of consumer goods. SMEs are now conscious of quality, production efficiencies and costs.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

SMEs have a repayment record comparable to the best borrowers. Sector growing at over 10% per annum. Large corporate are increasingly outsourcing work to SMEs.

As clearly stated above, SMEs sector has become a major source of income for the banks and mutual fund companies and is therefore selling like hot cake. Bust just making the funds and FMP s available is not a solution-neither for the SMEs nor for the banks. These products have to be made known to the investors for whom they are meant. The project undertaken deals with the marketing of these new and existing funds and FMP s to the SMEs. The project therefore started with the study of the history of mutual fund industry in India and various stages which contributed to its evolution in India and the various factors and developments added at each stage. When the thought and research process was started for the first one it was found out that the SMEs has several investment options in their pockets from the very starting like: Fixed interest government bonds. Bank fixed deposits. Share market. Commercial papers.

Although as we can see that there were various options available in the hands of the people but if we give a good analyzing look at most of these options today and have a comparative evaluation for various investments with reference to the rate of return and the unavoidable evil inflation rate we can see very clearly that in most of these investments the rate of return is very much closer to the inflation

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

rate which minimizes the net increase in the income and increase of the wealth of the people keeping it somewhere around 1-3%. So what is required by all the AMC s and other broking houses is that apart from the normal business they are doing they should also organize or sponsor several such seminars in which various prospective clients could be called and all their doubts can be cleared off according to their convenience and they should be encouraged to be a part of this booming Indian economy. Current Investment Pattern of SMEs The investment pattern of people whose investment perspective have taken a new turn, has changed a lot and they are looking towards new horizons of investments. Currently the chief options available for investment are: Government bonds and debentures Commercial papers and deposits Fixed deposits PPF Retirement and Pension schemes Equity based MF & ELSS plan Direct trading into stock market Multi commodity exchange Real estate

Now we can make out that today people are not just looking towards a simple and safer saving but they are making attempts to get an investment which can lead for a healthy return along with the security of money and moreover they are

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

diversifying their investment and following the simple policy of don t keep all your eggs in one basket. So a wise diversification no doubt reduces the net risk and makes the total portfolio a better returning one and obviously a lesser risky. Hence we can conclude by saying that the present day investor is much wiser and has more number of baskets to keep his eggs in. Factors affecting the investors while making the portfolio: Time frame of investment Return on investment Risk-benefit ratio Diversification of risk Tax benefits Risk coverage Value added features Flexibility and liabilities of investments Inflation rate

If we analyze closely we can see that the MF more or less satisfy all the parameters of the present day investor, may be this is the reason behind the fast and healthy growth of the MF industry. Instruments in the Indian Debt Market:

Certificate of Deposit: Issued by the scheduled commercial banks excluding the regional rural banks. These are unsecured negotiable promissory notes.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Commercial Paper: A CP is a short term, unsecured instrument issued by corporate bodies (public and private) to meet short term working capital requirements. The maturity varies between 3 months to 1 year.

Corporate debentures: These are issued by companies with physical assets, as secured instruments in the form of certificates. They are assigned a credit rating by the rating agencies.

Floating rate bonds: Short to medium term interest bearing instruments issued by financial corporations. A typical maturity ranges from 3 years to 5 years. Such bonds if issued by Financial Institutions are generally unsecured, while those issued by Private corporations are secured.

Government Securities: These are medium to long term interest bearing obligations issued by the Government of India and the States through the RBI. These are issues where the rates are prespecified and the investor (a corporate or an individual) only bids for quantity. The RBI here acts only as a Depository.

Treasury Bills: These are short term obligations issued through the RBI also by the government of India at a Discount. RBI issues T- Bills for different tenures ranging from 91 days to 364 days, also issued through an auction procedure. The yield is determined on the basis of bids tendered and accepted.

Bank and Financial institution Bond : Most of these are in the form of promissory notes transferable by endorsement and delivery. These are issued mainly by Financial Institutions such as ICICI/IDBI/IFCI or by commercial Banks

Public Sector Undertaking (PSU) Bonds : These are medium and long term obligations issued by public sector companies where the

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

government shareholding is grater than 51%. Some PSU bonds Carry tax exemptions. The minimum maturity is 5 years for taxable bonds and 7 years for tax free bonds. Such bonds are generally not guaranteed by the government and are transferable in the Formby endorsement and delivery

The Analysis Sources of Data Data are of two types namely primary and secondary: Primary Data refers to information that is developed or gathered by the researcher specifically for the research project at hand. Secondary Data refers to information that has previously been gathered by someone other than the researcher and/or for some other purpose than the research project at hand. When deciding if the data to be collected is secondary in nature, ask the following question: Would the data have been collected as a part of the normal course requirements? If the answer is no, then the data should be classified as primary.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

INTERNAL DATA Internal data are data available within the organization for which the research is being conducted. The information may be in a ready to use format or may require processing. In our organization data was found on the company server.

EXTERNAL DATA External data are data that originate external to the organization. This data was found on company websites, it included published material, online databases and some syndicated services.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

QUALITATIVE RESEARCH An unstructured, exploratory research methodology based on small samples that provides insights and understanding of the problem setting. QUANTITATIVE RESEARCH A research methodology that seeks to quantify the data and, typically, applies some form of statistical analysis Our research involved quantity, we had a large number of representative cases which had structured data collection and we also recommended a final course of action. In my study, primary data is the data that I collected by mapping the companies in Nehru place and appointments that I had with financial heads who gave valuable information. Secondary data would include the already existing database given initially by Reliance Mutual fund house and also data collected on the internet through websites like Fundoodata, Just Dial etc. Sampling Sampling Design

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

The sample chosen from the target population for retailers was based on the size of the particular area of Delhi as well as the number of retailers present in that particular area. This was also done on the basis of convenience sampling. The customers were sampled on the basis of convenience sampling. Sample Size The sample size for the project was taken as 200. The market research was based on convenient sampling. Scope of Study The research is categorically classified into three sub-researches on the basis of the products provided by the company. The scope of this study essentially includes the regions, areas, and the product categories in which the surveys have been conducted. The scope of the study can be broadly categorized into three scopes, namely:

Geographical scope Product scope Time scope or extent of study

Geographical scope The geographical scope covers areas from where the samples have been taken. Majorly the sample has been taken from Nehru place and the adjoining areas and a couple of samples have been taken from Okhla Industrial Estate

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Product scope The product scope features the product category in which the research has been carried out. The product category of this study is mutual funds and specifically highly liquid debt schemes catering to corporate clients.

Procedure for Data Collection Data collection means gathering information to address those critical evaluation questions that may be in the minds of the company/ researcher. And the procedure for data collection to be adopted depends on the requirements of the research. For the purpose of data collection, I first identified the area that I would work in and in that I identified the companies which were capable of making an investment who had decent turnover so that they could have the capacity to invest atleast 1 crore which is the minimum amount for institutional investment. This was done with the help of internet, database provided by the company as well as cold callings. Before going further to decide the method of data collection, we identified some of the important issues in this regard. These were: 1. Availability: We realized that there may be some information already available that can help answer some questions or guide the development of new guidelines. Hence we reviewed information in prior records, reports, and summaries. 2. Pilot Testing: It was essential to test the information collection instrument or the process we designed. 3. Protocol Needs: In many situations, we needed to obtain appropriate permission or clearance to collect information from people or other sources. 4. Reactivity: Reactivity refers to how the way of asking a question would alter the response we would get. It may also be a concern if our presence during data collection may possibly alter the results.. 5. Reliability: Will the evaluation process designed consistently measure what we want it to measure? That is whether multiple interviews, settings, or observers, will consistently measure the same thing each time? In whatever

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

instrument we design, will people interpret our questions the same way each time? 6. Validity: Validity means will the information collection methods designed produce information that measures what we require to measure? We should be sure that the information we collect is relevant to the purpose in hand. Having kept these issues in mind, we adopted the following methods for data collection: 1. Personal Interview An interview is called personal when the Interviewer asks the questions face-toface with the Interviewee. Personal interviews were conducted in companies where I went for the appointment. These were mainly of the form of structured interviews. 2. Questionnaire A questionnaire is a structured technique for data collection that consists of a series of questions that a respondent answers. The questionnaire comprised of multiple choice, numeric open-ended as well as text-open ended questions, depending on the nature of the query.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Results and Interpretation In this section we present all the facts and figures along with analysis collected during the market research activities performed during the course of thesis work. The analysis is based on the questionnaire, a copy of which is there in this report. The software used to analyse the data is Microsoft Excel and Stats software. The primary purpose of the study was to understand the current investment patterns of SMEs and their exposure to mutual funds. Companies at Nehru place which is considered to be the IT hub of Delhi were consciously chosen for the purpose of study as they house maximum number of companies in the city across various segments. The numbers of companies covered have already been mentioned (200).

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

The Findings Diversified Portfolio Figure 11 tells us that about how companies invest their money at present in the market.

We see that about 55% of the companies had diversified portfolio and 45% didnt. A diversified portfolio would mean investing in more than one instruments. Now which type of instruments are we talking about here remains to be seen which will come up in later questions. From the information given by ICICI we are here assuming that most companies are investing in either bank FDs or share market. Next question will prove whether it is true or not.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Investment Tools Company Invests In Instruments Company invests in as you can see, majority i.e. about 61% of investments were either done in equity or bank FDs where in Bank FDs share is 32% which actually proves our hypothesis earlier on based on past information.

Now if companies are majorly investing in FDs and Equity then Savings and Returns should be the two biggest factors in compelling the company to invest. It may be because of this only that Reliance Mutual Fund Houses Fixed Maturity Plan which is on the similar line as bank FD is selling like hot cake. This figure also shows another important result, only 14% of the companies invest in mutual funds which justifies our hypothesis showing lack of penetration of mutual funds in SMEs.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Reason for investment

As you can see from the above figure 45% of companies invests for savings purpose and 30% returns which confirms. This could be because of companies investing in bank FDs and equity. Rank Instruments

If you look at the ranking you can make out that majorly companies are opting for either bank FDs (95) or RBI bonds (66) which are safe as 1st rank or 2 nd or prefer for equities (116). This might indicate that companies are not aware about how safe mutual funds are on the debt side. This is an early indication that companies are not much aware about the safety and steady retruns given by mutual funds.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Frequency of company investment

The above figure shows the frequency of company investment where you can see majorly companies do it once in 15 days or once in a week. Short investment or Long term investment

As you can see from the above figure that mainly companies are going for long term investments which indicates two things. One, companies are not aware about highly liquid debt funds that we have in mutual funds where in you can

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

invest even for one day and get return on it. Second, it gives an indication that companies are sticking to longer term Bank Fixed deposits. Expected rate of return on Debt investments

Mainly companies are expecting return on debt investment to be above 6% which is reasonable enough. Expected return on Equity investments

As we can see from the above figure that undoubtedly companies are expecting 20% and above return on their equity investment which is again reasonable as capital gain has been increased to 15% recently.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Awareness Level if Already Investing in Mutual Funds

As you can see those who are already investing know the benefits provide by mutual funds. Mutual funds offer liquidity steady returns and tax advantage as well. On whose advice do you invest

This figure shows role of relationship management to an extent as 41% of the companies are investing through relationship managers. So this highlights the point that relationship management is quite necessary if you want to bring in business for the company. Its not only with the relationship managers, but it applies to all segments. If you want your company to grow you have to have

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

good relationship with the client from whom you are thinking of bringing in the business. Type of mutual fund you company invests in This again confirms the hypothesis that there is lack of awareness about highly liquid debt schems for corporates as you can see companies are heavily investing in equity (62%) which actually brings in another interesting point in the forefront. This figure is actually bringing in one of the limitations of the study which is wrong information provided by the company due to either lack of knowledge or some other reason. As earlier on we had a chart which showed those who invested in mutual funds knew about liquidity in mutual funds, and they also knew everything about mutual funds. But ehre the figure are giving contradictory views.

Reason for company investing in Debt Mutual Funds Here you can clearly see that mainly companies are investing in debt mutual funds because it offers steady returns and liquidity (total-74%)

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Reason for investing in equity mutual funds

As you can see mainly companies are investing in equity mutual funds for greater return over inflation which currently is a big factor in India. Company not investing in mutual funds because:

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

As you can see the reason for not investing is dipersed but majorly its either because of lack of knowledge or low returns as compared to share market which again strengthens our claim of companies investing in equities more than mutual funds. Would you consider investing in mutual funds if:

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Since mutual funds provides liquidity, steady returns, low risk,tax benefits, once companies are made aware about this they are either ready to invest in them or can think of investing.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Awareness about current account surplus earning interest

As it is clear from the above figure that mostly people are not aware about current account surplus earning interest for even one day (61%) which again strengthens our argument that companies are not aware about liquid funds that much.

Would you invest in mutual funds if you knew about benefits:

As you can clearly see that most of the companies (89%) are ready to invest if given proper information about mutual funds which is a very important point. So this gives mutual fund companies motivation to explore even more areas where they can find prospective clients.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Would you like to know more about mutual funds

As you can see the eagerness of companies once they are provided the right information about mutual funds. It states that 94% companies want to know more about mutual funds. This is a good indication for mutual fund houses that are always in a hunt to find new corporate.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Conclusion

The conclusion is that currently a lot of companies are still not fully informed about the benefits that are associated with investing in mutual funds. The ones which are investing are investing more in equity schemes which shows that they dont know much about the highly liquid debt schemes that mutual fund provides. Non mutual fund investors are mainly investing their money in bank fixed deposits of longer maturity when they can get better returns if they park money in mutual funds. Also, though the sample size is small but it still gives an indication that the sector in which an SME is in will affect its decision to whether or not invest in mutual funds but a conclusive research needs to be done on this. Its now the job of mutual fund houses to increase their efforts even more and try to create more and more awareness about mutual funds.

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

Annexure In the annexure I am attaching the questionnaire which used for analysis and interpretation: A Study On Investment Pattern of Small & Medium Enterprise (SME) Segment (Focus on Mutual Funds) Name: __________________________

Company:

__________________________

Designation:

__________________________

Contact Number:

__________________________

1. Does your company have a diversified portfolio?

Yes No

2. Which are the investment tools your company invests in?

Bank Fixed Deposit Mutual Funds RBI Bonds Others

Equity

Equities

3. Your company primarily invest for

Tax Benefits Returns Liquidity Savings Any other (Please Specify)

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

4. Rank the investments options according to your companys preference of Investment:

Bank Fixed Deposit RBI Bonds Mutual Funds Equities Any other (Please Specify)

5. What is the frequency of your companys investment? a. Once a Week b. Once in 15 Days c. Once a Month d. Once in 3 Months e. Once in 6 Months f. Once a Year 6. Does your company go in for: a. Short-term b. Long-term investments (Please specify the period) _____________________ 7. What is the expected rate of return of your company from debt investments? a. Below 4% b. 4%-5% c. 6%-7% d. Above 7% 8. What is the expected rate of return of your company from equity investments? a. 5% - 9% b. 10% - 14% c. 15% - 20% d. Above 20% 9. If your company invests in mutual finds: a. b. c. d. Are you aware of the various schemes offered by Mutual Funds? Do you know that Mutual Funds offers Liquidity to your funds? Do you know that Mutual Funds offers steady returns? Do you know you can get Tax Advantages by investing in Mutual Funds?

Yes Yes Yes Yes No No No No

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

e. Primarily on whose external advice do you invest? 1. 2. 3. 4. 5.

Debt

Bank Distributor Agent Direct Investment RM

Equities Balanced

f. Which type of Mutual Fund does your company primarily invest in? g. Your company invests in Debt Mutual Funds because it offers:

Steady Returns Risk Mitigation Liquidity Any Other Tax Benefits

h. Your company invests in Equities Mutual Funds because it offers:

Higher Returns Long Term Capital Gains Returns>Inflation Wealth Creation Tax Advantage Any Other Higher Returns than debt Tax Advantage funds Returns>Inflation Any other

i. Your company invests in Balanced Mutual Funds because it offers:

10. If your company does not invest in Mutual Funds: a. Your company does not invest in Mutual Funds because of i) Bitter Past Experience ii) Lack of Knowledge iii) Lack of Confidence in Service Being Provided iv) Difficulty in Selection of Schemes v) Inefficient Investment Advisors vi) Low Returns as compared to Share Market

Yes Yes Yes Yes Yes No No No No No

b. Would you invest in Mutual Funds for your company if it offered (Y/N) i) Greater Tax Benefits vis--vis Others. ii) Greater Liquidity vis--vis Others. iii) Investment for a Shorter Duration, Even for One Day iv) Steady Returns v) Net Returns Better than a Bank Fixed Deposit with High Liquidity vi) Diversification of Portfolio vii) Minimization of Risks

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

11. Are you aware that current account surpluses can also earn interest by parking in Mutual Funds even for one day?

Yes

No

12. .If Mutual Funds offer you Steady Returns, Tax Benefits, Liquidity, Diversification of portfolio, Lesser risk etc., would you consider it as an investment option in the future for your company?

Yes No

13. Would you be interested to know more about Mutual Funds?

Yes No

PGP/FW/08-10

DF/08/10-F-579

DIVYA KOTHIWAL

References

www.mutualfundsindia.com www.amfiindia.com

Richard I. Levin, David S. Rubin Seventh edition, Statistics For Management

www.worldbank.org

PGP/FW/08-10

DF/08/10-F-579

You might also like

- South Africa in DetailDocument1 pageSouth Africa in DetaildivzkNo ratings yet

- Italian HusbandsDocument1 pageItalian HusbandsdivzkNo ratings yet

- German Battleship BismarckDocument1 pageGerman Battleship BismarckdivzkNo ratings yet

- Thesis SynopsisDocument4 pagesThesis SynopsisdivzkNo ratings yet

- Ties That BindDocument123 pagesTies That BinddivzkNo ratings yet

- Africa Is The World's Second-Largest and Second-Most-PopulousDocument1 pageAfrica Is The World's Second-Largest and Second-Most-PopulousdivzkNo ratings yet

- A Short History of Africa Basil DavidsonDocument76 pagesA Short History of Africa Basil Davidsonnikolaas1No ratings yet

- Thesis Final SDocument62 pagesThesis Final SdivzkNo ratings yet

- A Short History of Africa Basil DavidsonDocument76 pagesA Short History of Africa Basil Davidsonnikolaas1No ratings yet

- R EetingsDocument1 pageR EetingsdivzkNo ratings yet

- Ties That BindDocument123 pagesTies That BinddivzkNo ratings yet

- JD - GBP - Research AnalystDocument2 pagesJD - GBP - Research AnalystdivzkNo ratings yet

- Consumer Behavior Study of Organizational IndustryDocument2 pagesConsumer Behavior Study of Organizational IndustrydivzkNo ratings yet

- Summer ProjectDocument58 pagesSummer ProjectdivzkNo ratings yet

- Cakesrecip VunitzqzDocument51 pagesCakesrecip VunitzqzChayma Bouaoiina100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Digital Media AirlinesDocument4 pagesDigital Media AirlinesdivzkNo ratings yet

- Calendar of National and International DaysDocument5 pagesCalendar of National and International DaysdivzkNo ratings yet

- JD - GBP - Research AnalystDocument2 pagesJD - GBP - Research AnalystdivzkNo ratings yet

- Luxor Writing Instruments Summer Internship ThanksDocument1 pageLuxor Writing Instruments Summer Internship ThanksdivzkNo ratings yet

- New Cover PageDocument2 pagesNew Cover PagedivzkNo ratings yet

- Airtel InfoDocument4 pagesAirtel InfodivzkNo ratings yet

- SloagansDocument1 pageSloagansdivzkNo ratings yet

- Harlequin PresentsDocument1 pageHarlequin Presentsdivzk0% (1)

- Shruti and Gaurav Engagement AnnouncementDocument1 pageShruti and Gaurav Engagement AnnouncementdivzkNo ratings yet

- Digital Media AirlinesDocument4 pagesDigital Media AirlinesdivzkNo ratings yet

- The General ManagerDocument1 pageThe General ManagerdivzkNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hath Way DraftDocument540 pagesHath Way DraftdivzkNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FIN 102 Banking and Financial Institutions OverviewDocument10 pagesFIN 102 Banking and Financial Institutions Overviewron aviNo ratings yet

- Medical Chart LicDocument3 pagesMedical Chart LicBijay Krishna Chatterjee43% (7)

- Annex V:: Pre-Financing Guarantee FormDocument1 pageAnnex V:: Pre-Financing Guarantee FormcristiancaluianNo ratings yet

- FAF Revision 3 With AnswersDocument4 pagesFAF Revision 3 With AnswersSadeep MadhushanNo ratings yet

- Loi NewDocument2 pagesLoi NewFikri Permana100% (1)

- Form 3815 Lost PolicyDocument2 pagesForm 3815 Lost Policyanurag655No ratings yet

- Clauses of Marine InsuranceDocument3 pagesClauses of Marine InsuranceSanjeev PradhanNo ratings yet

- Test Bank For Insurance Handbook For The Medical Office 14th Edition by FordneyDocument5 pagesTest Bank For Insurance Handbook For The Medical Office 14th Edition by Fordneya319573539100% (1)

- A Study on Perception of Customers towards Life Insurance with Special Reference to Birla Sun LifeDocument63 pagesA Study on Perception of Customers towards Life Insurance with Special Reference to Birla Sun Lifeharjot singhNo ratings yet

- Facebook India Online Services Pvt. LTD., Purchase Order: SupplierDocument9 pagesFacebook India Online Services Pvt. LTD., Purchase Order: SupplierVamsheeNo ratings yet

- Rhode Island Property Management Agreement PDFDocument4 pagesRhode Island Property Management Agreement PDFDrake MontgomeryNo ratings yet

- Mba Insurance Black BookDocument59 pagesMba Insurance Black BookleanderNo ratings yet

- Daily Derivatives Report: Nifty, Bank Nifty Pivot Points and F&O Recommendations for 5th May 2016Document3 pagesDaily Derivatives Report: Nifty, Bank Nifty Pivot Points and F&O Recommendations for 5th May 2016Rohan KoliNo ratings yet

- Candano Shipping Held Liable for DeathDocument2 pagesCandano Shipping Held Liable for DeathKylie Kaur Manalon Dado100% (1)

- HDFC ERGO General Insurance Company Limited: Policy No. 2311 2007 3732 9204 000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2311 2007 3732 9204 000Padmaja SNo ratings yet

- Go Digit General Insurance LTD.: IRDAN158RP0003V01201718Document3 pagesGo Digit General Insurance LTD.: IRDAN158RP0003V01201718sarath potnuriNo ratings yet

- OPD Form IHealthcare-2Document2 pagesOPD Form IHealthcare-2Masoom Kazmi100% (1)

- Examining Expected and Perceived Service Quality in Life Insurance Corporation of IndiaDocument9 pagesExamining Expected and Perceived Service Quality in Life Insurance Corporation of IndiaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- 7.aboitiz Shipping Corporation V New IndiaDocument4 pages7.aboitiz Shipping Corporation V New IndiaKeangela LouiseNo ratings yet

- Fundamental Legal Principles of Insurance Contract: QUESTION One (Multiple Choice)Document13 pagesFundamental Legal Principles of Insurance Contract: QUESTION One (Multiple Choice)Ameer Elatma100% (1)

- INDEMNITY BOND - Loss of Cheque Book UDocument2 pagesINDEMNITY BOND - Loss of Cheque Book UNeelam SharmaNo ratings yet

- Pandiman v. Marine Manning Management Corp. and Singhid: PPI Not Liable for Death Benefits as Non-Insurance AgentDocument2 pagesPandiman v. Marine Manning Management Corp. and Singhid: PPI Not Liable for Death Benefits as Non-Insurance AgentNN DDLNo ratings yet

- Geostellar PetitionDocument6 pagesGeostellar PetitionJohn Bringardner100% (1)

- Palileo v. CosioDocument4 pagesPalileo v. CosioHency TanbengcoNo ratings yet

- Proposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car PackageDocument2 pagesProposal No. PMTB112211795455: Motor Insurance - Proposal Form Cum Transcript Letter For Private Car Packagekrishna11143No ratings yet

- Shawshank 7-Year Financial ProjectionDocument10 pagesShawshank 7-Year Financial Projectionnyashadzashe munyatiNo ratings yet

- India's Gold Rush Its Impact and SustainabilityDocument35 pagesIndia's Gold Rush Its Impact and SustainabilitySCRIBDEBMNo ratings yet

- Nandigama RS No. 661 - Survey Boundry-ModelDocument1 pageNandigama RS No. 661 - Survey Boundry-Modelnnp townplanningNo ratings yet

- Everything You Need to Know About LIC of India (35Document10 pagesEverything You Need to Know About LIC of India (35mishthiNo ratings yet

- As 4303-1995 (Reference Use Only) General Conditions of Subcontract For Design and ConstructDocument8 pagesAs 4303-1995 (Reference Use Only) General Conditions of Subcontract For Design and ConstructSAI Global - APACNo ratings yet