Professional Documents

Culture Documents

Traders Playbook 2 Apr 2013

Uploaded by

Vinod MegendranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Traders Playbook 2 Apr 2013

Uploaded by

Vinod MegendranCopyright:

Available Formats

PRIVATE CLIENT RESEARCH

TRADERS PLAYBOOK

APRIL 2, 2013

Shrikant Chouhan shrikant.chouhan@kotak.com +91 22 6621 6360

Amol Athawale amol.athawale@kotak.com +91 20 6620 3350

Premshankar Ladha premshankar.ladha@kotak.com +91 22 6621 6261

Traders Playbook

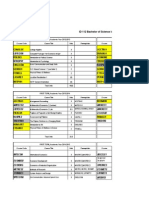

Scripts Action Stop loss NIFTYFUT BANKNIFTY-F RELIANCE SAIL RANBAXY TATASTEEL HDFC LT ONGC M&M MARUTI TATAMOTORS DLF BHARTIARTL LICHSGFIN RAYMOND TITAN JETAIRWAYS JSWSTEEL TECHM RELCAPITAL AXISBANK YESBANK SBIN INDUSINDBK ICICIBANK INFY TCS ACC AMBUJACEM BHEL RELINFRA TATAPOWER Buy at 176 Buy at 326 174 324 179 332 Buy at 302 300 308 Buy at 507 503 515 Buy at 248 246 252 Buy at 436 433 444 Target (Rs) Extreme 5628 11287 766 60 436 303 794 1345 304 824 1235 255 244 271 213 266 239 507 622 996 302 1234 425 1986 390 1011 2832 1497 1117 163 176 326 92 Supports Probable Achievable 5664 11358 771 61 441 306 805 1364 306 835 1250 259 248 279 215 269 243 513 630 1008 306 1249 428 2036 395 1024 2885 1526 1138 166 179 332 94 5686 11402 774 62 444 311 815 307 847 1268 262 250 286 221 276 251 526 647 314 1282 430 2065 405 Closings (Rs) Achievable 5721 11473 778.75 62.7 451.75 314.7 825.2 308.85 857.1 1283.8 265.5 253.2 293.65 226.55 283.1 254.75 539.95 663.2 322.15 1314.9 432.3 2090.6 415.7 5756 11544 784 64 459 319 835 1416 311 868 1300 269 256 301 232 290 261 547 671 1074 326 1348 435 2116 421 1065 2981 1576 1175 179 185 343 97 Resistance Probable 5778 11588 787 64 463 323 846 1433 312 879 1317 272 258 305 235 294 267 560 688 1102 334 1365 437 2145 431 1079 3003 1588 1184 181 186 346 98 Extreme 5814 11659 791 66 466 327 857 1452 314 890 1333 276 263 316 241 301 274 573 704 1135 342 1396 439 2195 441 1092 3057 1616 1205 185 189 352 100 Trend Levels 5682 11363 772.9 62.55 438.75 312.85 826.25 1366.2 311.4 861.3 1281.2 269.15 234.7 291.75 224.9 285.85 256.4 517.9 672.35 1059.5 312.7 1300.7 428.9 2072.75 404.7 1045.2 2889.35 1575.75 1159.2 174.2 177 324.45 96.5 % pft/ Loss 0.69% 0.97% 0.76% 0.24% 2.96% 0.59% -0.13% 2.38% -0.82% -0.49% 0.20% -1.36% 7.88% 0.65% 0.73% -0.96% -0.64% 4.26% -1.36% 0.16% 3.02% 1.09% 0.79% 0.86% 2.72% 0.61% 1.90% -1.20% 0.15% 0.03% 3.11% 4.41% -0.67% Strong Strong Strong Strong Strong Strong Weak Strong Weak Weak Strong Weak Strong Strong Strong Weak Weak Strong Weak Strong Strong Strong Strong Strong Strong Strong Strong Weak Strong Strong Strong Strong Weak Trend

1381 1398.65

1035 1061.15

1039 1051.55 2908 2944.2

1538 1556.85 1147 170 180 335 95 1160.9 174.25 182.5 338.75 95.85

Source:

Trading Tool changes daily and is valid only for the day. For Nifty and Bank Nifty, we have considered the F&O price For stocks, we have used cash price because of discount and premium variations. You can trade in cash segment or Futures using this as a base. If the cash segment is nearing the Stop Loss level, then it is recommended to exit the trade from the F&O segment irrespective of the discount or premium in cash levels.

... contd

TRADERS PLAYBOOK

April 2, 2013

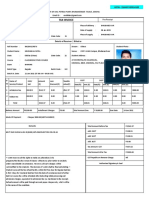

Closing Prices Closing price is that price at which a scrip closes on the previous day. Traders can start their intraday trade on this level. The stock or index should sustain above or below the closing price else you should exit the trade. Ideally, half a percent should be the stop loss above or below the closing price to enter the trade. Trend Trend is the level at which the tendency of Indices and Stocks can be identified. For best results, you can use the 'Trend Remarks' to trade. A 'Weak' trend means that traders can trade with a negative bias. If the trend is 'Strong', you can trade long with a positive bias. Base price should be the closing price. Achievable (Supp/Resis) It is the price which can be achieved if the Index/Stock trades above or below the closing price. During normal course of trading, first levels are important as one can take profits around first resistance and supports levels. Probable (Supp/Resis) It's a second resistance/support and can be achieved if stocks/indices are in trending mode. Events can lead stocks and indices to reach these levels. Extreme levels Sometimes, the stocks fall or rise to their average lowest or highest levels FOR THE DAY and that may act as an excellent contra buying or selling opportunity with a stop loss given in the table. This means buying around extreme support and selling around extreme resistance strictly with a given stop loss. For e.g. If the extreme support for Nifty is given at 5605, and in case the market comes down to similar levels, then you can initiate long positions with the given 'stop loss for long' in the column, say at 5585. If it breaks 5585 then the trader must exit the position. This is valid on both the sides.

Fundamental Research Team

Dipen Shah IT dipen.shah@kotak.com +91 22 6621 6301 Sanjeev Zarbade Capital Goods, Engineering sanjeev.zarbade@kotak.com +91 22 6621 6305 Teena Virmani Construction, Cement teena.virmani@kotak.com +91 22 6621 6302 Saurabh Agrawal Metals, Mining agrawal.saurabh@kotak.com +91 22 6621 6309 Saday Sinha Banking, NBFC, Economy saday.sinha@kotak.com +91 22 6621 6312 Arun Agarwal Auto & Auto Ancillary arun.agarwal@kotak.com +91 22 6621 6143 Ruchir Khare Capital Goods, Engineering ruchir.khare@kotak.com +91 22 6621 6448 Ritwik Rai FMCG, Media ritwik.rai@kotak.com +91 22 6621 6310 Sumit Pokharna Oil and Gas sumit.pokharna@kotak.com +91 22 6621 6313 Amit Agarwal Logistics, Transportation agarwal.amit@kotak.com +91 22 6621 6222 Jayesh Kumar Economy kumar.jayesh@kotak.com +91 22 6652 9172 K. Kathirvelu Production k.kathirvelu@kotak.com +91 22 6621 6311

Technical Research Team

Shrikant Chouhan shrikant.chouhan@kotak.com +91 22 6621 6360 Amol Athawale amol.athawale@kotak.com +91 20 6620 3350 Premshankar Ladha premshankar.ladha@kotak.com +91 22 6621 6261

Derivatives Research Team

Sahaj Agrawal sahaj.agrawal@kotak.com +91 22 6621 6343 Rahul Sharma sharma.rahul@kotak.com +91 22 6621 6198 Malay Gandhi malay.gandhi@kotak.com +91 22 6621 6350 Prashanth Lalu prashanth.lalu@kotak.com +91 22 6621 6110

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Transactions involving futures, options and other derivatives involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forwardlooking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Kotak Securities has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group. The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, ratings, and target price of the Institutional Equity Research Group of Kotak Securities Limited. Kotak Securities Limited is also a Portfolio Manager. Portfolio Management Team (PMS) takes its investment decisions independent of the PCG research and accordingly PMS may have positions contrary to the PCG research recommendation. We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or act as advisor or lender I borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. Kotak Securities Limited generally prohibits its analysts from maintaining financial interest in the securities or derivatives of any of the companies that the analysts cover. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Kotak Securities' prior written consent. Registered Kotak Securities Office: - Private Kotak Securities Client Research Limited, Bakhtawar, 1st floor, 229 Nariman For Point, Private Mumbai Circulation 400021 India.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Managerial Accounting Und Erst A DingsDocument98 pagesManagerial Accounting Und Erst A DingsDebasish PadhyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- FEES SCHEDULE 2011 - 2012: Australian International SchoolDocument2 pagesFEES SCHEDULE 2011 - 2012: Australian International SchoollephammydungNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2019-04-03 Certo V BONY Mellon FL1st DCA 17-4421Document5 pages2019-04-03 Certo V BONY Mellon FL1st DCA 17-4421D. BushNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Cost - CH-1 Cma-IiDocument14 pagesCost - CH-1 Cma-IiShimelis TesemaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Problems 13 14Document13 pagesProblems 13 14heyNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Valuation - Multiples and EV Value DriversDocument27 pagesValuation - Multiples and EV Value DriversstrokemeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Exercises For Corporate FinanceDocument13 pagesExercises For Corporate FinanceVioh NguyenNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Borrowing Powers of CompanyDocument37 pagesBorrowing Powers of CompanyRohan NambiarNo ratings yet

- Acc101 - 4Document14 pagesAcc101 - 4Nguyen Thi My Ngan (K17CT)No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Secrecy of Bank Deposits Unclaimed Balnaces Law QuestionsDocument4 pagesSecrecy of Bank Deposits Unclaimed Balnaces Law QuestionsRoseanne100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ithrees's Whole Ion Finalyzed To PrintDocument82 pagesIthrees's Whole Ion Finalyzed To PrintMohamed FayasNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Deliverables: Professional ExperienceDocument1 pageDeliverables: Professional ExperienceArjav jainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HUM-4717 Ch-5 Evaluating A Single Project 2020Document47 pagesHUM-4717 Ch-5 Evaluating A Single Project 2020SadatNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Solved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFDocument1 pageSolved Alpine Corporation Is A Qualified Small Business Corporation Eligible To PDFAnbu jaromiaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Investing 101Document27 pagesInvesting 101KaramSoftNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Marriott International COPORATE STRATEGYDocument5 pagesMarriott International COPORATE STRATEGYYasir Jatoi100% (1)

- An Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)Document37 pagesAn Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)samson naantongNo ratings yet

- Detailed Course Outlines of Term VI - 2018-19Document78 pagesDetailed Course Outlines of Term VI - 2018-19vimanyu vermaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CEB Architecture High Impact CapabilityDocument12 pagesCEB Architecture High Impact CapabilityCody LeeNo ratings yet

- Chapter 2 Ca AnswersDocument9 pagesChapter 2 Ca Answersfaaltu accountNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Apply For A U.SDocument1 pageApply For A U.Scm punkNo ratings yet

- AE-MGT FlowchartDocument9 pagesAE-MGT FlowchartJean Thor Renzo MutucNo ratings yet

- Ray, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyDocument20 pagesRay, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyEEMNo ratings yet

- Unit Ii: Audit of IntangiblesDocument13 pagesUnit Ii: Audit of IntangiblesMarj ManlagnitNo ratings yet

- Sap Fi /co Course Content in Ecc6 To Ehp 5Document8 pagesSap Fi /co Course Content in Ecc6 To Ehp 5Mahesh JNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- VP Director Finance Securitization in USA Resume Timothy LoganDocument3 pagesVP Director Finance Securitization in USA Resume Timothy LoganTimothyLoganNo ratings yet

- Chapter 2Document25 pagesChapter 2heobenicerNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)