Professional Documents

Culture Documents

Making Inv Dec

Uploaded by

Restu AgustiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Making Inv Dec

Uploaded by

Restu AgustiCopyright:

Available Formats

14

Strategic Issues In Making Investments Decisions

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-2

Investment Decisions

Investments are major decisions that have longterm consequences beyond current consumption.

Two effects of time on a decision and its outcomes distinguish an investment decision: 1. The decision commits resources for a lengthy period of time, and this commitment usually prevents taking another future opportunity 2. Managements flexibility to modify an investment as time and information unfold can affect alternative decisions.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-3

Learning Objective 1

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-4

Strategic Investments

A strategic investment is a choice among alternative courses of action and the allocation of resources to those alternatives most likely to succeed after considering . . . 1) changes in natural, social, and economic conditions, and 2) actions of competitors.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-5

Learning Objective 2

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-6

Information about External Events

Sources and Usefulness of External Information

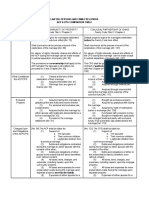

External Information Uncontrollable future events Organization's Financial Records Past financial records have limited usefulness for predicting future events if the organization has never operated in a similar environment Past financial records have limited usefulness for predicting future odds if the organization has never operated in a similar environment. Interviews with Knowledgeable Individuals Company personnel who can think creatively might identify future events. Experienced consultants also can be excellent sources of future events. Experienced consultants and company personnel can estimate odds, but individuals are notoriously weak at this task. Publicly Available information News, government, foundation, and industry analyses can be excellent sources of future events

Likelihood of future events' occurrence

Group brainstorming methods and decision-support software may help identify the range of future events.

News, government, foundation, and industry analyses can be excellent sources of the likeliness of future events.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-7

Likelihood of Future Events Occurrence

Sensitivity Analysis Scenario Analysis

Forecasts the effects of likely combinations of future events on investment outcomes.

Forecasts the effects of a likely change in each future, relevant event on investment outcomes.

Expected Value Analysis

Summarizes the combined effects of relevant future events on decision outcomes, weighted by the probability or odds of the events occurrence.

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-8

Expected Value Analysis

The management of Matrix, Inc. is in the process of accessing the probability of market growth for their product. The following consensus has been reached:

Relevant Future Event Annual market growth = 8% Annual market growth = 4% Annual market growth = 2% Total probability Probability of Occurrence 30% 40% 30% 100%

Expected Market = (8% .30) + (4% .40) + (2% .30) Growth

E[market growth] = 2.4% + 1.6% + .6% = 4.6%

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-9

Internal Information

Sources and Usefulness of Internal Information

Internal information Effect of future events on investment costs and benefits Organization's financial records Account or regression analysis of financial records might be useful to predict costs or benefits if expected future activities are similar to recent experience. Interviews with knowledgeable individuals Consultants can bring knowledge of other organizations' experiences with similar events. Company personnel can apply others' experiences and perform engineering analysis to predict costs and benefits. Publicly available information Descriptions of other organizations' experiences with similar events can be helpful for predicting future costs and benefits.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-10

Discounted Cash Flow Analysis

A method of comparing alternative investments Combines estimates of present and future cash outflows and inflows associated with each investment Discounts the cash flows to account for the opportunity costs of committing funds Differs from payback period methods:

DCF Includes all cash flows throughout the life of the investment DCF always discounts the cash flows

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

14-11

Investment Cash Flows

Estimate separately 3 types of cash flows:

1) Investment cash flows

a) Asset acquisition (and disposal of old asset) b) Tax effect from disposal of old asset c) Tax credit arising from the new acquisition

2) Periodic operating cash flows

a) Receipts from operations b) Cost savings that occur (including tax savings) c) Operating expenses

3) Cash flows from termination of investment Next, an illustration of these cash flows, courtesy of ShadeTree Roasters.

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-12

Investment Cash Flows

The entire purchase is made in cash at the end of year 0 (i.e. at start of the investment period) The equipment will be depreciated by the straight-line method over 4 years, and there are no salvage values Operating income will increase because of higher sales and savings in energy costs Income tax rate is ShadeTree Roasters - Investment in New Equipment Data Input 40% (for effect of New equipment cost, including depreciation) installation and training $200,000 Salvage value of new equipment Future cash flows New equipment useful life 4 years are discounted at Salvage value of old equipment Annual increase in contrib. margin $30,000 8% per year

Annual energy cost savings Income tax rate Discount rate

McGraw-Hill/Irwin

$40,000

40% 8%

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-13

Investment Cash Flows

Investment analysis Initial cash flows for year: Investment cost Proceeds from old equipment Annual operating income items Increase in contribution margin Energy cost savings Depreciation expense Change in operating income Tax on change in income After-tax change in operating income Add back depreciation expense After-tax operating cash flow 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 0 (200,000) 1 End of year 2 3 4

(50,000) (50,000) (50,000) (50,000)

Assume that cash flows are the same in each year. Note that depreciation expense is used only to estimate the tax savings. The expense itself is not a cash flow. These net cash flows must be discounted to get the investments net present value.

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-14

Choice of a Discount Rate

The discount rate is an estimate of the opportunity cost of making this investment instead of some other. If the rate chosen is too high, some profitable investments will be rejected. If the rate chosen is too low, some marginal investments will be approved too easily. Suggested discount rates:

A risk-free rate (e.g., Treasury bond rate) Long-term market return on equities The rate chosen should allow for price inflation

(1+r)^(-n)

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-15

Discounting Future Cash Flows

$10,000

$10,000

$10,000

$10,000

Cash to be received in the future has a cost. Alternative investments and price inflation reduce the value of those cash flows in current monetary terms (present value). That is why the cash flows are discounted, normally using a constant discount rate.

Assume annual cash flows of $10,000 and a discount rate of 8%. Every dollar received one year from now has a present value of ($1)*(1.08-1)=$0.926. After two years a dollar has a present value of $0.857.

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

14-16

Net Present Value

Compute the present value of each cash inflow and outflow. Sum all the present values to get the net present value (NPV). If the NPV of the investment is greater than zero, the project promises returns greater than the opportunity rate. The next slide calculates the NPV of the ShadeTree Roasters investment proposal.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-17

Net Present Value

The proposal estimates an NPV of $5,352. So the present value of the net cash inflows during four years exceeds the $200,000 initial investment.

Investment analysis Initial cash flows for year: Investment cost Proceeds from old equipment Annual operating income items Increase in contribution margin Energy cost savings Depreciation expense Change in operating income Tax on change in income After-tax change in operating income Add back depreciation expense After-tax operating cash flow Disposal value Present value factors Discounted cash flows Net present value $ 1.000 (200,000) 0.926 57,407 0.857 53,155 0.794 49,218 0.735 45,572 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 30,000 40,000 20,000 (8,000) 12,000 50,000 62,000 0 (200,000) 1 End of year 2 3 4

So do we go ahead?

I vote Yes!

(50,000) (50,000) (50,000) (50,000)

5,352 Note: =sum(b26:f26)

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-18

Payback Period

Managers may want to know how soon they will recover an initial investment. This method counts the time that will pass before the projected cash inflows equal the initial cash expenditure. The payback period method complements the discounted cash flow method, though the result may be different. In the ShadeTree Roasters example:

Divide the initial investment of $200,000 by the annual contribution margin of $62,000. The payback period is 3.23 years. Often the cash flows are not discounted.

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

14-19

Internal Rate of Return

This percentage is calculated together with the investments net present value. An investments IRR is the discount rate that would create an NPV of zero for the investment. So, if the NPV is greater than zero, then the IRR will be greater than the discount rate. In the case of ShadeTree Roasters, the proposed investment would have an IRR of 9.2%, higher than the required return of 8%.

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

14-20

Learning Objective 3

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-21

Forecasts of Investment Information

The management of ShadeTree Roasters has gathered the following information concerning a potential investment.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-22

Forecasts of Investment Information

Forecast and Net Present Value No Major Competitor

$50,000,000 1.046 = $52,300,000 $10,460,000 35% = $3,661,000

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-23

Forecasts of Investment Information

Forecast and Net Present Value No Major Competitor

$699,000 40% = $279,600

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-24

Forecasts of Investment Information

Forecast and Net Present Value No Major Competitor

=NPV(.08,F15:N15)+D15

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-25

Forecasts of Investment Information

Forecast and Net Present Value With Major Competitor

The major competitor does not enter the market until the second year.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-26

Forecasts of Investment Information

Forecast and Net Present Value With Major Competitor

=NPV(.08,F15:N15)+D15

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-27

Expected Value Analysis Decision Tree

Competitor 40% 60% 100%

NPV Outcome $ (4,965,809) 2,012,498

$ $

E[NPV] (1,986,324) 1,207,499 (778,825)

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

14-28

Value of Deferring Irreversible Decisions

Lets assume that ShadeTree Roasters wants to consider waiting one year to see if its major competitor decides to enter the market.

All other information remains the same. Lets look at our analysis now.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-29

Wait One Year, With No Major Competitor

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-30

Learning Objective 4

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-31

Wait One Year, With a Major Competitor

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-32

Defer Decision One Year

First decision Probability Competitor? Second decision Expand 40% Don't decide Expand 60% No Don't expand E[NPV] = $ 1,571,252 $ No $ 2,618,754 Yes Yes Don't expand $ Yes NPV outcome $ (4,139,865) Best choice No

($0 .40) + ($2,618,754 .60) = $1,571,252

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-33

Value of the Option to Wait

Under common investment conditions, the net present value that we calculated in our analysis is incorrect. We did not consider the situation where ShadeTree entered the market but terminated the project after one year when a major competitor may enter the same market. Though ShadeTree would not recover its investment (which is a sunk cost), it may be less costly to terminate after one year than to continue operations in the market. This analysis is referred to as real option value.

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-34

Learning Objective 5

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-35

Real Option Value Decision Tree

Decision now Choice Prob Competitor? Second decision Continue 40% Expand Continue Expand now or not Don't expand 60% No Terminate $ (4,093,148) $ No $ 2,925,012 Yes Yes Terminate $ (4,093,148) Yes NPV outcome $ (5,662,762) Best choice No

E[NPV, expand now] = [$(4,093,138) .40] + [$2,925,012 .60] E[NPV, expand now] = $117,752

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-36

Value of the Option to Wait

If ShadeTree postpones its decision to expand for one year and then expands into the new market, we calculate the expected net present value to be:

$1,571,252

If ShadeTree expands one nowyear and Postpone continues operations, Expand now we calculate the expected net Expected value of waiting present value to be:

$ 1,571,252 117,752 $ 1,453,500

$117,752

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-37

Learning Objective 6

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-38

Legal and Ethical Issues in Strategic Investment Analysis

Trade unions, regulators, investors, non-government organizations and some business executives have succeeded in influencing United States laws and recent Organisation for Economic Cooperation and Development guidelines that prohibit bribery and other corrupt practices by multination companies.

Such acts are designed to discourage companies from illegally obtaining information about the intentions of competitors.

McGraw-Hill/Irwin Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-39

Internal Ethical Pressures

1. Bias from personal commitment to an investment project. 2. Fear of loss of prestige, position, or compensation from a failed investment.

3. Greed and intentional behavior to defraud an organization or its stakeholders.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-40

Role of Internal Controls and Audits

o Hiring practices -- performing background and reference checks. o Investment reporting and reviews -- periodic progress reporting to see if the investment is meeting stated goals.

o Codes of ethics -- educate and support employees who want to behave ethically.

o Internal audits -- examinations of operations, programs, and financial results performed by independent investigators.

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

14-41

End of Chapter 14

McGraw-Hill/Irwin

Copyright 2008 The McGraw-Hill Companies, Inc. All rights reserved.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Balance Sheet OptimizationDocument32 pagesBalance Sheet OptimizationImranullah KhanNo ratings yet

- The Determinants of REIT Institutional Ownership: Tests of The CAPM vs. Individual Stock AttributesDocument3 pagesThe Determinants of REIT Institutional Ownership: Tests of The CAPM vs. Individual Stock AttributesShafqat BukhariNo ratings yet

- Public Natural Resources Equity Fund (PNREF) - April 2011 Fund ReviewDocument1 pagePublic Natural Resources Equity Fund (PNREF) - April 2011 Fund ReviewWen Yi TaoNo ratings yet

- Fair Value Accounting For FinancialDocument4 pagesFair Value Accounting For FinancialAashie SkystNo ratings yet

- Full and Variable CostingDocument20 pagesFull and Variable CostingAmitabhDashNo ratings yet

- Chapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisDocument32 pagesChapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisMichael SmithNo ratings yet

- Ebook Below Bank Value How To Buy and Own 4 PropertiesDocument16 pagesEbook Below Bank Value How To Buy and Own 4 PropertiesKhairul Fahmi100% (2)

- GreenTech Automotive Confidential Private Placement MemorandumDocument71 pagesGreenTech Automotive Confidential Private Placement MemorandumDavid Herron100% (1)

- Chapter 3 Part 3Document17 pagesChapter 3 Part 3api-401641492No ratings yet

- Final MainDocument81 pagesFinal MainYash GaonkarNo ratings yet

- Final Placement Report 2012 SJMSOM IITBDocument4 pagesFinal Placement Report 2012 SJMSOM IITBRKNo ratings yet

- Debt RestructureDocument2 pagesDebt RestructureJeffrey CincoNo ratings yet

- Composition of Cash and Cash EquivalentDocument20 pagesComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNo ratings yet

- Mohanram On Winners in GrowthDocument38 pagesMohanram On Winners in GrowthRoshan RamanNo ratings yet

- ACP Vs CPGDocument3 pagesACP Vs CPGSGT100% (4)

- The Accompanying Notes Are An Integral Part of The Financial StatementsDocument3 pagesThe Accompanying Notes Are An Integral Part of The Financial StatementsRavi BhartiaNo ratings yet

- DAAS2 DocxdgsdgsdDocument4 pagesDAAS2 DocxdgsdgsdemrangiftNo ratings yet

- Exide Industries LTDDocument8 pagesExide Industries LTDVikram FernandezNo ratings yet

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocument4 pages(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalakurilNo ratings yet

- Level Up MIDTERMS AE111 112Document17 pagesLevel Up MIDTERMS AE111 112Jim ButuyanNo ratings yet

- Musing On MarketsDocument5 pagesMusing On MarketsM Bagus RizkyNo ratings yet

- BAI2 Transmission File Format GuideDocument13 pagesBAI2 Transmission File Format Guideirfanusa0% (1)

- HGdghdhaghgadDocument9 pagesHGdghdhaghgadJohn Brian D. SorianoNo ratings yet

- Topic 2 Discharge of Contract and Remedies For BreachDocument45 pagesTopic 2 Discharge of Contract and Remedies For Breachamitesh100% (1)

- Chapter 6 Verification of Assets and Liabilities PMDocument60 pagesChapter 6 Verification of Assets and Liabilities PMKhalid Mustafa100% (1)

- SAP BudgetingDocument25 pagesSAP BudgetingMohammadGhouse50% (2)

- IDBI MergerDocument5 pagesIDBI MergerprajuprathuNo ratings yet

- Jun18l1fra-C02 QaDocument18 pagesJun18l1fra-C02 QajuanNo ratings yet

- 39 Ratio Analysis All Formula by MeDocument9 pages39 Ratio Analysis All Formula by Meangelohero6643No ratings yet

- FM For MBA - 2016Document3 pagesFM For MBA - 2016Anonymous duzV27Mx3No ratings yet