Professional Documents

Culture Documents

D08540000120114005Session 11 - Production Planning and Control

Uploaded by

Sagita SimanjuntakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D08540000120114005Session 11 - Production Planning and Control

Uploaded by

Sagita SimanjuntakCopyright:

Available Formats

Session 04

Inventory Control Systems

The newsvendor model and its applications.

D 0 8 5 4

Supply Chain : Manufacturing and Warehousing

The newsvendor model and its applications.

Bina Nusantara University

2

Newsvendor model implementation steps

Gather economic inputs:

selling price,

production/procurement cost,

salvage value of inventory

Generate a demand model to represent demand

Use empirical demand distribution

Choose a standard distribution function

the normal distribution,

the Poisson distribution.

Choose an objective:

maximize expected profit

satisfy a fill rate constraint.

Choose a quantity to order.

The Newsvendor Model:

Develop a Forecast

Historical forecast performance at ONeill

0

1000

2000

3000

4000

5000

6000

7000

0 1000 2000 3000 4000 5000 6000 7000

Forecast

A

c

t

u

a

l

d

e

m

a

n

d

.

Forecasts and actual demand for surf wet-suits from the previous season

How do we know the actual

when the actual demand > forecast demand

If we underestimate the demand, we stock less than

necessary.

The stock is less than the demand, the stockout occurs.

Are the number of stockout units (= unmet demand)

observable, i.e., known to the store manager?

Yes, if the store manager issues rain checks to customers.

No, if the stockout demand disappears silently.

No implies demand filtering. That is, demand is known

exactly only when it is below the stock.

Shall we order more than optimal to learn about demand

when the demand is filtered?

Empirical distribution of forecast accuracy

Order by A/F ratio

Empirical distribution function for the historical A/F ratios.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75

A/F ratio

P

r

o

b

a

b

i

l

i

t

y

Product description Forecast Actual demand Error* A/F Ratio**

JR ZEN FL 3/2 90 140 -50 1.56

EPIC 5/3 W/HD 120 83 37 0.69

JR ZEN 3/2 140 143 -3 1.02

WMS ZEN-ZIP 4/3 170 163 7 0.96

HEATWAVE 3/2 170 212 -42 1.25

JR EPIC 3/2 180 175 5 0.97

WMS ZEN 3/2 180 195 -15 1.08

ZEN-ZIP 5/4/3 W/HOOD 270 317 -47 1.17

WMS EPIC 5/3 W/HD 320 369 -49 1.15

EVO 3/2 380 587 -207 1.54

JR EPIC 4/3 380 571 -191 1.50

WMS EPIC 2MM FULL 390 311 79 0.80

HEATWAVE 4/3 430 274 156 0.64

ZEN 4/3 430 239 191 0.56

EVO 4/3 440 623 -183 1.42

ZEN FL 3/2 450 365 85 0.81

HEAT 4/3 460 450 10 0.98

ZEN-ZIP 2MM FULL 470 116 354 0.25

HEAT 3/2 500 635 -135 1.27

WMS EPIC 3/2 610 830 -220 1.36

WMS ELITE 3/2 650 364 286 0.56

ZEN-ZIP 3/2 660 788 -128 1.19

ZEN 2MM S/S FULL 680 453 227 0.67

EPIC 2MM S/S FULL 740 607 133 0.82

EPIC 4/3 1020 732 288 0.72

WMS EPIC 4/3 1060 1552 -492 1.46

JR HAMMER 3/2 1220 721 499 0.59

HAMMER 3/2 1300 1696 -396 1.30

HAMMER S/S FULL 1490 1832 -342 1.23

EPIC 3/2 2190 3504 -1314 1.60

ZEN 3/2 3190 1195 1995 0.37

ZEN-ZIP 4/3 3810 3289 521 0.86

WMS HAMMER 3/2 FULL 6490 3673 2817 0.57

* Error = Forecast - Actual demand

** A/F Ratio = Actual demand divided by Forecast

Normal distribution tutorial

All normal distributions are characterized by two parameters, mean =

and standard deviation = o

All normal distributions are related to the standard normal that has mean

= 0 and standard deviation = 1.

For example:

Let Q be the order quantity, and (, o) the parameters of the normal demand

forecast.

Prob{demand is Q or lower} = Prob{the outcome of a standard normal is z

or lower}, where

(The above are two ways to write the same equation, the first allows you to

calculate z from Q and the second lets you calculate Q from z.)

Look up Prob{the outcome of a standard normal is z or lower} in the

Standard Normal Distribution Function Table.

or

Q

z Q z

o

o

= = +

Start with an initial forecast generated from hunches,

guesses, etc.

ONeills initial forecast for the Hammer 3/2 = 3200 units.

Evaluate the A/F ratios of the historical data:

Set the mean of the normal distribution to

Set the standard deviation of the normal distribution to

Using historical A/F ratios to choose a

Normal distribution for the demand forecast

Forecast

demand Actual

ratio A/F =

Forecast ratio A/F Expected demand actual Expected =

Forecast ratios A/F of deviation Standard

demand actual of deviation Standard

=

ONeills Hammer 3/2 normal distribution forecast

3192 3200 9975 0 = = . demand actual Expected

1181 3200 369 0 = = . demand actual of deviation Standard

ONeill should choose a normal distribution with mean 3192 and

standard deviation 1181 to represent demand for the Hammer 3/2

during the Spring season.

Why not a mean of 3200?

Product description Forecast Actual demand Error A/F Ratio

JR ZEN FL 3/2 90 140 -50 1.5556

EPIC 5/3 W/HD 120 83 37 0.6917

JR ZEN 3/2 140 143 -3 1.0214

WMS ZEN-ZIP 4/3 170 156 14 0.9176

ZEN 3/2 3190 1195 1995 0.3746

ZEN-ZIP 4/3 3810 3289 521 0.8633

WMS HAMMER 3/2 FULL 6490 3673 2817 0.5659

Average 0.9975

Standard deviation 0.3690

Empirical vs normal demand distribution

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

0 1000 2000 3000 4000 5000 6000

Quantity

P

r

o

b

a

b

i

l

i

t

y

.

Empirical distribution function (diamonds) and normal distribution function with

mean 3192 and standard deviation 1181 (solid line)

The Newsvendor Model:

The order quantity that maximizes

expected profit

Too much and too little costs

C

o

= overage cost

The cost of ordering one more unit than what you would have ordered had you

known demand.

In other words, suppose you had left over inventory (i.e., you over ordered). C

o

is the increase in profit you would have enjoyed had you ordered one fewer

unit.

For the Hammer 3/2 C

o

= Cost Salvage value = c v = 110 90 = 20

C

u

= underage cost

The cost of ordering one fewer unit than what you would have ordered had you

known demand.

In other words, suppose you had lost sales (i.e., you under ordered). C

u

is the

increase in profit you would have enjoyed had you ordered one more unit.

For the Hammer 3/2 C

u

= Price Cost = p c = 180 110 = 70

Balancing the risk and benefit of ordering a unit

Ordering one more unit increases the chance of overage

Expected loss on the Q

th

unit = C

o

x F(Q), where F(Q) = Prob{Demand <= Q)

The benefit of ordering one more unit is the reduction in the chance of

underage:

Expected benefit on the Q

th

unit = C

u

x (1-F(Q))

As more units are ordered,

the expected benefit from

ordering one unit

decreases

while the expected loss of

ordering one more unit

increases.

0

10

20

30

40

50

60

70

80

0 800 1600 2400 3200 4000 4800 5600 6400

E

x

p

e

c

t

e

d

g

a

i

n

o

r

l

o

s

s

.

Expected marginal benefit

of understocking

Expected marginal loss

of overstocking

Expected profit maximizing order quantity

To minimize the expected total cost of underage and overage, order Q

units so that the expected marginal cost with the Q

th

unit equals the

expected marginal benefit with the Q

th

unit:

Rearrange terms in the above equation ->

The ratio C

u

/ (C

o

+ C

u

) is called the critical ratio.

Hence, to minimize the expected total cost of underage and overage,

choose Q such that we dont have lost sales (i.e., demand is Q or lower)

with a probability that equals the critical ratio

( ) ( ) Q F C Q F C

u o

= 1 ) (

u o

u

C C

C

Q F

+

= ) (

Parkas at L.L. Bean

Cost per parka = c = $45

Sale price per parka = p = $100

Discount price per parka = $50

Holding and transportation cost = $10

Salvage value per parka = v = 50-10=$40

Profit from selling parka = p-c = 100-45 = $55

Cost of understocking = $55/unit

Cost of overstocking = c-v = 45-40 = $5/unit

Optimal level of product availability

p = sale price; v = outlet or salvage price; c = purchase price

CSL = Probability that demand will be at or below order quantity

CSL later called in-stock probability

Raising the order size if the order size is already optimal

Expected Marginal Benefit of increasing Q= Expected Marginal Cost of Underage

=P(Demand is above stock)*(Profit from sales)=(1-CSL)(p - c)

Expected Marginal Cost of increasing Q = Expected marginal cost of overage

=P(Demand is below stock)*(Loss from discounting)=CSL(c - v)

Define C

o

= c-v; C

u

=p-c

(1-CSL)C

u

= CSL C

o

CSL= C

u

/ (C

u

+ C

o

)

Order Quantity for a Single Order

C

o

= Cost of overstocking = $5

C

u

=Cost of understocking = $55

Q

*

= Optimal order size

917 . 0

5 55

55

) (

*

=

+

=

+

> s =

o u

u

C C

C

Q Demand P CSL

Optimal Order Quantity

0

0.2

0.4

0.6

0.8

1

1.2

4 5 6 7 8 9 10 11 12 13 14 15 16 87

Cumulative

Probability

Optimal Order Quantity = 13(00)

0.917

Parkas at L.L. Bean

Expected demand = 10 (00) parkas

Expected profit from ordering 10 (00) parkas = $499

Approximate Expected profit from ordering 1(00) extra parkas if

10(00) are already ordered

= 100.55.P(D>=1100) - 100.5.P(D<1100)

Parkas at L.L. Bean

Additional

100s

Expected

Marginal Benefit

Expected

Marginal Cost

Expected Marginal

Contribution

11

th

5500.49 = 2695 500.51 = 255

2695-255 = 2440

12

th

5500.29 = 1595 500.71 = 355

1595-355 = 1240

13

th

5500.18 = 990 500.82 = 410

990-410 = 580

14

th

5500.08 = 440 500.92 = 460

440-460 = -20

15

th

5500.04 = 220 500.96 = 480

220-480 = -260

16

th

5500.02 = 110 500.98 = 490

110-490 = -380

17

th

5500.01 = 55 500.99 = 495

55-495 = -440

Revisit L.L. Bean as a Newsvendor Problem

Total cost by ordering Q units:

C(Q) = overstocking cost + understocking cost

} }

+ =

Q

u

Q

o

dx x f Q x C dx x f x Q C Q C ) ( ) ( ) ( ) ( ) (

0

0 )) ( 1 ( ) (

) (

= = Q F C Q F C

dQ

Q dC

u o

Marginal cost of overage at Q* - Marginal cost of underage at Q* = 0

u o

u

C C

C

Q D P Q F

+

= s = ) ( ) (

* *

Safety Stock

Inventory held in addition to the expected

demand is called the safety stock

The expected demand is 1026 parkas but

we order 1300 parkas.

So the safety stock is 1300-1026=274 parka.

The Newsvendor Model:

Performance measures

Newsvendor model performance measures

For any order quantity we would like to evaluate the following

performance measures:

Expected lost sales

The average number of units demand exceeds the order quantity

Expected sales

The average number of units sold.

Expected left over inventory

The average number of units left over at the end of the season.

Expected profit

Expected fill rate

The fraction of demand that is satisfied immediately

In-stock probability

Probability all demand is satisfied

Stockout probability

Probability some demand is lost

Expected (lost sales=shortage)

ESC is the expected shortage in a season

ESC is not a percentage, it is the number of units, also see next page

s

>

=

Q Demand

Q Demand

if

if

0

Q - Demand

Shortage

}

=

=

=

Q x

Q)f(x)dx - (x ESC

Q,0}) season a in nd E(max{Dema ESC

Inventory and Demand during a season

0

Q

Demand

During a

Season

Season

Inventory

D, Demand

During

A Season

0

0

Q

Inventory=Q-D

Upside

down

Shortage and Demand during a season

0

Q

Demand

Season

Shortage

D

:

D

e

m

a

n

d

D

u

r

i

n

g

s

S

e

a

s

o

n

0

0

Q

Shortage

=D-Q

Upside

down

Expected shortage during a season

First let us study shortage during the lead time

D. of pdf is f where ) ( ) (

}) 0 , (max{ shortage Expected

D

}

=

=

=

Q D

D

dD D f Q D

Q D E

Ex:

4

1

4

1

10)} - (11 max{0,

4

2

10)} - (10 max{0,

4

1

10)} - (9 max{0,

) ( )} (d )} ( max{0, shortage Expected

Shortage? Expected ,

1/4 prob with 11

2/4 prob with 10

1/4 prob with 9

, 10

11

10 d

3

1 i

3 3

2 2

1 1

= + + =

= = =

= =

= =

= =

= =

= =

d D P Q p Q d

p d

p d

p d

D Q

i i

Expected shortage during a season

2/6

) 10 ( 10

2

10

6

1

) 12 ( 10

2

12

6

1

10

2 6

1

6

1

) 10 ( shortage Expected

Shortage? Expected ), 12 , 6 ( , 10

2 2

12

10

2

12

10

=

|

|

.

|

\

|

|

|

.

|

\

|

=

\

|

= =

= =

=

=

=

}

D

D

D

D

D

dD D

Unif orm D Q

Ex:

Expected lost sales of Hammer 3/2s with Q = 3500

Normal demand with mean 3192, standard deviation=1181

Step 1: normalize the order quantity to find its z-statistic.

Step 2: Look up in the Standard Normal Loss Function Table the expected lost

sales for a standard normal distribution with that z-statistic: L(0.26)=0.2824 see

Appendix B table on p.380 of the textbook

or, in Excel L(z)=normdist(z,0,1,0)-z*(1-normdist(z,0,1,1)) see Appendix

D on p.389

Step 3: Evaluate lost sales for the actual normal distribution:

26 . 0

1181

3192 3500

=

=

o

Q

z

( ) 1181 0.2824 334 Expected lost sales L z o = = =

Keep 334 units in mind, we shall repeatedly use it

Measures that follow expected lost sales

Demand=Sales+Lost Sales

D=min(D,Q)+max{D-Q,0} or min(D,Q)=D- max{D-Q,0}

Expected sales = - Expected lost sales

= 3192 334 = 2858

Inventory=Sales+Left Over Inventory

Q=min(D,Q)+max{Q-D,0} or max{Q-D,0}=Q-min(D,Q)

Expected Left Over Inventory = Q - Expected Sales

= 3500 2858 = 642

Measures that follow expected lost sales

Expected total underage and overage cost with (Q=3500)

=70*334 + 20*642

( )

( )

( ) ( )

$70 2858 $20 642 $187, 221

Expected profit Price-Cost Expected sales

Cost-Salvage value Expected left over inventory

= (

(

= =

What is the relevant objective? Minimize the cost or maximize the profit?

Hint: What is profit + cost? It is 70*3192=C

u

*, which is a constant.

Type I service measure: Instock probability = CSL

) Q P(Demand bability InstockPro s =

Instock probability: percentage of seasons without a stock out

Q] season a during [Demand inventory] t [Sufficien

inventory sufficient has season single a y that Probabilit 0.7 y Probabilit Instock

7 . 0 y Probabilit Instock

otherwise 1 stockout, has season a if 0 Write

10

1 0 1 0 1 1 1 0 1 1

y Probabilit Instock

: seasons 10 consider example For

s =

= =

=

+ + + + + + + + +

=

Instock Probability with Normal Demand

( )

( )

|

.

|

\

|

=

|

.

|

\

|

s =

|

.

|

\

|

s

=

s =

=

s

1 , 1 , 0 , Normdist

on distributi normal standard Obtaining ) 1 , 0 (

StDev by the Dividing

) , (

mean out the Taking ) , (

,1) , , Normdist(Q

) , (

o

o

o

o

o

o

o

o

Q

Q

N P

Q N

P

Q N P

Q N P

N(,) denotes a normal demand with mean and standard deviation

Example: Finding Instock probability for given Q

= 2,500 /week; o= 500; Q = 3,000;

Instock probability if demand is Normal?

Instock probability = Normdist((3,000-2,500)/500,0,1,1)

Example: Finding Q for given Instock probability

= 2,500/week; o= 500; To achieve Instock

Probability=0.95, what should be Q?

Q = Norminv(0.95, 2500, 500)

Type II Service measure: Fill rate

Recall:

Expected sales = - Expected lost sales = 3192 334 = 2858

2858

1

3192

89.6%

Expected sales Expected sales

Expected fill rate

Expected demand

Expected lost sales

= =

= =

=

Is this fill rate too low?

Well, lost sales of 334 is with Q=3500, which is less than optimal.

Service measures of performance

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0 1000 2000 3000 4000 5000 6000 7000

Order quantity

In-stock probability

CSL

Expected fill

rate

Service measures: CSL and fill rate are different

CSL is 0%, fill rate is almost 100%

CSL is 0%, fill rate is almost 0%

inventory

inventory

time

time

0

0

Summary

Determine the optimal level of product availability

Demand forecasting

Profit maximization / Cost minimization

Other measures

Expected shortages = lost sales

Expected left over inventory

Expected sales

Expected cost

Expected profit

Type I service measure: Instock probability = CSL

Type II service measure: Fill rate

Homework Question:

A newsvendor can price a call option

Q1: Suppose that you own a simple call option for a stock

with a strike price of Q. Suppose that the price of the

underlying stock is D at the expiration time of the option. If

D <Q, the call option has no value. Otherwise its value is

D-Q. What is the expected value of a call option, whose

strike price is $50, written for a stock whose price at the

expiration is normally distributed with mean $51 and

standard deviation $10?

You might also like

- Ielts 42 Topics For Speaking Part 1Document32 pagesIelts 42 Topics For Speaking Part 1Zaryab Nisar100% (1)

- Solomon Cb09 PPT 16Document34 pagesSolomon Cb09 PPT 16Sagita SimanjuntakNo ratings yet

- Strategic ManagementDocument26 pagesStrategic ManagementSagita Simanjuntak100% (1)

- Solomon Cb09 PPT 02Document32 pagesSolomon Cb09 PPT 02garimadhamija02No ratings yet

- Solomon Cb09 PPT 14Document23 pagesSolomon Cb09 PPT 14Sagita SimanjuntakNo ratings yet

- Ver2 Service Marketing Chapter 11-12 FGDDocument43 pagesVer2 Service Marketing Chapter 11-12 FGDSagita SimanjuntakNo ratings yet

- Solomon Cb09 PPT 15Document31 pagesSolomon Cb09 PPT 15Sagita SimanjuntakNo ratings yet

- Form Rincian Soal Ujian Mata Kuliah CO ORDocument29 pagesForm Rincian Soal Ujian Mata Kuliah CO ORSagita SimanjuntakNo ratings yet

- D08540000120114009Session 10 - Production Planning and ControlDocument19 pagesD08540000120114009Session 10 - Production Planning and ControlSagita SimanjuntakNo ratings yet

- D08540000120114014Session 17 - Layout DesignDocument52 pagesD08540000120114014Session 17 - Layout DesignSagita SimanjuntakNo ratings yet

- Consumer Behavior by Michael R. Solomon Cb09 Ppt01Document33 pagesConsumer Behavior by Michael R. Solomon Cb09 Ppt01Suc Teng LiuNo ratings yet

- D08540000120114010Session 8 - Production Planning and ControlDocument29 pagesD08540000120114010Session 8 - Production Planning and ControlSagita SimanjuntakNo ratings yet

- D08540000120114013Session 15 and 16 - Layout DesignDocument62 pagesD08540000120114013Session 15 and 16 - Layout DesignSagita SimanjuntakNo ratings yet

- D08540000120114015Session 18 - Layout DesignDocument33 pagesD08540000120114015Session 18 - Layout DesignSagita SimanjuntakNo ratings yet

- D08540000120114012Session 13 and 14 - Review 1 and 2Document26 pagesD08540000120114012Session 13 and 14 - Review 1 and 2Sagita SimanjuntakNo ratings yet

- D08540000120114003Session 3 - Inventory Control SystemsDocument12 pagesD08540000120114003Session 3 - Inventory Control SystemsSagita SimanjuntakNo ratings yet

- D08540000120114011Session 7 - Production Planning and ControlDocument68 pagesD08540000120114011Session 7 - Production Planning and ControlSagita SimanjuntakNo ratings yet

- D08540000120114008Session 12 - Production Planning and ControlDocument37 pagesD08540000120114008Session 12 - Production Planning and ControlSagita SimanjuntakNo ratings yet

- 2finance Committee (Papers) 21 May 99Document1 page2finance Committee (Papers) 21 May 99Sagita SimanjuntakNo ratings yet

- D08540000120114007Session 5 and 6 - Inventory Control SystemsDocument55 pagesD08540000120114007Session 5 and 6 - Inventory Control SystemsSagita SimanjuntakNo ratings yet

- D08540000120114006Session 9 - Production Planning and ControlDocument29 pagesD08540000120114006Session 9 - Production Planning and ControlSagita SimanjuntakNo ratings yet

- BayeChap 007Document14 pagesBayeChap 007Sagita SimanjuntakNo ratings yet

- T Fxçáx Éy Cätvx Eéáxãééw: FactsDocument6 pagesT Fxçáx Éy Cätvx Eéáxãééw: FactsSagita SimanjuntakNo ratings yet

- D08540000120114004Session 4 - Inventory Control SystemsDocument41 pagesD08540000120114004Session 4 - Inventory Control SystemsSagita SimanjuntakNo ratings yet

- D08540000120114003Session 2 - The Role of Operations Management 2Document13 pagesD08540000120114003Session 2 - The Role of Operations Management 2Sagita SimanjuntakNo ratings yet

- Bahan Rapat Gugus Inds Untuk Rapat Persiapan Kuliah 2012-2013 Semester GanjilDocument40 pagesBahan Rapat Gugus Inds Untuk Rapat Persiapan Kuliah 2012-2013 Semester GanjilSagita SimanjuntakNo ratings yet

- Soal-Soal StatistikDocument3 pagesSoal-Soal StatistikSagita SimanjuntakNo ratings yet

- BayeChap 006Document12 pagesBayeChap 006Sagita SimanjuntakNo ratings yet

- MacroEconomic Miles Ch01Document7 pagesMacroEconomic Miles Ch01Sagita SimanjuntakNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Three Dimensional Geometry AssignmentDocument2 pagesThree Dimensional Geometry AssignmentsheetalNo ratings yet

- Bahan Kuliah Rantai MarkovDocument53 pagesBahan Kuliah Rantai Markovwiranegara muhammadNo ratings yet

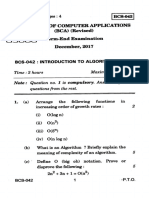

- BCS 042Document4 pagesBCS 042Nainoor PatelNo ratings yet

- Dynamical Systems and Fractals in Pascal by Doerfler BeckerDocument410 pagesDynamical Systems and Fractals in Pascal by Doerfler BeckerDaniel Stanica100% (1)

- ADP Semester - 1Document51 pagesADP Semester - 1Muhammad usama shehzadNo ratings yet

- Cot Math 6 1st QTR Week 5 Multiplies Decimals and Mixed DecimalsDocument11 pagesCot Math 6 1st QTR Week 5 Multiplies Decimals and Mixed DecimalsSofiaNo ratings yet

- Test Bank For Calculus Early Transcendentals 7th EditionDocument5 pagesTest Bank For Calculus Early Transcendentals 7th EditionKevin Brown97% (35)

- P, NP, NP-Complete and NP-Hard Problems Explained in 40 CharactersDocument29 pagesP, NP, NP-Complete and NP-Hard Problems Explained in 40 CharactersDebdatta PraharajNo ratings yet

- Numerical Methods - E. BalaguruswamyDocument124 pagesNumerical Methods - E. BalaguruswamyajayNo ratings yet

- Straight Line in 3DDocument11 pagesStraight Line in 3DNicey Raiyani100% (1)

- Exam 2solutionDocument5 pagesExam 2solutionJames Steven HaneyNo ratings yet

- Student WorkBook Math Grade-7Document39 pagesStudent WorkBook Math Grade-7Komang62100% (2)

- Homework 1Document2 pagesHomework 1Swarnav BanikNo ratings yet

- Quant Checklist 129 PDF 2022 by Aashish AroraDocument67 pagesQuant Checklist 129 PDF 2022 by Aashish AroraRajnish Sharma100% (1)

- Advance Engineering Mathematics ECE 321Document33 pagesAdvance Engineering Mathematics ECE 321Cllyan ReyesNo ratings yet

- Euler Bernoulli Beam TheoryDocument10 pagesEuler Bernoulli Beam TheoryinaNo ratings yet

- MathsDocument28 pagesMathsnitesh kumar guptaNo ratings yet

- Differentiating composite and product functionsDocument61 pagesDifferentiating composite and product functionsMamo JimmaNo ratings yet

- CSETDocument117 pagesCSETmroizo9999100% (1)

- Vieta's Formula - Brilliant Math & Science WikiDocument9 pagesVieta's Formula - Brilliant Math & Science Wikiasax57No ratings yet

- Pre University h2 Further MathematicsDocument22 pagesPre University h2 Further MathematicsLeng RyanNo ratings yet

- Data Analysis Expressions Excel PDFDocument679 pagesData Analysis Expressions Excel PDFedgar_romo_1100% (1)

- Kombinasi Hukum I Dan II Termodinamika - enDocument17 pagesKombinasi Hukum I Dan II Termodinamika - enEkok Ec100% (1)

- Jonathan Whiteley Auth. Finite Element Methods A Practical GuideDocument236 pagesJonathan Whiteley Auth. Finite Element Methods A Practical GuideBhupendra Sharma89% (9)

- Ratio 01 PowerpointDocument24 pagesRatio 01 PowerpointJay PeñarandaNo ratings yet

- Bivariate Analysis: Correlation and Scatter PlotsDocument10 pagesBivariate Analysis: Correlation and Scatter PlotsMadara UchihaNo ratings yet

- CT6Document7 pagesCT6Vishy BhatiaNo ratings yet

- Confidence Intervals for Unknown Population Mean Using t-DistributionDocument18 pagesConfidence Intervals for Unknown Population Mean Using t-DistributionJaneth MarcelinoNo ratings yet

- Lesson 04Document27 pagesLesson 04Mohammad KhazaalNo ratings yet

- Spline Power PointDocument52 pagesSpline Power PointShahad AlgazaaNo ratings yet