Professional Documents

Culture Documents

A Discussion of The Coase Theorem

Uploaded by

Tsang Shu-kiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Discussion of The Coase Theorem

Uploaded by

Tsang Shu-kiCopyright:

Available Formats

1

A Discussion of the Coase Theorem

Coase Theorem Weak version: Regardless of the specific initial assignment of property rights in market equilibrium the final outcome will be Pareto optimal provided that the initial legal assignment is well defined and that transactions involving exchange of rights are costless. e.g. Varians example of the smoker versus the non-smoker, which we have discussed:

The market will reach Pareto optimality through voluntary trading between A and B given the property rights assignment and there is no need for external intervention. Strong version (invariance hypothesis): The final optimal outcome will be independent of the specific assignment of property rights.

(See Varian: this is true only if peoples preferences are quasilinear in his Figure 33.2.) Smoke

money

If each consumers preferences are quasilinear, so that they are all horizontal translates of each other, the set of Pareto efficient allocations will constitute a horizontal line, i.e. the amount of the externality (smoke) will be unique; and the assignment of the legal rights to either A or B will not affect the result. Discussion For a favourable discussion of the theorem, see Hirshleifers section on it. My only observation is that Cheungs discovery of market activity taking place in the case of the apple and the bees does not prove Pareto optimality or lead to any firm conclusion about the comparative merits of government intervention (e.g. taxation) versus the market solution. To criticize the Coase Theorem is easy. always expressed: Several criticisms are

(i) It may be impossible to assign property rights; e.g. the assignment of water rights in Example 15.5 of Hirshleifer. (ii) Transaction costs may be very high. (iii) Strategic behaviour in negotiation, particularly when a large number of parties is involved etc. In any case, the weak version of the Coase Theorem is becoming increasingly accepted as of merit. As far as property rights can be defined, the optimal amount of externalities-causing goods may be determined through the market mechanism, i.e. trading----pollution is an example. On the other hand, the strong version seems to depend on peculiar sets of preferences, which may not obtain in many cases.

Mishans Critique of the Strong Version A more subtle criticism is raised by Mishan in his The Cost of Economic Growth, pp. 91-93. Note that the strong version of the Coase theorem implies the output invariance proposition, e.g. in the case of the chemical plant and the fishermen. No matter whether the chemical plant is assigned the property right of the river (so that the fishermen have to pay the chemical plant not to pollute) or the fishermen have it so that the plant has to pay them to pollute, the outcome is the same: the output of the chemical plant will be reduced to the socially optimal level, which must also be Pareto-optimal.

SMC PMC

MR

Output of chemical plant

Q1

SMC: social marginal cost PMC: private marginal cost

Q0

Q1 is the Pareto-optimal output level. As can be seen in the above diagram: it is unique so output in invariant to the assignment of property rights. Mishan does not agree with such a proposition. He points out that the output level is likely to be affected by distribution, which influences preferences of different parties. The results could vary under different situations.

4

e.g.

sea

A house, A , is already in existence and owned by A; now B intends to build a house on the site in front of A , thus blocking its view. Now the outcome where a house will be built on the site depends on distribution and hence preferences and is not invariant and the distribution of utility improvement is also not invariant.

I. B has the property right to the site (i) A is rich: willing to pay $2,000 to persuade B not to build on the site. B is poor: willing to accept $500 for not building on the site. They do not know each others preferences. Outcome: B accepts $600 from A and no house is built. In terms of utility, B gains $100, but A gains $1,400 still Pareto-improvement! (ii) A is poor: willing to pay $1,000 to B not to build B is rich: willing to accept $2,000 for not building Outcome: B proceeds to build the house! II A has the property right (i) A is rich: willing to accept $2,000 from B to have the house built

5

(ii) B is poor: willing to pay A $500 to build the house Outcome: no house is built but then A gains $2,000! B in fact loses $500 (compared with the situation of externalities, i.e. the house is built) A comparison between I(i) and II(i) should be made. We can argue that even if the output is invariant, distribution is variant. Mishans example on p.93 is more interesting. Matrix of reservation prices: A 1. prepared to pay a max. of 1,000 to B not to build on the site 2. willing to accept a min. of 1,200 to let B to build B 1. willing to pay a max. of 1,100 to build on the site 2. prepared to accept a min. of 1,300 for not building on the site

The numbers can be justified on grounds of diminishing marginal utility

A A U $1,200 U $1,000 : an addition of the same

amount of money to a mans income yields a smaller degree of utility than a subtraction of the same amount would remove from his utility. Now, given A(1, 2) and B(1, 2), the assignment of the property right to the site would matter, and the outcome will not be invariant. If A has the property right, no house will be built because A2 > B1. If B has the property right, a house will be built by B on the site because A1 < B2.

6

So the output invariance proposition is shown to be invalid by a counter example. (To refute a theory, several approaches can be adopted: 1. To prove that the theory is wrong in general. 2. To show that there are problems in the argument process: e.g. inconsistency between assumptions and derivation of propositions. 3. To find a counter-example, hence undermining the general relevance of the theory. Mishans critique of the strong version of the Coase Theorem belongs to approach 3.) Distribution Preferences Outcome: is this always true?

You might also like

- Cupp Remedies Spring 2015Document39 pagesCupp Remedies Spring 2015Katie F.100% (1)

- Remedies OutlineDocument50 pagesRemedies Outlinervillar1100% (3)

- Microeconomic Theory Basic Principles and Extensions 12Th Edition Nicholson Test Bank Full Chapter PDFDocument26 pagesMicroeconomic Theory Basic Principles and Extensions 12Th Edition Nicholson Test Bank Full Chapter PDFbetty.tylwalk199100% (11)

- Remedies Outline #1Document66 pagesRemedies Outline #1hfpmlg100% (2)

- Two Models of Land Overvaluation and Their Implications: October 2010Document33 pagesTwo Models of Land Overvaluation and Their Implications: October 2010JaphyNo ratings yet

- Tutorial 8Document3 pagesTutorial 8hNo ratings yet

- Public Eco PptsDocument191 pagesPublic Eco PptsshashaNo ratings yet

- Economic Way of Thinking 13Th Edition Heyne Solutions Manual Full Chapter PDFDocument26 pagesEconomic Way of Thinking 13Th Edition Heyne Solutions Manual Full Chapter PDFjoshua.king500100% (11)

- Pigou-Vs-Coase ApproachDocument32 pagesPigou-Vs-Coase ApproachGururaj MamdyNo ratings yet

- Solutions To Ch. 1, 3, 9, 11 ProblemsDocument11 pagesSolutions To Ch. 1, 3, 9, 11 ProblemsAnonymous 7CxwuBUJz3No ratings yet

- Test Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith IDocument36 pagesTest Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith Ihexade.pathosivny6d100% (44)

- Tax CaseDocument10 pagesTax Caseapi-127372805No ratings yet

- Test Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S SmithDocument19 pagesTest Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smithpainting.hoggeryt759t100% (38)

- Contracts OutlineDocument30 pagesContracts Outlinesublime12089No ratings yet

- Worked Solutions 3Document7 pagesWorked Solutions 3Zahied MukaddamNo ratings yet

- Full Test Bank For Modern Labor Economics Theory and Public Policy 13Th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith I PDF Docx Full Chapter ChapterDocument36 pagesFull Test Bank For Modern Labor Economics Theory and Public Policy 13Th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith I PDF Docx Full Chapter Chapterspradfroggy.egxp8u100% (9)

- Xid-4952288 2Document5 pagesXid-4952288 2Xiaofei DaiNo ratings yet

- Coase TheoremDocument32 pagesCoase TheoremHasnain KarachiainNo ratings yet

- Econ 102 S 07 FXDocument11 pagesEcon 102 S 07 FXhyung_jipmNo ratings yet

- PS Answers - Ch2 Quick Check Multiple ChoiceDocument3 pagesPS Answers - Ch2 Quick Check Multiple Choicehiuman wongNo ratings yet

- Full Download Test Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith I PDF Full ChapterDocument36 pagesFull Download Test Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smith I PDF Full Chaptercameradeaestivalnekwz7100% (22)

- Test Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S SmithDocument9 pagesTest Bank For Modern Labor Economics Theory and Public Policy 13th Edition Ronald G Ehrenberg Robert S Smith Ronald G Ehrenberg Robert S Smithsilvatedere999hcnNo ratings yet

- Ill Defined Property RightsDocument15 pagesIll Defined Property RightsAMRUTH ANAND 1750408No ratings yet

- MicroeconomicsDocument34 pagesMicroeconomicsLazarus PittNo ratings yet

- Puplic FinanceDocument6 pagesPuplic FinanceAdam MariNo ratings yet

- Intermediate M.Document10 pagesIntermediate M.Selma ShilongoNo ratings yet

- 2020 SPRING Final Exam Environmental Economics and Policy 101 Economics 125Document8 pages2020 SPRING Final Exam Environmental Economics and Policy 101 Economics 125JL HuangNo ratings yet

- Microeconomics Test 1Document14 pagesMicroeconomics Test 1Hunter Brown100% (1)

- Problem Set 3 New SolutionsDocument5 pagesProblem Set 3 New Solutionsapi-235832666No ratings yet

- EJS - Contracts and SalesDocument22 pagesEJS - Contracts and Sales1 LeeNo ratings yet

- ECON 101 Midterm 1 PracticeDocument4 pagesECON 101 Midterm 1 PracticeexamkillerNo ratings yet

- Eco 101Document12 pagesEco 101Nyamenose Adom BaidenNo ratings yet

- Contracts Outline L1Document75 pagesContracts Outline L1Mike ZappiNo ratings yet

- Contract Outline SpringDocument91 pagesContract Outline SpringnooyyllibNo ratings yet

- 11-Bba-02 Chapter 2Document6 pages11-Bba-02 Chapter 2Al EscobalNo ratings yet

- The King Takes Your Castle: City Laws That Restrict Your Property RightsFrom EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsNo ratings yet

- CBSE Sample Paper For Class 12 Economics With SolutionsDocument11 pagesCBSE Sample Paper For Class 12 Economics With SolutionsAritroy KunduNo ratings yet

- Econ 1 - Problem Set 6 With SolutionsDocument13 pagesEcon 1 - Problem Set 6 With SolutionsChilly Wu100% (4)

- Final Economic Analysis Additional Questions.2023Document32 pagesFinal Economic Analysis Additional Questions.2023Amgad ElshamyNo ratings yet

- Trabajo 3 - SoluciónDocument12 pagesTrabajo 3 - SoluciónJosé CotrinaNo ratings yet

- Assignment 2 101Document3 pagesAssignment 2 101Vlad PetryakovNo ratings yet

- Assignment 1 (Managerial Economics) XlriDocument5 pagesAssignment 1 (Managerial Economics) XlriNarendra N. SinghNo ratings yet

- Applying The Competitive Model: Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument24 pagesApplying The Competitive Model: Choose The One Alternative That Best Completes The Statement or Answers The QuestionMirzaNo ratings yet

- Solution Manual For Cost Benefit Analysis Concepts and Practice 5th EditionDocument38 pagesSolution Manual For Cost Benefit Analysis Concepts and Practice 5th Editionoldstermeacocklko8h8100% (15)

- Other Set of Mock Exam 2013 005 Appraisal Economics 1 PDF FreeDocument52 pagesOther Set of Mock Exam 2013 005 Appraisal Economics 1 PDF FreeJheovane Sevillejo LapureNo ratings yet

- Reviewer CH 4 & 5Document10 pagesReviewer CH 4 & 5Green StoneNo ratings yet

- Review - Part 1Document12 pagesReview - Part 1K61BF Lê Ngọc Gia HânNo ratings yet

- Principles of Economics Practice Exam 2015 QuestionsDocument6 pagesPrinciples of Economics Practice Exam 2015 Questionsjess100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionNguyen Dang Duong (K16HL)No ratings yet

- ECON 2101 - Fall 08 Test 1b KeyDocument7 pagesECON 2101 - Fall 08 Test 1b KeyKathy Lê100% (1)

- Macroeconomics. Case. Fair. 10Th Ed. Solutions To Problems Chs.1-4Document28 pagesMacroeconomics. Case. Fair. 10Th Ed. Solutions To Problems Chs.1-4Carlos Ferreira67% (3)

- Principles of Microeconomics Problem Set 12 Model AnswersDocument4 pagesPrinciples of Microeconomics Problem Set 12 Model AnswersHazman Abdul RahmanNo ratings yet

- Introduction To EconomicsDocument10 pagesIntroduction To EconomicsJack SikoliaNo ratings yet

- Chapter ReviewDocument7 pagesChapter ReviewMorgan AmoreNo ratings yet

- First Tuesday Broker Prep Exam Q&A 9Document11 pagesFirst Tuesday Broker Prep Exam Q&A 9Frank A. DuranNo ratings yet

- Economics Competition Question Book 2017 - AnswersDocument8 pagesEconomics Competition Question Book 2017 - AnswersDIVA RTHININo ratings yet

- Property Transactions OutlineDocument63 pagesProperty Transactions OutlineslcsandraNo ratings yet

- Building from the Ground Up: Reclaiming the American Housing BoomFrom EverandBuilding from the Ground Up: Reclaiming the American Housing BoomNo ratings yet

- The Mask, Secrets and Contradictions of Being A SuperpowerDocument3 pagesThe Mask, Secrets and Contradictions of Being A SuperpowerTsang Shu-kiNo ratings yet

- Report On Financial Market Review by The Hong Kong SAR Government in April 1998Document223 pagesReport On Financial Market Review by The Hong Kong SAR Government in April 1998Tsang Shu-kiNo ratings yet

- Kondratieff Long Waves UnsynchronizedDocument9 pagesKondratieff Long Waves UnsynchronizedTsang Shu-kiNo ratings yet

- Long Waves: An Update: Tsang Shu-KiDocument8 pagesLong Waves: An Update: Tsang Shu-KiTsang Shu-kiNo ratings yet

- The Jasmine Revolution and DemographyDocument4 pagesThe Jasmine Revolution and DemographyTsang Shu-kiNo ratings yet

- Currency Boards and OptionsDocument12 pagesCurrency Boards and OptionsTsang Shu-kiNo ratings yet

- PGM-199 R1Document5 pagesPGM-199 R1Faraz Ali Khan0% (1)

- EnglishtoMath##1Document8 pagesEnglishtoMath##1zubairNo ratings yet

- Direct Mail Success SecretsDocument0 pagesDirect Mail Success SecretsunpinkpantherNo ratings yet

- Jack Daniel'sDocument17 pagesJack Daniel'sIon TarlevNo ratings yet

- Scarcity and ChoiceDocument4 pagesScarcity and ChoicearuprofNo ratings yet

- Woolf Prompt WritingDocument1 pageWoolf Prompt Writingapi-2089824930% (1)

- Spisak Parfema NEWDocument1 pageSpisak Parfema NEWDouglas CoxNo ratings yet

- Uy Balance SheetDocument8 pagesUy Balance SheetMary Louise CamposanoNo ratings yet

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Tourism PolicyDocument6 pagesTourism Policylanoox0% (1)

- Masan Group CorporationDocument31 pagesMasan Group Corporationhồ nam longNo ratings yet

- Rufino Tan Vs Ramon Del RosarioDocument1 pageRufino Tan Vs Ramon Del RosarioJocelyn MagbanuaNo ratings yet

- Sap MM Standard Business ProcessesDocument65 pagesSap MM Standard Business ProcessesDipak BanerjeeNo ratings yet

- Harish NatarajanDocument10 pagesHarish NatarajanbananiacorpNo ratings yet

- Retainage Release Invoices in Oracle AP - ErpSchoolsDocument9 pagesRetainage Release Invoices in Oracle AP - ErpSchoolsK.rajesh Kumar ReddyNo ratings yet

- Apartment Community BrochureDocument7 pagesApartment Community Brochureapi-327678777No ratings yet

- Introduction To Business - 5Document11 pagesIntroduction To Business - 5Md. Rayhanul IslamNo ratings yet

- Short AnswerDocument4 pagesShort AnswerMichiko Kyung-soonNo ratings yet

- Forex Trend Line Strategy Note For Advance TraderDocument82 pagesForex Trend Line Strategy Note For Advance TraderMohd Ridzuan100% (2)

- PricelistDocument3 pagesPricelist4 fruit companyNo ratings yet

- CH 12 HWDocument45 pagesCH 12 HWHannah Fuller100% (1)

- Best Practices in Hotel Financial ManagementDocument3 pagesBest Practices in Hotel Financial ManagementDhruv BansalNo ratings yet

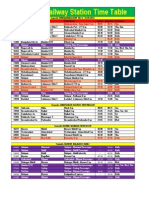

- Solapur Railway Station Time TableDocument2 pagesSolapur Railway Station Time TableAndrea Lopez33% (3)

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocument24 pagesPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterJiya Nitric AcidNo ratings yet

- Agriculture Subsidies and DevelopmentDocument2 pagesAgriculture Subsidies and Developmentbluerockwalla100% (2)

- Ticket PDFDocument1 pageTicket PDFVenkatesh VakamulluNo ratings yet

- Cheque and Its TypesDocument2 pagesCheque and Its Typesdevraj subediNo ratings yet

- Supervisory Development Final ProjectDocument12 pagesSupervisory Development Final ProjectCarolinaNo ratings yet

- Donner Company 2Document6 pagesDonner Company 2Nuno Saraiva0% (1)

- Diebold Case StudyDocument2 pagesDiebold Case StudySagnik Debnath67% (3)