Professional Documents

Culture Documents

For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 Email

Uploaded by

Anonymous Feglbx5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 Email

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

For Immediate Release (4 pages) Monday July 8, 2013

Contact: James Delmonte (212) 729-6973 email: james.delmonte@avisonyoung.com

Editors/Reporters

http://www.avisonyoung.com/sites/default/files/content-files/Media_Room/Temp/NewYorkStatsSummaryQ213.pdf

Disjointed Manhattan office market characterized by bright spots and flat notes at mid-year point

Avison Young announces second quarter 2013 Manhattan office market analysis New York City, NY Conflicting indicators are causing a bifurcation of the Manhattan office market, with limited interest in base floor availabilities offsetting accelerating leasing activity at the top of the market, according to a second quarter 2013 Manhattan office market analysis by Avison Young. Significant large blocks of available space coming to market served to counteract an increase in the number of leasing transactions. Avison Youngs research indicates the second quarter closed with an overall Manhattan office vacancy rate of 12.1%, up from 11.8% in the previous quarter. One of the more encouraging signs for the market is the increasing number of deals in excess of $100 per square foot (psf). To date in 2013, there have been 31 deals with starting rents north of the $100-psf mark, compared with 34 for all of 2012. Recent notable transactions with rents at or above $100 psf include Bank Itaus 16,000-square-foot (sf) deal at 767 Fifth Avenue for $195 psf, Ontario Teachers Pension Plans 3,000-sf lease at 375 Park for $140 psf, and Jeffries & Co.s 112,285-sf deal at 520 Madison for $100 psf. Avison Young notes that the vacancy rate for tower floors (26th floor and higher) in Manhattan trophy office properties is a mere 4.6%, with demand for prime space being driven by hedge funds and private equity firms that are now coming off the sidelines. With a very limited supply of available space in the tower floors of tro phy assets, pricing for this premium space is expected to remain high, comments Greg Kraut, Avison Young Principal and Managing Director of the companys New York City office. On the flip side, base floors are just now starting to see some activity and a number of significant blocks have come to market, with more on the horizon. This is creating disjointed movement in the market, whereby leasing activity is not having an impact on overall net absorption. According to Avison Young, average asking rents across Manhattan rose during the second

Page 1 of 4

quarter. In Midtown, class A rents finished at $72.39 psf, up from $71.79 psf at the end of March. Midtown Souths class A pricing surpassed $70 psf, finishing at $71.69 psf. Class A rents in Downtown were mostly flat quarter over quarter, finishing at $48.84 psf at the mid-year point. Kraut adds: Much like the nations economy, indicators for the Manhattan off ice market were also conflicted at mid-year. Conditions vary by submarket, building quality and location within the stack, but we are encouraged that overall activity has increased as tenants finally begin to make decisions after waiting for the economy to gain footing. Midtown After rising slightly during the first quarter, Midtowns class A vacancy reversed direction during the second quarter falling to 12.3%, down from 12.5% at the end of March. Avison Young predicts that the vacancy rate could rise during the third quarter, with nearly 400,000 sf expected to become available at 299 Park Avenue. The largest lease of the quarter was Simpson Thacher & Barletts renewal of 595,000 sf at 425 Lexington Avenue. Illustrating that tenants have a demand for new product, two of the largest deals for the quarter were completed in Hudson Yards. LOreal and SAP leased 402,000 sf and 115,000 sf, respectively, in towers that will be constructed on Manhattans far West Side. Although the aforementioned deals did not have a statistical impact, there was enough leasing activity to push Midtown absorption into positive territory despite recent space dispositions. Large blocks of space that came to the market during the quarter included: 285,000 sf at 1133 Avenue of the Americas and 123,000 sf at 101 Park Avenue. At the end of the quarter, there were a handful of class A blocks of space in excess of 250,000 sf available in Midtown, a majority of which were along Sixth Avenue. Midtown South With a class A vacancy rate of 7%, and an overall rate of 9.3%, Midtown South remains the tightest submarket in the city. Of the several notable deals during the quarter, the one that garnered the most attention was Facebooks lease of 98,750 sf at 770 Broadway. The deal further underscored Midtown Souths reputation as the technology and new media center of New York City. This is a prime example of how quickly things can change, notes James Delmonte, Avison Young Principal and Vice-President of Research, New York City. At one time this area benefitted from tenants who were priced out of Midtown or who were looking for alternatives to Downtown. Today, we are seeing that both Midtown and Downtown are catching demand from tenants who need large blocks of space of which there are very few options in Midtown South or by tenants who simply find that Midtown South has become unaffordable. Unlike Midtown, space coming back to the market in Midtown South outpaced leasing activity, creating rising vacancy and negative absorption. As a result, the overall vacancy rate notched up to 9.3%, from 9.1% at the end of the first quarter. The largest block of space placed on the market was 300,000 sf at 114 Fifth Avenue.

Page 2 of 4

Downtown Downtowns largest lease in the second quarter was Hughes Hubbard & Reeds renewal of 220,000 sf at One Battery Park Plaza, while the largest new lease was completed by Nyack College at 17 Battery Place North for 166,000 sf. Class A vacancy spiked to 16.8% during the second quarter, up from14.8% at the end of March, as significant blocks of space impacted the overall statistics. According to Avison Young, the vacancy rate will likely escalate again before the end of the year as space at One World Trade Center is added to the statistical set. The largest block of space was the addition of nearly 750,000 sf at 180 Maiden Lane. Also added to the mix was 242,000 sf at One Liberty Plaza. Both of these properties are considered two of the best in Lower Manhattan and present a tremendous opportunity for large-space users, says Delmonte. They will attract considerable attention in the final quarters of the year. Not surprisingly the increase in supply created negative absorption for the quarter. Market Forecast The outlook for the remainder of 2013 is promising as employment forecasts at both the national and local levels are encouraging. Hiring is expected to accelerate in the second half of the year and that should translate into positive net absorption for the office market. Since the stock market tends to be a bellwether for the financial industry, recent highs could be a harbinger of a resurgence of hiring on Wall Street, says Avison Young Principal Michael Leff. Historically, the financial sector has been the primary driver for the New York City office market and this beleaguered sector still remains 36,000 jobs below pre-recessionary highs. We are seeing glimmers of hope as some financial institutions are holding onto space that they had previously considered bringing to market, perhaps in anticipation of future growth. Its a waitand-see game at this point. Avison Young is the worlds fastest-growing commercial real estate services firm. Headquartered in Toronto, Canada, Avison Young is a collaborative, global firm owned and operated by its principals. Founded in 1978, the company comprises 1,200 real estate professionals in 48 offices, providing value-added, client-centric investment sales, leasing, advisory, management, financing and mortgage placement services to owners and occupiers of office, retail, industrial and multi-family properties. -endFor further information/comment/photos: James Delmonte, Principal and Vice-President of Research, New York City, Avison Young: (212) 729-6973 Christa Segalini, Vice-President, Beckerman PR: (201) 465-8021; cell: (908) 448-8591 Sherry Quan, National Director of Communications & Media Relations, Avison Young: (604) 647-5098; cell: (604) 726-0959 www.avisonyoung.com

Page 3 of 4

Avison Young was a winner of Canadas Best Managed Companies program in 2011 and requalified in 2012 to maintain its status as a Best Managed company. Follow Avison Young on Twitter: For industry news, press releases and market reports: www.twitter.com/avisonyoung For Avison Young listings and deals: www.twitter.com/AYListingsDeals Follow Avison Young Bloggers: http://blog.avisonyoung.com Follow Avison Young on LinkedIn: http://www.linkedin.com/company/avison-young-commercial-real-estate

Page 4 of 4

You might also like

- Real Estate Market Analysis: Trends, Methods, and Information Sources, Third EditionFrom EverandReal Estate Market Analysis: Trends, Methods, and Information Sources, Third EditionRating: 3 out of 5 stars3/5 (1)

- Commercial Power 2013Document103 pagesCommercial Power 2013NewYorkObserverNo ratings yet

- Hooked on Realty: Introduction to Real Estate InvestingFrom EverandHooked on Realty: Introduction to Real Estate InvestingNo ratings yet

- NY Highlights Q2 2011 JLLDocument1 pageNY Highlights Q2 2011 JLLAnonymous Feglbx5No ratings yet

- Foreclosed: High-Risk Lending, Deregulation, and the Undermining of America's Mortgage MarketFrom EverandForeclosed: High-Risk Lending, Deregulation, and the Undermining of America's Mortgage MarketRating: 3.5 out of 5 stars3.5/5 (2)

- JLL Pulse NYC 08Document4 pagesJLL Pulse NYC 08Anonymous Feglbx5No ratings yet

- 1CO1800A1016Document1 page1CO1800A1016Jotham SederstromNo ratings yet

- Bizjrnl Nov2011B SectionDocument12 pagesBizjrnl Nov2011B SectionThe Delphos HeraldNo ratings yet

- Midtown South, Northbound Rents: PostingsDocument1 pageMidtown South, Northbound Rents: Postingsjotham_sederstr7655No ratings yet

- Manhattan Q32013Document16 pagesManhattan Q32013Joseph DimaNo ratings yet

- Tenant Report 3Q 2011 DC - FINAL-LetterDocument4 pagesTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5No ratings yet

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDocument5 pagesDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8No ratings yet

- 1 - 2013 Futures Report: New York Tech Scene - OverviewDocument4 pages1 - 2013 Futures Report: New York Tech Scene - OverviewAnonymous Feglbx5No ratings yet

- Retail: ResearchDocument4 pagesRetail: ResearchAnonymous Feglbx5No ratings yet

- CCNKF Northbay Office Q2 2012Document10 pagesCCNKF Northbay Office Q2 2012mark_carrington_5No ratings yet

- LA Times - Reporte de Bajas de Precios en El Área - Julio 2009Document2 pagesLA Times - Reporte de Bajas de Precios en El Área - Julio 2009Nando FuentevillaNo ratings yet

- Miami Office Insight Q3 2013Document4 pagesMiami Office Insight Q3 2013Bea LorinczNo ratings yet

- Chapter 20 Real Estate Development and InvestmentDocument13 pagesChapter 20 Real Estate Development and InvestmentRy.KristNo ratings yet

- Houston 4Q11AptDocument4 pagesHouston 4Q11AptAnonymous Feglbx5No ratings yet

- Zell SardinesDocument5 pagesZell Sardinesswemo123No ratings yet

- CompStak Effective Rent ReportDocument2 pagesCompStak Effective Rent ReportCRE ConsoleNo ratings yet

- Urban Land: Space and The CityDocument2 pagesUrban Land: Space and The CityYamir EncarnacionNo ratings yet

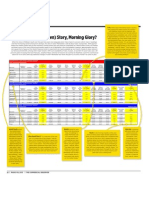

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Document1 pageWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655No ratings yet

- Globalization and The Real Estate Industry: Issues, Implications, OpportunitiesDocument36 pagesGlobalization and The Real Estate Industry: Issues, Implications, OpportunitiesarchitpandatNo ratings yet

- Manhattan Q42014Document16 pagesManhattan Q42014Joseph DimaNo ratings yet

- McDonagh Trends in The Use of The Internet PDFDocument21 pagesMcDonagh Trends in The Use of The Internet PDFMaica PinedaNo ratings yet

- 1CO2000A1106Document1 page1CO2000A1106Jotham SederstromNo ratings yet

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisNo ratings yet

- April 27thDocument4 pagesApril 27thAnonymous Feglbx5No ratings yet

- Marketbeat: Office SnapshotDocument1 pageMarketbeat: Office Snapshotapi-150283085No ratings yet

- Cushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Document0 pagesCushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Angie BrennanNo ratings yet

- Manhattan Sales Volume Q2 2012Document4 pagesManhattan Sales Volume Q2 2012Anonymous Feglbx5No ratings yet

- Valeria Gamarts PaperDocument4 pagesValeria Gamarts PaperValeria GamartNo ratings yet

- 2023 Midyear BigBox ReportDocument68 pages2023 Midyear BigBox ReportzhaoyynNo ratings yet

- 06 03 08 NYC JMC UpdateDocument9 pages06 03 08 NYC JMC Updateapi-27426110No ratings yet

- Miami-Dade LAR 3Q16Document4 pagesMiami-Dade LAR 3Q16Anonymous Feglbx5No ratings yet

- HoustonDocument1 pageHoustonAnonymous Feglbx5No ratings yet

- Avison Young - New Jersey Industrial Market Report - 2nd Quarter 2013Document4 pagesAvison Young - New Jersey Industrial Market Report - 2nd Quarter 2013Matt DollyNo ratings yet

- March 29thDocument4 pagesMarch 29thAnonymous Feglbx5No ratings yet

- Office OverviewDocument22 pagesOffice OverviewAnonymous Feglbx5No ratings yet

- Research Paper Housing MarketDocument4 pagesResearch Paper Housing Marketikrndjvnd100% (1)

- Harbor Point $107M Tax Deal Gets Final OK After Months of ControversyDocument3 pagesHarbor Point $107M Tax Deal Gets Final OK After Months of ControversyAnonymous Feglbx5No ratings yet

- Seeing The Big Picture - Central New Jersey Office Rebounds From RecessionDocument1 pageSeeing The Big Picture - Central New Jersey Office Rebounds From RecessionMatt DollyNo ratings yet

- Winning in Growth Cities 2012Document54 pagesWinning in Growth Cities 2012Gen ShibayamaNo ratings yet

- Debt Piles Add To RiskDocument8 pagesDebt Piles Add To RiskYOONNo ratings yet

- What'Ll Happen To US Commercial Real Estate As Chinese Money Dries Up - Zero HedgeDocument6 pagesWhat'Ll Happen To US Commercial Real Estate As Chinese Money Dries Up - Zero HedgefiestamixNo ratings yet

- SanFran 4Q11AptDocument4 pagesSanFran 4Q11AptGen ShibayamaNo ratings yet

- HE Usiness Imes: Housing Market Shows Classic Recovery SignsDocument1 pageHE Usiness Imes: Housing Market Shows Classic Recovery SignsbernicetsyNo ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- Office Market - Panama City: Quick Stats (Class A)Document4 pagesOffice Market - Panama City: Quick Stats (Class A)Fernando Rivas CortesNo ratings yet

- Fall 09 MailerDocument1 pageFall 09 Mailerjddishotsky100% (2)

- Extra Credit 3-2Document7 pagesExtra Credit 3-2api-741800996No ratings yet

- ENR04232012 500 Section Final1782916695Document71 pagesENR04232012 500 Section Final1782916695Mohammad OmairNo ratings yet

- 07 25 08 NYC JMC UpdateDocument9 pages07 25 08 NYC JMC Updateapi-27426110No ratings yet

- Climbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Document3 pagesClimbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Anonymous Feglbx5No ratings yet

- Emerging Trends 2012Document88 pagesEmerging Trends 2012atlramNo ratings yet

- ULI Emerging Trends in Real Estate 2012Document88 pagesULI Emerging Trends in Real Estate 2012Bruce BartlettNo ratings yet

- Feasibility Study: Condominiums CE40-A1: Group 4 (Reyes, Santillan, Salvador, Sultan, Tan, Tapanan, Tiongco)Document16 pagesFeasibility Study: Condominiums CE40-A1: Group 4 (Reyes, Santillan, Salvador, Sultan, Tan, Tapanan, Tiongco)Migs David100% (1)

- High Rents Low EconomyDocument5 pagesHigh Rents Low Economybob smithNo ratings yet

- Sample Real Estate Research PaperDocument6 pagesSample Real Estate Research Paperfemeowplg100% (1)

- Progress Ventures Newsletter 3Q2018Document18 pagesProgress Ventures Newsletter 3Q2018Anonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- Five Fast Facts - RIC Q3 2018Document1 pageFive Fast Facts - RIC Q3 2018Anonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Swastik Pipes - Case Laws On Cash CreditDocument5 pagesSwastik Pipes - Case Laws On Cash CreditPranjal SrivastavaNo ratings yet

- Motion To Dismiss CH 13 Petition For Bad Faith: Benjamin Levi Jones-NormanDocument8 pagesMotion To Dismiss CH 13 Petition For Bad Faith: Benjamin Levi Jones-Normangw9300100% (1)

- Cash Receipt 2Document13 pagesCash Receipt 2Aneesh ChandranNo ratings yet

- Fi32rk14 LRDocument44 pagesFi32rk14 LRAvnik 'nickz' NayeeNo ratings yet

- Libertas SRC NotesDocument14 pagesLibertas SRC NotesjrfbalamientoNo ratings yet

- TPA - Introduction and Important DefinitionsDocument41 pagesTPA - Introduction and Important DefinitionsakhilNo ratings yet

- Uses Cashflow From The Collateral Asset To Pay To Bondholders. So This New Bond Is Called CoveredDocument2 pagesUses Cashflow From The Collateral Asset To Pay To Bondholders. So This New Bond Is Called CoveredSarah DanaNo ratings yet

- Universal Work QueueDocument19 pagesUniversal Work QueueThulasee RamNo ratings yet

- Gold Investors FutureDocument153 pagesGold Investors FutureGlennThomas100% (1)

- Chapter 9 SolutionsDocument5 pagesChapter 9 SolutionsRivaldi SembiringNo ratings yet

- Final Project BCCBDocument73 pagesFinal Project BCCBgagana sNo ratings yet

- Product LevelsDocument17 pagesProduct LevelsArun MishraNo ratings yet

- PNB vs. GonzalesDocument1 pagePNB vs. GonzalesMaggi BonoanNo ratings yet

- 55-Garcia-vs-CA-GR No 128177Document2 pages55-Garcia-vs-CA-GR No 128177Ronald Alasa-as AtigNo ratings yet

- Caiib BFM Module D NotesDocument36 pagesCaiib BFM Module D NotesA Man TA100% (1)

- KCS ActDocument28 pagesKCS Actashok mvNo ratings yet

- Bank Guarantee TypesDocument4 pagesBank Guarantee TypesecpsaradhiNo ratings yet

- GovLab Jakarta Report 160902Document12 pagesGovLab Jakarta Report 160902Eni PurwantiNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- CA Agro-Industrial Development Corp V CA 219 SCRA 426Document4 pagesCA Agro-Industrial Development Corp V CA 219 SCRA 426Jay CruzNo ratings yet

- Special Power of Attorney (SPA, HQP-HLF-064, V02)Document2 pagesSpecial Power of Attorney (SPA, HQP-HLF-064, V02)Rpadc CauayanNo ratings yet

- Company Law CS Inter MCQsDocument19 pagesCompany Law CS Inter MCQsbitupon.sa108No ratings yet

- Anuva Residences Studio Sample ComputationDocument1 pageAnuva Residences Studio Sample ComputationJoyceNo ratings yet

- Ifs Cia 3.1Document15 pagesIfs Cia 3.1Andriana MihobeeNo ratings yet

- Income Tax Payment Challan: PSID #: 34336315Document1 pageIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNo ratings yet

- Reviewer in NegoDocument7 pagesReviewer in NegoJoan BartolomeNo ratings yet

- Project Report On Commodity Trading at IIFlDocument16 pagesProject Report On Commodity Trading at IIFlNarayan Sharma PdlNo ratings yet

- QuestionsDocument17 pagesQuestionskblitzin3804No ratings yet

- Compiled NILDocument40 pagesCompiled NILAnna Marie DayanghirangNo ratings yet

- Al Buhaira National Insurance CompanyDocument8 pagesAl Buhaira National Insurance CompanyInnocent ZeeNo ratings yet

- Composite Structures of Steel and Concrete: Beams, Slabs, Columns and Frames for BuildingsFrom EverandComposite Structures of Steel and Concrete: Beams, Slabs, Columns and Frames for BuildingsNo ratings yet

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda Cans (Father's Day Gift for Science and Engineering Curious Dads)From EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda Cans (Father's Day Gift for Science and Engineering Curious Dads)No ratings yet

- The Things We Make: The Unknown History of Invention from Cathedrals to Soda CansFrom EverandThe Things We Make: The Unknown History of Invention from Cathedrals to Soda CansRating: 4.5 out of 5 stars4.5/5 (21)

- Troubleshooting and Repair of Diesel EnginesFrom EverandTroubleshooting and Repair of Diesel EnginesRating: 1.5 out of 5 stars1.5/5 (2)

- Rocks and Minerals of The World: Geology for Kids - Minerology and SedimentologyFrom EverandRocks and Minerals of The World: Geology for Kids - Minerology and SedimentologyRating: 4.5 out of 5 stars4.5/5 (5)

- To Engineer Is Human: The Role of Failure in Successful DesignFrom EverandTo Engineer Is Human: The Role of Failure in Successful DesignRating: 4 out of 5 stars4/5 (138)

- Crossings: How Road Ecology Is Shaping the Future of Our PlanetFrom EverandCrossings: How Road Ecology Is Shaping the Future of Our PlanetRating: 4.5 out of 5 stars4.5/5 (10)

- The Great Bridge: The Epic Story of the Building of the Brooklyn BridgeFrom EverandThe Great Bridge: The Epic Story of the Building of the Brooklyn BridgeRating: 4.5 out of 5 stars4.5/5 (59)

- Skyway: The True Story of Tampa Bay's Signature Bridge and the Man Who Brought It DownFrom EverandSkyway: The True Story of Tampa Bay's Signature Bridge and the Man Who Brought It DownNo ratings yet

- Structural Cross Sections: Analysis and DesignFrom EverandStructural Cross Sections: Analysis and DesignRating: 4.5 out of 5 stars4.5/5 (19)

- Compendium of Best Practices in Road Asset ManagementFrom EverandCompendium of Best Practices in Road Asset ManagementNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Finite Element Analysis and Design of Steel and Steel–Concrete Composite BridgesFrom EverandFinite Element Analysis and Design of Steel and Steel–Concrete Composite BridgesNo ratings yet

- Summary of Taiichi Ohno's Taiichi Ohno's Workplace ManagementFrom EverandSummary of Taiichi Ohno's Taiichi Ohno's Workplace ManagementNo ratings yet