Professional Documents

Culture Documents

Global Oil Dashboard - Q2 2013 - Will Martin

Uploaded by

peakoilproofOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Oil Dashboard - Q2 2013 - Will Martin

Uploaded by

peakoilproofCopyright:

Available Formats

Peak Oil Dashboard: Page 1 Q2 2013

Created by Will Martin - Peakoilproof.com

Global Peak Oil Summary

This dashboard is designed to quickly summarize the global oil market over the past quarter. By keeping track of key quantitative indicators on a quarterly basis, this dashboard can help monitor the onset of peak oil.

Supply

The global rate of oil production is up slightly year-over-year. However, during the same period global net exports of oil declined. Production gains in Russia, the US and Canada are just barely offsetting production declines in Norway, UK, Latin America and the Middle East. Global supermajor production continues to fall. Based on this data, we are likely still on the "bumpy plateau" of peak oil and have likely passed "peak oil exports."

Global Oil Production

year-over-year growth

-2%

-4% 0%

2%

4%

-6%

-8%

6%

8%

-10%

10%

Demand

Global oil consumption was up slightly year-over-year with almost growth coming from the developing world. The developed world continues to fall from its "peak oil demand" peak. The economies of the developed world are shrinking on a relative basis to the global economy. Europe is officially in a double-dip recession. GDP growth remains strong in Asia and the developing world. In Q1 2013 China overtook the US as the world's largest oil importer - the first time the top spot has changed hands in 41 years.

Real World GDP Growth

-2% -4% -6% -8% -10% 10% 0% 2% 4% 6% 8%

Price

The price of Brent crude oil has been volatile and fell nearly 10% year-over-year, but remained well above historical averages. Prices in futures and options markets seem to indicate a belief that oil prices will continue to fall, possibly due to slowing global economic growth. The global money supply rose over 6% yearover-year as central banks pumped more money into their economies, but a falling velocity of money from economic stagnation has so far kept inflation from pushing up oil prices in real terms.

Crude Oil Price

Brent yoy change

-5% -10% -15% -20% <-25% 0% 5% 10% 15% 20% >25%

Peak Oil Dashboard: Page 2 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Supply: Global Oil Production Rates

The global oil production rate is up slightly year-over-year but has slowed since Q1 2013. The growth rate of the global oil production rate has been declining for nearly 30 years and is well below its 1986 peak. Major improvments in production rates in the past year have occured in the United States, Canada, Russia, China and West Africa. US oil production increased dramatically due to shale fracking, helping to offset the decline in production from Alaska and the Gulf of Mexico. Lybia experienced major production rate gains as it ramped back up following the Arab Spring.

2001 1999

Peak Oil: 1970

'02 '79 2007? 1970 '93

1974

2004

1970 2004 '97 800,000+ more BPD 600,000-800,000 more BPD 400,000-600,000 more BPD 200,000-400,000 more BPD 0-200,000 more BPD No Data 0-200,000 fewer BPD 200,000-400,000 fewer BPD 400,000-600,000 fewer BPD 600,000-800,000 fewer BPD 800,000+ fewer BPD Peak Oil: 2001 Peak Oil: 2000

Global Oil Production Rate YOY Growth

-2%

-4% -6% -8% -10% 10% 0%

2%

4% 6% 8% Peak Growth Rate: 7% in 1986

page 1 of 1

Peak Oil Dashboard: Page 3 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Supply: Export Supply

The Top 10 Oil Exporting Countries Represent 81% of World Oil Export Supply - Net Exports Estimated Using Jeffrey Brown's Export Land Model Global oil exports remain relatively flat year-on-year but are still down about 3 MMBPD from their peak in 2004. Six of the top 10 oil exporting nations are now experiencing 5-year net export rate declines. Saudi Arabia, Nigeria, Venezuela, Norway and Libya are all seeing lower rates of net exports. This decline has been somewhat offset by huge increases in oil exports from Iraq and Canada. Total liquid production rates continue to decline for the Supermajors. Overall, global net oil exports do not appear to be responding to record-high oil prices, signaling that we may be on the "bumpy plateau" of peak oil and may have passed the point of "peak oil exports."

Russia

5-Year Net Oil Export CAGR

Saudi Arabia

5-Year Net Oil Export CAGR

Iraq

5-Year Net Oil Export CAGR

United Arab Emirates

5-Year Net Oil Export CAGR

Kuwait

5-Year Net Oil Export CAGR

-2% -4% -6% -8% <-10%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

<-10%

<-10%

<-10%

<-10%

Nigeria

5-Year Net Oil Export CAGR

Venezuela

5-Year Net Oil Export CAGR

Norway

5-Year Net Oil Export CAGR

Libya

5-Year Net Oil Export CAGR

Canada

5-Year Net Oil Export CAGR

-2% -4% -6% -8% <-10%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

Peak Oil Sooner

>10%

8%

<-10%

<-10%

<-10%

<-10%

38%

Global Net Oil Exports

For Top 19 Oil Exporting Nations

Supermajor Production Rate

BP, Chevron, ExxonMobil, Shell, & Total

40,000 35,000

12,000

10,000

30,000 25,000 20,000 15,000 10,000 5,000 Russia 0 Jun-03 Jun-04 Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Jun-13 Saudi Arabia

Total Liquids Production Rate (Thousand BPD)

BP 8,000 Total 6,000 Shell

Thousand BPD

4,000 Chevron

2,000 ExxonMobil

2012

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Peak Oil Dashboard: Page 4 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Supply: Export Supply: News Summaries

The Top 10 Oil Exporting Countries Represent 81% of World Oil Export Supply - Net Exports Estimated Using Jeffrey Brown's Export Land Model - Summaries Come From Tom Whipple's Weekly "Peak Oil Review"

Russia

12000

Russia Q2 2013 News

In Q2, Russian oil production continued past its a postSoviet record achieved in Q1 2013. Russia is now the worlds largest oil producer and world largest oil exporter. In Q1 China passed Europe to become Russias number one oil market. In Q2, the Sino-Russian energy relationship grew even stronger. Russia announced that China National Petroleum Corp will begin exploring for Arctic oil in Russian waters alongside Rosneft. Rosneft then signed a 25 year agreement to deliver 365 million tons of oil to China - one of the largest oil deals in history. Russia gave temporary asylum to US whistleblower Edward Snowden - harming US-Russian relations.

12000 Thousand Barrels Per Day 10000 8000 6000 4000 2000 0

Saudi Arabia

Saudi Arabia Q2 2013 News

Export cannibalization continues to grow in Saudi Arabia. The Saudis have 3 new refineries under construction that will reduce net exports by 1.2 million BPD in 2017. In Q2, Saudi Arabia passed Germany in total oil consumption. Perhaps indicating Saudi Peak Oil is imminent, Saudi Arabia's Oil Minister Ali Al-Naimi was quoted as saying "We dont really see a need to build a capacity beyond what we have today." Stability remains precarious: oil revenue accounts for 93% of revenue for the Saudi government, which now needs $94/bbl oil to balance their budget. Based on actuarial tables, the 88-year old King Abdullah has a 15% chance of dying in the next year.

Thousand Barrels Per Day

10000 8000 6000 4000 2000 0

Production Consumption

Net Exports

Production Consumption

Net Exports

Iraq

3500

Iraq Q2 2013 News

1/2 of Iraqi oil exports now go to China. Chinese oil companies are increasingly displacing US ones. Chaos continued in many parts of the country with car bombs going off on an almost daily basis. 1000 Iraqis were killed in attacks in May. Southern Iraq is on the verge of a Sunni-Shiite civil war. Kurdistan began exporting oil directly to Turkey, bypassing the federal Iraqi government completely. In Q2 a brigade of Iraqs Kurdish troops defected to Kurdistan, further hurting relations. Turkey recently completed a new pipeline to Northern Iraq and signed an agreement Turkey to develop Iraqi oil fields.

Thousand Barrels Per Day

United Arab Emirates

3500 3000 2500 2000 1500 1000 500 0

United Arab Emirates Q2 2013 News

In Q2 UAE oil minister Suhail Al Mazrouei declared that the "Days of Easy, Cheap Oil are Gone" and announced that the country would begin constructing nuclear power plants to provide 25% of its electricity by 2021. In Q1 the UAE opened the worlds largest solar plant, named Shams 1.

Thousand Barrels Per Day

3000 2500 2000 1500 1000 500 0 -500 Production Consumption Net Exports

Production Consumption

Net Exports

Kuwait

3000

Kuwait Q2 2013 News

Thousand Barrels Per Day

Nigeria

3000 2500 2000 1500 1000 500 0

Nigeria Q2 2013 News

Nigerias oil production continues to fall, mostly as the result of vandalism and oil theft. Crude oil theft now costs the country $7 billion annually. Attacks on pipelines and offshore rigs and hijackings of tankers continues. A nationwide blackout hit the country in May. Nigeria's rebel MEND group, which frequently attacks oil infrastructure, announced it would begin attacking mosques. Nigeria's government continues to fight Islamist militants in the Northern provinces. Nigerias four main opposition parties formed a coalition, threatening President Goodluck Jonathan's hold on power.

Thousand Barrels Per Day

2500 2000 1500 1000 500 0

Kuwait announced that it plans to spend $56 billion over the next 5 years to raise production by 650,000 bpd by 2020. The Kuwaiti central bank announced that its economy would likely grow at just 1.9% in 2013 slowing oil export cannibalization.

Production Consumption

Net Exports

Production Consumption

Net Exports

Venezuela

3500

Venezuela Q2 2013 News

In Q2 Nicolas Maduro was sworn in as president, following the death of Hugo Chvez on March 5th, 2013. Maduro will continue the oil industry policies of Chvez. Maduro's oil minister, Rafael Ramirez, repeated his assertion that $100/bbl should be the floor for oil prices. Venezuela announced a major currency devaluation in Q1. As of Q2, the country is on the brink of hyperinflation, with annualized inflation topping 20%. The government has begun rationing everything from toilet paper to chickens. Blackouts are becoming more common and hyperinflation could collapse Venezuela's economy, forcing down oil production rates.

3500 Thousand Barrels Per Day 3000 2500 2000 1500 1000 500 0

Norway

Norway Q2 2013 News

Norway proves how relentless peak oil can be. Oil production continues to plummet; passing a 25-year low this year. The state of Texas now produces more oil than the country of Norway. Over the past 11 years, Norway has fallen from the world's 7th largest oil exporter to the world's 14th largest today. The oil ministry announced that it expects production to continue to decline in 2013 and bottom out next year as new projects come online.

Thousand Barrels Per Day

3000 2500 2000 1500 1000 500 0

Production Consumption

Net Exports

Production Consumption

Net Exports

Libya

2000

Libya Q2 2013 News

Oil production hit 70% of its pre-Arab Spring levels. Bombings, kidnappings and assassinations continue to make the prospects of stability uncertain. Protests continue in Benghazi. In Q2 NATO sent a contingent of soldiers to help train Libyan government forces against militants aligning themselves with Al Qaeda.

Thousand Barrels Per Day 4000 3500 3000 2500 2000 1500 1000 500 0 -500

Canada

Canada Q2 2013 News

Canadian oil production is up dramatically year-overyear. In Q2 Canada accounted for 38.7% of U.S. crude imports, the most ever by a single nation. Oil sands production rose 13% during 2012 despite cost increases of more than 10% per year. Oil sands production could rise from 1.8 MMBPD today to 5.2 MMBPD by 2030 if it isn't hampered by climate change legislation or lower prices. In March, 5,000 barrels of tar sands oil being delivered from Canada spilled from Exxon's Pegasus pipeline into a residential neighborhood in Arkansas.

Thousand Barrels Per Day

1500 1000 500 0 -500 Production Consumption Net Exports

Production Consumption

Net Exports

Peak Oil Dashboard: Page 5 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Supply: Production Costs and Operating Profits

Production costs continue to increase for oil drilling. Despite record-high oil prices, these increasing costs are resulting in declining profits for oil majors

US and Canada Total Drilling Rig Count

1,800 1,600 1,400 $50,000,000,000 1,200 1,000 800 600 400 $10,000,000,000 200 0 Jun-93 Nov-99 Oct-95 $0 Q1-2012 $40,000,000,000 $70,000,000,000

Supermajor Quarterly Operating Profits

$60,000,000,000

$30,000,000,000

$20,000,000,000

Jun-00

Jul-97

Feb-98

Sep-98

Oct-02

May-03

Aug-94

May-96

Mar-95

Aug-01

Mar-02

Jan-94

Dec-96

Apr-99

Jan-01

Q2-2012 ExxonMobil Chevron

Q3-2012 Shell Total

Q4-2012 BP

Q1-2013

US Capital & Labor Expenditure Spending per Barrel of Oil Produced

$160 $140 $120 $100 $2,500,000 $80 $60 $40 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 $0 2002 $4,500,000

US Cost Per Well Drilled

$4,000,000

$3,500,000 $3,000,000

$20

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 US Capital Expenditure per Barrel Produced US Labor Expenditure per Barrel Produced

2003

2004

2005

2006

2007

US Nominal Cost per Crude Oil Well Drilled US Real Cost per Crude Oil/Natural Gas/Dry Well Drilled

Peak Oil Dashboard: Page 6 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Supply: Global Oil Consumption Rates

Global oil consumption is up slightly year-over-year. Most consumption gains came from China, India, Japan, Brazil & Thailand. Consumption in the United States and Europe fell over the same period.

2005 '98 2001 '98 Peak Oil Demand: 2005 1996

800,000+ more BPD 600,000-800,000 more BPD 400,000-600,000 more BPD 200,000-400,000 more BPD 0-200,000 more BPD No Data 0-200,000 fewer BPD 200,000-400,000 fewer BPD 400,000-600,000 fewer BPD 600,000-800,000 fewer BPD 800,000+ fewer BPD

Global Oil Consumption Rate YOY Growth

-2% 0% 2%

-4%

-6% -8% -10%

4%

6% 8% 10%

page 1 of 1

Peak Oil Dashboard: Page 7 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Demand: World Relative GDP Growth Rates

The global economy grew slightly in real terms year-over-year. As measured in oil or gold (as opposed to Dollars) the world's economy is growing strongly. Most of this growth came from the developing world and in particular from Asia. The GDP of the developed world fell in relative terms, as measured by its share of total world GDP. All of Europe and North America experienced negative real GDP growth year-over-year.

negative 8% or more negative 6-8% negative 4-6% negative 2-4% negative 0-2% no data 0-1% growth 1-2% growth 2-3% growth 3-4% growth 4%+ growth

Real World GDP Growth Measured in USD

-2% -4% -6% -8% -10% 10% 0% 2% 4% 6% 8%

Real World GDP Growth Measured in Oil

-2% 0% 2%

Real World GDP Growth Measured in Gold

-2% 0% 2% 4% 6% 8% 10% -4% -6% -8% -10%

-4%

-6% -8% -10%

4%

6% 8% 10%

page 1 of 1

Peak Oil Dashboard: Page 8 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Demand: Global Oil Import Demand

The Top 5 Countries/Regions (US, EU, China, Japan & India) Represent 52% of World Oil Import Demand For the top oil importing countries, GDP continues to increase but at a slowing rate. Almost all of Europe is now in a recession. Some countries, such as Greece and Portugal are in a severe recession. The economies of the United States and Japan are both growing on a real basis but shrinking on a relative basis to the rest of the world. Economic growth remains robust in China and India, propping up global oil import demand, pushing the date of global peak oil closer.

China (#1 Oil Importer)

Real GDP Growth

United States (#2)

Real GDP Growth

European Union (#3)

Real GDP Growth

Japan (#4)

Real GDP Growth

India (#5)

Real GDP Growth

-2% -4% -6% -8% -10%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6%

Peak Oil Sooner

10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

China (#1 Oil Importer)

Real GDP Growth Relative to World

United States (#2)

Real GDP Growth Relative to World

European Union (#3)

Real GDP Growth Relative to World

Japan (#4)

Real GDP Growth Relative to World

India (#5)

Real GDP Growth Relative to World

-2% -4% -6% -8% -10%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6% -4% -6% -8%

-2%

0%

2% 4% 6%

Peak Oil Sooner

10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

Peak Oil Sooner

-10% 10%

8%

Global Real GDP

6.0% 5.0% 4.0% $18.50 $18.00

GDP Winners & Losers

Annual Real GDP Growth Rate

$17.50

$17.00

3.0% $16.50 2.0% $16.00

1.0%

$15.50 0.0% -1.0% -2.0% Q2-08 Q3-08 Q4-08 Q1-09 Q2-09 Q3-09 Q4-09 Q1-10 Q2-10 Q3-10 Q4-10 Q1-11 Q2-11 Q3-11 Q4-11 Q1-12 Q2-12 Q3-12 Q4-12 Q1-13 $15.00 $14.50 $14.00

Q2-13

China Thailand Iraq Philippines Indonesia Chile Malaysia India World Australia Mexico Hong Kong, China Venezuela, RB Russia Argentina Turkey Taiwan South Africa United States Brazil South Korea Switzerland Canada Slovak Republic Sweden Romania Norway Poland Singapore Bulgaria United Kingdom Japan Austria Germany Denmark France Belgium European Union W Europe Ireland Hungary Finland Netherlands Czech Republic Spain Croatia Italy Portugal Greece -8.00% -6.00% -4.00% -2.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00%

Quarterly Real World GDP ($Trillion 2005)

Annual Growth Rate (line)

Peak Oil Dashboard: Page 9 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Demand: Global Oil Import Demand: News Summaries

Top 5 Countries/Regions (US, EU, China, Japan & India) Represent 52% of World Oil Import Demand - Summaries From Tom Whipple's Weekly "Peak Oil Review"

China Q2 2013 News

In 2013 China overtook the US as the worlds largest net oil importer - a spot the US had held since 1972. Chinese car sales rose 20% year-over-year, but Chinas economy grew at its slowest rate in 13 years as exports fell. In April, a short-lived cash crisis hit the country. China signed a major gas deal with Russia to import natural gas from Russian fields. Russia also announced that it would double its exports of oil to China. China awarded contracts to 16 companies to drill in Chinas shale gas reserves, but not a single one has ever drilled a gas well before. So far China has drilled 60 shale wells and they have all come up dry. China is the world's largest emitter of carbon dioxide and at current pace will produce 4 times more CO2 than the US by 2020. Air pollution levels in Beijing went literally off the scale in Q1 2013. Not coincidentally, Chinas coal consumption levels reached a record high. China now burns as much coal as the rest of the world combined. It is estimated that 1.2 million Chinese die a year from the horrendous air pollution. In March 16,000 dead pigs were found floating down the river that supplies drinking water to Shanghai. In Q1 Chinese Premier Wen Jiabao called for action to alleviate the pollution and tax minister Jia Chen announced that China would introduce a carbon tax. In Q2, China announced it will begin setting up a carbon trading market. China continued to pull ahead as the world leader in renewable energy. Wind power overtook nuclear power in China, producing 2% more electricity overall. For 2013, China announced it will install more than 5 times more wind power than nuclear power and more than 3 times more solar power than nuclear power. China now installs three times more solar each year as the United States accounting for a third of the total world solar panels installed each year. China announced plans to build a second aircraft carrier and Hong Kong, a Chinese protectorate, gave temporary asylum to US whistleblower Edward Snowden - harming US-China relations.

United States Q2 2013 News

In Q1 US oil production reached a 20-year high, hitting 7 million bpd for the first time since March 1993. Meanwhile, the US has almost certainly passed peak oil demand. US oil demand dropped to an 18-year low and us oil imports fell to their lowest level in 25 years. Gasoline consumption is at its lowest level since 2004. In Q1 Obamas State of the Union address specifically endorsed the McCain/Lieberman cap and trade bill; If climate change legislation is enacted, US oil demand would drop further. While shale oil production rose dramatically, all other forms of US oil fell. US Gulf of Mexico oil production continued to decline off its 2009 peak. Production from Alaskas North Slope continues to fall from its 2002 peak and was down 8% year-over-year. Shell Oil gave up on the 2013 Arctic drilling season after its oil rig, the Kulluk, ran aground in Alaska. Worryingly, the Bakken shale oil boom in North Dakota may be slowing down, with the initial productivity of new wells dropping. Companies are shifting their focus to Californias Monterey shale, where they may face heavy environmentalist opposition. In Q2 Obama announced a series of executive actions designed to address Climate Change, including limitations on carbon emissions from existing power plants, increased appliance efficiency standards and promotion of renewable energy development on public lands. Renewable energy in the US continues to grow with solar capacity increasing 76% year-overyear. Obama announced Ernest Moniz, a supporter of fracking, as his nomination for Secretary of Energy. Obama also announced Gina McCarthy, a former Mitt Romney aide, as his pick to head the EPA. In Q2 the EPA announced its new "Tier 3" gasoline regulations which will bring US sulfur requirements in line with California's. The Federal Reserve has keep interest rates near 0% for four years and has tripled its balance sheet by continuing pump $85 billion each month into the economy. In Q2 FED Chairman Ben Bernanke announced plans to "taper" such money printing; the market reacted swiftly to the negative and Bernanke quickly reversed his rhetoric.

European Union Q2 2013 News

Europe was officially in a double-dip recession in Q1 2013, shrinking by 0.6%. Greeces economy shrunk by 6.4% year-over-year. Unemployment in the Eurozone rose to 12% - the highest level since the Eurozone was created in 1999. Europe has passed peak oil demand, with oil demand now down 2 million BPD from 7 years ago. In Q2 US exports of diesel to Europe hit a 23 year high. The EU now produces 13% of its energy from renewable sources. In Q1 Cyprus announced a one-time bank levy on all Cypriot bank accounts on March 15th as part of a 10 billion bailout. A panicked bank run ensued and the government was forced to close all banks for 12 days. The government reopened its banks after it promised not to confiscate money from accounts smaller than 100,000. In Italy, the government will likely remain in political gridlock after parliamentary elections split three ways, leaving no party in a position to govern.

Japan Q2 2013 News

Japan remained in a recession, with its economy contracting for the third straight quarter. The escalating rhetoric between Japan and China over the Senkaku islands cooled when Japans new prime minister Shinz Abe send a letter to Chinese president Xi Jinping, expressing his interest in a peaceful resolution. The new prime minister also announced he would approve the construction of new nuclear reactors a complete 180 from former Prime Minister Yoshihiko Noda, who planned to shut down all Japanese nuclear power plants by 2040. Japan announced it would begin restarting its idled nuclear power plants by the end of 2013 but in Q2 announced it would be impossible to restart the plants on schedule. New safety regulations are expected to shut down 10 more nuclear reactors. In Q1 2013, after spending $700 million on the decade-long project, Japanese scientists announced that they had successfully extracted natural gas from subsea methane hydrates.

India Q2 2013 News

In Q1 India became the 4th largest oil consumer after China, the US and Russia. Meanwhile, Indias oil production rate fell 4% year-over-year. Amidst continued electricity shortages, Indian coal imports fell 11% year-over-year. In Q1 the Indian government announced that it would raise gasoline and diesel prices as it continues to slowly phase out fuel subsidies. In Q2 Prime Minister Manmohan Singh announced plans to double India's renewable energy generation by 2017.

Peak Oil Dashboard: Page 10 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Prices

Global oil pries are down year-over-year. This 1-year and 2-year trend of declining oil prices has reversed the 5-year and 10-year trends of rising oil prices. Both Brent and WTI crude oil futures are in backwardation, indicating that traders expect the price of oil to fall in the future. This backwardation benefits investors who take long positions in futures ETFs (like DBO & OIL), as there is no negative roll yield," like when oil is in congtango. The commitment of speculative traders and the difference in expected payoffs from put and call options contracts, however, tell us that traders believe that a price drop is le3ss likely than a price rise over the long term.

Global Crude Oil Price

Brent year-over-year % change

US Gasoline Price

US Mogas year-over-year % change

Brent Put Option Payoffs

CAGR of Returns

Brent Call Payoffs

CAGR of Returns

Brent Straddle Payoffs

CAGR of Returns

Dec-14 -5% -10% -15% -20% <-25% 0% 5% 10% 15% 20% >25% -10% -15% -20% <-25% -5% 0% 5% 10% 15% 20% >25% Dec-16

Dec-15 Dec-17

Dec-14 Dec-16

Dec-15 Dec-17

Dec-14 Dec-16

Dec-15 Dec-17

100% 90% 80% 70% 60% 50%

100% 90% 80% 70% 60% 50% 40% 30% 20% 10%

100% 90% 80% 70% 60% 50% 40% 30% 20% 10%

-6.4% Brent Futures

$110 $105 $100 $95 $90 $85 $80 $75 $110 $105 $100 $95 $90 $85 $80 $75

-3.0% WTI Futures

40% 30%

20%

10% 0% -10% $40.00 $50.00 $60.00 $70.00 $80.00 $90.00

0%

-10% $100.00 $110.00 $120.00 $130.00 $140.00 $90.00

0%

-10%

$70

Backwardation

$70

Backwardation

Brent Crude Oil Price

10-Year 150.00 140.00 130.00 120.00 110.00 Linear (10-Year) Linear (5-Year) Linear (1-Year)

WTI Crude Oil Implied Volatility Surface

16.00% Implied Volatility (%) 14.00% 12.00% 10.00% 8.00% $110 $105 $100 6.00% $95

100.00 90.00 80.00 70.00 60.00 50.00 40.00 30.00 20.00 10.00 0.00 Feb-04 Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13 Feb-14

$90

$85

Strike Prices

Oct-04

Oct-03 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Oct-10 Oct-11

2.4

3.4

4.4

0.9

Jun-12

Jun-03 Jun-04 Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10 Jun-11 Oct-12 Jun-13 Oct-13 Jun-14

Greeks:

Real Option Price: Implied Volitility: Calculated Option Price:

(based on Black Scholes)

Brent Crude Call Options

$12.20 12.87% $14.39 0.83

Brent Crude Put Options

$5.92

CFTC Commitment of Traders (Futures and Options)

1,800,000,000 1,600,000,000

$1.46 -0.17

1,400,000,000 1,200,000,000 Barrels 1,000,000,000 800,000,000 600,000,000 400,000,000 200,000,000

Delta:

(Velocity: Change in option P&L per change in value of Brent crude; Moneyness: the implied probability of expiring in-the-money)

Gamma:

(Acceleration: Change in option Delta per change in value of Brent crude)

0.02 0.30 0.00 0.97

0.02 0.30 0.00 -0.25

Vega:

(Changes in Volitility: Change option P&L from change in volitility of Brent crude)

Theta:

(Passage of Time: Change in option P&L from the passage of time)

Long Commercial Speculators Short Non- Reportable Positions

Rho:

(Interest Rate Change: change in option P&L from changes in interest rates)

$80

1.4

$140.00

$115.00

$40.00

$65.00

$90.00

Peak Oil Dashboard: Page 11 Q2 2013

Created by Will Martin - Peakoilproof.com

Oil Demand: Money Supply Growth Rates

While supply and demand fundamentals affect the real price of oil, currency fluctuations affect its nominal price. The money supply for most countries continues to grow at unprecidented rates as central banks attempt to prop up their economies. For countries in the midst of severe recessions, such as Portugal and Ireland, the money supply is shrinking significanty, risking a deflationary spiral. Venezuela is in the opposite position, on the brink of hyperinflation, which could collapse the country's economy and severely harm the global oil export market. The global money supply is up over 6% year-over-year. This increase in money supply, however, has not resulted in severe inflation, as the velocity of money continues to shrink by over 3% per year.

negative 8% or more negative 6-8% negative 4-6% negative 2-4% negative 0-2% no data 0-5% growth 5-10% growth 10-25% growth 25-50% growth 50%+ growth

World Money Supply YOY Growth Rate

-2% -4% 0% 2% 4%

Velocity of Money USD YOY Change

-2% -4% -6% -8% -10% 10% 0% 2% 4% 6% 8%

-6%

-8%

6%

8%

-10%

10%

page 1 of 1

Peak Oil Dashboard: Page 12 Q2 2013

Created by Will Martin - Peakoilproof.com

Peak Oil Proof Portfolio Investments

The Peak Oil Proof Portfolio rose in value year-over-year but underperformed the overall equity market. This could be expected as the global oil production rate has not yet peaked. The biggest winners were timber, industrials, health care, media, global real estate. Clean Energy gained significantly year-over-year but is still down on a 5-year basis. The biggest losers were precious metals and zero-coupon bonds. Q2 2013 saw a major crash in gold prices and rising interest rates (spured on by FED talk of "tapering") caused bond prices to fall. Outside of the portfolio, railroads, car sharing and bitcoins all has dramatic gains. Bitcoins had a dramatic bubble and bust in Q2 2013, but are still up over 1000% year-over-year.

S&P 500

yoy return

Peak Oil Proof Portfolio

yoy return

Relative Performance

P.O.P. Portfolio vs. S&P 500 yoy

Oil

IXC yoy return

Clean Energy

ICLN yoy return

P.O.P. Hypothesis (H1)

Null Hypothesis (H0)

-5% -10% -15%

0%

5% 10% 15% -10% -15%

-5%

0%

5% 10% 15%

-5% -10% -15%

0%

5% 10% 15%

-5% -10% -15%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15%

-20%

<-25%

20%

>25%

-20%

<-25%

P.O.P. Hypoth.

20%

>25%

-20% <-25% >25%

20%

P.O.P. Hypoth.

P.O.P. Hypoth.

-20%

<-25%

20%

>25%

20% >25%

<-25%

1-Year: 18%

5-Year CAGR: 5%

1-Year: 2%

5-Year CAGR: 0%

1-Year: 8%

5-Year CAGR: 0%

1-Year: 25%

5-Year CAGR: -28%

Natural Resources

MXI yoy return

Timber

WOOD yoy return

Agriculture

VEGI yoy return

Water

PIO yoy return

Industrials

EXI yoy return

-5% -10% -15% -20%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15%

P.O.P. Hypoth.

20%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20%

P.O.P. Hypoth.

20% >25%

<-25%

>25%

<-25%

<-25%

<-25%

>25%

<-25%

1-Year: -2%

5-Year CAGR: -5%

1-Year: 22%

5-Year CAGR: 0%

1-Year: 6%

5-Year CAGR: 1%

1-Year: 16%

5-Year CAGR: -1%

1-Year: 20%

5-Year CAGR: 4%

Health Care

IXJ yoy return

Emerging Market Retail

EMDI yoy return

Media

PBS yoy return

Telecommunications

IXP yoy return

Utilities

JXI yoy return

-5% -10% -15% -20% <-25%

0%

5% 10% 15% 20% >25% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15%

P.O.P. Hypoth.

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

<-25%

<-25%

<-25%

<-25%

1-Year: 26%

5-Year CAGR: 9%

1-Year: 7%

5-Year CAGR: -1%

1-Year: 44%

5-Year CAGR: 13%

1-Year: 8%

5-Year CAGR: 4%

1-Year: 4%

5-Year CAGR: -3%

Technology

IXN yoy return

US Zero-Coupon Bonds

ZROZ yoy return

Intl. Bonds

LEMB yoy return

Intl. TIPS Bonds

ITIP yoy return

Intl. Real Estate

VNQI yoy return

-5% -10% -15% -20% <-25%

0%

5% 10% 15% 20% >25% -10% -15%

-5%

0%

5% 10% 15% -10% -15%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% 20% >25% -10% -15% -20%

-5%

0%

5% 10% 15% 20% >25%

P.O.P. Hypoth.

Hedge

-20% <-25% 20% >25% -20% <-25%

Hedge

20% >25%

P.O.P. Hypoth.

P.O.P. Hypoth.

<-25%

<-25%

1-Year: 9%

5-Year CAGR: 5%

1-Year: -16%

5-Year CAGR: 7%

1-Year: 2%

5-Year CAGR: 0%

1-Year: 0%

5-Year CAGR: -1%

1-Year: 18%

5-Year CAGR: 4%

Commodities

GSG yoy return

Physical Gold and Silver

50/50 GLD/SLV yoy return

Railroads

UNP, NSC, CNI, GSH, CSX yoy return

Carsharing

CAR & HTZ yoy return

Bitcoins

yoy return

-5% -10% -15% -20% <-25%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5%

10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% 20% >25% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

P.O.P. Hypoth.

20% >25%

P.O.P. Hypoth.

20% >25%

<-25%

<-25%

<-25%

<-25%

1-Year: 1%

5-Year CAGR: -14%

1-Year: -26%

5-Year CAGR: 4%

1-Year: 19%

5-Year CAGR: 7%

1-Year: 91%

5-Year CAGR: 24%

1-Year: 1695%

5-Year CAGR: 343%

Airlines

FAA yoy return

Trucking

JBHT, ODFL, LSTR, CHRW yoy return

Gasoline Toys

HZO, WGO, BX yoy return

Tires

GT yoy return

-5% -10% -15% -20% <-25%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15% -10% -15% -20%

-5%

0%

5% 10% 15%

POP Hypoth.

20% >25%

POP Hypoth.

20% >25%

POP Hypoth.

20% >25%

POP Hypoth.

20% >25%

<-25%

<-25%

<-25%

1-Year: 39%

5-Year CAGR: 16%

1-Year: 16%

5-Year CAGR: 11%

1-Year: 56%

5-Year CAGR: 14%

1-Year: 30%

5-Year CAGR: -5%

Peak Oil Dashboard: Data Notes Q2 2013

Created by Will Martin - Peakoilproof.com

About: I created this dashboard to keep track of the key quantitative indicators of peak oil. Oil is a finite resource and peak oil will happen eventually. Because some experts, such as the Energy Watch Group, believe that peak oil is happening right now, I want to keep track of these indicators on a real-time basis. I designed this dashboard to be mostly automated, in order to allow me to easily update it on a quarterly basis. All of the information contained herein is publically available; I use no private data. Page 1 Notes: This is simply a summary of the other pages

Page 2 Notes: "Oil Production" is the monthly total wellhead oil production rate. Wellhead production data comes from the Oil Market Intelligence report published by Energy Intelligence Group. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX).

Page 3 Notes: "Net Oil Exports" is the monthly total wellhead oil production rate minus the monthly petroleum consumption rate for each country/region. Wellhead production data comes from the Oil Market Intelligence report published by Energy Intelligence Group. Country/region petroleum consumption data comes from the annual Oil & Gas Journal from Pennwell Publishing. The annual oil consumption rate is extrapolated forward using the prior 5-Year compound annual growth rate of consumption (CAGR) and converted into a monthly rate. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX). Supermajor oil production rate data comes from 10-K annual reports published on the Securities and Exchange Commission Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

Page 4 Notes: Thank you to Jeffrey Brown for creating the "Export Land Model" that allows us to estimate current net exports of oil producing nations instead of waiting for the EIA to release their estimates 2 years after they happen. "Net Oil Exports" is the monthly total wellhead oil production rate minus the monthly petroleum consumption rate for each country/region. Wellhead production data comes from the Oil Market Intelligence report published by Energy Intelligence Group. Country/region petroleum consumption data comes from the annual Oil & Gas Journal from Pennwell Publishing. The annual oil consumption rate is extrapolated forward using the prior 5-Year compound annual growth rate of consumption (CAGR) and converted into a monthly rate. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX).

Page 5 Notes: Drilling rig count data comes from Baker Hughes. Sumermajor quaterly operating profits come from comes from 10-Q quarterly reports published on the Securities and Exchange Commission Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. US capital expenditure per barrel is derived from total US capital expenditure in the petrolium industry divided by the total US crude oil production. Data for capital expenditure, oil production, nominal cost per well and real cost per well come from the Oil & Gas Journal Annual Forecast & Review. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX). Page 6 Notes: "Oil Production" is the monthly total "Oil Product Demand" for each country. Demand data comes from the Oil Market Intelligence report published by Energy Intelligence Group. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX).

Page 7 Notes: Quarterly GDP data comes from Oxford Economics' global macroeconomic database. Relative GDP growth of each country is caculated as the change in the real (2005 US$ Prices & PPP Exchange Rate) GDP of a country as a percentage of total GDP. Data was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX). Thank you to Mark McHug (http://acrossthestreetnet.wordpress.com/) for giving me the idea to measure GDP growth of countries relative to one another as well as measuring global GDP growth USD as well as in oil barrels and ounces of gold. Page 8 Notes: "Real GDP" is country/region Gross Domestic Product at 2005 US Dollar prices and current Purchasing Power Parity exchange rates. Data comes from Oxford Economics and was pulled into Microsoft Excel using Haver Analytics Data Link Express (DLX).

Page 9 Notes: Summaries come from Tom Whipple's "Peak Oil Review" published weekly by the Association for the Study of Peak Oil and Gas USA (ASPO-USA): http://aspousa.org/category/peakoil-review/

Page 10 Notes: Data for crude oil prices and US gasoline prices comes from the Oil & Gas Journal. Data for Brent and WTI crude oil futures comes from IntercontinentalExchange and the Chicago Mercantile Exchange, respectivly. Data for Brent call and put options comes from barchart.com. Data for the WTI implied volitility surface comes from the Chicago Mercantile Exchange.

Page 11 Notes: Data for the money supply of each country comes from Haver Analytics. M3 money supply was used wherever possible. In countries that do not publish M3 data (such as the United States) M2 money supply is used instead. All money supplies are converted to USD using current exchange rates. Velocity of money comes from the US Federal Reserve.

Page 11 Notes: Stock price data comes from Yahoo Finance. All data is adjusted for dividends and splits.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Calculate Simple Interest Future and Present ValuesDocument21 pagesCalculate Simple Interest Future and Present ValuesアンジェロドンNo ratings yet

- Shanghai Mitsubishi Elevator Produces One Millionth UnitDocument3 pagesShanghai Mitsubishi Elevator Produces One Millionth Unitرياض ريزوNo ratings yet

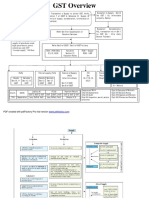

- GST OverviewDocument17 pagesGST Overviewprince2venkatNo ratings yet

- Executive SummaryDocument49 pagesExecutive SummaryMuhsin ShahNo ratings yet

- Entrepreneurial India: An Overview of Pre - Post Independence and Contemporary Small-Scale EnterprisesDocument8 pagesEntrepreneurial India: An Overview of Pre - Post Independence and Contemporary Small-Scale EnterprisesInternational Journal of Creative Mathematical Sciences and TechnologyNo ratings yet

- Afar Job Order Costing Spoilage DefectiveDocument4 pagesAfar Job Order Costing Spoilage DefectiveKaye Angelie UsogNo ratings yet

- Creating A BudgetDocument2 pagesCreating A BudgetLaci NunesNo ratings yet

- Customer Experience Department: Daily Incentive Program "Mcrewards"Document4 pagesCustomer Experience Department: Daily Incentive Program "Mcrewards"Cedie Gonzaga AlbaNo ratings yet

- Benefits of Corporate Social ResponsibilityDocument12 pagesBenefits of Corporate Social Responsibilityleong kuan lokNo ratings yet

- UPS, Inc. Strategy FormulationDocument16 pagesUPS, Inc. Strategy FormulationSusan Arrand100% (1)

- Analysis of Financial Statements Project: GUL AHMAD Textile MillsDocument32 pagesAnalysis of Financial Statements Project: GUL AHMAD Textile MillsHanzala AsifNo ratings yet

- RM Unit 2Document18 pagesRM Unit 2VickyNo ratings yet

- Trade Discount and Trade Discount Series.Document31 pagesTrade Discount and Trade Discount Series.Anne BlanquezaNo ratings yet

- Chapter 2 - Consumer BehaviourDocument95 pagesChapter 2 - Consumer BehaviourRt NeemaNo ratings yet

- Ds 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PDocument1 pageDs 3 ZJG PFA8 VV 0 Uhb Itzm K2 ARl EGBc 82 SQB 9 ZHC 4 PprabindraNo ratings yet

- Iobz - Syllabus Financial Accounting 11Document2 pagesIobz - Syllabus Financial Accounting 11josemusi0% (1)

- Ottoman Bow - Burgundy - MetbowsDocument1 pageOttoman Bow - Burgundy - MetbowsfazalNo ratings yet

- My Tax Espresso Newsletter Feb2023Document21 pagesMy Tax Espresso Newsletter Feb2023Claudine TanNo ratings yet

- The Phuket Beach CaseDocument4 pagesThe Phuket Beach Casepeilin tongNo ratings yet

- Scholarship Application 2024 1Document3 pagesScholarship Application 2024 1Abeera KhanNo ratings yet

- The Green Register - Spring 2011Document11 pagesThe Green Register - Spring 2011EcoBudNo ratings yet

- Sip ReportDocument72 pagesSip ReporthemanthreddyNo ratings yet

- FMCG Sales Territory ReportDocument21 pagesFMCG Sales Territory ReportSyed Rehan Ahmed100% (3)

- Ass6 10Document1 pageAss6 10Kath LeynesNo ratings yet

- Management Trainee - Business Intelligence & Project ManagementDocument2 pagesManagement Trainee - Business Intelligence & Project ManagementhimanshuNo ratings yet

- ch12 BaruDocument28 pagesch12 BaruIrvan Syafiq NurhabibieNo ratings yet

- Downsizing Best PracticesDocument26 pagesDownsizing Best PracticescorfrancescaNo ratings yet

- Amazon 7pDocument6 pagesAmazon 7pnyan hein aungNo ratings yet

- Foreign Exchange Risk: Types of ExposureDocument2 pagesForeign Exchange Risk: Types of ExposurepilotNo ratings yet