Professional Documents

Culture Documents

Advert - Business Relationship Manager-SME-Kariakoo Branch-July 2013

Uploaded by

Rashid BumarwaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advert - Business Relationship Manager-SME-Kariakoo Branch-July 2013

Uploaded by

Rashid BumarwaCopyright:

Available Formats

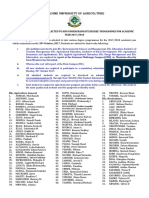

Tanzania Postal Bank is an established Bank by the Act No. 11 of 1991 as amended by Act No. 11 of 1992.

TPB is a Bank that provides competitive financial services to our customers and creates value for our stakeholders through innovative products. TPB is a Bank, whose vision is to be the leading bank in Tanzania in the provision of affordable, accessible and convenient financial services. As part of effective organizational development and management of its human capital in an effective way, TPB commits itself towards attaining, retaining and developing the highly capable and qualified workforce for TPB betterment and the Nation at large.

BUSINESS RELATIONSHIP MANAGER-SME-KARIAKOO BRANCH (1 POSITION)

1. Tanzania Postal Bank (TPB) seeks to appoint dedicated, self motivated and highly organized Business Relationship Manager-SME-Kariakoo Branch (1 position) to join the Bank in Operations & Technology Department team. The person will be responsible in acquiring profitable new customers for the SME Banking segment through the creation, development and maintenance of high quality advisory relationships, that includes effective consultative selling and creative structuring of financial solutions and will be required to market and manage SME customer relationships through pro-active and consultative approach and detailed understanding of new/existing customers business (es) to enhance profit. Reporting Line: Location: Work Schedule: Salary: Branch Manager-Kariakoo Branch Kariakoo Branch, Dar es Salaam As per TPB Staff regulations TPB

Main Purpose of the Job Directly work with customers to deepen and secure new business relationships through the analyses of needs and provision of products and services. Creatively tailor products to meet individual customer needs. Responsible for the growth of quality Business loans portfolio Analyses and reviews quality of potential and existing business to ensure maximum profitability. Maintain accurate and up-to-date records of all actual and attempted customer interactions.

Conduct customer meetings that have defined call objectives, desired outcomes and a well-constructed plan. Provide feedback to senior management, marketing and product management on customers needs and the efficiency of marketing strategies and tactics. Liaise and provide leadership in areas of expertise, particularly in the provision of products and services to customers. After consideration of individual case merits, recommend credits for approval by relevant authorities. Manages credit quality standards through effective management of risk according to the Credit manual policy. Be conversant with the AML/CDD requirements. Undertake actions to ensure compliance and report suspicions. Exercise due care and diligence in ensuring all anti-money laundering and CDD requirements are complied with. Guide prospective customers who come over the counter for enquiries. Scrutinize internal vouchers to ensure that they are properly drawn and authorized in line with the approval limits. Prepare monthly bank reconciliation statements timely and accurately. Check and sign back-office entries raised by the respective clerks/tellers. Reconcile and clear all suspended transactions Perform any other duties as may be assigned by BFO/Branch manager from time to time. Comply with the Policies and standards, Local laws and Regulations, Controls and Procedures of the Bank. Scrutinize loan applications, to review feasibility reports and prepare appraisal reports and accompanying memorandum for action of by relevant loan sanctioning authority. Supervise credit section/operations in collaboration with the Branch manager and the BFO

Process credit proposals received from customers and submit them with recommendations to the concerned higher authorities. Verify loan application forms, crosschecking the requirements and advise customers accordingly. Maintain borrowers files and ensure that all pre-disbursement conditions are fulfilled. Carry out regular follow-ups on loan recoveries/cheques collections from employers Ensure that loan installments from customers are posted into relevant accounts. Follow-ups on non performing loans/customers that are not paying their loan as per the agreement. Follow-ups of loan charged-off to ensure that they are recovered from respective obligor/employers. Ensure that weekly, monthly, quarterly, annual and any other reports on load portfolio are accurate, complete, and prepared on schedule. Prepare all branch returns and ensure they are in accordance with the credit policy and lending manual. Verify postings of loan administration fees for customers whose loans have been disbursed. Ensure proper filling of customer credit documents and correspondents.

Essential Duties and Responsibilities: Growth of the business banking products within the set targets. Geographical mix and sectoral distribution in line with the set thresholds. Achievement of the set targets on interest and other income from business banking product. Qualifications, Experience and Skills required: Education: Bachelor degree/Advance diploma in Banking, Economics, commerce, Business Administration, Finance or Accounting from any recognized University or equivalent.

Experience:

At least 5 years of experience in Lending & Credit administration. Working knowledge of Equinox Functionality People Management skills Attention to details Prioritize Tasks Team player

Skills and attributes

Salary and Remuneration The position attracts a competitive salary package, which include other fringe benefits. Mode of Application Applicants are invited to submit their resume, credentials and testimonials (indicating the position title in the subject heading) via e-mail to: recruitment@postalbank.co.tz Deadline The deadline for submitting the applications is two weeks from Monday, 29th July 2013 being regarded the first appearance of the advertisement of this post in our website (www.postalbank.co.tz), TPB all (for internal candidates and local Newspaper. The Deadline is therefore 12th August 2013.

Tanzania Postal Bank is an Equal Opportunity Employer

A candidate, who will not be contacted by Tanzania Postal Bank within seven (7) days after the closing date, should consider his application as unsuccessful. Late applications will not be considered. Short listed candidates may be subjected to any of the following: a security clearance; a competency assessment and reference checking. Please forward your applications before 12th August, 2013

You might also like

- Job Advert Central Zone - 2019Document8 pagesJob Advert Central Zone - 2019Rashid BumarwaNo ratings yet

- Job Vacancies - TPBDocument2 pagesJob Vacancies - TPBRashid BumarwaNo ratings yet

- Selected Bachelor Degree Students - MustDocument12 pagesSelected Bachelor Degree Students - MustRashid BumarwaNo ratings yet

- Curiculum VitaeDocument8 pagesCuriculum VitaeRashid BumarwaNo ratings yet

- Tangazo La Kazi 28 Machi 2019 TNBC Ministry of Finance and Planning Rea Mu and CbeDocument10 pagesTangazo La Kazi 28 Machi 2019 TNBC Ministry of Finance and Planning Rea Mu and CbeRashid BumarwaNo ratings yet

- Job Opportunity Laboratory Technologist March 2019Document2 pagesJob Opportunity Laboratory Technologist March 2019Rashid BumarwaNo ratings yet

- CRDB Bank Job Opportunities Branch Managers 2Document4 pagesCRDB Bank Job Opportunities Branch Managers 2Rashid BumarwaNo ratings yet

- Selected Students - SautDocument31 pagesSelected Students - SautRashid BumarwaNo ratings yet

- Job Opportunities 22.08.2017 PDFDocument2 pagesJob Opportunities 22.08.2017 PDFRashid BumarwaNo ratings yet

- Job Opportunities 22.08.2017 PDFDocument2 pagesJob Opportunities 22.08.2017 PDFRashid BumarwaNo ratings yet

- Students Selected For Undergraduate Programs 2017 18Document8 pagesStudents Selected For Undergraduate Programs 2017 18Rashid BumarwaNo ratings yet

- Sokoine University of Agriculture Morogoro: Job OpportunitiesDocument2 pagesSokoine University of Agriculture Morogoro: Job OpportunitiesRashid BumarwaNo ratings yet

- Nafasi Za TaalumaDocument6 pagesNafasi Za TaalumaRashid BumarwaNo ratings yet

- TPA ICT VacanciesDocument13 pagesTPA ICT VacanciesRashid BumarwaNo ratings yet

- Advert Receptionist 2Document3 pagesAdvert Receptionist 2Rashid BumarwaNo ratings yet

- UTUMISHIDocument3 pagesUTUMISHIRashid BumarwaNo ratings yet

- Advert Temporary Credit Officer Sumbawanga 5Document4 pagesAdvert Temporary Credit Officer Sumbawanga 5Rashid BumarwaNo ratings yet

- Advert Assistant Branch Manager Mto Wa Mbu 2Document5 pagesAdvert Assistant Branch Manager Mto Wa Mbu 2Rashid BumarwaNo ratings yet

- Vacancy Sacids March2017Document3 pagesVacancy Sacids March2017Rashid BumarwaNo ratings yet

- Scholarships ThailandDocument2 pagesScholarships ThailandRashid BumarwaNo ratings yet

- Advert-Credit Supervisor 2Document5 pagesAdvert-Credit Supervisor 2Rashid BumarwaNo ratings yet

- The International AssociationScholarships 2017Document1 pageThe International AssociationScholarships 2017Rashid BumarwaNo ratings yet

- Advert-Manager-Operational Risk and ComplianceDocument4 pagesAdvert-Manager-Operational Risk and ComplianceRashid BumarwaNo ratings yet

- Vacancy Research Assistant March2017Document2 pagesVacancy Research Assistant March2017Rashid BumarwaNo ratings yet

- Apopo Job Vacancy 2017Document3 pagesApopo Job Vacancy 2017musa hauleNo ratings yet

- HESLBDocument32 pagesHESLBKarim MtilahNo ratings yet

- Research Coordinator Post Re AdvertisedDocument2 pagesResearch Coordinator Post Re AdvertisedRashid BumarwaNo ratings yet

- Job Advert MSDDocument24 pagesJob Advert MSDRashid BumarwaNo ratings yet

- Job Vacancies - SUZADocument3 pagesJob Vacancies - SUZARashid BumarwaNo ratings yet

- Employment Vacancies - Postal BankDocument3 pagesEmployment Vacancies - Postal BankRashid BumarwaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Law Offices of Harry Finkle, A Professional Corporation Proposal - RedactedDocument5 pagesLaw Offices of Harry Finkle, A Professional Corporation Proposal - RedactedL. A. PatersonNo ratings yet

- Modeling The Internet of Things Adoption Barriers in Food Retail Supply ChainsDocument15 pagesModeling The Internet of Things Adoption Barriers in Food Retail Supply ChainsKhoa TranNo ratings yet

- FARAP 4404 Property Plant EquipmentDocument11 pagesFARAP 4404 Property Plant EquipmentJohn Ray RonaNo ratings yet

- 23 - Cash Flow Forecasting and Working CapitalDocument29 pages23 - Cash Flow Forecasting and Working Capitalnader100% (1)

- Global Cardiac Catheters - 2012-2018Document4 pagesGlobal Cardiac Catheters - 2012-2018Axis Research MindNo ratings yet

- Isocertificate PDFDocument1 pageIsocertificate PDFSarmiento HerminioNo ratings yet

- Guangxi Investment Group CoDocument20 pagesGuangxi Investment Group Coferdhian90No ratings yet

- Introduction To Management by Stephen P. Robbins Chapter.7Document16 pagesIntroduction To Management by Stephen P. Robbins Chapter.7Murtaza Moiz0% (1)

- Training Project: A Study ofDocument45 pagesTraining Project: A Study ofAnkur Malhotra0% (1)

- Gamp5 For Basic Training PDFDocument47 pagesGamp5 For Basic Training PDFVimlesh Kumar PandeyNo ratings yet

- PlanetTran EvaluationDocument18 pagesPlanetTran EvaluationNATOEENo ratings yet

- Oracle ASCP: How To Configure High Speed Manufacturing Routings in Oracle Applications For ASCPDocument7 pagesOracle ASCP: How To Configure High Speed Manufacturing Routings in Oracle Applications For ASCPAvinash RoutrayNo ratings yet

- Audit of Educational InstitutionDocument19 pagesAudit of Educational InstitutionMa. Hazel Donita Diaz100% (1)

- Developing SMART Goals For Your OrganizationDocument2 pagesDeveloping SMART Goals For Your OrganizationtrangNo ratings yet

- Vikas Dairy Project 2022 ChangenewDocument32 pagesVikas Dairy Project 2022 ChangenewAnchitJaiswalNo ratings yet

- Sap Modules Overview PDFDocument32 pagesSap Modules Overview PDFRamonaIrofteNo ratings yet

- CFI - Accounting - Fundementals - Johannes Period 1 To 3 SolutionDocument5 pagesCFI - Accounting - Fundementals - Johannes Period 1 To 3 SolutionsovalaxNo ratings yet

- Minutes of MeetingDocument15 pagesMinutes of MeetingNikita J. Ladiwala92% (12)

- Budget PLUS 2011Document108 pagesBudget PLUS 2011Meenu Mittal SinghalNo ratings yet

- Mckinsey 7S Model:: The Seven S Are Divided in Two Categories Which Are: Strategy StyleDocument5 pagesMckinsey 7S Model:: The Seven S Are Divided in Two Categories Which Are: Strategy StyleSuvankarNo ratings yet

- Airbed&Breakfast: Book Rooms With Locals, Rather Than HotelsDocument17 pagesAirbed&Breakfast: Book Rooms With Locals, Rather Than HotelsMd Mostakin RabbiNo ratings yet

- Assets Current AssetsDocument2 pagesAssets Current AssetsRIAN MAE DOROMPILINo ratings yet

- Module-1 Introduction To RetailingDocument29 pagesModule-1 Introduction To RetailingSWAPNARUN BANERJEENo ratings yet

- Ibc Notes 636839419149778471 PDFDocument151 pagesIbc Notes 636839419149778471 PDFVrinda GuptaNo ratings yet

- Chevron OEDocument9 pagesChevron OESundar Kumar Vasantha GovindarajuluNo ratings yet

- Cooperative BanksDocument8 pagesCooperative Banksmetmmsa2014No ratings yet

- This Study Resource Was: Page 1 of 5Document5 pagesThis Study Resource Was: Page 1 of 5debate ddNo ratings yet

- Ecomerece and M-ComereceDocument24 pagesEcomerece and M-ComereceSIDDHESHNo ratings yet

- International Payment: Edward G. HinkelmanDocument23 pagesInternational Payment: Edward G. HinkelmanQuỳnh PhươngNo ratings yet

- Nutanix Designing & Building Hybrid Cloud OReillyDocument51 pagesNutanix Designing & Building Hybrid Cloud OReillyPiyush ChavdaNo ratings yet