Professional Documents

Culture Documents

ZICA Advanced Stage Audit Syllabus

Uploaded by

Vainess S ZuluOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ZICA Advanced Stage Audit Syllabus

Uploaded by

Vainess S ZuluCopyright:

Available Formats

INTRODUCTION

Contents

Page

Syllabus Part A Framework

1 2 3 4 5 6 Audit and assurance services Rules of professional conduct Changes in professional appointment Professional responsibility and liability Practice management Regulatory environment 3 23 39 61 85 101

Part B Process

7 8 9 10 11 Audit planning Audit evidence Audit evaluation and review Internal control and evaluation of control risk Audit of financial statements 129 155 185 225 261

Part C Other service

12 13 Internal audit and other assurance engagements Environmental issues 293 341

Part D Reporting

14 Reports 351

Exam question bank Exam answer bank

ZICA Advanced Stage

INTRODUCTION

ZICA Advanced Stage

ii

INTRODUCTION

SYLLABUS

Purpose:

This paper covers the fundamental principles and concepts of auditing of financial statements. Students are required to have a good knowledge of the legal and professional framework governing the proper conduct of an audit. In addition, they are expected to have a thorough knowledge of the audit process of evidence accumulation and reporting. This process would ordinarily include planning, assessment of risk and materiality, performance of tests of control and substantive procedures and the final issuance of an auditors report. The paper will also ensure that candidates can exercise judgement and apply techniques in the analysis of matters relating to the provision of audit and assurance services, and can evaluate and comment on current practices and comments. ZICA Advanced Stage iii

INTRODUCTION

This paper also covers the principles and procedures relating to other assurance engagements, which include internal audit and other work where opinion is provided to interested parties who have participated in setting the scope of the engagement.

General Learning Objectives:

On completion of this paper, the student should be able to: Demonstrate ability to carry out Audit services as required under the Companies Act and Approved International Standards on Auditing. Undertake procedures of auditing and the provision of other forms of assurance services so as to enable them integrate this knowledge with training and work experience. Explain and evaluate the Auditors position in relation to the acceptance and retention of professional appointment. Evaluate and recommend quality control policies and procedures in operations. Identify and confirm the work required to meet the objectives of Audit Assignment. Evaluate findings and results of work performed and submit an appropriate Audit report.

Position of the Paper in the Overall syllabus:

Candidates need a thorough understanding of paper 2.4 Auditing, 1.1 Financial Accounting I and 2.1 Financial Accounting II. Knowledge of Management Information Systems will be needed considering its impact on assignments. Paper 3.3 develops further the knowledge gained in paper 2.4 Auditing by extending the basic awareness of professional codes of ethics and fundamental principles to a detailed understanding of rules of professional conduct. Practice management as also been introduced. Procedures involved in planning, conducting and reporting on audit assignments to audit related services and non-audit assignments. Current issues and developments have also been addressed.

Weights for Exams and Coverage purposes:

Overview of Audit Framework (5%) Legal and Professional Considerations (10%) Audit Committee and Functions (5%) ZICA Advanced Stage iv

INTRODUCTION

Audit Planning (10%) Internal Control and Evaluation of Control Risk (15%) Performance of Audit (15%) Internal Audit and Other Assurance Engagements (15%) Reporting and Communications (15%) New Developments in Auditing (10%)

LINKAGE OF THE COURSES

3.1

Advanced Financial Accounting and Reporting

3.3 Audit and Assurance 2.1 Financial Accounting II

1.1

Financial Accounting I

2.4 Auditing

Structure of Examination paper:

The Examination paper will be a Three (3) hour paper divided into TWO (2) sections; section A and section B. Questions in both sections will be almost entirely discursive. However, students may also be required to do some calculations where need arise for judgement purposes. Section A: This will be based on case study type scenarios, which address a range of topics, issues and requirements. It will comprise of TWO (2) COMPULSORY questions worth TWENTY FIVE (25) marks each. ZICA Advanced Stage v

INTRODUCTION Section B: In this section, there will be FOUR (4) questions each worth TWENTY FIVE (25) marks each. Candidates are required to attempt any TWO (2) questions. These are likely to be set on specific audit topics such as practice management, audit related services, non-audit assignments and new developments in auditing not examinable in paper 2.4-Advanced auditing. This does not preclude these topics from featuring in section A. they will have less scenario than in section A.

ZICA Advanced Stage

vi

You might also like

- ABFA 3114 Principle of AuditDocument151 pagesABFA 3114 Principle of AuditGary Siaw100% (2)

- 1 IntroductionDocument13 pages1 IntroductiontsololeseoNo ratings yet

- Dpa5043 SG PDFDocument2 pagesDpa5043 SG PDFMohd Aza AzranNo ratings yet

- AUDITING THEORY COURSE SYLLABUSDocument8 pagesAUDITING THEORY COURSE SYLLABUSrollramsNo ratings yet

- OBE SyllabusDocument8 pagesOBE SyllabusRex Banggawan73% (11)

- Project Guideline (25%) : Bka2013 Audit & Assurance Services Project SECOND SEMESTER 2014/2015 (A142)Document3 pagesProject Guideline (25%) : Bka2013 Audit & Assurance Services Project SECOND SEMESTER 2014/2015 (A142)Thanaa LakshimiNo ratings yet

- So-Acc 303Document27 pagesSo-Acc 303herueuxNo ratings yet

- Lesson 3Document167 pagesLesson 3Marjorie BalboaNo ratings yet

- Syllabus Aku 3302 - Auditing 2Document6 pagesSyllabus Aku 3302 - Auditing 2alfianaNo ratings yet

- Contoh Scheme of WorkDocument2 pagesContoh Scheme of WorkSafuan JaafarNo ratings yet

- IRCA 2180 - QMS Internal Auditor Feb 2013Document13 pagesIRCA 2180 - QMS Internal Auditor Feb 2013numuai0% (1)

- A&a L3 EditedDocument3 pagesA&a L3 EditedKimosop Isaac KipngetichNo ratings yet

- Module For MonitorinngDocument5 pagesModule For MonitorinngYogun BayonaNo ratings yet

- 2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsDocument5 pages2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsNina Almonidovar-MacutayNo ratings yet

- ACCT 2161 auditing revision guideDocument4 pagesACCT 2161 auditing revision guideBao NguyenNo ratings yet

- Change of Syllabus: Assurance Has Been Revised, and Changes Will Be Effective From The JuneDocument4 pagesChange of Syllabus: Assurance Has Been Revised, and Changes Will Be Effective From The Junesoorayah1414No ratings yet

- 4551 Summer 2015 Course Outline Rev1Document16 pages4551 Summer 2015 Course Outline Rev1cricket1223No ratings yet

- Toaz - Info Instructional Material Auditing Theory 2020 PRDocument169 pagesToaz - Info Instructional Material Auditing Theory 2020 PRVeronica Rivera100% (1)

- Audit PlanningDocument15 pagesAudit Planningemc2_mcv75% (4)

- Audit ManualDocument80 pagesAudit ManualhaninadiaNo ratings yet

- AA Examiner's Report M20Document11 pagesAA Examiner's Report M20Ngọc MaiNo ratings yet

- Applied AuditingDocument2 pagesApplied Auditingctcasiple50% (2)

- Examiner's Report: Audit and Assurance (AA) December 2018Document10 pagesExaminer's Report: Audit and Assurance (AA) December 2018Pink GirlNo ratings yet

- MU1 Module 2 NotesDocument28 pagesMU1 Module 2 NotesCGASTUFFNo ratings yet

- CIA 2013 Exam Syllabus Part 1Document10 pagesCIA 2013 Exam Syllabus Part 1Rhon NunagNo ratings yet

- Professional Auditing Assignment PlanDocument5 pagesProfessional Auditing Assignment PlanBrijesh GajjarNo ratings yet

- CIA and CRMA 2013 Exam SyllabusDocument13 pagesCIA and CRMA 2013 Exam SyllabusChengChengNo ratings yet

- Prepare an Audit Plan Before Commencing an AuditDocument27 pagesPrepare an Audit Plan Before Commencing an AuditPrathyusha KorukuriNo ratings yet

- DUTY-2 Over Viewing Audit Process: Overviewing of Financial Statement AuditDocument11 pagesDUTY-2 Over Viewing Audit Process: Overviewing of Financial Statement AudittemedebereNo ratings yet

- Accounting Principles and Related Computer ApplicationsDocument7 pagesAccounting Principles and Related Computer Applicationstrahan_mabNo ratings yet

- IQA Course Outline, 2023Document5 pagesIQA Course Outline, 2023Karen GoolcharanNo ratings yet

- Syllabus of Auditing TheoryDocument2 pagesSyllabus of Auditing Theorykellyshaye080% (1)

- Acct230 Syllabus Spring 12 13Document7 pagesAcct230 Syllabus Spring 12 13Omar E. GeryesNo ratings yet

- P1 Full Course NotesDocument170 pagesP1 Full Course NotesKelly Tan Xue LingNo ratings yet

- Auditing Theory Review Course SyllabusDocument8 pagesAuditing Theory Review Course SyllabusRomy WacasNo ratings yet

- f8 Practice & Revision Notes 2014-15Document104 pagesf8 Practice & Revision Notes 2014-15emmadavisons100% (7)

- Cma Cso 2015Document12 pagesCma Cso 2015Thasveer AvNo ratings yet

- BSBFIM601A Manage Finances Trainer Assessment GuideDocument59 pagesBSBFIM601A Manage Finances Trainer Assessment Guidenanda53% (17)

- 2022 Icas TC Ar V ImpDocument534 pages2022 Icas TC Ar V ImphayatmyNo ratings yet

- The Cpa Licensure Examination Syllabus AuditingDocument4 pagesThe Cpa Licensure Examination Syllabus AuditingGlorden Mae Ibañez SalandananNo ratings yet

- Tnss f8 Full NoteDocument102 pagesTnss f8 Full NoteArbab JhangirNo ratings yet

- 01Document6 pages01Sheen SiNo ratings yet

- Module 6: Audit PlanningDocument15 pagesModule 6: Audit PlanningMAG MAGNo ratings yet

- On The Job Traning Guideline For Graduate AuditorsDocument3 pagesOn The Job Traning Guideline For Graduate AuditorsMetodio Caetano MonizNo ratings yet

- CIA 2013 Exam SyllabusDocument10 pagesCIA 2013 Exam SyllabusILDEFONSO DEL ROSARIONo ratings yet

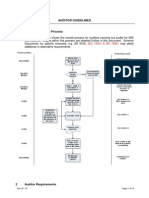

- Auditor GuidelinesDocument15 pagesAuditor GuidelinesAnubhav GuptaNo ratings yet

- Completed Completed by Date Notes: Company ABC SOX Overall Compliance ChecklistDocument4 pagesCompleted Completed by Date Notes: Company ABC SOX Overall Compliance ChecklistnnauthooNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- Information Systems Auditing: The IS Audit Reporting ProcessFrom EverandInformation Systems Auditing: The IS Audit Reporting ProcessRating: 4.5 out of 5 stars4.5/5 (3)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- The Operational Auditing Handbook: Auditing Business and IT ProcessesFrom EverandThe Operational Auditing Handbook: Auditing Business and IT ProcessesRating: 4.5 out of 5 stars4.5/5 (4)

- TVM Concepts ExplainedDocument25 pagesTVM Concepts ExplainedVainess S Zulu0% (1)

- Chapter 2 - The Financial System in The EconomyDocument24 pagesChapter 2 - The Financial System in The EconomyVainess S ZuluNo ratings yet

- Tax Rates and AllowancesDocument5 pagesTax Rates and AllowancesVainess S ZuluNo ratings yet

- Table of Content - 2Document13 pagesTable of Content - 2Vainess S ZuluNo ratings yet

- Advanced TaxationDocument1 pageAdvanced TaxationVainess S ZuluNo ratings yet

- Chapter 7 - Paper 3.4 (Advanced Taxation)Document43 pagesChapter 7 - Paper 3.4 (Advanced Taxation)Vainess S ZuluNo ratings yet

- Chapter 11 - Paper 3.4 (Advanced Taxation)Document46 pagesChapter 11 - Paper 3.4 (Advanced Taxation)Vainess S ZuluNo ratings yet

- Advance Financial ContentDocument6 pagesAdvance Financial ContentVainess S ZuluNo ratings yet

- Chapter 2 (Paper 3.4 - Advanced Taxation)Document52 pagesChapter 2 (Paper 3.4 - Advanced Taxation)Vainess S ZuluNo ratings yet

- ZICA Accountancy Programme Students HandbookDocument72 pagesZICA Accountancy Programme Students HandbookVainess S Zulu100% (1)

- Zambia Taxation Bibliography ReferencesDocument1 pageZambia Taxation Bibliography ReferencesVainess S ZuluNo ratings yet

- Tax Rates and AllowancesDocument5 pagesTax Rates and AllowancesVainess S ZuluNo ratings yet

- Part CDocument1 pagePart CVainess S ZuluNo ratings yet

- Top exam revision tipsDocument1 pageTop exam revision tipsVainess S ZuluNo ratings yet

- Terms Cases 1 PDFDocument6 pagesTerms Cases 1 PDFVainess S ZuluNo ratings yet

- chapter4ZICA4 6Document26 pageschapter4ZICA4 6Vainess S ZuluNo ratings yet

- English 09 P 2 CoverDocument1 pageEnglish 09 P 2 CoverVainess S ZuluNo ratings yet

- Advanced MGT Accounting Paper 3.2 by PPLDocument354 pagesAdvanced MGT Accounting Paper 3.2 by PPLVainess S Zulu100% (1)

- Chapter 16 - Paper T5Document15 pagesChapter 16 - Paper T5Vainess S Zulu100% (1)

- Part BDocument1 pagePart BVainess S ZuluNo ratings yet

- Understanding Capital Allowances and DeductionsDocument35 pagesUnderstanding Capital Allowances and DeductionsVainess S ZuluNo ratings yet

- Advanced MGT Accounting Paper 3.2 by PPLDocument354 pagesAdvanced MGT Accounting Paper 3.2 by PPLVainess S Zulu100% (1)

- Chapter 2 - Paper T5Document31 pagesChapter 2 - Paper T5Vainess S ZuluNo ratings yet

- Chapter 6 ZicaDocument45 pagesChapter 6 ZicaVainess S Zulu100% (4)

- Chapter 11 - PaperT5Document18 pagesChapter 11 - PaperT5Vainess S ZuluNo ratings yet

- IctDocument200 pagesIctVainess S ZuluNo ratings yet

- Chapter 15 - PaperT5Document10 pagesChapter 15 - PaperT5Vainess S ZuluNo ratings yet

- Carbohydrates AaaaaaDocument6 pagesCarbohydrates AaaaaaVainess S ZuluNo ratings yet

- Proteins 2aaaDocument25 pagesProteins 2aaaVainess S ZuluNo ratings yet

- 4 Validating Documenting DataDocument17 pages4 Validating Documenting DataLeila Therese TorioNo ratings yet

- BRM PPT, 2021Document22 pagesBRM PPT, 2021best OneNo ratings yet

- Chapter 3: Forecasting: Learning InsightDocument3 pagesChapter 3: Forecasting: Learning InsightJoey RosalesNo ratings yet

- Pengaruh Family Empowerment Program Terhadap: Quality of Life Anak ThalasemiaDocument11 pagesPengaruh Family Empowerment Program Terhadap: Quality of Life Anak ThalasemiaWidyaNo ratings yet

- Cab Aggregators StudyDocument14 pagesCab Aggregators StudyJoydeepNandiNo ratings yet

- Msu Transcript 1Document2 pagesMsu Transcript 1api-232013722No ratings yet

- Position PaperDocument43 pagesPosition PaperyenkreshnaNo ratings yet

- BUZELIN 2007 - Translations in The Making - PDFDocument21 pagesBUZELIN 2007 - Translations in The Making - PDFRafaela CabralNo ratings yet

- Assessment of The Impact of Window Size Position and Orientation On Building Energy Load Using BimDocument8 pagesAssessment of The Impact of Window Size Position and Orientation On Building Energy Load Using BimMemoona SheesNo ratings yet

- Black Rock Playa DRI Report - Physical Processes and Aquatic LifeDocument20 pagesBlack Rock Playa DRI Report - Physical Processes and Aquatic LifeTedd St RainNo ratings yet

- Lennox Supplier Qualification Development Guidelines English February 2014 Rev 5Document27 pagesLennox Supplier Qualification Development Guidelines English February 2014 Rev 5alexrferreiraNo ratings yet

- Central Obesity of Housewives in Dukuh Tapen, Ngrandu Village, Geyer District, Grobogan RegencyDocument11 pagesCentral Obesity of Housewives in Dukuh Tapen, Ngrandu Village, Geyer District, Grobogan Regencyvera zulfiNo ratings yet

- Climate Atlas of Croatia 1961. - 1990., 1971.-2000.Document172 pagesClimate Atlas of Croatia 1961. - 1990., 1971.-2000.cavrisNo ratings yet

- Chapter 1 - Historical AntecedentsDocument32 pagesChapter 1 - Historical AntecedentsGlemarie Joy Unico EnriquezNo ratings yet

- Community Engagement, Solidarity, and CitizenshipDocument2 pagesCommunity Engagement, Solidarity, and CitizenshipSummer HarielleNo ratings yet

- Effect of Electronic Word of Mouth in Online Impulsive Buying BehaviorDocument11 pagesEffect of Electronic Word of Mouth in Online Impulsive Buying BehaviorNabin ShakyaNo ratings yet

- Leader Follower StrategyDocument42 pagesLeader Follower StrategyNaman Bhojak0% (1)

- Screening Children For Social Determinants of Health - A Systematic Review - Sokil Et Al, 2019Document15 pagesScreening Children For Social Determinants of Health - A Systematic Review - Sokil Et Al, 2019Cata UndurragaNo ratings yet

- Cooperative Management Midterm ReviewDocument22 pagesCooperative Management Midterm ReviewPesidas, Shiela Mae J.No ratings yet

- EDQM PAT Proceedings, 2004Document141 pagesEDQM PAT Proceedings, 2004huynhhaichauchauNo ratings yet

- Geosoft's Master Communication PlanDocument4 pagesGeosoft's Master Communication PlanAli RazaNo ratings yet

- Njala University Department of Physics and Computer ScienceDocument5 pagesNjala University Department of Physics and Computer ScienceAlhaji DaramyNo ratings yet

- Medication Therapy Management Current ChallengesDocument11 pagesMedication Therapy Management Current ChallengesDzaky UlayyaNo ratings yet

- Portfolio Task 1 AssessmentDocument2 pagesPortfolio Task 1 Assessmentapi-321869116No ratings yet

- Peace Psychology Chapter #01Document2 pagesPeace Psychology Chapter #01Paras LarikNo ratings yet

- 05a 9FM0-3B Further Statistics 1 Mock PaperDocument28 pages05a 9FM0-3B Further Statistics 1 Mock PaperKrishan LalNo ratings yet

- ETC GTU Study Material E-Notes All-Units 23012021092307AMDocument81 pagesETC GTU Study Material E-Notes All-Units 23012021092307AMRidham chitre100% (1)

- Design, Analysis and Development of Hydraulic Scissor LiftDocument8 pagesDesign, Analysis and Development of Hydraulic Scissor Liftmohit talrejaNo ratings yet

- Pavement DesignDocument17 pagesPavement DesignDhanushka Manjula100% (1)

- Daily Lesson Log WEEK 1-4 Sessions 8Document4 pagesDaily Lesson Log WEEK 1-4 Sessions 8Irene DausNo ratings yet