Professional Documents

Culture Documents

68245attachment To 1702

Uploaded by

Jim M. MagadanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

68245attachment To 1702

Uploaded by

Jim M. MagadanCopyright:

Available Formats

TAXPAYER NAME: Mandatory Attachment to BIR Form No.

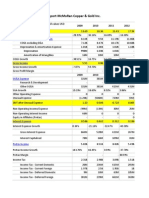

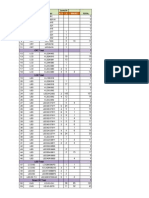

1702 1 Advertising and Promotions Amortizations (specify) 2 3 4 Bad Debts 5 Charitable Contributions 6 Commissions 7 Communication, Light and Water 8 Depletion 9 Depreciation 10 Director's Fees 11 Fringe Benefits 12 Fuel and Oil 13 Insurance 14 Interest 15 Janitorial and Messengerial Services 16 Losses 17 Management and Consutancy Fee 18 Miscellaneous 19 Office Supplies 20 Other Services 21 Professional Fees 22 Rental 23 Repairs and Maintenance-Labor 24 Repairs and Maintenance-Materials/Supplies 25 Representation and Entertainment 26 Research and Development 27 Royalties 28 Salaries and Allowances 29 Security Services 30 SSS, GSIS, Philhealth, HDMF and Other Contributions 31 Taxes and Licenses 32 Tolling Fees 33 Trainings and Seminars 34 Transportation and Travel Others (specify) 35 36 37 Total Regular Allowable Itemized Deductions (Sum of Items 1 to 36) (to Item 22)

TIN: Regular Allowable Itemized Deductions (attach additional sheet/s, if necessary) Exempt Special Rate 1A 2A 3A 4A 5A 6A 7A 8A 9A 10A 11A 12A 13A 14A 15A 16A 17A 18A 19A 20A 21A 22A 23A 24A 25A 26A 27A 28A 29A 30A 31A 32A 33A 34A 35A 36A 37A 1B 2B 3B 4B 5B 6B 7B 8B 9B 10B 11B 12B 13B 14B 15B 16B 17B 18B 19B 20B 21B 22B 23B 24B 25B 26B 27B 28B 29B 30B 31B 32B 33B 34B 35B 36B 37B 1C 2C 3C 4C 5C 6C 7C 8C 9C 10C 11C 12C 13C 14C 15C 16C 17C 18C 19C 20C 21C 22C 23C 24C 25C 26C 27C 28C 29C 30C 31C 32C 33C 34C 35C 36C 37C

TAXABLE YEAR: Regular/Normal Rate 1C 2C 3C 4C 5C 6C 7C 8C 9C 10C 11C 12C 13C 14C 15C 16C 17C 18C 19C 20C 21C 22C 23C 24C 25C 26C 27C 28C 29C 30C 31C 32C 33C 34C 35C 36C 37C

dditional sheet/s, if necessary)

You might also like

- A Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaFrom EverandA Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- Design Guidelines for Surface Mount TechnologyFrom EverandDesign Guidelines for Surface Mount TechnologyRating: 5 out of 5 stars5/5 (1)

- BIR Form 2316Document1 pageBIR Form 2316edz_ramirez87% (15)

- Corporate Bodies and Guilty Minds: The Failure of Corporate Criminal LiabilityFrom EverandCorporate Bodies and Guilty Minds: The Failure of Corporate Criminal LiabilityRating: 3 out of 5 stars3/5 (1)

- BIR Form 1800 - Donor's Tax ReturnDocument2 pagesBIR Form 1800 - Donor's Tax ReturnangelgirlfabNo ratings yet

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- DCF ValuationDocument19 pagesDCF ValuationVIJAYARAGAVANNo ratings yet

- (BIR Form 1706) Capital Gains Tax ReturmDocument2 pages(BIR Form 1706) Capital Gains Tax Returmjongsn70057% (7)

- BIR Form2305Document1 pageBIR Form2305Gayle Abaya75% (4)

- Documentary Stamp Tax FormDocument3 pagesDocumentary Stamp Tax Formnegotiator0% (1)

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Chapter 16: Tool Kit For Working Capital ManagementDocument23 pagesChapter 16: Tool Kit For Working Capital ManagementosamaNo ratings yet

- 1st LectDocument16 pages1st LectAnju MotwaniNo ratings yet

- Acova RadiateursDocument10 pagesAcova RadiateursAnandNo ratings yet

- A/C No. Head of Accounts Debit Rs. Credit Rs. Trial Balance CashDocument6 pagesA/C No. Head of Accounts Debit Rs. Credit Rs. Trial Balance CashhassanmohsinNo ratings yet

- CR CR CR CRDocument22 pagesCR CR CR CRReeni SamuelNo ratings yet

- Year ICP (Days) DCP (Days) CPP (Days) CCC EBIT (In CR)Document4 pagesYear ICP (Days) DCP (Days) CPP (Days) CCC EBIT (In CR)NishaNo ratings yet

- 1701 AifDocument7 pages1701 AifJOHAYNIENo ratings yet

- Ramesh Kumar SoniDocument13 pagesRamesh Kumar SoniShreeRang ConsultancyNo ratings yet

- DT Master Plan: Do Everything & FinallyDocument5 pagesDT Master Plan: Do Everything & FinallyGurvinder Mann Singh PradhanNo ratings yet

- Review Guide W/ Tables For Depreciation & TaxesDocument29 pagesReview Guide W/ Tables For Depreciation & Taxesjer7313No ratings yet

- Cashflow FixDocument158 pagesCashflow FixMario JuniorNo ratings yet

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitNo ratings yet

- Fourth Quarter 2012 Results PreliminaryDocument31 pagesFourth Quarter 2012 Results Preliminarytjl84No ratings yet

- Practical: Capital Budgeting TechniquesDocument13 pagesPractical: Capital Budgeting Techniquespandeyabhishek459No ratings yet

- For Vip Mac Decode Challenge, Decode This To Reveal The Hidden MacDocument1 pageFor Vip Mac Decode Challenge, Decode This To Reveal The Hidden MacsymbianizeNo ratings yet

- Team 4Document34 pagesTeam 4hazdyNo ratings yet

- Las Cruses P21-8 of NeilDocument1 pageLas Cruses P21-8 of NeilMainul RazeebNo ratings yet

- Acuerdo de Transformaion 2Document6 pagesAcuerdo de Transformaion 2Resendiz Saldaña Celina 2IV4No ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- Factors Influencing Customer Satisfaction with Star City BikesDocument16 pagesFactors Influencing Customer Satisfaction with Star City BikesPraveen KumarNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- NICAM BOARD SCHEMATICDocument2 pagesNICAM BOARD SCHEMATICmarialixd4472100% (1)

- Dewi Kartika Ramadhani Marpaung - Mantekpro ADocument3 pagesDewi Kartika Ramadhani Marpaung - Mantekpro ANurmaiNo ratings yet

- Bibek Pashu Tatha Machha PalanDocument44 pagesBibek Pashu Tatha Machha PalanBIBUTSAL BHATTARAINo ratings yet

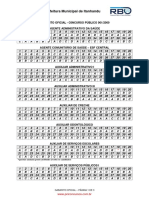

- Prefeitura Municipal de Itanhandu: Questão Anulada Ponto Atribuído A Todos Os CandidatosDocument3 pagesPrefeitura Municipal de Itanhandu: Questão Anulada Ponto Atribuído A Todos Os CandidatosPaula BorgesNo ratings yet

- Annual Income Tax Return: (To Be Filled Up by The BIR)Document6 pagesAnnual Income Tax Return: (To Be Filled Up by The BIR)keir17No ratings yet

- GABARITODocument3 pagesGABARITOLenitaSerafimNo ratings yet

- dafтоЛІКА ЧЕРВОНИЙ _2024_04_12_16_54Document5 pagesdafтоЛІКА ЧЕРВОНИЙ _2024_04_12_16_54romasinyavitskyNo ratings yet

- Public Services Budget Presentation 2022Document23 pagesPublic Services Budget Presentation 2022WVXU NewsNo ratings yet

- Prefeitura Municipal de Itanhandu: Questão Anulada Ponto Atribuído A Todos Os CandidatosDocument3 pagesPrefeitura Municipal de Itanhandu: Questão Anulada Ponto Atribuído A Todos Os CandidatosIsabela EmerickNo ratings yet

- Annual Income Tax Return for CorporationDocument9 pagesAnnual Income Tax Return for CorporationMarvin CeledioNo ratings yet

- Tabel Account ReferenceDocument86 pagesTabel Account ReferenceShandy NewgenerationNo ratings yet

- SIX YEARS FINANCIAL SUMMARYDocument144 pagesSIX YEARS FINANCIAL SUMMARYFatimaMalik100% (1)

- Corp Fin - Radio One IncDocument39 pagesCorp Fin - Radio One IncMarco Quispe PerezNo ratings yet

- SBI Branch Operating Statement AnalysisDocument15 pagesSBI Branch Operating Statement Analysissiddharthzala0% (1)

- Bishnu Pashu Tatha Machha FirmDocument238 pagesBishnu Pashu Tatha Machha FirmBIBUTSAL BHATTARAINo ratings yet

- 2018 - Modelo Rama 005001 DEF Vol-ValDocument371 pages2018 - Modelo Rama 005001 DEF Vol-ValJorge Javier Mba Nzang MesieNo ratings yet

- AbcdeDocument202 pagesAbcdecitraNo ratings yet

- Fiscal - Tributario Gabarito - RetificadoDocument5 pagesFiscal - Tributario Gabarito - RetificadoketelenNo ratings yet

- Financial Accounting and ManagementDocument130 pagesFinancial Accounting and ManagementGopuk KNo ratings yet

- HP CurrentPriceListZero NormalDocument46 pagesHP CurrentPriceListZero NormalMuneeba AttiqueNo ratings yet

- Balance Sheet PepsiDocument2 pagesBalance Sheet Pepsiankit_aggarwal107No ratings yet

- Statement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Document11 pagesStatement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Tinatini BakashviliNo ratings yet

- Financial Data & RatiosDocument18 pagesFinancial Data & RatiosAnkitGhildiyalNo ratings yet

- ReportStockWarehouse (2014 09 05)Document2 pagesReportStockWarehouse (2014 09 05)Priyance NababanNo ratings yet

- Cincinnati: Current Commercial Tax Abatement ProgramDocument2 pagesCincinnati: Current Commercial Tax Abatement ProgramWVXU NewsNo ratings yet

- Fluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceFrom EverandFluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Accountants' Handbook, Special Industries and Special TopicsFrom EverandAccountants' Handbook, Special Industries and Special TopicsNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Petroleum CompleteDocument4 pagesPetroleum CompleteAngela ArleneNo ratings yet

- Additional SlidesDocument55 pagesAdditional SlidesAngela ArleneNo ratings yet

- General Audit Procedures and DocumentationDocument7 pagesGeneral Audit Procedures and DocumentationCaroline MastersNo ratings yet

- MINERAL CompleteDocument3 pagesMINERAL CompleteAngela ArleneNo ratings yet

- Excise Tax Return: For Alcohol ProductsDocument4 pagesExcise Tax Return: For Alcohol ProductsAngela ArleneNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- 209952114-NAP Participation Form Sept. 2006Document2 pages209952114-NAP Participation Form Sept. 2006Angela ArleneNo ratings yet

- FinalDocument1 pageFinalAngela ArleneNo ratings yet

- 107792200A Latest CompleteDocument3 pages107792200A Latest CompleteAngela ArleneNo ratings yet

- Excise Tax Return: For Tobacco ProductsDocument4 pagesExcise Tax Return: For Tobacco ProductsrjgingerpenNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaNo ratings yet

- CFfinalDocument4 pagesCFfinalAngela ArleneNo ratings yet

- A (062101) (Final)Document2 pagesA (062101) (Final)JessicaWeinNo ratings yet

- TOBACCO CompleteDocument3 pagesTOBACCO CompleteAngela ArleneNo ratings yet

- 30291707Document2 pages30291707Angela ArleneNo ratings yet

- An (Aug) CompleteDocument3 pagesAn (Aug) CompleteAngela ArleneNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- (MAY2001) FinalDocument3 pages(MAY2001) FinalAngela ArleneNo ratings yet

- BIR Form 1703 filing guideDocument2 pagesBIR Form 1703 filing guideAnisah C. AzisNo ratings yet

- 1702Document6 pages1702kathkathNo ratings yet

- 19091701AIF (ENCS) FullDocument3 pages19091701AIF (ENCS) FullSANSHA_03No ratings yet