Professional Documents

Culture Documents

No On Proposition AA Campaign Letter To US Attorney John Walsh

Uploaded by

Michael_Lee_RobertsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No On Proposition AA Campaign Letter To US Attorney John Walsh

Uploaded by

Michael_Lee_RobertsCopyright:

Available Formats

437 West Colfax Ave.

, Suite 300, Denver, Colorado 80204; 720-420-9225

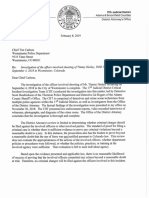

October 9, 2013 John Walsh United States Attorney for Colorado 1225 17th Street, Suite 700 Denver, CO 80202 Re: Colorado Proposition AA, Tax Increase on Marijuana Dear Mr. Walsh: This November, Colorado voters will consider Proposition AA, a 15% sales tax plus a 15% excise tax on marijuana sales. City and County of Denver voters will consider an additional 15% sales tax on top of these State taxes. These taxes would be in addition to the taxes already in place on marijuana, 2.9% Statewide and 7.62% in Denver, and Federal taxes that are higher than any other industry due to the inability of these businesses to take full deductions. I serve as Treasurer and General Counsel to the No on Prop AA campaign, No Over Taxation, an issue committee registered with the Colorado Secretary of State. Proposition AA would be the largest tax increase in Colorado history, a reckless proposal that would create a dysfunctional market for marijuana, undermining the goal of the AlcoholMarijuana Equalization Initiative, (Colorados Amendment 64; Colorado Constitution, Article XVIII 16). As a framer and supporter of Amendment 64, the purpose of the measure was to bring marijuana out of Prohibition and regulate it like alcohol. The pro-Proposition AA campaign, Committee for Responsible Regulation, refuses to debate our campaign and refuses to submit their dangerous ideas to open voter scrutiny, as is normal in the political process. The Yes on AA campaign is supported by what Jacob Sullum of Reason Magazine has accurately labeled The Marijuana Cartel, i.e. the large dispensaries that use burdensome and expensive government regulation and taxation to suppress fair competition from smaller businesses. Instead of participating in normal political debate, the Yes on AA campaign is running a devious campaign of fear, making threats and representations of backroom deals with the U.S. Department of Justice. Statements from the Yes campaign include that the U.S. Department of Justice supports a Yes vote on Proposition AA, and if Colorado voters decide not to tax ourselves at an unprecedented rate and that Proposition AA were to fail, that the U.S. Department of Justice would retaliate against Colorado voters by dismantling Colorados marijuana industry with Federal intervention in the form of criminal prosecution and forfeiture of property. Specifically, the Yes campaign points to alleged conversations between Colorado

Governor John Hickenlooper, the Governors Counsel Jack Findlaw, U.S. Attorney General Eric Holder, and yourself, to the effect that you and the U.S. Department of Justice have made a promise to allow Colorados marijuana industry to exist if Proposition AA passes. Specific past guidance from the U.S. Department of Justice would seem to indicate that in fact a No vote on Proposition AA is favored by the Department. The August 29, 2013 memo from Deputy Attorney General James M. Cole does not mention--anywhere in the detailed guidance--local or state taxes on marijuana, but does mention the desire of the U.S. Department of Justice for an enforcement system that is effective in practice. An effective tax rate of over 50% creates a dysfunctional system that is ineffective in practice. Basic economics indicate that over-taxation creates a marijuana market ripe for takeover by the unregulated, untaxed, underground market. Your counterpart U.S. Attorney for the Northern District of California, Melinda Haag, also indicated in a February 1, 2011 letter to the City of Oakland that a local government licensing scheme for marijuana cultivation involved drug proceeds, which the U.S. Government would seize. Oakland then declined to initiate its licensing scheme following this letter. Moreover, the marijuana-only taxes in Proposition AA run afoul of constitutional law and would be susceptible to legal challenge if passed by voters and collected by state or local governments. See Timothy Leary v. United States, 395 U.S. 6 (1969) (invalidating federal Marihuana Tax Act due to marijuanas federal illegality thus mandating all payers of tax to incriminate themselves). State taxes on marijuana in North Carolina, Massachusetts, Idaho, South Dakota, and Tennessee have all been struck down by courts. The State of Tennessee was even forced to refund millions of dollars it unconstitutionally collected on taxes similar to Proposition AA. Obviously, the representations of the Yes campaign and the Marijuana Cartel are either true or false. The U.S. Department of Justice has a proud history of supporting the civil rights of Americans and protecting our right to self-determination and to vote our conscience without threat or interference. As a former Majority Counsel to the U.S. House of Representatives Judiciary Committee that conducted oversight on the Justice Department, I do not believe that the U.S. Department of Justice would bully voters in this manner. Either way, sunshine is the best disinfectant. The U.S. Department of Justice should be clear and unambiguous in its position since the Yes campaign seeks to use the U.S. Department of Justice as a political bludgeon. Accordingly, we write to inquire of you directly as to whether the U.S. Department of Justice supports a Yes or a No vote on Colorado Proposition AA. Coloradans do not have a Maybe option on this ballot, so it would be greatly appreciated if the U.S. Department of Justice would articulate a clear Yes or No position on this important matter. There is precedent for the U.S. Department of Justice to be open and honest about endorsing positions on state ballot matters. In 2010, California voters considered Proposition 19, which would have legalized marijuana. The U.S. Department of Justice was then quite explicit in its wishes than Californians vote No. If you are not able to respond to our request by October 11, 2013, we will assume that you support the status quo, which is a No on Proposition AA, and will request the Yes campaign correct its misrepresentations.

Thank you very much for your time and consideration of this request. If you have any questions, please contact me via email Robert.Corry@comcast.net. Perhaps we can discuss these matters in person at the upcoming Stanford Law School Reunion, if you plan to attend. Sincerely, Robert J. Corry, Jr. Treasurer and General Counsel

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Provisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceDocument7 pagesProvisional Breed-Restricted License For Owners of Pit Bulls Draft OrdinanceMichael_Lee_RobertsNo ratings yet

- Brandon Valdez Officer-Involved Shooting Decision LetterDocument13 pagesBrandon Valdez Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- Dr. William Moreau Lawsuit Press ReleaseDocument1 pageDr. William Moreau Lawsuit Press ReleaseMichael_Lee_RobertsNo ratings yet

- Estate of Allan George, Et Al., v. City of Rifle, Et Al.Document20 pagesEstate of Allan George, Et Al., v. City of Rifle, Et Al.Michael_Lee_RobertsNo ratings yet

- 3 6Document5 pages3 6Akuna Ra100% (2)

- Complete Guide To The CHSTDocument32 pagesComplete Guide To The CHSTJoel MartinezNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportDocument25 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators ReportMichael_Lee_RobertsNo ratings yet

- Officer Susan Mercado: Denver Police Department Order of DisciplineDocument15 pagesOfficer Susan Mercado: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Natasha Patnode Settlement AgreementDocument6 pagesNatasha Patnode Settlement AgreementMichael_Lee_RobertsNo ratings yet

- Officer Austin Barela: Denver Police Department Order of DisciplineDocument15 pagesOfficer Austin Barela: Denver Police Department Order of DisciplineMichael_Lee_RobertsNo ratings yet

- Lookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsDocument20 pagesLookout Mountain Youth Services Center: Council of Juvenile Correctional Administrators Recommendations With Action StepsMichael_Lee_RobertsNo ratings yet

- Missing and Murdered Indigenous Women and Girls ReportDocument28 pagesMissing and Murdered Indigenous Women and Girls ReportMichael_Lee_RobertsNo ratings yet

- Paul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewDocument4 pagesPaul Vranas Denver Pit Bull Expert Testimony and Evidence ReviewMichael_Lee_Roberts0% (1)

- Xiaoli Gao and Zhong Wei Zhang IndictmentDocument12 pagesXiaoli Gao and Zhong Wei Zhang IndictmentMichael_Lee_RobertsNo ratings yet

- Iheart Media Division Presidents and Market NamesDocument3 pagesIheart Media Division Presidents and Market NamesMichael_Lee_RobertsNo ratings yet

- Denver Dog and Cat Bites by Breed 2019Document2 pagesDenver Dog and Cat Bites by Breed 2019Michael_Lee_RobertsNo ratings yet

- Travis Cook v. City of Arvada, Et Al.Document19 pagesTravis Cook v. City of Arvada, Et Al.Michael_Lee_RobertsNo ratings yet

- Senate Joint Resolution 20-006Document7 pagesSenate Joint Resolution 20-006Michael_Lee_RobertsNo ratings yet

- 2020 Rental Affordability Report DataDocument160 pages2020 Rental Affordability Report DataMichael_Lee_RobertsNo ratings yet

- Colorado Senate Bill 20-065Document7 pagesColorado Senate Bill 20-065Michael_Lee_RobertsNo ratings yet

- Denver Public Schools Gender-Neutral Bathrooms ResolutionDocument3 pagesDenver Public Schools Gender-Neutral Bathrooms ResolutionMichael_Lee_Roberts100% (1)

- Suicide by Cop: Protocol and Training GuideDocument12 pagesSuicide by Cop: Protocol and Training GuideMichael_Lee_RobertsNo ratings yet

- Comcast Motion To Dismiss Altitude Sports & Entertainment LawsuitDocument23 pagesComcast Motion To Dismiss Altitude Sports & Entertainment LawsuitMichael_Lee_RobertsNo ratings yet

- Johnny Leon-Alvarez Probable Cause StatementDocument3 pagesJohnny Leon-Alvarez Probable Cause StatementMichael_Lee_RobertsNo ratings yet

- Erik Jensen Sentence Commutation LetterDocument1 pageErik Jensen Sentence Commutation LetterMichael_Lee_RobertsNo ratings yet

- Estate of Timmy Henley v. City of Westminster, Et Al.Document34 pagesEstate of Timmy Henley v. City of Westminster, Et Al.Michael_Lee_RobertsNo ratings yet

- Susan Holmes Judge Recusal MotionDocument12 pagesSusan Holmes Judge Recusal MotionMichael_Lee_RobertsNo ratings yet

- IHeartMedia Markets Group Division President BiosDocument3 pagesIHeartMedia Markets Group Division President BiosMichael_Lee_RobertsNo ratings yet

- Trevante Johnson Officer-Involved Shooting Decision LetterDocument5 pagesTrevante Johnson Officer-Involved Shooting Decision LetterMichael_Lee_RobertsNo ratings yet

- Timmy Henley Decision LetterDocument13 pagesTimmy Henley Decision LetterMichael_Lee_RobertsNo ratings yet

- Ending A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyDocument60 pagesEnding A Broken System: Colorado's Expensive, Ineffective and Unjust Death PenaltyMichael_Lee_RobertsNo ratings yet

- Non Compliance With The Rules of Court PDFDocument6 pagesNon Compliance With The Rules of Court PDFJunx LimNo ratings yet

- HandbookDocument104 pagesHandbooksony0% (1)

- Spouses Villaluz Vs Land BankDocument2 pagesSpouses Villaluz Vs Land Bankjovifactor100% (1)

- RamayanaDocument28 pagesRamayanaShrikant SamletiNo ratings yet

- Re Report On The Judicial Audit Conducted in The Regional Trial Court Branch 24, Cebu City DigestDocument1 pageRe Report On The Judicial Audit Conducted in The Regional Trial Court Branch 24, Cebu City DigestEmir MendozaNo ratings yet

- Pride and Prejudice DialogsDocument100 pagesPride and Prejudice DialogsmussinNo ratings yet

- Human RightsDocument7 pagesHuman Rightscharmi100% (1)

- De Facto de JureDocument3 pagesDe Facto de JureChristian Karl CalanoNo ratings yet

- Assignment - Criminal Law From Article 1-20Document43 pagesAssignment - Criminal Law From Article 1-20Regh Ariente50% (2)

- Team Teaching RevDocument39 pagesTeam Teaching RevErika DianaNo ratings yet

- SAs 18 EDU 536Document8 pagesSAs 18 EDU 536Reygen TauthoNo ratings yet

- The Baby in The NbackpackDocument4 pagesThe Baby in The NbackpackChristein Roger Dondoyano GamaleNo ratings yet

- Basic Customer Service SkillsDocument90 pagesBasic Customer Service SkillsGillian Delos ReyesNo ratings yet

- Relevancy and Admissibility of ConfessionsDocument8 pagesRelevancy and Admissibility of ConfessionsVikas Denia0% (1)

- Bos KFCDocument5 pagesBos KFCMuhammad Uzair Khalid BhuttaNo ratings yet

- Perdev Reviewer 1Document7 pagesPerdev Reviewer 1Jean DaclesNo ratings yet

- The Conntract WordingDocument9 pagesThe Conntract WordingAnonymous oQEx3zNo ratings yet

- My 1/27/20 Follow-Up Re: "Y-Strap" Device & FDA Reply Re: InvestigationDocument3 pagesMy 1/27/20 Follow-Up Re: "Y-Strap" Device & FDA Reply Re: InvestigationPeter M. HeimlichNo ratings yet

- RNM User Kajal Kanti Dey's Photo & Tortured in Kolkata, India 22/07/18Document11 pagesRNM User Kajal Kanti Dey's Photo & Tortured in Kolkata, India 22/07/18KunalNo ratings yet

- Steven LayDocument120 pagesSteven LayAndreea SimonaNo ratings yet

- The Leadership Quarterly: Nathan Eva, Mulyadi Robin, Sen Sendjaya, Dirk Van Dierendonck, Robert C. Liden TDocument22 pagesThe Leadership Quarterly: Nathan Eva, Mulyadi Robin, Sen Sendjaya, Dirk Van Dierendonck, Robert C. Liden Tjalan sungaiNo ratings yet

- Crisis of Rhetoric ReportDocument11 pagesCrisis of Rhetoric ReportBrian Jenner100% (1)

- Belbin InventoryDocument8 pagesBelbin InventoryOsemhen AkhibiNo ratings yet

- Namibia Law Journal House Style GuideDocument6 pagesNamibia Law Journal House Style Guideraquel100% (1)

- Besr q4 Module 2Document12 pagesBesr q4 Module 2Myra Kristel FerrerNo ratings yet

- SPM p3 Speaking Test (f5 Unit 4)Document3 pagesSPM p3 Speaking Test (f5 Unit 4)JΞτΗασNo ratings yet

- Financial Institution PI - Proposal FormDocument17 pagesFinancial Institution PI - Proposal FormNimesh Prakash /Insurance/SreiNo ratings yet

- Fallacy Of: Legend: Those in Are Examples of FallaciesDocument2 pagesFallacy Of: Legend: Those in Are Examples of FallaciesJohn Paul FernandezNo ratings yet