Professional Documents

Culture Documents

Bhushan Steel LTD

Uploaded by

Arpita MukherjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bhushan Steel LTD

Uploaded by

Arpita MukherjeeCopyright:

Available Formats

FINANCIAL STATEMENT ANALYSIS AND RESEARCH

REPORT ON BHUSHAN STEEL LTD.

Submitted To: Dr. Pawan Jain

Submitted By: Saurabh Singhal (2012282)

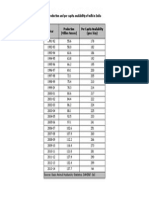

Incorporated in January 1983, Bhushan Steel is Indias third largest secondary steel producing company with an existing steel production capacity of 2.2mn tonne. The company is the largest auto-grade steelmaker in India and specializes in manufacturing value-added flat products. It has three manufacturing units in the states of Uttar Pradesh (Sahibabad Unit), Maharashtra (Khopoli unit), and Orissa (Meramandali unit) in India and has a sales network across many countries. The market capitalization of Bhushan Steel is Rs. 10,858 crores with the current market price of Rs. 480.40 per share which is 5.26% up from April 2013 price, which is quite consistent with the Sensex that also increases by 5.93% since April this year. The market cap of Bhushan steel is closer to its next competitor i.e. JSW steel (Rs. 15,790 crores) while still quite behind that of TATA steel (Rs. 30,583 crores). For First quarter of FY2014, Bhushan Steel reported a decline in top-line of 13.33% QoQ; however, its bottom-line declined 62.97% QoQ due to higher depreciation and interest costs. Raw material accounts for nearly 53% of sales and 72% of total expenditure. The iron ore prices have increased by almost 33% from a level of $101/ton to $133/ton from September last year. Coking coal prices have decreased by 19.33% to $65/ton from the levels of $80/ton. Any further hike in raw material prices would dent the margins to the tune of 3-5%. The decline in sales is majorly in domestic sales that fall by 17.75% while export sales have increased by 10.25%.

Sales Turnover

50,000.00 40,000.00 30,000.00 20,000.00 10,000.00 0.00 15000 10000 5000 0

Operating Profit

Bhushan

JSW

TATA

Bhushan

JSW

TATA

Bhushan steel has been growing at a rate of over 18% a year effectively from 2008 onwards. The operating and net profit has also been consistently increasing for the company.

EPS

250 200 150 100 50 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Bhushan JSW TATA 8000 6000 4000 2000 0

Net profit

Bhushan

JSW

TATA

Future Prospects: Steel manufactures have hiked steel prices nearly 21% during the last four months, thereby leaving little scope for further hikes. Adding to that high interest rate scenario is prevailing in the industry. Bhushan Steel which primarily caters to auto manufactures is likely to be affected by high interest, as the demand for auto grade steel is expected to slow down. A complete pass- through to final steel consumers remains unlikely, that means steel producers may have to bite into their margins for the next two quarters. Bhushan Steel has nearly doubled its steel capacity over the past five years. The benefits of its phase III expansion is expected to be witnessed during FY2014-15 with strong volume growth. However, its high leverage remain as the matter of concern. Depreciation expense increased 13.10% YoY to Rs.233cr on account of increased capacity. Interest expenses also increased 6.63% YoY to Rs.402cr due to increase in debt. Consequently, the reported net profit decreased by 62.97% YoY to Rs.76cr.

During the quarter the company commissioned 0.45 mtpa CRM in Odisha which is under trial and run process. The 2.5 MTPA HRC plant under Odisha phase III expansion is running on track and is expected to commission by October 2013. Further, the company is setting up 1.3 mtpa coke oven, 197MW CPP and 1.8 mtpa CRM in Odisha, expected in FY14 FY15. Considering the highly leveraged balance sheet (Total debt of INR 200 bn with a D/E of 4.34 x) company board has approved the fund raising plan of INR 7 bn through the rights issue. This would result in lower interest expenses and considered as a positive development in the long run. Recommendation: The company is continuously focusing; both on forward as well as backward integration which may provide it a high growth trajectory. However, higher interest expenses and abrupt raw material supply at Odisha would be a major concern for the company going forward but companys strategic moves towards financial restructuring and initiatives towards captive raw material sourcing may provide some relief going forward. At current market price, the stock is trading at 7.3x FY13E EV/ EBITDA which seems to be at the lower end considering the product basket and the expansion plans. We believe company to deliver better performance on the back of higher capacity along with better product mix and recommend ACCUMULATE on the stock with a price target of INR 510.

You might also like

- 2011-05-02 Quant REITSDocument40 pages2011-05-02 Quant REITSstepchoinyNo ratings yet

- William CV - BlackRockDocument2 pagesWilliam CV - BlackRockWilliam GameNo ratings yet

- Ethics and Corporate Social Responsibility in The Corporate World Are Very ImportantDocument10 pagesEthics and Corporate Social Responsibility in The Corporate World Are Very ImportantSeroney JustineNo ratings yet

- Business Plan Bolt & Nuts - Financial AspectsDocument14 pagesBusiness Plan Bolt & Nuts - Financial AspectsgboobalanNo ratings yet

- 26 Nitisha Ib1816335Document9 pages26 Nitisha Ib1816335purged_500198870_241No ratings yet

- Relative Valuation of Bhushan Steel LtdDocument6 pagesRelative Valuation of Bhushan Steel LtdMohit OberoiNo ratings yet

- Technical Analysis of TATA STEELDocument6 pagesTechnical Analysis of TATA STEELshalintrivedi28No ratings yet

- Organization Structure Training at Visakhapatnam Steel PlantDocument33 pagesOrganization Structure Training at Visakhapatnam Steel PlantMeera JoshyNo ratings yet

- Investment DecisionDocument4 pagesInvestment DecisionnrjmarutNo ratings yet

- Working Capital Management of Tata Steel and Comparative Analysis with Jindal and SAILDocument116 pagesWorking Capital Management of Tata Steel and Comparative Analysis with Jindal and SAILManu Srivastav50% (2)

- Tata Steel Balance Sheet 2005-06Document172 pagesTata Steel Balance Sheet 2005-06karthikrmNo ratings yet

- India Cement (INDCEM) : Higher Prices Lead To Margin ExpansionDocument11 pagesIndia Cement (INDCEM) : Higher Prices Lead To Margin ExpansionumaganNo ratings yet

- 28 Annual Report 2009-10Document96 pages28 Annual Report 2009-10Haritha IduriNo ratings yet

- Executive Summary Industry OverviewDocument5 pagesExecutive Summary Industry OverviewVarun SinghNo ratings yet

- AFM ReportDocument26 pagesAFM ReportHetviNo ratings yet

- Tata Steel tops corporate reputation list, Bharti Airtel fifthDocument4 pagesTata Steel tops corporate reputation list, Bharti Airtel fifthGurudutt MohapatraNo ratings yet

- Ador Welding - Co Visit Note QSDocument9 pagesAdor Welding - Co Visit Note QSRajesh VoraNo ratings yet

- Reasons for selecting steel and auto stocksDocument6 pagesReasons for selecting steel and auto stocksSreekumar ThottapillilNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Corp LTD: (GMDV)Document5 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- BEL Poised to Gain From India's Growing Defence SpendingDocument1 pageBEL Poised to Gain From India's Growing Defence SpendingRitz AmbyyNo ratings yet

- Chairman'S Address: Global OutlookDocument6 pagesChairman'S Address: Global OutlookabhinandanboradNo ratings yet

- Face To Face 0111Document2 pagesFace To Face 0111niti modiNo ratings yet

- Sapm ProjectDocument8 pagesSapm ProjectSweet tripathiNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- BSRM Steels LimitedDocument2 pagesBSRM Steels Limitedashek ishtiak haqNo ratings yet

- India's Growing Steel IndustryDocument11 pagesIndia's Growing Steel IndustryPearlNo ratings yet

- Tata Steel: Risk To Indian Business Margins AbatingDocument14 pagesTata Steel: Risk To Indian Business Margins AbatingSachin GuptaNo ratings yet

- Tata Steel: Risk To Indian Business Margins AbatingDocument14 pagesTata Steel: Risk To Indian Business Margins AbatingSachin GuptaNo ratings yet

- HDFC-Research SteelCast Buy at 147Document6 pagesHDFC-Research SteelCast Buy at 147DeepakGarudNo ratings yet

- TATA STEEL EQUITY VALUATIONDocument33 pagesTATA STEEL EQUITY VALUATIONMedha SinghNo ratings yet

- Financial Analysis - JSW and JSL PDFDocument13 pagesFinancial Analysis - JSW and JSL PDFAnirban KarNo ratings yet

- Project Finance of JSW (Steel) .: Industry Analysis and Ratio AnalysisDocument17 pagesProject Finance of JSW (Steel) .: Industry Analysis and Ratio AnalysisLiza DsouzaNo ratings yet

- Jindal July 11Document5 pagesJindal July 11Surya YerraNo ratings yet

- Century Textile IndustriesDocument22 pagesCentury Textile IndustriesKothapatnam Suresh BabuNo ratings yet

- Market Outlook 27th February 2012Document5 pagesMarket Outlook 27th February 2012Angel BrokingNo ratings yet

- Tata SteelDocument9 pagesTata SteelAmyo RoyNo ratings yet

- Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Financial Accounting Project: TATA Steel Ltd. JSW Steel LTDDocument17 pagesFinancial Accounting Project: TATA Steel Ltd. JSW Steel LTDSanju VisuNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Financial Accounting Project: MembersDocument12 pagesFinancial Accounting Project: MembersSanju VisuNo ratings yet

- Dolat PreferredDocument45 pagesDolat PreferredAnonymous W7lVR9qs25No ratings yet

- Ashok Leyland: Sell Investment ConcernsDocument8 pagesAshok Leyland: Sell Investment ConcernsPrabhakar SinghNo ratings yet

- Sushil BHEL 03feb10Document15 pagesSushil BHEL 03feb10VIBHAVNo ratings yet

- Developing A Growth Strategy For The CompanyDocument11 pagesDeveloping A Growth Strategy For The CompanyAbhinandan ChatterjeeNo ratings yet

- Promoter's Background: Equity Shares Locked-In For One YearDocument8 pagesPromoter's Background: Equity Shares Locked-In For One YearabeeraksNo ratings yet

- Equity Note - GPH Ispat LimitedDocument2 pagesEquity Note - GPH Ispat LimitedOsmaan GóÑÍNo ratings yet

- Way2wealth Steel 27sep10Document29 pagesWay2wealth Steel 27sep10Nishant PathakNo ratings yet

- Nikkei Falls Sharply As Italy Election Spooks Investors: Suzlon Bags 103 MW Order From ONGCDocument12 pagesNikkei Falls Sharply As Italy Election Spooks Investors: Suzlon Bags 103 MW Order From ONGCBhavin PrajapatiNo ratings yet

- Tata Steel AnalysisDocument16 pagesTata Steel AnalysisVivek PandeyNo ratings yet

- Indian Steel Industry Value Chain and StrategiesDocument23 pagesIndian Steel Industry Value Chain and StrategiesSaurav BhargavNo ratings yet

- Ultratech Cement ReportDocument19 pagesUltratech Cement Reportkishor waghmareNo ratings yet

- Equity Research: Tata Steel - Hold, Start SIPDocument9 pagesEquity Research: Tata Steel - Hold, Start SIPNeel KapoorNo ratings yet

- Sutlej Textiles Industries LTD 30 July 2015Document13 pagesSutlej Textiles Industries LTD 30 July 2015Yakub PashaNo ratings yet

- Tata SteelDocument28 pagesTata SteelmuzammilNo ratings yet

- Sharekhan top picks outperform in FY2010Document6 pagesSharekhan top picks outperform in FY2010Kripansh GroverNo ratings yet

- Tata Steel - R - 30082019Document16 pagesTata Steel - R - 30082019Amitabh100% (1)

- Adhunik Metaliks Outperformer Rating Reiterated on Strong Q4 ResultsDocument4 pagesAdhunik Metaliks Outperformer Rating Reiterated on Strong Q4 Resultsbosudipta4796No ratings yet

- 4Document65 pages4Pappu KumarNo ratings yet

- Cummins India - Investment Idea 010607Document2 pagesCummins India - Investment Idea 010607meetwithsanjayNo ratings yet

- KSB Pumps: Not Rated Rs87Document5 pagesKSB Pumps: Not Rated Rs87kaushal upasaniNo ratings yet

- Sample Data Packaged Food BiscuitsDocument755 pagesSample Data Packaged Food BiscuitsArpita MukherjeeNo ratings yet

- Aquafeed July August 2015 FULL EDITIONDocument68 pagesAquafeed July August 2015 FULL EDITIONArpita MukherjeeNo ratings yet

- Milk Production and Per Capita Availability of Milk in IndiaDocument1 pageMilk Production and Per Capita Availability of Milk in IndiaArpita MukherjeeNo ratings yet

- Vodafone Brand ManagementDocument17 pagesVodafone Brand ManagementArpita MukherjeeNo ratings yet

- Spicejet Brand ManagementDocument18 pagesSpicejet Brand ManagementArpita MukherjeeNo ratings yet

- Arpita Mukherjee BM SonyDocument6 pagesArpita Mukherjee BM SonyArpita MukherjeeNo ratings yet

- Retail ManagementDocument1 pageRetail ManagementArpita MukherjeeNo ratings yet

- Tata Mind Rover 2013 Case SolutionsDocument18 pagesTata Mind Rover 2013 Case SolutionsArpita MukherjeeNo ratings yet

- FINANCIAL ANALYSIS OF BHUSHAN STEELDocument3 pagesFINANCIAL ANALYSIS OF BHUSHAN STEELArpita MukherjeeNo ratings yet

- Trident Campus Mba PresentationDocument36 pagesTrident Campus Mba PresentationArpita MukherjeeNo ratings yet

- Supply Chain ManagementDocument25 pagesSupply Chain ManagementAnup MohanNo ratings yet

- Spicejet Brand ManagementDocument18 pagesSpicejet Brand ManagementArpita MukherjeeNo ratings yet

- CFS ANALYSIS: GRASIM INDUSTRIESDocument3 pagesCFS ANALYSIS: GRASIM INDUSTRIESArpita MukherjeeNo ratings yet

- Grasim Industries - CFDocument6 pagesGrasim Industries - CFArpita MukherjeeNo ratings yet

- "Scope of Tourism Industry in Brazil": Business EnvironmentDocument3 pages"Scope of Tourism Industry in Brazil": Business EnvironmentArpita MukherjeeNo ratings yet

- Arpita EconomicsDocument11 pagesArpita EconomicsArpita MukherjeeNo ratings yet

- Vision Mission N Business ModelDocument8 pagesVision Mission N Business ModelSanket DangiNo ratings yet

- Basel II AccordDocument5 pagesBasel II Accordmhossain98No ratings yet

- NestleDocument2 pagesNestleMd WasimNo ratings yet

- Small Scale EntrepreneurDocument12 pagesSmall Scale EntrepreneurHephzibah JohnNo ratings yet

- Amity School of Business: Bba, Ii SemesterDocument14 pagesAmity School of Business: Bba, Ii SemesterhimnnnNo ratings yet

- Financial Report On Pioneer CementDocument62 pagesFinancial Report On Pioneer Cementl080082No ratings yet

- ACCA F2 March 2016 NotesDocument3 pagesACCA F2 March 2016 Noteskevior2No ratings yet

- Annual-Report-13-14 AOP PDFDocument38 pagesAnnual-Report-13-14 AOP PDFkhurram_66No ratings yet

- International Corporate Finance 10 Edition: by Jeff MaduraDocument20 pagesInternational Corporate Finance 10 Edition: by Jeff MaduraNatashaAimilNo ratings yet

- PPCDocument21 pagesPPCJournalist ludhianaNo ratings yet

- Questionnaire - Yash PareekDocument4 pagesQuestionnaire - Yash PareekYash PareekNo ratings yet

- FATCA Self-Certification Supporting DocumentDocument8 pagesFATCA Self-Certification Supporting DocumentDhavalNo ratings yet

- Ambit Reporton Dairy Industry PDFDocument60 pagesAmbit Reporton Dairy Industry PDFrajesh katareNo ratings yet

- Grasim Industries, Aditya Birla Nuvo About To MergeDocument3 pagesGrasim Industries, Aditya Birla Nuvo About To MergeSubham MazumdarNo ratings yet

- SEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16Document61 pagesSEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16scion.scionNo ratings yet

- The Application and Impacts of Operation Research Methodologies On Financial MarketsDocument6 pagesThe Application and Impacts of Operation Research Methodologies On Financial MarketsAnonymous lAfk9gNPNo ratings yet

- Ijrar Issue 20542869Document5 pagesIjrar Issue 20542869FathimaNo ratings yet

- Portfolio Analysis and BCG Matrix: The Growth Share MatrixDocument11 pagesPortfolio Analysis and BCG Matrix: The Growth Share MatrixRutvi Shah RathiNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasKurtNo ratings yet

- The New Government Accounting System ManualDocument35 pagesThe New Government Accounting System ManualelminvaldezNo ratings yet

- SA2 Life InsuranceDocument6 pagesSA2 Life InsuranceVignesh SrinivasanNo ratings yet

- Notice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Document2 pagesNotice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Justia.comNo ratings yet

- Unit 7Document11 pagesUnit 7BasappaSarkarNo ratings yet

- PAS38 TheoriesDocument3 pagesPAS38 TheoriesAngelicaNo ratings yet

- Unit 15 Grammar Present Perfect and Past SimpleDocument17 pagesUnit 15 Grammar Present Perfect and Past SimpleJhorch Garcia ChavezNo ratings yet

- Demand TheoryDocument19 pagesDemand TheoryRohit GoyalNo ratings yet