Professional Documents

Culture Documents

HW 8

Uploaded by

urbuddy542Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW 8

Uploaded by

urbuddy542Copyright:

Available Formats

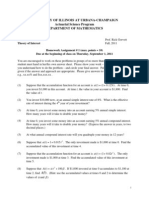

UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN Actuarial Science Program DEPARTMENT OF MATHEMATICS

Math 210 Theory of Interest Prof. Rick Gorvett Fall, 2011

Homework Assignment # 8 (max. points = 10) Due at the beginning of class on Thursday, November 17, 2011 You are encouraged to work on these problems in groups of no more than 3 or 4. However, each student must hand in her/his own answer sheet. Please show your work enough to show that you understand how to do the problem and circle your final answer. Full credit can only be given if the answer and approach are appropriate. Please give answers to two decimal places e.g., xx.xx% and $xx,xxx.xx . Note: Homework assignments are due at the beginning of the class. If you arrive at the class after it has started, you must hand in your assignment upon entering the classroom. Assignments will not be accepted at the end of the class period.

(1)

A 30-year X% annual coupon bond has a face value of $1,000. The price of the bond is $930, and the annual effective interest rate is 8%. Find X. A 20-year 6% annual coupon bond has a face value of $1,000, and a redemption value of $1,100. The annual effective interest rate is 4%. Find the price of the bond. A 30-year 8% annual-coupon bond with a face value of $1,000 is purchased at a time when the interest rate in the market is 10%. Immediately after the 12th coupon payment, the interest rate in the market is 6%. The book value of the bond immediately after the 12th coupon payment is BV, and the market value of the bond immediately after the 12th coupon payment is MV. Find the difference, MV BV. A 20-year 10% annual-coupon bond with a face value of $1,000 is purchased at a yield of 8%. Thus, the purchase price represents a premium above $1,000. Find the amount of amortization of premium during the 7th year of the bond. A 20-year 10% annual-coupon bond with a face value of $1,000 is purchased at a yield of 12%. Thus, the purchase price represents a discount below $1,000. Find the amount of accumulation of discount during the 11th year of the bond. You purchase a 30-year 7% annual coupon bond with a face value of 1000, at a yield rate of 8%. The bond is a callable corporate bond, with a call price of 1,050, and can be called by the issuing corporation after five years. Immediately after the 14th coupon payment, the issuing corporation redeems the bond. Determine the effective annual yield you achieved on this 14-year investment. (Note: you can determine the yield rate with a

1

(2)

(3)

(4)

(5)

(6)

calculator, or by using the Solver tool in Excel. Examples of how to perform this calculation on calculators which are permitted to be used on the FM exam can be found as follows: For the TI BA-35 calculator: on pages 14-15, Finding Bond Yield on a Coupon Date, of the instruction manual: http://www.soa.org/files/pdf/FM-22-05.pdf For the TI BA II Plus: on pages 20-21, Finding the Bond Yield on a Coupon Date, of the instruction manual: http://www.soa.org/files/pdf/FM-23-05.pdf Other calculators with similar capabilities are likely to use similar techniques.) (7) Let P be the price, based on the Dividend Discount Model (basically, just a geometrically-growing perpetuity-immediate formula), of a share of common stock. You expect the stock to pay a dividend of 2.50 one year from now, and 3.50 two years from now. Thereafter, you expect the amount of each annual dividend to grow at a rate of 3% per year. The effective annual interest rate is 9%. Find P. Let the market rate of interest be 10%, and let the inflation rate be 4%. Find the implied real rate of interest. (All rates are annual effective rates.) Find the present value, now, of a five-year annuity-immediate which pays $1,000 one year from now, and each subsequent payment is $500 greater than the previous payment. Assume that the real interest rate is 2.5% and the inflation rate is 3.755%. A jury awards you a 20-year stream of 20 annual payments, with the first payment of $50,000 due now. After that, each payment will increase over the prior payment by a 3.5% annual inflation adjustment. The market interest rate is 8%. Find the present value, now, of this stream of payments.

(8)

(9)

(10)

You might also like

- HW 8Document2 pagesHW 8urbuddy542No ratings yet

- HW 6Document2 pagesHW 6urbuddy542No ratings yet

- University of Illinois at Urbana-Champaign Actuarial Science Program Department of MathematicsDocument2 pagesUniversity of Illinois at Urbana-Champaign Actuarial Science Program Department of Mathematicsurbuddy542No ratings yet

- HW 8Document2 pagesHW 8urbuddy542No ratings yet

- HW 2Document2 pagesHW 2urbuddy542No ratings yet

- HW 8Document2 pagesHW 8urbuddy542No ratings yet

- HW 1Document2 pagesHW 1urbuddy542No ratings yet

- Old 5 AnsDocument2 pagesOld 5 Ansurbuddy542No ratings yet

- Old 2 AnsDocument4 pagesOld 2 Ansurbuddy542No ratings yet

- Old 1 AnsDocument2 pagesOld 1 Ansurbuddy542No ratings yet

- HW 8Document2 pagesHW 8urbuddy542No ratings yet

- HW 2 AnsDocument2 pagesHW 2 Ansurbuddy542No ratings yet

- Old 6 AnsDocument2 pagesOld 6 Ansurbuddy542No ratings yet

- HW 1 AnsDocument2 pagesHW 1 Ansurbuddy542No ratings yet

- HW 5 AnsDocument2 pagesHW 5 Ansurbuddy542No ratings yet

- Modernism: Muyuan Zhang, Jamey Stolbom, Maisy PorterDocument7 pagesModernism: Muyuan Zhang, Jamey Stolbom, Maisy Porterurbuddy542No ratings yet

- Econ303 hw1 Spring13 PDFDocument9 pagesEcon303 hw1 Spring13 PDFurbuddy542No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)