Professional Documents

Culture Documents

HW 4

Uploaded by

urbuddy542Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW 4

Uploaded by

urbuddy542Copyright:

Available Formats

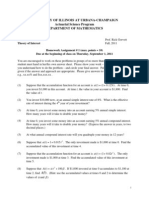

UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN Actuarial Science Program DEPARTMENT OF MATHEMATICS

Math 210 Theory of Interest Prof. Rick Gorvett Fall, 2011

Homework Assignment # 4 (max. points = 10) Due at the beginning of class on Thursday, October 6, 2011 You are encouraged to work on these problems in groups of no more than 3 or 4. However, each student must hand in her/his own answer sheet. Please show your work enough to show that you understand how to do the problem and circle your final answer. Full credit can only be given if the answer and approach are appropriate. Please give answers to two decimal places e.g., xx.xx% and $xx,xxx.xx . Note: Homework assignments are due at the beginning of the class. If you arrive at the class after it has started, you must hand in your assignment upon entering the classroom. Assignments will not be accepted at the end of the class period.

Problems (1) through (4) involve determining the interest rates which underlie the annuity calculations. You must use a calculator (or Excel, if youd like) to determine these values.

1) A 30-year $1,000-annual-payment annuity-immediate has a present value of $12,000. Find the effective annual interest rate underlying this present value. 2) A 20-year $5,000-annual-payment annuity-immediate has an accumulated vale (immediately after the final payment at time 20) of $166,000. Find the effective annual interest rate underlying this accumulated value. 3) A 25-year $750-quarterly-payment annuity-immediate has a present value of $27,500. Find the effective quarterly interest rate underlying this present value, and use it to determine the equivalent effective annual interest rate. 4) A 30-year $200-monthly-payment annuity-immediate has an accumulated vale (immediately after the final payment at time 30) of $366,000. Find the effective monthly interest rate underlying this accumulated value, and use it to determine the equivalent nominal interest rate convertible monthly.

5) You want to accumulate $1,000,000 over the next 30 years. You intend to do this by making deposits of X into an investment account at the end of each quarter, for 30 years. The account earns i (12 ) = 12%. Find X.

1

6) A 30-year annuity-immediate pays $20,000 every third year (for a total of 10 payments). If i ( 4) = 9%, what is the present value of this annuity three years prior to the first payment? 7) A perpetuity will make annual payments of $3,000, with the first payment occurring 18 months from now. The interest rate is i ( 2) = 10%. Find the present value, now, of this annuity. 8) Thirty years from now, you want to be able to purchase a perpetuity-immediate which will pay you $80,000 at the end of each year. In order to make this purchase, you deposit money into an account continuously, at the rate of X per annum, for 30 years. Suppose that the effective annual interest rate is a constant 8.5%. Find the annual deposit rate, X, necessary to achieve this purchase. 9) Same problem as (8) above, except that the interest rate, instead of being i = 8.5%, is actually i (12 ) = 8.5%. Find the annual deposit rate, X, necessary to achieve your goal. 10) Abby offers to pay you at the rate of $10,000 per annum, continuously, for the next 10 years. Ben offers to pay you X at the end of each of the next 10 years. The force of interest applying to both offers is 12%. Find the value of X such that you are indifferent between these two offers.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- University of Illinois at Urbana-Champaign Actuarial Science Program Department of MathematicsDocument2 pagesUniversity of Illinois at Urbana-Champaign Actuarial Science Program Department of Mathematicsurbuddy542No ratings yet

- HW 6Document2 pagesHW 6urbuddy542No ratings yet

- HW 2Document2 pagesHW 2urbuddy542No ratings yet

- HW 1Document2 pagesHW 1urbuddy542No ratings yet

- Econ303 hw1 Spring13 PDFDocument9 pagesEcon303 hw1 Spring13 PDFurbuddy542No ratings yet

- Modernism: Muyuan Zhang, Jamey Stolbom, Maisy PorterDocument7 pagesModernism: Muyuan Zhang, Jamey Stolbom, Maisy Porterurbuddy542No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)