Professional Documents

Culture Documents

Financial Management MB0045

Uploaded by

Tushar AhujaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management MB0045

Uploaded by

Tushar AhujaCopyright:

Available Formats

Master of Business Administration - MBA Semester 2 MB0045 Financial Management ASSIGNMENT- Set I

Question1. What are the goals of financial management? Answer- Financial management means maximization of economic welfare of its shareholders. Shareholder`s wealth maximization is reflected in the market value of the firm`s shares. The goal of financial management is attained when it maximizes the market value of shares. There are two versions of the goals of financial management of the firm: 1. Profit maximization 2. Wealth maximization Profit maximization- profit maximization is based on the cardinal rule of efficiency. Its goal is to maximize the return with the best output and price levels. Profit maximization is the traditional and narrow approach, which aims at maximizing the profit of the concern. Allocation of resources and investor`s perception of the company`s performance can be traced to the goal of profit maximization. The concept of profit lacks clarity. What does profit mean? Is it profit after tax or before tax? Is it operating profit or net profit available to shareholders? In this sense, profit is neither defined precisely nor correctly. It creates unnecessary conflicts regarding the earning habits of the business concern. Differences in interpretation of the concept of profits thus expose the weakness of profit maximization. Profit maximization neither considers the time value of money nor the net present value of the cash inflow. It does not differentiate between profits of current year with the profits to be earned in later years.The concept of profit maximization apprehends to be either accounting profit or economic normal profit or economic supernormal profit. Wealth maximization-The term wealth means shareholder`s wealth of the persons those who are involved in the business concern, also known as value maximization or net present worth maximization. Wealth maximization is possible only when the company pursues policies that would increase the market value of shares of the company. Argument is in support of the superiority of wealth maximization over profit maximization; wealth maximization is based on the concept of cash flows. Cash flows are a reality and not based on any subjective interpretation. Time value factor is known as the time preference maximization rate; that is, the sum of risk free rate and risk premium.We can conclude that maximization of wealth is probably the more appropriate goal of

financial management in today`s context. It is important to understand that profit maximization as a goal, in a way, leads to wealth maximization.

Question 2. Calculate the PV of an annuity of Rs. 500 received annually for four years when discounting factor is 10%. AnswerComputation of PV of Annuity End of year cash inflows PV factor PV in Rs. 1 Rs.500 0.909 454.5 2 RS.500 0.827 413.5 3 Rs.500 0.751 375.5 4 Rs.500 0.683 341.5 3.170 1585.0 Present value of an annuity is Rs. 1585. Calculation: PV= 500*PVIFA(10%,4y) =500*3.170 =RS.1585 The present value of annuity is Rs. 1585.

Question 3. Suraj Metals are expected to declare a dividend of Rs. 5 per share and the growth rate in dividends is expected to grow @ 10% P.a. The price of one share is currently at Rs. 110 in the market. What is the cost of equity capital to the company? Answer- Calculation of cost of equity capital : Ke = (D1/Pe) +g = (5/110) +0.10 = 0.1454 or 14.54% Cost of equity capital is 14.54% Question4. What are the assumptions of MM approach? Answer- Following the basic assumptions of the MM approach: Perfect capital markets Securities can be freely traded, that is, investors are free to buy and sell securities (both shares and debt instruments), no hindrances on the borrowings, no presence of transaction costs, securities are infinitely divisible, and availability of all required information at all times. Investors behave rationally They choose the combination of risk and return which is most advantageous to them. Homogeneity of investors risk perception All investors have the same perception of business risk and returns. Taxes There is no corporate or personal income tax.

Dividend payout is 100% The firms do not retain earnings for future activities. Question5. An investment will have an initial outlay of Rs 100,000. It is expected to generate cash inflows. Table highlights the cash inflow for four years. Table : cash inflow Year Cash inflow 1 40000 2 50000 3 15000 4 30000 If the risk free rate and the risk premium is 10%, a) compute the NPV using the risk free rate b) Compute NPV using risk-adjusted discount rate. Answer- a) NPV can be computed using risk free rate. Calculation of NPV risk free rate Table: PV Using Risk Free Rate Year 1 2 3 4 Cash flows(inflows) PV factor at 40000 50000 15000 30000 PV of cash inflows PV of cash outflows NPV 0.909 0.826 0.751 0.683 1, 09,415 (1, 00,000) 9,415 PV of cash flows (inflows) 36,360 41,300 11,265 20,490

B) NPV can be computed using risk-adjusted discount. Table: NPV Using Risk-adjusted Discount Rate Year 1 2 3 4 cash inflows Rs. sPV factor at 20% 40000 50000 15000 30000 0.833 0.694 0.579 0.482 PV of cash inflows 33,320 34,700 8,685 14,460

PV of cash inflows PV of cash outflows NPV

91,165 (100,000) (8,835)

The project would be accepted when no allowance is made for risk. However, it will not be acceptable if risk premium is added to the risk free rate. By doing so, it moves from positive NPV to negative NPV. If the firm were to use the internal rate of return (IRR), then the project would be accepted, when IRR is greater than the risk-adjusted discount rate. Question6. What are the features of optimum credit policy? Answer- Optimum credit policy is one which would maximise the value of the firm. Value of a firm is maximised when the incremental rate of return on an investment is equal to the incremental cost of funds used to finance the investment. Therefore, credit policy of a firm can be regarded as: Trade-off between higher profits from increased sales and The incremental cost of having large investment in receivables The credit policy to be adopted by a firm is influenced by the strategies pursued by its competitors. If competitors are granting 15 days credit and if the firm decides to extend the credit period to 30 days, the firm will be flooded with customers demand for companys products. To summarise, in order to achieve the goal of maximising the value of the firm the evaluation of investment in receivables accounts should involve the following four steps: 1. Estimation of incremental operating profit. 2. Estimation of incremental investment in accounts receivables. 3. Estimation of the incremental rate of return of investment. 4. Comparison of incremental rate of return with the required rate of return In reality, it is rather a different task to establish an optimum credit policy as the best combination of variables of credit policy is quite difficult to obtain. The important variables of credit policy should be identified before establishing an optimum credit policy and then they should be evaluated.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- EcDocument2 pagesEcArgie FlorendoNo ratings yet

- Use The Figure Below To Answer The Following QuestionsDocument5 pagesUse The Figure Below To Answer The Following QuestionsSlock TruNo ratings yet

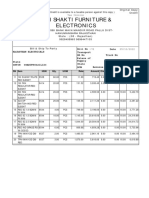

- Shri Shakti Furniture & Electronics: Credit OrginalDocument1 pageShri Shakti Furniture & Electronics: Credit OrginalRahul BansalNo ratings yet

- Srilanka GemstoneDocument148 pagesSrilanka GemstoneJaganathan ChokkalingamNo ratings yet

- Honda Case StudyDocument11 pagesHonda Case StudySarjodh SinghNo ratings yet

- SSUSH 17: The Student Will Analyze The Causes and Consequences of The Great DepressionDocument18 pagesSSUSH 17: The Student Will Analyze The Causes and Consequences of The Great DepressionDewanshu GuptaNo ratings yet

- Labeling, Handling and Collection of Healthcare WasteDocument28 pagesLabeling, Handling and Collection of Healthcare WasteKanze AhiuNo ratings yet

- (Deloitte) Entrance Test & AnswerDocument36 pages(Deloitte) Entrance Test & AnswerLê Quang Trung75% (4)

- French Interiors AzraDocument7 pagesFrench Interiors Azraherra husainNo ratings yet

- Engineering Economy Chapter # 02Document55 pagesEngineering Economy Chapter # 02imran_chaudhryNo ratings yet

- Fundamental Analysis of InfosysDocument4 pagesFundamental Analysis of Infosyspuneet98888100% (1)

- Effect of Nigerian Border ClosureDocument5 pagesEffect of Nigerian Border Closuretundescribd1No ratings yet

- Contract & Accounts (CE6G) - TenderDocument24 pagesContract & Accounts (CE6G) - TenderRamaiz DarNo ratings yet

- KSB Pumps - Key Officials With ContactsDocument3 pagesKSB Pumps - Key Officials With ContactsCatherine JovitaNo ratings yet

- Overview of HR Shared ServicesDocument21 pagesOverview of HR Shared ServicesAyman ShetaNo ratings yet

- Shell International MarketingDocument37 pagesShell International MarketingParin Shah0% (1)

- Acct Statement - XX6440 - 28032023Document16 pagesAcct Statement - XX6440 - 28032023Maran PrabakaranNo ratings yet

- Holiday Lighting Story With GraphicDocument2 pagesHoliday Lighting Story With GraphickourtneygeersNo ratings yet

- Ntse Social Science - The Age of IndustrialisationDocument7 pagesNtse Social Science - The Age of IndustrialisationMohitNo ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- Annual Report 2017Document158 pagesAnnual Report 2017speedenquiryNo ratings yet

- There Were No Winners in This Govt Shutdown.Document4 pagesThere Were No Winners in This Govt Shutdown.My Brightest Star Park JisungNo ratings yet

- UnescoDocument124 pagesUnescoo8o0o_o0o8o2533No ratings yet

- 0040 Jugal BakersDocument3 pages0040 Jugal BakersVarghese PDNo ratings yet

- CBSE Class 3 GK Practice WorksheetDocument2 pagesCBSE Class 3 GK Practice Worksheetpinky basak100% (4)

- Kilo Meter Sheet - 01-02-23 TO 15-2-23Document6 pagesKilo Meter Sheet - 01-02-23 TO 15-2-23Vijay chauhanNo ratings yet

- SITXWHS001 - Participate in Safe Work Practices Student Assessment GuideDocument34 pagesSITXWHS001 - Participate in Safe Work Practices Student Assessment GuideKAROL ESTEFANIA GARCIANo ratings yet

- Discurs LeninDocument2 pagesDiscurs LeninGeanina IchimNo ratings yet

- Country Profile Official Name in Other Official LanguagesDocument53 pagesCountry Profile Official Name in Other Official LanguagesMarnelli MabiniNo ratings yet

- Power of The Commissioner To Interpret Tax Laws and To Decide Tax CasesDocument3 pagesPower of The Commissioner To Interpret Tax Laws and To Decide Tax CasesLovelyNo ratings yet