Professional Documents

Culture Documents

Nenshi's 2014 Budget Memo To Council

Uploaded by

jmarkusoffOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nenshi's 2014 Budget Memo To Council

Uploaded by

jmarkusoffCopyright:

Available Formats

Memorandum

TO: CC: FROM: DATE:

Council Colleagues Administrative Leadership Team Naheed K. Nenshi 24 November 2013

Budget 2014 deliberations

This week, we will be discussing the 2014 budget, starting with Administrations proposal. This brief note highlights the process we will be following, as well as my thoughts on the key decisions before us. I have also been contacted by a couple of you on amendments you would like to propose, and I have incorporated them here.

PROCESS We will start at 9:30 AM on Monday with a presentation from Administration and questions on the presentation. We will then have public submissions, which will be like a public hearing: five minutes each followed by questions from Council. I have not heard a lot of buzz around these submissions, and I dont think there will be very many this year. We will then have some housekeeping motions, including one to change the time of recess so that we go from 9:30 am to 6 pm every day, which is my recommendation. We will then move to table 4.1 and 4.2 to the right positions in the agenda and I will ask Coun. Farrell as Vice-Chair of PFC to move the recommendations in 5.1. We will then go through each of the departments in the order in the binder, starting with Community Services and Protective Services. Each GM will present their adjustments and youll have the chance to ask questions of them or of the Directors. You may also propose amendments to any of the departments at this time. Once we have completed all departments, I will ask for amendments that impact across departments, including any relating to the $52 million tax room. Once we have dealt with all amendments, we will return to a vote on 5.1, which is essentially a vote on the budget as a whole. Should this not pass, bad things happen. I will recommend that we simply keep going until there is a budget that a majority can agree upon. And I will go first to those who voted against to look for proposals that they could support. Once we have a budget, we pass a number of other motions to put it into place. The tax rate is not finalized, however, until Tax Rate Finalization day, which happens in the spring. So if, for example, new labour contracts are finalized, there may be changes to the

733 Coral Springs Blvd NE Calgary, Alberta T3J 3T4 Canada +1 (403) 830-8232 naheed@post.harvard.edu

rate at that time. Thats typically also when we discuss the tax room, if any, as the provincial budget is done by that time.

BACKGROUND We are being asked to approve both the Capital and the Operating budget. The Capital budget, with the exception of pay-as-you-go capital, is funded from grants and reserves. Adjustments to the capital budget have no impact on the property tax rate. On the Operating budget, you will see that there are both one-time and base adjustments. One-time adjustments are typically funded from reserves. Changes to these also have no impact on the property tax rate. Only changes to base funding change the property tax rate.

ADJUSTMENTS Ive gone through all of the proposed adjustments, and I am not opposed to any of them up front, though I have a number of questions that I will be asking about a number of them. The adjustments are by and large rather small numbers, and very few of them impact the base budget (and therefore the property tax rate). I understand that one Councillor has some questions on item 4.2, and will have an amendment asking for a report back to Council in January. I think this is fine. However, despite the fact that I think the adjustments are fine, I feel that 6.1% is much too high. I think an absolute maximum should be growth plus MPI, which is 5.7%. This is a difference of about $5 million. So, I suggest the following motion: BE IT RESOLVED THAT Council direct administration to bring the tax rate increase down to 5.7%, cuts to be subject to the approval of the City Manager. Now, I would also be interested in bringing the rate down further, if this is Councils will. I understand that a Councillor will be bringing a motion to freeze management exempt-level salaries for 2014. I favour this, but will also point out that, to be logically consistent, we should freeze Council salaries as well. I dont know what the impact of this would be on the property tax rate, but I expect it would actually be quite small - certainly far less than one point. I would also favour broad-based cut at the end of the process. If you are interested in such a cut, I would suggest a motion such as: BE IT RESOLVED THAT Council direct administration to bring the tax rate increase down to 4.9%, cuts to be subject to the approval of the City Manager. 2

I would NOT use this technique to go down much below this amount, which is about $14 million below the 6.1%. If your desire is to see a lower rate, then I think Council has to be accountable for the resulting cuts. If you want to go lower than about one point, then I would suggest a motion that either outlines the specific cuts you would like to see, or ask Administration to come back with those cuts for Council approval.

THE FAMOUS $52 MILLION

For 2014

Administrations recommendation is to use the 2014 $52 million for as-yet-unspecified flood mitigation work. I believe that this is not the best use for these funds in 2014. When we have a better sense of what mitigation efforts are needed, we will appeal to the province and the federal government for these funds. If we need to cover a shortfall (and we will), I believe that would be a good use for FSR funds. However, I believe that funds are still needed for flood recovery work in this year. You will see that there is a recommendation for a 4% increase in drainage fees. This may not seem like much, but it is on top of very large increases we have already assessed in water and wastewater to get a handle on the utilitys debt. The present value of this fee increase, as near as I can tell, is about $70 million. I believe it is dishonest to tell citizens on the one hand, were giving you back the $52 million and, on the other, Were raising your fees by $70 million. The fact is that there are costs to the flood that will not be covered by other sources and we need to determine how best to cover them. I would not like to use the FSR exclusively for this purpose, as I am certain that some of these funds will be needed for supplementary mitigation work. So, I propose that we REJECT the drainage fee increase and give the 2014 tax room to the utility for flood recovery work. Should they require more than $52 million, they can make application to Council for a one-time transfer from the FSR.

For future years

I know there are many different and strongly-held opinions on this matter. I will remind Council, however, that returning the $52 million to taxpayers means a one-time decline in the tax increase for 2015 only, but would remove a permanent source of revenue and funding for the City. Some have suggested that we give back the $52 million for 2014 only. This is not possible. If it is removed from the base, it is removed forever. A couple of Councillors will be moving to create a ten-year plan for transit, specifically the Green Line. Given the financial constraints on the provincial government post-flood, I suspect we will not see a new commitment to transit (including the promised but unannounced GreenTrip funds) until 2016 or 2017 at the earliest. I believe that the people in SE and NC Calgary deserve better transit sooner than that, and I favour this use of the funds. 3

You might also like

- HANSSON PRIVATE LABEL Income Statement and Financial Analysis 2003-2007Document13 pagesHANSSON PRIVATE LABEL Income Statement and Financial Analysis 2003-2007rohan pankar67% (3)

- Finance Chapter 9 Questions and SolutionsDocument28 pagesFinance Chapter 9 Questions and SolutionsAliAltaf67% (3)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDocument8 pagesInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsMarta RodriguesNo ratings yet

- Chap 11 Promissory NotesDocument21 pagesChap 11 Promissory NotesDarwinNo ratings yet

- 03 03 Technical Interview Basic PDFDocument9 pages03 03 Technical Interview Basic PDFAgung Racers WeightliftingNo ratings yet

- Case 40 Primus Automation Division 2002 Leasing Opsi 4Document39 pagesCase 40 Primus Automation Division 2002 Leasing Opsi 4rizkal rizaldiNo ratings yet

- CAPE Economics 2015 U2 P1 PDFDocument9 pagesCAPE Economics 2015 U2 P1 PDFamrit100% (1)

- Spa For Loan With Mortgage - HDMF - Special Power of AttorneyDocument3 pagesSpa For Loan With Mortgage - HDMF - Special Power of AttorneyAnonymous iBVKp5Yl9A100% (10)

- 2012 Downtown Traffic Flow MapDocument1 page2012 Downtown Traffic Flow MapjmarkusoffNo ratings yet

- Fundamentals of SFP ElementsDocument33 pagesFundamentals of SFP ElementsAbyel Nebur100% (2)

- Hybrid Script 8-8-23Document17 pagesHybrid Script 8-8-23Andrés FlórezNo ratings yet

- Town of Holden Beach: "Unofficial" Minutes & CommentsDocument11 pagesTown of Holden Beach: "Unofficial" Minutes & Commentscutty54No ratings yet

- Lanier Response To ContractDocument1 pageLanier Response To ContractFOX 5 NewsNo ratings yet

- Capitol Update 1 - 2014Document1 pageCapitol Update 1 - 2014Terri BonoffNo ratings yet

- text-675FE683D730-1Document1 pagetext-675FE683D730-1Matt BroadwayNo ratings yet

- BU 12 Tentative MOU Legislative Transmittal PackageDocument7 pagesBU 12 Tentative MOU Legislative Transmittal PackageJon OrtizNo ratings yet

- 2013 Wrap UpDocument4 pages2013 Wrap UpTerri BonoffNo ratings yet

- Capitol Update 11Document2 pagesCapitol Update 11Terri BonoffNo ratings yet

- HON2Document9 pagesHON2Political AlertNo ratings yet

- Departments of Transportation, Treas-Ury, The Judiciary, Housing and Urban Development, and Related Agencies Appropriations For Fiscal YEAR 2006Document86 pagesDepartments of Transportation, Treas-Ury, The Judiciary, Housing and Urban Development, and Related Agencies Appropriations For Fiscal YEAR 2006Scribd Government DocsNo ratings yet

- Capitol Update 13 - 2013Document5 pagesCapitol Update 13 - 2013Terri BonoffNo ratings yet

- Complete PMR Guide TipsDocument2 pagesComplete PMR Guide TipsPatricio Alejandro Vargas FuenzalidaNo ratings yet

- REVISED Retreat Follow Up Memo - 3.8.18finalDocument34 pagesREVISED Retreat Follow Up Memo - 3.8.18finalKOLD News 13100% (1)

- Capitol Update 6Document1 pageCapitol Update 6Terri BonoffNo ratings yet

- Senate Hearing, 110TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2008Document45 pagesSenate Hearing, 110TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2008Scribd Government DocsNo ratings yet

- Report 2 PDFDocument5 pagesReport 2 PDFRecordTrac - City of OaklandNo ratings yet

- A Bipartisan Path Forward To Securing America's Future: Questions and AnswersDocument5 pagesA Bipartisan Path Forward To Securing America's Future: Questions and AnswersPeggy W SatterfieldNo ratings yet

- Capitol Update 15Document4 pagesCapitol Update 15Terri BonoffNo ratings yet

- This Old FormDocument13 pagesThis Old Formekuhni2012No ratings yet

- House Hearing, 114TH Congress - Committee Resolution Amending The Committee's Regulations and For Other PurposesDocument28 pagesHouse Hearing, 114TH Congress - Committee Resolution Amending The Committee's Regulations and For Other PurposesScribd Government DocsNo ratings yet

- Budget Deficit ThesisDocument5 pagesBudget Deficit ThesisErica Thompson100% (1)

- From The Desk of The Mayor March 2013: Fleischmanns 2013-2014 Village BudgetDocument2 pagesFrom The Desk of The Mayor March 2013: Fleischmanns 2013-2014 Village BudgetFleischmannsNYNo ratings yet

- 2018 California Propositions GuideDocument7 pages2018 California Propositions GuideAnonymous RVJyVUqNo ratings yet

- Northville Transit ManagementDocument8 pagesNorthville Transit Managementruth_tupeNo ratings yet

- Pennertestimony 9212011Document10 pagesPennertestimony 9212011Committee For a Responsible Federal BudgetNo ratings yet

- New Job Effects of Eliminating The Automatic Spending Reductions CBODocument3 pagesNew Job Effects of Eliminating The Automatic Spending Reductions CBOPatricia DillonNo ratings yet

- Understanding The Budget Proposal 2019Document6 pagesUnderstanding The Budget Proposal 2019Rainwalker Tatterheart100% (1)

- Don't Forget The Final Salary Process Is A Little Longer. Needs A UK FCA Report.Document4 pagesDon't Forget The Final Salary Process Is A Little Longer. Needs A UK FCA Report.Michael McmullenNo ratings yet

- My 7 Point Proposal For The First 12 MonthsDocument8 pagesMy 7 Point Proposal For The First 12 Monthstrc100% (1)

- Testimony Stenholm HBCMarch 2006Document10 pagesTestimony Stenholm HBCMarch 2006Committee For a Responsible Federal BudgetNo ratings yet

- Glen Grell: Fall 2008 ReportDocument4 pagesGlen Grell: Fall 2008 ReportPAHouseGOPNo ratings yet

- Community Bulletin - April 2013Document9 pagesCommunity Bulletin - April 2013State Senator Liz KruegerNo ratings yet

- GovAcc - Essay QuestionDocument5 pagesGovAcc - Essay QuestionJosephine DayonNo ratings yet

- Dupage County Budget Update For Choose Dupage - With Edits 09-18-13Document3 pagesDupage County Budget Update For Choose Dupage - With Edits 09-18-13api-298116588No ratings yet

- Show Me The Numbers!Document1 pageShow Me The Numbers!Valerie DaleNo ratings yet

- Budget Update July 142006Document7 pagesBudget Update July 142006Committee For a Responsible Federal BudgetNo ratings yet

- Speaking Notes (Red Deer) - 2015-04-15Document15 pagesSpeaking Notes (Red Deer) - 2015-04-15William AndersonNo ratings yet

- Island Transit Exec Director Martha Rose Letter To Island Transit Board MembersDocument3 pagesIsland Transit Exec Director Martha Rose Letter To Island Transit Board MembersGrowlerJoeNo ratings yet

- HCG Connection April 2013Document10 pagesHCG Connection April 2013lrbrennanNo ratings yet

- Report 2Document5 pagesReport 2RecordTrac - City of OaklandNo ratings yet

- Repairing Your Finances: Finding Your Way To Better Money ManagementFrom EverandRepairing Your Finances: Finding Your Way To Better Money ManagementNo ratings yet

- B P S R: Udget Rocess Urvey EsultsDocument9 pagesB P S R: Udget Rocess Urvey Esultsloyan3141No ratings yet

- Business Plan Guidelines Part 2Document12 pagesBusiness Plan Guidelines Part 2oxade21100% (1)

- Updated To Kmpdu Doctors May 2013Document4 pagesUpdated To Kmpdu Doctors May 2013api-221773049No ratings yet

- 2007 - 01 - 05 - ColumnDocument2 pages2007 - 01 - 05 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Audio File: Confusion - Clouds - New - Sops - Mp3Document5 pagesAudio File: Confusion - Clouds - New - Sops - Mp3No OneNo ratings yet

- Budget Reform BillDocument3 pagesBudget Reform BillMark Joseph BajaNo ratings yet

- Capitol Update 2Document2 pagesCapitol Update 2Terri BonoffNo ratings yet

- News Articles 19Document32 pagesNews Articles 19alan_mockNo ratings yet

- LEAKED: CBC Internal Employee Q&ADocument4 pagesLEAKED: CBC Internal Employee Q&ACANADALANDNo ratings yet

- Capitol Update 7Document2 pagesCapitol Update 7Terri BonoffNo ratings yet

- Community Bulletin - April 2014Document11 pagesCommunity Bulletin - April 2014State Senator Liz KruegerNo ratings yet

- Response To House Letter To CRCDocument5 pagesResponse To House Letter To CRCMarilynMarksNo ratings yet

- Testimony Before NYS Legislative Fiscal CommitteeDocument3 pagesTestimony Before NYS Legislative Fiscal CommitteemaryrozakNo ratings yet

- The Renaissance Review: Yes We Did!!!!Document9 pagesThe Renaissance Review: Yes We Did!!!!Cathy LeeNo ratings yet

- HCG Connection December 2012Document12 pagesHCG Connection December 2012lrbrennanNo ratings yet

- To: From: CC: Date: ReDocument11 pagesTo: From: CC: Date: ReBrad TabkeNo ratings yet

- BiennialBudgetPresentation Monday121613Document12 pagesBiennialBudgetPresentation Monday121613normanomtNo ratings yet

- PBS23 SpeakersDocument10 pagesPBS23 SpeakersRobin SharmaNo ratings yet

- Jim Prentice's Letter To Naheed Nenshi During PC Leadership RaceDocument2 pagesJim Prentice's Letter To Naheed Nenshi During PC Leadership RacejmarkusoffNo ratings yet

- Centre City Cycle Track NetworkDocument11 pagesCentre City Cycle Track NetworkjmarkusoffNo ratings yet

- "Just The Facts" About Being A World Class "Comfort Capital"Document2 pages"Just The Facts" About Being A World Class "Comfort Capital"jmarkusoffNo ratings yet

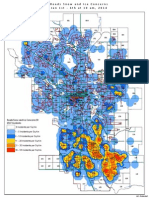

- Snow Complaints, by Frequency and RegionDocument1 pageSnow Complaints, by Frequency and RegionjmarkusoffNo ratings yet

- Bike Lane CostsDocument1 pageBike Lane CostsjmarkusoffNo ratings yet

- Snow Complaints, by Frequency and RegionDocument1 pageSnow Complaints, by Frequency and RegionjmarkusoffNo ratings yet

- CDLC Support LetterDocument1 pageCDLC Support LetterjmarkusoffNo ratings yet

- Calgary: New Central Library Master ProgramDocument61 pagesCalgary: New Central Library Master ProgramjmarkusoffNo ratings yet

- Peak ToiletDocument1 pagePeak ToiletjmarkusoffNo ratings yet

- 2014 Budget MemoDocument3 pages2014 Budget MemocalcitydeskNo ratings yet

- Non-Union Staff Pay: Report To Administrative Leadership Team and Minutes, Nov 13, 2012Document9 pagesNon-Union Staff Pay: Report To Administrative Leadership Team and Minutes, Nov 13, 2012jmarkusoffNo ratings yet

- West LRT AuditDocument23 pagesWest LRT AuditjmarkusoffNo ratings yet

- PGIB Ward 9 Re-Edit TestDocument4 pagesPGIB Ward 9 Re-Edit TestjmarkusoffNo ratings yet

- Cost-Benefit Analysis, Calgary Transit CorridorsDocument10 pagesCost-Benefit Analysis, Calgary Transit CorridorsjmarkusoffNo ratings yet

- 121CTC FinalSketchRenders WithPhotos Oct4, 2012Document20 pages121CTC FinalSketchRenders WithPhotos Oct4, 2012jmarkusoffNo ratings yet

- General Manager Pay: Report To Priorities and Finance Committee, Dec. 18, 2012Document3 pagesGeneral Manager Pay: Report To Priorities and Finance Committee, Dec. 18, 2012jmarkusoffNo ratings yet

- CalendarDocument28 pagesCalendarjmarkusoffNo ratings yet

- Cities - Angus Reid Poll, Jul 13Document9 pagesCities - Angus Reid Poll, Jul 13jmarkusoffNo ratings yet

- Ward 13 BudgetDocument1 pageWard 13 BudgetjmarkusoffNo ratings yet

- Edmonton MPI 2012Document17 pagesEdmonton MPI 2012jmarkusoffNo ratings yet

- Tunnel UpdateDocument2 pagesTunnel UpdatejmarkusoffNo ratings yet

- Swerve Oct 12Document1 pageSwerve Oct 12jmarkusoffNo ratings yet

- Waterloo MP 2013Document59 pagesWaterloo MP 2013jmarkusoffNo ratings yet

- City Transit Summary MapDocument1 pageCity Transit Summary MapjmarkusoffNo ratings yet

- City Transit SummaryDocument2 pagesCity Transit SummaryjmarkusoffNo ratings yet

- City 1Document2 pagesCity 1jmarkusoffNo ratings yet

- Tunnel ContractDocument126 pagesTunnel ContractjmarkusoffNo ratings yet

- West LRTupdateDocument6 pagesWest LRTupdatejmarkusoffNo ratings yet

- SELF-BALANCING LEDGERS & SECTIONAL BALANCINGDocument11 pagesSELF-BALANCING LEDGERS & SECTIONAL BALANCINGImran KhanNo ratings yet

- Why Creativity and Innovation Is Important To MalaysiaDocument14 pagesWhy Creativity and Innovation Is Important To MalaysiaDr Bugs Tan100% (1)

- t8. Money Growth and InflationDocument53 pagest8. Money Growth and Inflationmimi96No ratings yet

- Short-Term Financial Planning GuideDocument23 pagesShort-Term Financial Planning GuideRao786No ratings yet

- Questions For Advanced AccountingDocument3 pagesQuestions For Advanced AccountingHelena ThomasNo ratings yet

- 1Document3 pages1PerdanaMenteriNo ratings yet

- Galan Associates Financial Statement AnalysisDocument5 pagesGalan Associates Financial Statement AnalysisrickNo ratings yet

- Journal of Macroeconomics: Huixin Bi, Wenyi Shen, Shu-Chun S. YangDocument12 pagesJournal of Macroeconomics: Huixin Bi, Wenyi Shen, Shu-Chun S. YangRamona DincaNo ratings yet

- Credit 5Document7 pagesCredit 5Maria SyNo ratings yet

- Class XII Commerce (1) GGBDocument10 pagesClass XII Commerce (1) GGBAditya KocharNo ratings yet

- The Concepts of Macro EconomicsDocument5 pagesThe Concepts of Macro EconomicsRahulNo ratings yet

- Bar ChartDocument19 pagesBar ChartsrivathsalNo ratings yet

- A: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?Document47 pagesA: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?juan planas rivarolaNo ratings yet

- An Introduction To Money: MacroeconomicsDocument3 pagesAn Introduction To Money: Macroeconomicsameen17aNo ratings yet

- 02 Altprob 8eDocument8 pages02 Altprob 8emihNo ratings yet

- Pecking Order TheoryDocument2 pagesPecking Order TheoryBijoy SalahuddinNo ratings yet

- Chapter 10 QuestionsDocument2 pagesChapter 10 QuestionsFreeBooksandMaterialNo ratings yet

- Problems on issue and redemption of debenturesDocument2 pagesProblems on issue and redemption of debenturesSiva SankariNo ratings yet

- FIN 3331 Managerial Finance: Time Value of MoneyDocument23 pagesFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenNo ratings yet

- Raghuram Rajan On World EconomyDocument2 pagesRaghuram Rajan On World EconomyAbhinav RajNo ratings yet

- Macroeconomics 8eDocument12 pagesMacroeconomics 8eAntonietteParris0% (1)

- U.S. International Transactions with Mexico by Current Account Components 2003-2004Document9 pagesU.S. International Transactions with Mexico by Current Account Components 2003-2004Tareq Tareq TareqNo ratings yet