Professional Documents

Culture Documents

China Plan Sale From Stockpile

Uploaded by

cottontradeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China Plan Sale From Stockpile

Uploaded by

cottontradeCopyright:

Available Formats

(An ISO 9001: 2008 & AQSIQ Certified Agency)

Date : 27/11/2013

China Plans Sale From Cotton Stockpile

NEW YORKThe Chinese government is planning to sell part of its roughly 10 million-ton stockpile of cotton this week, an event long anticipated by traders of the fiber. But while the prospect of a sale from such a large holding would usually push down international cotton prices, concern over the quality and price of the fiber China is offering is expected to mute the effect somewhat. News of the sale came as some traders worried over a late-autumn storm that hit growing regions in the southern part of the U.S., the world's biggest cotton exporter. The government plans to sell the cotton via auction starting on Thursday with a minimum price of 18,000 Yuan a ton, equal to about $1.34 a pound, according to a notice posted on the website of the China National Cotton Information Center, a government-run cottonindustry body. Previous cotton sales have had only limited success. The China National Cotton Reserves Corp. held daily auctions from January through July this year, but mills bought just 25% of the cotton offered because of the high prices the corporation wanted, traders said. Thursday's auction price is about 70% higher than U.S. cotton futures, a market benchmark. Cotton for delivery in March on the ICE Futures U.S. exchange ended at a more-than-one-month high of 79.14 cents a pound. In addition, China National Cotton Reserves will first offer cotton from the 2011 crop, raising concerns about the quality. Older cotton can grow brittle in storage, making it more difficult to spin into yarn and dye. Neither China National Cotton Reserves nor the China National Cotton Information Center was immediately available for comment. "I don't think [the auction is] a game changer" because of the quality concerns, said Gary Raines, an economist at brokerage INTL FCStone. "You could have a Ferrari in the driveway [and] you can come back in 15 years to drive it, but don't expect it to be the same Ferrari." Traders and analysts said they had been expecting China to release some of its reserves before the end of the year, a prospect that sent cotton prices to a more-than-nine-month low in early November. China's reserves total about 10.3 million metric tons, according to the

International Cotton Advisory Committee, a Washington-based group that advises cottongrowing countries. The reserve is equal to about 40% of global production last year. Cotton traders and analysts largely shrugged off China's announcement The focus is on the U.S. weather," said Kona Haque, head of agricultural commodities research at Macquarie Bank. A large storm passed through the eastern U.S. on Tuesday after dumping snow on growing areas in Texas, the country's top cotton-producing state. "There are some concerns how much quality will be impacted from the ongoing wet weather," said Sharon Johnson, a senior cotton specialist at KCG Futures. "Yields could suffer as well, depending on the extent and length of adverse conditions."

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- PT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedDocument3 pagesPT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedcottontradeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

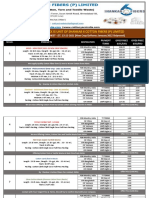

- 16 11 2021 Yarn Export Price OfferDocument1 page16 11 2021 Yarn Export Price OffercottontradeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 12-11-2021-Todays Export Price OfferDocument3 pages12-11-2021-Todays Export Price OffercottontradeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- PT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedDocument3 pagesPT Global Spintex Is Unit of Shankar 6 Cotton Fibers (P) LimitedcottontradeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Tanzania Mortgage Market Update 2014Document7 pagesTanzania Mortgage Market Update 2014Anonymous FnM14a0No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

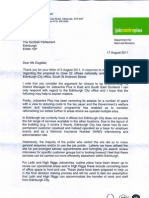

- Job Centre PlusDocument4 pagesJob Centre PlusKezia Dugdale MSPNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 0 Wage TheoriesDocument13 pages0 Wage Theoriessatyam.pmir6789No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ethiopia Profile Enhanced Final 7th October 2021Document6 pagesEthiopia Profile Enhanced Final 7th October 2021sarra TPINo ratings yet

- SWOT AnalysisDocument12 pagesSWOT AnalysisSam LaiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Folder Gründen in Wien Englisch Web 6-10-17Document6 pagesFolder Gründen in Wien Englisch Web 6-10-17rodicabaltaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Application Form For GKM-EAPDocument1 pageApplication Form For GKM-EAPCamille CasugaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Your Electricity Bill For: Sayan Ghosh MondalDocument2 pagesYour Electricity Bill For: Sayan Ghosh MondalJagadish ChandraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Steger Cooper ReadingGuideDocument2 pagesSteger Cooper ReadingGuideRicardo DíazNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Health Mitra PamphletDocument2 pagesHealth Mitra Pamphletharshavardhanak23No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- 2019 Apr 20 Dms Aiu MasterDocument25 pages2019 Apr 20 Dms Aiu MasterIrsyad ArifiantoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Please Quote This Reference Number in All Future CorrespondenceDocument2 pagesPlease Quote This Reference Number in All Future CorrespondenceSaipraveen PerumallaNo ratings yet

- Case Study 3 NirmaDocument9 pagesCase Study 3 NirmaPravin DhobleNo ratings yet

- Hybrid Vehicle ToyotaDocument30 pagesHybrid Vehicle ToyotaAdf TrendNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CH 16Document7 pagesCH 16shabirishaq141No ratings yet

- U.S. Customs Form: CBP Form 7552 - Delivery Certificate For Purposes of DrawbackDocument2 pagesU.S. Customs Form: CBP Form 7552 - Delivery Certificate For Purposes of DrawbackCustoms FormsNo ratings yet

- Evening AdviseeDocument4 pagesEvening AdviseeHay JirenyaaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Evio Productions Company ProfileDocument45 pagesEvio Productions Company ProfileObliraj KrishnarajNo ratings yet

- Kristen's Cookies CaseDocument4 pagesKristen's Cookies CaseSunset Watcher100% (1)

- Dokumen - Tips - Copy of GrandeuraparkDocument22 pagesDokumen - Tips - Copy of GrandeuraparkSachin RaiNo ratings yet

- Poland Eastern Europe's Economic MiracleDocument1 pagePoland Eastern Europe's Economic MiracleJERALDINE CANARIANo ratings yet

- Garuda Indonesia Vs Others, Winning The Price WarDocument16 pagesGaruda Indonesia Vs Others, Winning The Price Waryandhie570% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- AP Macro 2008 Audit VersionDocument24 pagesAP Macro 2008 Audit Versionvi ViNo ratings yet

- Five Year PlanDocument5 pagesFive Year PlanrakshaksinghaiNo ratings yet

- Economy of Pakistan Course OutlineDocument2 pagesEconomy of Pakistan Course OutlineFarhan Sarwar100% (1)

- Microfinance Program For Their Startup Graduates, and We Are Pleased To Inform You That We HaveDocument2 pagesMicrofinance Program For Their Startup Graduates, and We Are Pleased To Inform You That We HaveZewdu Lake TNo ratings yet

- Introduction To GlobalizationDocument6 pagesIntroduction To GlobalizationcharmaineNo ratings yet

- 200400: Company Accounting Topic 3: Accounting For Company Income TaxDocument15 pages200400: Company Accounting Topic 3: Accounting For Company Income TaxEhtesham HaqueNo ratings yet

- Intel 5 ForcesDocument2 pagesIntel 5 ForcesNik100% (1)

- Latest Berthing-Report MundraDocument2 pagesLatest Berthing-Report MundraphilmikantNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)