Professional Documents

Culture Documents

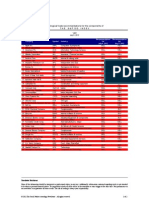

BetterInvesting Weekly Stock Screen 12-23-13

Uploaded by

BetterInvestingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BetterInvesting Weekly Stock Screen 12-23-13

Uploaded by

BetterInvestingCopyright:

Available Formats

Company Name

Alexander's

Alliance Resource Partners LP

AstraZeneca PLC

Becton Dickinson & Co

Colgate-Palmolive Company

CSX Corp.

Chevron Corp.

Deere & Co

Dover Corp.

Female Health Company

Flowers Foods

Hormel Foods Corp.

Harris Corporation

Nordstrom

L-3 Communications Holdings

Lockheed Martin Corp.

McDonald's Corp.

Monarch Financial Holdings

National Research Corp.

Norfolk Southern Corp.

Praxair

Republic Bancorp

Raytheon Company

Southside Bancshares

Strayer Education

Safeway

Sunoco Logistics Partners

T. Rowe Price Group

WEEK OF DECEMBER 23, 2013

Avg Div

Symbol Industry

Yield (%)

ALX

REIT - Retail

3.0

ARLP Coal

6.6

AZN

Drug Manufacturers - Major

5.5

BDX

Medical Instruments & Supplies

2.1

CL

Household & Personal Products

2.5

CSX

Railroads

2.0

CVX

Oil & Gas Integrated

3.4

DE

Farm & Construction Equipment

2.3

DOV

Diversified Industrials

2.4

FHCO Household & Personal Products

3.4

FLO

Packaged Foods

2.8

HRL

Packaged Foods

2.1

HRS

Communication Equipment

2.5

JWN

Department Stores

2.3

LLL

Aerospace & Defense

2.2

LMT

Aerospace & Defense

3.5

MCD Restaurants

3.1

MNRK Banks - Regional - US

2.1

NRCIB Diagnostics & Research

16.9

NSC

Railroads

2.7

PX

Specialty Chemicals

2.1

RBCAA Banks - Regional - US

2.6

RTN

Aerospace & Defense

3.1

SBSI

Banks - Regional - US

3.1

STRA Education & Training Services

2.4

SWY

Grocery Stores

2.3

SXL

Oil & Gas Midstream

6.4

TROW Asset Management

2.2

Screen Notes

MyStockProspector screen on Dec. 23

Average dividend yield of at least 2%

10-year dividend R2 of 0.95 or more

10-year dividend growth of 10% and above per year

Dividend payout of less than 60%

10-year annual EPS growth of 10% or more

Div

Dividend

Payout (%) R2 10 Yr

58.0

0.96

48.4

0.98

44.6

0.96

32.5

0.99

44.5

1.00

26.0

0.96

30.3

0.99

29.9

0.98

32.0

0.99

53.0

0.96

53.7

0.95

31.0

0.98

27.5

0.98

30.8

0.97

19.7

0.95

36.2

0.99

48.8

0.95

11.6

0.97

52.5

1.00

35.1

0.95

40.4

0.96

19.6

0.96

30.6

0.96

27.5

0.99

41.2

0.96

22.1

0.99

58.4

0.99

47.7

0.97

Div Gr (%)

41.4

16.3

17.1

14.1

12.3

28.6

10.4

15.4

10.0

19.1

23.6

12.8

25.5

20.0

22.4

22.4

24.9

19.5

17.7

23.8

19.0

13.2

10.9

14.3

37.5

22.3

11.6

17.1

Hist 10 Yr

EPS Gr (%)

2.085511

0.2174303

0.1442834

0.1017273

0.1060663

0.2680602

0.1176531

0.1330364

0.1123015

1.099693

0.1422601

0.1050241

0.1778035

0.120545

0.1435101

0.145347

0.1822329

0.1754029

0.1456013

0.1404612

0.1337553

0.2185102

0.2087482

0.1480642

0.1726659

0.34843

0.2082588

0.1268893

Hist 10 Yr

EPS Gr (%)

208.6

21.7

14.4

10.2

10.6

26.8

11.8

13.3

11.2

110.0

14.2

10.5

17.8

12.1

14.4

14.5

18.2

17.5

14.6

14.0

13.4

21.9

20.9

14.8

17.3

34.8

20.8

12.7

You might also like

- BetterInvesting Weekly Stock Screen 10-21-13Document1 pageBetterInvesting Weekly Stock Screen 10-21-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-3-12Document1 pageBetterInvesting Weekly Stock Screen 12-3-12BetterInvestingNo ratings yet

- Ny IndexDocument9 pagesNy IndextalupurumNo ratings yet

- BetterInvesting Weekly Stock Screen 9-16-13Document3 pagesBetterInvesting Weekly Stock Screen 9-16-13BetterInvestingNo ratings yet

- DT Reports Symbol Guide: Through Aug. 5, 2015: Index EtfsDocument6 pagesDT Reports Symbol Guide: Through Aug. 5, 2015: Index Etfschr_maxmannNo ratings yet

- BetterInvesting Weekly Stock Screen 2-4-13Document1 pageBetterInvesting Weekly Stock Screen 2-4-13BetterInvestingNo ratings yet

- Chwmeg MembersDocument4 pagesChwmeg MembersJudea EstradaNo ratings yet

- Dallas Top CompaniesDocument275 pagesDallas Top CompaniesCharles Binu67% (3)

- BetterInvesting Weekly Stock-Screen 9-22-14Document1 pageBetterInvesting Weekly Stock-Screen 9-22-14BetterInvestingNo ratings yet

- 2 ND 100Document1 page2 ND 100Parth V. PurohitNo ratings yet

- Top 100 Contractors Report Fiscal Year 2010Document156 pagesTop 100 Contractors Report Fiscal Year 2010Ansh ShuklaNo ratings yet

- Company NamesDocument11 pagesCompany NamesVasanth KumarNo ratings yet

- List of Companies of The United States by StateDocument93 pagesList of Companies of The United States by StateRaghu PonugotiNo ratings yet

- Oil and Gas ResourcesDocument2 pagesOil and Gas ResourceschavaNo ratings yet

- Top Companies & Industries From America, Europe AsiaDocument114 pagesTop Companies & Industries From America, Europe Asiatawhide_islamicNo ratings yet

- Dividend Radar 2023-02-24Document315 pagesDividend Radar 2023-02-24jenkisanNo ratings yet

- Copia de GAS Module - 4 Years of Financial DataDocument53 pagesCopia de GAS Module - 4 Years of Financial Dataadrian5pgNo ratings yet

- Molecular Products Group Announces Acquisition of The Henkel SODASORB® BusinessDocument3 pagesMolecular Products Group Announces Acquisition of The Henkel SODASORB® BusinessPR.comNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-13Document1 pageBetterInvesting Weekly Stock Screen 8-19-13BetterInvestingNo ratings yet

- Companies Who Uses SAPDocument2 pagesCompanies Who Uses SAPkhnaveedNo ratings yet

- BetterInvesting Weekly Stock Screen 7-28-14Document1 pageBetterInvesting Weekly Stock Screen 7-28-14BetterInvestingNo ratings yet

- Top 100 Contractors Report Fiscal Year 2013Document152 pagesTop 100 Contractors Report Fiscal Year 2013FhreewayNo ratings yet

- Fortune 500 Companies 2014Document60 pagesFortune 500 Companies 2014bahveshNo ratings yet

- BetterInvesting Weekly Stock Screen 11-25-13Document1 pageBetterInvesting Weekly Stock Screen 11-25-13BetterInvestingNo ratings yet

- 500 FortuneDocument24 pages500 Fortunecrafted with happinessNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Productivity 1236Document165 pagesProductivity 1236Sameer GuptaNo ratings yet

- Restraint and Handling of Wild and Domestic AnimalsFrom EverandRestraint and Handling of Wild and Domestic AnimalsRating: 4.5 out of 5 stars4.5/5 (2)

- Bitácora Bolsa de ValoresDocument9 pagesBitácora Bolsa de ValoresCarib Yára EnríquezNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Company Coverage Overview - As of December 16, 2011: Consumer Energy Financials MediaDocument1 pageCompany Coverage Overview - As of December 16, 2011: Consumer Energy Financials Mediaaditya81No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 4-29-13Document1 pageBetterInvesting Weekly Stock Screen 4-29-13BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- sp500 Components 2022 07 16Document9 pagessp500 Components 2022 07 16Carlos TresemeNo ratings yet

- Excel Baron AristocratasDocument84 pagesExcel Baron AristocratasEl caminanteNo ratings yet

- U S DividendChampionsDocument322 pagesU S DividendChampionshdsetanhdsetaNo ratings yet

- Strategic Management Seminar Dr. Carmen CastroDocument23 pagesStrategic Management Seminar Dr. Carmen Castromemogarza1No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- CD TalDocument188 pagesCD Talmst04012002No ratings yet

- Bio EnterpriseDocument6 pagesBio EnterpriseAjay JaglanNo ratings yet

- Plans by State PDFDocument20 pagesPlans by State PDFJoshua NelsonNo ratings yet

- CT Abnormal Security 06.10.2022Document9 pagesCT Abnormal Security 06.10.2022Amicardo CrupezNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Investment Screener Results 9Document1 pageInvestment Screener Results 9Adeniyi AleseNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Sheet1: Stock Name Return Payout Ratio Div Yield YearsDocument2 pagesSheet1: Stock Name Return Payout Ratio Div Yield Yearspython_lion_926No ratings yet

- Russel 3000 Deletions 2020Document4 pagesRussel 3000 Deletions 2020BenNo ratings yet

- Ascendere Associates LLC Innovative Long/Short Equity ResearchDocument10 pagesAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- List of US Companies Who Outsource To IndiaDocument17 pagesList of US Companies Who Outsource To Indiapraveenbagde80% (5)

- Starland Registration For ContractsDocument4 pagesStarland Registration For ContractsabdelnjifendjouNo ratings yet

- Handbook of International Electrical Safety PracticesFrom EverandHandbook of International Electrical Safety PracticesNo ratings yet

- BetterInvesting Weekly Stock Screen 1-6-2020Document1 pageBetterInvesting Weekly Stock Screen 1-6-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-9-2020Document2 pagesBetterInvesting Weekly Stock Screen 3-9-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-27-2020Document3 pagesBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-3-2020Document1 pageBetterInvesting Weekly Stock Screen 2-3-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-20-2020Document1 pageBetterInvesting Weekly Stock Screen 1-20-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-24-2020Document1 pageBetterInvesting Weekly Stock Screen 2-24-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-23-19Document1 pageBetterInvesting Weekly Stock Screen 12-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-13-19Document1 pageBetterInvesting Weekly Stock Screen 8-13-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-6-19Document1 pageBetterInvesting Weekly Stock Screen 5-6-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet