Professional Documents

Culture Documents

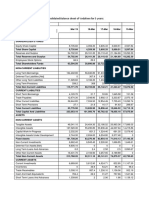

PUBLIC SECTOR BANKS Consolidated Balance Sheets

Uploaded by

Jogender0 ratings0% found this document useful (0 votes)

527 views2 pagesIt wul let u know how Public sector banks performed the last year.......

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIt wul let u know how Public sector banks performed the last year.......

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

527 views2 pagesPUBLIC SECTOR BANKS Consolidated Balance Sheets

Uploaded by

JogenderIt wul let u know how Public sector banks performed the last year.......

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

Appendix Table III.

1(A) : Consolidated Balance Sheet of Pub

(As at end-March)

Items Public Sector Banks* Nationalised

2007 2008 2007

Amount Per cent Amount Per cent Amount

to total to total

1 2 3 4 5 6

Liabilities

1 Capital 12416.31 0.51 13064.66 0.43 10656.16

2 Reserve and Surplus 1,23,214.08 5.05 1,61,787.74 5.35 73733.01

3 Deposits 19,94,199.57 81.72 24,53,867.68 81.19 13,17,369.93

3.1 Demand Deposits 2,35,401.27 9.65 2,83,321.97 9.37 1,28,777.70

3.2 Savings Bank Deposits 5,18,471.05 21.25 5,95,733.73 19.71 3,42,354.26

3.3 Term Deposits 12,40,327.25 50.83 15,74,811.98 52.11 8,46,237.97

4 Borrowings 1,21,772.60 4.99 1,51,146.76 5.00 31045.30

5 Other Liabilities and Provisions 1,88,563.37 7.73 2,42,370.37 8.02 97727.05

Total Liabilities 24,40,165.92 100.00 30,22,237.21 100.00 15,30,531.44

Assets

1 Cash and Balances with RBI 1,42,211.48 5.83 2,29,679.09 7.60 91977.73

2 Balances with Banks and Money 94396.77 3.87 64439.68 2.13 63834.50

at Call and Short Notice

3 Investments 6,64,855.89 27.25 7,99,028.64 26.44 4,27,305.90

3.1 In Government Securities 5,38,374.89 22.06 6,48,847.47 21.47 3,44,728.68

(a+b)

a. In India 5,34,953.25 21.92 6,43,429.70 21.29 3,41,874.76

b. Outside India 3421.64 0.14 5417.77 0.18 2853.93

3.2 In Other Approved Securities 12338.56 0.51 10274.09 0.34 8228.05

3.3 In Non-Approved Securities 1,14,142.43 4.68 1,39,907.08 4.63 74349.17

4 Loans and Advances 14,40,146.49 59.02 17,97,504.19 59.48 8,95,405.99

4.1 Bills Purchased and 92695.50 3.80 1,07,782.87 3.57 53314.39

4.2 Discounted

Cash Credits, Overdrafts, etc. 5,56,956.43 22.82 6,92,473.00 22.91 3,70,782.69

4.3 Term Loans 7,90,494.56 32.40 9,97,248.31 33.00 4,71,308.92

5 Fixed Assets 20195.16 0.83 28796.89 0.95 13455.22

6 Other Assets 78360.13 3.21 1,02,788.73 3.40 38552.10

Total Assets 24,40,165.92 100.00 30,22,237.21 100.00 15,30,531.44

* Includes IDBI Bank Ltd.

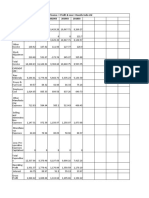

ated Balance Sheet of Public Sector Banks

at end-March)

(Amount in Rs. crore)

Nationalised Banks State Bank Group

2007 2008 2007 2008

Per cent Amount Per cent Amount Per cent Amount Per cent

to total total to total to total

7 8 9 10 11 12 13

0.70 10773.93 0.57 1035.80 0.13 1565.97 0.15

4.82 93550.59 4.98 41905.56 5.20 60139.95 5.95

86.07 16,06,995.05 85.46 6,33,475.60 78.61 7,73,874.65 76.53

8.41 1,55,858.57 8.29 99634.96 12.36 1,20,194.95 11.89

22.37 3,86,277.18 20.54 1,72,082.37 21.36 2,04,635.03 20.24

55.29 10,64,859.30 56.63 3,61,758.27 44.89 4,49,044.66 44.41

2.03 47943.36 2.55 48322.92 6.00 64590.85 6.39

6.39 1,21,111.14 6.44 81055.27 10.06 1,10,997.34 10.98

100.00 18,80,374.07 100.00 8,05,795.15 100.00 10,11,168.75 100.00

6.01 1,48,270.51 7.89 44827.28 5.56 74713.74 7.39

4.17 43306.82 2.30 29057.65 3.61 19068.92 1.89

27.92 5,02,402.45 26.72 2,11,874.68 26.29 2,63,823.26 26.09

22.52 4,16,780.28 22.16 1,77,454.82 22.02 2,08,763.78 20.65

22.34 4,11,756.74 21.90 1,76,887.11 21.95 2,08,369.55 20.61

0.19 5023.54 0.27 567.72 0.07 394.23 0.04

0.54 7003.36 0.37 4093.27 0.51 3260.11 0.32

4.86 78618.81 4.18 30326.59 3.76 51799.37 5.12

58.50 11,21,569.13 59.65 4,82,269.67 59.85 5,93,722.37 58.72

3.48 60859.81 3.24 37086.93 4.60 44280.01 4.38

24.23 4,62,470.32 24.59 1,80,696.10 22.42 2,21,770.59 21.93

30.79 5,98,239.00 31.81 2,64,486.65 32.82 3,27,671.77 32.41

0.88 21440.05 1.14 3961.58 0.49 4590.85 0.45

2.52 43385.10 2.31 33804.30 4.20 55249.60 5.46

100.00 18,80,374.07 100.00 8,05,795.15 100.00 10,11,168.75 100.00

You might also like

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaNo ratings yet

- Dabur India LTD.: Standalone Balance SheetDocument21 pagesDabur India LTD.: Standalone Balance SheetAniketNo ratings yet

- Draft Consolidated BPCL Financial StatementsDocument18 pagesDraft Consolidated BPCL Financial StatementsMahesh RamamurthyNo ratings yet

- Consolidated Balance Sheet of Cipla - in Rs. Cr.Document7 pagesConsolidated Balance Sheet of Cipla - in Rs. Cr.Neha LalNo ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

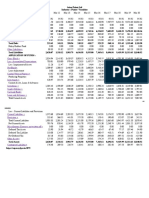

- Vodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDocument5 pagesVodafone Idea Limited: Consolidated Balance Sheet of Vodafone For 5 YearsDeepak ChaharNo ratings yet

- Gujarat Mineral Development Corporation Balance Sheet Summary 2007-2016Document128 pagesGujarat Mineral Development Corporation Balance Sheet Summary 2007-2016Riya ShahNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Company Name Last Historical Date Currency: State Bank of India (SBIN) 31-Mar-19 in Crore INRDocument40 pagesCompany Name Last Historical Date Currency: State Bank of India (SBIN) 31-Mar-19 in Crore INRshivam vermaNo ratings yet

- Godfrey Phillips India PVT LTDDocument16 pagesGodfrey Phillips India PVT LTDSwapnil ChaudhariNo ratings yet

- Analysis of 2005.08 HCL TechDocument10 pagesAnalysis of 2005.08 HCL TechsantoshviswaNo ratings yet

- DownloadDocument136 pagesDownloadrdhNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- HDFC BankDocument13 pagesHDFC BankAnkit KejriwalNo ratings yet

- Reported Net Profit 9,607.73 9,844.71 10,200.90 11,223.25 12,464.32Document14 pagesReported Net Profit 9,607.73 9,844.71 10,200.90 11,223.25 12,464.32shubhamNo ratings yet

- India Cements FADocument154 pagesIndia Cements FARohit KumarNo ratings yet

- Balance Sheet: Year Mar 18 Mar 17Document39 pagesBalance Sheet: Year Mar 18 Mar 17Amit JhaNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- Facebook FSDocument30 pagesFacebook FSperezzzzmay06No ratings yet

- Ashok LeylandDocument5 pagesAshok LeylandAmal RoyNo ratings yet

- Grasim Industries Consolidated Balance Sheet AnalysisDocument5 pagesGrasim Industries Consolidated Balance Sheet AnalysisDaniel Mathew VibyNo ratings yet

- World Currency Composition of Official Foreign Exchange Reserves US DollarsDocument4 pagesWorld Currency Composition of Official Foreign Exchange Reserves US DollarsRajesh NsNo ratings yet

- Tata Steel Balance Sheet and Profit Loss Statement AnalysisDocument7 pagesTata Steel Balance Sheet and Profit Loss Statement AnalysisSahil SawantNo ratings yet

- Arvind Limited Balance Sheet With Common SizeDocument4 pagesArvind Limited Balance Sheet With Common SizeAnkit VermaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetABHIRAJ OJHANo ratings yet

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianNo ratings yet

- Khushboo Tomar Altman Zscore FinalDocument9 pagesKhushboo Tomar Altman Zscore FinalKHUSHBOO TOMARNo ratings yet

- Hindustan Unilever LTD Industry:Personal Care - MultinationalDocument17 pagesHindustan Unilever LTD Industry:Personal Care - MultinationalZia AhmadNo ratings yet

- Ten Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Document2 pagesTen Years Activities of ICB at A Glance: 2007-08 To 2016-17 (Tk. in Crore)Undefined OrghoNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Liabilities: Assets 2016 Rs. 2016 Vs 2015 2015 RsDocument3 pagesLiabilities: Assets 2016 Rs. 2016 Vs 2015 2015 RsAnonymous 8YZr86XzNo ratings yet

- Shree CementsDocument30 pagesShree Cementspgp39356No ratings yet

- BAV Final ExamDocument27 pagesBAV Final ExamArrow NagNo ratings yet

- AMULDocument22 pagesAMULsurprise MFNo ratings yet

- Britannia Industries Vertical Income Statement AnalysisDocument4 pagesBritannia Industries Vertical Income Statement AnalysisMEENU MARY MATHEWS RCBSNo ratings yet

- HDIL Balance Sheet NewDocument5 pagesHDIL Balance Sheet NewbacardiblastwineNo ratings yet

- Kalyan JewellersDocument8 pagesKalyan Jewellersaarushikhunger12No ratings yet

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- TechnoFunda Investing Excel Analysis - Versio STEPS TO USE THIS ANALYSIS EXCELDocument57 pagesTechnoFunda Investing Excel Analysis - Versio STEPS TO USE THIS ANALYSIS EXCELParth DanagayaNo ratings yet

- Table EII Financial Ratios Over TimeDocument7 pagesTable EII Financial Ratios Over TimeAyush KapoorNo ratings yet

- Year Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key RatiosDocument11 pagesYear Latest 2017 2016 2015 2014 2013 2012 2011 2010 2009 Key Ratiospriyanshu14No ratings yet

- FM Assignment 1Document4 pagesFM Assignment 1Akansha BansalNo ratings yet

- Consolidated Balance Sheet Equity and Liabilities Shareholders' FundsDocument17 pagesConsolidated Balance Sheet Equity and Liabilities Shareholders' FundsGaurav SharmaNo ratings yet

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocument42 pagesDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180No ratings yet

- IT Department Time Series Data FY 2000 01 To 2018 19Document11 pagesIT Department Time Series Data FY 2000 01 To 2018 19Ajay RakdeNo ratings yet

- Kirloskar Institute of Management Financial HighlightsDocument3 pagesKirloskar Institute of Management Financial HighlightsSiddharth YadiyapurNo ratings yet

- Ten Years Performance For The Year 2006-07Document1 pageTen Years Performance For The Year 2006-07api-3795636No ratings yet

- Analyzing the financial performance of ACC and Madras CementDocument13 pagesAnalyzing the financial performance of ACC and Madras CementAshish SinghNo ratings yet

- Report On Strategic Corporate FinanceDocument21 pagesReport On Strategic Corporate Financesrohit2No ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- SebiDocument9 pagesSebiJogenderNo ratings yet

- SebiDocument9 pagesSebiJogenderNo ratings yet

- Who I Am Makes A DifferenceDocument34 pagesWho I Am Makes A DifferenceJogenderNo ratings yet

- How To Counter InflationDocument6 pagesHow To Counter InflationJogenderNo ratings yet

- Mukesh Ambani BiographyDocument2 pagesMukesh Ambani BiographyJogenderNo ratings yet

- Capital Markets NCFMDocument260 pagesCapital Markets NCFMChetan Sharma92% (12)

- Derivatives 100128112108 Phpapp02Document152 pagesDerivatives 100128112108 Phpapp02savla_jayNo ratings yet

- Project Planning KhodakeramiDocument25 pagesProject Planning KhodakeramiJogender50% (2)

- FIIs in India.........Document12 pagesFIIs in India.........JogenderNo ratings yet

- A To Z of Being A Successful......Document28 pagesA To Z of Being A Successful......JogenderNo ratings yet

- MahabharataDocument20 pagesMahabharataKetan Bhatt100% (3)

- Equity Segment On National Stock Exchange......Document96 pagesEquity Segment On National Stock Exchange......JogenderNo ratings yet

- RBI Board PresentlyDocument1 pageRBI Board PresentlyJogenderNo ratings yet

- Highlights of The Interim Budget 2009Document9 pagesHighlights of The Interim Budget 2009JogenderNo ratings yet

- Anil Ambani BiographyDocument2 pagesAnil Ambani BiographyJogenderNo ratings yet

- HR Management Implementing Best PracticesDocument4 pagesHR Management Implementing Best PracticesJogender100% (2)

- NBFCsDocument18 pagesNBFCsJogenderNo ratings yet

- Resume For HRDocument3 pagesResume For HRJogenderNo ratings yet

- Sensex 2008Document2 pagesSensex 2008JogenderNo ratings yet

- Beautiful QuotesDocument16 pagesBeautiful QuotesJogender100% (3)

- Introduction To Management (Model Paper)Document22 pagesIntroduction To Management (Model Paper)Jogender100% (5)

- Punch LinesDocument7 pagesPunch LinesJogender93% (14)

- Complete RetailDocument18 pagesComplete RetailJogender100% (3)

- Wipro's BanDocument7 pagesWipro's BanJogenderNo ratings yet

- AmfiDocument11 pagesAmfiJogender100% (2)

- G-20 Major Economies: Group of Twenty Finance Ministers and Central Bank GovernorsDocument7 pagesG-20 Major Economies: Group of Twenty Finance Ministers and Central Bank GovernorsJogenderNo ratings yet

- Interview: Submitted To Ms. Pooja Jetly Faculty, INC, Yamunanagar Submitted by Jogender Kumar INC, YamunanagarDocument9 pagesInterview: Submitted To Ms. Pooja Jetly Faculty, INC, Yamunanagar Submitted by Jogender Kumar INC, YamunanagarJogenderNo ratings yet

- GD TrainingDocument21 pagesGD TrainingJogender100% (1)

- Sensex 2008Document2 pagesSensex 2008JogenderNo ratings yet

- Recent Technological Developments In Indian Banking SectorDocument44 pagesRecent Technological Developments In Indian Banking SectorRanvijay SinghNo ratings yet

- HDFC BankDocument74 pagesHDFC BankHasna HarisNo ratings yet

- A STUDY ON EFFECTIVENESS OF AGRICULTURAL LOANSDocument4 pagesA STUDY ON EFFECTIVENESS OF AGRICULTURAL LOANSRakshith AcharyaNo ratings yet

- AMP Brochure 2022-23Document24 pagesAMP Brochure 2022-23Rahul SinghNo ratings yet

- IMDocument183 pagesIMRavi AgarwalNo ratings yet

- Logo-.: Shaktikanta Das (Born 26 February 1957) Is Serving As The Current & 25thDocument3 pagesLogo-.: Shaktikanta Das (Born 26 February 1957) Is Serving As The Current & 25thlovelybsharmaNo ratings yet

- 20 Themes For PrelimsDocument5 pages20 Themes For PrelimsAdarshNo ratings yet

- Nippon India Mutual FundDocument87 pagesNippon India Mutual FundMohammad MushtaqNo ratings yet

- Rural Banking - SCRIPTDocument16 pagesRural Banking - SCRIPTArchisha GargNo ratings yet

- Msme Finance 1Document69 pagesMsme Finance 1Gauri MittalNo ratings yet

- N S Toor Table of ContentsDocument6 pagesN S Toor Table of ContentsAYUSH RAINo ratings yet

- Lai 111954262Document29 pagesLai 111954262Allanoor KhiljiNo ratings yet

- Cfmip 28092 P 2Document19 pagesCfmip 28092 P 2Amit MakwanaNo ratings yet

- Mba ProjectDocument88 pagesMba ProjectRupan VermaNo ratings yet

- Assets Management Liabilities in Bank PDFDocument61 pagesAssets Management Liabilities in Bank PDFHoàng Trần HữuNo ratings yet

- The Basics of the Foreign Exchange MarketDocument70 pagesThe Basics of the Foreign Exchange MarketSunny MahirchandaniNo ratings yet

- Synopsis On HDFC BankDocument10 pagesSynopsis On HDFC BankjohnNo ratings yet

- NTPC Limited: Korba Super Thermal Power StationDocument9 pagesNTPC Limited: Korba Super Thermal Power StationSAURAV KUMARNo ratings yet

- Class CDocument83 pagesClass CAnish Serious Abt ExamsNo ratings yet

- Mba (Bank MGT.)Document32 pagesMba (Bank MGT.)Sneha Angre0% (1)

- An Analytical Study On Foreign Direct Investment Fdi and Its Relative Impac PDFDocument20 pagesAn Analytical Study On Foreign Direct Investment Fdi and Its Relative Impac PDFAastha BhandariNo ratings yet

- NABARD: India's apex rural development bankDocument64 pagesNABARD: India's apex rural development bankdrastishah980% (5)

- Moneymood 2023Document10 pagesMoneymood 2023AR HemantNo ratings yet

- Importance: TradeDocument552 pagesImportance: TradeJeetin KumarNo ratings yet

- Contemporary: Corporate Training & Development Institute (Ctdi)Document20 pagesContemporary: Corporate Training & Development Institute (Ctdi)navneet gauravNo ratings yet

- Kisan Credit Card (KCC) and Crop Loaning SystemDocument17 pagesKisan Credit Card (KCC) and Crop Loaning SystemRajivNo ratings yet

- Caveat EmptorDocument14 pagesCaveat EmptorKarthik S VNo ratings yet

- CRISIL Insights Into India's Growing Corporate Bond MarketDocument108 pagesCRISIL Insights Into India's Growing Corporate Bond Marketafaque khanNo ratings yet

- EMFS (Environment & Management of Financial Services)Document12 pagesEMFS (Environment & Management of Financial Services)Jayesh ChaudhariNo ratings yet

- School of Management & Entrepreneurship Shiv Nadar UniversityDocument18 pagesSchool of Management & Entrepreneurship Shiv Nadar UniversityDevanshiNo ratings yet