Professional Documents

Culture Documents

Tax

Uploaded by

Marvin H. Taleon IICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Uploaded by

Marvin H. Taleon IICopyright:

Available Formats

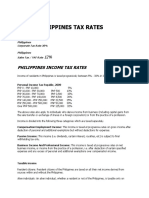

Tax Rate For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Profession

Amount of Net Taxable Income Over P10,000 P30,000 P70,000 P140,000 P250,000 P500,000 But Not Over P10,000 P30,000 P70,000 P140,000 P250,000 P500,000 5% P500 + 10% of the Excess over P10,000 P2,500 + 15% of the Excess over P30,000 P8,500 + 20% of the Excess over P70,000 P22,500 + 25% of the Excess over P140,000 P50,000 + 30% of the Excess over P250,000 P125,000 + 32% of the Excess over P500,000 in 2000 and onward Rate

Note: When the tax due exceeds P2,000.00, the taxpayer may elect to pay in two equal installments, the first installment to be paid at the time the return is filed and the second installment 15 of the same year at on or before July the Authorized Agent Bank (AAB) within the jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered.

Tax Rate 1. Domestic Corporations: a. In General b. Minimum Corporate Income Tax* c. Improperly Accumulated Earnings 2. Proprietary Educational Institution 30% (effective Jan. 1, 2009) 2% 10%

Taxable Base Net taxable income from all sources Gross Income Improperly Accumulated Taxable Income Net taxable income provided that the gross income from unrelated trade, business or other activity does not exceed 50% of the total gross income Net taxable income provided that the gross income from unrelated trade, business or other activity does not exceed 50% of the total gross income

10%

3. Non-stock, Non-profit Hospitals 4. GOCC, Agencies & Instrumentalities a. In General

10%

30%

Net taxable income from all sources

b. Minimum Corporate Income Tax* c. Improperly Accumulated Earnings 5. National Gov't. & LGUs a. In General b. Minimum Corporate Income Tax* c. Improperly Accumulated Earnings 6. Taxable Partnerships a. In General b. Minimum Corporate Income Tax* c. Improperly Accumulated Earnings

2% 10%

Gross Income Improperly Accumulated Taxable Income Net taxable income from all sources Gross Income Improperly Accumulated Taxable Income Net taxable income from all sources Gross Income Improperly Accumulated Taxable Income

30% 2% 10%

30% 2% 10%

7. Exempt Corporation a. On Exempt Activities b. On Taxable Activities 8. General Professional Partnerships 9. Corporation covered by Special Laws 10. International Carriers 11. Regional Operating Head 12. Offshore Banking Units (OBUs) 0% 30% 0% Rate specified under the respective special laws 2.5% 10% 10% 30% 13. Foreign Currency Deposit 10% Units (FCDU) 30% Gross Philippine Billings Taxable Income Gross Taxable Income On Foreign Currency Transaction On Taxable Income other than Foreign Currency Transaction Gross Taxable Income On Foreign Currency Transaction On Taxable Income other than Foreign Currency Transaction Net taxable income from all sources

*Beginning on the 4th year immediately following the year in which such corporation commenced its business operations, when the minimum corporate income tax is greater than the tax computed using the normal income tax.

Passive Income 1. Interest from currency deposits, trust funds and deposit substitutes - In general 3. Prizes (P10,000 or less ) - In excess of P10,000 4. Winnings (except from PCSO and lotto) 5. Interest Income of Foreign Currency Deposit 6. Cash and Property Dividends - To individuals from Domestic Corporations - To Domestic Corporations from Another Domestic Corporations 7. On capital gains presumed to have been realized from sale, exchange or other disposition of real property (capital asset) 8. On capital gains for shares of stock not traded in the stock exchange - Not over P100,000 - Any amount in excess of P100,000 5% 10% 10 % 0% 6% 20%

2. Royalties (on books as well as literary & musical composition) 10% 20% 5% 20% 20% 7.5%

9. Interest Income from long-term deposit or investment in the Exempt form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments evidenced by certificates Upon pretermination before the fifth year , there should be imposed on the entire income from the proceeds of the longterm deposit based on the remaining maturity thereof: Holding Period Four (4) years to less than five (5) years Three (3) years to less than four (4) years Less than three (3) years 5% 12% 20%

B. For Non-Resident Aliens Engaged in Trade or Business 1. Interest from currency deposits, trust funds and deposit substitutes 20%

2. Interest Income from long-term deposit or investment in the form of savings, common or individual trust funds, deposit Exempt substitutes, investment management accounts and other investments evidenced by certificates Upon pretermination before the fifth year, there should be imposed on the entire income from the proceeds of the long-

term deposit based on the remaining maturity thereof: Holding Period: -Four (4) years to less than five (5) years -Three (3) years to less than four (4) years -Less than three (3) years 3. On capital gains presumed to have been realized from the sale, exchange or other disposition of real property 4. On capital gains for shares of stock not traded in the Stock Exchange - Not over P100,000 - Any amount in excess of P100,000 C) For Non-Resident Aliens Not Engaged in Trade or Business 1. On the gross amount of income derived from all sources within the Philippines 2. On capital gains presumed to have been realized from the exchange or other disposition of real property located in the Phils. 3. On capital gains for shares of stock not traded in the Stock Exchange Not Over P100,000 Any amount in excess of P100,000 5% 10% 25% 6% 5% 10% 5% 12% 20% 6%

D) On the gross income in the Philippines of Aliens Employed by Regional Headquarters (RHQ) or Area Headquarters and Regional Operating Headquarters (ROH), Offshore Banking Units (OBUs), Petroleum Service Contractor and Subcontractor E) General Professional Partnerships F) Domestic Corporations 1) a. In General on net taxable income b. Minimum Corporate Income Tax on gross income c. Improperly Accumulated Earnings on improperly accumulated taxable income 2) Proprietary Educational Institution and Non-profit Hospitals - In general (on net taxable income) - If the gross income from unrelated trade, business or other activity exceeds 50% of the total gross income from all sources 4) GOCC, Agencies & Instrumentalities a. In General - on net taxable income

15%

0% 30% 2% 10% 10% 10% 30%

30% 2% 10%

b. Minimum Corporate Income Tax on gross income c. Improperly Accumulated Earnings on improperly accumulated taxable income 5) Taxable Partnerships

a. In General on net taxable income b. Minimum Corporate Income Tax on gross income c. Improperly Accumulated Earnings on improperly accumulated taxable income 6) Exempt Corporation a. On Exempt Activities b. On Taxable Activities 8) Corporation covered by Special Laws

30% 2% 10%

0% 30% Rate specified under the respective special laws

G) Resident Foreign Corporation 1)a. In General on net taxable income b. Minimum Corporate Income Tax on gross income c. Improperly Accumulated Earnings on improperly accumulated taxable income 2) International Carriers on gross Philippine billings 3) Regional Operating Headquarters on gross income 4) Corporation Covered by Special Laws 5) Offshore Banking Units (OBUs) on gross income 6) Foreign Currency Deposit Units (FCDU) on gross income 30% 2% 10% 2.50% 10% Rate specified under the respective special laws 10% 10%

You might also like

- Deminimis BenefitsDocument24 pagesDeminimis Benefitsdaryl canoza100% (1)

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Legal Ethics 2011 Bar Exam QuestionnaireDocument12 pagesLegal Ethics 2011 Bar Exam QuestionnaireAlly Bernales100% (1)

- Philippine Estafa Case Against James Sustiguer SrDocument3 pagesPhilippine Estafa Case Against James Sustiguer SrMarvin H. Taleon IINo ratings yet

- Income Tax of CorporationsDocument16 pagesIncome Tax of CorporationsLonjin Huang100% (1)

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Tax Reform For Acceleration and Inclusion LawDocument28 pagesTax Reform For Acceleration and Inclusion LawGloriosa SzeNo ratings yet

- Amount of Net Taxable Income Rate Over But Not OverDocument11 pagesAmount of Net Taxable Income Rate Over But Not OverKayle MoralesNo ratings yet

- TAXES CORPORATIONSDocument9 pagesTAXES CORPORATIONSMervidelleNo ratings yet

- Taxation of CorporationsDocument26 pagesTaxation of CorporationsjolinaNo ratings yet

- Income Tax Table - NIRCDocument6 pagesIncome Tax Table - NIRCgoateneo1bigfightNo ratings yet

- RareJob TemplateDocument3 pagesRareJob TemplateMarvin H. Taleon IINo ratings yet

- Labor Relations TermsDocument5 pagesLabor Relations TermsMarvin H. Taleon IINo ratings yet

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioNo ratings yet

- Classification of Individual Taxpayers:: Income Tax RatesDocument21 pagesClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoNo ratings yet

- Tax TableDocument6 pagesTax TableNickford AcidoNo ratings yet

- 10 Income Tax Rates 12Document12 pages10 Income Tax Rates 12jomarvaldezconabacaniNo ratings yet

- Types of Income and Corresponding Tax RatesDocument13 pagesTypes of Income and Corresponding Tax RatesJessa Belle EubionNo ratings yet

- Non Resident CitizensDocument3 pagesNon Resident CitizensJessa Belle EubionNo ratings yet

- Nonresident Citizen Philippines TaxationDocument5 pagesNonresident Citizen Philippines TaxationJM GapisaNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- TAXATION LAW HIGHLIGHTSDocument4 pagesTAXATION LAW HIGHLIGHTSJM BermudoNo ratings yet

- Philippines Individual & Corporate Tax RatesDocument4 pagesPhilippines Individual & Corporate Tax Ratesiona4andalNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Colaste, Carl John Sanchez, Honorio Jr. Napiza, Jose Miguel TAX 3F/ Atty. Acosta Summary of Income Tax RatesDocument8 pagesColaste, Carl John Sanchez, Honorio Jr. Napiza, Jose Miguel TAX 3F/ Atty. Acosta Summary of Income Tax RatesJosh NapizaNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- Gross IncomeDocument24 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Tax obligations of resident Filipino citizensDocument2 pagesTax obligations of resident Filipino citizensAJ Quim100% (1)

- Chapter 2Document38 pagesChapter 2Alyssa Camille DiñoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- Income Taxation Power NotesDocument10 pagesIncome Taxation Power NotesJezelle NanoNo ratings yet

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

- Taxation Basics & PrinciplesDocument8 pagesTaxation Basics & PrinciplescesalyncorillaNo ratings yet

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDocument6 pagesAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNo ratings yet

- Lecture-Corporate-Income-Tax 2Document5 pagesLecture-Corporate-Income-Tax 2Ragelli Mae NatalarayNo ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- Special Taxpayers Subject To Preferential Tax RatesDocument42 pagesSpecial Taxpayers Subject To Preferential Tax RatesErneylou RanayNo ratings yet

- Tax 1 - Summary of Important MattersDocument18 pagesTax 1 - Summary of Important MattersBon BonsNo ratings yet

- Taxpayer's checklist for TRAIN law changesDocument6 pagesTaxpayer's checklist for TRAIN law changesChrislynNo ratings yet

- Template - Post Test - Classification of Taxpayers Other Than IndividualsDocument3 pagesTemplate - Post Test - Classification of Taxpayers Other Than IndividualsAleksander DagreytNo ratings yet

- Discussion Income TaxDocument7 pagesDiscussion Income TaxAljay LabugaNo ratings yet

- Pay taxes explained: Holiday, hazard, overtime, minimum wage, senior citizensDocument7 pagesPay taxes explained: Holiday, hazard, overtime, minimum wage, senior citizensAljay LabugaNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Sec. 2 of The Corporation Code of The Philippines. Batas Blg. 68Document6 pagesSec. 2 of The Corporation Code of The Philippines. Batas Blg. 68jetotheloNo ratings yet

- Income TaxDocument4 pagesIncome TaxLea Samantha GallardoNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- Quiz 1: Tax 3 Final Period QuizzesDocument10 pagesQuiz 1: Tax 3 Final Period QuizzesJhun bondocNo ratings yet

- INCTAX QuizletDocument4 pagesINCTAX QuizletJoshua LisingNo ratings yet

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNo ratings yet

- Lesson Income TaxDocument8 pagesLesson Income TaxEfren Lester ReyesNo ratings yet

- 20% 7.5% Exemp T 10% 20% 10% 6%: ExemptDocument7 pages20% 7.5% Exemp T 10% 20% 10% 6%: Exemptgoateneo1bigfightNo ratings yet

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- Philippines Taxation GuideDocument8 pagesPhilippines Taxation GuideCindy-chan DelfinNo ratings yet

- O o o o o O: Who Are Required To File Income Tax Returns?Document8 pagesO o o o o O: Who Are Required To File Income Tax Returns?Aliyah SandersNo ratings yet

- Amount of Net Taxable Income Rate Over But Not OverDocument11 pagesAmount of Net Taxable Income Rate Over But Not OverKat KatNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- 2014 List of ReviewersDocument5 pages2014 List of ReviewersMarvin H. Taleon IINo ratings yet

- Tips From AidaDocument2 pagesTips From AidaMarvin H. Taleon IINo ratings yet

- 2014 List of ReviewersDocument5 pages2014 List of ReviewersMarvin H. Taleon IINo ratings yet

- For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument5 pagesFor Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionMarvin H. Taleon IINo ratings yet

- Bir RJ IiDocument1 pageBir RJ IiMarvin H. Taleon IINo ratings yet

- JRDocument1 pageJRMarvin H. Taleon IINo ratings yet

- RJDocument1 pageRJMarvin H. Taleon IINo ratings yet

- Bir RJDocument1 pageBir RJMarvin H. Taleon IINo ratings yet

- Facts of The CaseDocument2 pagesFacts of The CaseMarvin H. Taleon IINo ratings yet

- Bir RJDocument1 pageBir RJMarvin H. Taleon IINo ratings yet

- Complaint For RapeDocument2 pagesComplaint For RapeMarvin H. Taleon IINo ratings yet

- Remedial EditDocument26 pagesRemedial EditMarvin H. Taleon IINo ratings yet

- Bar Examination Questionnaire For Commercial LawDocument24 pagesBar Examination Questionnaire For Commercial LawSi Kaka MiaNo ratings yet

- Taxation I Notes 2Document2 pagesTaxation I Notes 2Marvin H. Taleon IINo ratings yet

- Labor McqsDocument18 pagesLabor McqsdteroseNo ratings yet

- PrayerDocument1 pagePrayerMarvin H. Taleon IINo ratings yet

- Table of Contents Term PaperDocument1 pageTable of Contents Term PaperMarvin H. Taleon IINo ratings yet

- SorianoDocument1 pageSorianoMarvin H. Taleon IINo ratings yet

- Charter of The United NationsDocument22 pagesCharter of The United NationsMarvin H. Taleon IINo ratings yet

- Assignment in Thesis 1Document2 pagesAssignment in Thesis 1Marvin H. Taleon IINo ratings yet

- His Training Will Prepare You To Become An Effective Tutor As The SOPs and FAQs Will Be Further DiscussedDocument1 pageHis Training Will Prepare You To Become An Effective Tutor As The SOPs and FAQs Will Be Further DiscussedMarvin H. Taleon IINo ratings yet

- Deep Down in The Soul of Everyone Who Determinedly Follows ChristDocument1 pageDeep Down in The Soul of Everyone Who Determinedly Follows ChristMarvin H. Taleon IINo ratings yet

- Reviewer in OBLICONDocument2 pagesReviewer in OBLICONMarvin H. Taleon IINo ratings yet

- Missing Cases 1.) Privacy of CommunicationDocument1 pageMissing Cases 1.) Privacy of CommunicationMarvin H. Taleon IINo ratings yet

- AJ SubDocument6 pagesAJ SubMarvin H. Taleon IINo ratings yet

- Term Paper in Legal MedDocument19 pagesTerm Paper in Legal MedMarvin H. Taleon IINo ratings yet