Professional Documents

Culture Documents

Q2 State Tax Collections

Uploaded by

wagnebOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q2 State Tax Collections

Uploaded by

wagnebCopyright:

Available Formats

GOVS/09-2

Released September 29, 2009

Quarterly Summary of State and Local

Government Tax Revenue

SALES AND INCOME TAX REVENUE DECLINE FOR THIRD CONSECUTIVE QUARTER

2009 Quarter 2

Second quarter 2009 (2009:2) tax revenue for state and General Sales Tax and Individual

local governments, as compared with second quarter Income Tax Revenues: 1997–2009

2008 (2008:2), was down 12.2 percent, marking the Billions of dollars

third consecutive quarter of negative growth. Tax rev- 350

enue for the quarter totaled $308.3 billion compared

with $351.2 billion reported for second quarter 2008. 300

Sales tax

Of the four largest tax categories: property tax, general 250

sales tax, individual income tax, and corporate income

tax; general sales and income tax saw negative growth 200

in the second quarter; while both property tax and cor- Individual income tax

porate income tax showed positive growth. 150

Taxes by Category 100

Property Tax 50

Total Property tax revenue increased less than 0.1 per-

cent in the first quarter of 2009 to $81.9 billion from 0

97 98 99 00 01 02 03 04 05 06 07 08 09

$81.8 billion in the first quarter of 2008.

Source: U.S. Census Bureau, Quarterly Summary of State and

Individual Income Tax Local Government Tax Revenue.

Individual income tax growth was negative over the

past three quarters, dropping by 27.2 percent from the

same quarter prior year. 2009:2 revenue was $77.0 Other Taxes

billion, down from $105.9 billion in 2008:2.

Motor fuels sales tax revenue was down 3.0 percent

General Sales Tax from the second quarter of 2008. Tobacco sales tax

General sales tax growth was down 9.3 percent, lead- and alcoholic beverage sales tax revenue were up 1.2

ing to the third consecutive quarter of negative sales percent and 0.5 percent respectively when compared

tax growth. General sales tax revenue fell $7.5 billion with second quarter 2008. Severance taxes collected

from $80.0 billion in 2008:2 to $72.5 billion in 2009:2. in the second quarter totaled $2.1 billion, down 71.0

percent from the second quarter 2008, and documen-

Corporate Income Tax

tary and stock transfer taxes collected in the second

Corporate income tax growth was positive for the first quarter totaled $1.1 billion, down 36.1 percent from

time in five quarters, up 3.6 percent. 2009:2 revenue the same quarter prior year.

was $18.8 billion, up from $18.2 billion in 2008:2.

For further information on state and local government tax revenue please contact Governments Division, U.S. Census Bureau,

on 866-492-0140 or by email at <govs.qtax@census.gov>.

Th data

The d and

d technical

h lddocumentation ffor this

hi release

l can

USCENSUSBUREAU be found at <www.census.gov/govs/www/qtax.html>.

Helping You Make Informed Decisions

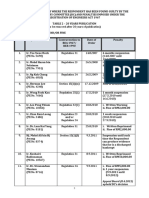

Table 1.

Percentage Change From 2008:2 to 2009:2 for Selected State Government Tax Revenues

(The statistics in this table are for state governments only. They should not be interpreted as state area data (state plus local

government tax collections combined))

Percent change

Individual Corporate net Documentary and

General sales tax income tax income tax Severance tax stock transfer tax

United States . . . . . . . . . –9.5 –27.5 2.9 –71.0 –36.1

Alabama . . . . . . . . . . . . . . . . –9.8 –24.2 10.4 –60.9 –20.7

Alaska . . . . . . . . . . . . . . . . . . – – –63.7 –93.6 –

Arizona . . . . . . . . . . . . . . . . . –27.3 –44.5 –29.9 –80.2 –

Arkansas . . . . . . . . . . . . . . . . –7.5 –13.5 9.9 35.3 –33.4

California . . . . . . . . . . . . . . . . –10.2 –33.4 71.9 0.0 –

Colorado . . . . . . . . . . . . . . . . –13.5 –30.4 –30.8 –21.3 –

Connecticut . . . . . . . . . . . . . . –8.7 –27.3 –7.2 – –45.2

Delaware . . . . . . . . . . . . . . . . – –36.1 –71.4 – –37.9

Florida . . . . . . . . . . . . . . . . . . –13.5 – –19.3 13.6 –39.0

Georgia . . . . . . . . . . . . . . . . . –11.4 –19.1 –29.0 – –

Hawaii . . . . . . . . . . . . . . . . . . –8.5 –33.8 –44.8 – –32.1

Idaho . . . . . . . . . . . . . . . . . . . –13.6 –29.3 –38.4 50.6 –

Illinois. . . . . . . . . . . . . . . . . . . –10.1 –23.7 –6.1 – –52.2

Indiana . . . . . . . . . . . . . . . . . . –5.3 –18.1 –12.6 – –

Iowa . . . . . . . . . . . . . . . . . . . . 6.3 –15.9 –26.9 – –10.8

Kansas. . . . . . . . . . . . . . . . . . –1.6 –17.3 –42.7 –66.5 –

Kentucky . . . . . . . . . . . . . . . . –3.0 –17.0 –24.7 0.3 0.0

Louisiana . . . . . . . . . . . . . . . . –10.8 –16.0 –38.9 –47.0 –

Maine . . . . . . . . . . . . . . . . . . . –6.5 –26.6 –27.4 – –29.4

Maryland . . . . . . . . . . . . . . . . –9.5 –26.7 2.7 – –31.3

Massachusetts. . . . . . . . . . . . –9.5 –26.7 2.7 – –31.3

Michigan . . . . . . . . . . . . . . . . 12.1 –23.5 –38.2 –59.8 –12.1

Minnesota . . . . . . . . . . . . . . . –4.6 –24.0 –19.1 100.4 –9.4

Mississippi . . . . . . . . . . . . . . . –8.0 –10.4 –26.0 –59.2 –

Missouri . . . . . . . . . . . . . . . . . –9.1 –25.3 –29.9 –60.0 62.4

Montana. . . . . . . . . . . . . . . . . – –21.9 –22.7 –51.6 –

Nebraska . . . . . . . . . . . . . . . . –9.3 –15.0 –15.5 –28.4 –5.0

Nevada . . . . . . . . . . . . . . . . . –17.7 – – 95.4 –30.1

New Hampshire . . . . . . . . . . . – –31.3 –19.7 – –42.8

New Jersey . . . . . . . . . . . . . . –9.5 –26.7 2.7 – –31.3

New Mexico . . . . . . . . . . . . . . –15.1 –59.0 –56.4 –27.3 –

New York . . . . . . . . . . . . . . . . –9.1 –31.1 21.3 – –51.8

North Carolina . . . . . . . . . . . . –7.9 –35.7 –12.9 –22.5 –48.9

North Dakota . . . . . . . . . . . . . –4.5 12.4 –40.4 –32.8 –

Ohio . . . . . . . . . . . . . . . . . . . . –8.8 –24.6 –40.1 12.1 –8.7

Oklahoma . . . . . . . . . . . . . . . –4.5 –18.0 –36.5 –71.7 –33.0

Oregon. . . . . . . . . . . . . . . . . . – –30.1 –51.2 –21.0 –29.6

Pennsylvania . . . . . . . . . . . . . –7.9 –20.4 –18.1 – –35.9

Rhode Island . . . . . . . . . . . . . –6.0 –17.4 –22.8 – –42.5

South Carolina . . . . . . . . . . . . –13.5 –29.3 –38.7 – –57.5

South Dakota . . . . . . . . . . . . . 15.0 – –48.3 –81.5 50.0

Tennessee . . . . . . . . . . . . . . . –10.1 –26.0 –18.3 –22.6 –29.0

Texas . . . . . . . . . . . . . . . . . . . –6.5 – – –78.0 –

Utah . . . . . . . . . . . . . . . . . . . . –9.5 –26.7 2.7 –23.9 –

Vermont . . . . . . . . . . . . . . . . . –6.2 –29.4 –5.4 – –27.0

Virginia. . . . . . . . . . . . . . . . . . –9.6 –19.9 –6.1 –30.4 –22.0

Washington . . . . . . . . . . . . . . –9.5 – – –23.9 –31.3

West Virginia . . . . . . . . . . . . . –1.5 2.1 3.1 –58.3 –33.7

Wisconsin . . . . . . . . . . . . . . . –34.4 –32.1 –6.6 –84.1 –53.1

Wyoming . . . . . . . . . . . . . . . . –13.5 – – –6.4 –

District of Columbia . . . . . . . . –9.0 –24.7 –26.8 – –44.5

– Represents zero or rounds to zero.

Source: U.S. Census Bureau, Quarterly Summary of State and Local Government Tax Revenue. For information on nonsampling error, see

<www.census.gov/govs/www/qtax.html>. Data users who create their own aggregations should cite the U.S. Census Bureau as the source of the

original data only.

You might also like

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesRating: 5 out of 5 stars5/5 (1)

- CCG - Taxes U.SDocument65 pagesCCG - Taxes U.SGalaaBoldooNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- GMO Grantham July 09Document6 pagesGMO Grantham July 09rodmorleyNo ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet

- BSNL FTTH Wallet GuideDocument43 pagesBSNL FTTH Wallet GuideNarottam Narayan100% (2)

- Easy IntentionsDocument10 pagesEasy IntentionsUmmahTechnology100% (1)

- Tenancy Agreemen2222Document8 pagesTenancy Agreemen2222Samuel Chukwuma100% (1)

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- f2 Fou Con Sai PL Qa 00002 Project Quality Plan Rev 00Document52 pagesf2 Fou Con Sai PL Qa 00002 Project Quality Plan Rev 00Firman Indra JayaNo ratings yet

- Caballes V CADocument2 pagesCaballes V CATintin CoNo ratings yet

- g11 Qtax4Document2 pagesg11 Qtax4Falak ShahNo ratings yet

- HR 6760 Distributional EffectsDocument2 pagesHR 6760 Distributional EffectsStephen LoiaconiNo ratings yet

- M - R T R: Ining Elated AX EvenuesDocument14 pagesM - R T R: Ining Elated AX EvenuesGregorius Aryoko GautamaNo ratings yet

- State Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeDocument18 pagesState Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeFrank A. Cusumano, Jr.No ratings yet

- HR3 TitleI&II MemoDocument16 pagesHR3 TitleI&II MemoPeter SullivanNo ratings yet

- National Data: A. Selected NIPA TablesDocument46 pagesNational Data: A. Selected NIPA TablesDeliajrsNo ratings yet

- Government Other Information (Unaudited) Tax Burden and Tax GapDocument2 pagesGovernment Other Information (Unaudited) Tax Burden and Tax GapLokiNo ratings yet

- Utah Tax Commission Revenue ReportDocument7 pagesUtah Tax Commission Revenue ReportThe Salt Lake TribuneNo ratings yet

- Management of Mineral EconomyDocument7 pagesManagement of Mineral EconomyChola MukangaNo ratings yet

- I. Economic Environment (1) I: Nigeria WT/TPR/S/247Document12 pagesI. Economic Environment (1) I: Nigeria WT/TPR/S/247gghNo ratings yet

- Global Stationery Imports - Exports 2009Document1 pageGlobal Stationery Imports - Exports 2009riazdollarNo ratings yet

- Averting The Doldrums: Will Connecticut Avoid Recession?Document14 pagesAverting The Doldrums: Will Connecticut Avoid Recession?Patricia DillonNo ratings yet

- U.S. Gulf of Mexico Oil and Natural Gas Industry Economic Impact AnalysisDocument156 pagesU.S. Gulf of Mexico Oil and Natural Gas Industry Economic Impact AnalysisEnergy TomorrowNo ratings yet

- Macro FinalDocument14 pagesMacro Finalsteven msusaNo ratings yet

- PC2020 Mid Year ReportDocument9 pagesPC2020 Mid Year ReportKW SoldsNo ratings yet

- ReceiptsDocument92 pagesReceiptslosangelesNo ratings yet

- Un Pan 023194Document16 pagesUn Pan 023194Ellaine VirayoNo ratings yet

- PT Annual 2012Document105 pagesPT Annual 2012Ajai KarthikeyanNo ratings yet

- Polymers of Styrene, in Primary FormsDocument1 pagePolymers of Styrene, in Primary FormslyesNo ratings yet

- Agriculture Law: RL33718Document20 pagesAgriculture Law: RL33718AgricultureCaseLawNo ratings yet

- Property and Title 2022 Mid-Year Industry ReportDocument11 pagesProperty and Title 2022 Mid-Year Industry ReportDaniela TunaruNo ratings yet

- Japan Statistical 2010Document2 pagesJapan Statistical 2010Gabriel KanekoNo ratings yet

- Estadistica Indec-Gob-Ar Junio 2020Document20 pagesEstadistica Indec-Gob-Ar Junio 2020Luca CarettoNo ratings yet

- Income Inequality in ColombiaDocument100 pagesIncome Inequality in Colombiacarapalida01No ratings yet

- Corporate Income Tax Liability by Asset SizeDocument1 pageCorporate Income Tax Liability by Asset SizeLokiNo ratings yet

- Half-Year Financial: Interim Report AS OF JUNE 30, 2020Document54 pagesHalf-Year Financial: Interim Report AS OF JUNE 30, 2020Rathawit SingpanjanateeNo ratings yet

- Japan's Economy: GDP, Industries, TrendsDocument5 pagesJapan's Economy: GDP, Industries, TrendsTristan Nicholai Fernandez YambaoNo ratings yet

- Signet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - UkDocument25 pagesSignet Reports Third Quarter Profit: WWW - Hsamuel.co - Uk WWW - Ernestjones.co - Ukpatburchall6278No ratings yet

- Gandhi PPT On Re Vests 062209Document15 pagesGandhi PPT On Re Vests 062209Susie CambriaNo ratings yet

- Incidence Analysis of Minnesota Governor Budget 2019Document11 pagesIncidence Analysis of Minnesota Governor Budget 2019FluenceMediaNo ratings yet

- MnDOR LetterDocument3 pagesMnDOR LetterTim NelsonNo ratings yet

- Georgia Miscellaneous Event Tax FormDocument1 pageGeorgia Miscellaneous Event Tax FormMichele RossNo ratings yet

- Spanish Treasury Chart Pack: Macroeconomic Scenario and Economic IndicatorsDocument81 pagesSpanish Treasury Chart Pack: Macroeconomic Scenario and Economic Indicatorsandres rebosoNo ratings yet

- U.S. I T G S: Nternational Rade IN Oods AND ErvicesDocument2 pagesU.S. I T G S: Nternational Rade IN Oods AND ErvicesslawiNo ratings yet

- Ks Whopays FactsheetDocument2 pagesKs Whopays FactsheetbrentwistromNo ratings yet

- Rising Tide of Taxes and Fees 07-02-09Document8 pagesRising Tide of Taxes and Fees 07-02-09Grant BosseNo ratings yet

- Kevyn Orr's Proposal To Detroit's CreditorsDocument134 pagesKevyn Orr's Proposal To Detroit's CreditorsHuffPostDetroitNo ratings yet

- Brazil Country Profile PDFDocument35 pagesBrazil Country Profile PDFdrubivilNo ratings yet

- Financial Condition ReportDocument29 pagesFinancial Condition ReportStatesman JournalNo ratings yet

- Chart PackDocument83 pagesChart PackDksndNo ratings yet

- Argentina: Key Indicators, 2010Document2 pagesArgentina: Key Indicators, 2010Stephen HartantoNo ratings yet

- Brazil 2010Document2 pagesBrazil 2010Matias ArenasNo ratings yet

- I Argent 02 207C5EA3BCD1Document20 pagesI Argent 02 207C5EA3BCD1rafaelamorim34hNo ratings yet

- Agriculture Law: RL30600Document33 pagesAgriculture Law: RL30600AgricultureCaseLawNo ratings yet

- AgriculturalDocument2 pagesAgriculturalGrowing AmericaNo ratings yet

- RWI Econ Diversification BotswanaDocument22 pagesRWI Econ Diversification BotswanaHAKIM ILILANo ratings yet

- Property Taxes in NYS 2019Document4 pagesProperty Taxes in NYS 2019Cayla HarrisNo ratings yet

- Agriculture Law: RS20593Document6 pagesAgriculture Law: RS20593AgricultureCaseLawNo ratings yet

- Ranking de Competitividad PerúDocument2 pagesRanking de Competitividad PerúCarlos Alexander Espinoza HNo ratings yet

- Quick Guide To Using This Utility For EreturnsDocument18 pagesQuick Guide To Using This Utility For EreturnsAadish JainNo ratings yet

- FY 19 Budget Overview 3818Document83 pagesFY 19 Budget Overview 3818Chris SwamNo ratings yet

- U.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019From EverandU.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019No ratings yet

- North American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsFrom EverandNorth American Free Trade Agreement, 1992 Oct. 7 Tariff Phasing DescriptionsNo ratings yet

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- S.E.C.'s Civil Lawsuit Against Goldman Over C.D.ODocument22 pagesS.E.C.'s Civil Lawsuit Against Goldman Over C.D.ODealBook100% (2)

- Keep The Casinos OpenDocument6 pagesKeep The Casinos OpenZerohedge100% (1)

- Fiscal Condition of The City of DetroitDocument74 pagesFiscal Condition of The City of DetroitwagnebNo ratings yet

- Letter To Labor and TreasuryDocument3 pagesLetter To Labor and TreasurywagnebNo ratings yet

- Fed Beige Book March 2010Document50 pagesFed Beige Book March 2010wagnebNo ratings yet

- Exxon - Energy Outlook 2030Document42 pagesExxon - Energy Outlook 2030ReadEverything100% (1)

- Earnings Release and Supplemental Information - UnauditedDocument43 pagesEarnings Release and Supplemental Information - UnauditedwagnebNo ratings yet

- FDIC Quarterly Banking ProfileDocument28 pagesFDIC Quarterly Banking ProfilewagnebNo ratings yet

- Mna BrochureDocument12 pagesMna BrochurewagnebNo ratings yet

- Barney Frank Letter To BanksDocument2 pagesBarney Frank Letter To BankswagnebNo ratings yet

- AlphaNinja 2010Document10 pagesAlphaNinja 2010wagnebNo ratings yet

- Open Letter To Board 011210Document2 pagesOpen Letter To Board 011210wagnebNo ratings yet

- MNA FactsheetDocument2 pagesMNA FactsheetwagnebNo ratings yet

- RecommendationsfortheFutureGovernmentRoleintheCoreSecondaryMortgageMarketDocument12 pagesRecommendationsfortheFutureGovernmentRoleintheCoreSecondaryMortgageMarketwagnebNo ratings yet

- GAO Report On The FTHBCDocument15 pagesGAO Report On The FTHBCwagnebNo ratings yet

- DELLFY10 Q2 Earnings PresentationDocument23 pagesDELLFY10 Q2 Earnings PresentationwagnebNo ratings yet

- Madoff Whistle BlowerDocument19 pagesMadoff Whistle BlowerwagnebNo ratings yet

- News Release: Gross Domestic Product: Third Quarter 2009 (Advance Estimate)Document14 pagesNews Release: Gross Domestic Product: Third Quarter 2009 (Advance Estimate)Nathan MartinNo ratings yet

- News Release Earnings2q09Document15 pagesNews Release Earnings2q09wagneb100% (2)

- GAO Report On The USPSDocument11 pagesGAO Report On The USPSwagnebNo ratings yet

- State & Local EmploymentDocument21 pagesState & Local EmploymentwagnebNo ratings yet

- g:/8k/2009 Filings/form8k - 2q09resultsDocument36 pagesg:/8k/2009 Filings/form8k - 2q09resultswagnebNo ratings yet

- The Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009Document31 pagesThe Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009wagnebNo ratings yet

- News Release: P&G Fiscal Year and Fourth Quarter Eps Exceed ExpectationsDocument13 pagesNews Release: P&G Fiscal Year and Fourth Quarter Eps Exceed ExpectationswagnebNo ratings yet

- APPENDIX: List of Recommended Savings (By Agency)Document20 pagesAPPENDIX: List of Recommended Savings (By Agency)wagneb100% (2)

- The Reaper Is CheaperDocument3 pagesThe Reaper Is CheaperwagnebNo ratings yet

- GAO ReportDocument14 pagesGAO ReportwagnebNo ratings yet

- DR Hopper On CO2 Famine To US SENATE IndexDocument12 pagesDR Hopper On CO2 Famine To US SENATE IndexRadioFreePeruNo ratings yet

- Report on 5 Warehouses for LeaseDocument6 pagesReport on 5 Warehouses for LeaseMirza MešanovićNo ratings yet

- Full Download Understanding Human Sexuality 13th Edition Hyde Test BankDocument13 pagesFull Download Understanding Human Sexuality 13th Edition Hyde Test Bankjosiah78vcra100% (29)

- 02 Formal RequisitesDocument8 pages02 Formal Requisitescmv mendozaNo ratings yet

- Market CapDocument13 pagesMarket CapVikas JaiswalNo ratings yet

- Nit 391 Ninl Erp TenderdocDocument405 pagesNit 391 Ninl Erp TenderdocK Pra ShantNo ratings yet

- Immanuel Sangcate ResumeDocument2 pagesImmanuel Sangcate ResumeNonjTreborTendenillaToltolNo ratings yet

- Bulletin No 18 August 16 2019 - PassDocument770 pagesBulletin No 18 August 16 2019 - PassNithyashree T100% (1)

- AKD Daily Mar 20 202sDocument3 pagesAKD Daily Mar 20 202sShujaat AhmadNo ratings yet

- San Miguel CorpDocument6 pagesSan Miguel CorpMonster BebeNo ratings yet

- Electronics Permit (For Commercial Building Only)Document2 pagesElectronics Permit (For Commercial Building Only)Gabriel C. Obias0% (1)

- Electrical FoundationDocument2 pagesElectrical FoundationterrenceNo ratings yet

- Characteristics Literature of Restoration PeriodDocument4 pagesCharacteristics Literature of Restoration PeriodIksan AjaNo ratings yet

- Doctrine of Basic Structure DebateDocument36 pagesDoctrine of Basic Structure DebateSaurabhNo ratings yet

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Life in Madinah - Farewell Pilgrimage 10AH-11AHDocument3 pagesLife in Madinah - Farewell Pilgrimage 10AH-11AHkinza yasirNo ratings yet

- Ambit Good & Clean Midcap Portfolio September 2020: Asset ManagementDocument20 pagesAmbit Good & Clean Midcap Portfolio September 2020: Asset ManagementVinay T MNo ratings yet

- Term Paper FinalDocument16 pagesTerm Paper FinalItisha JainNo ratings yet

- Arizona Reception For Dan CrenshawDocument2 pagesArizona Reception For Dan CrenshawBarbara EspinosaNo ratings yet

- Provisional Appointment For Driving Skill TestDocument1 pageProvisional Appointment For Driving Skill TestRahul Kumar SahuNo ratings yet

- Unit 8 Money ManagementDocument6 pagesUnit 8 Money ManagementJasmine Mae BalageoNo ratings yet

- What Is Defined As A Type of Living in Which Survival Is Based Directly or Indirectly On The Maintenance of Domesticated AnimalsDocument26 pagesWhat Is Defined As A Type of Living in Which Survival Is Based Directly or Indirectly On The Maintenance of Domesticated AnimalsJen JenNo ratings yet

- Work Permit ProcedureDocument13 pagesWork Permit ProcedureMohamed ElsaneeNo ratings yet

- Derbes, Program of Giotto's ArenaDocument19 pagesDerbes, Program of Giotto's ArenaMarka Tomic DjuricNo ratings yet

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDocument1 pageLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenNo ratings yet