Professional Documents

Culture Documents

Sunlight Foundation Comments For IRS Rule-Making

Uploaded by

Sunlight Foundation0 ratings0% found this document useful (0 votes)

502 views3 pagesComments submitted to the IRS urging the agency to adopt strong rules on political activity of nonprofit organizations.

Original Title

Sunlight Foundation Comments for IRS Rule-making

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentComments submitted to the IRS urging the agency to adopt strong rules on political activity of nonprofit organizations.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

502 views3 pagesSunlight Foundation Comments For IRS Rule-Making

Uploaded by

Sunlight FoundationComments submitted to the IRS urging the agency to adopt strong rules on political activity of nonprofit organizations.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Febiuaiy 24, 2u14

Ns. Amy F. uiuliano

0ffice of the Associate Chief Counsel (Tax Exempt anu uoveinment Entities)

CC:PA:LPB:PR (REu-1S4417-1S)

Room S2uS

Inteinal Revenue Seivice

P.0. Box 76u4, Ben Fianklin Station

Washington, BC 2uu44

SENT vIA FEBERAL E-R0LENAKINu P0RTAL

RE: PR0P0SEB u0IBANCE F0R TAX-EXENPT S0CIAL WELFARE 0RuANIZATI0NS 0N

CANBIBATE-RELATEB P0LITICAL ACTIvITIES

Beai Ns. uiuliano:

The Inteinal Revenue Seivice's (IRS) iulemaking on Pioposeu uuiuance foi Tax-

Exempt Social Welfaie 0iganizations on Canuiuate Relateu Political Activities is an

impoitant step towaiu cieating bettei iules to uefine political campaign activity foi

nonpiofits. The Sunlight Founuation applauus the intent of the pioposal. The IRS must

cieate cleai iules about political activities by nonpiofits, both to guiue the agency as it

enfoices the law, anu to pioviue claiity to oiganizations as to which activities aie

peimissible unuei theii tax-exempt status. Bowevei, significant mouifications to the

substance of the pioposeu iules aie in oiuei, so as not to unnecessaiily hinuei gioups like

the Sunlight Founuation anu otheis fiom engaging in non-election-ielateu activities, anu to

ensuie tianspaiency of political contiibutions. We uige the IRS anu Tieasuiy to iewoik the

uiaft iegulations, with objective uefinitions anu safe haiboi exceptions that caiefully

uistinguish paitisan anu nonpaitisan activities in oiuei to cieate the ieliable iegulations

that aie wiuely iecognizeu as necessaiy to piomote integiity anu accountability in non-

piofits' involvement in politics. A new set of iules that univeisally applies to all nonpiofits

will oveicome uecaues of confusion anu unceitainty unuei the olu "facts anu

ciicumstances" appioach that has been useu to juuge tax-exempt oiganizations.

The Sunlight Founuation is a nonpaitisan nonpiofit founueu in 2uu6 that uses the

powei of the Inteinet to catalyze gieatei goveinment openness anu tianspaiency. We uo so

by cieating tools, open uata, policy iecommenuations, jouinalism anu giant oppoitunities

to uiamatically expanu access to vital goveinment infoimation to cieate accountability of

oui public officials. 0ui oveiaiching goal is to achieve changes in the law to iequiie ieal-

time, online tianspaiency foi all goveinment infoimation, with a special focus on the

political money flow anu who tiies to influence goveinment anu how goveinment

iesponus. We aie conceineu that oui woik woulu be cuitaileu if the pioposeu iules weie

enacteu.

Special tax benefits foi nonpiofit oiganizations weie cieateu by Congiess to

encouiage the woik of oiganizations like ouis, but those tax auvantages weie not intenueu

to subsiuize inteivention in political campaigns. Noieovei, long-establisheu pieceuent anu

policy have establisheu the impoitance of ensuiing that election ielateu contiibutions anu

expenuituies aie tianspaient, to uetei coiiuption anu the appeaiance of coiiuption.

Biight-line iules about what is oi isn't political activity, applicable to eveiyone, woulu give

non-paitisan oiganizations such as ouis the confiuence to continue oui woik while

ensuiing that oiganizations engageu in political activities aie subject to iules iequiiing

tianspaiency of uonois. The Sunlight Founuation's woik coulu be seveiely cuitaileu if, as

the iegulations piopose, any mention of a lawmakei who is iunning foi office, anu any use

of the name Bemociat oi Republican, on oui web pages within 6u uays of a geneial election

oi Su uays of a piimaiy election weie ueemeu "political." At the same time, by failing to

incluue communications (shoit of expiess auvocacy) in the uefinition of canuiuate-ielateu

activity outsiue the 6uSu-uay winuow, the IRS opens the uooi to vast tax-exempt

spenuing by unuiscloseu uonois on sham issue aus that piaise oi uispaiage canuiuates

eailiei in the campaign season.

The IRS must apply cleai anu unequivocally neutial iules to its ueteiminations

about whethei a gioup is entitleu to tax exempt status but not iequiieu to uisclose its

uonois, oi whethei it is a political oiganization, also entitleu to tax exempt status but not

alloweu to keep its uonois seciet. Pioposeu iules shoulu iecognize that moie than the

"magic woius" of expiess auvocacy (vote foi oi against the canuiuate) must be tieateu as

political. The iegulations neeu to auuiess all communications that ieflect positively oi

negatively on a canuiuate. Paiu mass meuia aus that piaise oi uispaiage canuiuates anu aie

uiiecteu at contesteu elections shoulu be ueemeu political. Nessages that uo not mention a

canuiuate geneially shoulu not be tieateu as political, although instiuctions to voteis to use

a "litmus test" in ueciuing who to vote foi shoulu be consiueieu political. votei

engagement piogiams that taiget an oiganization's natuial constituency oi infiequent

voteis with neutial motivational messages shoulu fall within the scope of an oiganization's

tax-exempt social-welfaie oi chaiitable puiposes, while activating voteis baseu on

canuiuate oi paity piefeience shoulu be political. With such biight lines, the neeu to use

"facts anu ciicumstances" to evaluate the iemaining cases shoulu be gieatly lesseneu, anu

in all close cases, the tie-bieakei shoulu be a tax policy favoiing fieeuom of speech.

In auuition, the pioposeu iules must apply beyonu gioups oiganizeu unuei section

Su1(c)(4) of the IRC. If it uoes not apply to all types of exempt oiganizations, the

iulemaking may meiely shift the pioblem to a uiffeient aiena: those piefeiiing the vague

"facts anu ciicumstances" test may choose to oiganize anu funuiaise unuei othei tax-

exempt categoiies wheie they have moie latituue. Noieovei, it is ciitical that iules close

the loophole that allows those engageu in paitisan political activities to avoiu uisclosuie.

Such gioups shoulu be iequiieu to oiganize under 527 of the IRC in order to ensure donors

to such groups are disclosed.

The IRS must move foiwaiu with the iulemaking piocess. It has nevei been moie

impoitant, since the Supieme Couit ueclaieu in !"#"$%&' )&"#%* that election laws cannot

piohibit coipoiations fiom inuepenuent political spenuing, foi oui tax laws to plainly

iuentify what may anu may not be funueu with tax-fiee money. We neeu objective, biight-

line uefinitions of political inteivention that apply consistently acioss the tax coue anu that

aie compiehensible both to those insiue the IRS who must enfoice the law anu to those in

the nonpiofit sectoi who must comply with the law. The Sunlight Founuation stiongly

suppoits the continuation of constiuctive iulemaking by the IRS but woulu auvocate foi

impiovements in the next iounu of uiafting. Cleai, sensible guiuelines anu safe haibois

woulu encouiage moie nonpaitisan public engagement by nonpiofits anu help pievent

abusive exploitation of the tax-exempt system by political opeiatives. With faii, pieuictable

iules, eveiy one of us will benefit, iegaiuless of iueology. We uige the IRS anu Tieasuiy to

piouuce a new, impioveu set of pioposeu iules foi public comment.

Sinceiely,

The Sunlight Founuation

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Information SessionDocument2 pagesInformation SessionSunlight FoundationNo ratings yet

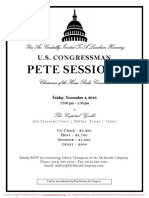

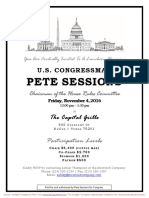

- LuncheonDocument4 pagesLuncheonSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

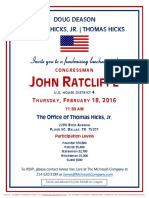

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- FundraiserDocument1 pageFundraiserSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- #PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicyDocument14 pages#PromoteOpenData: How Cities Can Use Social Media To Publicize Open Data PolicySunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction Legal English Units 4-10 and Keys PDFDocument100 pagesIntroduction Legal English Units 4-10 and Keys PDFAni Rukhadze100% (2)

- Local Government ActDocument450 pagesLocal Government ActvictorNo ratings yet

- Pamplona Plantation vs. TinghilDocument1 pagePamplona Plantation vs. TinghilLance MorilloNo ratings yet

- NOTICE & Demand To Clarify JurisdictionDocument3 pagesNOTICE & Demand To Clarify JurisdictionKeith Muhammad: Bey100% (1)

- SG Fire Safety ActDocument78 pagesSG Fire Safety ActPerie Anugraha WigunaNo ratings yet

- Mayo, Et Al.) For Unlawful Detainer, Damages, Injunction, Etc., An Appealed Case From TheDocument4 pagesMayo, Et Al.) For Unlawful Detainer, Damages, Injunction, Etc., An Appealed Case From TheRian Lee TiangcoNo ratings yet

- Mendoza VS ComelecDocument22 pagesMendoza VS ComelecVincent De VeraNo ratings yet

- Barmax Mpre Study Guide: X. Communications About Legal Services (4% To 10%)Document2 pagesBarmax Mpre Study Guide: X. Communications About Legal Services (4% To 10%)TestMaxIncNo ratings yet

- PAL V Savillo, Et. Al (G.R. No. 149547)Document4 pagesPAL V Savillo, Et. Al (G.R. No. 149547)Alainah ChuaNo ratings yet

- USHII Final Exam ReviewDocument6 pagesUSHII Final Exam Reviewzpat_630No ratings yet

- Tax Estate Exercise 3Document6 pagesTax Estate Exercise 3scfsdNo ratings yet

- State of Punjab and Ors Vs Amritsar Beverages LTDDocument4 pagesState of Punjab and Ors Vs Amritsar Beverages LTDjuhiNo ratings yet

- Midterm Notes - CONSTI LAW 1Document10 pagesMidterm Notes - CONSTI LAW 1Adrian Jeremiah VargasNo ratings yet

- Digest PEOPLE v. LalliDocument2 pagesDigest PEOPLE v. LalliDahlia Claudine May Perral50% (2)

- Chapter 5commercial ArbitrationDocument8 pagesChapter 5commercial ArbitrationMa. Princess CongzonNo ratings yet

- Watson Et Al v. Kingdom of Saudi Arabia Complaint 2-22-2021Document158 pagesWatson Et Al v. Kingdom of Saudi Arabia Complaint 2-22-2021Lucas Manfredi100% (1)

- Espiritu, Et Al Vs Petron CorporationDocument3 pagesEspiritu, Et Al Vs Petron Corporationjdg jdgNo ratings yet

- Intro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMDocument19 pagesIntro PPT 2 - CHAPTER 2 - CRIMINAL JUSTICE SYSTEMKenneth PuguonNo ratings yet

- List of RTC MeTC Phones and EmialsDocument15 pagesList of RTC MeTC Phones and EmialsOnie Bagas100% (1)

- Heirs of Maningding v. CADocument5 pagesHeirs of Maningding v. CAPrincess Samantha SarcedaNo ratings yet

- Japanese Period (The 1943 Constitution)Document3 pagesJapanese Period (The 1943 Constitution)Kiko CorpuzNo ratings yet

- Doctrine of ElectionDocument3 pagesDoctrine of ElectionzeusapocalypseNo ratings yet

- West Pakistan Government Servants Benevolent Fund Part-I (Disbursement) RULES, 1965Document6 pagesWest Pakistan Government Servants Benevolent Fund Part-I (Disbursement) RULES, 1965General BranchNo ratings yet

- U.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Document152 pagesU.S. v. Stuart Carson El Al. (Declaration of Professor Michael Koehler)Mike KoehlerNo ratings yet

- Sarcos V CastilloDocument6 pagesSarcos V CastilloTey TorrenteNo ratings yet

- Paras Vs ComelecDocument2 pagesParas Vs ComelecAngel VirayNo ratings yet

- A Brief Overview of The Supreme CourtDocument2 pagesA Brief Overview of The Supreme CourtJerik SolasNo ratings yet

- Oblicon - PrescriptionDocument32 pagesOblicon - PrescriptionrapturereadyNo ratings yet

- People of The Philippines,: DecisionDocument12 pagesPeople of The Philippines,: DecisionGlendie LadagNo ratings yet