Professional Documents

Culture Documents

Finance

Uploaded by

A Kaur MarwahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance

Uploaded by

A Kaur MarwahCopyright:

Available Formats

DRIVE PROGRAM SEMESTER SUBJECT CODE & NAME BK ID CREDITS MARKS

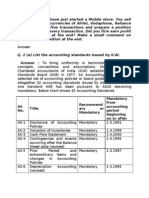

ASSIGNMENT WINTER 2013 MBADS/ MBAFLEX/ MBAHCSN3/ MBAN2/ PGDBAN2 1 MB0041 FINANCIAL AND MANAGEMENT ACCOUNTING B1624 4 60

Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme.

Q.No

Questions

Marks

Total Marks

Give the classification of Accounts according to accounting equation approach with its meaning and examples. Compare the traditional approach with modern approach of accounting equation approach. Analyze the transaction under traditional approach. a. b. c. d. e. f. g. h. 20.1.2011 Paid salary Rs. 30,000 20.1.2011 Paid rent by cheque Rs. 8,000 21.1.2011 Goods withdrawn for personal use Rs. 5,000 25.1.2011 Paid an advance to suppliers of goods Rs. 1,00,000 26.1.2011 Received an advance from customers Rs. 3,00,000 31.1.2011 Paid interest on loan Rs. 5,000 31.1.2011 Paid instalment of loan Rs. 25,000 31.1.2011 Interest allowed by bank Rs. 8,000 4 10

Classification of accounting equation approach with meaning and examples Analysis of transaction with accounts involved-nature of accountaffects and debit/credit

The following trial balance was extracted from the books of Chetan, a small businessman. Do you think it is correct? If not, rewrite it in the correct form.

Debits Rs. Credits Rs.

Stock Purchases Returns outwards

8250 Capital 12750 Sales 700 Returns inwards

10000 15900 1590

Discount received Wages and salaries Rent and rates Sundry debtors Bank Overdraft Journal entries of all the transactions Conclusion 3

800 2500 1850 7600 2450

Discount allowed Scooty Carriage charges Sundry creditors Bills payable

800 1750 700 7250 690 6 4 10

From the given trial balance draft an Adjusted Trial Balance. Trial Balance as on 31.03.2011 Debit balances Furniture and Fittings Buildings Sales Returns Bad Debts Sundry Debtors Purchases Advertising Cash Taxes and Insurance General Expenses Salaries TOTAL Adjustments: 1. 2. 3. 4. 5. Charge depreciation at 10% on Buildings and Furniture and fittings. Write off further bad debts 1000 Taxes and Insurance prepaid 2000 Outstanding salaries 5000 Commission received in advance1000 6 4 10 Rs. Credit balances 10000 Bank Over Draft 500000 Capital Account 1000 Purchase Returns 2000 Sundry Creditors 25000 Commission 90000 Sales 20000 10000 5000 7000 20000 690000 TOTAL 690000 Rs. 16000 400000 4000 30000 5000 235000

Preparation of ledger accounts Preparation of trial balance 4

Compute trend ratios and comment on the financial performance of Infosys Technologies Ltd. from the following extract of its income statements of five years.

(in Rs. Crore)

Particulars Revenue Operating Profit (PBIDT) PAT from ordinary activities

2010-11 27,501 8,968 6,835

2009-10 22,742 7,861 6,218

2008-09 21,693 7,195 5,988

2007-08 16,692 5,238 4,659

2006-07 13,893 4,391 3,856

(Source: Infosys Technologies Ltd. Annual Report) Preparation of trend analysis Preparation of trend ratios Conclusion 4 4 2 10

Give the meaning of cash flow analysis and put down the objectives of cash flow analysis. Explain the preparation of cash flow statement. Meaning of cash flow analysis Objectives of cash flow analysis Explanation of preparation of cash flow analysis 2 3 5 10

Write the assumptions of marginal costing. Differentiate between absorption costing and marginal costing. Assumptions of marginal costing (all 7 points) Differences of marginal and absorption costing (Includes all 8 points) 4 6 10

You might also like

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Armed Struggle in Africa (1969)Document167 pagesArmed Struggle in Africa (1969)Dr.VolandNo ratings yet

- Accounting Decisions Workbook Covers Financials, Costing, AnalysisDocument96 pagesAccounting Decisions Workbook Covers Financials, Costing, AnalysisSatyabrataNayak100% (1)

- Managing Performance with Balanced ScorecardDocument25 pagesManaging Performance with Balanced ScorecardPooja RanaNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Contemporary Theories of MotivationDocument17 pagesContemporary Theories of MotivationArsalan SattiNo ratings yet

- Evoked PotentialsDocument49 pagesEvoked PotentialsparuNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Talent ManagementDocument33 pagesTalent ManagementPooja Rana100% (3)

- The Future of The Indian Print Media Ind PDFDocument22 pagesThe Future of The Indian Print Media Ind PDFAdarsh KambojNo ratings yet

- Capital Structure TheoriesDocument31 pagesCapital Structure TheoriesShashank100% (1)

- Capital Structure TheoriesDocument31 pagesCapital Structure TheoriesShashank100% (1)

- Xu10j4 PDFDocument80 pagesXu10j4 PDFPaulo Luiz França100% (1)

- MB0041Document3 pagesMB0041Smu DocNo ratings yet

- MB0041 - Summer 2014Document3 pagesMB0041 - Summer 2014Rajesh SinghNo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- MBA Semester 1 Spring 2015 Solved Assignments - MB0041Document3 pagesMBA Semester 1 Spring 2015 Solved Assignments - MB0041SolvedSmuAssignmentsNo ratings yet

- MB0041 Financial and Management AccountingDocument12 pagesMB0041 Financial and Management AccountingDivyang Panchasara0% (2)

- SITXFIN003 - Student Assessment v3.1Document11 pagesSITXFIN003 - Student Assessment v3.1Esteban BuitragoNo ratings yet

- MBA Financial Accounting Exercises SolutionsDocument17 pagesMBA Financial Accounting Exercises SolutionsRasanjaliGunasekeraNo ratings yet

- Assignment Front Sheet: BusinessDocument13 pagesAssignment Front Sheet: BusinessHassan AsgharNo ratings yet

- CCE E MBA (Aviation Management) Assignment 1Document6 pagesCCE E MBA (Aviation Management) Assignment 1Sukhi MakkarNo ratings yet

- ISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICESDocument6 pagesISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICEStysonhishamNo ratings yet

- Multiple Choice Questions: Section-IDocument6 pagesMultiple Choice Questions: Section-Isah108_pk796No ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- CA IPCC Nov 2010 Accounts Solved AnswersDocument13 pagesCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Solved SMU AssignmentDocument4 pagesSolved SMU AssignmentArvind KNo ratings yet

- VEC Dept of Mgt Studies BA7106 QBDocument12 pagesVEC Dept of Mgt Studies BA7106 QBSRMBALAANo ratings yet

- BMAC5203 Assignment Jan 2015 (Amended)Document6 pagesBMAC5203 Assignment Jan 2015 (Amended)Robert WilliamsNo ratings yet

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- Goals, Functions of Finance Manager, Working Capital RequirementsDocument3 pagesGoals, Functions of Finance Manager, Working Capital RequirementsISLAMICLECTURESNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- BBA203 Financial AccountingDocument3 pagesBBA203 Financial AccountingRajdeep KumarNo ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Manage Finances Within The BudgetDocument12 pagesManage Finances Within The BudgetEsteban BuitragoNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- M Com Part I Accounts Question PDFDocument15 pagesM Com Part I Accounts Question PDFpink_key711No ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- Single EntryDocument0 pagesSingle EntrylathadevaraajNo ratings yet

- 29234rtp May13 Ipcc Atc 1Document50 pages29234rtp May13 Ipcc Atc 1rahulkingdonNo ratings yet

- Accounting For Managers GTU Question PaperDocument3 pagesAccounting For Managers GTU Question PaperbhfunNo ratings yet

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- Review and Evaluate Financial Management Processes: Submission DetailsDocument9 pagesReview and Evaluate Financial Management Processes: Submission Detailsrida zulquarnainNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- Finance Past PaperDocument6 pagesFinance Past PaperNikki ZhuNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- MB41Document5 pagesMB41Prajeesh Kumar KmNo ratings yet

- Examination Paper-2010Document5 pagesExamination Paper-2010api-248768984No ratings yet

- AC100 Exam 2012Document17 pagesAC100 Exam 2012Ruby TangNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034 Loyola College (Autonomous), Chennai - 600 034Mohan MuthusamyNo ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- 05mba14 July 07Document4 pages05mba14 July 07nitte5768No ratings yet

- QBDocument34 pagesQBAadeel NooraniNo ratings yet

- IBF FINAL Exam SP 2020 ONLINE BDocument4 pagesIBF FINAL Exam SP 2020 ONLINE BSYED MANSOOR ALI SHAHNo ratings yet

- Funds Flow AnalysisDocument20 pagesFunds Flow AnalysisRajeevAgrawalNo ratings yet

- Financial Management - I (Practical Problems)Document9 pagesFinancial Management - I (Practical Problems)sameer_kini100% (1)

- Fundamentals of Accounting Problems and SolutionsDocument7 pagesFundamentals of Accounting Problems and SolutionsashwinNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument38 pages© The Institute of Chartered Accountants of IndiaSarah HolmesNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Presentation On Capital GainsDocument12 pagesPresentation On Capital GainsSheemaShaheenNo ratings yet

- Project Risk MGMTDocument22 pagesProject Risk MGMTPooja RanaNo ratings yet

- Techniques of BudgetingDocument88 pagesTechniques of BudgetingPooja RanaNo ratings yet

- Chapter 5 - Cost of Capital SML 401 BtechDocument52 pagesChapter 5 - Cost of Capital SML 401 BtechfikeNo ratings yet

- Income From House Property KarthikDocument45 pagesIncome From House Property KarthikPooja RanaNo ratings yet

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaNo ratings yet

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaNo ratings yet

- Event MGTDocument20 pagesEvent MGTPooja RanaNo ratings yet

- Project Risk MGMTDocument22 pagesProject Risk MGMTPooja RanaNo ratings yet

- Bo RDocument15 pagesBo RPooja RanaNo ratings yet

- Political Environment of Business: Presented by Aun AhmedDocument18 pagesPolitical Environment of Business: Presented by Aun AhmedMdheer09No ratings yet

- BR 3Document39 pagesBR 3Akhil VashishthaNo ratings yet

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaNo ratings yet

- Imt CDLDocument56 pagesImt CDLPooja Rana50% (4)

- Global SCM OverviewDocument8 pagesGlobal SCM OverviewPooja RanaNo ratings yet

- Imt LawDocument42 pagesImt LawPooja RanaNo ratings yet

- Application For The Post of - at Media Lab Asia, Delhi Position CodeDocument3 pagesApplication For The Post of - at Media Lab Asia, Delhi Position CodePooja RanaNo ratings yet

- Oltp VS OlapDocument9 pagesOltp VS OlapSikkandar Sha100% (1)

- LawDocument19 pagesLawPooja RanaNo ratings yet

- StatsDocument5 pagesStatsPooja RanaNo ratings yet

- HRM Cross-Border M&A GuideDocument14 pagesHRM Cross-Border M&A GuidePooja RanaNo ratings yet

- Groupware Technology (Sameer)Document15 pagesGroupware Technology (Sameer)DIPAK VINAYAK SHIRBHATENo ratings yet

- ReserchDocument14 pagesReserchPooja RanaNo ratings yet

- Architecture of DSS, GDSS & ESSDocument28 pagesArchitecture of DSS, GDSS & ESSPooja Rana50% (2)

- Akriti Shrivastava CMBA2Y3-1906Document6 pagesAkriti Shrivastava CMBA2Y3-1906Siddharth ChoudheryNo ratings yet

- Guidelines Regarding The Handling of Cable Drums During Transport and StorageDocument5 pagesGuidelines Regarding The Handling of Cable Drums During Transport and StorageJegan SureshNo ratings yet

- Washington State Employee - 4/2010Document8 pagesWashington State Employee - 4/2010WFSEc28No ratings yet

- My Sweet Beer - 23 MaiDocument14 pagesMy Sweet Beer - 23 Maihaytem chakiriNo ratings yet

- Kitchen in The Food Service IndustryDocument37 pagesKitchen in The Food Service IndustryTresha Mae Dimdam ValenzuelaNo ratings yet

- Creating Rapid Prototype Metal CastingsDocument10 pagesCreating Rapid Prototype Metal CastingsShri JalihalNo ratings yet

- 1 s2.0 S0313592622001369 MainDocument14 pages1 s2.0 S0313592622001369 MainNGOC VO LE THANHNo ratings yet

- Pg-586-591 - Annexure 13.1 - AllEmployeesDocument7 pagesPg-586-591 - Annexure 13.1 - AllEmployeesaxomprintNo ratings yet

- Rohini 43569840920Document4 pagesRohini 43569840920SowmyaNo ratings yet

- Section - I: Cover Page Section - II:: IndexDocument21 pagesSection - I: Cover Page Section - II:: Indexamit rajputNo ratings yet

- PC-II Taftan Master PlanDocument15 pagesPC-II Taftan Master PlanMunir HussainNo ratings yet

- B JA RON GAWATDocument17 pagesB JA RON GAWATRon GawatNo ratings yet

- Grate Inlet Skimmer Box ™ (GISB™ ) Suntree Technologies Service ManualDocument4 pagesGrate Inlet Skimmer Box ™ (GISB™ ) Suntree Technologies Service ManualOmar Rodriguez OrtizNo ratings yet

- Wireshark Lab: 802.11: Approach, 6 Ed., J.F. Kurose and K.W. RossDocument5 pagesWireshark Lab: 802.11: Approach, 6 Ed., J.F. Kurose and K.W. RossN Azzati LabibahNo ratings yet

- Management principles and quantitative techniquesDocument7 pagesManagement principles and quantitative techniquesLakshmi Devi LakshmiNo ratings yet

- Brochures Volvo Engines d11 CanadaDocument4 pagesBrochures Volvo Engines d11 CanadaDIONYBLINK100% (2)

- Dhilshahilan Rajaratnam: Work ExperienceDocument5 pagesDhilshahilan Rajaratnam: Work ExperienceShazard ShortyNo ratings yet

- Tdi Hazid TemplateDocument11 pagesTdi Hazid TemplateAnonymous rwojPlYNo ratings yet

- Tds Uniqflow 372s enDocument1 pageTds Uniqflow 372s enm daneshpourNo ratings yet

- Sonydsp v77 SM 479622 PDFDocument41 pagesSonydsp v77 SM 479622 PDFmorvetrNo ratings yet

- Url Profile Results 200128191050Document25 pagesUrl Profile Results 200128191050Wafiboi O. EtanoNo ratings yet

- Shrey's PHP - PracticalDocument46 pagesShrey's PHP - PracticalNahi PataNo ratings yet

- The Mpeg Dash StandardDocument6 pagesThe Mpeg Dash Standard9716755397No ratings yet

- 9643 SoirDocument38 pages9643 SoirpolscreamNo ratings yet

- Dhabli - 1axis Tracker PVSYSTDocument5 pagesDhabli - 1axis Tracker PVSYSTLakshmi NarayananNo ratings yet