Professional Documents

Culture Documents

Canada - Budget Balance

Uploaded by

Eduardo Petazze0 ratings0% found this document useful (0 votes)

24 views11 pagesThere was a budgetary deficit of $6.7 billion in March 2014, compared to a deficit of $8.0 billion in March 2013.

For the April 2013 to March 2014 period of the 2013–14 fiscal year, there was a budgetary deficit of $12.1 billion, compared to a deficit of $18.7 billion for the same period of 2012–13.

Original Title

Canada - Budget balance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThere was a budgetary deficit of $6.7 billion in March 2014, compared to a deficit of $8.0 billion in March 2013.

For the April 2013 to March 2014 period of the 2013–14 fiscal year, there was a budgetary deficit of $12.1 billion, compared to a deficit of $18.7 billion for the same period of 2012–13.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views11 pagesCanada - Budget Balance

Uploaded by

Eduardo PetazzeThere was a budgetary deficit of $6.7 billion in March 2014, compared to a deficit of $8.0 billion in March 2013.

For the April 2013 to March 2014 period of the 2013–14 fiscal year, there was a budgetary deficit of $12.1 billion, compared to a deficit of $18.7 billion for the same period of 2012–13.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Department of Finance Canada

The Fiscal Monitor

A publication of the Department of Finance

Highlights

March 2014: budgetary deficit of $6.7 billion

There was a budgetary deficit of $6.7 billion in March 2014, compared to a deficit of $8.0 billion in March

2013.

Revenues increased by $2.4 billion, or 10.7 per cent, reflecting increases in most revenue streams. Program

expenses increased by $1.1 billion, or 3.9 per cent, while public debt charges decreased by $1 million.

April 2013 to March 2014: budgetary deficit of $12.1 billion

For the April 2013 to March 2014 period of the 201314 fiscal year, the budgetary deficit stood at

$12.1 billion, compared to a deficit of $18.7 billion for the same period of 201213.

Revenues were up $13.2 billion, or 5.2 per cent, reflecting increases in most revenue streams. Program

expenses were up $6.8 billion, or 2.8 per cent, reflecting increases in major transfers to persons and other

levels of government and direct program expenses. Public debt charges were down $0.2 billion, or

0.6 per cent.

March 2014

There was a budgetary deficit of $6.7 billion in March 2014, compared to a deficit of $8.0 billion in March

2013.

Revenues increased by $2.4 billion, or 10.7 per cent, to $24.5 billion.

Personal income tax revenues were up $0.6 billion, or 5.6 per cent.

Corporate income tax revenues were up $0.2 billion, or 7.9 per cent.

Non-resident income tax revenues were up $0.3 billion, or 91.7 per cent.

Excise taxes and duties were up $0.4 billion, or 14.7 per cent. Goods and Services Tax (GST)

revenues were up $0.3 billion, or 17.7 per cent. Energy taxes increased by $11 million, customs import

duties increased by $20 million, and other excise taxes and duties increased by $0.1 billion.

Employment Insurance (EI) premium revenues were down $0.1 billion, or 4.6 per cent, due mainly to

a one-time adjustment in March 2013 that increased revenues.

Other revenues, consisting of net profits from enterprise Crown corporations, revenues of consolidated

Crown corporations, revenues from sales of goods and services, returns on investments, net foreign

exchange revenues and miscellaneous revenues, were up $1.0 billion, or 30.9 per cent, in large part due

to the $0.6-billion gain on the March 27, 2014 sale of Macdonald House, a Canadian High Commission

property in London. This sale was undertaken as part of the Governments plan to consolidate the

Canadian High Commissions diplomatic activities in the United Kingdom at Canada House on Trafalgar

Square in London.

Program expenses were $28.9 billion, up $1.1 billion, or 3.9 per cent, from the previous year.

Page 1 of 11 The Fiscal Monitor - March 2014

Major transfers to persons, consisting of elderly, EI and childrens benefits, increased by $0.4 billion,

or 6.9 per cent. Elderly benefits increased by $0.1 billion, or 3.7 per cent, due to growth in the elderly

population and changes in consumer prices, to which benefits are fully indexed. EI benefit payments

increased by $0.1 billion, or 4.6 per cent. Childrens benefits, which consist of the Canada Child Tax

Benefit and the Universal Child Care Benefit, increased by $0.2 billion, or 19.7 per cent.

Major transfers to other levels of government consist of federal transfers in support of health and

other social programs (primarily the Canada Health Transfer and the Canada Social Transfer), fiscal

arrangements and other transfers (Equalization, transfers to the territories, as well as a number of

smaller transfer programs), transfers to provinces on behalf of Canadas cities and communities, and the

Quebec Abatement. Major transfers to other levels of government increased by $0.2 billion, or

4.3 per cent, largely reflecting legislated growth in the Canada Health Transfer and the Canada Social

Transfer, as well as an increase in transfers to Canadas cities and communities.

Direct program expenses include transfer payments to individuals and other organizations not included

in major transfers to persons and other levels of government, and other direct program expenses, which

consist of operating expenses of National Defence and other departments and agencies and expenses of

Crown corporations. Direct program expenses were up $0.4 billion, or 2.6 per cent, from the previous

year. Within direct program expenses:

Transfer payments increased by $0.1 billion, or 2.2 per cent.

Other direct program expenses increased by $0.3 billion, or 2.9 per cent.

Public debt charges decreased by $1 million.

April 2013 to March 2014

For the April 2013 to March 2014 period of the 201314 fiscal year, there was a budgetary deficit of

$12.1 billion, compared to a deficit of $18.7 billion for the same period of 201213.

Revenues increased by $13.2 billion, or 5.2 per cent, to $267.3 billion.

Personal income tax revenues were up $5.0 billion, or 4.0 per cent.

Corporate income tax revenues were up $0.4 billion, or 1.0 per cent.

Non-resident income tax revenues were up $1.3 billion, or 25.4 per cent.

Excise taxes and duties were up $2.3 billion, or 5.4 per cent, largely reflecting a $2.2-billion increase

in GST revenues. Energy taxes increased by $29 million, customs import duties increased by $0.3 billion,

and other excise taxes and duties decreased by $0.1 billion.

EI premium revenues were up $1.3 billion, or 6.6 per cent, reflecting growth in insurable earnings and

the EI premium rate of $1.88 per $100 of insurable earnings for 2013 and 2014.

Other revenues were up $2.9 billion, or 11.3 per cent, reflecting in part the gains realized on the sale

of General Motors common shares and Macdonald House during the year.

Program expenses were $250.6 billion, up $6.8 billion, or 2.8 per cent, from the same period the previous

year.

Major transfers to persons were up $1.9 billion or 2.7 per cent. Elderly benefits increased by

$1.5 billion, or 3.7 per cent, reflecting growth in the elderly population and changes in consumer prices,

to which benefits are fully indexed. EI benefit payments increased by $0.1 billion, or 0.7 per cent, and

childrens benefits were up $0.3 billion, or 2.4 per cent.

Major transfers to other levels of government were up $2.1 billion, or 3.6 per cent, due to legislated

growth in the Canada Health Transfer, the Canada Social Transfer, Equalization transfers and transfers to

the territories, offset in part by a decrease in total transfer protection payments.

Direct program expenses were up $2.8 billion, or 2.4 per cent. Within direct program expenses:

Transfer payments increased by $3.3 billion, or 9.5 per cent, largely reflecting the accrual of a

liability for disaster assistance related to the 2013 flood in Alberta.

Other direct program expenses decreased by $0.6 billion, or 0.7 per cent.

Page 2 of 11 The Fiscal Monitor - March 2014

Public debt charges decreased by $0.2 billion, or 0.6 per cent.

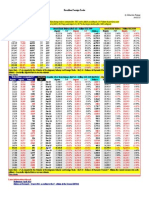

Revenues and expenses (April 2013 to March 2014)

Note: Totals may not add due to rounding.

Financial source of $14.8 billion for April 2013 to March 2014

The budgetary balance is presented on an accrual basis of accounting, recording government revenues and

expenses when they are earned or incurred, regardless of when the cash is received or paid. In contrast, the

financial source/requirement measures the difference between cash coming in to the Government and cash

going out. This measure is affected not only by changes in the budgetary balance but also by the cash

source/requirement resulting from the Governments investing activities through its acquisition of capital

assets and its loans, financial investments and advances, as well as from other activities, including payment

of accounts payable and collection of accounts receivable, foreign exchange activities, and the amortization

of its tangible capital assets. The difference between the budgetary balance and financial source/requirement

is recorded in non-budgetary transactions.

With a budgetary deficit of $12.1 billion and a source of $26.9 billion from non-budgetary transactions, there

was a financial source of $14.8 billion for the April 2013 to March 2014 period, compared to a financial

requirement of $29.4 billion for the same period the previous year. The change in the financial

source/requirement over the previous year mainly reflects the repayment of principal on assets maturing

under the Insured Mortgage Purchase Program.

Net financing activities down $13.0 billion

The Government used this financial source of $14.8 billion to reduce its unmatured debt by $13.0 billion and

increase its cash balances by $1.8 billion. The reduction in unmatured debt was achieved primarily through a

decrease in treasury bills. The level of cash balances varies from month to month based on a number of

factors including periodic large debt maturities, which can be quite volatile on a monthly basis. Cash

balances at the end of March 2014 stood at $26.1 billion, up $1.8 billion from their level at the end of March

2013.

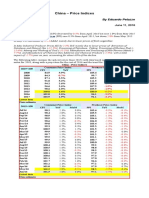

Table 1

Summary statement of transactions

$ millions

Page 3 of 11 The Fiscal Monitor - March 2014

March April to March

2013

1

2014 201213

1

201314

Budgetary transactions

Revenues 22,164 24,530 254,148 267,347

Expenses

Program expenses -27,810 -28,888 -243,848 -250,644

Public debt charges -2,366 -2,365 -28,993 -28,817

Budgetary balance (deficit/surplus) -8,012 -6,723 -18,693 -12,114

Non-budgetary transactions 5,274 13,480 -10,690 26,889

Financial source/requirement -2,738 6,757 -29,383 14,775

Net change in financing activities 951 -10,928 40,366 -13,018

Net change in cash balances -1,787 -4,171 10,983 1,757

Cash balance at end of period 24,316 26,072

Note: Positive numbers indicate a net source of funds. Negative numbers indicate a net requirement for

funds.

1

Comparative figures have been restated to reflect accounting changes in 201314 and to conform with the

presentation in the Public Accounts of Canada 2013.

Page 4 of 11 The Fiscal Monitor - March 2014

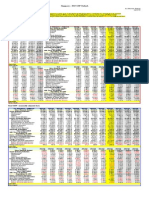

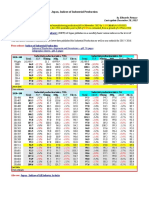

Table 2

Revenues

March April to March

2013

($ millions)

2014

($ millions)

Change

(%)

201213

($ millions)

201314

($ millions)

Change

(%)

Tax revenues

Income taxes

Personal income tax

1

10,347 10,924 5.6 125,405 130,364 4.0

Corporate income tax

2

3,052 3,294 7.9 34,604 34,967 1.0

Non-resident income tax

3

314 602 91.7 5,216 6,543 25.4

Total income tax 13,713 14,820 8.1 165,225 171,874 4.0

Excise taxes and duties

Goods and Services Tax 1,761 2,072 17.7 28,304 30,461 7.6

Energy taxes 431 442 2.6 5,407 5,436 0.5

Customs import duties 290 310 6.9 3,952 4,210 6.5

Other excise taxes and duties 299 365 22.1 5,379 5,271 -2.0

Total excise taxes and duties 2,781 3,189 14.7 43,042 45,378 5.4

Total tax revenues 16,494 18,009 9.2 208,267 217,252 4.3

Employment Insurance

premiums 2,544 2,428 -4.6 20,272 21,601 6.6

Other revenues

4

3,126 4,093 30.9 25,609 28,494 11.3

Total revenues 22,164 24,530 10.7 254,148 267,347 5.2

Note: Totals may not add due to rounding.

1

Comparative figures have been restated to reflect a change in methodology for reporting monthly personal

income tax revenue.

2

Comparative figures have been restated to reflect a change in methodology for reporting monthly

corporate income tax revenue.

3

Comparative figures have been restated to reflect a change in methodology for reporting monthly non-

resident income tax revenue.

4

Comparative figures have been restated to reflect the reclassification of interest owed to taxpayers from

other revenues to other direct program expenses of departments and agencies.

Page 5 of 11 The Fiscal Monitor - March 2014

Table 3

Expenses

March April to March

2013

($ millions)

2014

($ millions)

Change

(%)

201213

($ millions)

201314

($ millions)

Change

(%)

Major transfers to persons

Elderly benefits 3,464 3,591 3.7 40,369 41,862 3.7

Employment Insurance benefits 1,498 1,567 4.6 17,303 17,425 0.7

Children's benefits 1,126 1,348 19.7 13,101 13,421 2.4

Total 6,088 6,506 6.9 70,773 72,708 2.7

Major transfers to other levels

of government

Support for health and other

social programs

Canada Health Transfer 2,401 2,544 6.0 28,912 30,543 5.6

Canada Social Transfer 988 1,018 3.0 11,859 12,215 3.0

Total 3,389 3,562 5.1 40,771 42,758 4.9

Fiscal arrangements and other transfers 1,941 1,916 -1.3 19,728 19,833 0.5

Canada's cities and communities 0 110 n/a 1,964 2,107 7.3

Quebec Abatement -317 -357 12.6 -4,094 -4,223 3.2

Total 5,013 5,231 4.3 58,369 60,475 3.6

Direct program expenses

Transfer payments

Aboriginal Affairs and

Northern Development 1,088 1,051 -3.4 6,268 6,160 -1.7

Agriculture and Agri-Food 546 317 -41.9 1,927 1,539 -20.1

Employment and Social Development 807 857 6.2 5,952 6,128 3.0

Foreign Affairs, Trade and Development 1,401 1,323 -5.6 3,911 3,872 -1.0

Health 367 340 -7.4 2,651 2,830 6.8

Industry 297 582 96.0 2,255 2,803 24.3

Other 1,652 1,825 10.5 12,158 15,125 24.4

Total 6,158 6,295 2.2 35,122 38,457 9.5

Other direct program expenses

Crown corporations 576 632 9.7 7,685 7,445 -3.1

National Defence 3,387 4,051 19.6 22,123 22,626 2.3

All other departments

and agencies

1

6,588 6,173 -6.3 49,776 48,933 -1.7

Total other direct program expenses 10,551 10,856 2.9 79,584 79,004 -0.7

Page 6 of 11 The Fiscal Monitor - March 2014

Total direct program expenses 16,709 17,151 2.6 114,706 117,461 2.4

Total program expenses 27,810 28,888 3.9 243,848 250,644 2.8

Public debt charges 2,366 2,365 0.0 28,993 28,817 -0.6

Total expenses 30,176 31,253 3.6 272,841 279,461 2.4

Note: Totals may not add due to rounding.

1

Comparative figures have been restated to reflect the reclassification of interest owed to taxpayers from

other revenues to other direct program expenses of departments and agencies.

Page 7 of 11 The Fiscal Monitor - March 2014

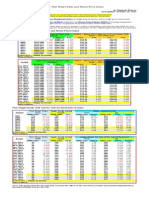

Table 4

The budgetary balance and financial source/requirement

$ millions

March April to March

2013 2014 201213 201314

Budgetary balance (deficit/surplus) -8,012 -6,723 -18,693 -12,114

Non-budgetary transactions

Capital investment activities -688 -195 -4,143 -3,847

Other investing activities 752 3,861 -2,372 40,670

Pension and other accounts 929 727 5,391 5,485

Other activities

Accounts payable, receivables, accruals and allowances

1

3,837 8,301 -11,905 -5,457

Foreign exchange activities -28 644 -1,761 -13,513

Amortization of tangible capital assets 472 142 4,100 3,551

Total other activities 4,281 9,087 -9,566 -15,419

Total non-budgetary transactions 5,274 13,480 -10,690 26,889

Financial source/requirement -2,738 6,757 -29,383 14,775

Note: Totals may not add due to rounding.

1

Comparative figures have been restated to reflect a change in methodology for reporting monthly

personal, corporate, and non-resident income tax revenues.

Page 8 of 11 The Fiscal Monitor - March 2014

Table 5

Financial source/requirement and net financing activities

$ millions

March April to March

2013 2014 201213 201314

Financial source/requirement -2,738 6,757 -29,383 14,775

Net increase (+)/decrease (-) in financing activities

Unmatured debt transactions

Canadian currency borrowings

Marketable bonds -1,668 -8,864 20,877 4,273

Treasury bills 3,400 -1,800 17,300 -27,700

Retail debt -99 -55 -1,514 -1,191

Other 0 0 -11 0

Total 1,633 -10,719 36,652 -24,618

Foreign currency borrowings -292 -242 87 5,227

Total 1,341 -10,961 36,739 -19,391

Cross-currency swap revaluation -946 20 1,029 5,745

Unamortized discounts and premiums on market debt 366 -8 2,139 639

Obligations related to capital leases and other unmatured debt 190 21 459 -11

Net change in financing activities 951 -10,928 40,366 -13,018

Change in cash balance -1,787 -4,171 10,983 1,757

Note: Totals may not add due to rounding.

Page 9 of 11 The Fiscal Monitor - March 2014

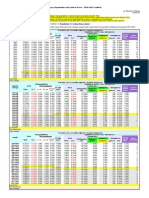

Table 6

Condensed statement of assets and liabilities

$ millions

March 31,

2013

March 31,

2014 Change

Liabilities

Accounts payable and accrued liabilities 118,744 120,071 1,327

Interest-bearing debt

Unmatured debt

Payable in Canadian currency

Marketable bonds 469,039 473,312 4,273

Treasury bills 180,689 152,989 -27,700

Retail debt 7,481 6,290 -1,191

Subtotal 657,209 632,591 -24,618

Payable in foreign currencies 10,802 16,029 5,227

Cross-currency swap revaluation -3,419 2,326 5,745

Unamortized discounts and premiums on market debt -2,156 -1,517 639

Obligations related to capital leases and other unmatured

debt 4,564 4,553 -11

Total unmatured debt 667,000 653,982 -13,018

Pension and other liabilities

Public sector pensions 151,667 152,972 1,305

Other employee and veteran future benefits 67,301 71,725 4,424

Other liabilities 6,046 5,802 -244

Total pension and other liabilities 225,014 230,499 5,485

Total interest-bearing debt 892,014 884,481 -7,533

Total liabilities 1,010,758 1,004,552 -6,206

Financial assets

Cash and accounts receivable 124,154 132,695 8,541

Foreign exchange accounts 58,759 72,272 13,513

Loans, investments, and advances (net of allowances)

1

156,482 118,196 -38,286

Total financial assets 339,395 323,163 -16,232

Net debt 671,363 681,389 10,026

Non-financial assets 68,922 69,218 296

Federal debt (accumulated deficit) 602,441 612,171 9,730

Page 10 of 11 The Fiscal Monitor - March 2014

Note: Totals may not add due to rounding.

1

March 31, 2014 amount includes $2.4 billion in other comprehensive income from enterprise Crown

corporations and other government business enterprises for the April 2013 to March 2014 period.

Note: Unless otherwise noted, changes in financial results are presented on a year-over-year basis.

For inquiries about this publication, contact Nicholas Leswick at 613-995-6391.

May 2014

Her Majesty the Queen in Right of Canada (2014)

All rights reserved

All requests for permission to reproduce this document or any part thereof shall

be addressed to the Department of Finance Canada.

Cette publication est galement disponible en franais.

Cat. No.: F12-4E-PDF

ISSN: 1487-0134

Page 11 of 11 The Fiscal Monitor - March 2014

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzeNo ratings yet

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNo ratings yet

- U.S. Federal Open Market Committee: Federal Funds RateDocument1 pageU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNo ratings yet

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNo ratings yet

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNo ratings yet

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzeNo ratings yet

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzeNo ratings yet

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNo ratings yet

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNo ratings yet

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzeNo ratings yet

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzeNo ratings yet

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNo ratings yet

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNo ratings yet

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNo ratings yet

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzeNo ratings yet

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzeNo ratings yet

- Mainland China - Interest Rates and InflationDocument1 pageMainland China - Interest Rates and InflationEduardo PetazzeNo ratings yet

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzeNo ratings yet

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNo ratings yet

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzeNo ratings yet

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNo ratings yet

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- UP 2008 Commercial Law (Banking Law)Document52 pagesUP 2008 Commercial Law (Banking Law)Adalie NageauNo ratings yet

- Suzanne Mellen, HVS: Hotel Values and Cap RatesDocument29 pagesSuzanne Mellen, HVS: Hotel Values and Cap RatesJefferMangelsNo ratings yet

- 5.1 Legal Aspects of Sale, Mortgage & LeaseDocument130 pages5.1 Legal Aspects of Sale, Mortgage & LeaseLexcela Casana100% (2)

- The Equitable Doctrine of Marshalling Applies To Construction LiensDocument2 pagesThe Equitable Doctrine of Marshalling Applies To Construction LiensThomas G. HeintzmanNo ratings yet

- Business MathDocument33 pagesBusiness MathAirene CastañosNo ratings yet

- Counter Bautista Estafa bp22Document4 pagesCounter Bautista Estafa bp22Bornok TamolmolNo ratings yet

- Banker's Lien: in The Creditor and Debtor Relationship Between The Banker andDocument30 pagesBanker's Lien: in The Creditor and Debtor Relationship Between The Banker andzviyedzo chimwaraNo ratings yet

- CAIIB Information Technology Short NotesDocument14 pagesCAIIB Information Technology Short NotesVicky20% (5)

- Essential elements of an oral contract of saleDocument1 pageEssential elements of an oral contract of saleCareyssa MaeNo ratings yet

- Sps Yu Vs PCIBDocument7 pagesSps Yu Vs PCIBAudrey MartinNo ratings yet

- Petitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaDocument5 pagesPetitioner Vs Vs Respondents Cauton Associates Francisco G. MendozaIan Timothy SarmientoNo ratings yet

- Commercial Law Pre-Week - Dean DivinaDocument249 pagesCommercial Law Pre-Week - Dean DivinaDianne SaltoNo ratings yet

- G Holdings Vs National Mines and Allied Workers UnionDocument1 pageG Holdings Vs National Mines and Allied Workers UnionKrizea Marie DuronNo ratings yet

- Annuities: Simple and Compound AnnuitiesDocument21 pagesAnnuities: Simple and Compound AnnuitiesDanickaRomanoNo ratings yet

- Supreme Court of the Philippines ruling on partnership dispute and property ownershipDocument8 pagesSupreme Court of the Philippines ruling on partnership dispute and property ownershipLeigh De JesusNo ratings yet

- Reyes v. Bancom Development - Corp.Document11 pagesReyes v. Bancom Development - Corp.DkNarcisoNo ratings yet

- Paradigma Manajemen Sumberdaya LahanDocument74 pagesParadigma Manajemen Sumberdaya LahanDita SeptyanaNo ratings yet

- Real Estate MortgageDocument5 pagesReal Estate MortgageAnn MarinNo ratings yet

- Cordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Document3 pagesCordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Chapter 11 DocketsNo ratings yet

- Tally Ledger Under Group ListDocument3 pagesTally Ledger Under Group ListRAMESHNo ratings yet

- Mortgage NotesDocument6 pagesMortgage NotesJohn AguirreNo ratings yet

- Financial Journalism, News Sources and The Banking Crisis: Paul ManningDocument17 pagesFinancial Journalism, News Sources and The Banking Crisis: Paul ManningmargarethhlrNo ratings yet

- Substantive rights under due process: Acts that cannot be criminalized such as debtsDocument2 pagesSubstantive rights under due process: Acts that cannot be criminalized such as debtsJebellePuracanNo ratings yet

- The VanCougar: January 26, 2009Document12 pagesThe VanCougar: January 26, 2009VanCougarNo ratings yet

- Barrera vs. LorenzoDocument9 pagesBarrera vs. Lorenzopoiuytrewq9115No ratings yet

- Domestic Tax Laws of Uganda 2016. Updated and Tracked Compendium.Document370 pagesDomestic Tax Laws of Uganda 2016. Updated and Tracked Compendium.URAuganda100% (8)

- Hills Cement FinalDocument204 pagesHills Cement FinalAniruddha DasNo ratings yet

- VP Commercial Lending Officer in New York City Resume William StephensDocument2 pagesVP Commercial Lending Officer in New York City Resume William StephensWilliamStephens1No ratings yet

- Ligon vs. RTC 56 Makati City DigestDocument2 pagesLigon vs. RTC 56 Makati City DigestAldous Sison100% (1)

- Highland Rental Application PDFDocument2 pagesHighland Rental Application PDFMike CrakerNo ratings yet