Professional Documents

Culture Documents

Mudaraba Case Study 1,2 and 3

Uploaded by

jmfaleelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mudaraba Case Study 1,2 and 3

Uploaded by

jmfaleelCopyright:

Available Formats

Case Study 1 Dr.

Faleel Jamaldeen

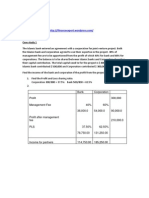

For more case studies : http://ifinanceexpert.wordpress.com/ Profit is calculated after deducting the operating expenses. The profit sharing ratio between Islamic bank and the investment account holders (assume only one investment account) is 75% for investment account holder and 25% of Islamic banks. Islamic banks act as a Mudarib for fund management. Unrestricted Investment Accounts (UIA) is 70% of total investors' deposits. The Mudaraba contract states that Islamic bank can only deduct the operating expenses before distributing the income to the investors and Mudarib. The total revenue and expenses of Islamic bank is $ 120,000 and $ 110,000 respectively. The deductible operating expenses are 65% of total expenses. Find the profit distributable among the Unrestricted Investment Account holders? Answers: Operating expenses = 110,000 x 65% = $ 71,500 Profit = Revenue operating expenses. (120,000 71,500 = $ 48,500) The share of UIA = 48,500 X 70% = $ 33,950 Profit distributable to investment account holder = 33,950 x 75% = $ 25,462.5

Case study 2

Two tiered Profit and Loss sharing An Islamic bank has Restricted Investment Account (RIA) based on Mudaraba contract sharing profit and loss, 25% (Islamic bank): 75% (Investment Account holders). Under the agreement of RIA Islamic bank can only use the fund in the restricted or specified business activity. Real estate financing is one of the investments categorized under RIA contract. The Islamic bank invested $ 450,000 with a reputable investment company for one year with the agreement to share the profit and loss of 40% (Real Estate Co.) and 60% (Islamic bank). At the end of the year the real estate company earned $ 250,000 as profit. Find the income distributable to the RIA holders. Tier 1: Islamic bank and Real Estate Company Islamic bank = 250,000 x 60% = $ 150,000, Real Estate Co. 250,000 x 40% = $ 100,000 Tier 2 : Islamic bank and RIA holders

Islamic bank = 150,000 x 25% = 37,500 and RIA = 150,000 X 75% = $ 112,500 Profit rate for RIA = 112,500/450,000 = 25%

Case Study 3

Capital contribution by the Mudarib. (Sometimes the Mudarib contribute additional capital, in this case the first the profit or loss belongs to the Mudarib will be distributed and then the rest will be shared between the investor and the Mudarib. The profit and loss sharing ratio between the investor and Islamic bank is 20% of Islamic bank and 80% of investment account holders. The Islamic bank invested with their additional capital of 30% in a project. Find if the project earned a profit for the year is $ 150,000 or loss of $ 100,000 how much both Islamic bank and the investment account holder will get as a return. Profit $ 150,000 1. First bank's share of additional capital (150,000 X 30% = 45,000) 2. The balance will be shared between Islamic banks and Investment account is (150,000 45,000 = 105,000). 3. The investment account holder will get 105,000 X 80% = $ 84,000. 4. The Islamic bank will get 105,000 X 20% = $ 21,000 + 45000 (Mudarib contribution) = $ 66,000 Loss $ 100,000 1. First bank's share of additional capital for loss (100,000 X 30% = 30,000) 2. The balance $ 70,000 will be shared only by an Investment account holder.

You might also like

- Form 1040-V: What Is Form 1040-V How To Prepare Your PaymentDocument2 pagesForm 1040-V: What Is Form 1040-V How To Prepare Your PaymentGary KrimsonNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormLaz Equality Estrada100% (2)

- Islamic Banking McqsDocument20 pagesIslamic Banking McqsAllauddinagha17% (6)

- Introduction To Islamic Finance QuizDocument3 pagesIntroduction To Islamic Finance QuizSaad Nadeem 090100% (4)

- Chapter5 HW AnswersDocument54 pagesChapter5 HW Answerscourtdubs100% (11)

- Chapter 11.liquidity and Reserve Management Strategies and PoliciesDocument33 pagesChapter 11.liquidity and Reserve Management Strategies and PoliciesYeu Waj100% (1)

- AAOIFI Past PaperDocument43 pagesAAOIFI Past Papermohamed said omar100% (1)

- IFQ Sample QsDocument14 pagesIFQ Sample Qspuliyanam100% (1)

- NISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)Document162 pagesNISM-Series-VIII-Equity Derivatives Workbook (New Version September-2015)janardhanvn100% (3)

- Murabaha Accounting-1Document22 pagesMurabaha Accounting-1AbdullahiNo ratings yet

- MCQ Islamic Finance 22Document16 pagesMCQ Islamic Finance 22Faisal khan63% (8)

- Difference Between Bai-Murabaha & Bai-MuajjalDocument6 pagesDifference Between Bai-Murabaha & Bai-MuajjalMD. ANWAR UL HAQUE100% (10)

- MurabahaDocument21 pagesMurabahaFiza kamran100% (1)

- Islamic Forex ForwardDocument10 pagesIslamic Forex Forwardjmfaleel100% (1)

- Chap 9 ExercicesDocument6 pagesChap 9 ExercicesYousouf Estt100% (2)

- Bai Inah N TawaruqDocument16 pagesBai Inah N TawaruqDayana Syafiqah100% (1)

- Accounting For Mudarabah Financing: at The End of The Chapter, You Should Be Able ToDocument10 pagesAccounting For Mudarabah Financing: at The End of The Chapter, You Should Be Able ToRaihah Nabilah HashimNo ratings yet

- Chapter 1Document22 pagesChapter 1Low Joey100% (1)

- Murabaha Case Studies PDFDocument4 pagesMurabaha Case Studies PDFHassham Yousuf100% (1)

- Solution Reilly-Brown Ch-8Document10 pagesSolution Reilly-Brown Ch-8রাসেলআহমেদ50% (2)

- Pool Management For Islamic BanksDocument27 pagesPool Management For Islamic Bankssjawaidiqbal83% (6)

- Credit Quant SightDocument26 pagesCredit Quant SightmarioturriNo ratings yet

- Diminishing Musharakah ProjectDocument98 pagesDiminishing Musharakah ProjectMuhsin Mohamed Said100% (8)

- Musharaka Case Study 1Document1 pageMusharaka Case Study 1jmfaleel75% (4)

- Islamic Commercial BankingDocument26 pagesIslamic Commercial BankingjmfaleelNo ratings yet

- Murabaha Case StudiesDocument2 pagesMurabaha Case StudiesOwais Ahmed86% (7)

- Internship Report of Adamjee InsuranceDocument20 pagesInternship Report of Adamjee InsuranceMohsin Rahim100% (4)

- Investment StrategyDocument30 pagesInvestment StrategyAjay YadavNo ratings yet

- Bonds and Stocks SolutionsDocument3 pagesBonds and Stocks SolutionsLucas AbudNo ratings yet

- Mudaraba Case Study 4 - Islamic Finance Case StudyDocument1 pageMudaraba Case Study 4 - Islamic Finance Case Studyjmfaleel100% (1)

- CIPA Sample QuestionsDocument7 pagesCIPA Sample Questionswarbaas100% (1)

- Assignment Chapter 6Document5 pagesAssignment Chapter 6Zaid Harithah67% (3)

- Demonetisation in India: A Study of Its' Impact On Various Key SectorsDocument8 pagesDemonetisation in India: A Study of Its' Impact On Various Key SectorsHimanshuNo ratings yet

- Case Studies MurabahaDocument1 pageCase Studies MurabahajmfaleelNo ratings yet

- Case Studies MurabahaDocument1 pageCase Studies MurabahajmfaleelNo ratings yet

- Mudarabah: Instructor: Dr. Abidullah KhanDocument18 pagesMudarabah: Instructor: Dr. Abidullah KhanDavid Carl100% (1)

- Bai' Istijrar (Supply Contract)Document12 pagesBai' Istijrar (Supply Contract)Urfi Achyuta0% (1)

- Different Between Islamic Letter of Credit and Conventional Letter of CreditDocument4 pagesDifferent Between Islamic Letter of Credit and Conventional Letter of Creditfatinchegu78% (9)

- Case Studies MurabahaDocument4 pagesCase Studies MurabahajmfaleelNo ratings yet

- Musharaka Case Study 2Document1 pageMusharaka Case Study 2jmfaleelNo ratings yet

- Structuring Musharakah Project Financing - Case StudyDocument30 pagesStructuring Musharakah Project Financing - Case StudyMuhammad-Suhaini67% (3)

- Problems and Their Solution in MudarabahDocument43 pagesProblems and Their Solution in Mudarabahatiqa tanveerNo ratings yet

- Case StudiesDocument3 pagesCase StudiesjmfaleelNo ratings yet

- 2 (A) Case Study-Istisna NewDocument20 pages2 (A) Case Study-Istisna Newafshi1850% (2)

- Sample Answers For The Questions of Final TermDocument11 pagesSample Answers For The Questions of Final TermUsama Khan0% (1)

- Banking and Insurance Chapter Seven Solution (4-10)Document5 pagesBanking and Insurance Chapter Seven Solution (4-10)MD. Hasan Al Mamun100% (1)

- Case Study-Istisna NewDocument2 pagesCase Study-Istisna Newmali27a767100% (1)

- 5 Ch04 ProblemsDocument13 pages5 Ch04 Problemscooljani01100% (4)

- Investment Bank in BangladeshDocument13 pagesInvestment Bank in BangladeshTopu RoyNo ratings yet

- Meezan Bank - Banking ProductsDocument103 pagesMeezan Bank - Banking Productsskepticalbeing63% (19)

- Meezan Bank Internship ReportDocument32 pagesMeezan Bank Internship ReportRanaAakashAhmadNo ratings yet

- Deposit Mobilization TechniquesDocument8 pagesDeposit Mobilization TechniquesFahad Bhuiyan100% (1)

- Bank Alfalah Internship Report 2018Document28 pagesBank Alfalah Internship Report 2018Hamza Butt100% (3)

- Islamic Accounting AssignmentDocument2 pagesIslamic Accounting AssignmentAhmad Saifuddin Che AbdullahNo ratings yet

- Case Study of Bank Al Habib - LatestDocument34 pagesCase Study of Bank Al Habib - LatestAdnan Jamil67% (3)

- RB Vye Ch6 SW Q&answersDocument5 pagesRB Vye Ch6 SW Q&answersAira Estalane100% (8)

- Ch4 SolutionsDocument23 pagesCh4 SolutionsFahad Batavia100% (1)

- Managerial AccountingDocument3 pagesManagerial AccountingEmad Rashid100% (1)

- Assignment On of Islamic BankingDocument14 pagesAssignment On of Islamic BankingSanjani80% (5)

- Difference Musharakah and Mudarabah 1Document1 pageDifference Musharakah and Mudarabah 1SK LashariNo ratings yet

- An Analysis of The Courts' Decisions On Islamic Finance DisputesDocument23 pagesAn Analysis of The Courts' Decisions On Islamic Finance DisputesMahyuddin KhalidNo ratings yet

- Askari Islamic Bank Internship ReportDocument71 pagesAskari Islamic Bank Internship ReportWaqas Yousaf70% (10)

- Al Kharaj Bi Al DamanDocument3 pagesAl Kharaj Bi Al DamanNik Fatin0% (1)

- Department of Management Sciences, National University of Modern LanguagesDocument3 pagesDepartment of Management Sciences, National University of Modern LanguagesSheiryNo ratings yet

- Tute 10 PDFDocument3 pagesTute 10 PDFRony RahmanNo ratings yet

- FIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Document6 pagesFIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Nourhan KhaterNo ratings yet

- Banking AssignmentDocument3 pagesBanking AssignmentAsad Khan100% (1)

- Solution of 16 &17Document15 pagesSolution of 16 &17Jabed GuruNo ratings yet

- Case StudiesDocument3 pagesCase StudiesjmfaleelNo ratings yet

- Countif Sumif ExercisesDocument24 pagesCountif Sumif Exercisessatya jitendraNo ratings yet

- What Is EMD in Contract Work - Google SearchDocument3 pagesWhat Is EMD in Contract Work - Google SearchRanjanNo ratings yet

- Business InfographicDocument1 pageBusiness InfographicLuck BananaNo ratings yet

- Voucher and VRET Format For Payment 12.06.19Document2 pagesVoucher and VRET Format For Payment 12.06.19RahulNo ratings yet

- Discount Inflation UploadDocument4 pagesDiscount Inflation Uploadniaz kilamNo ratings yet

- Futures - Meaning, Types, Mechanism, SEBI GuidelinesDocument49 pagesFutures - Meaning, Types, Mechanism, SEBI GuidelinesKARISHMAAT67% (6)

- Meezan Rozana Amdani FundDocument2 pagesMeezan Rozana Amdani FundAbdur rehmanNo ratings yet

- CH 18 AnsDocument3 pagesCH 18 AnsUsama SaleemNo ratings yet

- FIN531 Investment Analysis: Faculty of BusinessDocument85 pagesFIN531 Investment Analysis: Faculty of Businessusername6969100% (1)

- 04 2013-2014 Financial AgreementDocument2 pages04 2013-2014 Financial Agreementapi-234678525No ratings yet

- Working Capital Management AssignmentDocument10 pagesWorking Capital Management AssignmentRitesh Singh RathoreNo ratings yet

- New Signature Update FormDocument3 pagesNew Signature Update FormKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- Payback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsDocument2 pagesPayback Period Year IC FC TVC TC Gross Benefits Net Benefits YearsIzhiel Mai PadillaNo ratings yet

- InvoicemmDocument1 pageInvoicemmankithmallelaNo ratings yet

- Auction CatalogDocument128 pagesAuction CatalogSanjay100% (1)

- Final Word-Over The Counter Exchange of IndiaDocument14 pagesFinal Word-Over The Counter Exchange of IndiaVidita VanageNo ratings yet

- Holydays Homework EcoDocument3 pagesHolydays Homework EcoAkshita ChauhanNo ratings yet

- Chapter 2 Macro SolutionDocument11 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- End of Season: Spring Summer 2021Document29 pagesEnd of Season: Spring Summer 2021Abdaud RasyidNo ratings yet

- Accounting AssignmentDocument11 pagesAccounting AssignmentTakunda GumbuNo ratings yet

- Indian Bank Debit Card Application Form 1Document2 pagesIndian Bank Debit Card Application Form 1Devil World0% (1)

- Bop in IndiaDocument54 pagesBop in IndiaChintakunta PreethiNo ratings yet

- Preparation of Financial Statements-PartnershipsDocument7 pagesPreparation of Financial Statements-PartnershipsHeavens MupedzisaNo ratings yet

- Elite AISDocument70 pagesElite AISDiana Rose OrlinaNo ratings yet

- FMT 14Document8 pagesFMT 14Armel AbarracosoNo ratings yet