Professional Documents

Culture Documents

Anuario Lopes 130423175513 Phpapp02

Uploaded by

Jonas JúniorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anuario Lopes 130423175513 Phpapp02

Uploaded by

Jonas JúniorCopyright:

Available Formats

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

MERCADO IMOBILIRIO: ANLISE DE 2012 E

EXPECTATIVAS

PARA 2013

ltimo ano foi marcado por grandes conquistas para a Lopes. Uma delas foi fruto de um trabalho mpar por seu ineditismo: o lanamento do Anurio do Mercado Imobilirio 2011. O estudo indito apresentou informaes completas do cenrio nacional de lanamentos, agregando conhecimento a todo setor. O reconhecimento Inteligncia de Mercado da Lopes se deu com a vitria do Prmio Master Imobilirio e grandes destaques na imprensa, com matrias de capa em revistas de circulao nacional, como poca e Exame. A partir desta 2 edio do Anurio j conseguimos comparar informaes, iniciando uma srie histrica com dados do mercado imobilirio de lanamentos, cujo grande diferencial a mesma metodologia de pesquisa aplicada em mais de 110 cidades. De acordo com o Anurio do Mercado Imobilirio 2012, o mercado nacional de lanamentos foi estimado em R$ 80 bilhes, o que denotou estabilidade no mercado, apenas 7% inferior ao VGV lanado em 2011 (R$ 86 bilhes). A pesquisa realizada pela Lopes contemplou 86% do total lanado em 2012 (R$ 69 bilhes de R$ 80 bilhes) e a amostra foi composta por 1.321 empreendimentos e 182.803 unidades. Dentre o VGV lanado, a Regio Metropolitana de So Paulo e Grande Rio de Janeiro chamam a ateno, com 50% do montante R$ 28 bilhes e R$ 11 bilhes, respectivamente. Dentre as unidades lanadas, 80% so apartamentos que apresentaram um tquete mediano de R$ 375 mil e R$ 5.110/m (10% superior a 2011, R$ 4.630/m). Se considerarmos que o INCC acumulou 7% em 2012, notamos certa estabilidade nos preos dos apartamentos lanados. Na regio metropolitana de So Paulo observamos 8% de aumento nominal no preo mediano, R$ 5.430/m em 2012 contra R$ 5.010/m em 2011. Quanto aos mercados complementares ao residencial, notamos reduo do nmero de conjuntos comerciais lanados nacionalmente e retomada do segmento

hoteleiro. Em 2012 houve reduo de 23% dos conjuntos comerciais lanados (39 mil unidades em 2011 e 30 mil unidades em 2012), sobretudo nos mercados paulista e carioca. Em contrapartida, a Copa do Mundo de 2014 e as Olimpadas de 2016 impulsionam os lanamentos de hotis e flats: em 2011 foram 21 empreendimentos, com 6.426 unidades, localizados em 11 cidades, que totalizaram R$ 1,7 bilho lanado; j em 2012 foram R$ 2,1 bilhes lanados em 30 empreendimentos compostos por 6.667 unidades, localizados em 17 cidades. As perspectivas do mercado imobilirio nunca foram to favorveis e alguns fatores demogrficos constroem este cenrio. O Brasil possui a quinta maior populao do mundo com 190 milhes de habitantes e est vivendo o bnus demogrfico, perodo em que a populao ativa mais numerosa, o que amplia a demanda por imveis. Outros pontos favorveis so o crescimento do PIB, baixas taxas de desemprego, inflao e juros, alm da prevista expanso de 15% na concesso de crdito imobilirio em 2013, chegando a R$ 95 bilhes. Vale ressaltar tambm o programa Minha Casa Minha Vida, que j beneficiou dois milhes de famlias, e o ICCI ndice de Confiana do Comprador de Imveis, idealizado pela Lopes para monitorar demanda , que confirma nossas expectativas para 2013, mostrando otimismo recorde entre os brasileiros interessados em adquirir imveis. Melhorias pblicas em grandes cidades tambm estimulam o mercado imobilirio. Em So Paulo, se destacam o Rodoanel, as novas estaes de metr e a reviso do Plano Diretor. No Distrito Federal e em Belo Horizonte surgiram os novos centros administrativos. Houve tambm a revitalizao da regio central do Rio de Janeiro, atuao no pr-sal em Santos e retomada de licitaes para futuras incorporaes em Braslia. Por essas razes, uma honra apresentar o Anurio do Mercado Imobilirio 2012 aos nossos clientes incorporadores, investidores e interessados no mercado imobilirio em geral.

Marcos Lopes Presidente

2

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

Recursos da caderneta de poupana, estimativa Abecip.

REAL ESTATE MARKET: ANALYSIS OF 2012 AND

OUTLOOK

FOR 2013

ast year was marked by great accomplishments at Lopes, one of which was the results of its unparalleled work on an unprecedented project: the release of the 2011 Annual Report of the Real Estate Market. This unprecedented study provides comprehensive information on the environment for real estate launches in Brazil, which is complemented with intelligence on the entire sector. The recognition of Lopes Market Intelligence team came from winning the Real Estate Master Award and being highlighted in the media, with cover articles on national-circulation magazines such as poca and Exame. With this second issue of the annual report, we are now able to compare information, effectively launching a historical data series on the real estate market for launches whose major differential is the application of the same survey methodology in more than 110 municipalities. The 2012 Annual Report on the Real Estate Market estimated the Brazilian real estate launch market at R$80 billion, which denotes a stable market, with potential sales value (PSV) launched just 7% down from 2011 (R$86 billion). The survey conducted by Lopes encompassed 86% of all launches in 2012 (R$69 billion out of R$80 billion) and the sample comprised 1,321 projects and 182,803 units. Of the total PSV launched, the So Paulo Metropolitan Area and Greater Rio de Janeiro together accounted for 50%, with R$28 billion and R$11 billion, respectively. Of the units launched, 80% were apartments with a median ticket of R$375,000 and prices averaging R$5,110/m (up 10% from R$4,630/m in 2011). Considering that the INCC construction price index measured inflation of 7% in 2012, the apartments launched in the period registered certain stability in prices. In the So Paulo Metropolitan Area we observed an 8% nominal increase in the median price to R$5,430/m in 2012, compared to R$5,010/m in 2011. In the markets complementary to the residential market, we noted a reduction in the number of office suite towers launched nationwide and a resumption of activity in the ho-

tel segment. In 2012, launches of office suite towers decreased 23% (39,000 units in 2011, vs. 30,000 units in 2012), especially in the So Paulo and Rio de Janeiro markets. On the other hand, the 2014 Soccer World Cup and 2016 Olympics helped drive launches of hotels and flats: in 2011, 21 projects were launched with 6,426 units in 11 cities, for a total of R$1.7 billion in PSV launched, while in 2012, a total of R$2.1 billion was launched through 30 projects with 6,667 units in 17 cities. The outlook for the real estate market has never been so positive and certain demographic factors are responsible for this environment. Brazil is the worlds fifth most populous country with 190 million people and is currently experiencing a demographic bonus, a period during which the proportion of working age people is most numerous, which helps drive demand for real estate. Other favorable factors are GDP growth, low rates of unemployment, inflation and interest and projected growth in mortgage lending for 2013 of 15% to R$95 billion. Other factors are the My Home, My Life housing program that has already benefited two million families and the Real Estate Buyers Confidence Index (ICCI) created by Lopes to monitor demand, which confirmed our expectations for 2013 by measuring record optimism by Brazilians interested in buying real estate. Public improvements in large cities are also driving demand in the real estate market. In So Paulo, such projects include the beltway, new subway stations and the revision of the citys Master Plan. In the Federal District and Belo Horizonte, we saw the creation of new administrative centers. Meanwhile, the city center was revitalized in Rio de Janeiro, activities related to the pre-salt oil discoveries continued strong in Santos and bidding was resumed on future developments in Braslia. As you can see, it has been a great honor for me to present the 2012 Annual Report of the Real Estate Market to our client developers, investors and those interested in the real estate market.

Marcos Lopes Chairman

1 Funds from savings accounts, estimate by the Brazilian Savings and Loan Trade Association (ABECIP).

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

PORTO ALEGRE/RS

RIO DE JANEIRO/RJ

FLORIANPOLIS/SC

FORTALEZA/CE

DISTRITO FEDERAL/DF

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

CAMPINAS/SP

SO PAULO/SP

VITRIA/ES

RECIFE/PE

CURITIBA/PR

SALVADOR/BA

BELO HORIZONTE/BH

SANTOS/SP

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

Prezado Leitor, Produzir o Anurio do Mercado Imobilirio sempre um desafio, dado o tamanho da amostra e distribuio geogrfica. So mais de 1.300 empreendimentos lanados, com cobertura de 111 regies 92 municpios e 19 cidades-satlite. Entre profissionais de Inteligncia de Mercado, Marketing e especialistas de cada regio, so 50 profissionais envolvidos neste projeto, que realizado em 15 meses. Os dados dos produtos so cadastrados e validados mensalmente ao longo do ano e o fechamento do estudo feito em trs meses. No final, temos um excelente relatrio sobre empreendimentos lanados em todo o Pas, o que torna possvel identificar tendncias e os momentos de cada mercado. Finalmente, estabelecemos uma leitura integrada indita nacional e temos os grandes nmeros do mercado imobilirio analisados com a mesma metodologia. Bons negcios e boa leitura!

Dear Reader, Producing the Annual Report of the Real Estate Market is always a great challenge, given its size and geographic distribution, with over 1,300 projects launched in 111 different regional markets (92 municipalities and 19 satellite cities). The project involved a total of 50 professionals who specialize in market intelligence, marketing and specific regional markets and took 15 months to complete. Data on the products are recorded and validated on a monthly basis over the year and the study is finalized over a three-month period. The end product is an excellent report on the projects launched all over the country, which makes it easier to identify the trends and highlights of each market. We finally have created an integrated reference that is unprecedented in Brazil and presents key data for real estate markets that is analyzed using the same methodology. We hope you enjoy the report and wish you great deals!

Cristiane Crisci Diretora de Inteligncia de Mercado, CRM e GPN.

Cristiane Crisci Director of Market Intelligence, CRM and BPM

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

O Anurio do Mercado Imobilirio Brasileiro uma pesquisa quantitativa contnua realizada pela rea de Inteligncia de Mercado da Lopes cujo objetivo determinar o tamanho do mercado de lanamentos anualmente e analisar a verticalizao do Pas por meio do monitoramento de empreendimentos residenciais verticais, conjuntos comerciais, hotis e flats lanados em 111 regies (92 municpios e 19 cidades-satlite). O VGV lanado em 2012 foi estimado em R$ 80 bilhes, praticamente estvel, se comparado a 2011 (R$ 86 bilhes). Em 2012, a amostra do Anurio foi composta por 1.321 empreendimentos, 2.769 torres e 182.803 imveis lanados em 2012 pela Lopes e/ou por empresas concorrentes em 72 regies (65 municpios e 7 cidades-satlite), que totalizaram R$ 69 bilhes em lanamentos, 86% do VGV total lanado no Pas (R$ 80 bilhes). Veja os patamares de mercados por regio e explicao sobre amostra da pesquisa.

The Annual Report of the Brazilian Real Estate Market is an ongoing and quantitative survey conducted by the Market Intelligence Department of Lopes that aims to determine, on an annual basis, the size of the market for real estate launches and to analyze the countrys verticalization process by monitoring the vertical residential projects, corporate towers, hotels and flats launched in 111 regions of the country (92 municipalities and 19 satellite cities). The total potential sales value (PSV) launched in 2012 was estimated at R$80 billion, relatively stable compared to 2011 (R$86 billion). In 2012, the Annual Report sample was formed by 1,321 projects, 2,769 towers and 182,803 properties launched in the year by Lopes and/or its competitors in 72 regions (65 municipalities and 7 satellite cities), which totaled R$69 billion in launches, or 86% of the total PSV launched in the country (R$80 billion). Market data by region and an explanation of the research sample follow:

PSV OF LAUNCHES PER MARKET LOCATION BRAZIL, 2012

REGIO

LOCATION

VGV LANADO POR MERCADO BRASIL, 2012/

ESTADO VGV LANADO (MM)

STATE LAUNCHED PSV (M)

% % ACUM.

% %

86

1 REGIO METROPOLITANA DE SO PAULO/ SO PAULO METROPOLITAN AREA 2 GRANDE RIO DE JANEIRO/ GREATER RIO DE JANEIRO 3 BELO HORIZONTE E/ AND BETIM 4 DISTRITO FEDERAL/ FEDERAL DISTRICT 5 PORTO ALEGRE 6 SALVADOR, LAURO DE FREITAS E/ AND CAMAARI 7 FORTALEZA 8 SANTOS, GUARUJ E/ AND SO VICENTE 9 CURITIBA 10 GOINIA E/ AND APARECIDA DE GOINIA 11 RECIFE E/ AND JABOATO DOS GUARARAPES 12 FLORIANPOLIS, PALHOA E/ AND SO JOS 13 VITRIA, VILA VELHA, SERRA E/ AND CARIACICA 14 CAMPINAS, VALINHOS, HORTOLNDIA E/ AND SUMAR 15 MANAUS 16 NATAL E/ AND PARNAMIRIM 17 BELM OUTROS/ OTHERS TOTAL/ TOTAL

SP RJ MG DF RS BA CE SP PR GO PE SC ES SP AM RN PA -

R$ 28.481 R$ 11.141 R$ 3.913 R$ 3.331 R$ 2.976 R$ 2.661 R$ 2.400 R$ 2.215 R$ 2.024 R$ 1.951 R$ 1.922 R$ 1.465 R$ 1.326 R$ 1.050 R$ 1.018 R$ 707 R$ 324 R$ 10.769 R$ 79.676

35,7% 14,0% 4,9% 4,2% 3,7% 3,3% 3,0% 2,8% 2,5% 2,4% 2,4% 1,8% 1,7% 1,3% 1,3% 0,9% 0,4% 13,5% 100%

36% 50% 55% 59% 63% 66% 69% 72% 74% 77% 79% 81% 83% 84% 85% 86% 86% 100% 100%

mercados brasileiros, detalhados na pesquisa realizada pela Lopes

R$ 69 bilhes lanados nos principais

Brazilian markets detailed in the study conducted by Lopes

R$69 billion launched in the key

14

R$ 11 bi em VGV

complementar estimado lanado em outros municpios que no foram contemplados na pesquisa

R$11 billion in estimated

additional PSV in other locations not contemplated by this study

A Regio Metropolitana de So Paulo e Grande Rio de Janeiro so os dois principais mercados brasileiros, com 50% do VGV total lanado em 2012. Ao acrescentar cinco praas Regio de Belo Horizonte, Distrito Federal, Porto Alegre, Regio de Salvador e Fortaleza atinge-se 70% do mercado./ The So Paulo Metropolitan Area and Greater Rio de Janeiro are two of Brazils key markets, accounting for 50% of the total PSV launched in 2012. Adding another five regions, namely the Belo Horizonte Metropolitan Area, the Federal District, Porto Alegre, the Salvador Metropolitan Area and Fortaleza, leads this figure to rise to 70% of the overall market.

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

VGV LANADO POR MERCADO (R$/BI) BRASIL, 2012/ PSV pER MARKET BRAZIL, 2012

28,48

79,7 bi Total Brasil/Total Brazil

11,14

10,77

3,91

3,33

2,98

2,66

2,40

2,22

2,02

1,95

1,92

1,47

1,33

1,05

1,02

0,71

Natal1

0,32

Belm Outros/ Others

RMSP/ Grande RJ/

MRSP Greater RJ

BH1

DF

P. Alegre Salvador1 Fortaleza

Santos1

Curitiba

Goinia1

Recife1

Florianpolis1

Vitria1 Campinas1 Manaus

A maioria dos mercados cresceu ou permaneceu estvel quanto ao VGV lanado. Os mercados que mais cresceram em relao a 2011 foram o de Vitria (+25%), Porto Alegre (+18%), Grande Rio de Janeiro (+15%), Campinas (+14%) e Belo Horizonte (+12%). A Regio Metropolitana de So Paulo (-7%) e de Santos (+4%) permaneceram estveis, enquanto 4 praas sofreram reduo no VGV lanado. So elas: Distrito Federal (-50%), Curitiba (-46%), Salvador (-35) e Goinia (-28%).

Most markets either grew or remained flat in terms of the potential sales value (PSV) launched. The markets that grew the most compared to 2011 were Vitria (+25%), Porto Alegre (+18%), Greater Rio de Janeiro (+15%), Campinas (+14%) and Belo Horizonte (+12%). The So Paulo Metro Area (-7%) and Santos (+4%) remained stable, while 4 markets suffered reductions in PSV launched, which were: Federal District (-50%), Curitiba (-46%), Salvador (-35) and Goinia (-28%).

1. e regio, detalhe na tabela na pgina 7./ 2. and region, detail on table on page 7.

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

No mapa abaixo, possvel observar o desempenho de cada praa quanto ao nmero de lanamentos, unidades e VGV lanado em 2012./ The following map shows the performance of each market in terms of number of launches, units and PSV launched in 2012.

DADOS GERAIS DO MERCADO PRINCIPAIS MERCADOS BRASILEIROS, 2012/

GENERAL DATA PER MARKET KEY BRAZILIAN MARKETS, 2012

BELM L: 4 U: 708 VGV/PSV: 324

AM PI CE

MANAUS L: 11 U: 2.536 VGV/PSV: 1.018 DISTRITO FEDERAL L: 51 U: 8.823 VGV/PSV: 3.331

FORTALEZA L: 44 U: 6.380 VGV/PSV: 2.400

PB

PA

PE TO AL BA RO MT SE

NATAL / PARNAMIRIM L: 23 U: 4.008 VGV/PSV: 707 RECIFE / JABOATO / OLINDA

GOINIA / APARECIDA L: 38 U: 7.513 VGV/PSV: 1.951 BELO HORIZONTE /

L: 49 U: 5.376 VGV/PSV: 1.922

BETIM

L: 134 U: 12.030 VGV/PSV: 3.913

MG

BOLVIA

SALVADOR / LAURO DE FREITAS / CAMAARI

ES

SO PAULO

MS RJ

PARAGUAY

L: 67 U: 7.889 VGV/PSV: 2.661

REGIO METROPOLITANA

L: 427 U: 66.204 VGV/PSV: 28.481

CURITIBA L: 49 U: 5.164 VGV/PSV: 2.024

VITRIA / VILA VELHA / SERRA

PR SC

L: 47 U: 5.659 VGV/PSV: 1.326

ARGENTINA

RIO DE JANEIRO

RS GRANDE RIO SO VICENTE / GUARUJ

PALHOA / SO JOS

FLORIANPOLIS /

L: 36 U: 4.585 VGV/PSV: 1.465

PORTO ALEGRE L: 64 U: 7.823 VGV/PSV: 2.976

SANTOS /

L: 33 U: 4.754 VGV/PSV: 2.215

HORTOLNDIA / VALINHOS

CAMPINAS / SUMAR

L: 32 U: 4.191 VGV/PSV: 1.050

L: 212 U: 29.160 VGV/PSV: 11.141

BRASIL/ BRAZIL

CIDADES VGV LANADO MM (R$) CITIES PSV LAUNCHED MM (R$) 5.000 3.000 2.000 1.000 324 28.481 4.999 2.999 1.999 999

NUMBER OF LAUNCHES

ESTADOS/ STATES PASES/ COUNTRIES OCEANO/ OCEAN L: NMERO DE LANAMENTOS/ U: UNIDADES LANADAS/ UNITS LAUNCHED VGV: VGV LANADO R$ MM/

PSV: PSV LAUNCHED IN R$ (M)

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

GENERAL DATA BY TYPE OF PROJECT KEY BRAZILIAN MARKETS, 2012

TIPO DE EMPREENDIMENTO/

TYPE OF PROJECT

DADOS GERAIS POR TIPO DE EMPREENDIMENTO PRINCIPAIS MERCADOS BRASILEIROS, 2012/

NMERO DE EMPREENDIMENTOS/

NO. OF PROJECTS

TORRES/

TOWERS

UNIDADES LANADAS/

UNITS LAUNCHED

VGV (MM)/

PSV (MM)

PREO M2 MEDIANO/

MEDIAN PRICE/ M

RESID. VERTICAL/ VERTICAL RESIDENTIAL COMERCIAL/ OFFICE SUITE FLAT/HOTEL/ FLAT/HOTEL TOTAL/ TOTAL

1.128 163 30 1.321

2.539 195 35 2.769

146.316 29.820 6.667 182.803

R$ 55.804 R$ 11.040 R$ 2.063 R$ 68.907

R$ 5.110 R$ 8.460 R$ 11.530 R$ 5.590

Quanto aos empreendimentos lanados nos principais mercados brasileiros: a) 86% foram residenciais verticais (1.128 ante 1.132 em 2011, -1%); b) 12% comerciais (163 ante 192 em 2011, -15%); c) 2% hotis e flats (30 ante 21 em 2011, +43%). Em 2012 foram lanadas 182.803 unidades, 15% menos em relao a 2011 (213.782 unidades). O preo mediano geral de um lanamento realizado no Brasil R$ 5.590/m, aumento de 9% em relao a 2011 (R$ 5.140/m). Para apartamentos, o preo mediano R$ 5.110/m, conjuntos comerciais R$ 8.460/m e hotis/flats R$ 11.530/ m. Em relao a 2011, verifica-se maior valorizao em hotis/flats, 15% (R$ 10.050/m em 2011), seguido por residenciais verticais com 10% (R$ 4.630/m) e conjuntos comerciais com 7% (R$ 7.930/m)./

Regarding projects launched in Brazils key markets: a) 86% were vertical residential projects (1,128, versus 1,132 in 2011, -1%); b) 12% were office suite projects (163, versus 192 in 2011, -15%); c) 2% were hotels and flats (30, versus 21 in 2011, -43%); In 2012, a total of 182,803 units were launched, or 15% less than in 2011 (213,782 units). The median price of launches in Brazil was R$5,590/m, increasing 9% from 2011 (R$5,140/m). The median price for apartments was R$5,110/m, for office suite towers was R$8,460/m and for hotels/flats was R$11,530/m. Compared to 2011, we observed greater price appreciation in hotels/flats of 15% (R$10,050/m in 2011), following by vertical residential projects with 10% (R$4,630/m) and office suite towers with 7% (R$7,930/m).

UNIDADES LANADAS POR MERCADO PRINCIPAIS MERCADOS BRASILEIROS, 2012/

PSV PER MARKET BRAZIL, 2012

66.204

183 mil Total Brasil/Total Brazil

29.160 12.030 8.823 7.823 7.889 6.380 4.754 5.164 7.513 5.376 4.585 5.659 4.191 2.536 4.008

DF P. Alegre Salvador1 Fortaleza Santos1 Curitiba Goinia1 Recife1 Florianpolis1 Vitria1 Campinas1 Manaus Natal1

708

Belm

RMSP/

MRSP

Grande RJ/

Greater RJ

BH1

1. e regio, detalhe na tabela na pgina 7./ 2. and region, detail on table on page 7.

10

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUaL REPOrT OF THE BraZILIaN REaL ESTaTE MarKET

Por meio dos dados gerais da pesquisa, algumas estatsticas relevantes foram definidas como: a) Nmero de empreendimentos, torres e unidades lanadas por tipo de empreendimento; b) Nmero mdio de unidades por empreendimento; c) VGV lanado total e mdio por tipo de empreendimento; d) Tquete mediano e preo do m mediano por tipo de empreendimento./ Based on the surveys general data, we defined certain relevant statistics, such as: a) Number of projects, towers and units launched by type of project; b) Average number of units per project; c) Total and average PSV launched by type of project; d) Median ticket and median price/m by type of project.

DADOS GERAIS/ GENERAL DATA

EMPREENDIMENTOS/ PROJECTS Residencial vertical/ Vertical residential 1.128 (86%) Comercial/ Office suite 163 (12%) Flat/Hotel/ Flat/Hotel 30 (2%) Total/ Total 1.321

TORRES/ TOWERS Residencial vertical/ Vertical residential 2.539 (92%) Comercial/ Office suite 195 (7%) Flat/Hotel/ Flat/Hotel 35 (1%) Total/ Total 2.769

UNIDADES LANADAS/ UNITS LAuNChEd Residencial vertical/ Vertical residential 146.316 (80%) Comercial/ Office suite 29.820 (16%) Flat/Hotel/ Flat/Hotel 6.667 (4%) Total/ Total 182.803

UNIDADES, MDIA POR EMPREENDIMENTO/ AVERAGE UNITS PER PROJETCT Residencial vertical/ Vertical residential 130 Comercial/ Office suite 183 Flat/Hotel/ Flat/Hotel 222 Total/ Total 138

VGV LANADO (R$)/ PSV OF LAUNCHED PROJECTS (R$) Residencial vertical/ Vertical residential 55,8 bi/ B (81%) Comercial/ Office suite 11,0 bi (16%) Flat/Hotel/ Flat/Hotel 2,1 bi (3%) Total/ Total 68,9 bihes/ billion

VGV MDIO POR EMPREENDIMENTO (R$)/ AVERAGE PSV PER BUILDING (R$) Residencial vertical/ Vertical residential Comercial/ Office suite Flat/Hotel/ Flat/Hotel Total/ Total

49 mi/ M 68 mi/ M 69 mi/ M 52 mi/ M

PREOS/ PRICES

TQuETE MEDIANO (R$)/ MEdIAN TICKET (R$) Residencial vertical/ Vertical residential 375 mil/ K Comercial/ Office suite 360 mil/ K Flat/Hotel/ Flat/Hotel 307 mil/ K Total/ Total 368 mil/ K

PREO M MEDIANO (R$)/ MEdIAN PRICE/m2 (R$) Residencial vertical/ Vertical residential 5.110/m Comercial/ Office suite 8.460/m Flat/Hotel/ Flat/Hotel 11.530/m Total/ Total 5.590/m

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

11

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

O quadro abaixo complementa dados gerais por mercado citados na pgina 9./ The following table complements the general data by market shown on page 9.

GENERAL DATA BY MARKET KEY BRAZILIAN MARKETS, 2012

REGIO/

LOCATION

DADOS GERAIS POR MERCADO PRINCIPAIS MERCADOS BRASILEIROS, 2012/

ESTADO/

STATE

NMERO DE EMPREENDIMENTOS/

NO. OF PROJECTS

TORRES/

TOWERS

UNIDADES LANADAS/

UNITS LAUNCHED

VGV (MM)/

PSV (M)

REGIO METROPOLITANA DE SO PAULO/ SO PAULO METROPOLITAN AREA GRANDE RIO DE JANEIRO/ GREATER RJ BELO HORIZONTE E/AND BETIM DISTRITO FEDERAL/ FEDERAL DISTRICT PORTO ALEGRE SALVADOR, LAURO DE FREITAS E/AND CAMAARI FORTALEZA SANTOS, GUARUJ E/AND SO VICENTE CURITIBA GOINIA E/AND APARECIDA DE GOINIA RECIFE E/AND JABOATO DOS GUARARAPES FLORIANPOLIS, PALHOA E/AND SO JOS VITRIA, SERRA, VILA VELHA E/AND CARIACICA CAMPINAS, VALINHOS, HORTOLNDIA E/AND SUMAR MANAUS NATAL E/AND PARNAMIRIM BELM TOTAL/ TOTAL

SP RJ MG DF RS BA CE SP PR GO PE SC ES SP AM RN PA -

427 212 134 51 64 67 44 33 49 38 49 36 47 32 11 23 4 1.321

683 491 347 75 137 135 100 37 93 63 82 119 94 142 73 84 14 2.769

66.204 29.160 12.030 8.823 7.823 7.889 6.380 4.754 5.164 7.513 5.376 4.585 5.659 4.191 2.536 4.008 708 182.803

R$ 28.481 R$ 11.141 R$ 3.913 R$ 3.331 R$ 2.976 R$ 2.661 R$ 2.400 R$ 2.215 R$ 2.024 R$ 1.951 R$ 1.922 R$ 1.465 R$ 1.326 R$ 1.050 R$ 1.018 R$ 707 R$ 324 R$ 68.907

Dez municpios representam 56% do VGV total lanado (R$ 45 bi de R$ 80 bi): So Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre, Fortaleza, Salvador, Curitiba, Guarulhos, Goinia e Santos. Destaque para Fortaleza e Guarulhos que no estavam no Top 10 em 2011 e que em 2012 ficaram na 5 e na 8 colocao, respectivamente. / Ten municipalities account for 56% of the total PSV launched (R$45 billion of R$80 billion): So Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre, Fortaleza, Salvador, Curitiba, Guarulhos, Goinia and Santos. Note that although Fortaleza and Guarulhos did not figure among the Top 10 in 2011, this year they ranked 5th and 8th, respectively.

TOP 10 MUNICPIOS POR VGV LANADO, 2012/ TOP 10 MUNICIPALITIES BY LAUNCH PSV, 2012

MUNICPIO/

CITY

NMERO DE EMPREENDIMENTOS/

NO. OF PROJECTS

TORRES/

TOWERS

UNIDADES LANADAS/

UNITS LAUNCHED

VGV (MM)/

PSV (M)

% VGV/

% PSV

SO PAULO RIO DE JANEIRO BELO HORIZONTE PORTO ALEGRE FORTALEZA SALVADOR CURITIBA GUARULHOS GOINIA SANTOS TOTAL/ TOTAL

265 134 113 64 44 55 49 26 36 21 807

347 278 206 137 100 78 93 56 55 22 1.372

34.722 17.812 8.968 7.823 6.380 5.704 5.164 5.883 6.713 3.659 102.828

R$ 18.343 R$ 7.829 R$ 3.488 R$ 2.976 R$ 2.400 R$ 2.373 R$ 2.024 R$ 1.957 R$ 1.841 R$ 1.726 R$ 44.958

41% 17% 8% 7% 5% 5% 5% 4% 4% 4% 100%

12

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

APARTAMENTOS/ APARTMENTS

As anlises desta pgina retratam os apartamentos lanados em 2012 nos principais mercados brasileiros (146.316 apartamentos). Veja os grficos de unidades lanadas por n de dormitrios, rea privativa e trimestre./ The analyses on this page cover apartments launched in 2012 in key Brazilian markets (146,316 apartments). See the charts on units launched by number of bedrooms, useful area and quarter.

UNIDADES LANADAS POR DORMITRIO (MIL)12

UNITS LAUNCHED PER BEDROOM (K)12

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012 APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

UNIDADES LANADAS POR TRIMESTRE (MIL)

UNITS LAUNCHED PER QUARTER (K)

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012 APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

80,30 41,66 11,93

1 2 3 4

56%

29

8%

29,65 8,27

5 ou mais or more

20%

35,65

24

33,20

23%

47,83

33%

0,08

1 TRI 1st Q 2 TRI 2nd Q 3 TRI 3rd Q 4 TRI 4th Q

0%

A distribuio de unidades lanadas por dormitrio manteve-se estvel em relao a 2011. O maior volume de apartamentos lanados no Brasil possui 2 dormitrios (80 mil unidades ou 56% do total). Apartamentos com 2 ou 3 dormitrios representam 85% do total lanado, 8% possuem 1 dormitrio e 6% possuem 4 dormitrios ou mais./ The distribution of units launched by number of bedrooms remained stable compared to 2011. Most apartments launched in Brazil have 2 bedrooms (80,000 units, 56% of total). Apartments with 2 or 3 bedrooms represent 85% of all new property launches, with 1-bedroom apartments accounting for 8% and apartments with 4 or more bedrooms accounting for 6%.

Conclui-se que o segundo semestre do ano acumula a maioria das unidades lanadas, 56%, sendo o quarto trimestre o mais importante para o setor, com 33% das unidades lanadas. J o primeiro trimestre sofre sazonalidade e recebe apenas 20% do total lanado./ We concluded that the second half of the year concentrates most units launched, or 56%, with the fourth quarter being the most important for the industry, with 33% of units launched. On the other hand, the first quarter is impacted by seasonality, accounting for only 20% of all units launched.

UNIDADES LANADAS POR REA PRIVATIVA (MIL)1/ UNITS LAUNCHED PER PRIVATE USEFUL AREA (K)1

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012/ APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

39%

55,83

29%

40,94

16%

23,29

6%

8,92

4%

5,79

A distribuio dos apartamentos por rea privativa tambm mantevese estvel em relao a 2011, sendo 68% at 69 m, 84% at 89 m e 90% at 109 m./ The distribution of apartments by private useful area also remained stable from 2011, with 68% up to 69m, 84% up to 89m and 90% up to 109m.

2%

2,47

1%

1,68

1%

1,18

1%

1,53

0%

0,68

0%

0,28

at/ up to 49

50 a/ to 69

70 a/ to 89

90 a/ to 109

110 a/ to 129

130 a/ to 149

150 a/ to 169

170 a/ to 199

200 a/ to 249

250 a/ to 299

300 ou mais or more m2

At/ up to 69 m: 68% At/ up to 89 m: 84% At/ up to 109 m: 90%

1. Somente unidades tipo. 2. Foram desconsiderados 3 empreendimentos com 0 dormitrio./ 1. Only these unit types. 2. 3 projects with 0 bedrooms were disconsidered.

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

13

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

APARTAMENTOS/ APARTMENTS

O preo mediano dos apartamentos no Brasil R$ 5.110/m, 10% superior a 2011 (R$ 4.630/m). Veja grficos de preos do m por n de dormitrios e rea privativa./ The median price of apartments in Brazil is R$ 5,110/m, higher than in 2011 (R$4,630/m). See the charts on prices/m per number of bedrooms and private useful area.

PREO M2 MEDIANO POR N DE DORMITRIO123

PRICE/M2 BY NUMBER OF BEDROOMS123

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012 APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

O preo mediano do m de apartamentos com 1 dormitrio R$ 6.650/m, 2 dormitrios R$ 4.530/m, 3 dormitrios R$ 5.120/m, 4 dormitrios R$ 6.630/m e 5 ou mais R$ 7.740/m. De modo geral, os apartamentos com at 49 m de rea privativa custam em mdia R$ 4.000/m. Apartamentos de 50 a 89 m custam cerca de R$ 5.000/ m, de 90 a 169 m R$ 6.000/m, de 170 a 199 m R$ 7.000/m e apartamentos maiores, a partir de 200 m, custam em mdia de R$ 8.000/m a 9.000/m./ The median price per m of 1-bedroom apartments was R$6,650/m, for 2 bedrooms was R$4,530/m, for 3 bedrooms was R$5,120/m, for 4 bedrooms was R$6,630/m and for 4 or more bedrooms was R$7,740/m. In general, apartments with up to 49 m of private useful area cost on average R$4,000/m. Apartments from 50 to 89 m cost on average R$ 5,000/m, from 90 to 169 m cost around R$ 6,000/m, from 170 to 199 m cost around R$7,000/m, and larger apartments from 200 m and above cost on average from R$8,000 to R$9,000 per m.

R$ 7.740 R$ 6.650 R$ 4.530 R$ 5.120 R$ 6.630

5 ou mais/ 5 or more

PREO M MEDIANO POR REA PRIVATIVA13/ MEDIAN PRICE/M2 PER PRIVATE USEFUL AREA13

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012/ APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

R$ 7.940 R$ 5.530 R$ 5.720 R$ 6.250 R$ 6.250 R$ 6.830

R$ 8.580 R$ 8.610

R$ 4.030

R$ 4.700

R$ 5.200

at/ up to 49

50 a/ to 69

70 a/ to 89

90 a/ to 109

110 a/ to 129

130 a/ to 149

150 a/ to 169

170 a/ to 199

200 a/ to 249

250 a/ to 299

m2 300 ou mais/ or more

1. Somente unidades tipo. 2. Foram desconsiderados 3 empreendimentos com 0 dormitrio. 3. Mnimo de duas tipologias para cada cruzamento./ 1. Only these unit types. 2. 3 projects with 0 bedrooms were disconsidered. 3. Minimum of 2 typologies for each cross-referenced data.

14

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

APARTAMENTOS/ APARTMENTS

PREO M2 MEDIANO POR MUNICPIO12/ MEDIAN PRICE/M PER CITY 12

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012/ APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

BRASLIA (DF) SANTOS (SP) SO PAULO (SP) FLORIANPOLIS (SC) NITERI (RJ) GUAS CLARAS (DF) CAMPINAS (SP) PETRPOLIS (RJ) RIO DE JANEIRO (RJ) GUARUJ (SP) RECIFE (PE) TAGUATINGA (DF) SO CAETANO DO SUL (SP) JABOATO DOS GUARARAPES (PE) PORTO ALEGRE (RS) CURITIBA (PR) FORTALEZA (CE) SALVADOR (BA) VITRIA (ES) SO BERNARDO DO CAMPO (SP) GUARULHOS (SP) SANTO ANDR (SP) DIADEMA (SP) BELO HORIZONTE (MG) PALHOA (SC) MANAUS (AM) TABOO DA SERRA (SP) OSASCO (SP) BARUERI (SP) NATAL (RN) VALINHOS (SP) MOGI DAS CRUZES (SP) MACA (RJ) SAMAMBAIA (DF) MAU (SP) COTIA (SP) ITABORA (RJ) VILA VELHA (ES) SO GONALO (RJ) GOINIA (GO) BETIM (MG) SO JOS (SC) SUMAR (SP) HORTOLNDIA (SP) SERRA (ES) CAMAARI (BA) 2.940 2.910 2.840 2.780 2.710 2.590 2.540 2.480

1. Somente unidades tipo. 2. Mnimo de oito tipologias para cada cruzamento./ 1. Only these unit types. 2. Minimum of 8 typologies for each cross-referenced data.

11.030 6.920 6.870 6.620 6.200 6.060 6.000 5.890 5.800 5.800 5.650 5.520 5.520 5.470 5.420 5.320 5.150 5.090 4.800 4.680 4.670 4.630 4.580 4.510 4.440 4.330 4.240 4.210 4.060 4.050 4.050 4.040 4.030 3.980 3.950 3.720 3.710 3.620

R$ 5.110 Preo do m mediano no Brasil Median price/m Brazil

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

15

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

APARTAMENTOS/ APARTMENTS

Se em 2011 o tquete mediano de um apartamento no Brasil era de R$ 316 mil, em 2012 este valor subiu para R$ 375 mil, aumento de 19%./ Whereas in 2011 the median ticket of an apartment in Brazil was R$ 316,000, in 2012 this figure increased 19% to R$375,000.

PREO MEDIANO POR MERCADO (MIL)1/ MEDIAN PRICE PER MARKET (K)1

APARTAMENTOS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012/ APARTMENTS LAUNCHED KEY BRAZILIAN MARKETS, 2012

RMSP/ MRSP Grande RJ/ Greater RJ

Santos2

Fortaleza

Natal2

Porto Alegre

R$ 387

R$ 375

Salvador2

R$ 360

R$ 337

R$ 328

R$ 281

R$ 273

R$ 236

R$ 198

1. Somente unidades tipo. 2. e regio, detalhe na tabela da pgina 7./ 1. Only these unit types. 2. and region, detail on table on page 7.

16

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

DF/ FD

Vitria2

Goinia2

Campinas2

R$ 182

R$ 540

R$ 486

R$ 427

R$ 420

R$ 396

R$ 395

Manaus

Curitiba

BRASIL

Florianpolis2

BH2

Recife2

R$ 302

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

CONJUNTOS COMERCIAIS/ OFFICE SUITES

Em 2012 foram lanados 163 empreendimentos comerciais, VGV de R$ 11 bi, 195 torres e 29.820 unidades. O preo mediano geral R$ 8.460/m./ In 2012, 163 office suite projects were launched with combined PSV of R$11 billion, 195 towers and 29,820 units. The median price was R$8,460/m.

DADOS GERAIS EMPREENDIMENTOS COMERCIAIS CONJUNTOS COMERCIAIS LANADOS. PRINCIPAIS MERCADOS BRASILEIROS, 2012/ GENERAL DATA FOR OFFICE SUITE PROJECTS OFFICE SUITE LAUNCHED. KEY BRAZILIAN MARKETS, 2012

REGIO/

LOCATION

NMERO DE ESTADO EMPREENDIMENTOS/ TORRES/

STATE NO. OF PROJECTS TOWERS

UNIDADES LANADAS/

UNITS LAUNCHED

VGV (MM)/

PSV (M)

% VGV/

% PSV

TQUETE MEDIANO (MIL)/

MEDIAN TICKET (K)

PREO M2 MEDIANO

MEDIAN PRICE/ M

REGIO METROPOLITANA DE SO PAULO/ MRSP GRANDE RIO DE JANEIRO/ GREATER RJ DISTRITO FEDERAL/ FEDERAL DISTRICT BELO HORIZONTE E/ AND BETIM SANTOS, SO VICENTE E GUARUJ PORTO ALEGRE GOINIA SALVADOR E/ AND LAURO DE FREITAS CURITIBA FLORIANPOLIS E/ AND PALHOA RECIFE CAMPINAS E/ AND SUMAR VITRIA, VILA VELHA E/ AND CARIACICA FORTALEZA NATAL TOTAL/ TOTAL

SP RJ DF MG SP RS GO BA PR SC PE SP ES CE RN -

66 23 8 15 7 7 6 5 6 3 4 3 5 3 2 163

70 27 21 19 7 7 6 5 6 6 6 3 7 3 2 195

11.087 4.900 2.596 1.702 1.632 1.097 1.562 1.136 1.061 631 504 362 744 503 303 29.820

R$ 4.996 R$ 1.317 R$ 1.134 R$ 824 R$ 577 R$ 447 R$ 369 R$ 323 R$ 270 R$ 200 R$ 177 R$ 123 R$ 114 R$ 108 R$ 61 R$ 11.040

45% 12% 10% 7% 5% 4% 3% 3% 2% 2% 2% 1% 1% 1% 1% 100%

R$ 431 R$ 187 R$ 371 R$ 540 R$ 356 R$ 367 R$ 252 R$ 278 R$ 299 R$ 265 R$ 344 R$ 355 R$ 156 R$ 225 R$ 199 R$ 360

R$ 9.880 R$ 7.480 R$ 10.860 R$ 7.300 R$ 7.430 R$ 8.290 R$ 5.310 R$ 7.650 R$ 6.350 R$ 7.910 R$ 7.730 R$ 5.850 R$ 5.800 R$ 7.060 R$ 5.350 R$ 8.460

Em 2012, os lanamentos de conjuntos comerciais representaram 16% do VGV total lanado nos principais mercados brasileiros, 16% das unidades e 12% do nmero de empreendimentos. Em relao a 2011 houve reduo de 15% no nmero de lanamentos, 23% em unidades e 19% em VGV. A maioria dos conjuntos comerciais foi lanada na RMSP e Grande Rio de Janeiro: 54% do total lanado no Pas, 15.987 de 29.820. A maioria dos mercados cresceu ou permaneceu estvel quanto ao nmero de unidades lanadas. Os mercados que mais receberam unidades em relao a 2011 foram Recife, Santos, Campinas, Belo Horizonte e Fortaleza. Porto Alegre, Natal, Salvador, Goinia, Curitiba e Florianpolis permaneceram estveis, com variao de 10% para mais ou para menos, enquanto a minoria sofreu reduo no nmero de unidades lanadas: Grande Rio de Janeiro, Vitria, Distrito Federal e Regio Metropolitana de So Paulo./ In 2012, office suite tower launches represented 16% of the total PSV of all launches in key Brazilian markets, 16% of units and 12% of the total number of projects. In relation to 2011, the number of launches fell by 15%, units by 23% and PSV by 19%. Most office suite towers were launched in the So Paulo Metro Area and in Greater Rio de Janeiro: 54% of all launches in the country, or 15,987 of the total of 29,820. Most markets either grew or remained flat in terms of units launched. The markets that grew the most in terms of units from 2011 were Recife, Santos, Campinas, Belo Horizonte and Fortaleza. Porto Alegre, Natal, Salvador, Goinia, Curitiba and Florianpolis remained relatively stable, with increases or decreases of less that 10%, while a few markets suffered reductions in units launched: Greater Rio de Janeiro, Vitria, Federal District and So Paulo Metro Area.

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

17

MERCADO BRASILEIRO DE LANAMENTOS 2012 2012 BRAZILIAN MARKET FOR REAL

ESTATE PROJECT LAUNCHES

Preo m2 medIano por mUnIcpIo1/ MEDIAN pRICE/m pER CITY1

ConjUntos comErcIaIs Lanados PrIncIpaIs mErcados brasILEIros, 2012/ OFFICE sUITEs LAUNCHED. KEy BRAZILIAN MARKETs, 2012

11.840 11.300 10.250 8.900 8.720 8.540 8.320 8.290 8.270 8.190 8.110 8.100 7.990 7.870 7.870 7.730 7.710 7.690 7.690 7.550 7.500 7.490 7.150 7.100 7.060 7.030 6.690 6.570 6.510 6.350 5.980 5.840 5.780 5.590 5.440 5.350 5.310 5.080 5.030 4.260

1. Somente unidades tipo./ 1. Only these unit types.

BRASLIA (DF) SO PAULO (SP) NITERI (RJ) vItrIa (es) campInas (sp) TAGUATINGA (DF) So caetano (Sp) PORTO ALEGRE (RS) FLORIANPOLIS (SC) osasco (sp) BARUERI (SP) rIo de janeIro (RJ) taBoo da serra (sp) salvador (Ba) santo andr (sp) RECIFE (PE) dUQUe de caXIas (RJ) Belo horIZonte (mg) cotIa (sp) santana de parnaBa (sp) santos (sp) so Bernardo (sp) dIadema (sp) gUarUlhos (sp) fortaleZa (ce) campos dos goYtacaZes (rj) so vIcente (sp) mogI das crUZes (sp) ItaBora (rj) cUrItIBa (pr) so gonalo (rj) palhoa (sc) BetIm (mg) sUmar (sp) laUro de freItas (Ba) natal (rn) goInIa (go) carIacIca (es) gUarUj (sp) vIla velha (es)

R$ 8.460 Preo do m mediano no Brasil Median price/m Brazil

18

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

2012 ANNUAL REPORT OF THE BRAZILIAN REAL ESTATE MARKET

FLATS/HOTIS/ FLATS/HOTELS

Quanto a flats/hotis, 30 empreendimentos foram lanados nos principais mercados nacionais, VGV de R$ 2,1 bi, 35 torres e 6.667 unidades, sendo que 72% dessas unidades esto localizadas no Sudeste: Grande Rio de Janeiro (1.663), RMSP (1.557 unidades), Belo Horizonte (1.431) e Vitria (160). O preo mediano geral de um imvel tipo hotel/flat de R$ 11.530/m./ A total of 30 hotel/flat projects were launched in key Brazilian markets, with combined PSV of R$2.1 billion, 35 towers and 6,667 units, of which 72% were located in the Southeast region: Greater Rio de Janeiro (1,663), So Paulo Metro Area (1,557 units), Belo Horizonte (1,431) and Vitria (160). The overall median price of a hotel/ flat property was R$11,530/m.

DADOS GERAIS HOTIS/FLATS PRINCIPAIS MERCADOS BRASILEIROS, 2012/

GENERAL DATA HOTELS/FLATS LAUNCHED KEY BRAZILIAN MARKETS, 2012

REGIO/

LOCATION

NMERO DE ESTADO EMPREENDIMENTOS/ TORRES/

STATE NO. OF PROJECTS

UNIDADES LANADAS/

VGV (MM)/

PSV (M)

% VGV/

TQUETE MEDIANO (MIL)/

PREO M2 MEDIANO

TOWERS UNITS LAUNCHED

% PSV MEDIAN TICKET (K) MEDIAN PRICE/ M

RMSP GRANDE RIO DE JANEIRO/ GREATER RJ BELO HORIZONTE SALVADOR CURITIBA PORTO ALEGRE DISTRITO FEDERAL/ FEDERAL DISTRICT SANTOS GOINIA VITRIA TOTAL/ TOTAL

SP RJ MG BA PR RS DF SP GO ES -

5 6 9 2 2 2 1 1 1 1 30

7 9 9 2 2 2 1 1 1 1 35

1.557 1.663 1.431 428 376 358 264 240 190 160

R$ 548 R$ 541 R$ 377 R$ 132 R$ 123 R$ 110 R$ 100 R$ 74 R$ 37 R$ 21

27% 26% 18% 6% 6% 5% 5% 4% 2% 1%

R$ 400 R$ 317 R$ 230 R$ 243 R$ 329 R$ 305 R$ 380 R$ 307 R$ 223 R$ 133 R$ 307

R$ 13.600 R$ 11.160 R$ 11.530 R$ 7.250 R$ 12.150 R$ 11.740 R$ 15.280 R$ 16.650 R$ 7.000 R$ 7.710 R$ 11.530

6.667 R$ 2.063 100%

PREO M2 MEDIANO POR MUNICPIO1/ MEDIAN PRICE/M PER CITY1

HOTIS/FLATS LANADOS PRINCIPAIS MERCADOS BRASILEIROS, 2012/ HOTELS/FLATS LAUNCHED KEY BRAZILIAN MARKETS, 2012

RIO DE JANEIRO (RJ) SO PAULO (SP) SANTOS (SP) BRASLIA (DF) SO CAETANO DO SUL (SP) SANTO ANDR (SP) DUQUE DE CAXIAS (RJ) CURITIBA (PR) PORTO ALEGRE (RS) BELO HORIZONTE (MG) MACA (RJ) CAMPOS DOS GOYTACAZES (RJ) BARUERI (SP) ITABORA (RJ) VITRIA (ES) SALVADOR (BA) GOINIA (GO) 8.930 7.710 7.250 7.000

1. Somente unidades tipo./ 1. Only these unit types.

Embora tenha aumentado o nmero de empreendimentos lanados (30 ante 21 em 2011), o nmero de unidades manteve-se estvel (6.667 ante 6.426 em 2011).

22.840

17.750 16.650 15.280 14.450 13.600 13.010 12.150 11.740 11.530 11.510 10.810 10.630

Como curiosidade, 7 das 12 cidades-sede da Copa do Mundo de 2014 tiveram lanamentos hoteleiros em 2012: Rio de Janeiro, So Paulo, Braslia, Curitiba, Porto Alegre, Belo Horizonte e Salvador. J Fortaleza, Manaus, Natal e Recife no receberam lanamentos. Cuiab, que tambm uma cidadesede da Copa, no faz parte da amostra detalhada do Anurio. Despite the increase in the number of projects launched (30, versus 21 in 2011), the number of units remained flat (6,667, versus 6,426 in 2011). Its curious to note that 7 of the 12 host cities for the 2014 FIFA World Cup had hotel launches in 2012: Rio de Janeiro, So Paulo, Braslia, Curitiba, Porto Alegre, Belo Horizonte and Salvador. Four of these cities Fortaleza, Manaus, Natal and Recife registered no launches. Cuiab, the last host city of the Soccer World Cup, is not part of the sample of the Annual Report.

19

R$ 11.530 preo m mediano Brasil Median price/m Brazil

ANURIO DO MERCADO IMOBILIRIO BRASILEIRO 2012

inteligenciademercado@lopes.com.br

You might also like

- Esta Velha Angustia Alvaro CamposDocument1 pageEsta Velha Angustia Alvaro CamposAnonymous ApivFR2Rr0% (1)

- 3 Guia Re Ciclo 15 PDFDocument24 pages3 Guia Re Ciclo 15 PDFJayne de MeloNo ratings yet

- TCC - Fernanda SampaioDocument33 pagesTCC - Fernanda SampaioLia VieiraNo ratings yet

- Atividade Avaliativa de Matemática 4 Ano 2021Document5 pagesAtividade Avaliativa de Matemática 4 Ano 2021Ariane DominguesNo ratings yet

- Aula 3 - Acidente Do Trabalho - LiaDocument41 pagesAula 3 - Acidente Do Trabalho - LiaLia Tavares TeixeiraNo ratings yet

- A Kroton Educacional e o Discurso de Negação Da Docência Como ProfissãoDocument6 pagesA Kroton Educacional e o Discurso de Negação Da Docência Como ProfissãolopesmelopcNo ratings yet

- Salvador Gentile - o Passe MagnéticoDocument106 pagesSalvador Gentile - o Passe MagnéticoKahel_Seraph100% (3)

- Balanço PatrimonialDocument57 pagesBalanço Patrimonialmorais_phillip5327No ratings yet

- Pratica de Pesquisa I Aula 1Document29 pagesPratica de Pesquisa I Aula 1LAZARO LUCIANONo ratings yet

- Teste de Português 9º AnoDocument1 pageTeste de Português 9º AnoRikkLetrasNo ratings yet

- Sermão de Santo António Aos PeixesDocument7 pagesSermão de Santo António Aos PeixesInês PereiraNo ratings yet

- Desafio 3 - Plano - Do - Projeto - ArgonauticaDocument19 pagesDesafio 3 - Plano - Do - Projeto - ArgonauticaCristiana Drumond100% (5)

- Portas Abertas Eli Soares - Pesquisa GoogleDocument1 pagePortas Abertas Eli Soares - Pesquisa Google764my5b2h7No ratings yet

- Luz Sobre Hildegarda PDFDocument26 pagesLuz Sobre Hildegarda PDFRafael FrotaNo ratings yet

- Fatura: Signature Not VerifiedDocument1 pageFatura: Signature Not VerifiedpaubernardoNo ratings yet

- Tipos de AconselhamentoDocument6 pagesTipos de Aconselhamentobenedito costa juniorNo ratings yet

- Inglês TécnicoDocument14 pagesInglês TécnicoFabricio FélixNo ratings yet

- EDITAL 004 21 PPGCAF Mestrado 2022 Com ERRATADocument29 pagesEDITAL 004 21 PPGCAF Mestrado 2022 Com ERRATAcarolcruzrjNo ratings yet

- Acidente Do Trabalho FATEC PDFDocument24 pagesAcidente Do Trabalho FATEC PDFGabriel SantosNo ratings yet

- Trabalho de LiteraturaDocument10 pagesTrabalho de LiteraturaVictorDieselDieselNo ratings yet

- 5 - Planejamento Regional e Urbano - Pós-GraduaçãoDocument43 pages5 - Planejamento Regional e Urbano - Pós-GraduaçãoProf. Eduardo AlmeidaNo ratings yet

- Avaliação - Filosofia Da LinguagemDocument5 pagesAvaliação - Filosofia Da LinguagemRaniere Antônio Bicalho JúniorNo ratings yet

- Globalização DR4Document8 pagesGlobalização DR4Ana Paula Gaspar100% (10)

- Check List - Talha - MensalDocument1 pageCheck List - Talha - MensalRafael HerdyNo ratings yet

- PPC ArquiteturaeUrbanismoDocument283 pagesPPC ArquiteturaeUrbanismoVenoninho EtstuemeNo ratings yet

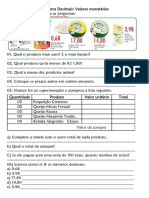

- Valores MonetáriosDocument2 pagesValores MonetáriosKatia Teixeira95% (22)

- Edital UnibraDocument7 pagesEdital UnibraLucas LkNo ratings yet

- Os Nomes de DeusDocument5 pagesOs Nomes de DeusprwilsonrafaelNo ratings yet

- 012 Eventos Finais - A SacudiduraDocument17 pages012 Eventos Finais - A SacudiduraMarcelo Pereira100% (1)

- Estratificacao e Mobilidade Social.Document17 pagesEstratificacao e Mobilidade Social.mineliochemaneNo ratings yet