Professional Documents

Culture Documents

Smith Injury NJ Redacted Tinari 405

Uploaded by

George ConkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Smith Injury NJ Redacted Tinari 405

Uploaded by

George ConkCopyright:

Available Formats

REDACTED REPORT

AN APPRAISAL OF ECONOMIC LOSS SUFFERED BY MARY SMITH

Frank D. Tinari, Ph.D.

TINARI ECONOMICS, INC. 220 South Orange Avenue Suite 203 Livingston, NJ 07039 973 / 992-1800 phone 973 / 992-0023 fax

www.TinariEconomics.com

November 5, 2004

TABLE OF CONTENTS

Certification

.................................. 1

Purpose of Appraisal . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Opinion of Economic Damages . . . . . . . . . . . . . . . . . . . . 2 Background Facts and Assumptions . . . . . . . . . . . . . . . . 3 Components of Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Net Earnings in Past Years . . . . . . . . . . . . . . . . . . . . . . . 7 Net Earnings in Future Years . . . . . . . . . . . . . . . . . . . . . 10 Pension Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Household Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 Social Security Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 Exhibit Appendix of Tables Qualifications Profile Statement of Ethical Principles and Principles of Professional Practice

Certification This is to certify that I am not related to any of the parties to subject action, nor do I have any present or intended financial interest in this case beyond the fees due for professional services rendered in connection with this report and possible subsequent services. Further, I certify that my professional fees are not contingent on the outcome of this matter but are based on the time expended on the services provided to counsel in connection with subject action. This is to further certify that all assumptions, methodologies, and calculations utilized in this appraisal report are based on current knowledge and methods applied in the determination of projected pecuniary losses. In addition, this is to further certify that I pledge to abide by the spirit and the letter of the Statement of Ethical Principles and Principles of Professional Practice of the National Association of Forensic Economics, a copy of which is attached to this report.

Frank D. Tinari, Ph.D.

SMITH

/ Law Firm

page

Purpose of Appraisal Counsel requested us to prepare an evaluation of the economic damages suffered by Mary Smith as a result of her injury. Background facts regarding the plaintiff were provided in a packet of documents pursuant to this matter. Facts from these sources as well as additional information gathered from published documents are fully referenced at the point of use in this report. The purpose of this report, therefore, is to provide a written appraisal of economic loss in the case of Mary Smith.

Opinion of Economic Damages Within a reasonable degree of economic certainty, and based on the analysis contained in this report, it is our professional opinion that the total present value of the pecuniary losses resulting from injury to suffered by Mary Smith amounts to between

NINE HUNDRED TWENTY-ONE THOUSAND, THREE HUNDRED THIRTY-FOUR DOLLARS, AFTER TAXES [ $921,334 ] and NINE HUNDRED NINETY-FIVE THOUSAND, ONE HUNDRED THIRTY-ONE DOLLARS, AFTER TAXES [ $995,131 ]

This range of estimated losses is a function of the degree of plaintiffs impairment in performing household services, a matter ultimately to be determined by the trier-of-fact. Further, these amounts do not take into account the ramifications of intangible, noneconomic losses such as human suffering, love, emotional feelings, or consortium that may have been suffered by plaintiff or family members.

SMITH

/ Law Firm

page

Background Facts and Assumptions 1) Plaintiff: 2) Date of birth: 3) Date of incident: 4) Residence: 5) Education: 6) Prior health: 7) Spouse: 8) Child: Mary Smith; female May 27, 1960 March 24, 2002 New Jersey some college excellent John (dob: 4/15/62) Amy (dob: 10/18/95)

9) Life expectancy: as of the date of injury, persons of Mrs. Smiths age (41.82 years) live, on average, an additional 35.87 years. [SOURCE: Rules Governing the Courts of the State of New Jersey , 2004 Edition, Appendix I.] Therefore, persons in plaintiff's statistical cohort have an expected total life span averaging 77.69 years, implying a statistical date of death of January 24, 2038. 10) Statistical retirement age: as of the date of injury, females of Mrs. Smiths age (41.82 years) and level of education (some college) have 20 years to retirement. [SOURCE: Tamorah Hunt, Joyce Pickersgill, and Herbert Rutemiller, "Median Years to Retirement and Worklife Expectancy for the Civilian U.S. Population" (Prepared Using 1992/93 BLS Labor Force Participation rates), Journal of Forensic Economics, 10(2), 1997, pp. 171-205, Appendix A - Table 5, by interpolation.] Applying the years to retirement results in a statistical retirement age of 61.82 years, occurring on March 24, 2022. For purposes of this report, we assume plaintiff would have retired at age 65, occurring on May 27, 2025. This is based on the normal retirement age noted in the Company Pension Plan. [SOURCE: Focus on you: Compensation, Benefits, Retirement.] 11) Expected working years: worklife expectancy tables provide statistics descriptive of the actual working life experience of the civilian population by age, employment status, and schooling. As of the date of injury, females of Mrs. Smiths age/education/labor-forceactivity statistical cohort average 17.43 years of remaining labor force activity. [SOURCE: James Ciecka, Thomas Donley, and Jerry Goldman, A Markov Process Model of Work-Life Expectancies by Educational Attainment Based on Labor Market Activity in 1997-98", Journal of Legal Economics, Volume 10, Number 3, Winter 2000-1, pp. 8-20, by interpolation.] 12) Worklife-to-retirement ratio: the number of years from March 24, 2002, until Mrs. Smiths statistical retirement date (20 years in this case) exceeds the number of expected

SMITH

/ Law Firm

page

remaining working years (17.43 in this case). Thus arithmetically, the number of years of worklife for this statistical cohort comprises 87.15% of the total remaining number of years until retirement. 13) Occupation and employment: Mrs. Smith had been employed by the Company located in New Jersey, since 1989. At the time of her injury, plaintiff was working part-time as a data quality analyst. [SOURCE: responses to Tinari Economics Fact-Finding Questionnaire.] In August 2001, plaintiff changed her employment status from full-time to part-time with the intention to be more available for her daughter since Amy was attending kindergarten. Plaintiff states that she had a verbal agreement with her supervisor and it was understood that she should regain her full-time status in September 2002 when her daughter entered first grade. Plaintiff was injured in an automobile accident on March 24, 2002, six months prior to her scheduled return to a full-time capacity. [SOURCES: letter from counsel, dated April 22, 2004, and letter from plaintiff, dated July 12, 2004.] For purposes of this analysis, we assume, had she not been injured, plaintiff would have returned to her full-time position beginning September 1, 2002. 14) Earnings history: [SOURCE: plaintiff's federal income tax returns, and W-2 Wage and Tax Statements.] Year 1999 2000 2001 2002 ^ W-2 Earnings $ 35,764 36,132 36,070 * 23,836

* plaintiff began part-time work in August ^ injury date: March 24

Based on review of plaintiff's paystubs, her hourly rates were $22.36 and $23 for 2001 and 2002, respectively. Further, her paystubs indicate that she worked about 37.5 and 28.5 hours per week in the periods July 28, 2001 (full-time), and October 20, 2001 (part-time), respectively. [SOURCES: plaintiff's paystubs, dated July 28, 2001, October 20, 2001, and June 29, 2002.] Given the aforementioned and plaintiffs previously noted intention to return to full-time status, we assume that plaintiff would have worked 28.5 hours per week in a parttime capacity through August 31, 2002, returning to full-time status (37.5 hour per week)

SMITH

/ Law Firm

page

effective September 1, 2002. Thus, we establish plaintiffs part-time earnings capacity at $34,086 ($23 x 28.5 hours x 52 weeks) in 2002 dollars and her full-time earnings capacity at $44,850 ($23 x 37.5 hours x 52 weeks) in 2002 dollars. Should other information be supplied, we could issue a supplementary report upon request. 15) Other sources of income: it is reported that plaintiff had received a total of $41,600 in loss-of-wage benefits from her automobile insurance carrier (Insurance Company) as of August 24, 2004. [SOURCE: letter from Senior Claims Representative, Insurance Company, dated August 24, 2004.] We do not apply this income as a source of mitigation in this report. Subsequent to a hearing on October 1, 2004, plaintiff was awarded Social Security Disability benefits. [SOURCE: Notice of Decision from Social Security Administrative Law Judge, undated.] It has been reported that plaintiff is expected to receive $1,200 per month. [SOURCES: letter from counsel, dated October 6, 2004, and facsimile transmission from counsel, dated October 14, 2004.] For purposes of this report, we assume that plaintiff is to receive this benefit retroactively effective to a date six months after her date of injury (September 1, 2002). Should more detail information be provided we could then issue a supplementary report, upon request. 16) Functionality and employment prospects: Dr. Murray opines that plaintiff would not be returning to work due to the extent of her discogenic pain and myofascial pain. He further states that plaintiff is unable to work because the patient has excessive pain with even minimum movement and work, at this time, would not be appropriate. [SOURCE: letter from George Murray, M.D., dated June 2, 2003.] In his report on plaintiffs pain management re-evaluation, Dr. Singer states: I agree with Dr. Murray that I do not believe that she would be able to return to work at this time. He further states: I do not believe that she would be able to hold down a job at this point, nor do I anticipate this in the future. [SOURCE: outpatient reevaluation of Smith, Mary prepared by Brian Singer, M.D., dated August 27, 2004.] Based on the aforementioned medical opinions, and the approval for Social Security Disability benefits, this appraisal assumes that plaintiff will not return to the work force. Should additional information be provided indicating that plaintiff has the ability to return to work in some capacity, we could provide a supplementary report at that time. 17) Fringe benefits: as a full-time employee of the Company, Mrs. Smith received a broad array of fringe benefits. These included family health insurance (medical, and prescription), life insurance (three times salary), long-term disability, and a pension plan (more on this

SMITH

/ Law Firm

page

below). Plaintiff also reports participating in the company 401(k) plan. She contributed seven (7) percent of earnings, and her employer matched $0.65 for every dollar contributed, up to 7% of salary. [SOURCES: Questionnaire, op. cit., Compensation & Benefits Statement 12/31/1999, and The Company - Draft 204(h) Notice for Transition Group, dated May 10, 2002.] Subsequent to her termination, plaintiff obtained coverage through her spouses employer-provided health insurance plan. [SOURCE: letter from counsel, dated July 14, 2004.] As a part-time employee, plaintiffs fringe benefits included a 401(k) plan, and pension. [SOURCES: plaintiffs Compensation & Benefits Statement - 3/31/2002, and Focus On You, op. cit.] Given the prospective nature of insurance, the loss of fringe benefits in past years is limited to out-of-pocket medical costs (none reported), and the 401(k) plan match (4.5%). Fringe benefits as a full-time employee are valued at 5.5% of gross earnings based on combined life and long-term disability insurance (1%), and 401(k) (4.5%). Given that plaintiff is currently covered by her husbands employer-provided health insurance, we do not consider a loss of future health benefits in this report. 18) Pension benefits: plaintiff participated in the Retirement Income Plan for the Company, an employer-funded pension plan. Effective on July 1, 2002, the plan has been amended and adapted a new pension benefits formula. At the time of her injury, plaintiff was fully-vested. [SOURCES: Questionnaire, ibid , and Draft 204(h) Notice, op. cit.] As the result of this amendment, plaintiffs pension benefit is the sum of the pre-June 30, 2002 benefit and the post-June 30, 2002 benefit. For purposes of this report, we calculate the potential pension income losses to plaintiff beginning on July 1, 2002, through her projected retirement age 65, based upon her projected pre-injury full-time employment. 19) Job-maintenance expenses: we assume that, as a result of this injury, plaintiff will not be employed. Her earnings, therefore, are adjusted (downward) to account for those job maintenance expenses normally incurred in maintaining employment. These expenses typically include transportation expenses, clothing, meals outside the home, and other costs. For purposes of this analysis, we estimate plaintiffs job maintenance expenses at five (5) percent of after-tax earnings. 20) Household services: prior to her injury, plaintiff reportedly performed cooking, cleaning, doing laundry, shopping, painting the house, mowing the law, gardening, removing snow, washing cars, and performing other house chores in and around her single family home. She also paid the family bills. Post-injury, plaintiff performs limited cleaning, cooking, and laundry. She needs help in performing shopping and washing cars. She does very little

SMITH

/ Law Firm

page

gardening work. She is still paying bills but the process takes longer than before. [SOURCE: notes from Mary Smith, dated July 12, 2004.] Based upon the information above, we calculate a range of loss of ability to perform household services of between forty (40) and sixty (60) percent. The exact degree of loss is left to a determination by the trier-of-fact upon a full hearing of all relevant facts in this matter. We reserve the right to amend this report should further information become available.

Components of Loss The pecuniary value of loss resulting from Mrs. Smiths injury is estimated by consideration of the following components of loss: 1. net earnings in past years 2. net earnings in future years 3. pension income 4. household services Each of these components is analyzed separately in the following sections of this appraisal report.

Loss of Net Earnings in Past Years This loss component consists of the net earnings Mrs. Smith would have been able to earn, had she not been injured, from the date of the injury to the present time. As stated in the Background Facts and Assumptions section, Mrs. Smith's pre-injury annual earnings capacity is established at $34,086 through the end of August 2002 in her part-time position and at $44,850 thereafter in a full-time position (both in 2002 dollars). To project plaintiffs annual earnings for the years 2003 and 2004, we apply an annual growth rate of 2.6 percent to her established earnings capacity, reflecting wage growth trends in recent years. [SOURCE: Hours and earnings in private nonagricultural industries, 1959-2003, Economic Report of the President, February 2004, Table B -47, http://w w w .gpoaccess.gov/ usbudget/fy05/sheets/b47.xls.] Applying the aforementioned, we calculate the following:

SMITH

/ Law Firm

page

Year 2002 2002 2003 2004

Gross Earnings Capacity [@ 2.6%] $ 34,086 ^ 44,850 * 46,016 47,213

^ part-time earnings rate * full-time earnings rate

Gross earnings are adjusted to take into account several factors that help determine net income lost. An adjustment for worklife expectancy is necessary because the number of years of actual working life is generally less than the total number of years until retirement. The estimated remaining years of worklife, given in the Background Facts and Assumptions section above, amounts to 87.15% of the total remaining number of years until retirement for persons of plaintiff's statistical cohort. An adjustment to gross earnings typically made in such appraisals takes into consideration the likelihood of periods of unemployment during a person's expected working life. Unemployment is an economy-wide phenomenon, but various statistical cohorts of the labor force experience different rates of unemployment. This adjustment is usually necessary since unemployment is not taken into consideration by worklife expectancy figures. The latter indicate the number of expected years of participation in the labor force, whereas unemployment refers to periods of no work of those persons already active in the labor force. The unemployment adjustment factor is calculated by first considering a time period in the immediate past that is comparable to the number of years until the projected retirement date. Between 1980 and 2003, females in plaintiffs age cohort experienced an unemployment rate average 4.1% per annum. [SOURCE: http://data.bls.gov/cgi-bin/srgate.] Moreover, since state unemployment compensation benefits serve to replace a portion of most workers' lost earnings during periods of unemployment, the percentage is adjusted downward from 4.1% to 3%. Thus, a downward adjustment of the estimated gross earnings losses is made using that percentage to represent the probability of unemployment (and, hence, lost earnings) during the remaining years of labor force activity.

SMITH

/ Law Firm

page

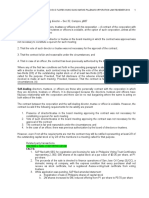

A reduction of gross earnings is made to account for the likely amounts of federal and state income taxes that would have been paid by the plaintiff on her projected earnings. Tax burdens vary in accordance with numerous factors that differ from taxpayer to taxpayer. Hence, it is quite difficult to ascertain the relevant liabilities in any individual instance without extensive knowledge of such factors. Given her projected level of earnings (fulltime), and plaintiffs federal income tax returns, we estimate her effective combined federal-state rate at fifteen (15) percent. Another adjustment takes into account the value of fringe benefits and out-of-pocket medical expenses incurred (none reported). As stated in the Background Facts and Assumption section, the assumed employer-matching portion (4.5%) of the 401(k) plan is applied to plaintiffs earnings in this appraisal report for the past years. The loss of fringe benefits for future years is estimated at 5.5%. This is based upon the loss of 401(k) plan (4.5%), and combined long-term disability and life insurance (1%). A final adjustment taken into account is job maintenance expenses that plaintiff would have continued to incur in maintaining her employment. These expenses typically include transportation expenses, clothing, meals outside the home and other costs. We estimate these expenses at 5% of earnings. Algebraically, the preceding adjustments are summarized as follows:

past years Gross Earnings Base x Worklife adjustment = Worklife-Adjusted Earnings x (1 - 3% unemployment probability) = Adjusted Earnings Base (AEB) x (1 + 4.5%, 5.5% fringe benefits) x (1 - 15% tax liabilities (TL)) = Tax/Fringe Adjusted Base x (1 - 5% job maintenance expenses) = Net Earnings Factor 1.0000 0.8715 0.8715 0.9700 0.8454 AEB x 1.0450 AEB x 0.8500 0.7566 (AEB - TL) x 0.95 0.7207 future years 1.0000 0.8715 0.8715 0.9700 0.8454 1.0550 0.8500 0.7650 0.9500 0.7291

Applying the preceding information, net earnings losses through the end of 2004 are derived as follows:

SMITH

/ Law Firm

page 10

Projected Gross Earnings Capacity Time Period [@ 2.6%] (1) 2002.80 2003 2004 (2) $30,929* 46,016 47,213 total:

Projected Net Earnings Capacity [(2) x 72.07%] (3) $22,291 33,164 34,026 $89,481

* application of part-annual earnings of $34,086 through 8/31 and $44,850 thereafter

Loss of Net Earnings in Future Years Future losses are calculated beginning January 1, 2005, and continue until plaintiffs projected date of retirement on May 27, 2025. Plaintiffs 2004 gross earnings capacity is established at $47,213. A growth rate of 4% per annum, reflecting expected wage growth, is applied through her projected retirement date. [SOURCES: Economic Assumptions and Methods, 2004 Annual Report of the Board of Trustees of the Federal Old-age and Survivors Insurance and Disability Insurance Trust Funds , Table V.B1, http://www.ssa.gov/OACT /TR/TR04/V_economic.html#131323, and Hours and earnings in private nonagricultural industries, 1959-2003 , Economic Report of the President, February 2004, Table B-47, http://w3.access.gpo.gov/usbudget/fy2005/sheets/b47.xls.] Regarding future projected losses, it is possible to set aside a lump-sum monetary amount at the present time such that the annual flow of interest earnings from it plus a part of the principal would generate the equivalent amount of lost financial sums projected for each successive year under consideration. In other words, money has a time value. Individual will forgo the use of a dollar today only if they expect that they will receive a larger amount in the future. This implies that pecuniary losses expected to be suffered at some future point in time are worth less in today's dollars. Thus, to calculate the present value of the required lumpsum amount, it is necessary to establish a reasonable discount rate factor. The tax-free return on Aaa municipal bonds serves as the basis of our discount rate. Over the past 5 years, the yield on Aaa municipal bonds of varying maturities has averaged 5.41%.

SMITH

/ Law Firm

page 11

Over the past 10 years, it has averaged 5.7%, and over the past 20 years, the yield has averaged 7.08%. [SOURCE: Thomas Ireland, Addendum: Historical Net Discount Rates An Update Through 2001, Table 2. Average Values for Various Interest Rates and Growth Rates in the CPI and the MCPI for the Number of Years Shown as Ending in 2001, Journal of Legal Economics, Volume 10, Number 3, Winter 2000-01, Table 2, pp. 65-66.] In light of historical municipal bond returns and current financial market trends, we select 6% as the appropriate discount rate. We note that interest earnings from any award in this case will be subject to future income taxation in each subsequent year. This poses a problem since the award will be, in effect, taxed indirectly when no provision has been made for this tax burden. Thus, it is assumed that any lump-sum award, will be used to purchase investment instruments that will provide a flow of nontaxable payments to plaintiff. Application of the preceding information yields a total present value of plaintiffs future net earnings loss, calculated as follows:

(see table on following page)

SMITH

/ Law Firm

page 12

Time Period (1) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025.38

Projected Gross Earnings Capacity [@ 4%] (2) $ 49,102 51,066 53,109 55,233 57,442 59,740 62,130 64,615 67,199 69,887 72,683 75,590 78,614 81,758 85,029 88,430 91,967 95,646 99,472 103,451 40,884

Projected Net Earnings Capacity [(2) x 72.91%] (3) $ 35,800 37,232 38,722 40,270 41,881 43,557 45,299 47,111 48,995 50,955 52,993 55,113 57,317 59,610 61,994 64,474 67,053 69,735 72,525 75,426 29,808 total:

Present Value [@ 6%] (4) $ 35,800 35,125 34,462 33,812 33,174 32,548 31,934 31,331 30,740 30,160 29,591 29,033 28,485 27,948 27,420 26,903 26,395 25,897 25,409 24,929 9,091 $ 610,181

Loss of Pension Income As the result of her injury, we assume that plaintiff will not return to work. As stated in the Background Fact and Assumptions, plaintiffs pension losses begin on July 1, 2002, given that the new amended plan guidelines become effective on that date. Assuming plaintiff would have retired at the plans normal retirement age 65 years, we project that she would have accrued an additional 22.88 years of benefit service from 7/1/2002 through her projected retirement date but for her injury. This assumes that plaintiff would have met the pension eligibility rule in each of these years.

SMITH

/ Law Firm

page 13

As provided in the Company Pension Plan booklet (Focus On You), the formula for the monthly pension benefits at normal retirement age 65 is as follows: 1.2% x FAP (final average pay) x Benefit Service FAP is the average monthly earnings based on the five highest years of base salary in the last 10 years prior to retirement. Benefits service is the number of service years. [SOURCE: Focus On You, op. cit.] Using plaintiffs projected earnings for the years 2015 through 2024, we calculate plaintiffs FAP at $7,983 at her projected retirement age of 65 years. Plaintiffs monthly pension income is calculated at $2,192 (1.2% x $7,983/month x 22.88 years of benefit service).This is equivalent to $26,304 annually. Based on the preceding analysis, the following table shows our calculations of pension income loss (based on a single life annuity payout option) beginning on May 27, 2025, through plaintiffs statistical date of death.

Annual Pension Income $16,308 26,304 26,304 26,304 26,304 26,304 26,304 26,304 26,304 26,304 26,304 26,304 26,304 1,578 total: Present Value [@ 6%] $ 5,085 7,737 7,299 6,886 6,497 6,129 5,782 5,455 5,146 4,855 4,580 4,321 4,076 231 $ 74,078

Time Period 2025.62 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038.06

SMITH

/ Law Firm

page 14

Loss of Household Services In the United States, time devoted to work is usually compensated in dollars and cents. A major exception is household work. Those who do this work include most of the women, children and men in our society. A significant cost of this work to the family is time, and not just a little of it! Household work is indispensable to the functioning of the family and society. It generally takes place outside the context of the business world, however, and therefore time spent at it is not normally given a dollar value. ... Household services take time to provide, if not the housewife's then the time of someone else. ... When the household services are turned over to someone else to produce, they have a money value--the value of the time spent by the worker. The same services are just as valuable when provided by a family member. Consequently, a money value can be given to the services... [SOURCE: William H. Gauger and Kathryn E. Walker, The Dollar Value of Household Work. Information Bulletin 60, New York State College of Human Ecology, Cornell University, September 1980, pages 1, 3.] Studies have been conducted to determine the extent and value of household services performed by various members of the family unit. According to a well-known study, the amount of household services provided by a married female where both husband and wife are employed in the labor force varies with the number and age of dependent children, as shown in the table below. [SOURCE: David H. Ciscel and David C. Sharp, "Household Labor in Hours by Family Type," Journal of Forensic Economics, 8(2), 1995, pages 117 & 119, Tables 1 and 3.] Moreover, with advancement in years, physical strength naturally diminishes. As people age, the probability of their being able to perform all of the household chores which were once done also diminishes. The elderly are more prone to slips, falls and various disabling illnesses. Statistical research provides data on the probability of such disabling occurrences. Therefore, we reduce the annual hours of household services by 11.3% between the ages of sixty-five (65) and seventy-five (75) and by 30.7% after age seventy-five (75) to account for the probability of plaintiff becoming disabled over her remaining statistical life expectancy. [SOURCE: U.S. Department of Commerce, Current Population Reports, Disability, Functional, Limitation, and Health Insurance Coverage: 1984/85, Household Economic Studies, Series P-70, No. 8, Table G, p. 8.]

SMITH

/ Law Firm

page 15

Application of the preceding information yields the adjusted number of hours assumed for each time period as follows:

Number /Age of Youngest Child (1) 1 / > 6 < 11 1 / >11 n/a n/a n/a Annual Number of Hours (3) 947 936 838 743 581

Age of Parent (2) under 65 under 65 under 65 65 to 74 over 75

Applicable Time Period (4) 03/14/02 - 10/07/07 10/08/07 - 10/07/13 10/08/13 - 05/16/25 05/17/25 - 05/16/35 05/17/35 - 01/24/38

Turning to the monetary value of these hours, average hourly earnings of nonsupervisory workers in the Private Service-Providing industry sector were $14.56 in 2002, and $14.96 in 2003. [SOURCE: U.S. Department of Labor, Bureau of Labor Statistics, Monthly Labor Review , May 2004, Table 25, p. 88.] To obtain a corresponding value for 2004, we apply a growth rate of 2.7%, which is the rate exhibited by the data between 2002 and 2003. This yields a wage rate of $15.36 for 2004. The pecuniary value of the household services that would have been provided through the present time is provided in the following table: Annual Number of Hours 758 947 947 total:

Year 2002 2003 2004

Portion of Year 0.80 1.00 1.00

Annual Value $ 11,031 14,167 14,546 $ 39,744

Services in future years are calculated beginning January 1, 2005, and extend until Mrs. Smiths statistical date of death. To project future values, we apply the assumed annual growth rate of 4%.

SMITH

/ Law Firm

page 16

To calculate the present value of the projected figures, it is necessary to establish a reasonable discount rate factor. We utilize 6% per annum as explained in the previous section. Application of the aforementioned information yields a total present value of future household services as calculated below:

Annual Hours of Service 947 947 944 936 936 936 936 936 913 838 838 838 838 838 838 838 838 838 838 838 779 743 743 743 743 743 743 743 743 743 643

Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

Annual Value [@ 4%] $ 15,128 15,733 16,318 16,819 17,492 18,191 18,919 19,676 19,970 19,053 19,815 20,608 21,432 22,290 23,181 24,108 25,073 26,076 27,119 28,203 27,270 27,047 28,129 29,254 30,424 31,641 32,906 34,223 35,592 37,015 33,292

Present Value [@ 6%] $ 15,128 14,842 14,523 14,122 13,855 13,594 13,337 13,086 12,530 11,278 11,065 10,856 10,651 10,450 10,253 10,060 9,870 9,684 9,501 9,322 8,503 7,956 7,806 7,659 7,514 7,372 7,233 7,097 6,963 6,831 5,796

SMITH

/ Law Firm

page 17

Year 2036 2037 2038.06

Annual Hours of Service 581 581 38

Annual Value [@ 4%] $ 31,306 32,559 2,187 total:

Present Value [@ 6%] $ 5,142 5,045 320 $329,241

Correspondingly, in light of these findings, the range of losses, based on a diminution of ability to perform household services of between forty (40) and sixty (60) percent, is provided in the following table: Value of Household Services Past Years [$39,744] Future Years [$329,241] Total Loss Assumed Range of Loss 40% $15,898 131,696 $147,594 50% $ 19,872 164,621 $ 184,493 60% $ 23,846 197,545 $221,392

SMITH

/ Law Firm

page 18

Social Security Income As stated in the Background Facts and Assumptions section of this report, plaintiff is expected to receive an award of $1,200 per month (in 2004 dollars) effective September 1, 2002. Social Security payments are subject to an annual Cost of Living Adjustment (COLA). For purposes of this appraisal report, 2.6%, 1.4% and 2.7% COLAs are applied to the years of 2002, 2003, and 2005, respectively. [SOURCES: http://www.ssa.gov/OACT/COLA/ colaseries.html, and http://www.ssa.gov/pressoffice/pr/ 2004cola-pr.htm.] To estimate future benefits for years 2006 and 2007, and subsequent to 2007, we apply projected COLA factors of 1.8% and 2.8%, respectively. [SOURCE: Economic Assumptions and Methods, 2004 Annual Report of the Board of Trustees of the Federal Old-age and Survivors Insurance and Disability Insurance Trust Funds , Table V.B1, http://www.ssa.gov/OACT/TR/TR04/ V_economic.html#141324.] Recent New Jersey case law has established that the court recognizes that, if Social Security benefits were treated as mitigating income, plaintiff would be entitled to a credit for the income tax portion of Social Security contributions made or that could have been made by the plaintiff for the time period for which Social Security Disability payments would have been deducted as offsetting payments. [SOURCE: Woodger v. Christ Hospital, 364 N.J. Super. 144, decided November 10, 2003.] The current Social Security (FICA) maximum rate is 7.65%, made up of two components: 1. Social Security benefits (OASDI) at a 6.20% tax rate 2. Medicare at a 1.45% tax rate Therefore, we credit an amount equal to 6.20% of earnings for each year that Social Security payments are deducted as an offset to earnings losses. These calculations are shown in a separate exhibit attached to this report.

SMITH

/ Law Firm

page 19

Summary We now combine the previously calculated losses in this case to arrive at the following total loss value in present dollar amounts: Range of Value of Loss 40%* 50%* 60%* $ 89,481 $ 89,481 $ 89,481 610,181 610,181 610,181 74,078 74,078 74,078 15,898 19,872 23,846 131,696 164,621 197,545 $921,334 $958,232 $ 995,131

Components of Loss net earnings in past years net earnings in future years pension income *household services in past years *household services in future years total present value of loss

* degree of loss of ability to perform household services

Each loss figure presented above is an adjusted present value amount (in 2005 dollars), representing a lump-sum payment made at present needed to generate a flow of payments sufficient to compensate for the losses in each year of loss included in this appraisal. In addition, please note that pre-trial or pre-judgment interest has not been calculated. These interest losses are typically determined at the time of trial and would be in addition to the losses calculated in this appraisal report. The preceding findings are based on information provided to us as of this date. They are subject to revision should additional information be forthcoming that would change any facts or assumptions upon which this analysis rests. We also note that damages are an approximation and are provided by the economic expert as a guide to the trier-of-fact. Because a loss stream cannot be computed with absolute confidence, a lump-sum payment represents a rough and ready attempt to put the plaintiff in the same position had the injury not occurred. [SOURCE: Jones & Laughlin Steel Corp. v. Pfiefer, (1983), 103 S. Ct. at 2555.]

Exhibit Mary Smith Social Security Income Past Years Social Security Tax Credit [6.2% of Earnings] (3) $ 1,534 2,853 2,927 total:

Year (1) 2002.80 2003 2004

Social Security Benefits [@ COLA] (2) $ 4,948* 14,604 14,400

Social Security Net Income [(2) - (3) ] (4) $3,414 11,751 11,473 $26,638

* assume award begins on September 1

Mary Smith Social Security Income Future Years

Social Social Security Security Tax Credit Benefits [6.2% of [@ COLA] Earnings] (2) $ 14,789 15,055 15,326 15,755 16,196 16,650 17,116 17,595 18,088 18,595 19,115 19,650 20,201 20,766 21,348 21,945 22,560 23,192 23,841 24,509 8,112 (3) $ 3,044 3,166 3,292 3,424 3,561 3,703 3,852 4,006 4,166 4,333 4,506 4,686 4,874 5,068 5,271 5,482 5,701 5,929 6,167 6,413 2,952 Social Security Net Income [(2) - (3)] (4) $ 11,745 11,889 12,034 12,331 12,635 12,946 13,265 13,590 13,922 14,262 14,609 14,964 15,327 15,698 16,077 16,463 16,859 17,262 17,674 18,095 5,160

Years (1) 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025.38

Present Value [@ 6%] (5) $ 11,745 11,216 10,710 10,354 10,008 9,674 9,351 9,038 8,735 8,442 8,158 7,883 7,617 7,360 7,111 6,870 6,636 6,411 6,192 5,981 1,609

Cumulative Present Value (6) $ 11,745 22,961 33,671 44,025 54,033 63,708 73,059 82,097 90,832 99,273 107,431 115,314 122,931 130,291 137,402 144,271 150,908 157,318 163,510 169,491 171,100

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tax Return Enclosures List: FEDERAL T1 2009Document16 pagesTax Return Enclosures List: FEDERAL T1 2009Christine TemplemanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 39 Serrano v. Santos TransitDocument2 pages39 Serrano v. Santos TransitGabrielle Adine SantosNo ratings yet

- Fiduciary Duties and Obligations in Administering 457 (B) Plans Under California LawDocument21 pagesFiduciary Duties and Obligations in Administering 457 (B) Plans Under California LawScott Dauenhauer100% (2)

- Goodyear Philippines Inc. vs. AngusDocument1 pageGoodyear Philippines Inc. vs. AngusAnn MarieNo ratings yet

- Prosper Chapter6v2 PDFDocument28 pagesProsper Chapter6v2 PDFAdam Taggart100% (2)

- PDF Question Bank CompressDocument220 pagesPDF Question Bank CompressSyamil Sanusi100% (1)

- Case StudiesDocument44 pagesCase StudiesUzzal HaqueNo ratings yet

- CFA Level 1 (Book-B)Document170 pagesCFA Level 1 (Book-B)butabutt100% (1)

- Parreño Vs COADocument3 pagesParreño Vs COAAnonymous 8SgE99No ratings yet

- Prosecutors and Judges Chapter 7 - Special Ethical Rules Pearce, Et AlDocument51 pagesProsecutors and Judges Chapter 7 - Special Ethical Rules Pearce, Et AlGeorge ConkNo ratings yet

- Brain Injury Association Amicus Brief in Re NFL Players Concussion 59Document44 pagesBrain Injury Association Amicus Brief in Re NFL Players Concussion 59George ConkNo ratings yet

- D.J.L. v. Armour PharmaceuticalsDocument17 pagesD.J.L. v. Armour PharmaceuticalsGeorge ConkNo ratings yet

- Punctuated EquilibriumDocument46 pagesPunctuated EquilibriumGeorge ConkNo ratings yet

- Timeline - Hepatitis C Recognition and Testing UKDocument2 pagesTimeline - Hepatitis C Recognition and Testing UKGeorge ConkNo ratings yet

- Sarbanes Oxley - Attorney RegulationsDocument43 pagesSarbanes Oxley - Attorney RegulationsGeorge ConkNo ratings yet

- Counsel Fees - O'Bannon v. NCAADocument13 pagesCounsel Fees - O'Bannon v. NCAAGeorge ConkNo ratings yet

- A and Others vs. National Blood AuthorityDocument45 pagesA and Others vs. National Blood AuthorityGeorge ConkNo ratings yet

- Order Approving Settlement in Re World Trade Center Lower Manhattan Disaster Site LitigationDocument53 pagesOrder Approving Settlement in Re World Trade Center Lower Manhattan Disaster Site LitigationGeorge ConkNo ratings yet

- Clare Marie Trautfield ConkDocument3 pagesClare Marie Trautfield ConkGeorge ConkNo ratings yet

- Chapter 5 Conflicts of Interest Part 2 Professional Responsibility - A Contemporary Approach .Spring.2015Document78 pagesChapter 5 Conflicts of Interest Part 2 Professional Responsibility - A Contemporary Approach .Spring.2015George Conk100% (1)

- Chapter 5 Conflicts of Interest - Part 1 Spring 2015Document95 pagesChapter 5 Conflicts of Interest - Part 1 Spring 2015George ConkNo ratings yet

- Fees & Billing - Chapter 3 Professional Responsibility - A Contemporary Approach (Pearce, Et Al.)Document240 pagesFees & Billing - Chapter 3 Professional Responsibility - A Contemporary Approach (Pearce, Et Al.)George ConkNo ratings yet

- NCAA - Opposition To Motion For Counsel Fees in O'Bannon v. NCAADocument32 pagesNCAA - Opposition To Motion For Counsel Fees in O'Bannon v. NCAAGeorge ConkNo ratings yet

- A Reading From ProverbsDocument2 pagesA Reading From ProverbsGeorge ConkNo ratings yet

- Clare Marie Trautfield Conk, A Special MomDocument2 pagesClare Marie Trautfield Conk, A Special MomGeorge ConkNo ratings yet

- Clare Marie Trautfield Conk - Eulogy by George W.ConkDocument3 pagesClare Marie Trautfield Conk - Eulogy by George W.ConkGeorge ConkNo ratings yet

- Ch.2.Allocating Decision-Making Between Cawyer and ClientDocument31 pagesCh.2.Allocating Decision-Making Between Cawyer and ClientGeorge ConkNo ratings yet

- PhilippiansDocument1 pagePhilippiansGeorge ConkNo ratings yet

- No Contempt Against DavisDocument3 pagesNo Contempt Against DavisChad PetriNo ratings yet

- 1:14-cv-00208 #71 Contempt Motion (Searcy)Document3 pages1:14-cv-00208 #71 Contempt Motion (Searcy)Equality Case FilesNo ratings yet

- Ch.3. Part 1 AdvertisingDocument75 pagesCh.3. Part 1 AdvertisingGeorge ConkNo ratings yet

- Judicial Contempt in AlabamaDocument11 pagesJudicial Contempt in AlabamaGeorge ConkNo ratings yet

- Searcy v. Strange: Merits RulingDocument10 pagesSearcy v. Strange: Merits RulingGeorge ConkNo ratings yet

- NFL Order Re Settlement AmendmentsDocument3 pagesNFL Order Re Settlement AmendmentsRobert LeeNo ratings yet

- Ch. 2 Ineffective Assistance of Counsel Counsel For Immigrants Facing RemovalDocument42 pagesCh. 2 Ineffective Assistance of Counsel Counsel For Immigrants Facing RemovalGeorge Conk100% (1)

- Moore Order To Ala. Probate JudgesDocument6 pagesMoore Order To Ala. Probate JudgesLGBTQ NationNo ratings yet

- Ch.2 Basic Elements of Law Practice 2015Document105 pagesCh.2 Basic Elements of Law Practice 2015George ConkNo ratings yet

- Specimen Policy Lawyers Professional Liability Insurance - ChubbDocument13 pagesSpecimen Policy Lawyers Professional Liability Insurance - ChubbGeorge ConkNo ratings yet

- Application For Lawyers Professional Liability InsuranceDocument9 pagesApplication For Lawyers Professional Liability InsuranceGeorge ConkNo ratings yet

- Other Allowances and Reimbursements policy summaryDocument11 pagesOther Allowances and Reimbursements policy summaryGokul ChidambaramNo ratings yet

- Appn 07 08Document447 pagesAppn 07 08kunalNo ratings yet

- The Investments and Securities Act 2007 NigeriaDocument165 pagesThe Investments and Securities Act 2007 NigeriaIbi MbotoNo ratings yet

- Fa11 14Document48 pagesFa11 14adisty astrianiNo ratings yet

- BILTIR Fact Sheet 2019 PDFDocument2 pagesBILTIR Fact Sheet 2019 PDFBernewsAdminNo ratings yet

- Final AR English 21-7-19 PDFDocument222 pagesFinal AR English 21-7-19 PDFRahul DeyNo ratings yet

- Cardiff Council 2011/2012 Budget ReportDocument199 pagesCardiff Council 2011/2012 Budget ReportThe GuardianNo ratings yet

- CLFR Nov 29 FinalDocument197 pagesCLFR Nov 29 FinalLanz OlivesNo ratings yet

- Maven Minds Budget Brief 2022Document24 pagesMaven Minds Budget Brief 2022Salman AhmedNo ratings yet

- Act 140 Penang Port Commission Act 1955Document90 pagesAct 140 Penang Port Commission Act 1955Adam Haida & CoNo ratings yet

- Kemppi TuomasDocument182 pagesKemppi TuomassapimachoNo ratings yet

- FINNISH GOVERNMENT CIVIL SERVICEDocument4 pagesFINNISH GOVERNMENT CIVIL SERVICEShurel Marl BuluranNo ratings yet

- Vba 21P 534ez AreDocument14 pagesVba 21P 534ez AreARNOLD GONZALESNo ratings yet

- Literature Review On Unemployment EssaysDocument9 pagesLiterature Review On Unemployment Essaysaflrrefsn100% (1)

- GNFC Ar 2008 Full FinalDocument44 pagesGNFC Ar 2008 Full FinalNour Saad EdweekNo ratings yet

- Bank Loan Application DetailsDocument8 pagesBank Loan Application Detailsbalamurali sankaranarayananNo ratings yet

- Stakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Document103 pagesStakeholder Engagement Plan SEP GAMBIA FISCAL MANAGEMENT DEVELOPMENT PROJECT P166695Ali ZilbermanNo ratings yet

- Individual Aging Vs Population AgingDocument78 pagesIndividual Aging Vs Population AgingAnonymous iG0DCOf0% (2)

- Pass Rules With Latest InstructionsDocument24 pagesPass Rules With Latest InstructionsSrDEE PowerNo ratings yet

- Ann Caroline R. Calixto IJSETDocument8 pagesAnn Caroline R. Calixto IJSETAnn CarolineNo ratings yet