Professional Documents

Culture Documents

Duke Energy

Uploaded by

Statesman Journal0 ratings0% found this document useful (0 votes)

12 views3 pagesAs long-term institutional investors with substantial holdings in Duke Energy, we are deeply troubled by recent

events surrounding the Dan River coal ash spill, one of the largest in our nation’s history. Our concerns include

the severity of the spill, Duke’s purported violations of numerous regulations, the lack of clarity on clean up and

costs, the failure to adequately address the future disposition of Duke’s other coal ash ponds and federal criminal

subpoenas issued to Duke, the North Carolina Department of Environment and Natural Resources and the North

Carolina Utilities Commission.1 These events, and Duke’s response to them, have shaken investors' confidence in

Duke and its Board.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAs long-term institutional investors with substantial holdings in Duke Energy, we are deeply troubled by recent

events surrounding the Dan River coal ash spill, one of the largest in our nation’s history. Our concerns include

the severity of the spill, Duke’s purported violations of numerous regulations, the lack of clarity on clean up and

costs, the failure to adequately address the future disposition of Duke’s other coal ash ponds and federal criminal

subpoenas issued to Duke, the North Carolina Department of Environment and Natural Resources and the North

Carolina Utilities Commission.1 These events, and Duke’s response to them, have shaken investors' confidence in

Duke and its Board.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesDuke Energy

Uploaded by

Statesman JournalAs long-term institutional investors with substantial holdings in Duke Energy, we are deeply troubled by recent

events surrounding the Dan River coal ash spill, one of the largest in our nation’s history. Our concerns include

the severity of the spill, Duke’s purported violations of numerous regulations, the lack of clarity on clean up and

costs, the failure to adequately address the future disposition of Duke’s other coal ash ponds and federal criminal

subpoenas issued to Duke, the North Carolina Department of Environment and Natural Resources and the North

Carolina Utilities Commission.1 These events, and Duke’s response to them, have shaken investors' confidence in

Duke and its Board.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

March 27, 2014

VIA FASCIMILE 704-382-7705

Philip R. Sharp

Chair, Regulatory Policy &

Operations Committee

c/o Corporate Secretary

Duke Energy Corporation

P.O. Box 1321

Charlotte, NC 28201-1321

Dear Mr. Sharp:

As long-term institutional investors with substantial holdings in Duke Energy, we are deeply troubled by recent

events surrounding the Dan River coal ash spill, one of the largest in our nations history. Our concerns include

the severity of the spill, Dukes purported violations of numerous regulations, the lack of clarity on clean up and

costs, the failure to adequately address the future disposition of Dukes other coal ash ponds and federal criminal

subpoenas issued to Duke, the North Carolina Department of Environment and Natural Resources and the North

Carolina Utilities Commission.

1

These events, and Dukes response to them, have shaken investors' confidence in

Duke and its Board.

In spite of the continuing flurry of news accounts, we are unaware of any action taken by the Board to address

these serious issues. We call upon you as Chair of the Regulatory Policy and Operations Committee to

immediately initiate an independent investigation consistent with the Committees charter and to provide a

written report to shareholders on its findings and recommendations upon completion. As an immediate

first step, we call on you to step forward at the upcoming annual meeting of shareholders to provide a

status report on the investigation, including the terms of reference, scope of the inquiry and a timetable for

the final report.

Such action is explicitly authorized in the charter, which notes that, The Committee, in discharging its oversight

role, is empowered to study or investigate any matter of interest or concern that the Committee deems appropriate

and shall have the authority to retain outside counsel or other experts for this purpose, including the authority to

approve the fees payable to such counsel or experts and any other terms of retention.

2

We firmly believe that

such an investigation is called for and must be separate and independent from any investigation being conducted

by the Company itself. Specifically, we request the Committee investigate the following in accordance with its

charter:

(1) The facts and circumstances behind the coal ash spill and an assessment of the current situation with respect

to the spill, condition of surrounding waterways, clean up, costs and allocation of costs to the Company and

ratepayers.

(2) Whether adequate procedures, policies and practices are in place within the Company and at the board level

to prevent such occurrences at other coal ash sites--including the current condition, risk of failure and

adequacy of mitigation and relocation plans as compared to best practices in the industry.

(3) The allegations and underlying circumstances that are now the subject of a federal criminal investigation

involving Duke, and whether senior management was aware of, or engaged in, improper conduct and/or

violations of Company policy.

(4) The full details as to the legislative lobbying and political activities undertaken by the Company, particularly

with respect to the McCrory Administration, the Department of Environment and Natural Resources and the

North Carolina Utility Commission, regarding governmental, regulatory and enforcement efforts at the

Companys coal ash facilities.

All findings and recommendations should be included in a report to shareholders upon completion. The report

should include a full account of conversations with regulators as well as recommended actions to bring the

Company back into compliance with current regulations and industry best practices. It should also spell out what

changes the Board and this Committee will make to policy and practice to ensure regulatory compliance and

adequate oversight of these matters going forward. Finally, it should include measures to hold accountable any

Duke executive found to have breached regulatory requirements, engaged in improper conduct and/or to have

violated any Duke policy.

In light of the escalating crisis, it is incumbent upon Duke's directors to assert independent leadership by acting

promptly. We urge you to exercise your ability to retain independent counsel and the expertise of individuals

with no prior financial, professional or other ties to Duke Energy, its executives or the Board to conduct this

investigation. The investigation should be specifically convened on behalf of shareholders and must operate in a

manner that is fully independent of management.

The spill, subsequent revelations regarding regulatory violations and the ensuing criminal investigation have

created serious reputational risks. These developments also raise broader questions about Dukes approach to the

management of long-term environmental risks like climate change and water pollution and underscore the need

for greater transparency of political and lobbying activity, consistent with the proposal submitted for this years

proxy by the Nathan Cummings Foundation. If they remain unaddressed, these matters may have material

consequences for Duke Energy and its long-term shareholders.

The gravity of these matters requires immediate Board action. The Nathan Cummings Foundation will be

facilitating investor engagement with respect to this matter. Please contact Laura Campos at 212-787-7300 or

laura.campos@nathancummings.org to follow up. We look forward to a prompt response.

Sincerely,

William Dempsey

Senior Vice President

The Nathan Cummings Foundation

Ted Wheeler

Oregon State Treasurer

Denise L. Nappier

Connecticut State Treasurer

Robert M. McCord

Pennsylvania Treasurer

William R. Atwood

Executive Director

Illinois State Board of Investment

Dawn Wolfe

Vice President, Governance & Sustainable Investment

F&C Management Ltd.

Greg Kinczewski

Vice President/General Counsel

Marco Consulting Group

Stu Dalheim

Vice President, Shareholder Advocacy

Calvert Investments

Joellen Sbrissa, CSJ

Congregation of St. Joseph

Leslie Samuelrich

President

Green Century Capital Management

Jonas Kron

Senior Vice President

Trillium Asset Management

Anne Sheehan

Director of Corporate Governance

California State Teachers Retirement System

Stephen Abrecht

Co-chair

SEIU Master Trust

Amelia Timbers

Energy Program Manager

As You Sow

Steve Viederman

Chair, Finance Committee

Christopher Reynolds Foundation

Mark Regier

Director of Stewardship Investing

Everence Financial and the Praxis Mutual Funds

Marcela I. Pinilla

Director, Shareholder Advocacy

Mercy Investment Services

Nora M. Nash, OSF

Sisters of St. Francis of Philadelphia

Kathryn McCloskey

Director, Social Responsibility

United Church Funds

Cc: William Barnet III, Member, Regulatory Policy & Operations Committee

G. Alex Bernhardt Sr., Member, Regulatory Policy & Operations Committee

John T. Herron, Member, Regulatory Policy & Operations Committee

James B. Hyler, Jr., Member, Regulatory Policy & Operations Committee

James T. Rhodes, Member, Regulatory Policy & Operations Committee

Carlos A. Saladrigas, Member, Regulatory Policy & Operations Committee

1

hLLp://www.laLlmes.com/naLlon/naLlonnow/la-na-nn-coal-ash-splll-regulaLors-20140228,0,4932463.sLory#axzz2wl3[SlL2,

hLLp://www.wral.com/duke-energy-vague-on-fuLure-of-nc-coal-ash-ponds/13477108/ and

hLLp://www.Lheguardlan.com/world/2014/feb/13/norLh-carollna-coal-ash-splll-duke-energy

2

hLLps://www.duke-energy.com/corporaLe-governance/board-commlLLee-charLers/regulaLory-pollcy-and-operaLlons.asp

You might also like

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNo ratings yet

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNo ratings yet

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNo ratings yet

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

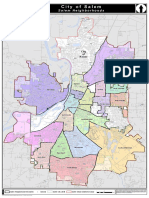

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalNo ratings yet

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)